IOSG report: Rollup empowers a new financial system

Author: Momir Amidzic

This article is from IOSG Ventures,Odaily is authorized to publish exclusively.

TLDR

After five years of rapid development, the winners of each track are gradually emerging, and the DeFi market has achieved considerable development.

Due to the lack of new stories, most public chains are basically just copying Ethereum's DeFi graph. Multi-chain DeFi can be regarded as a new narrative direction.

Although the multi-chain statement and the saturated Ethereum have gradually increased activities on other chains, giant whales still have a soft spot for security. The TVL of Curve.fi, the largest protocol on Ethereum, is greater than the combined TVL of all DeFi applications built on top of Avalanche and Solana.

On the other hand, because these multi-chains can provide lower handling fees, some users who cannot afford the fees of Ethereum are gradually migrating to these chains. However, the contribution these users can provide is not enough.

However, it is clear that currently no single blockchain can handle the throughput of all DeFi applications.

In the long run, we expect that most applications will be built on top of Rollup. Because it’s the only solution that can sustainably support billions of users over the long term without sacrificing fundamental principles like decentralization, censorship resistance, security, and trustlessness.

first level title

birth to development

In the past five years, the DeFi ecosystem on Ethereum has experienced explosive expansion.

image description

Source: IOSG Ventures

Looking back from today’s perspective, DeFi use cases mainly include three types

Spot Trading on Decentralized Exchanges

Derivatives

Derivatives

spot market

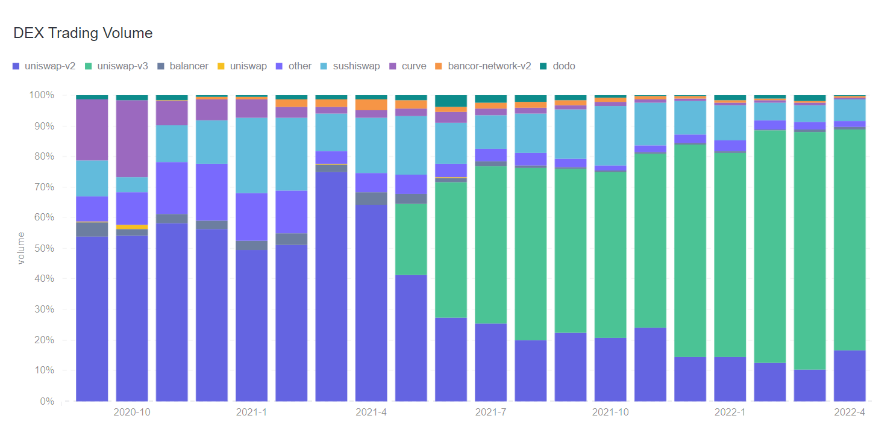

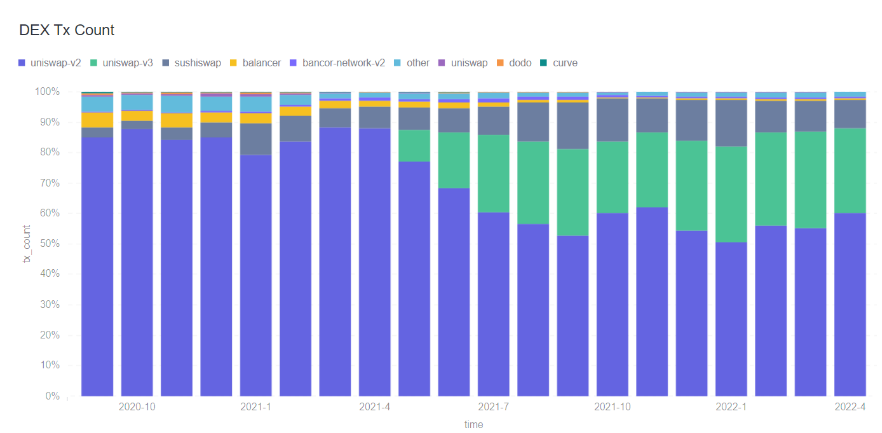

At present, the spot trading market of Ethereum is very saturated, and most of the trading activities are concentrated in the leading projects, and the threshold for new protocols is very high. From the initial experiments, such as the on-chain order book model, to the later constant product market maker (CPMM), it has been replaced by various new mechanisms:

