Terra falls apart, what about ecological projects?

Looking back at the development of Terra in the past year, the price of LUNA reached a maximum of 119.18 US dollars, and its market value once reached 41 billion US dollars. Its ecological industry has launched more than 100 projects, involving DeFi, Metaverse, games, NFT, etc., of which DeFi projects account for big head.

According to DeFi Llama data, Terra's TVL reached 31.35 billion U.S. dollars at the highest, ranking second. Due to its high participation and capital volume, Terra DeFi was also given the title of TeFi. In addition, the TeFi project needs to use UST as the main stable currency for its liquidity pairs, so this also accelerates the use of UST. The market value of UST has also grown from US$180 million in early 2021 to US$18.7 billion in early May 2022, and is in the algorithmic The leading position in the stablecoin sector.

Additionally, most of the protocols launched on Terra are native protocols on the chain. This also proves the attractiveness of the Terra chain to developers.

secondary title

Affected by the decoupling of UST, the Terra ecology collapsed

Since UST is the main stablecoin used as a liquidity pair in the Terra ecosystem, the UST decoupling event has a huge impact on the DeFi projects on Terra, and any DeFi projects with a liquidity pool composed of UST and LUNA will be hit hard.

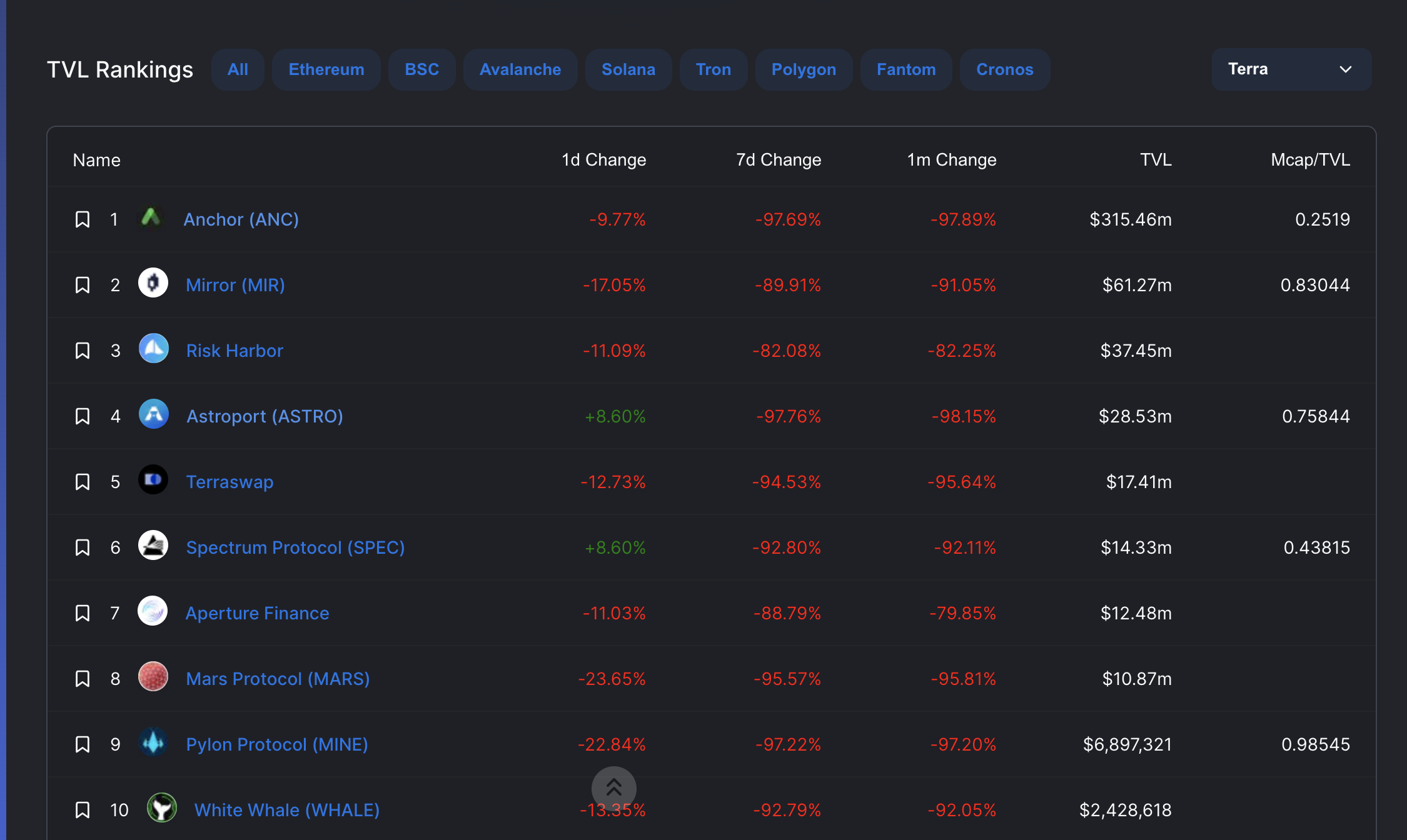

According to DeFi Llama data, Terra TVL has dropped to US$500 million, and the top 10 protocols in its ecological TVL have all shrunk sharply, with an average 7-day drop of about 93%.

Anchor is the most important lending agreement in the Terra ecosystem. Its special feature is that you can get about 20% APY just by depositing UST into Anchor. Anchor stabilizes this rate through the rewards of multiple PoS chains. Therefore, a large number of investors flock to the Anchor protocol, wanting to obtain stable income through deposits.

As of May 5th, Anchor TVL rose to 17 billion US dollars, while the market value of UST was 18.7 billion US dollars at this time, which shows that almost all UST in the market has been deposited in it, and it can also be seen that Anchor and Terra chain The degree of ecological correlation is very high, and it affects the whole body.

