Can the Governance Token OP explore the on-chain ecology for Optimism?

Although the encryption market is in a downward trend, the Layer 2 expansion network built with Rollup expansion technology has taken frequent actions, and has successively announced plans to issue governance tokens.

First, on April 27th, Optimism, which was developed based on the "Optimistic Rollup" expansion technology, announced that it would issue the governance token OP and airdrop part of it to the community; then on May 9th, the expansion solution based on "ZK Rollup" was launched zkSync stated that it will issue governance tokens, but the specific time has not been disclosed.

Optimism became the first Layer 2 network to implement governance tokens. According to public information, the initial supply of its governance token OP is 4.294 billion, and the total supply will expand at a rate of 2% per year. 19% of the initial supply OP will For airdrops, 5% of which were airdropped to the community in the first round, and the other 14% will be distributed in the future.

Despite the issuance of governance tokens, the total value locked (TVL) on the Optimism network is currently not high.

At present, among the four Layer 2 networks represented by Rollup technology, Optimism, Arbitrum, zkSync, and StarNet, Arbitrum’s TVL is the highest at $3.168 billion, and Optimism’s TVL is $580 million, ranking second. zkSync and StarNet’s on-chain ecology Still in beta.

Like Arbitrum, Optimistic Rollup expansion technology is also adopted, but the TVL on the Optimism chain is far from that, mainly because the Optimism network has set a whitelist requirement for imported applications in the early stage, which restricts the entry of developers and also limits the ecology of the chain. prosperity.

At present, the whitelist restriction has been lifted, and the Optimism network has allowed developers to freely build and deploy applications. It has also issued OPs, and plans to provide occasional airdrop rewards to users of applications on the chain. In addition, the network has also set up a special governance fund organization, through which rewards will be distributed to applications on the chain to stimulate ecological development.

In fact, before the issuance of OP tokens, there were already developers on the Optimism network. However, because its on-chain ecological applications are mainly built around the synthetic asset protocol Synthetix platform, and these derivative products are mostly options and contract applications, etc., The mechanism is not friendly enough for ordinary users, so there is no popular product.

first level title

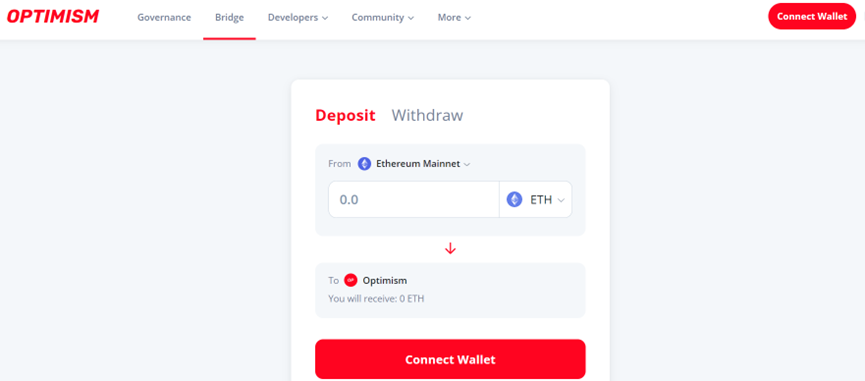

Official cross-chain bridge Optimism Bridge

image description

Optimism Bridge

In addition to supporting asset cross-chain, Optimism Bridge also provides users with access to other fund entrances, including the two paths of "purchasing encrypted assets by credit card" and "directly recharging assets on a centralized exchange platform (CEX)". The latter path accommodates Platforms include Binance, Coinbase, FTX, etc.

first level title

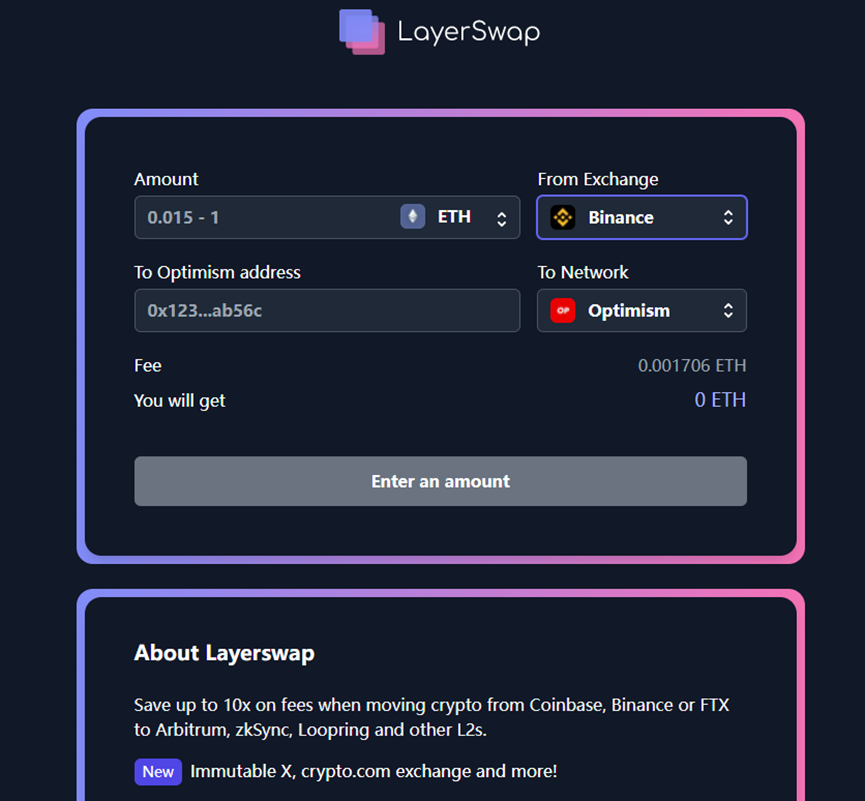

CEX direct charging tool Layerswap

Layerswap is a tool for directly withdrawing encrypted assets from a centralized exchange (CEX) to the Layer 2 network, developed by Bransfer, a basic service provider for encrypted payments.