AMMs with centralized liquidity, stable currency transactions led by Curve.fi, and later DODO, Uniswap v3, Curve v2 apply the model of centralized liquidity to non-stable currencies. (Of course, each protocol has design differences)

AMMs that support more than two assets, such as Balancer's constant average market maker

Automated market makers with gratuitous loss protection, such as Bancor

Constant market makers like Uniswap v2 and Sushiswap

DEX against MEV

DEX, etc. customized for retail investors or giant whales

Looking back, until the end of 2020, investing in Ethereum's spot DEX was a good opportunity. Starting in 2021, several outstanding teams have continued to enter this field. However, as more and more ideas come to fruition, innovative development does not seem to be enough to capture a larger market share.

image description

Source: IOSG Ventures, Footprint Analytics

(https://www.footprint.network/chart/DEX-Trading-Volume-fp-17021)

Source: IOSG Ventures, Footprint Analytics

(https://www.footprint.network/chart/DEX-Tx-Count-fp-17022)

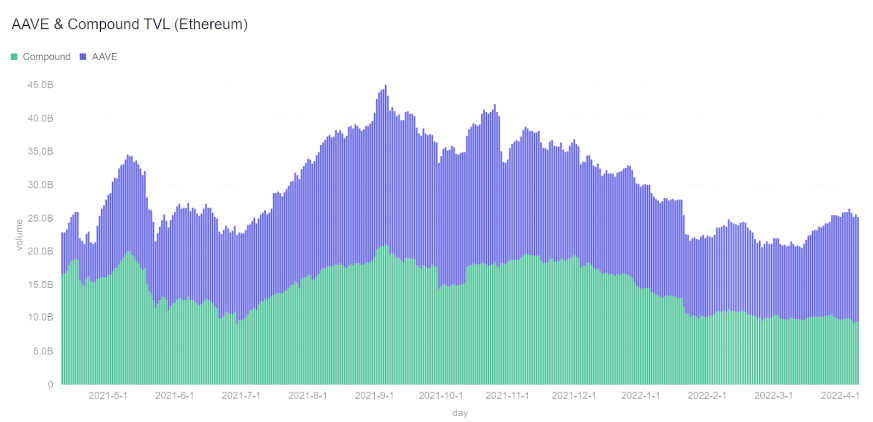

capital market

image description

Source: IOSG Ventures, Footprint Analytics

(https://www.footprint.network/chart/AAVE-%26-Compound-TVL-(Ethereum)-fp-17026)

Compared with the DEX of spot trading, the gameplay of the lending agreement has yet to be explored. The new agreement can provide more customized terms, dynamic parameter updates, and more diversified mortgages by reducing collateral ratios, combining DiD and credit scores Commodities (NFT collateral and the like) stand out.

More recently, Euler and Beta Finance have attempted to provide arbitrary lendable assets in a permissionless manner. The practical effect of this measure would be to enable traders to short more altcoins.

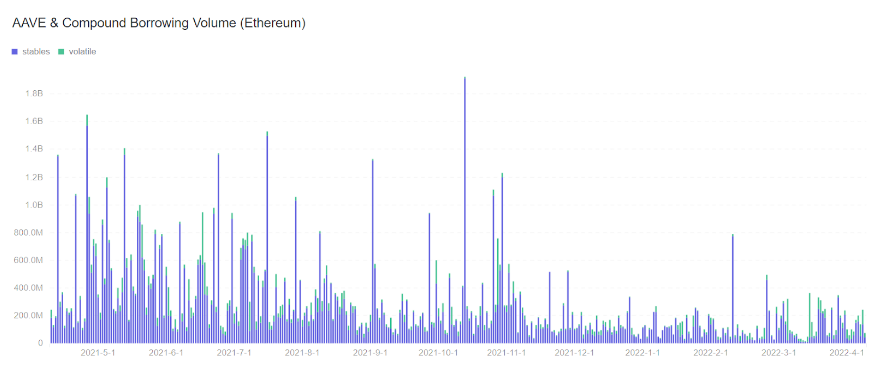

synthetic assets

Source: IOSG Ventures, Footprint Analytics

(https://www.footprint.network/chart/AAVE-%26-Compound-Borrowing-Volume-(Ethereum)-fp-17025)

synthetic assets

Broadly speaking, synthetic assets cover several important directions, such as financial derivatives, synthetic real-world assets, and stablecoins.

