JZL Capital Blockchain Industry Weekly Report No. 20

1. Industry dynamics last week

secondary title

1. Industry dynamics last week

Last week was a process of being repeatedly slapped in the face for the vast majority of risk investors. In the early hours of Thursday morning Beijing time, the Federal Reserve FOMC announced that it would raise interest rates by 50 basis points and start to shrink interest rates at a monthly pace of US$47.5 billion in June. At the same time, Powell also stated at the meeting that excluding the possibility of raising interest rates by 75 basis points in the future, raising interest rates by 50 basis points in the next few times is a high probability option. This slightly moderate speech in line with market expectations gave the market a certain degree of confidence. The three major U.S. stock indexes closed up close to 3% that day, and Bitcoin also followed the market to rise by nearly 3%.

But the good times didn’t last long. The market gave completely different reactions in the next two days. Constrained by the highest level of CPI and PPI in 40 years, the Fed has fallen far behind the inflation curve, and the negative growth of GDP caused by supply chain problems, in the Under the circumstance that the effectiveness of the tightening measures has not yet been verified, institutions and market makers have chosen a relatively conservative response. On Friday, the three major US stock indexes collectively closed down, and all set a record for the longest weekly decline in the past 10 years. As the "volatility amplifier" of U.S. stocks, the encryption market naturally cannot escape the sanctions of the market. After following the U.S. stock market's decline on Friday, it continued its downward momentum. As of writing, Bitcoin closed at 34466.1, a drop of nearly 10.45% from last week.

From the weekly chart, the Nasdaq has continuously fallen below the 120-week moving average, and the downward support is the 250-week moving average, which is around 10,000 points, corresponding to a decline of nearly 16%. It is a strong support point. The 16% decline corresponds to Bitcoin being around $28,900, which happened to be the lowest point last year. If the market continues to maintain a pessimistic attitude towards economic recession and even depression expectations, the crypto market may bottom out again.

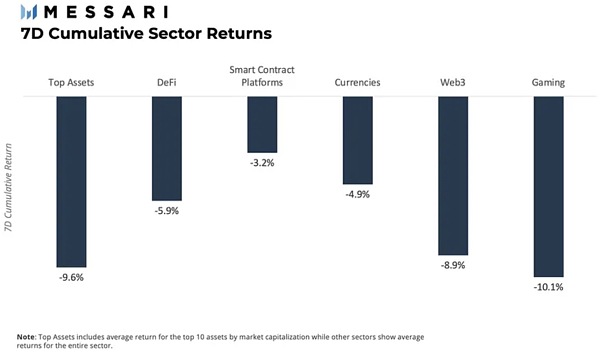

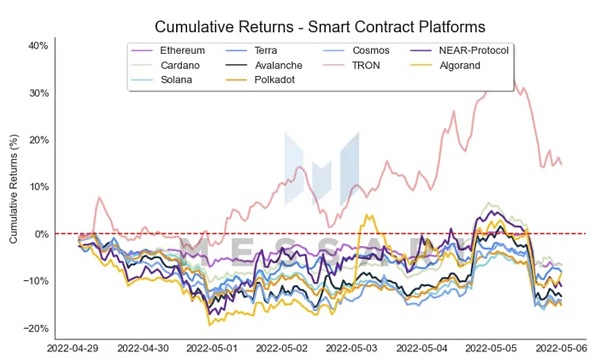

Looking back at the performance of each sector last week, first of all, the market value of cryptocurrencies has dropped from US$1.8 billion to US$1.55 billion. The most severely hit is still the Gaming sector, which fell by 10.1% last week according to incomplete statistics. The public chain sector It still maintains the most resistant characteristics, falling only 3.2% last week, but on Sunday, Terra fell by more than 20% in a short period of time due to the sell-off of UST, which was not included in this decline. In addition, another important factor for the outstanding performance of the public chain sector is Tron, which issues its own ecological algorithmic stablecoin. On May 5, the algorithmic stablecoin USDD issued by TRON DAO and some institutions was officially launched. 200 million, Tron has launched a highly profitable defi product for USDD, not only USDD pledge, but also USDD and other token LP dual-currency wealth management, which is similar to Terra's UST, and its algorithmic stablecoin mechanism is also It is basically the same as UST. At present, it seems that the market still pays for such a mechanism in the short term, making TRX one of the few currencies that rose against the trend last week. In a poor market environment, investors tend to invest funds in assets with low risk attributes, and the same is true in the encryption ecology, so JZL will conduct in-depth research on stablecoins next, and look at the encryption market from another perspective investment opportunities.

secondary title

2. Macro and analysis

Last week, the market rose slightly after the Fed raised interest rates and shrunk its balance sheet, and then fell across the board due to the impact of the Nasdaq trading sentiment. The reasons for the decline in US stocks are:

1. Market transactions quickly shifted from "rising interest rates and shrinking the balance sheet" to "economy moving towards stagflation", presenting a situation of double killing of stocks and debts. The economic data released by the United States this week reflects the gradual weakening of the fundamentals, but the tightening expectations have not yet eased, and the signs of stagflation are becoming more and more obvious. Our logic of judging short-term trading "stagflation" may continue to a certain extent.