Today, the decoupled UST can no longer maintain its 20% APY, a large number of users have withdrawn funds from Anchor, and its TVL has plummeted from $17 billion to around $300 million, a drop of 98%. The native token ANC has also dropped from $2.18 to $0.22. To avoid a further crash, Daniel Hong wrote an "emergency proposal" recommending that Anchor amend its interest policy to protect its yield reserves from being depleted.If the proposal passes, Anchor will implement a 4% target rate. However, it will not be a fixed rate of return, but will be maintained between 3.5% and 5.5% depending on the demand for the service and the amount of the yield reserve.But that's a far cry from its previous APY of 20%. Without such a tempting condition, even if Anchor can survive this level, it will never be able to return to its original state.

Both Astroport and TerraSwap are the AMM DEXs of the Terra ecosystem, facilitating the exchange and flow between all assets on Terra. Among them, Astroport accounts for more than 75% of all DEX liquidity on Terra. According to the Messari report, LUNA-UST and bLUNA-LUNA are the two top trading pairs on Astroport. They account for almost 90% of the transaction volume on Astroport.The price drop of LUNA and UST this time also had a huge impact on Astroport, with a sharp decrease in liquidity and a drop of about 98% in its TVL.

In addition, there is Nexus Protocol, a yield aggregator on Terra, whose treasury has liquidated approximately 395,000 bLUNA, 70 bATOM, and 1900 bAVAX.According to preliminary calculations, the total loss of Nexus Protocol is approximately US$600,000.

What's more serious is that part of Terra's agreement adopts the form of Lockdrop, which allows users to lock UST in the agreement in exchange for token rewards when the agreement starts, but these USTs have not yet reached the unlocking time, and Terra will face the risk of stopping block production at any time (the fact has been suspended twice), the user hopes to unlock UST in advance to recover part of the loss appropriately,In the face of a large number of UST being unlocked, it will bring more selling pressure to the market.This puts a lot of pressure on users and protocols.

