Twelve Lessons From the Terra Crash

Original author:The DeFi Edge

Original author:

Compilation of the original text: The Way of DeFi

This is the lesson I learned from the events of the Terra Luna debacle.

First, I need to emphasize that this is not a "I tell you how to do it" topic.

5% of my portfolio is in Luna

15% of my portfolio is in UST

I quit at a loss last night.

I am writing this mainly to share how I have updated my cryptocurrency investing thesis based on the events of the past few days.

avoid personality cult

The founders of these cryptocurrency projects became popular through charisma, prowess, and meme mastery.

Skyrocketing token prices and solid partnerships make their words more authoritative.

But what's the problem?

It is the past success of these people that leads to their narcissism and arrogance.

We've seen this with Frog Nation, Solidly, Node Projects, and now Luna.

These founders are not good at taking criticism.

These founders and their followers will choose to attack anyone who criticizes what they are trying to build.

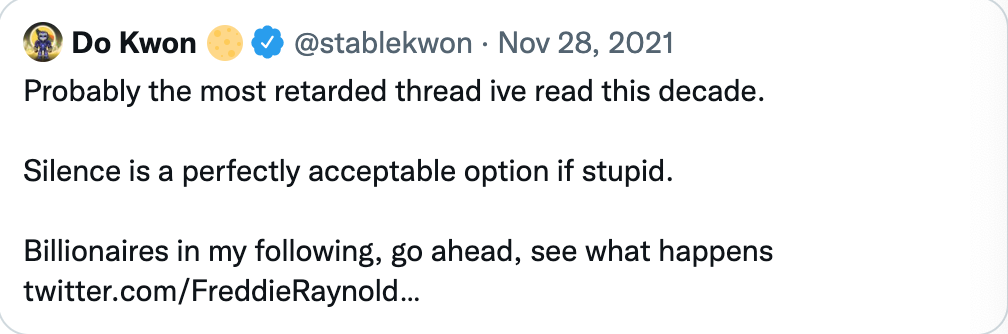

This is probably the most mentally handicapped subject I've read in ten years.

Silence is a perfectly acceptable option if the topic is too silly.

Billionaire among my fans, go see what happens

There is no room for healthy debate here

We've seen @banklesshq, @gametheorizing, @JackNiewold, @algotrading, and other crypto accounts get hacked for criticizing Terra.

There were fewer voices of doubt, because "it's not worth dealing with those crazy followers".

Risk Management

Risk Management

I'm amazed at how many people have "broke and stud" on the Luna and Anchor protocols.

You can't put all your eggs in one basket, and you should never devote yourself to anything.

There is no guarantee that any asset, whether cryptocurrency or non-cryptocurrency, will always retain its value.

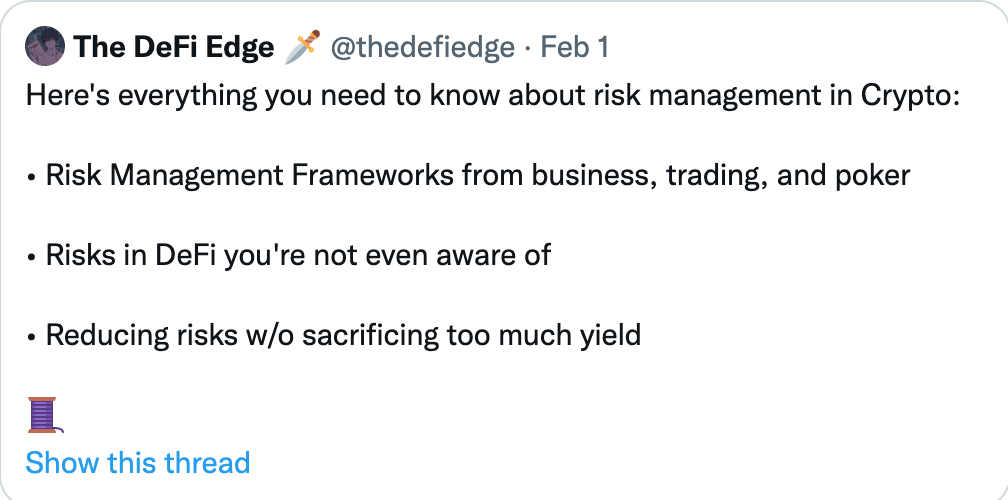

Here's everything you need to know about risk management with cryptocurrencies.

