GameFi track and representative project Sandbox research report

I. Overview

first level title

I. Overview

GameFi refers to blockchain games that provide players with economic incentives to earn money while playing. Players typically earn cryptocurrency and NFT rewards by completing quests, battling other players, and leveling up.

In 2022, Web3.0 game companies will be favored by major institutions. In the second quarter, they received a total of US$756 million in financing, and A16Z even set up a US$600 million game fund.

first level title

secondary title

1. Track data

text

According to the footprint data, there are currently 1,491 games, and the GameFi field has 34 million users in May.

As of April 30, 2022, the total number of transactions on GameFi is 20,599,614, and the total transaction volume is 34,291,577.74.

As of June 6, 2022, GameFi's total market capitalization was US$11 billion, and the largest market capitalization occurred on November 25, 2021, at US$45.7 billion.

secondary title

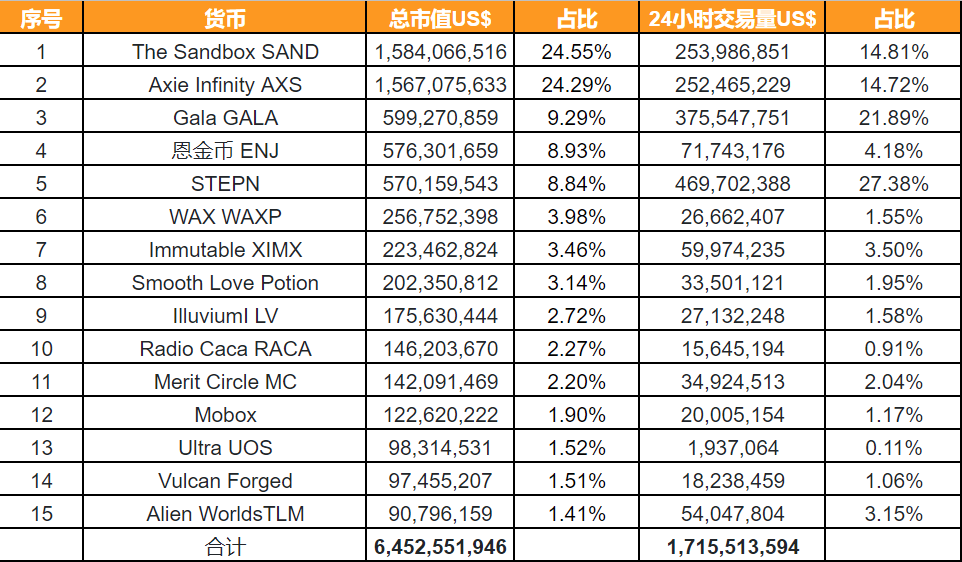

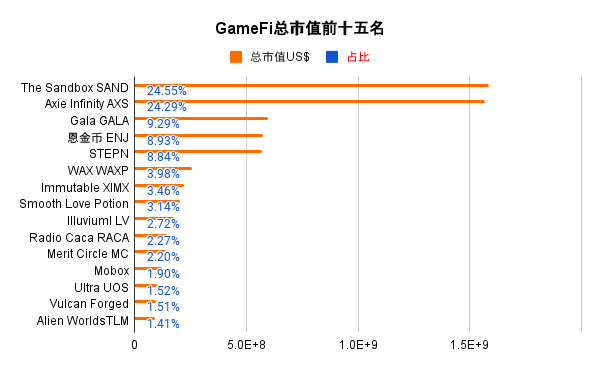

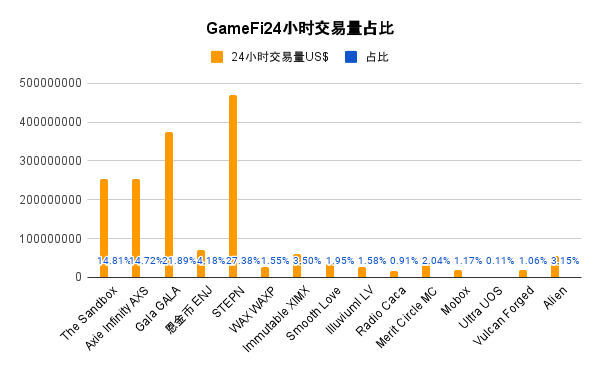

We counted 100 GameFi projects, the total market capitalization last week was 8 billion US dollars, and the 24-hour trading volume was 2.1 billion US dollars, of which the total market capitalization of the top 15 was 6.5 billion US dollars. At the forefront, we can see that Sandbox and Axie are on par in terms of total market capitalization and 24-hour trading volume, and STEPN occupies the top spot in 24-hour trading volume.

