On the verge of death, Terra broke his arm to survive

Author |

Editor | Hao Fangzhou

Produced | Odaily (ID: o-daily)

Author |

Produced | Odaily (ID: o-daily)

Terra's death spiral has finally arrived.

image descriptionStart the death spiral or the end of the stress test? Can UST be saved?LUNA/USDT, data from Binance, as of May 12th at 11:15Regarding the evolution of this black swan event, there have been many introductions and interpretation articles on the market (see "Start the death spiral or the end of the stress test? Can UST be saved?

"or"

Review the beginning and end of the UST collapse: 84 million US dollars leveraged a 40 billion financial empire

", what I want to talk about here is mainly whether Terra's current self-help plan (accelerating the LUNA issuance plan and raising external funds) is feasible.

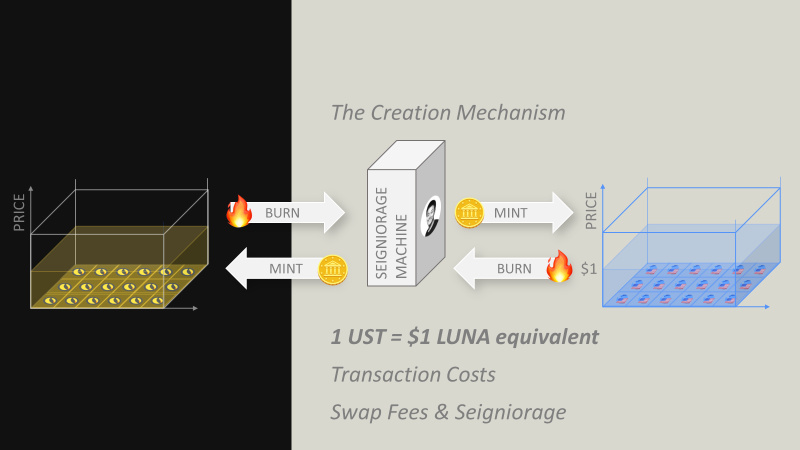

In Terra's economic model, UST price stability is regulated through the arbitrage system and agreement mechanism. Market participants can mint UST by destroying equivalent LUNA, and vice versa.

