iZUMi Research: In the new Curve War, will Uniswap V3 be a better choice for UST and DAI?

first level title

Foreword: Terra's 4 Pool Proposal--Curve War's Endgame?

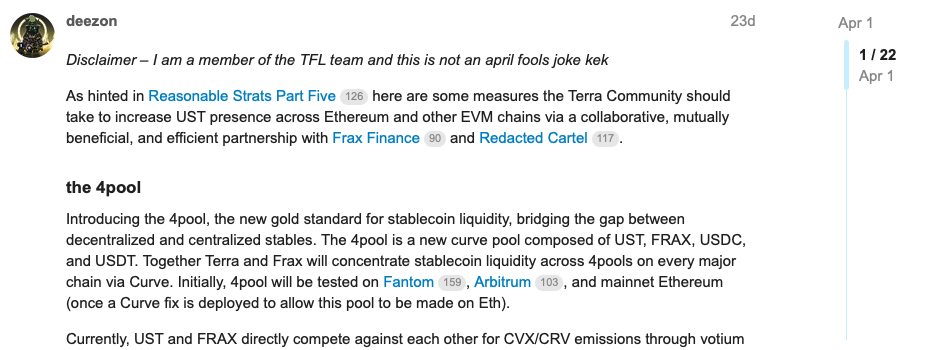

In order to broaden the use scenarios of the UST algorithm stablecoin in Ethereum and compatible public chains, and find new ways to alleviate the high capital cost of the 20% annualized rate of return provided by the Anchor lending agreement, on April 1, 2022 , in the Terra Research forums, Terra member Zon (@ItsAlwaysZonny) officially launched4Pool Proposal, announced a partnership with Frax Finance and Redacted Cartel,Olympus also joined later. The four parties will work together to launch a new stablecoin trading pool 4Pool on the stablecoin trading platform Curve: USDT, FRAX, USDC, UST, and challenge the original largest stablecoin trading pool 3Crv (USDC, USDT, DAI) on Curve. A new wave of Curve Ecosystem War battles. (Supplement: BadgerDAO and TOKEMAK alsoimage description)

(https://agora.terra.money/t/ust-goes-interchain-the-4pool-and-redacted-cartel/5648)

Curve is an AMM decentralized exchange focusing on stable currency and linked asset transactions. Based on its Stable Assets AMM algorithm, compared to other DEXs, Curve can provide a trading experience with lower slippage under the same amount of liquid funds, which is suitable for large-scale stable currency and linked asset transactions. At the same time, the Curve platform provides CRV tokens as liquidity mining rewards to encourage liquidity providers to provide better liquidity depth for their different trading pools.

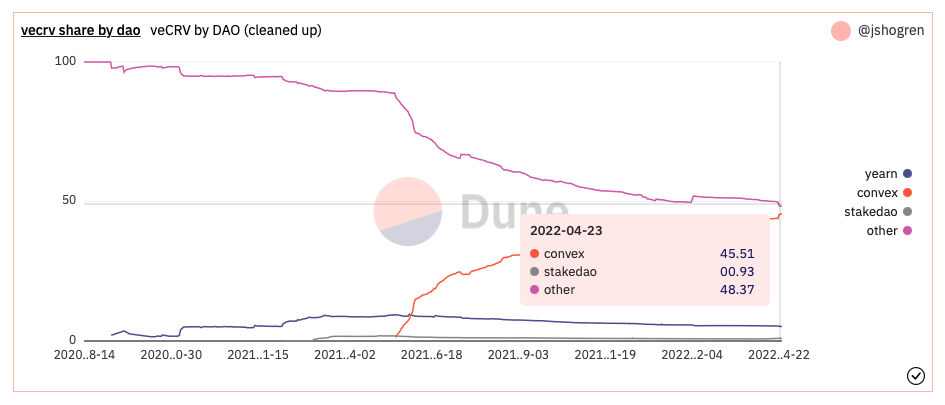

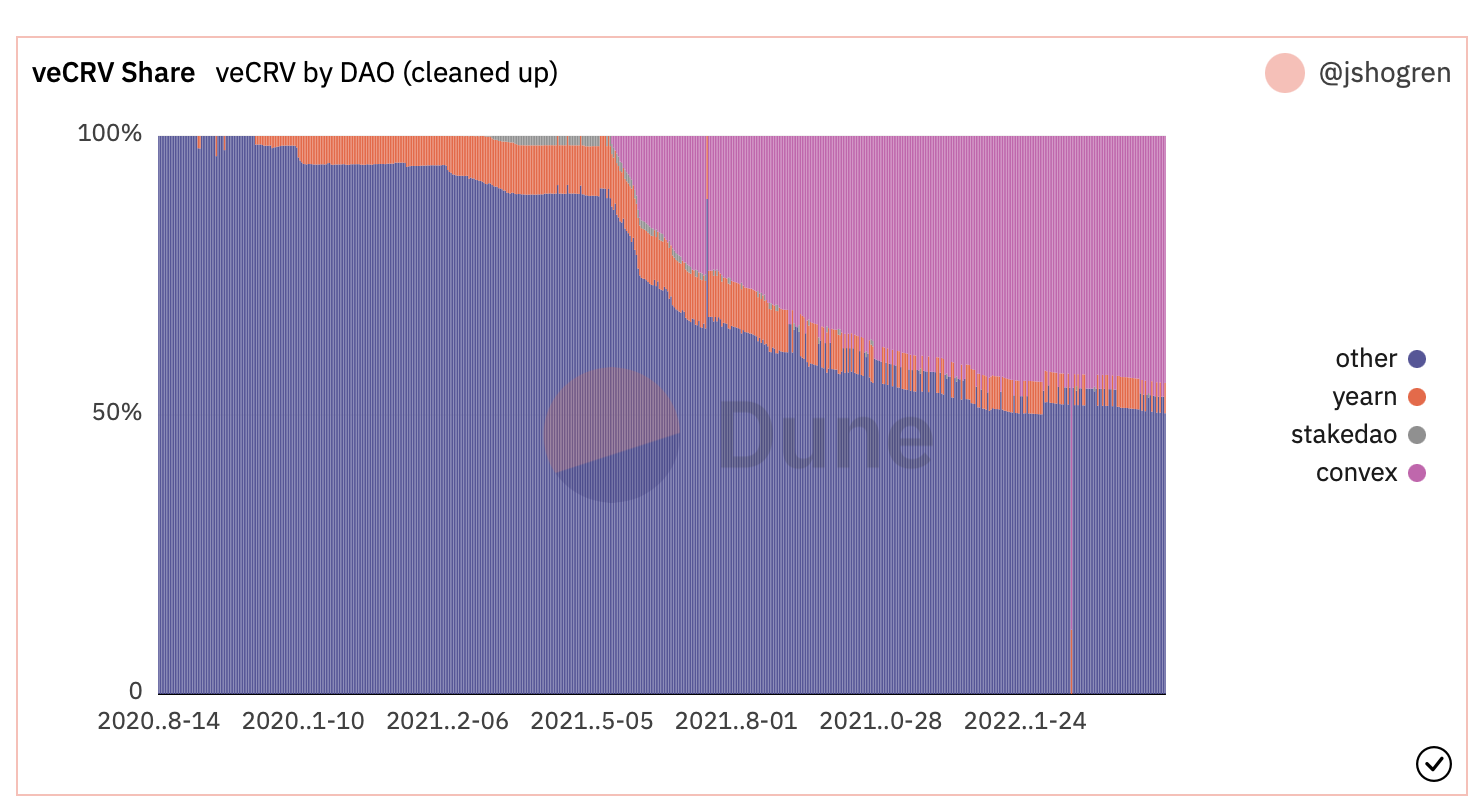

However, the CRV token rewards of different trading pools need to be determined through platform governance and revenue token veCRV voting. veCRV requires users to lock CRV to obtain it, and then they can choose the supported trading pool to vote to increase their CRV liquidity mining rewards and achieve the purpose of attracting more liquidity funds. Therefore, in order to provide deeper transaction depth for their project tokens and achieve stable currency prices, many stable asset project parties choose to continuously accumulate veCRV to compete for the liquidity incentives of the Curve platform, and Curve War follows.

