UST decoupled from the US dollar, LUNA plummeted 99.9%

Apr. 2022, Vincy

Data Source: Footprint Analytics - Algorithmic Stablecoin Analysis

TerraUSD(UST)Is - although "was" might be better - an algorithmic stablecoin. Its stable mechanism stems from theLUNAA promise to honor. Out of trust in the public chain Terra, traders mint and destroy tokens as needed to ensure the stability of UST.

However, in the last week, the price of UST crashed and fell below 10 cents, completely losing the role of the peg. UST was the third-largest stablecoin by market capitalization before depegging from the U.S. dollar. This flash crash became one of the most worrisome developments in the crypto space and something everyone interested in blockchain needs to know.

Why is UST, which has been stable for a long time, depegged? What are the consequences?

Algorithmic stablecoins are different from other stablecoins

Before analyzing the decoupling of UST, let’s see how it differs from fiat stablecoins and overcollateralized stablecoins:

Algorithmic stablecoins do not require any collateral. On the contrary, they adjust the amount of currency held by users through currency price fluctuations. When the currency price rises, it decreases, and when the currency price falls, it increases.

Fiat stablecoins and over-collateralized stablecoins require collateral in exchange for them. For example, Tether (USDT) fiat stablecoin needs fiat currency USD as collateral. Over-collateralized stablecoins need to be collateralized with digital currencies BTC and ETH. Due to the large fluctuations in BTC and ETH prices, the collateral must be over-collateralized.

UST is the same as a stablecoin pegged to $1, but without sufficient mortgage assets. Once the currency price falls below $1, its entire ecology, including LUNA and the protocolAnchorwill be dragged down.

Trend analysis before and after UST price decoupling

UST currency price is stable at $1image description

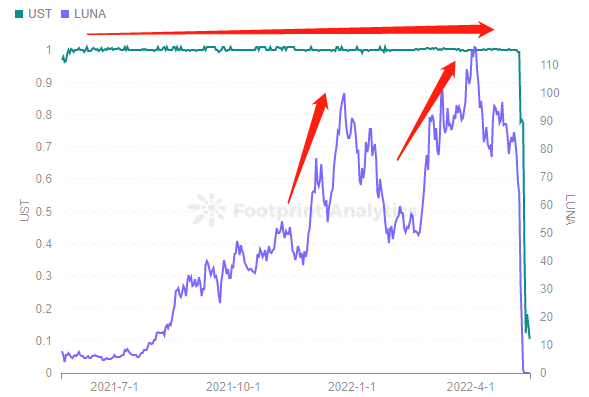

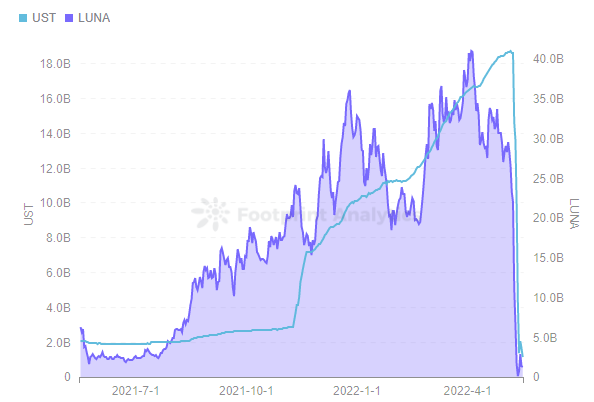

Footprint Analytics - Token Price: UST vs LUNA

The stability of UST anchored at $1 is the driving force for Terra's ecological growth.

image description

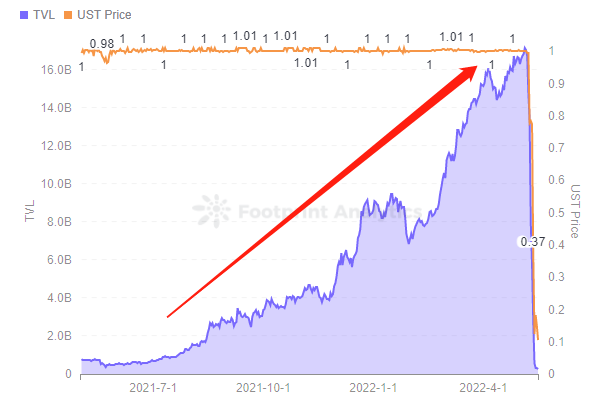

Footprint Analytics - Anchor TVL vs UST Price

LFG (Luna Foundation Guard) was established in January 2022 to support the stability of UST and promote the development of Terra ecology. In February, it raised US$1 billion in financing from multiple VCs by selling LUNA, with BTC as the backing to help anchor UST and the development of Terra ecology.