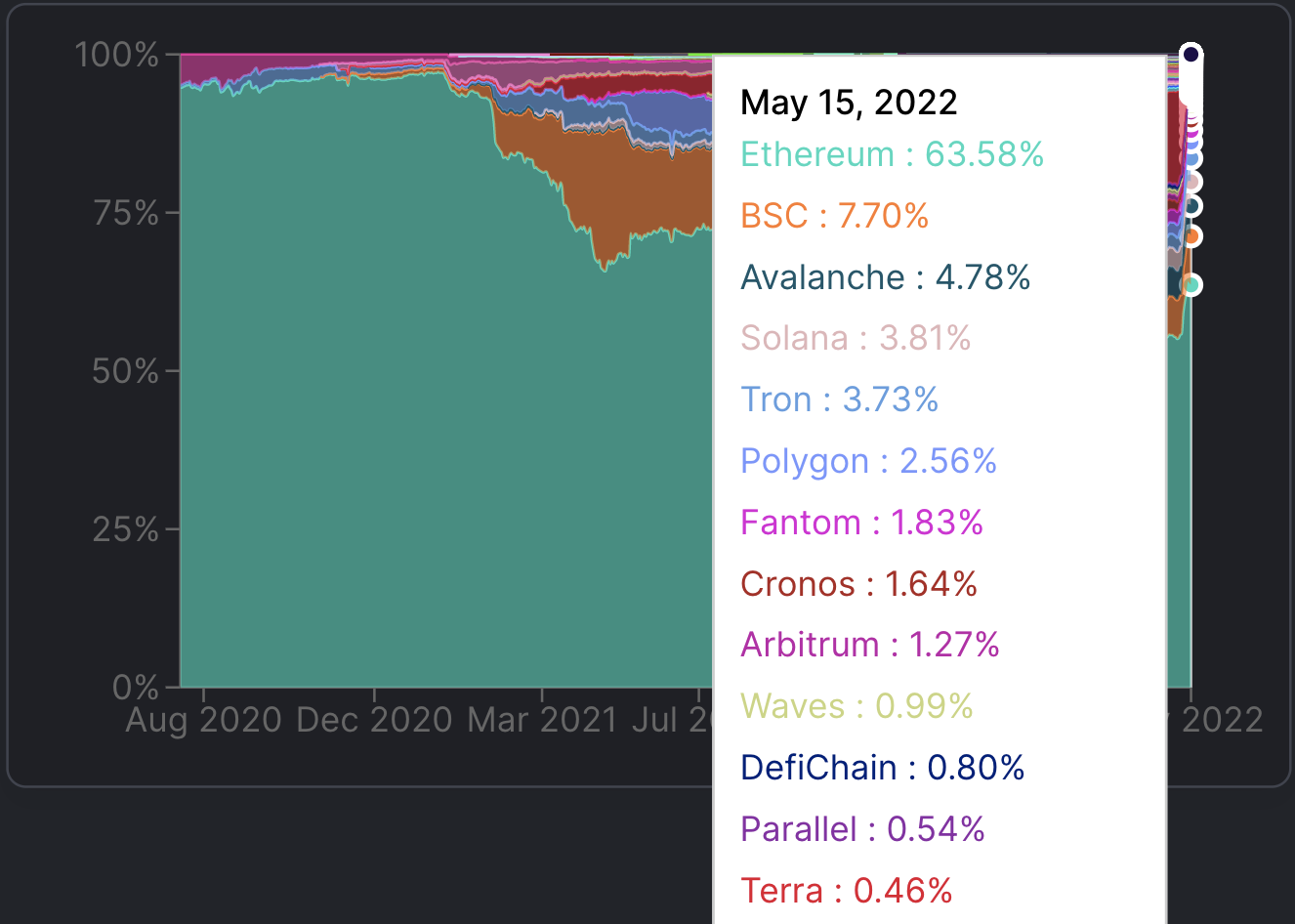

From the perspective of the entire market, the TVL of the Terra chain has dropped to 0.46% of all public chains, and has a huge impact on most non-Terra chain DeFi projects.Among them, the total weekly TVL of lending agreements fell by 68.85 billion US dollars, a drop of 38%.secondary title

Where does the Terra developer go from here?

Looking back on Terra over the past year, hard-working developers, radical leaders, support from leading institutions, and an upward trending encryption market have all played an indispensable role in the rise of Terra. But most important is its core promise to build a range of financial applications around UST, and the Terra Empire is built on this firm belief.

When UST is decoupled, the Terra ecology collapses, and various applications are liquidated, this belief is also gradually collapsing, which is also a fatal blow to the ecology builders. Should we continue to wait for Terra's follow-up solution to revitalize the ecology, or should we abandon Terra and find another way? Developers must also plan ahead.

In the recent Terra proposal, the team will initiate a Terra hard fork to protect the community and developer ecosystem by reorganizing the chain without a stablecoin.Do Kwon believes that the top priority now is to maintain the stability of the Terra chain and keep as many developers as possible.Then we will discuss the issue of decentralized currency. That is to say, Do Kwon is going to give up UST temporarily.But maintaining the Terra ecosystem without a stablecoin could pose significant risk and cause value destruction.

First of all, Terra considered the role of UST at the early stage of construction, and all the ecological applications it led to develop point to a common indicator: to make UST as widely adopted as possible in the world, so most DeFi projects are associated with it close.If the UST is abandoned, then most protocols may not function properly.Re-deployment is required, which requires time, money and manpower, and is a huge challenge for developers.

Secondly, it can be said that most Terra developers are attracted by the financial ecology built by UST, and they stay on Terra for common interests and beliefs.If Terra is hard forked, a community without a common belief will have to face a situation where different stakeholders cannot agree, there will be disputes caused by community governance chaos, re-forking, user loss, etc., which will further lead to the loss of ecological value and fragmentation of the community.