image description

(https://dune.com/jshogren/veCRV-Tracking)

image description

(Top 10 CVX Holding DAO, https://daocvx.com/leaderboard/)

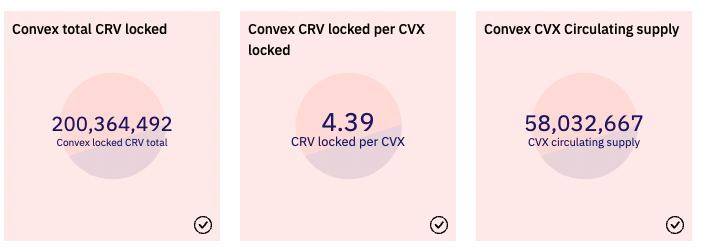

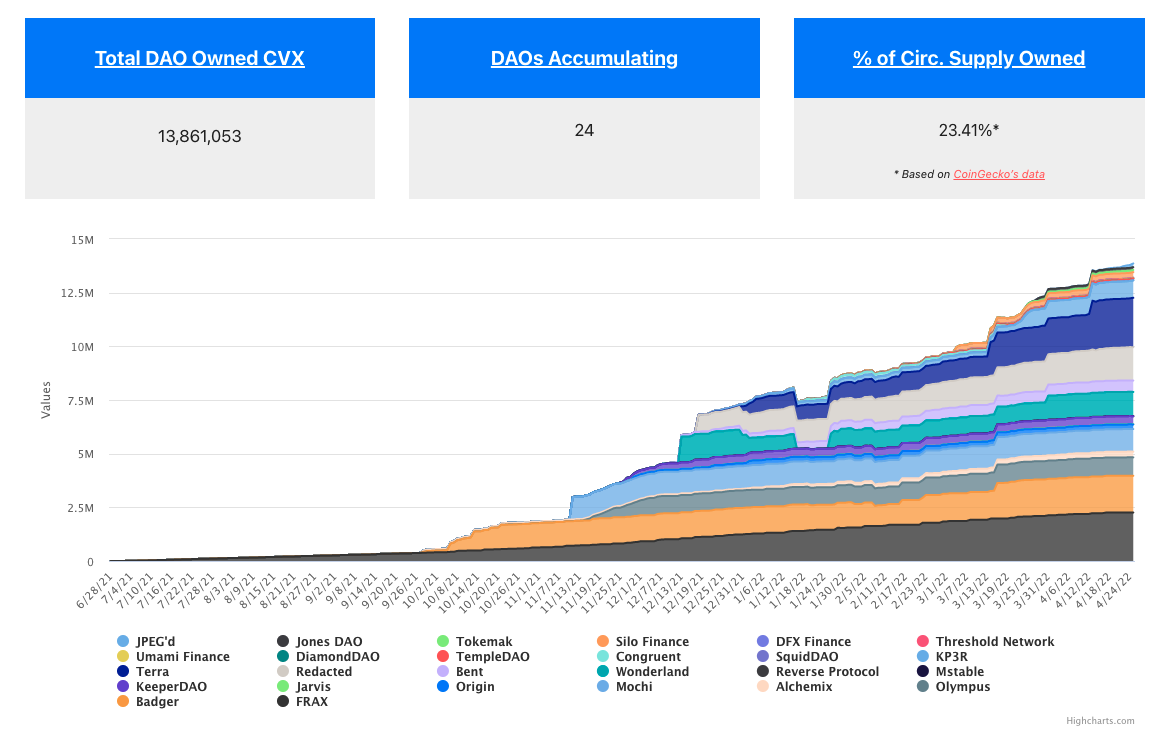

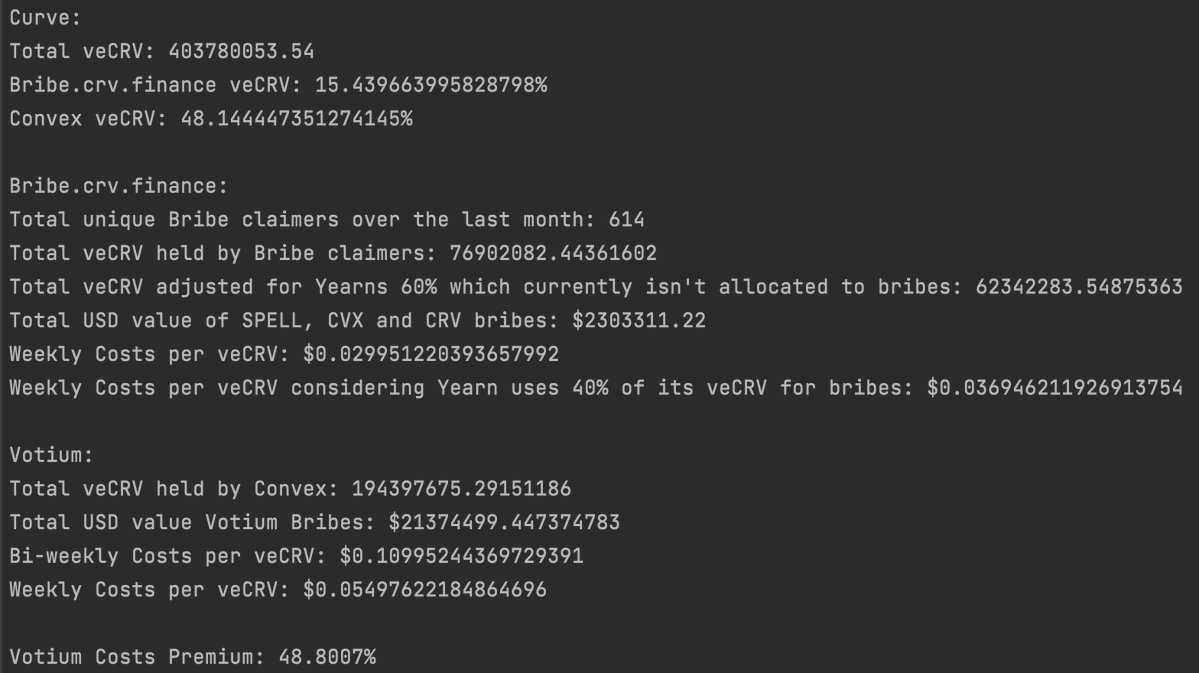

Although the four promoters of 4Pool currently hold about 6.9M CVX tokens in total, accounting for 50.3% of the total CVX tokens held by DAO (about 13.7M), the founder of Terra also tweetedIt controls 50% of claimsdeclaredThe end of the Curve War, but the fact is that it only controls 15% of the total vlCVX (45.9M). Therefore, in order to occupy the control of Convex, Terra and Frax chose to bribe the holders of CVX through the Votium platform, but they also need to pay a huge capital cost for this.