first level title

3. The Sandbox

1. Project introduction

Sandbox is a platform for creating and hosting entertainment experiences in virtual worlds. In The Sandbox, players can create 3D assets such as buildings, in-game items, and non-player characters. These assets can then be used to create diverse experiences including games, music and fashion events, social events, quests, art exhibits and competitions. The characters, props and equipment in the game can be "NFTized" through blockchain technology, and players can build them into their personal "digital assets".

secondary title

2. How to play

1) The Sandbox is a UGC-driven pixel-like metaverse platform, and its core elements include 5 types: assets, land, SAND, gems and catalysts.

2) The Sandbox contains two important tools: Model Editor (VoxEdit) and Game Maker (GameMaker). Users can use VoxEdit to create related game models, such as game characters, trucks, capes, etc. So, what is the use of creating a game model? First, if the model creator is also a game developer, he can use the model in the game. If the model creator does not develop games, then he can put the model on the NFT trading platform. Game developers can purchase models from the NFT trading platform and use them in games. The development of the game requires the use of a game maker.

3) After the game development is completed, it needs to be bound to the land before it can be released, and the land needs to be purchased or leased.

4) The price of land is determined by the location. Since Sandbox has developed the shuttle function of adjacent plots, the price of land adjacent to popular games or well-known IPs is higher.

secondary title

3. Profit model

1) Tokens: 5% of the SAND transaction volume will be allocated 50% to the betting pool and 50% to the foundation (transaction volume data will be shown in the next section);

2) Land sales: Several rounds of land sales started in 2019. As of the first quarter of 22, the total revenue of the primary market has exceeded 15 million US dollars;

It can be seen from the official website that in the second season, 10 million SANDs will be allocated, 10,000 Alpha Passes will be allocated, and 700,000 users will participate in the competition.

4) The project is in a virtuous circle, and SAND rises.

secondary title

4. Key data

4.1. Token Information

◆Market value: $1,613,004,716

◆Current price: $1.30

◆Circulation supply: 41%

Through intotheblock, we can see that the proportion of large holders of SAND is 93%, indicating that users have high investment attributes.

text

4.2. Token economy

1) Access to Platforms - Players spend SAND to play games, buy equipment, or customize their characters. Creators spend SAND to obtain assets, land, and through betting. Land sales drive demand for SAND, artists spend SAND to upload assets to the market, buy gems to define rarity and scarcity;

2) Governance - SAND is a governance token that allows holders to participate in the governance decisions of the platform using a decentralized governance structure. They can exercise voting power on key elements, such as the attributes granted by the foundation to content and game creators, and the prioritization of features on the platform's roadmap. Owners of SAND can vote themselves, or delegate voting rights to other players of their choice;

3) Betting - SAND can realize betting, and can realize passive income on land. It's also the only way to get the valuable gems and catalysts needed to create assets.