However, these mechanisms and reserves cannot maintain the stability of UST.

Why will UST be decoupled?The price of UST fell from $1 on May 8 to a low of $0.18 on May 14. It bounced briefly, foretelling that maybe the mechanism would be resilient enough, but then the flash crash resumed.

As of May 16, UST appears to be dead, killing market confidence in algorithmic stablecoins.

What happened?

On May 7th, a giant whale dumped UST worth $285 million. This was the trigger that prompted the decoupling of UST from the US dollar.

With UST losing its peg, LUNA is being released. This is because users abandon the unpegged UST in their hands, resulting in more Minting of LUNA, which leads to a deeper decline in LUNA.

However, the devaluation of LUNA happened so quickly that it simply couldn't buy back enough UST to repeg it back to $1.

Both LUNA and UST are down to pennies.

image description

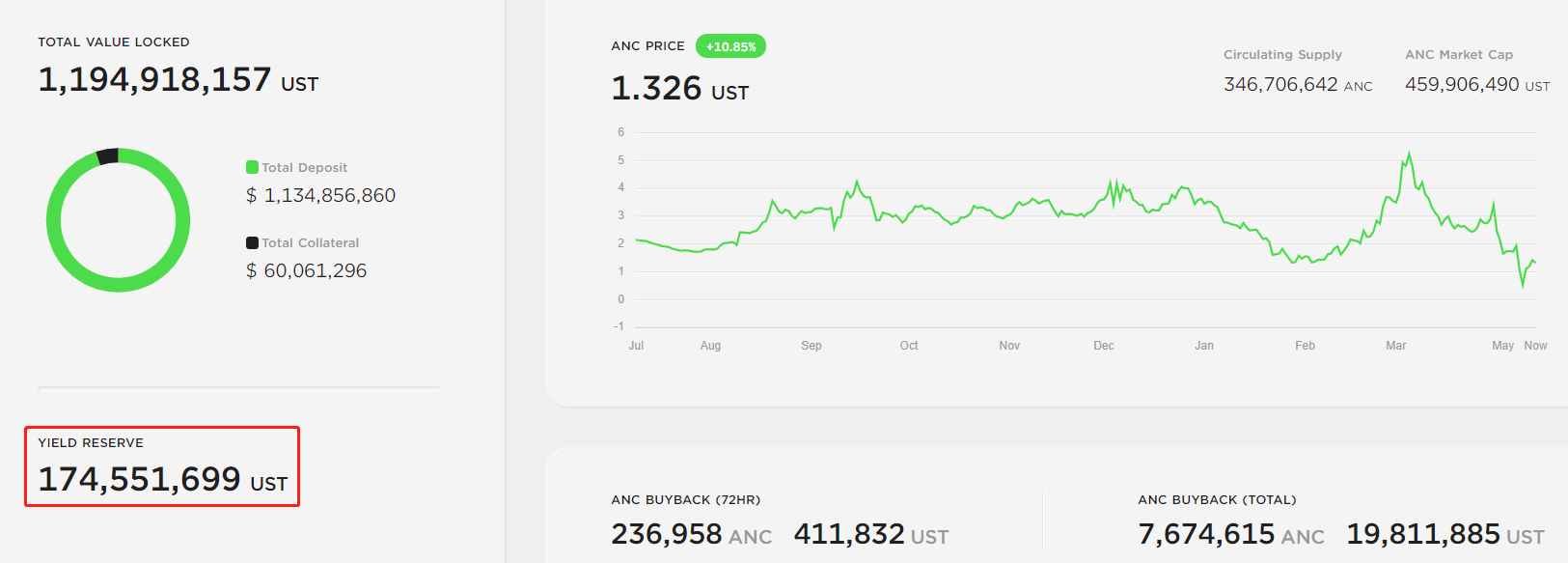

Screenshot Source - Anchor Website Yield Reserve

image description

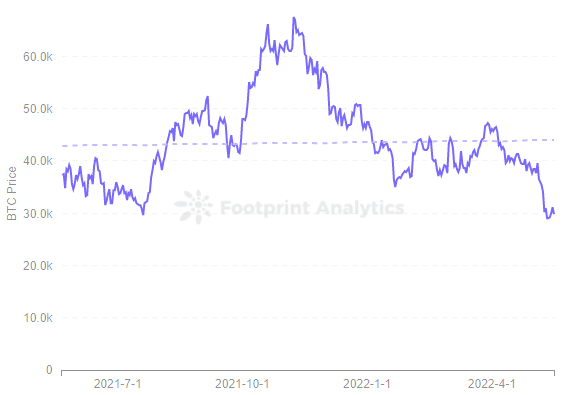

Footprint Analytics - BTC Price

This has a great negative impact on the anchoring of UST and the development of Terra ecology.