2. The active de-leveraging of funds brought about by the shrinking of the balance sheet exacerbated the market decline.

At present, the impact on the capital market is still spreading, and we need to be cautious in the short term.

BTC has fallen to around $34,000 at present, and we judge that the support position is at $32,900. If it falls below, the market may continue to fall.

ETH follows BTC, with short-term support at $2150.

1. Technical indicators:

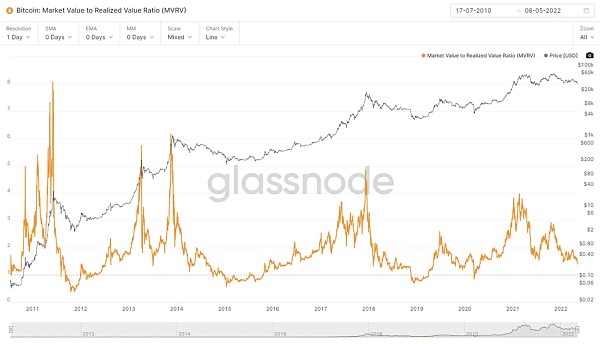

1) Ahr999: The short-term cost performance is already good, and you can start to try small-position fixed investment.

2) MVRV: The cost performance is the same as Ahr999.

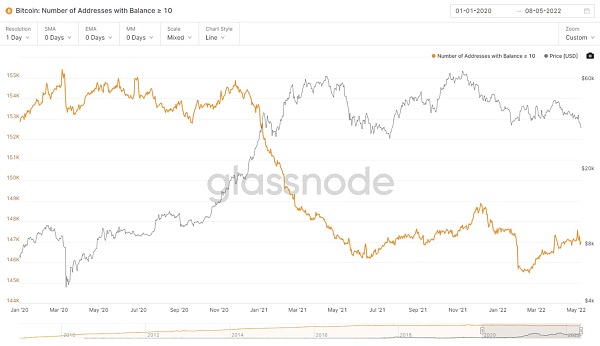

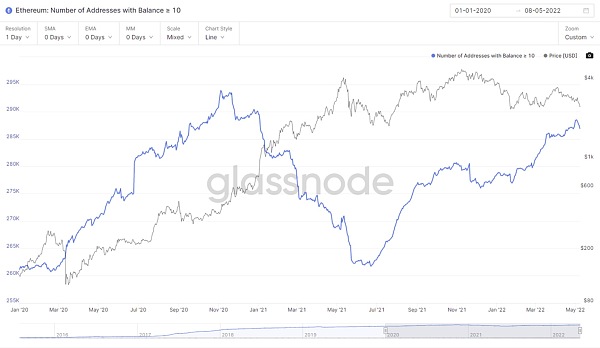

3) The number of BTC holding addresses: the number of addresses holding less than 10 coins has grown steadily, but the number of addresses holding more than 10 coins has decreased in the short term.

2. Summary:

Combining the short-term macro and the number of addresses, we found that with the increase of retail investors entering the market, the number of octopus (holding more than 10) currency-holding addresses is decreasing, and the overall market is still in a weak position. It is not ruled out that there will be a rebound in the future, but the strength of the decline will be Stronger than a rebound, if it falls below an important support level, you can take advantage of the trend to short, if not, you can increase your position in the short term to win a rebound.

secondary title

1)Sandbox:

3. Encrypted ecological tracking

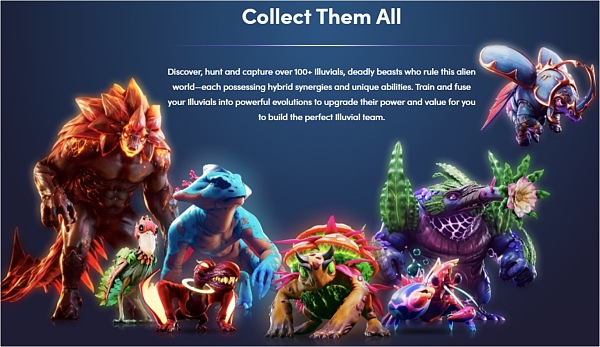

2)IlluviumSpace:

1. Metaverse

• Hong Kong Regal Hotel Group (Regal Hotel), NFTScan and Dubai Virtual Assets Regulatory Authority have announced their entry into the metaverse, buying land in The Sandbox and building a metaverse headquarters or a personal metaverse conference center.