4) Start a gas-free staking project on Polygon

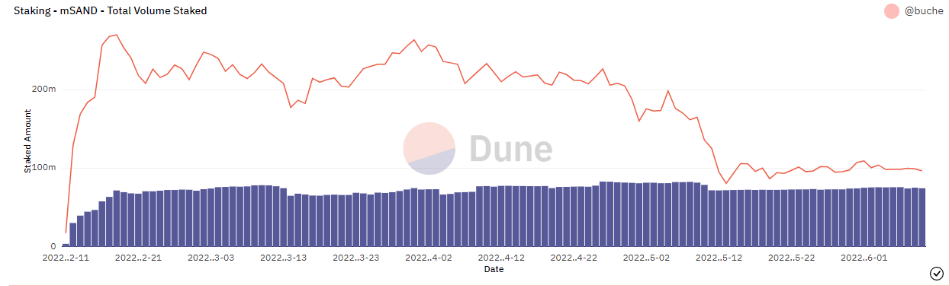

While SAND has built a liquidity pool on Uniswap, The Sandbox launched gas-free mSAND staking in February, a project that allows everyone on Polygon to earn a portion of the 500,000 mSAND weekly rewards. Additionally, mSAND holders who provide liquidity to the program will be eligible to share in a monthly token distribution of 500,000 mSAND. At the end of last year, The Sandbox launched the mSAND-MATIC pledge function. We will refer to the SAND on Polygon as mSAND, maintaining a 1:1 exchange ratio. SAND holders who provide liquidity for the mSAND/MATIC pair on Quickswap will be eligible to share in the monthly SAND distribution proceeds.

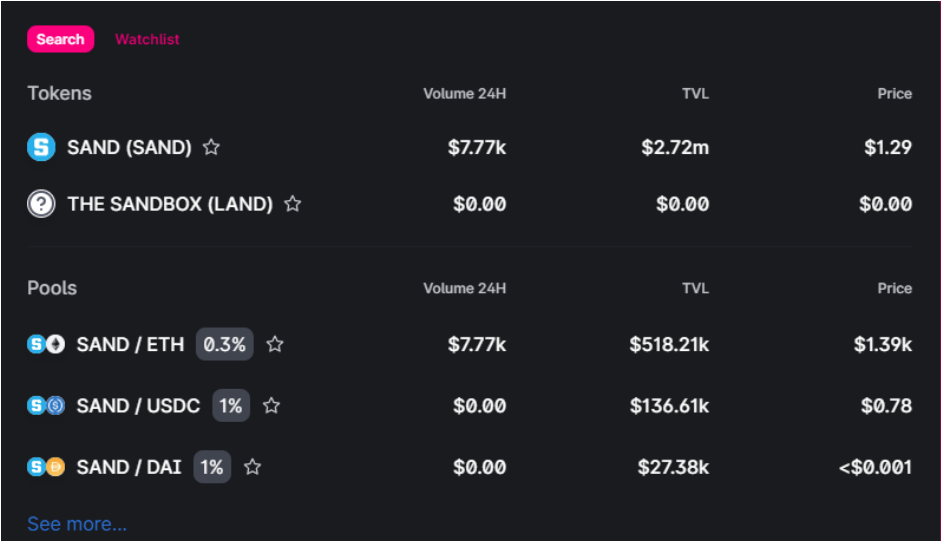

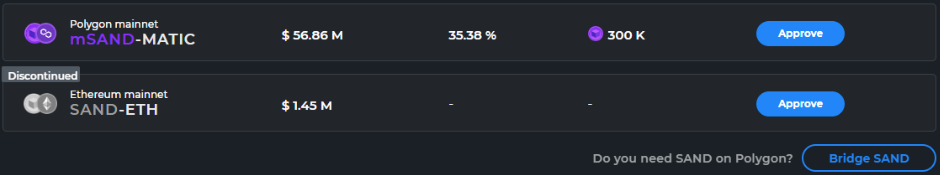

The following is the pool situation in Uniswap and Polygon:

On Uniswap, there are three pools, which are composed of ETH/USDC/DAI, and the TVL is $518.21K, $136.61K and $27.38K respectively.

On Uniswap, there are three pools, which are composed of ETH/USDC/DAI, and the TVL is $518.21K, $136.61K and $27.38K respectively.

From the figure below, we can see the pledge situation of mSAND since February 22, which has dropped sharply since the bear market, and is currently relatively stable.

In order to facilitate users to better complete the pledge, The Sandbox provides Polygon's cross-chain bridge service to realize the cross-chain between Ethereum and Polygon's SAND.

text

4.3. Land sales income

Sandbox has a total of 166,464 pieces of land, which will never increase or decrease, of which 123,840 pieces can be sold, 25,920 pieces are allocated as rewards to partners, creators, and players, and the other 16,704 pieces are used as places for events and games. The land area is 1:1 square pixels, players can also buy adjacent land to form a larger land. Once a user owns a piece of land, the user can fill it with games and assets.