Risk Management Framework from Business, Trading and Poker

Risks in DeFi You Don't Even Realize

Reduce risk without sacrificing too much benefit

Create your own system

My own system has a rule: no one token will ever have a position greater than 15% of my portfolio.

My position in UST has never exceeded 15% of my total position.

If it weren't for this rule, I would have allocated more funds to UST and the Anchor protocol.

Create your own rules so you can protect yourself from emotions and prejudices.

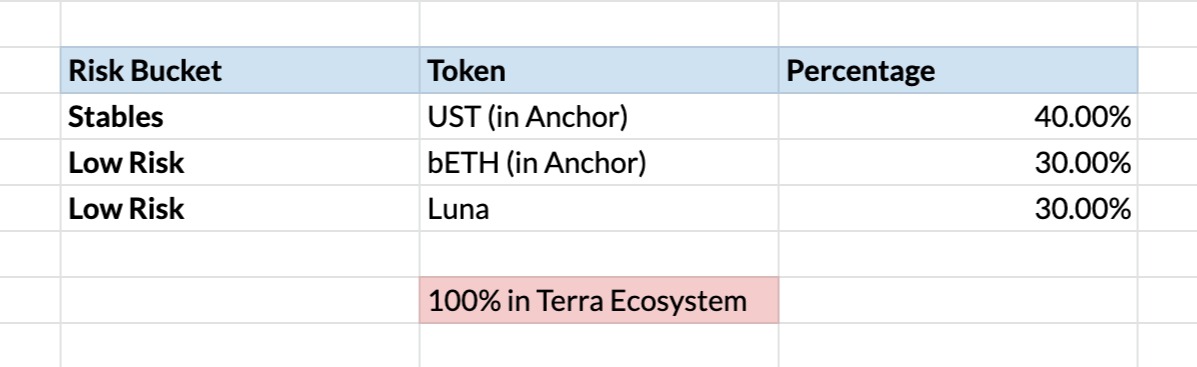

ecosystem blind spots

They hold Luna

The stablecoin they hold is UST

They have ETH and AVAX as collateral

In their own eyes, they are pluralistic.

They don't realize that their stake in the Terra ecosystem is too high.

What are blue chip cryptocurrencies?

I previously considered Luna and AVAX to be blue chip cryptocurrencies.

But I was wrong.

A cryptocurrency needs to survive at least two cycles (and be in an uptrend) to become a blue chip cryptocurrency.

Currently, the only blue-chip cryptocurrencies are Bitcoin and Ethereum.

(don't get me wrong, I still like AVAX)

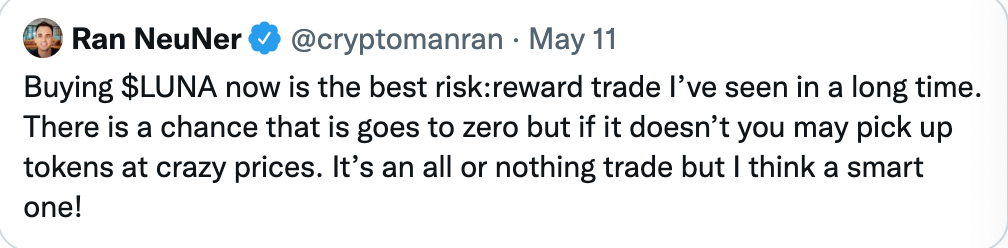

Don't try to lick blood on a knife's edge

Luna's price dropped from $85 to $50, then down to $20, and now it's at $0.07.

It may be tempting to try to buy Luna at a "relatively cheap price", but in doing so you are essentially comparing its real-time price to its all-time high, which you think will go up.

Iron men, when the price of the currency drops rapidly, get out of the car quickly.