After the price of UST falls, how will it affect the Terra ecology and cryptocurrency

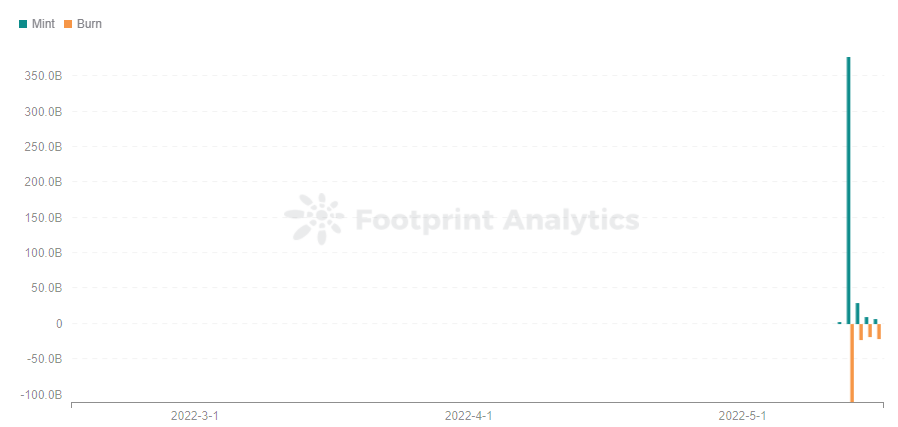

image description

Footprint Analytics - Daily Mint & Burn: LUNA

image description

Footprint Analytics - UST vs LUNA of Market Cap

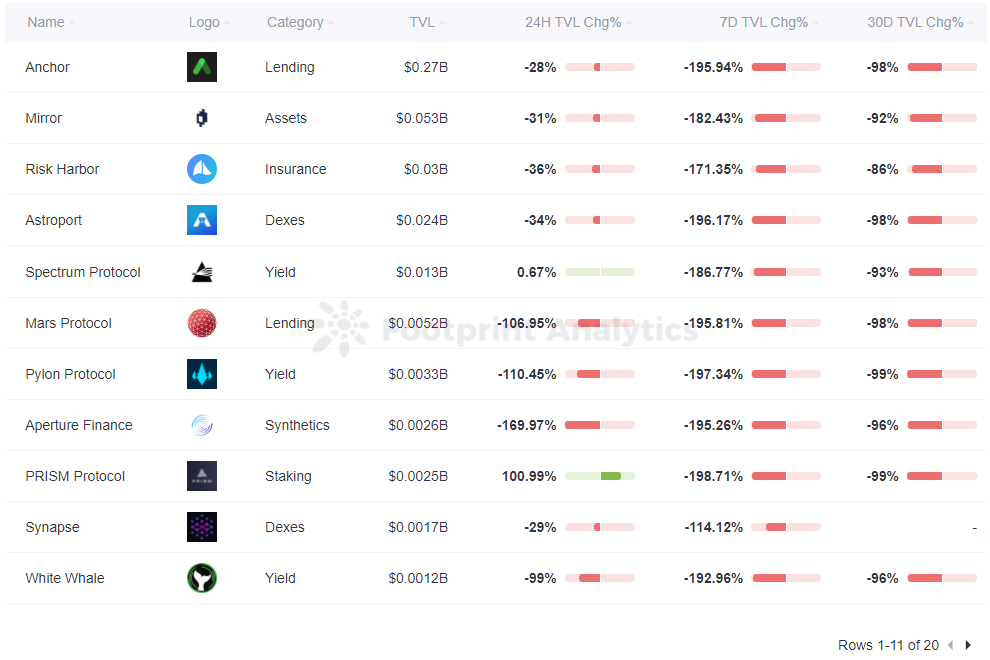

Of course, in addition to the impact on indicators such as currency prices and market value, there are also negative growth in the TVL of various protocols in the Terra ecosystem. Especially Anchor andLidosummary

Footprint Analytics - Terra Top 10 Protocols TVL Change

summary

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.

This article comes fromFootprint Analyticscommunity contribution

The above content is only a personal opinion, for reference and communication only, and does not constitute investment advice. If there are obvious understanding or data errors, feedback is welcome.

Copyright Notice:

This work is original by the author, please indicate the source for reprinting. Commercial reprinting needs to be authorized by the author, and those who reprint, extract or use other methods without authorization will be investigated for relevant legal responsibilities.

The Footprint Community is a global, mutually supportive data community where members leverage data visualizations to co-create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research on blockchains such as Web 3, Metaverse, GameFi, and DeFi. Many active, diverse, and highly engaged members inspire and support each other through the community, and a worldwide user base is built to contribute data, share insights, and drive the community forward.