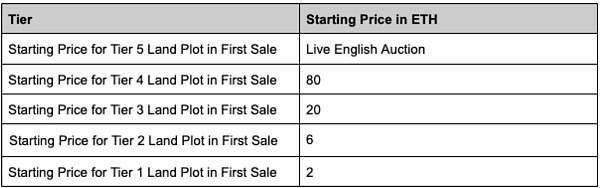

•The RPG chain game Illuvium Council last week passed the IIP-20 proposal on the details of the land sale. This land sale will be scheduled for June 2, and the sale will be sold in the Dutch auction method for a period of three days. The project land has a total of 100,000 pieces, and the number of land for the first sale is 20,000 pieces. The land will be divided into 5 grades and sold in ETH or sILV2.

1)Polygon

•IlluviumSpace is a 3A level RPG auto chess game. The game is produced by the most popular Unreal 5 engine in the market. Its main feature is high-quality graphics and high playability. It combines battle, exploration and collection. , Cultivation and other game modes. As a land owner, you can get more game resources, and you can also share about 5% of the revenue from in-game item transactions. Its token ILV is a governance token and a way to generate the main currency sILV2 in the game. The current game has launched a beta version and is scheduled to be launched this year.

2. Scalability expansion

2)zkSync

•ApeCoin (APE), a subsidiary of Yuga Labs, announced its integration with Polygon. Previously, the auction of Yuga Labs metaverse project Otherside land caused extremely high Gas Fee. Yuga Labs once proposed to develop its own chain, so the integration of Polygon should be the current Temporary measures.

• Meta's social platform Instagram plans to integrate Ethereum, Polygon, Solana and Flow's NFT, and will first conduct a pilot. In addition, Instagram will not charge users to upload and display NFT. Instagram currently has nearly 1 billion monthly active users. After this move, it may open the function of issuing and displaying NFT on its own platform.

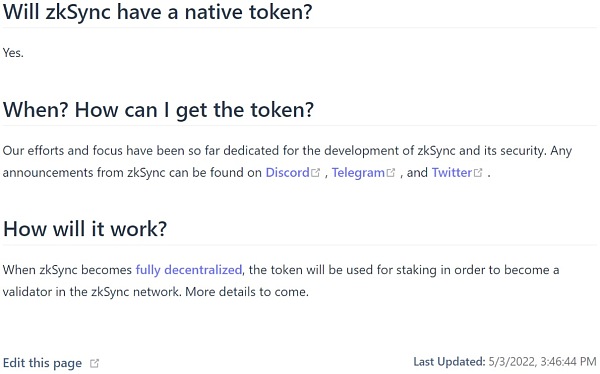

•The four major Ethereum expansion plans, zkSync, have recently updated the description of tokens in User Docs, indicating that tokens will be issued, but the specific time has not been disclosed. It is worth noting that during the last reporting period, another expansion leader, Optimism, just released its own token economy and airdrop plan. The main airdrop targets are network users and early participants.

• zkSync is an expansion solution that achieves expansion through ZK-Rollup. The advantage of ZK-rollup is that it can effectively shorten the verification time and eliminate the need for the 7-day challenge period for optimistic rollup. The disadvantage is that it is difficult to be compatible with EMV.

1)• The zkSync team Matter Labs was established in December 2019. Its founding team is not well-known, but it has strong execution capabilities. In 2021, its team claimed that the second step of its roadmap, zkSync2. Although the composability of smart contracts has been delayed, its zkEVM test network has been launched in February 2022. In the future, there will be opportunities to see more complex applications using zk-rollup as the main expansion solution.

3. GameFi chain games

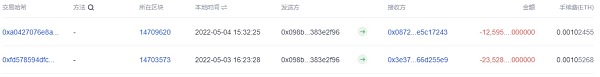

Ronin Sidechain Hacking Attack (5) -- Almost all of the stolen funds were raised•Okey Cloud Chain data, Ronin Network attacker address (0x098B716B8Aaf21512996dC57EB0615e2383E2f96) transferred the remaining 36,125.89 ETH to the new address twice on May 3rd and 4th.。

• In this hacking incident, the attack address transferred out 28 large amounts (more than 500 ETHs were transferred out), and almost all of the stolen 172,000 ETHs were transferred out.