Things have fermented to this day, the Terra ecosystem has begun to split,Many protocols on Terra are exploring new outlets - migrating to other public chains。

The most discussed new home is the universe. Since Terra is a Cosmos SDK blockchain using the Tendermint consensus, and Terra also activates the IBC function, assets and data between Terra and other chains that support IBC (such as Cosmos Hub, Secret Network, Juno Network, etc.) seam transfer. Therefore, the same underlying technology and close ecological connection make most people thinkThe Cosmos ecosystem is the best choice for Terra developers。

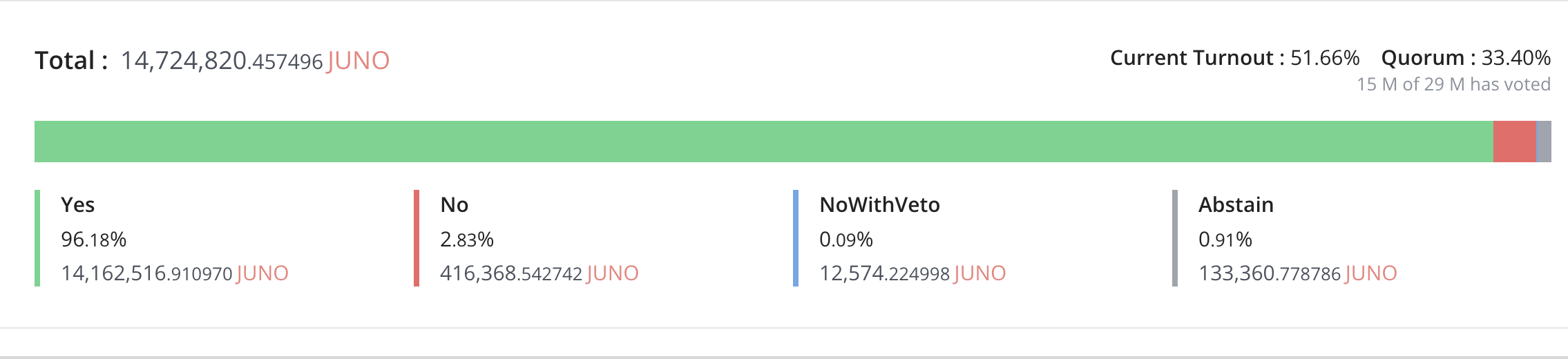

For example, Juno Network, the Cosmos ecological smart contract public chain, said that several Terra projects have contacted them and are interested in migrating to Juno Network for development. Therefore, Juno Network proposed the LUNA Community Rescue Plan, which will allocate a total of 1,000,000 JUNO (700,000 JUNO from the Juno Community Pool, 300,000 JUNO from the Juno Development Fund) to Terra Developer Fund Multi-sig for project migration and Juno ecosystem development. Continuous development. In addition, Juno Network also plans to establish a development DAO for these developers, hoping to help the community and developers out of the current predicament. As of 8:30 am on the 16th, the proposal has a support rate of 96.18%, and the voting will end in 4 days.

At the same time, Stargaze, an NFT market based on Cosmos, also stated that it is developing tools and development funds to help the Terra project migrate.

This advantage of Cosmos quickly attracted the attention of some Terra projects. For example, Kujira, a liquidation mortgage agreement on Terra, decided to use the Cosmos ecosystem and Cosmos SDK to build its own sovereign L1 chain to quickly restart and run.

In addition, there are other public chains throwing olive branches to Terra developers. For example, Kadena is also preparing to provide $10 million in funding to attract Terra developers. The Fantom official also expressed that it welcomes the Terra Luna project looking for a new chain and can provide a funding plan. Ryan Wyatt, CEO of Polygon Studios, also tweeted that he is working with many Terra projects to help them quickly migrate to Polygon, and will invest money and resources to help them migrate.

Some developers are also actively seeking a way out. The pledge agreement Stader and the NFT project Stoned Ducks Lifestyle Club decided to migrate to the stable development of Ethereum. Many NFT projects on the Terra chain value Solana's NFT ecosystem, as well as its strong foundation in community and DAO, and decide to migrate to Solana, such as HellCatsNFT, Hero NFT, Smoked Ape, GenesisWolfNFT, etc.

Related Reading

Related Reading

Start the death spiral or the end of the stress test? Can UST be saved?

On the verge of death, Terra broke his arm to survive

A new proposal from the Terra community proposes to issue new LUNA tokens to the community

From peak to collapse, UST's roller coaster rideFrom peak to collapse, UST's roller coaster ride