Through this article, we will stand on the perspective of Terra, the main participant of Curve War, and analyze the three-layer DeFi protocol platforms of Curve, Convex and Votium, in order to obtain CRV liquidity rewards to motivate their trading pools on the Curve platform Liquidity depth (TVL), the corresponding capital cost that needs to be paid. Then we will analyze the current trading environment of the corresponding stablecoins on Uniswap V3, hoping to provide some valuable reference information for all stable asset project parties and DeFi investors.

image description

(https://dirtroads.substack.com/p/-31-curve-wars-plata-o-plomo?s=r)

image description

(https://dirtroads.substack.com/p/-31-curve-wars-plata-o-plomo?s=r)

image description

(https://llama.airforce/#/curve/gauges/mim)

image description

(https://dao.curve.fi/minter/gauges)

Convex level

image description

(https://dune.com/jshogren/veCRV-Tracking)

image description

(https://daocvx.com/leaderboard/)

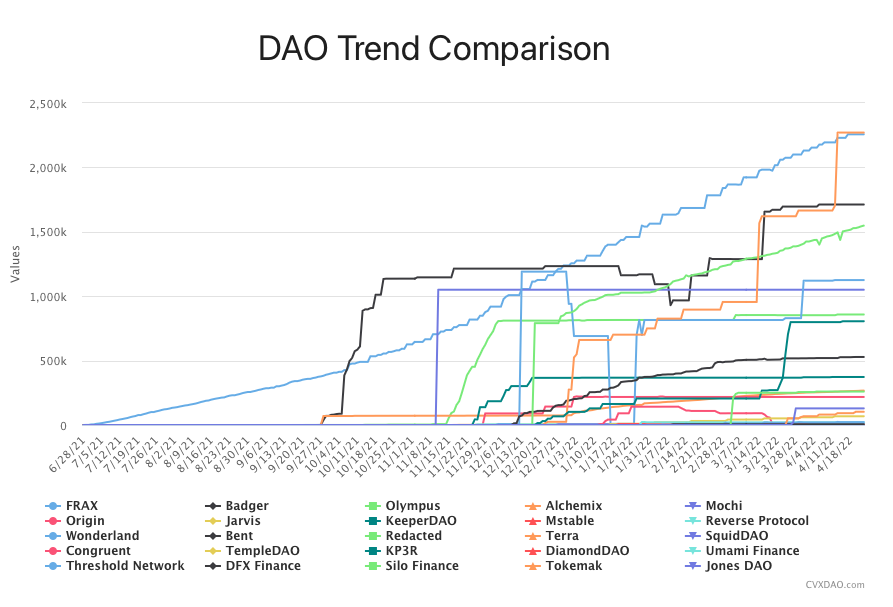

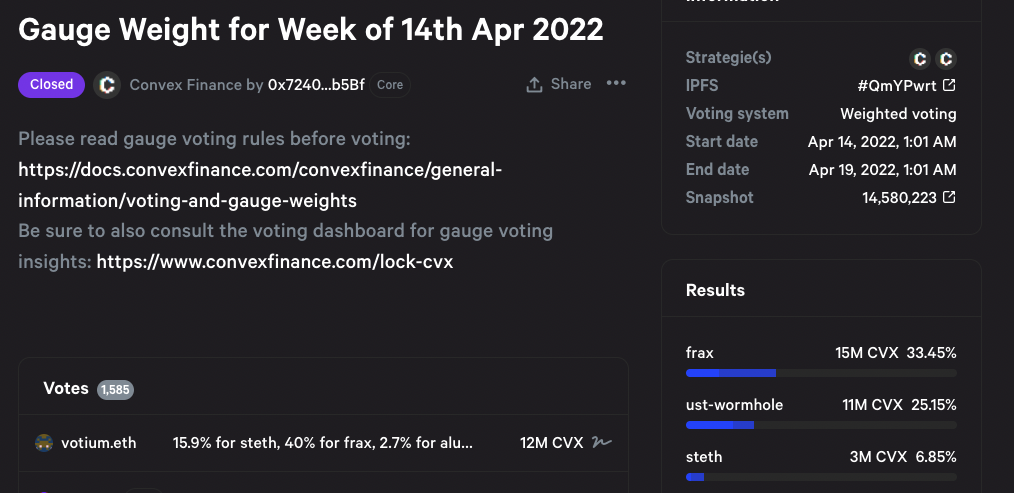

Therefore, the main focus of Curve War participants such as Terra and Frax is to compete for the control of Convex. We can also see that various DeFi protocol parties are constantly accumulating the amount of CVX they control, and after locking up vlCVX to guide the voting of the underlying veCRV controlled by Convex through voting.

image description

image description

(https://vote.convexfinance.com/#/proposal/QmYPwrtFLnwc8ryB9ac6ChbFSm5PnP5F6AdomX7CqjpaCF)

Level of bribery agreement

In addition to directly purchasing CRV and CVX tokens to vote to increase the incentives of their own fund pools, the project party now has a more efficient way to obtain the required voting rights: Bribe and Bribe, a bribery platform based on DeFi Lego attributes. Votium.

Bribe.crv--Curve

image description

(https://bribe.crv.finance/)

But at present, its main use case is that the project party provides token rewards to bribe veCRV holders to vote on the Gauge of their project tokens, increasing the proportion of their liquidity mining $CRV rewards. At the same time, it is also equivalent to innovatively providing a liquidity mechanism for veCRV's own voting rights. Different project parties need to bribe more veCRV votes through bidding, which provides efficient market pricing for veCRV's voting rights and also provides veCRV holders bring in additional income.

Holders of veCRV only need to vote for the fund pool with bribe rewards, and they will automatically receive bribe rewards according to the proportion of their votes. The Convex protocol itself is also a member of the "veCRV holders" group, so the Convex protocol will also receive the bribe rewards provided on the Bribe platform, and will be distributed to Convex protocol users according to the proportion.