At present, there are only 1.79 ETH left in the attacker's address

•The attacker team continued to transfer the stolen funds to Tornado Cash through the intermediate address. Due to the upper limit of a single transfer, it is expected to cost about 100 ETH to complete 172,000 ETH.

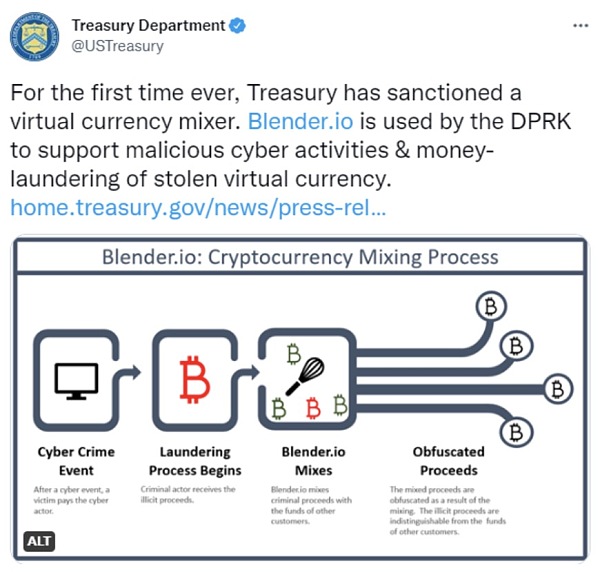

2) The centralized currency mixer Blender.io was sanctioned

• The US Department of the Treasury's Office of Foreign Assets Control (OFAC) stated that it will impose sanctions on Blender.io, a centralized mixing pool deployed on the Bitcoin blockchain. The reason for the sanctions is that it involved providing transaction support for Ronin Network's cyber attacks, and any platform that facilitates illegal virtual currency transactions will pose a threat to the national security interests of the United States.

•Blender.io mainly provides English-Russian bilingual services, which researchers call one of the most popular cryptocurrency money laundering services for cybercriminal gangs.

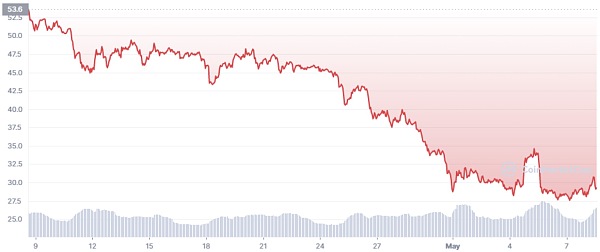

3) The number of users of AxieInfinity continues to decline, and the price of AXS is in a slump

• Affected by the overall downturn in the market and the attack on the Ronin sidechain, the number of AxieInfinity players has dropped significantly recently, and the price of AXS tokens has even fallen off a cliff, falling by nearly 50% in the past month, significantly underperforming BTC and ETH Prices fluctuate.

4) Agency Tracking - AnimocaBrands

• Hockenheimring joins the REVV Motorsport ecosystem

On May 2, AnimocaBrands announced that it has received permission from Hockenheimring Baden-Württemberg (Hockenheimring) to incorporate it into the REVV Motorsport racing ecosystem. Hockenheimring is located in the southwestern part of Germany and has decades of experience in motorsports, making it one of the most famous circuits in the world;

AnimocaBrands will integrate Hockenheimring into the REVV Motorsport ecosystem and will produce and sell NFTs representing partial ownership of Hockenheimring within the REVV ecosystem. Holders of Hockenheimring NFTs will passively earn a portion of entry fees, sponsorship fees and/or race revenue generated on the virtual track.Invested in the game studio Untamed Planet to create a metaverse with the theme of protecting the natural environment and wild animalsOn May 5, Untamed Planet completed a $24.3 million Series A round led by AnimocaBrands. As part of the partnership, Untamed Planet and AnimocaBrands will

Co-develop the metaverse game UntamedMetaverse

, nWay, a subsidiary of AnimocaBrands, will provide development support for the Untamed Metaverse;Untamed Metaverse is a 3D immersive experience where players will be able to explore digital twins of the world's most stunning wild landscapes, participate in quests, collect NFT assets, and form communities passionate about protecting nature. A core element of Untamed Planet's mission is the commitment to "50% profit share for nature," whereby the company donates, invests or distributes at least half of each project's profits to local conservation initiatives and the local communities that support them.。

• nWay is a game development and distribution platform headquartered in San Francisco. Its nWayPlay is a decentralized trading platform built on the FLOW chain. nWayPlay has released many Olympic-themed NFTs, including digital posters, pictograms and 2020 An NFT themed on the Tokyo Olympics. more importantly,

nWayPlay will be officially authorized by the Beijing Winter Olympics Organizing Committee in 2022 to issue 2022 themed NFT Bing DwenDwen

5) Important project - LootRush• On May 5, 2022, LootRush, a blockchain game publishing platform with NFT Market functions, completed a $1,200 Series A financing led by Paradigm, with participation from a16z, Dapper Labs and others.。

•LootRush provides a fast-start platform for blockchain games, aiming to become Steam in the blockchain game field, and also provides NFT leasing services, aiming to lower the threshold for new gamers and earn income for NFT owners.