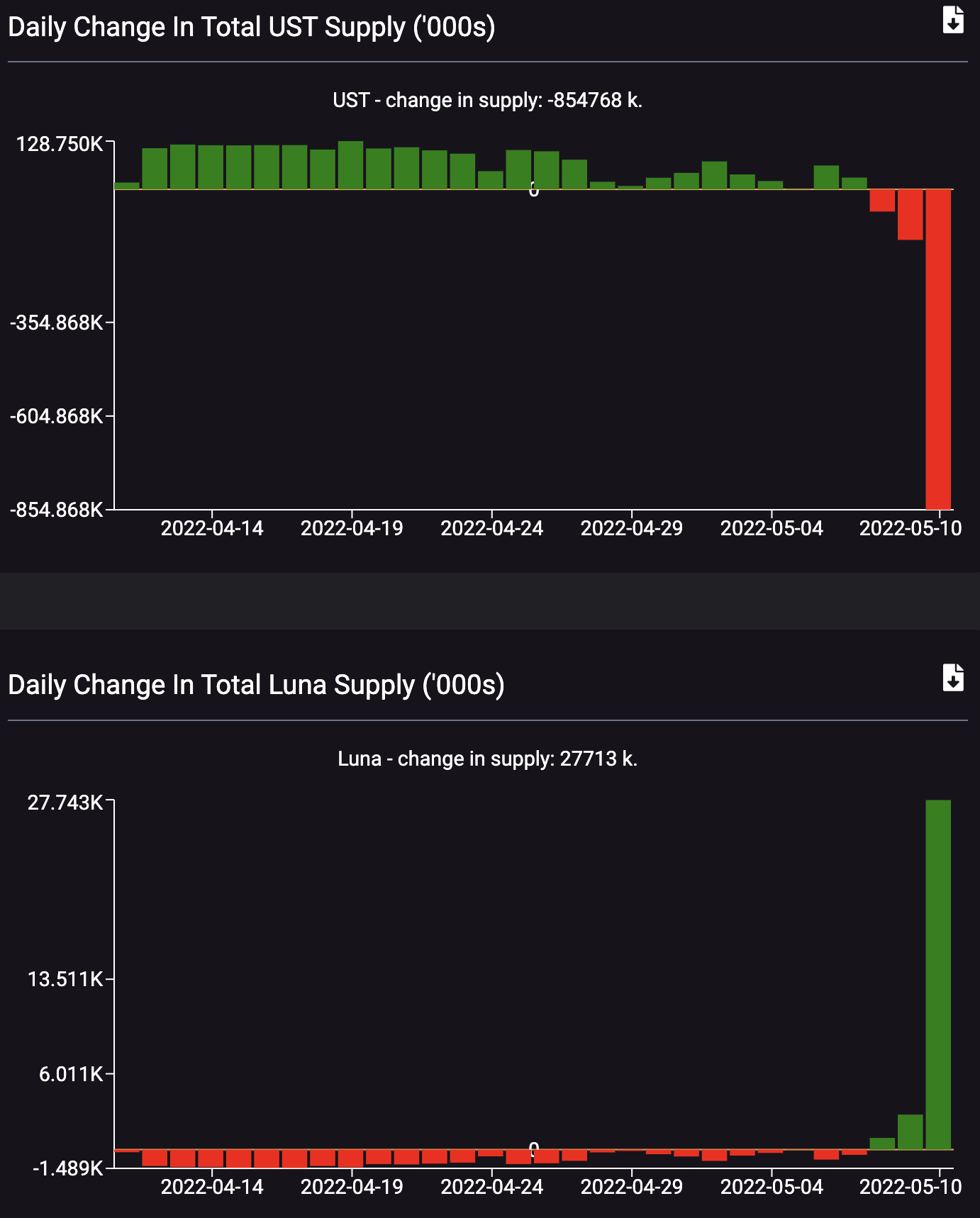

Therefore, if the demand for UST exceeds the current supply (assuming the price is $1.01), arbitrageurs have the opportunity to destroy LUNA on the chain and mint UST, and then use the difference as profit on the open market; conversely, if the demand for UST is greater than supply (assuming a price of $0.98), arbitrageurs can buy 1 UST for less than $1, and then burn and mint $1 of LUNA at a profit.Since the price of UST has been under water since May 8th, the market balance mechanism of "burning UST to mint LUNA" has been continuously operating in the past few days (reflected in the LUNA circulating supply changes), but under extreme panic, the mechanism has been unable to achieve its ideal regulatory effect.

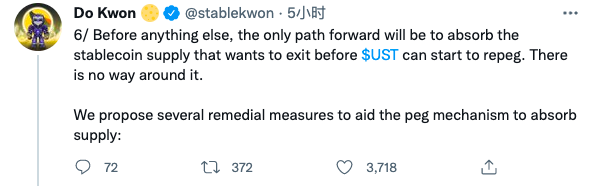

On the afternoon of May 11th, Do Kwon, the founder of Terra, tweeted the latest developments to the community, mentioning that the only way out for self-help is to absorb the excess UST supply in the market, and help UST gradually return to anchoring by balancing market supply and demand. At the same time, Do Kwon also proposed some specific solutions in different directions.Externally, Do Kwon said the team is still continuing to explore options to bring in more external capital to the overall Terra system.

In the morning, some people familiar with the matter revealed that Luna Foundation Guard (LFG) is seeking to raise $1 billion to $1.5 billion in external funds to provide more support for UST, and several institutions including Jump Trading, Celsius and Jane Street have agreed To invest, the condition is to get LUNA spot at a 50% price discount and lock it for one year. However, people familiar with the matter also emphasized that the financing has not yet been confirmed, and everything may change. In view of the collapse of LUNA's price, the progress of the financing is not expected to be too smooth.

Internally, Do Kwon hopes that the community will vote for the governance proposal Proposal 1164

, the proposal aims to increase the size of BasePool (UST-LUNA virtual liquidity pool) in the LUNA-UST minting and redemption module, and reduce the requirements of PoolRecoveryBlock (the number of blocks required for BasePool to automatically return to a balanced state), thereby improving " The execution efficiency of this set of balance mechanism of "burning UST to cast LUNA" will speed up the absorption of excess UST supply.

As of 11:00 on the 12th, Proposal 1164 has received more than 60% of the votes in favor, and the voting will end in 6 days, but in view of the emergency and the total number of votes in favor (136 million) is approaching 50% of the total votes (288 million), The community is seeking immediate adoption of the proposal.In Proposal 1164, the proposer GS390 pointed out that the reason why parameters need to be adjusted at this point in time is that the return speed of the current arbitrage balance mechanism to the excess UST supply is far slower than the market demand. From the data point of view, on May 8 From the 10th to the 10th, about 8 billion US dollars in UST circulation were withdrawn from Anchor, but at the same time only about 1 billion US dollars in UST were recovered through the redemption mechanism. Affected by panic, these unrecovered UST UST has become the main source of selling pressure for its price to continue to break free.In this case, the price of UST cannot be regulated by the balance mechanism in the economic model at all. With the further fermentation of panic, FUD, selling and shorting came one after another, and the prices of UST and LUNA also accelerated their decline. Because of this, Do Kwon and Proposal 1164 hope to improve the execution efficiency of the balance mechanism, accelerate the burning speed of UST, and recover the excess circulating supply as soon as possible.Obviously,

This plan will obviously put considerable pressure on the price of LUNA, because accelerating the burning of UST will in turn mean that the minting of LUNA will be greatly accelerated.