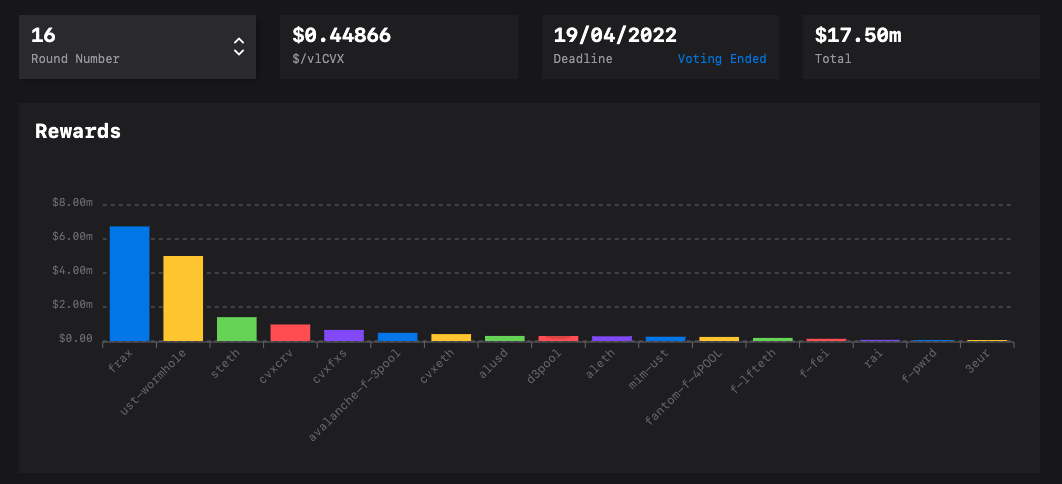

Votium-Convex

image description

(https://llama.airforce/#/votium/rounds/16)

Similar to the logic of the Bribe platform, the buyer of voting rights can provide bribery rewards on the Votium platform to guide more vlCVX voting rights into their designated fund pool. Voting on the Votium platform takes place every two weeks, which means that every two weeks the buyer needs to provide a new round of bribery funds. In the last round of voting, FRAX and Terra provided bribes worth about $11.74M in total, and each vlCVX token received a bribe worth about $0.45.