AxieInfinity is the only game currently playable on LootRush

6) Important project - Zora

• Up to now, many applications such as Friends with Benefits and Mirror have been deployed on the Zora protocol.

4.Platform public chain

1) Dynamic summary of the public chain:

4.Platform public chain

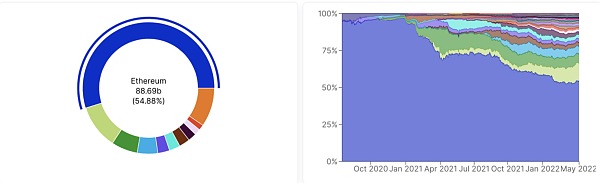

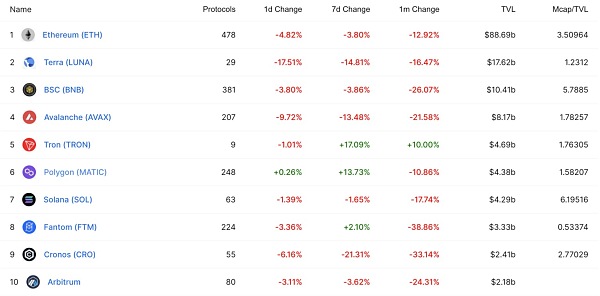

•Last week, the overall lock-up volume of the public chain (including Staking) dropped from US$170.6 billion to US$161.6 billion, with a small change of less than -1%. The top five TVL is still Curve, Lido, Anchor, MakerDAO and Convex Finance, There is no change in ranking. Judging from the Gas Fee of Ethereum, the activity on the chain increased significantly last week, and the risk aversion sentiment in the market rose significantly.

• In the top ten TVL rankings, Tron and Polygon continued to rise steadily last week, and Tron's monthly growth rate even reached +10%.

•Horizontally comparing the locked positions of various public chains, the proportion of Ethereum has changed slightly, from 54.68% last week to 54.43%. It is worth noting that due to the impact of Solana’s network downtime, its ranking dropped to seventh place, while Tron and Polygon rose one place each.

Tron founder Justin Sun announced the launch of USDD through the TRON DAO Reserve on Thursday, May 5. SunSwap, Uniswap, PancakeSwap, and Ellipsis were among the first companies to list USDD. Through the cross-chain protocol BitTorrentChain (BTTC), the initial total supply will be 66,560,006.61 on TRON, 3,100,000 on Ethereum, and 13,100,000.1 on BNB Chain. Justin Sun stated that USDD Network will provide custody services for the $10 billion "highly liquid assets" raised by blockchain industry promoters. These funds will be used as an "early reserve";

2) Summary of public chain and infrastructure investment:

On May 2, the Apecoin project announced a partnership with Polygon. With the support of Polygon, users can now earn APE through MATIC's 19,000 decentralized applications (dapps) and games.

2) Summary of public chain and infrastructure investment:

• Particle Network, a Web3 game data and development platform, announced on May 4 that it completed the Pre-seed round of financing, with a financing amount of US$1.8 million, led by LongHashVentures. The round also included Insignia Ventures Partners, CyberConnect, BitCokeVentures, sevenO'Clock Capital, FSCventures, and Monad Labs. It is understood that Particle Network will use the funds to develop the team, cultivate the global developer community, improve the platform, and provide developers with the fastest way from creativity to large-scale development of Web 3 games.