When it comes to derivatives, there are few other protocols that can compete with dYdX, even those that have only recently launched their latest versions. In addition, many of these protocols rely on expansion solutions, and the expansion solutions themselves are not yet fully mature.

Similar to spot DEXs and lending protocols, they took two to three years to reach wider market adoption. Derivatives exchanges established in the past 12 months may be able to achieve similar achievements in the next 12-24 months. The premise of this is that the technology stack is mature, and the protocol finds the correct product-market fit.

Synthetic real world assets (RWA) also struggle to find product-market fit, despite the narrative being based on democratizing the U.S. stock market and commodity markets more. Only when the time is right, that is, when there are more diverse user groups on DeFi, will it be possible for these decentralized futures protocols to achieve on-chain RWA.

The last point is that decentralized stable currency is still a direction that continues to attract the attention of many top talents. The failure of many algorithmic stablecoins has not stopped new protocols from making new attempts to build a more mature stablecoin system.

Some notable (but not necessarily successful) attempts in the direction of synthetic assets in recent times include:

dYdX Starknet Exchange

SQUEETH on Opyn

Liquity's Zero Interest Rate Synthetic Stablecoin

FEI's POL-based stablecoin

Primitive's Copy Market Maker

Ribbon's Option Vault

Perpetual Protocol v2

SynFutures & MCDEX's License-Free Futures AMM

Deri's perpetual options

first level title

Layer 2 DeFi protocol

In the Ethereum DeFi ecosystem, compared to other L1 or sidechains, L2 DeFi protocols have already entered the stage in 2021. They are defined as L2 because they are based on composability, without the underlying DeFi projects cannot exist.

Some DeFi L1 projects, such as Uniswap, AAVE, Opyn, Synthetix, have their own ecosystems and have attracted a large number of protocols to build on them.

For example, Uniswap v3 introduced the need for active liquidity management, so a series of protocols were developed with the idea of optimizing liquidity supply while allowing end users to enjoy passive income. Some examples are G-UNI by Gelato, Alpha vaults by Charm, Visor Finance, Teahouse, etc. Similarly, Izumi Finance is also building tools to help the protocol launch an incentive mechanism for liquidity mining on the basis of Uniswap v3 and achieve ideal liquidity distribution. These tools are not only important for the launch of new tokens, but also have a profound impact on protocols such as Perpetual Protocol v2 and Sense Finance that use Uniswap v3 as the base layer, aiming to provide incentives for liquidity providers to achieve efficient market making .

Other notable protocols are Tokemak and Convex, which are built on spot markets. The former is trying to position itself as a meta-liquidity aggregator, while the latter is part of the Curve.fi ecosystem and is one of the largest shareholders of the CRV token.

first level title

DeFi Map; Source: IOSG Ventures

create sustainable income

image description

Ribbon Finance TVL; Source: defillama.com

Vovo Finance, for example, aims to remove reliance on centralized market makers and build principal-guaranteed products on top of existing spot and derivatives exchanges. As mentioned above, lending protocols are able to attract billions of dollars in funding because they offer stable yields without threatening the principal of liquidity providers. Therefore, for principal protection, Vovo has the potential to attract a large amount of TVL, while allowing users to obtain income.

Finally, structured products have broader implications and implications for the entire DeFi economy, namely that the increasing supply of capital in DeFi protocols reduces yields. For example, at the time of writing this report (mid-April 2022), stablecoins Compound and AAVE generally have APYs below 3%. The APY of Curve.fi 3pool is estimated to be around 0.5%, and 1.18% including CRV mining rewards.