At present, mainstream CEXs do not support users to directly recharge encrypted assets to Layer 2 networks such as Optimism, Arbitrum, zkSync, etc. If users want to enter them, they often need to extract encrypted assets from CEX to Ethereum wallets first, and then pass The chain bridge transfers assets from Layer1 to Layer2 network. Such a process increases the operation steps, and also increases the transfer cost, including the handling fee from CEX to the Ethereum network, the cross-chain bridge handling fee required for cross-chain, and the gas fee when Layer1 transfers to Layer2.

In order to solve the above problems, Layerswap was developed to support users to transfer encrypted assets directly from CEX to Layer2 network. Currently, the CEXs supported by Layerswap include Binance, Coinbase, FTX, OKX, etc., and the supported Layer 2 networks include Optimism, Arbitrum, and zkSync.

image description

Layerswap

It should be noted that Layerswap currently only supports the withdrawal of assets from CEX to the Layer2 network, and does not support reverse operations. The development team said that the function of extracting encrypted assets from Layer 2 to CEX will be released in the second quarter of 2022. For details, please pay attention to the official news.

first level title

Synthetic Asset Distribution Protocol Synthetix

Synthetix (SNX) was originally a synthetic asset issuance and trading application built on Ethereum. Users can generate various synthetic assets (Synths) by over-mortgaging Synthetix’s governance token SNX. In September 2021, Synthetix announced that it would migrate this application from the Ethereum mainnet to the Optimism network, becoming the first Ethereum head DeFi application to support the Layer 2 solution.

As of May 11, Synthetix had a TVL of $140 million on the Optimism network, the highest TVL app on the network.

Currently, the synthetic asset products supported on the Synthetix platform mainly include:

Synthetic assets that track the price of fiat currency - such as sUSD that tracks the price of the US dollar, sEUR that tracks the price of the euro, etc.;

Synthetic assets anchored to encrypted assets—such as sBTC anchored to BTC, sETH anchored to ETH, and sLINK anchored to LINK;

Synthetic assets that track the price of a stock or stock market index – such as sTSLA, which tracks the price of Tesla (Tesla), or sFTSE, which tracks the price of the FTSE;

Synthetic assets that track commodity prices — like sGOLD, which tracks the price of gold.

Among them, synthetic assets such as sUSD, sETH, sBTC, and sLINK have become mainstream assets on Ethereum and the Optimism network. Based on these synthetic assets, Synthetix has built multiple application scenarios on the Optimism network, including synthetic asset comprehensive trading platform Kwenta, options trading Platform Lyra, one-stop options investment platform Polynomial, asset management platform dHEDGE, derivatives trading platform Thales, etc.

Kwenta, a comprehensive trading platform for synthetic assets - it is the main place for mutual exchange of "sToken" such as sUSD, sETH, sBTC, sLINK; its v2 version has launched the contract leverage trading function, which supports sUSD as a margin, long/short ETH , LINK, AVAX, SOL and other mainstream assets.

Options trading platform Lyra——Users can use sUSD as margin and handling fees to buy or sell options on mainstream encrypted assets such as ETH and LINK.

One-stop option investment income platform Polynomial - it is built on the basis of the options platform Lyra and the synthetic asset agreement Synthetix, users can deposit sUSD and sETH assets into the option pool on the platform according to their own judgment, and obtain automatic income, and the income will also be returned Automatic re-casting.

The asset management protocol dHEDGE-supports anyone to establish their own investment fund on Ethereum or the Optimism chain, or invest in funds managed by others. Users can choose investment pools to invest according to their own wishes.

first level title

Comprehensive trading application ZipSwap

ZipSwap (ZIP) is a decentralized exchange application (DEX) native to the Optimism network. It is built on the code of the Uniswap v2 version, hoping to provide Optimism users with a low-cost asset exchange venue.

In addition to being a DEX, ZipSwap is also a LP asset income cultivation platform, and supports the Optimism ecological application to issue its own Token for the first time. It is reported that in the future, it will also build a stable currency exchange pool with low slippage. From this point of view, ZipSwap is more like a comprehensive DEX.

first level title

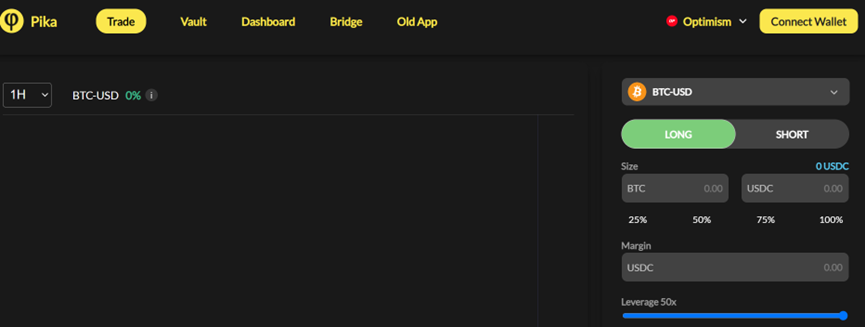

Perpetual contract platform Pika Protocol

image description

Pika Protocol

Traders use PikaProtocol on the premise that they need to have both USDC and ETH on the Optimism network, where USDC is used as a margin and ETH is used to pay the gas fee on the Optimism chain.

The reason why PikaProtocol has attracted attention is that the platform has not yet issued governance tokens, and the official has stated in the early stage that PIKA tokens will be launched, and users who actively use the product may have the opportunity to get airdrops.