OP Research: ZK Rollup's latest take-off guide

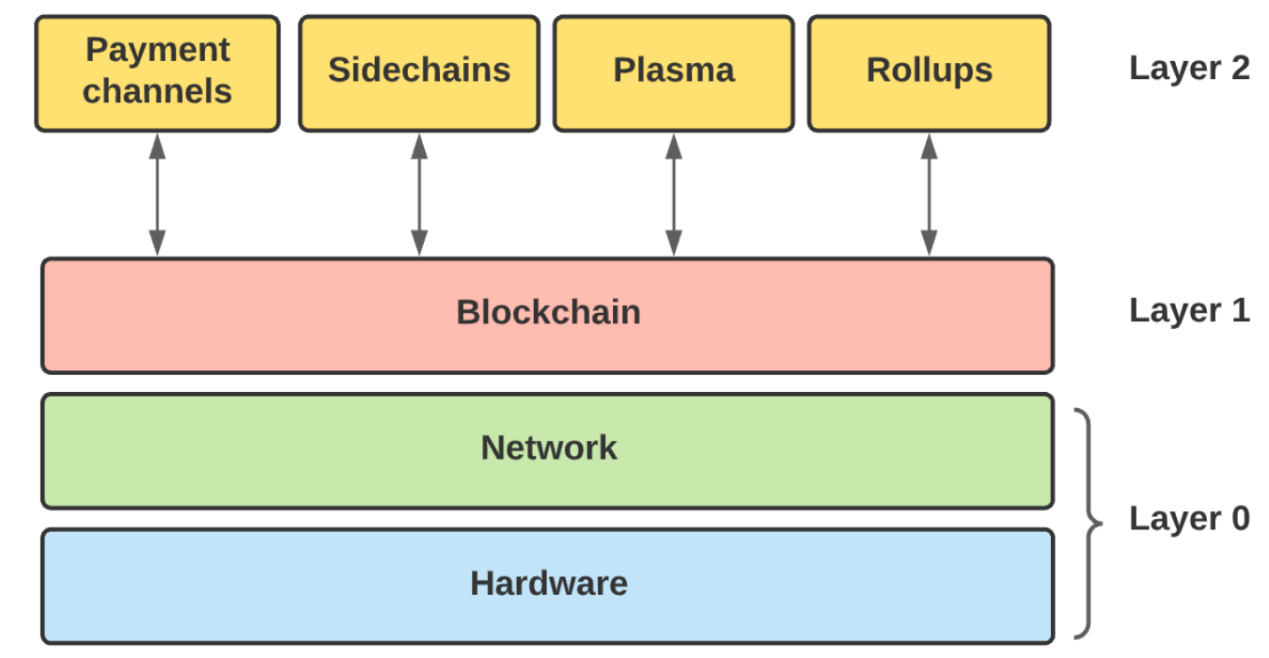

As the optimization solution of the Ethereum public chain, Layer 2 has always been a hot spot of attention, discussion, and research and development. For example, Ronin where Axie is located, Starknet, Arbitrum, Optimism, ZKSync used by DYDX, etc., many R&D teams have actively tried Layer 2 technical solutions . So what exactly is Layer2? The Ethereum public chain itself is called Layer 1, the main network or the main blockchain layer, and Layer 2 refers to moving transactions from the main blockchain layer to a separate layer that can communicate with the main chain to achieve faster transactions and transactions. Lower gas fees.