Since the aforementioned protocol is the DeFi version of a risk-free rate, it’s no wonder capital has been pouring into their smart contracts and dropping yields to levels offered to TradFi banks.

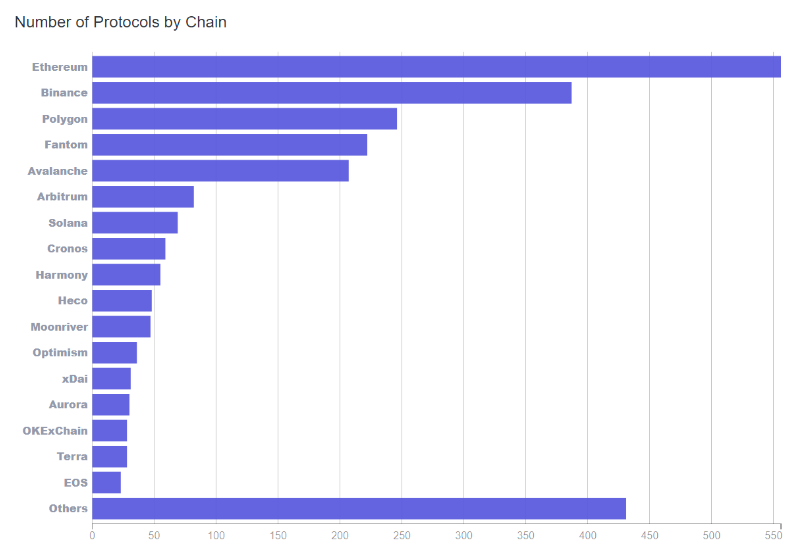

image description

Federal Funds Effective Rate, Historical Data;

Source: https://fred.stlouisfed.org/series/FEDFUNDS

What happens if you join the central bank and start tightening monetary policy? Assuming that most of the new capital entering DeFi in search of yield in 2021 is institutions, the increase in interest rates will make the current TVL of DeFi unsustainable, so a large amount of capital will flow out to the off-chain economy.

If DeFi wants to maintain the current TVL level, it must find additional sources of income.

At present, the income of DeFi mainly comes from the following activities:

Spot trading (earn income by providing liquidity to spot DEX)

Leveraged long demand (loan agreement, perpetual contract).

Short selling demand (lending agreement, perpetual contract)

Yield farming, such as borrowing a specific token, is required for yield farming protocol X while still maintaining exposure to collateral.

Other (building a Ponzi economy to generate revenue, borrowing against collateral to support operations, etc.).

first level title

Multi-chain DeFi

Multi-chain expansion has been a bright spot in 2021, with BSC, Polygon, Terra, Avalanche, and Solana dominating the discussion. While most of these chains position themselves as competitors to Ethereum, the Polygon leadership and community have opted for the "Pro-Ethereum" narrative, even announcing an ambitious rollout roadmap and positioning themselves as leaders in the modular blockchain approach. one of them.

The main driver of multi-chain expansion is the slow progress of Ethereum’s native scaling solutions, which opens up a certain window of opportunity for competitors/sidechains to capture some of the market share.

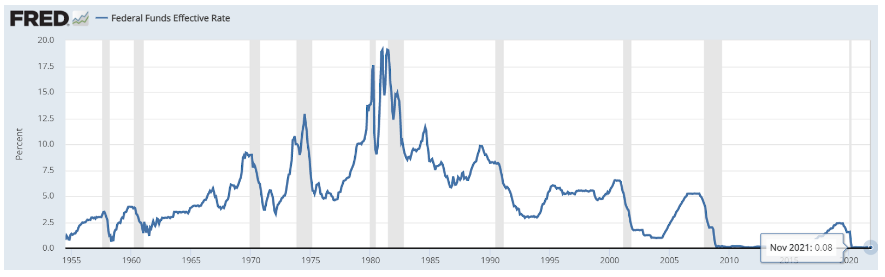

While TVL is most widely used to explain activity on a single chain, the metric has certain drawbacks. Since TVL usually refers to the amount locked in the native token of a particular L1, the price appreciation of the token naturally leads to an increase in TVL, which further causes speculators to drive up the token price.