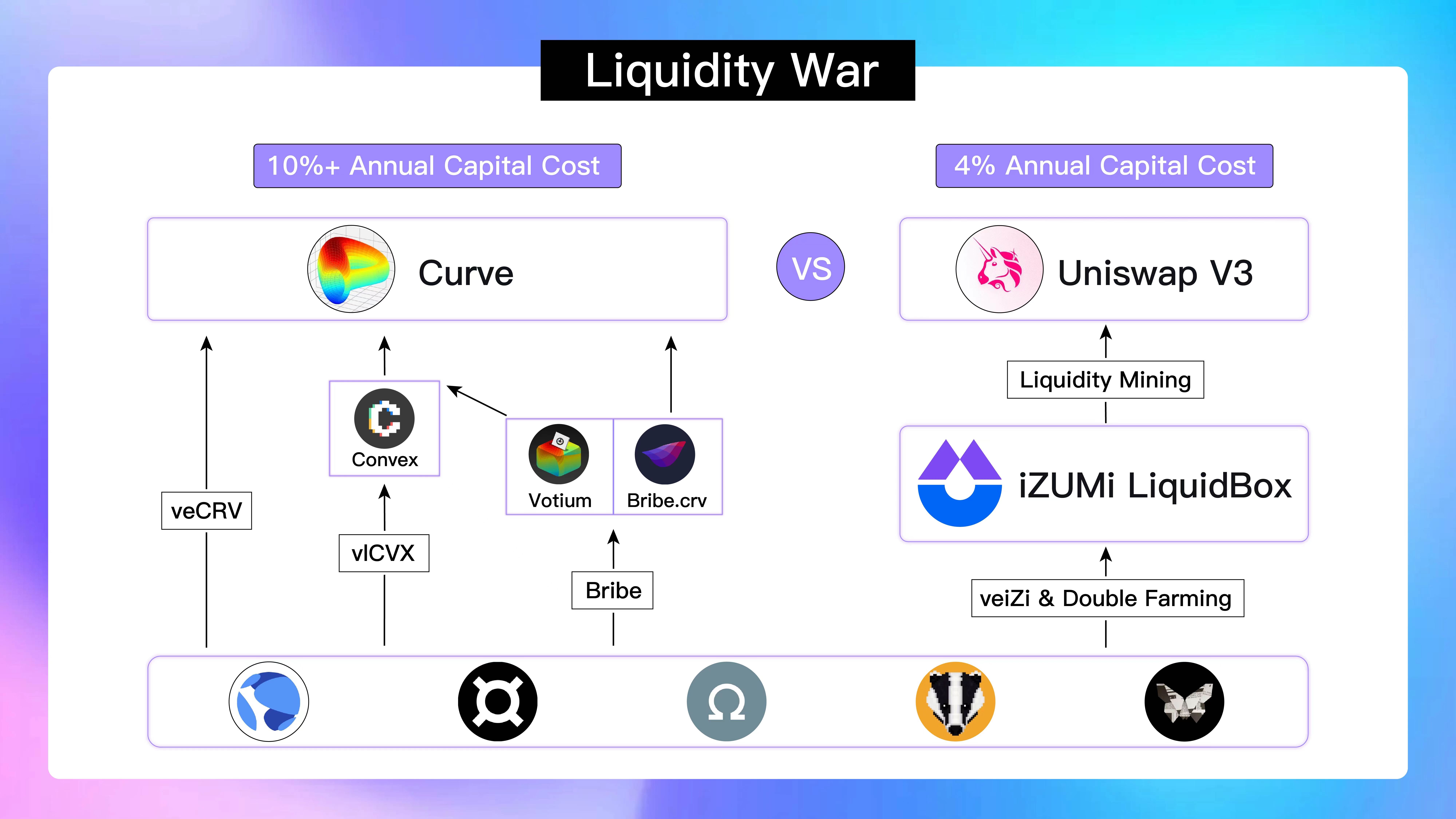

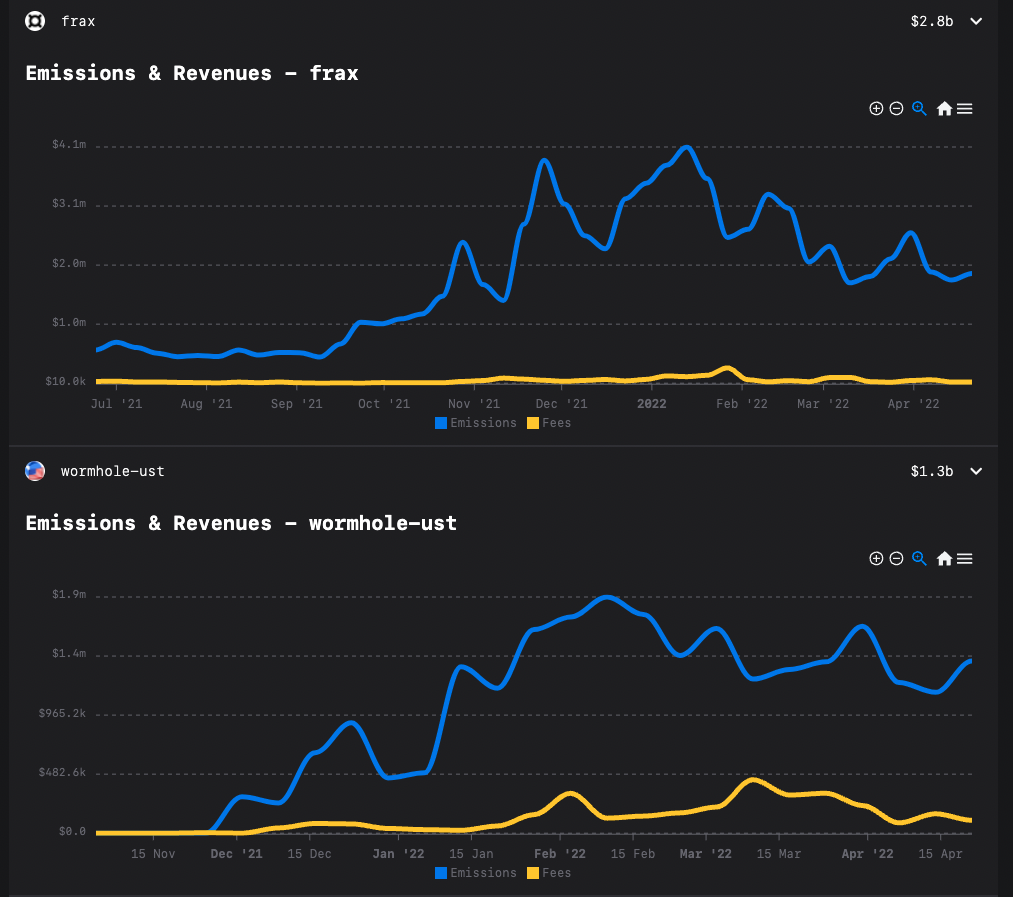

If the cost of bribery remains the same, the annual cost of bribery paid by Terra and Frax will reach $306M, corresponding to the current TVL of the two project tokens on the Curve platform, and the annualized cost of bribery paid by them will be as high as 13.5% , considering that Terra and Frax have spent a lot of money on the purchase of CVX tokens, compared with Anchor's annualized interest rate cost of about 20%, in addition to providing more sufficient liquidity for its token chain transactions, It has not effectively reduced the cost of relying on incentives to maintain its token circulation. And with the more intense competition for Convex voting rights, the cost of bribery will gradually increase.

image description

(https://twitter.com/0xSEM/status/1511835532287959040?s=20&t=8aRAGpfVL0WVY3lrUQah9A)

Uniswap V3 is ending Curve War?

image description

(Pink in the picture is Uniswap V3, https://dune.com/msilb7/Uniswap-v3-Competitive-Analysis)

image description

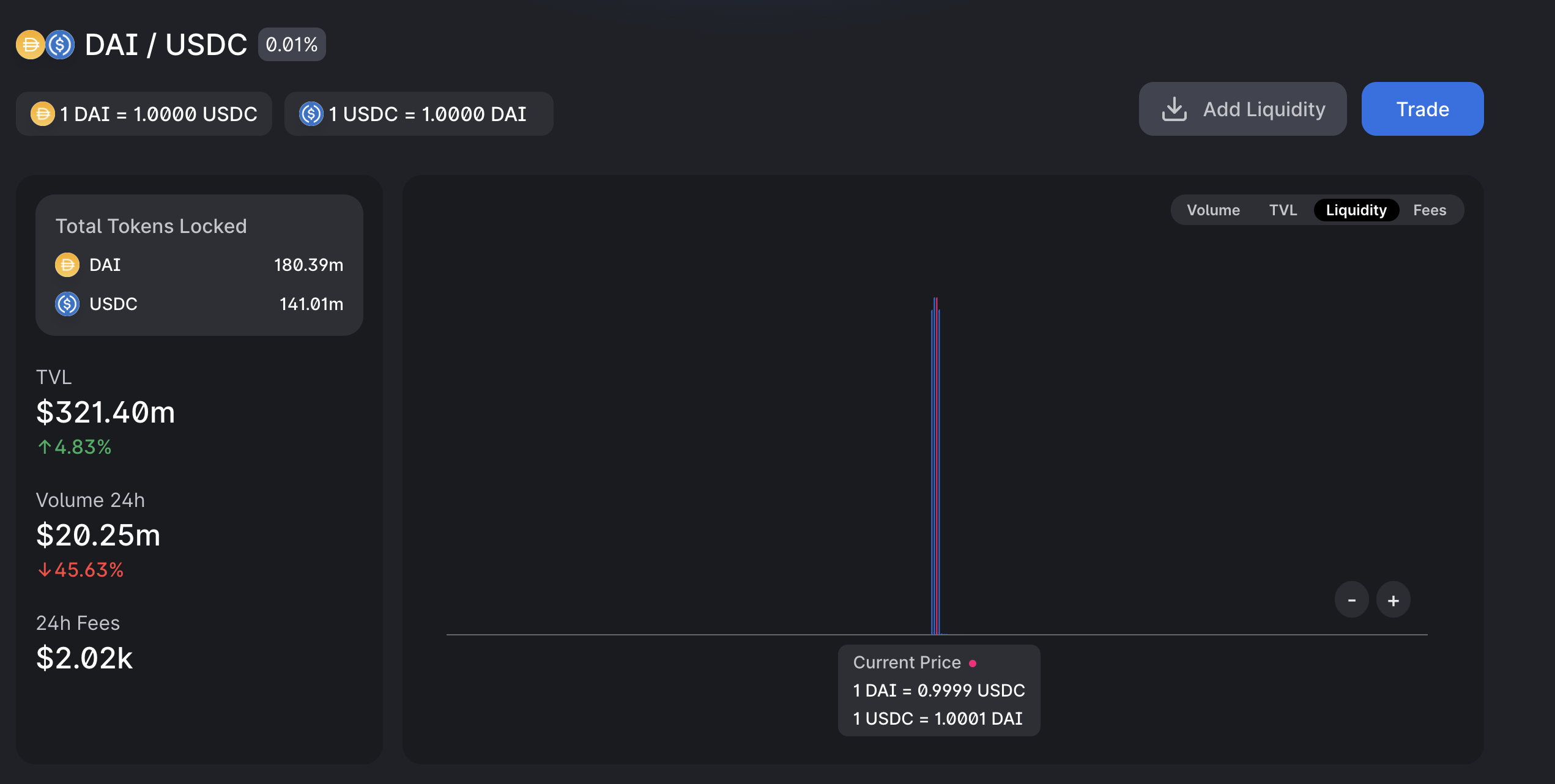

(https://info.uniswap.org/#/pools/0x5777d92f208679db4b9778590fa3cab3ac9e2168)