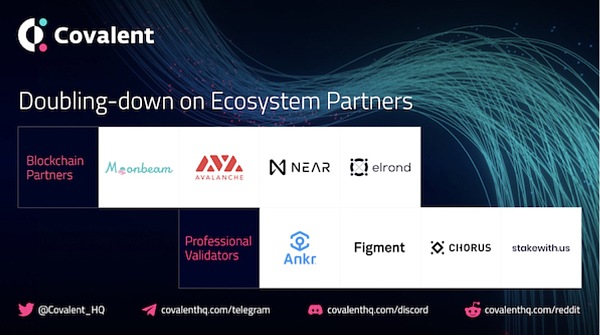

• Covalent, a unified API company for Web3 data, disclosed on May 4 that it has opened a financing of 25 million US dollars. At the same time, it announced the launch of the world's first proof-based data indexer, based on the pledge on the Covalent decentralized network. Network staking via Covalent Query Token (CQT) enables anyone in the community to contribute to governing and securing the decentralized protocol. The company provides on-chain data and analytics for the Ethereum network and develops self-service SDKs that allow building new APIs for all as yet undiscovered use cases, providing developers with simple APIs that allow rapid integration in new or existing projects . The company completed a US$2 million financing in March 2021, led by Hashed. Participating investors include Coinbase Ventures, Binance Labs, and Delphi Ventures. Previous rounds of investors include Alameda Research and AU21 Capital.

• Web3 media company Decrypt announced the completion of $10 million in financing on May 3, and has since spun out of blockchain incubator project ConsenSysMesh. 22 institutions participated in this round of financing, including VC, HashkeyCapital and Canvas Ventures, with a post-financing valuation of approximately US$50 million. Based on this financing, Decrypt will also establish Decrypt Studio to activate brands for NFTs and metaverses in fashion, entertainment and real estate. Decrypt also plans to invest in its decentralized newswire PubDAO.

•Amberdata, a digital asset data provider, announced the completion of a $30 million Series B round of financing led by Knollwood Investment Company, with participation from Coinbase, Nexo, Susquehanna International Group, NasdaqVentures, NABVentures and Chicago Trading Company. This round of financing will be used to increase Amberdata's cooperation with potential customers in the United States and internationally. Amberdata provides financial institutions with data and insights on blockchain networks, crypto markets and DeFi to facilitate institutional adoption of digital assets.

3)Algorand

• Americana, a company focused on physical NFT transactions, announced the completion of a seed round of financing on May 3, with a financing amount of US$6.9 million. The financing was led by Seven Seven Six, with participation from NFT trading platform OpenSea, rapper Future and Reddit founder Alexis Ohanian. The company's core product is the NFTA universal chip, which can be connected to a physical object and connect the object to the blockchain. The chip provides both Web 2.0-level security and real-time GPS data, and includes a way to transfer ownership and royalties without an intermediary -- as easy as scanning objects and navigating apps with your phone. It reportedly only supports Ethereum blockchain integration, but Solana and other chains are being explored.

• On May 2, the privacy infrastructure Nym’s innovation fund received a $300 million investment commitment. Supporters include Polychain, GreenfieldOne, HuobiIncubator, TiogaCapital, EdenBlock, NGCVentures, HashKeyCapital, Figment, FenbushiCapital, OKXBlockdreamVentures, TayssirCapital, KR1, Lemniscap, and a16z . The fund will be used to attract developers to its ecosystem, with individual grants ranging from $50,000 to several million dollars.

• The public chain with the most gains this week is Algorand, which is characterized by the use of Pure Proof of Stake (PPoS), a highly democratized PoS consensus mechanism. The minimum stake required for users to participate and secure the network is low - only one ALGO coin is required to participate.

4)CosmosHub

On May 2, FIFA announced that it has reached a sponsorship and technical cooperation agreement with blockchain technology company Algorand. The agreement means that Algorand will become FIFA's official blockchain platform and provide an official blockchain-backed wallet solution. Under the sponsorship agreement, Algorand will become a regional supporter of the 2022 Qatar World Cup in North America and Europe, and an official sponsor of the 2023 Women's World Cup in Australia and New Zealand;

The news came as ALGO prices rallied for three straight days, hitting a weekly high of $0.7408 before Thursday’s sell-off. Ahead of Monday’s news, ALGO had fallen to a yearly low of $0.5388 on April 30.

5)Terra

• The Cosmos hub community proposal #69 IncludeCosmWasmin Rho Upgrade is expected to be rejected. This proposal is to develop the smart contract framework and deploy CosmWasm on the Cosmos Hub public chain, which means that smart contract applications can be developed on it, but it will bring security risks and maintenance burden.

•Since there are dedicated application chains and platform-type public chains in the Cosmos ecosystem to carry smart contract applications, we believe that the Cosmos Hub should give top priority to ensuring security, and there is no need to develop applications on it. Prior to this, Juno stopped producing blocks due to smart contracts being attacked, and if a similar incident happened to the Cosmos Hub, which is the IBC cross-chain hub, the blow to the entire ecology would be devastating.