image description

Source: The Block

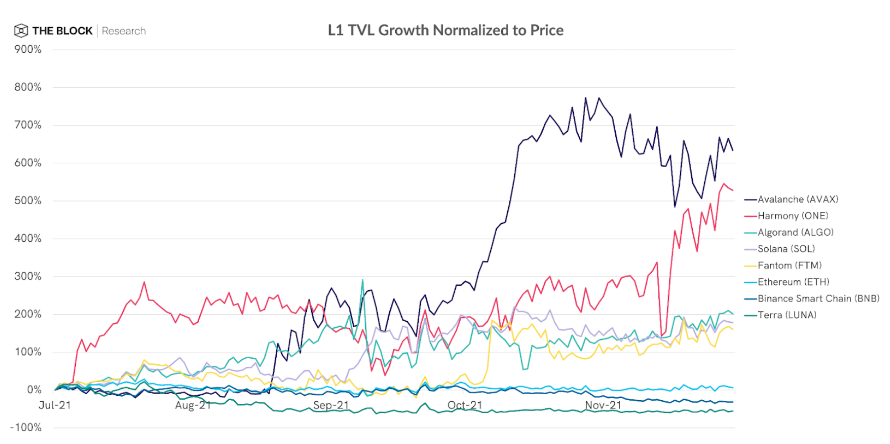

image description

Source: Footprint Analytics

(https://www.footprint.network/guest/chart/Number-of-Protocols-by-Chain-fp-66347dc7-530f-43c5-a9f5-80227f1ff432)

The development progress of other chains lags behind Ethereum by more than 12 months. New chains will have to stand the test of time in order to prove themselves sufficiently secure to large capital providers. If we compare the returns of stablecoins on Solana and Ethereum, the risk comparison is clear. For example, Solend, the largest money market protocol on Solana, offers 2-3 times larger APY on USDC and USDT than AAVE. This gap suggests a larger implied risk premium for interacting with new protocols on a new chain.

Any chain that seeks to compete with Ethereum must rebuild the Ethereum DeFi map. So while the Ethereum DeFi ecosystem has been trying to explore new primitives and build vertically, most other L1s are replicating the Ethereum DeFi map.

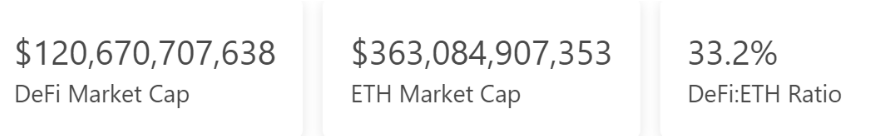

If we look at the market capitalization of DeFi tokens, the dominance of Ethereum DeFi is also very obvious, and only 4 of the top 20 token assets are non-Ethereum.