image description

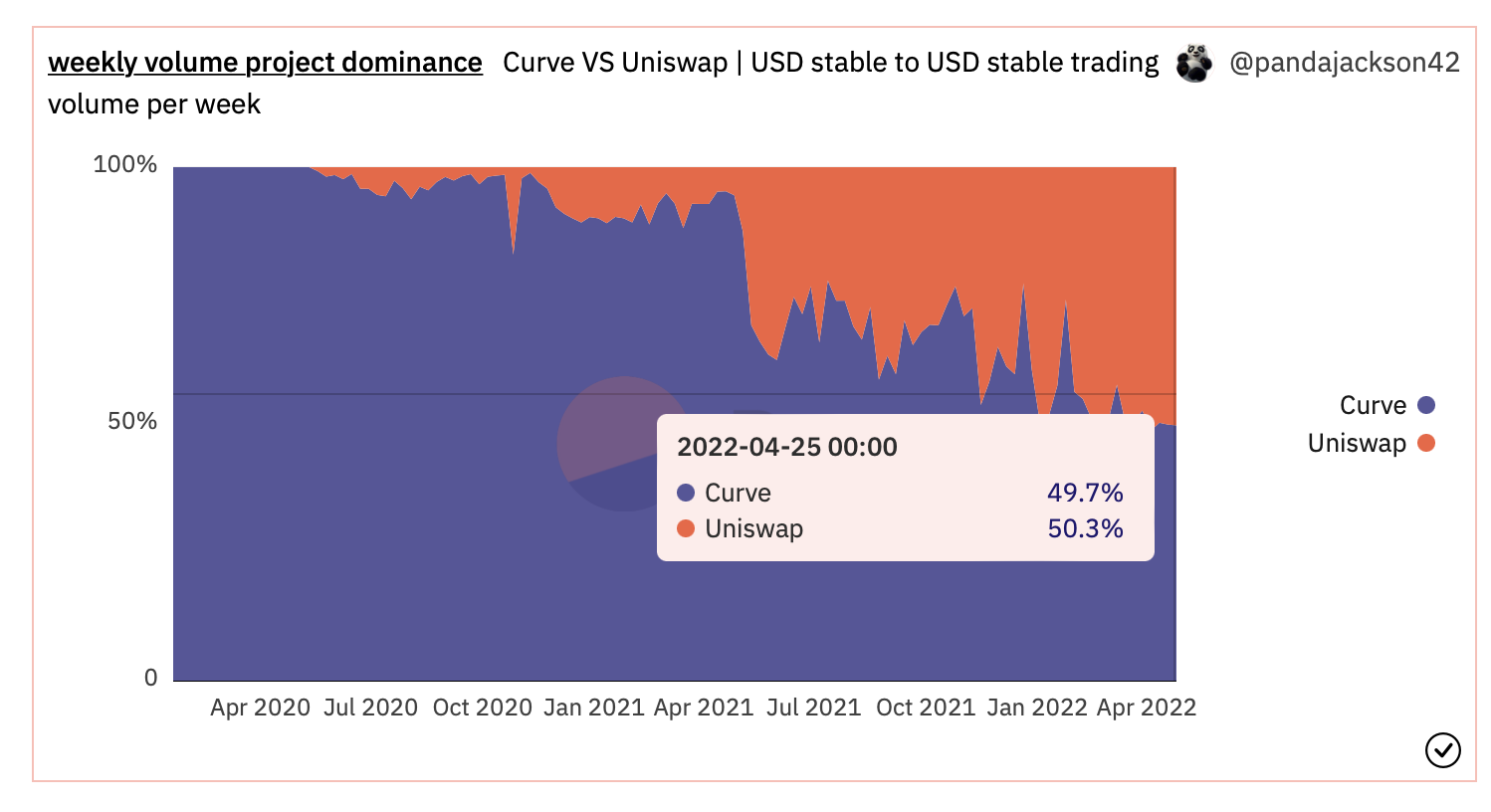

(https://dune.com/pandajackson42/Curve-VS-Uniswap-or-USD-Stable-to-USD-Stable-Trading-Volume)