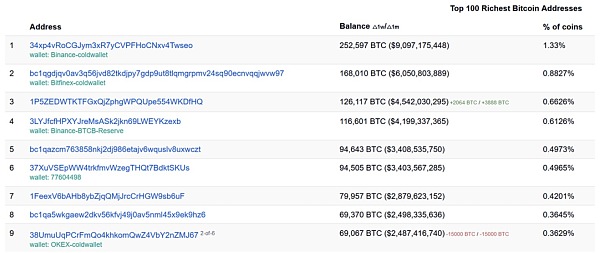

• After nearly a month, Luna Foundation Guard (LFG) bought BTC again. On May 5, LFG announced that it had purchased a total of 37,863 bitcoins, worth approximately $1.5 billion, through over-the-counter transactions. Among them, US$1 billion was purchased using UST through the broker Genesis, and US$500 million was purchased through cooperation with Three Arrows Capital. Previously CNBC reported that it was "purchased from Sanjian Capital", but Do Kwon stated on Twitter that the fact was "cooperating with Sanjian Capital to purchase in the market".

• LFG's total BTC holdings reached approximately 80,394 pieces, making it one of the seventh largest holders of BTC. Do Kwon said he expects to hit the $10 billion target by the end of the third quarter.

6)Cosmos——Juno

•Although LFG has included this part of the newly purchased BTC in the published reserve data table, the wallet address previously marked as LFG has not seen any change in balance, so Twitter has a comment asking LFG to disclose the wallet address to prove the authenticity of the reserve .

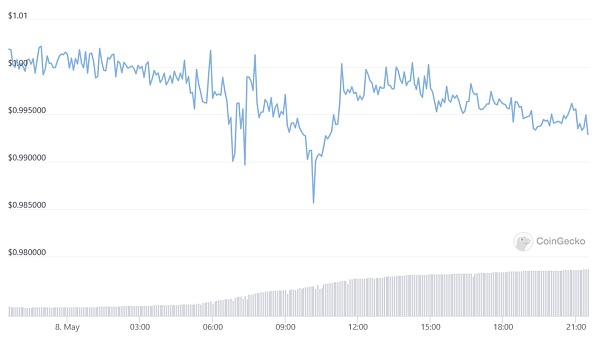

• LUNA fell sharply this week, from about US$83 on May 2 to US$60.21, a drop of nearly 28% in three days. Under extreme conditions, the price of the algorithmic stablecoin UST even briefly dropped from the anchor, and fell to $0.985 for a short time on May 8, but was pulled back to normal within an hour.

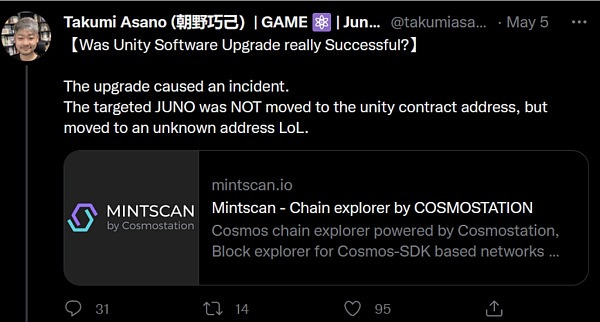

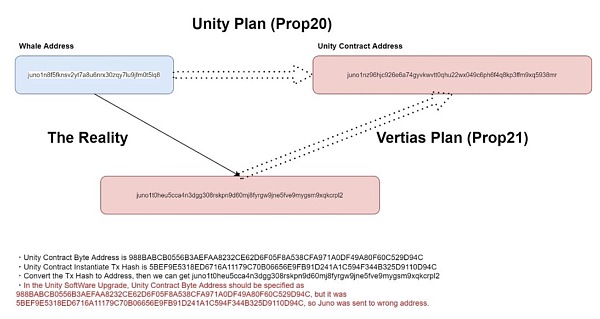

• The dispute between the Juno community and the giant whale (Twitter: @takumiasano_jp) should have been settled with the implementation of Proposal#20, but to everyone’s surprise, the Juno development team made a mistake during the implementation and transferred what should have been into Juno in the smart contract controlled by the community mistakenly transferred to an unmanned address (the operator took the hash value of the transaction as the contract address), and none of the 120 verification nodes of the Juno blockchain discovered this problem and performed the transfer operation.

1)CityDAO

•Although the Juno community has launched Proposal #21 to correct the error, frequent modifications to the blockchain ledger have caused users to question the "unalterable" property of the blockchain. Ethan Buchman, one of the founders of Cosmos, also expressed shock at the matter.