first level title

Multi-chain dApps

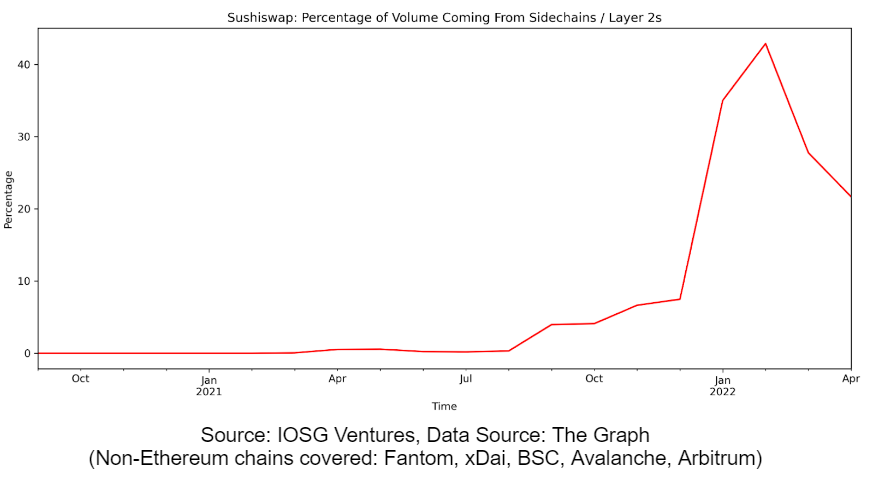

The emergence of well-capitalized EVM-compatible chains has led to the expansion of Ethereum-native applications in multiple ways. Sushiswap is the first protocol to advocate aggressive scaling.

Sushiswap is present on more than 15 chains, yet it has struggled to become the dominant DEX in the new ecosystem. Because in general, DEXs that only focus on one specific chain tend to attract more interest. Therefore, Pancake Swap, Trader Joe, Quick Swap, and SpookySwap are positioned as the number one DEX on BSC, Avalanche, Polygon, and Fantom, respectively, while Sushi is generally the second. This happens because each of these protocols only focus on one specific chain, so they are able to centrally allocate all resources, including new token rewards, to attract users and build communities on the new chain, And Sushiswap has diluted attention in many places.

image description

Source: IOSG Ventures, Data Source: The Graph

(Non-Ethereum chains covered: Fantom, xDai, BSC, Avalanche, Arbitrum)

Do scalability solutions deliver on their promises?

The main promise of a scalability solution is to make blockchain usable for everyone. To test how well altchains are achieving this goal, we observed activity on Polygon.

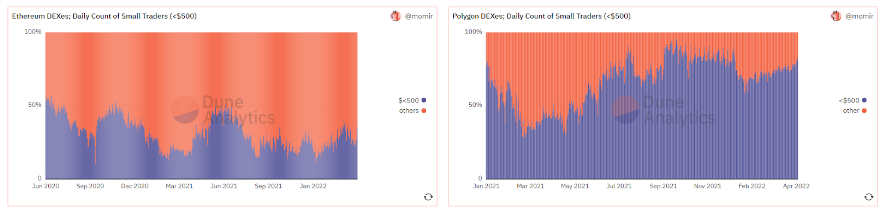

We used $500 as the threshold to identify small traders and observed how many traders fit into this category each day.

image description

Source: IOSG Ventures, Dune Analytics

(https://dune.xyz/momir/DEX-Users)

Based on the conclusions drawn from Polygon’s example, we can answer the above question with certainty: yes, alternative chains have fulfilled their promises.

first level title

Source: IOSG Ventures, Dune Analytics

(https://dune.xyz/momir/DEX-Users)

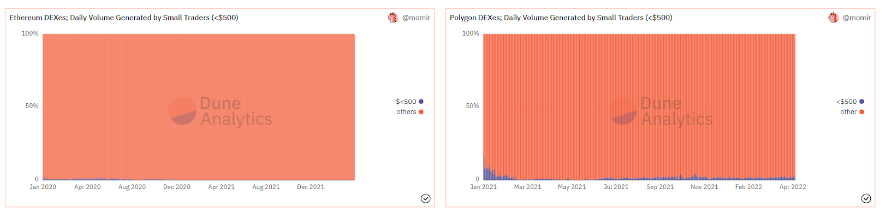

One whale is worth ten thousand turtles: the 90-4 rule

On Ethereum, whales (those addresses generating more than $100,000 in transaction volume per day) account for less than 4% of traders (approximately 3,000 addresses per day), but they contribute nearly 90% of all Ethereum DEXes total transaction volume.

image description

Source: IOSG Ventures, Dune Analytics

(https://dune.xyz/momir/DEX-Users)

Even though Polygon DEXs recorded more traders in certain months, Ethereum DEXs combined still generated several times the volume of Polygon. The main reason for Ethereum’s dominance is not to have the most users, but to be the chain of choice for big capital.