What's even more frightening is that although the drop in currency prices and the increase in circulation will not have much impact on the overall market value in theory, this is only an ideal assumption based on a peaceful market environment. In an extreme market, more LUNA holders will The choice to sell due to panic caused the currency price to fall much faster than the increase in circulation, which in turn led to a continuous decline in the total market value of LUNA.

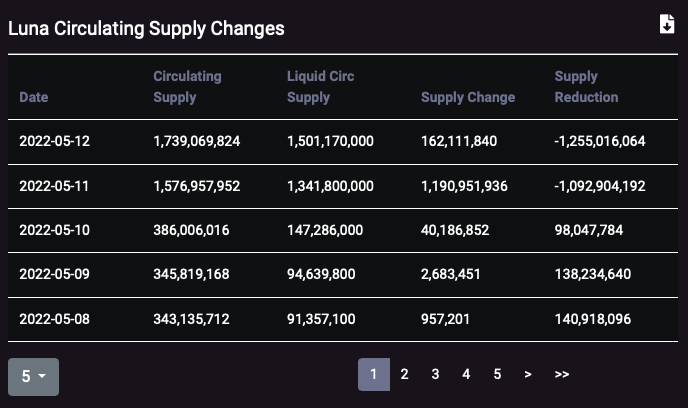

On the one hand, the supply of UST gradually decreases with recovery, and on the other hand, the total market value of LUNA, which is the indirect value support of UST, is also decreasing. The balance between the two will come later than estimated under static conditions.SmartStake data shows that as of 10:20 on the 12th, the circulating supply of LUNA has increased by 1.35 billion in two days, and the total circulating supply has reached 1.739 billion.Do Kwon is well aware of this, and Do Kwon also mentioned in the tweet that this will bring a "high price." GS390 also wrote clearly in the proposal: "Yes, billions of UST will be burned and LUNA will be greatly diluted...Allowing more efficient UST burning and LUNA casting will put pressure on LUNA prices in the short term, But would be an efficient way to bring UST back to the peg, which would eventually stabilize LUNA prices as well.”

It is not difficult to see from Do Kwon's statement and the Proposal 1164 that the Terra community is pushing hard,

The current remedial concept chosen by Terra is to give priority to solving the problem of UST's unanchoring and supply-demand imbalance, so it does not hesitate to sacrifice the price of LUNA in the short term.

It's like Terra has to take a strong medicine in a desperate situation. If you take it, you have to face a series of pressure brought by the decline of LUNA, but if you don't take it, both UST and LUNA may die in a spiral.Some readers may ask, doesn't LFG reserve billions of dollars worth of BTC as a potential value support? Is the money still there? Regarding this point, GS390 pointed out in the proposal that LFG did have a BTC reserve worth 3.5 billion U.S. dollars (the amount will disappear after falling), but Terra has become a fish in the eyes of various funds and hastily used this part of the reserve Funds will only be encircled and suppressed by various funds, and may eventually be eaten away.

On this point, I am willing to agree with GS390's statement, not to believe anyone, but objectively speaking, Terra's current hole is too big (as of 10:25, the total circulation of UST is 13.1 billion, and the total market value of LUNA Only 1.9 billion US dollars), the reserve funds are not enough, so the main task now is to squeeze the bubble (reduce UST supply), and then use the reserve funds and the external funds that may come back to implement other remedial measures after the hole shrinks.Although Terra's self-rescue measures are not necessarily successful (in fact, failure is more likely), but thinking about it from Terra's standpoint, it seems that this is the only one that does not adjust the core economic model. Feasible measures are available. This economic model once gave them unparalleled brilliance, but now it seems to be a knife that will continue to cut off the "value" of LUNA.

Of course, Terra may also choose to decouple UST from LUNA as some readers have suggested, but doing so would be like asking Terra to admit that its past has been a total failure.

Looking further, the current problem is just the first hurdle facing Do Kwon and the entire Terra team. Even if the plan can successfully save UST and stabilize the price of LUNA afterwards, there will be another one after another gate of hell,

For example, the community reputation crisis after the black swan incident, such as the economic loss caused by the price drop of LUNA to the community and partners (such as local traditional business resources), and the regulatory sword that is already hanging over the head...

A number of institutions and platforms have chosen to "cut seats" or "avoid" when the Terra building is about to collapse, in order to ensure their own stability and prevent the spread of risks.