Buying LUNA right now is the best risk-reward trade I've seen in a long time. It has the potential to go to zero, but if it doesn't, you could pick up a bargain at an insane price. It's an all or nothing deal, but I think a smart one!

don't use leverage

Many veterans in the currency circle were ruined overnight because they used leverage.

People always think they can pay back to maintain a healthy ratio.

We saw how quickly Luna's price collapsed

Bank run leads to network congestion

So don't use leverage, no exceptions.

The Risks of Stablecoins

I mainly hold UST, USDC and some Dai for my stablecoin positions.

I should have diversified my stablecoins more, but I didn't because I wanted to keep it simple. 🤦

I will be diversifying my stablecoins more across bUSD, Frax and other stablecoins.

Every stablecoin has its own risks:

USN is new

USDC is centralized

USDD is Justin Sun's project

The best way to do this is to diversify your stablecoins and spread out as much risk as possible.

I intend to cap the cap at 5% per stablecoin.

Stablecoins will continue to come under attack

Some speculate that this Luna and Ust debacle was a coordinated attack on UST.

If this is true, expect more attacks on stablecoins in the coming years.

Centralized powers don't want decentralized currencies to succeed.

You need to adjust your risk accordingly.

Be alert to the risks of founders with black history

Everyone knows that the projects of anonymous founders have certain risks.

I underestimated the risk of a founder with a dark history who may have done some shady things anonymously in the past.

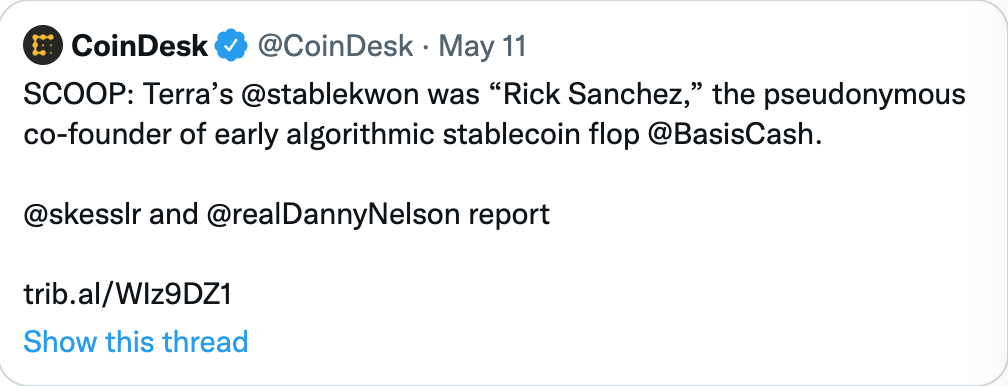

SCOOP: Terra's @stablekwon is "Rick Sanchez," the anonymous co-founder of @BasisCash, an early algorithmic stablecoin failure.

Reporting by @skesslr and @realDannyNelson

"Too Big To Fail"

Terra is the top ten currency by market capitalization

It is backed by a lot of top venture capital, such as Three Arrows Capital/Jump Capital

They have partnerships with AVAX, Lido, and countless others

"I think Terra has become too big to fail, especially after UST unanchored on May 21st, the project side defended it, and then UST re-anchored."

lol we should be maximalists for bitcoin or ethereum

The maximalists want to take this opportunity to kick off the players of the copycat public chain.

Solunavax and other new public chains have been doing incredible things over the past year.

If you invest in them early and make a profit, you will be rewarded.

There's some survivor bias here.

It depends on when you buy, where you profit, and which coins you invest in.

I like bitcoin and as a store of value, but not for maximizing profits.

This can be boiled down to your own investing style:

Want the easy way to invest? You can buy Bitcoin and Ethereum with dollar cost averaging (fixed investment), then forget about it, and look at it in a few years.

Want to further optimize your profits? (With more risk) Invest in solid public chains or altcoins cheaply and put profits into Bitcoin, Ethereum and stablecoins.

the past few days have not been easy

I've been through a few cycles and this feeling is familiar.

Cryptocurrency prices always come back.

The next cycle may be with a different coin, but the market always bounces back.

If you survive this level and you're still in the game, you've earned your spot.

Tiezi, we must bear in mind the lesson.