first level title

Source: IOSG Ventures

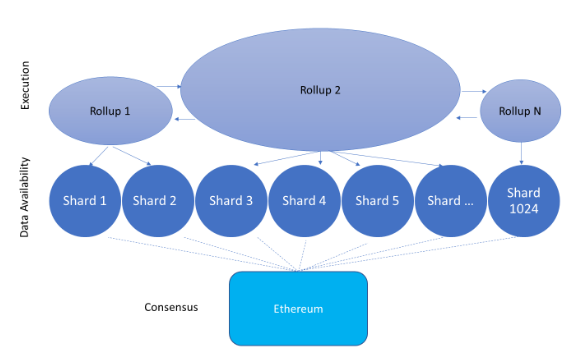

Source: https://vitalik.ca/general/2021/04/07/sharding.html

finale

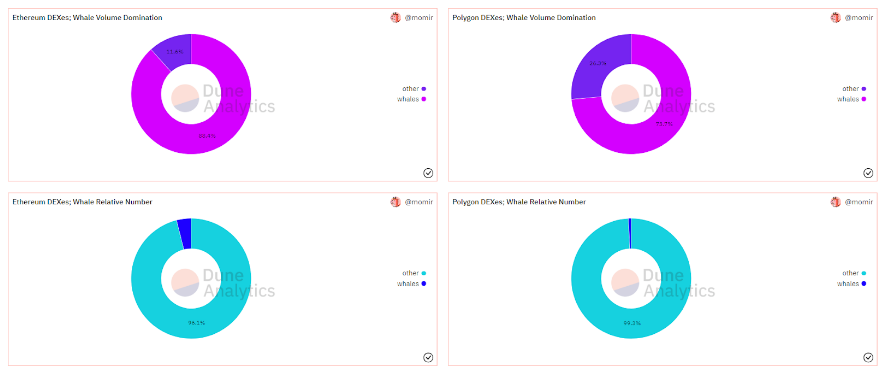

Security is critical for financial applications and high-value transactions.

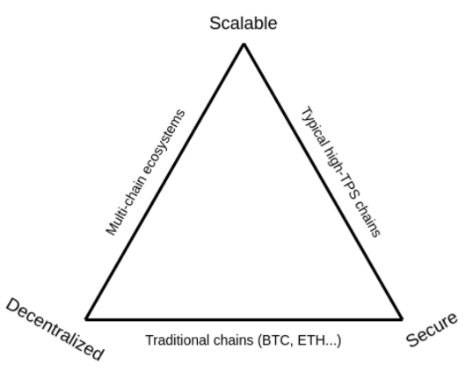

While some altchains have managed to create the “cold-boot their own DeFi ecosystem by finding vacancy on the blockchain Trilemma” narrative, Ethereum remains focused on decentralization and security. Critics often justifiably attack ethereum as inflexible, pointing out that at its current scale, ethereum will not be able to become a global settlement layer.

This problem has led to a lot of innovation, from sharded blockchains such as Near and Zilliqa, to application-specific chains such as Polkadot and Cosmos, to single-chip highly scalable solutions such as Solana, EOS, etc.

However, while each of these solutions brings certain improvements in terms of scaling, it is impossible to claim that any one chain is a viable solution for global/mass adoption. The following issues still exist.

1) Economic Sustainability - The large discrepancy between inflationary rewards and transaction fees casts doubt on the ability to maintain low fees in the long run

2) Scale up - supporting high throughput of a single chain will inevitably lead to increased requirements on node operators, which will naturally exclude many who can keep up with the hardware requirements, eventually leaving only a small number of trusted people.

People Providing Security for Whales vs. Whales Providing Security for People

In 2022, the irony is that highly decentralized blockchains, like Ethereum, are priced at prices that exclude ordinary users from participating, while more centralized chains, like BSC, Solana, or Polygon, is open to the public.

first level title

The Magic of ZK Technology

Blockchains have traditionally achieved zero trust by adding redundancy and having a large number of computers perform the same computation. The greater the number of computers performing computations, the more decentralized the network becomes, however, this places a burden on the scalability of the network.

What if the computation could be performed by only one computer while still maintaining the security assumptions of the most decentralized and tried-and-tested blockchains?