New LAND parcels are subject to primary market sales (they are sold to private entities or sold through auctions).

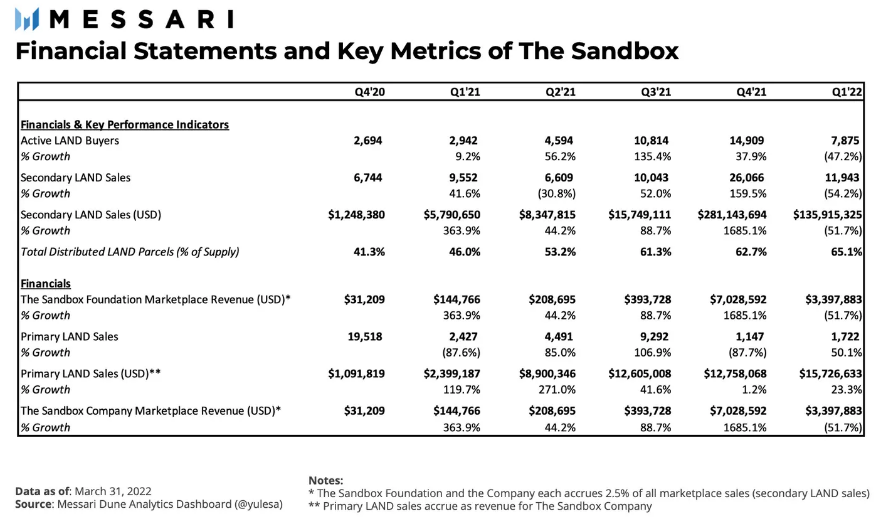

The picture below is the land income situation table in the first quarter of 22:

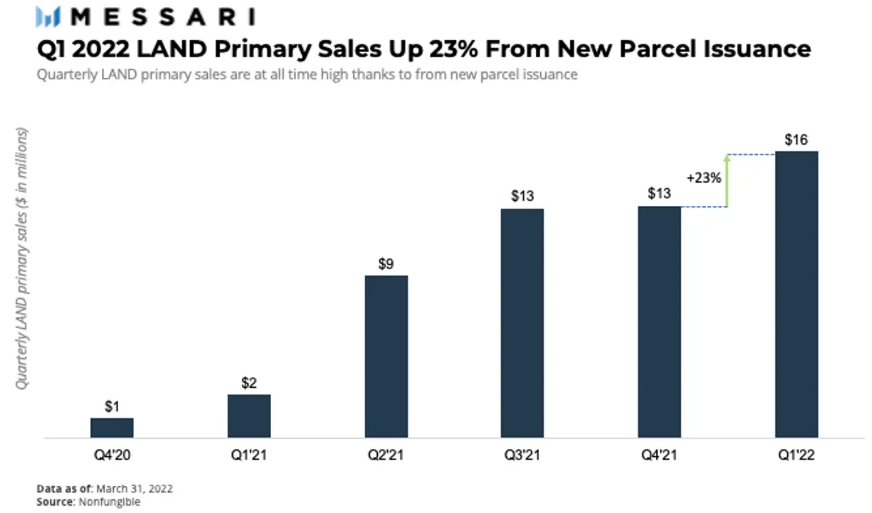

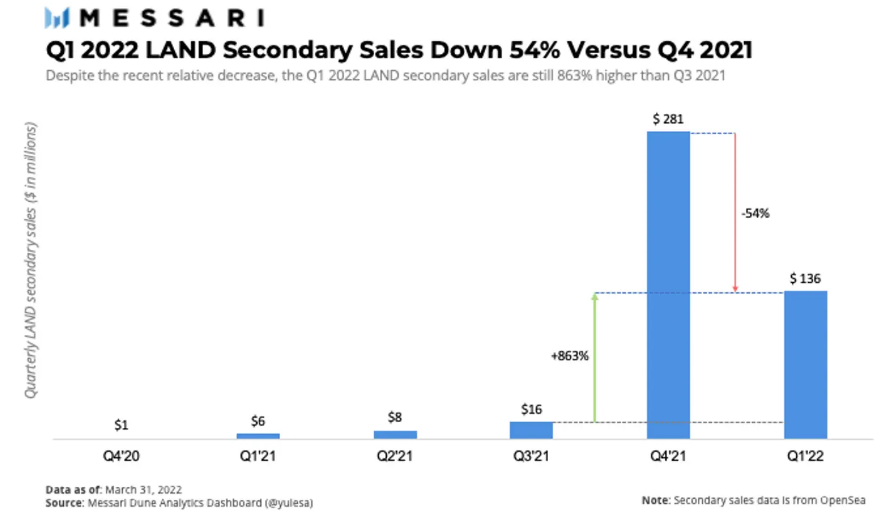

Compared to the fourth quarter of 2021, land sales in the primary market were $16 million, an increase of 23%. The main subject of the sale is newly released land. Still, in the first quarter of 2022, primary market sales accounted for only 12% of secondary market sales ($136 million).

LAND secondary market sales fell 54% compared to the previous quarter. To put that in perspective, Q1 2022 secondary sales are still up 863% relative to Q3 2021. The Q1 decline is the result of the Metaverse hype starting to die down since Meta announced its name change in October 2021.

Notably, 65% of LAND parcels have been allocated in Q1 2022, a 2% increase from Q4 2021.

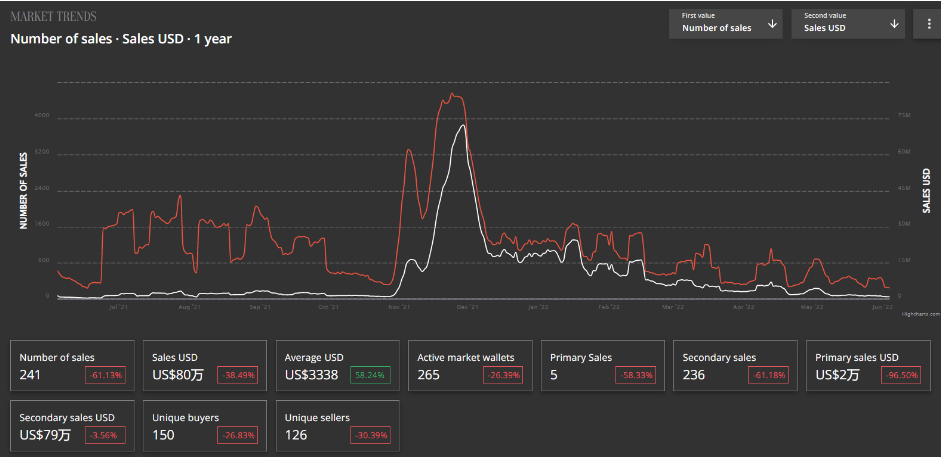

The recent land sales situation is as follows (from https://nonfungible.com/)

In January, a total of 20 pieces of land were sold in the secondary market, with a sales volume of US$60,000 (no new transaction data this week);

Historically, a total of more than 150,000 pieces of land have been sold, including $57.1 million in the primary market and $400 million in the secondary market.

Note that the above data includes all transactions, not just the Sandbox project's own data.

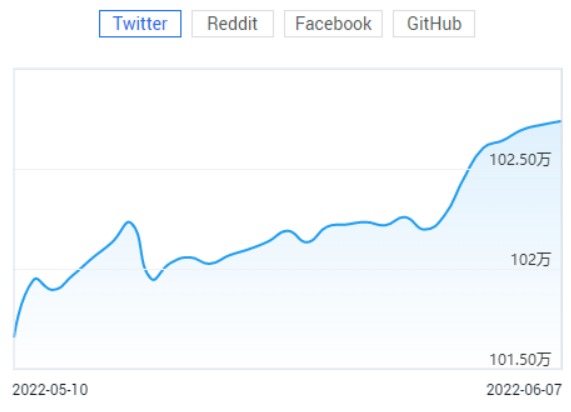

5. Marketing situation

Although it is a bear market, the marketing of Sandbox has been very active. It can be seen in all major media newsletters, and the number of Twitter fans has also continued to grow.

secondary title