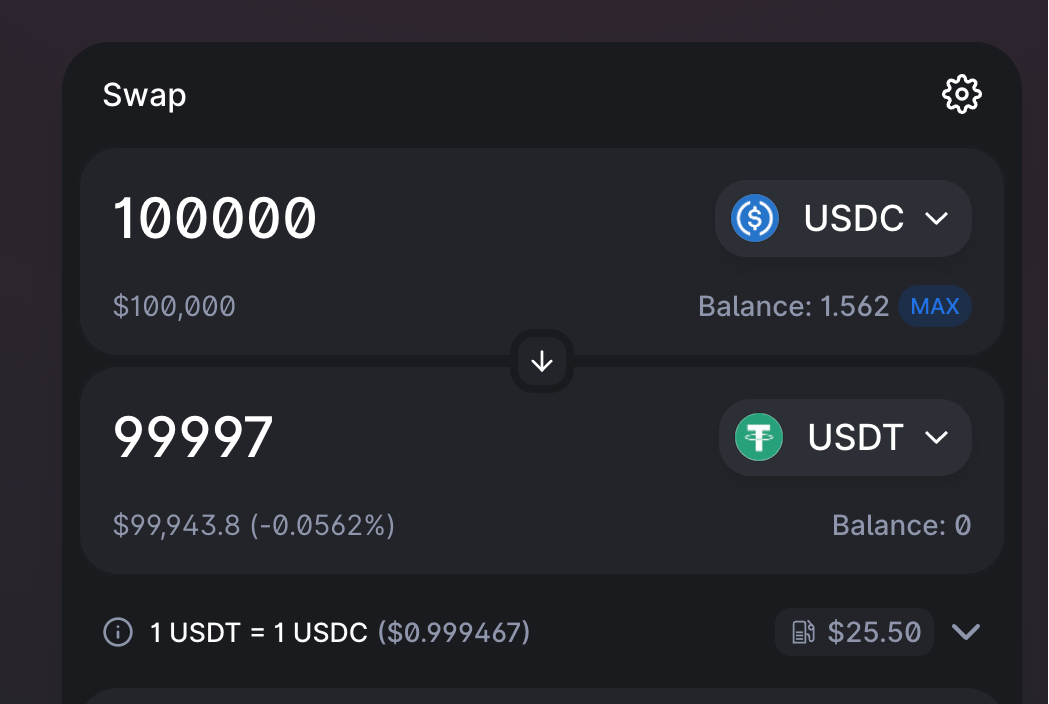

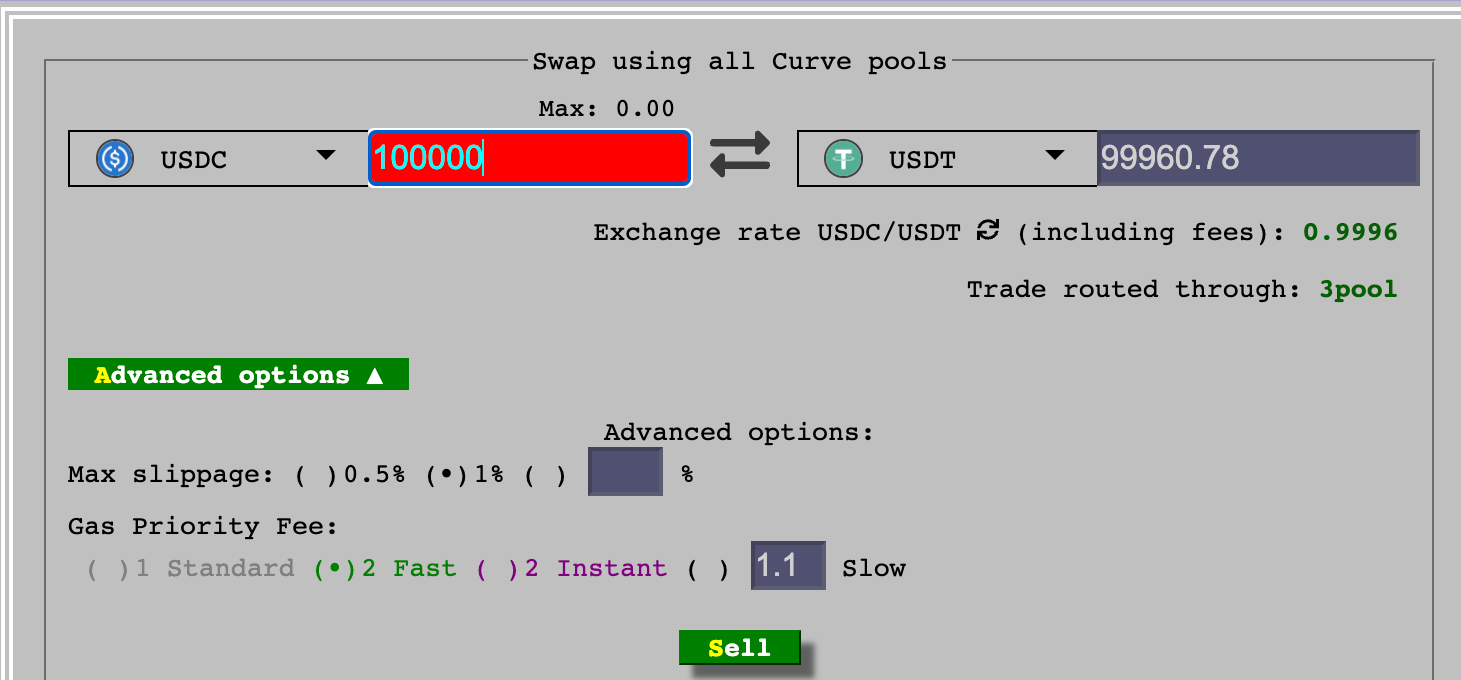

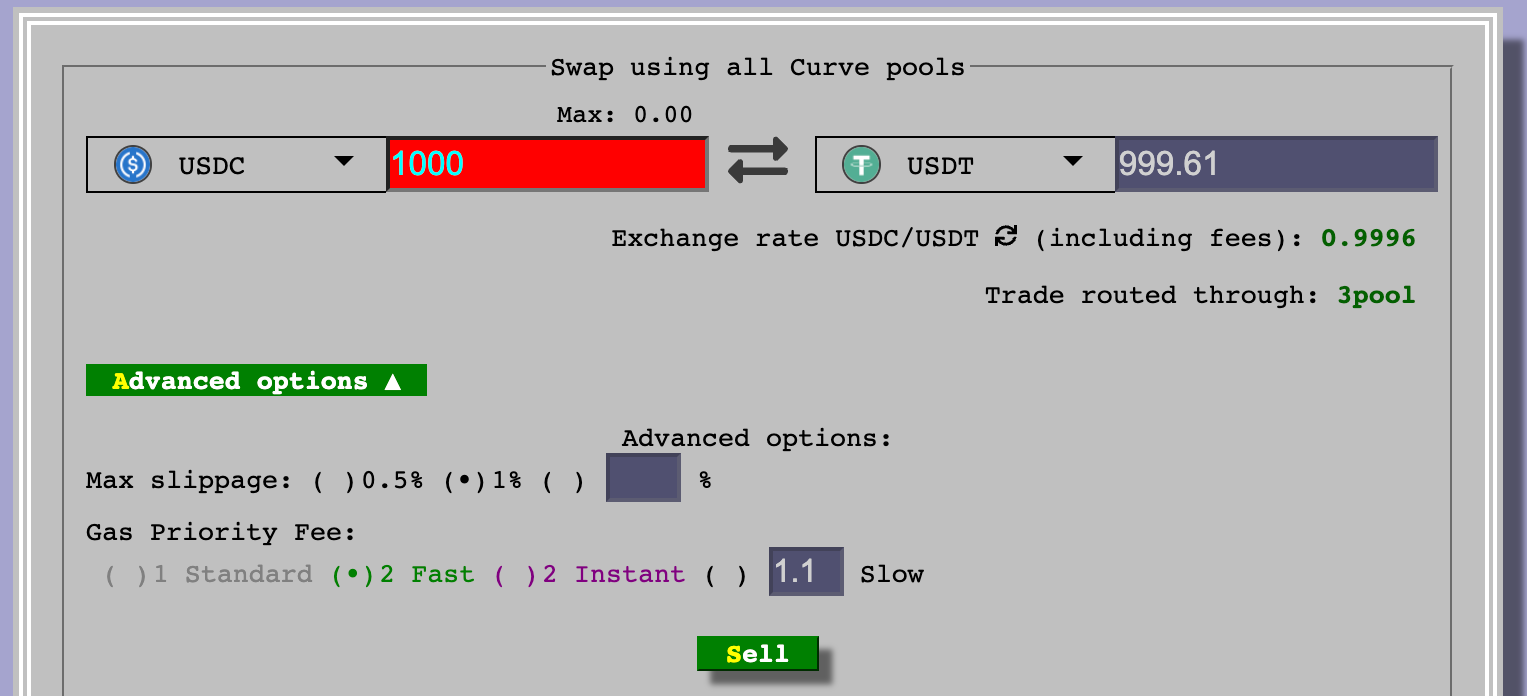

Currently (2022.05.01) the TVL of USDC + USDT in Curve 3-pool is $1.95B, and the TVL of Uniswap V3 USDC/USDT trading pool is $217.43M, the former is about 9 times that of the latter. If we compare the current real trading situation, take USDC/USDT transactions of 100,000 US dollars and 1,000 US dollars representing the single currency transaction shares of giant whales and retail investors as examples:

From the screenshot above, we can see that regardless of the size of the transaction, transactions on Uniswap V3 will achieve better transaction results. The main reason for the gap is not the transaction slippage caused by the AMM mechanism, but because the transaction fee of Uniswap V3 corresponding to the transaction pool is 0.01%, while the transaction fee of Curve’s 3Pool is 0.03%.