"Any sufficiently advanced technology is indistinguishable from magic."

The modular blockchain theory with Rollup as the core is achieving the above goals. The impossible triangle of blockchain has become an obsolete question, as future applications will be able to take full advantage of all three: scalability, decentralization, and security.

Furthermore, the modular blockchain theory could be the biggest paradigm shift in the industry and is the only viable solution that can drive mass adoption of blockchain technology without sacrificing its fundamental principles.

Rollups enable scalability without worrying about the friction of economic sustainability, scaling out, and composability.

first level title

Source: IOSG Ventures

A Catalyst for DeFi Adoption on Rollup Solutions

If a new global financial system serving billions of people were to be built entirely on the blockchain, then Rollup seemed the only logical choice that could support low-cost instant transactions without sacrificing security and decentralization assumptions .

However, it will take at least 10+ years to realize this vision. At the same time, Rollup had to compete for existing crypto audiences and applications. Additionally, some authors predict that Rollup will encounter difficulties in adoption in the short term, especially since sidechains offer extremely low fees, which help them attract low-income users who may not be sensitive to decentralization and security concerns.

However, cost may not be a critical factor for widespread adoption of a particular Rollup solution, ie the lowest cost Rollup may not have a dominant market share. From a Layer 2 project perspective, network effects should take precedence over low fees.

Achieving network effects has several prerequisites:

The long-term vision should align with Ethereum

Deploying Ethereum mainnet code should be easy for developers

Proven technology that will make big capital providers indifferent between participating in mainnet or Rollup

first level title

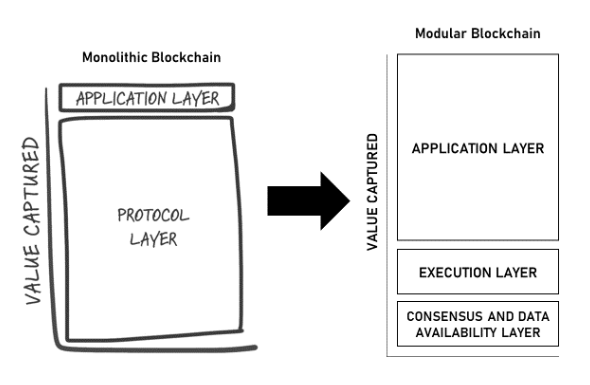

fat application theory

Regarding Rollup, the short-to-medium term is relatively vague and uncertain, while the long-term is relatively clear.

Monolithic chain has the following options:

Adjust their roadmaps to incorporate a modular and Rollup-centric approach: While some blockchains, such as Near Protocol, can function well as data availability layers, other execution-focused blockchains can benefit by becoming Rollups themselves unleash great potential,

Relying on memetics, exerting the stored value,

Or risk being eliminated.

In some creative scenarios, we can even imagine some centralized exchanges like FTX becoming decentralized, computing ZK proofs, and publishing them to the data availability layer. The best thing about this technology is that it completely opens up the design space and is no longer limited by a specific smart contract language.

image description

Source: coingecko.com

Such a situation is not only due to speculation, but its root cause is closely related to the single blockchain. That is, if we price a layer network in a manner similar to valuing equity, basically the market cap should equal the present value of expected future cash flows.

To put it simply, let's say there is a $5,000 transaction on Sushiswap. Sushiswap will charge a transaction fee of $15, of which only $2.5 is protocol income, and the rest is income from liquidity providers. Depending on network congestion, such transactions can generate fees for miners in excess of $100, which is almost 50 times the revenue of the protocol.

image description

Source: https://tokenterminal.com/terminal/metrics/protocol_revenue

However, modular blockchains break the above relationship:

Due to advanced technology, we think the ecosystem of projects built on rollups, validium, etc. will become larger, and due to the economies of scale associated with ZKrollups, in a thriving ecosystem, projects will pay very little to the security layer cost of.

By paying a fixed fee to the base layer, the combined value of the application may be several times greater than the value of the base layer.

Original link

Source: IOSG Ventures; Illustration inspired by the original Fat Protocols thesis