5. DAO Decentralized Autonomous Organization

2) BitDAO

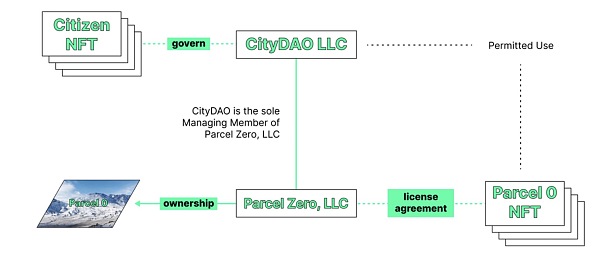

On May 4th, the decentralized real estate construction project CityDAO announced that it will airdrop Parcel 0 NFT to its Citizen NFT holders. Holders of this NFT will have the right to use and govern part of "Plot 0", which is 40 undeveloped acres adjoining the Shoshone National Forest in Northwest Wyoming.

CityDAO was established in July 2021 with the vision of "building a future city on Ethereum through the tokenization of land, ownership, and governance." According to the laws of Wyoming, DAO is recognized as a limited liability company (LLC). The organization established an offline company locally, and raised approximately US$8.5 million in funds through the sale of Citizen NFT, and purchased the "Lot 0" locally. ", hoping to develop and utilize the land. However, the local area is too dry and desolate, lacks infrastructure, and the development cost is too high, so far no actual progress has been made. The SeeDAO commented that the project was "born in Ethereum, trapped in Wyoming".

On May 6, BitDAO, an investment DAO organization, passed the BIP-9: $BIT Purchase Program proposal, deciding to use part of the funds provided by Bybit to BitDAO to repurchase its token BIT in the secondary market and donate it to the BitDAO treasury. The repurchase amount will initially be set at $700,000 per day (beginning on June 1st, the amount may be adjusted by subsequent proposals). The proposal also states that the burning of BIT in the BitDAO treasury may be initiated in the future.

BitDAO was founded in July 2021 by Bybit, a derivatives exchange, with the main purpose of investing in crypto startups through investment, token exchange and product development. Since Bybit provides 0.025% of its futures contract trading volume in the form of ETH and USDC as financial support every day, BitDAO's AUM exceeds US$2 billion, making it the largest investment-oriented DAO organization. Since the beginning of this year, the average daily transfer amount of Bybit is about 2.1 million US dollars (annualized over 750 million US dollars).

3)Syndicate

The organization has a relatively high threshold for publishing investment proposals (holding at least 200,000 BIT). Since its establishment, it has only invested in 4 projects, including: ZK sync $200 million, EduDAO $33 million, and chain game developer Forte Co-founded Game7, and PleasrDAO $6.5 million.

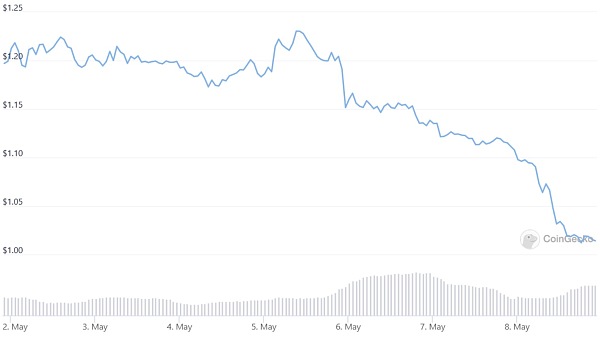

The news did not have a significant impact on the price of BIT, which continued to fall this week, with a drop of more than 15%.

On May 3, Syndicate, an investment DAO infrastructure platform, completed a strategic financing of US$6 million. Investors include a16z, South Park Commons, CartaLedger, OpenSea, CircleVentures, Polygon, UnitedTalent Agency, CoinList, FalconX and other 50+ customers and partners .

This financing will be used to deepen capabilities and partnerships in important areas, and will launch new investment DAO infrastructure and tools for new markets, users and use cases in the coming months. Since its establishment in January 2021, Syndicate has raised a total of US$28 million, and more than 150 institutions and investors have participated in the project.

As part of this funding round, Syndicate partnered with more than 10 mission-driven organizations and investors, including Flourish Ventures (financial health), Evolve (emotional health), Reach Capital (education), Unshackled Ventures (immigrant founders) , Ulu Ventures (diverse founders), We3 (female and non-binary web3 talent network), Afropolitan (global African community), The Players Company (professional athlete community), etc.

about Us

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

We are always looking for creative ideas, business and cooperation opportunities, welcome to contact us and subscribe on JZL official website. We also look forward to your reading feedback. If there are obvious facts, understandings or data errors in the above content, please contact us for correction.