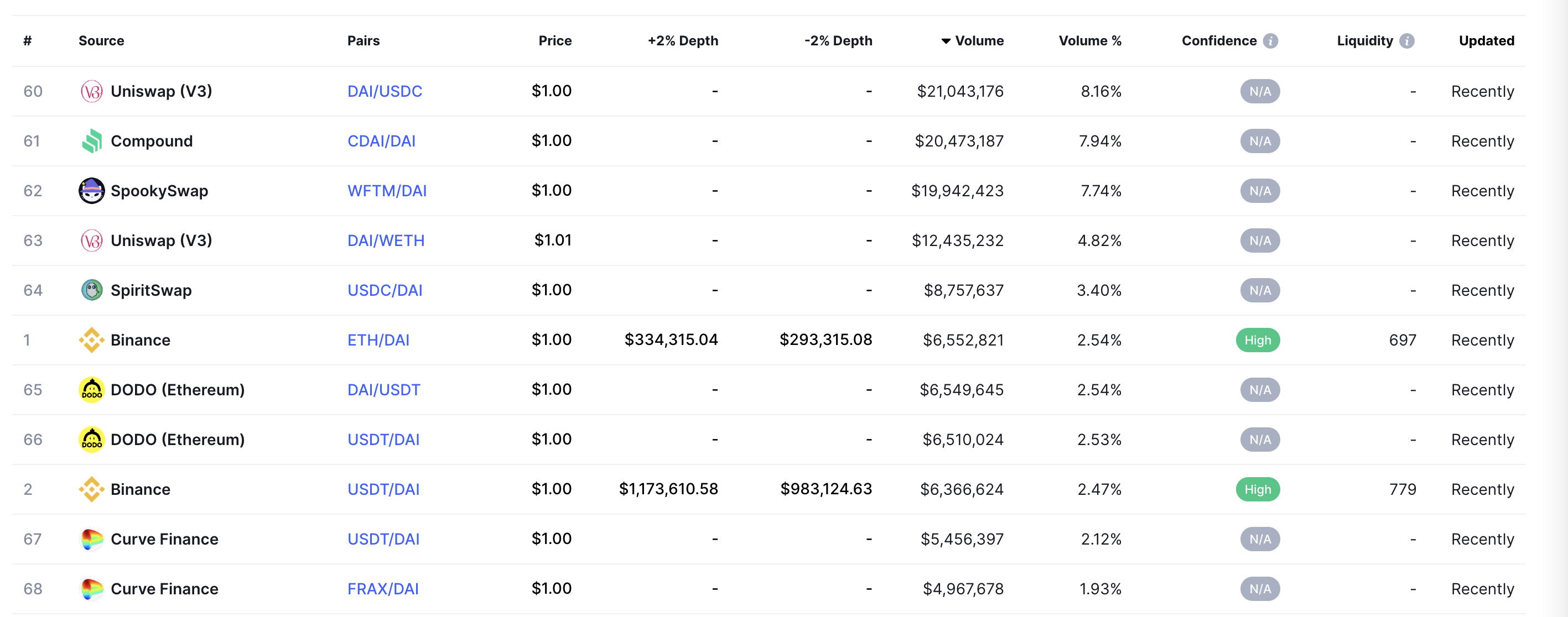

image description

(DAI is based on 24 trading pairs and corresponding trading platform rankings, https://coinmarketcap.com/currencies/multi-collateral-dai/markets/)

If you consider MakerDAO's ownPSM mechanism, supports 1:1 exchange of DAI and USDCimage description

(https://twitter.com/RuneKek/status/1510691073462521857)

image description

(https://twitter.com/MonetSupply/status/1520094314789056514?s=20&t=dWaVozqUEtQlexi3Ahc21Q)

Capital Efficiency: Uniswap V3 > Curve

A very important indicator for comparing DEX is the capital efficiency of its liquidity funds: Volume/TVL. Here we use Uniswap V3’s USD stablecoin to compare the capital efficiency of the Curve platform. The 7 days volume/TVL of the Uniswap V3 USD stablecoin trading pair is 1.15, while that of Curve is only 0.06. Therefore, Uniswap V3 has 19 times the capital efficiency of Curve on the USD stable currency. Therefore, for LPs, more transaction fees can be captured through Uniswap V3.

At present, more funds choose the Curve platform to provide liquidity mainly because of the liquidity mining rewards provided by the Curve and Convex platforms. The corresponding trading pairs of UST and Frax can reach APR of 9.54% and 5.95%. On Uniswap V3, USD stablecoin trading pairs, such as USDC/USDT, have an estimated annualized rate of return of 1.5% based on 7-day trading volume. Although the APR of the corresponding 3 Pool on Curve is only 1.26%, as a liquidity provider, it is a better investment choice to obtain low-risk liquidity mining incentives for USD stablecoins through the Curve ecosystem.

But if we can add a liquidity mining incentive model based on Uniswap V3, can this gap be made up or even surpassed?

iZUMi's LiquidBox — Curve Killer of Uniswap V3 Ecosystem

In the centralized liquidity mechanism of Uniswap V3, since users can customize the value range of liquidity provided, the liquidity provided by each user is unique, so the LP Token provided by Uniswap V3 has also been transformed into an NFT model, which breaks the The traditional model of issuing liquidity mining rewards is based on the number of ERC-20 LP Tokens mortgaged by users.

This change in the LP Token model makes it impossible for the traditional liquidity mining model to be carried out on Uniswap V3, and liquidity mining incentives are the main means by which the Curve ecosystem can provide higher liquidity incentives than Uniswap V3. But in order to solve this problem, iZUMi Finance launched the LiquidBox platform based on Uniswap V3, allowing users to participate in liquidity mining activities by staking Uniswap V3 LP NFT to obtain token rewards.

image description

(https://izumi-finance.medium.com/model-1-concentrated-liquidity-mining-model-with-a-fixed-reward-price-range-for-stablecoin-and-b6472f87f93d)

The fixed price range liquidity mining model is suitable for stable coins or anchor assets with little price fluctuation, and supports project parties and platforms to customize the target liquidity market-making range. Users can arrange a specified price range to inject liquidity on Uniswap V3, and pledge the obtained Uniswap V3 NFT on the iZUMi platform. Afterwards, liquidity providers will also earn iZi platform token rewards while receiving Uniswap V3 transaction renewal fees .

Such a model can not only meet the needs of price-stable assets for centralized liquidity, but also directly enable Uniswap V3 to directly benchmark Curve's CFMM algorithm + CRV token incentive model under the blessing of liquidity mining on the iZUMi platform. And the original Uniswap V3 liquidity provider can also obtain additional liquidity mining rewards in addition to transaction fees.

Based on this model, iZUMi supports the liquidity mining of Uniswap V3 in Ethereum, Polygon and Arbitrum's USDC/USDT trading pair, and participates in iZUMi's flow in the $4.7M liquidity fund of Uniswap V3@Polygon USDC/USDT trading pair Sexual mining accounted for 87% of the share ($4.1M). Also in the liquidity funds of Uniswap V3@Arbitrum USDC/USDT, the TVL of $13.3M on the iZUMi platform accounts for 95% of the total fund pool ($13.95M). Such a large TVL liquidity mining participation rate has proved its attractiveness to stable asset holders, and greatly improved the liquidity and transaction depth of the corresponding trading pairs.

Compared with the current APR yield of about 9.5% provided by Curve+Convex, and Uniswap V3 can achieve a yield of 1.5% for liquidity providers based on handling fees. On this basis, as long as iZUMi Finance provides liquidity mining income of 8% APR for liquidity funds, half of which is provided by iZi platform token mining, and the remaining half is the corresponding liquidity capital cost of the project party: Only 4%.

Summarize

Summarize

Although UST and Luna themselves have not 100% proven the reliability of their value support, the 4Pool proposal initiated by Terra can be said to be the most exciting event in the entire DeFi industry in April. Its impact on the Curve War and 4Pool The uncertainty of the final result highlights the high innovation and high risk of the DeFi industry itself. Through this research report, I hope to help you understand the capital costs that external participants of Curve War, whose main purpose is to promote the liquidity of their own project tokens, need to pay for projects at different levels of the ecology. And through the analysis of the current status of Uniswap V3 USD stablecoin transactions, I hope everyone realizes that Uniswap V3 has become a better trading platform than Curve, and through the LP NFT liquidity mining function supported by iZUMi Finance LiquidBox, Uniswap V3 already has all the necessary The conditions surpass Curve in an all-round way. Once the core value function of the Curve platform-stable asset transactions is surpassed by competitors, the value support of its ecological projects will quickly collapse. Once this point of view becomes mainstream market perception, the foreseeable ending of Curve War may not be far away from us.