image description

text

text

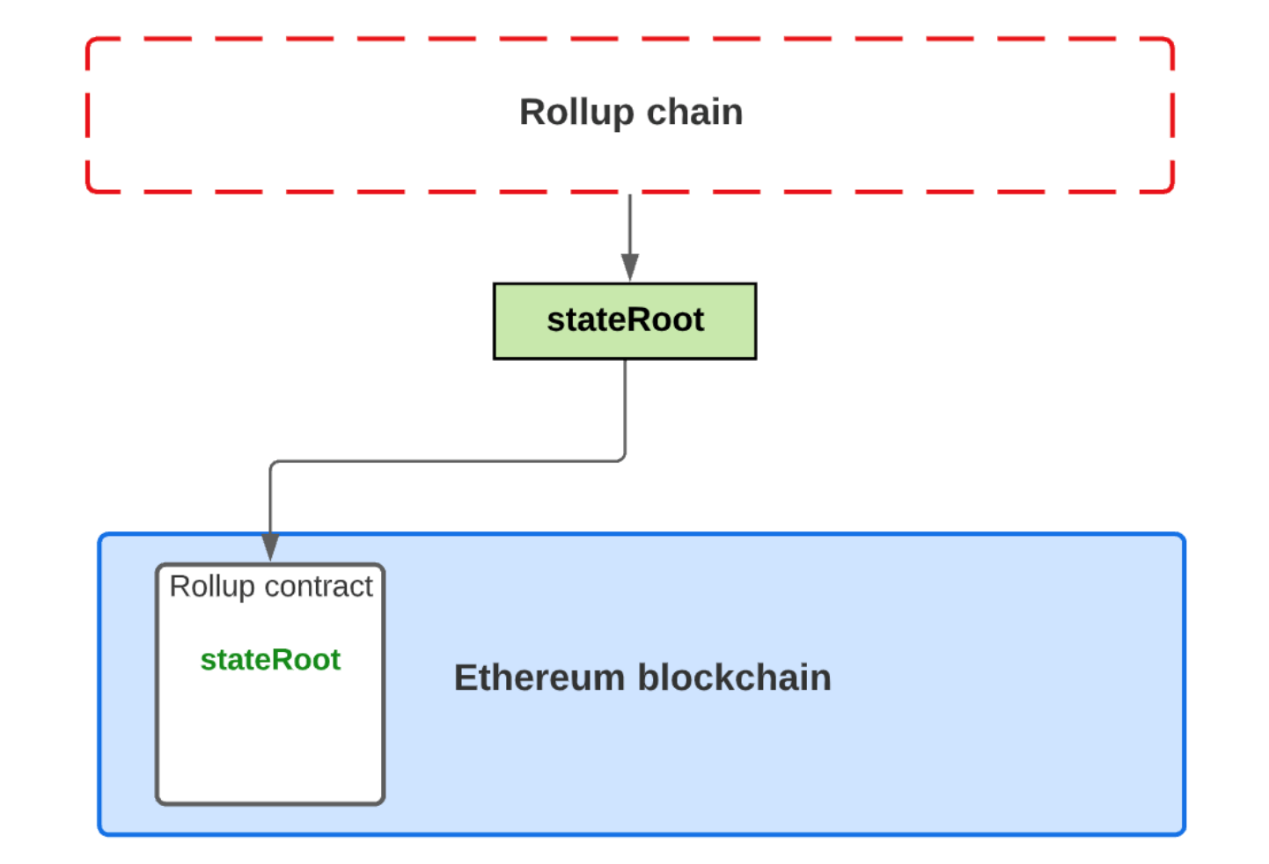

image description

Figure 2: Schematic diagram of Rollup technology principle

Unlike Optimistic Rollup, which optimistically believes that all submitted state roots are credible, and guarantees security by submitting fraud proofs, ZK-Sync in ZK Rollup uses ZK-SNARK encryption proofs to publish state roots, and uses zero-knowledge Proof techniques (allowing one party to prove something to another party without revealing the information necessary to prove it) to verify the authenticity of the state root, thereby avoiding access to the data itself to guarantee privacy. Compared with Optimistic Rollup, which takes a week to withdraw, ZK Rollup can withdraw assets in only 10 minutes.

However, ZK-SNARK is a new technology, and its mathematical principles are extremely complex. As a result, ZK Rollup is still in the development stage, and its adaptability is weaker than that of Optimistic Rollup. However, the advantages of ZK Rollup are also obvious. ZK-SNARK eliminates the need for transaction witnesses, which greatly reduces the data stored on the chain and increases scalability. ZK-SNARK can verify each transaction and make it more efficient. Safety.

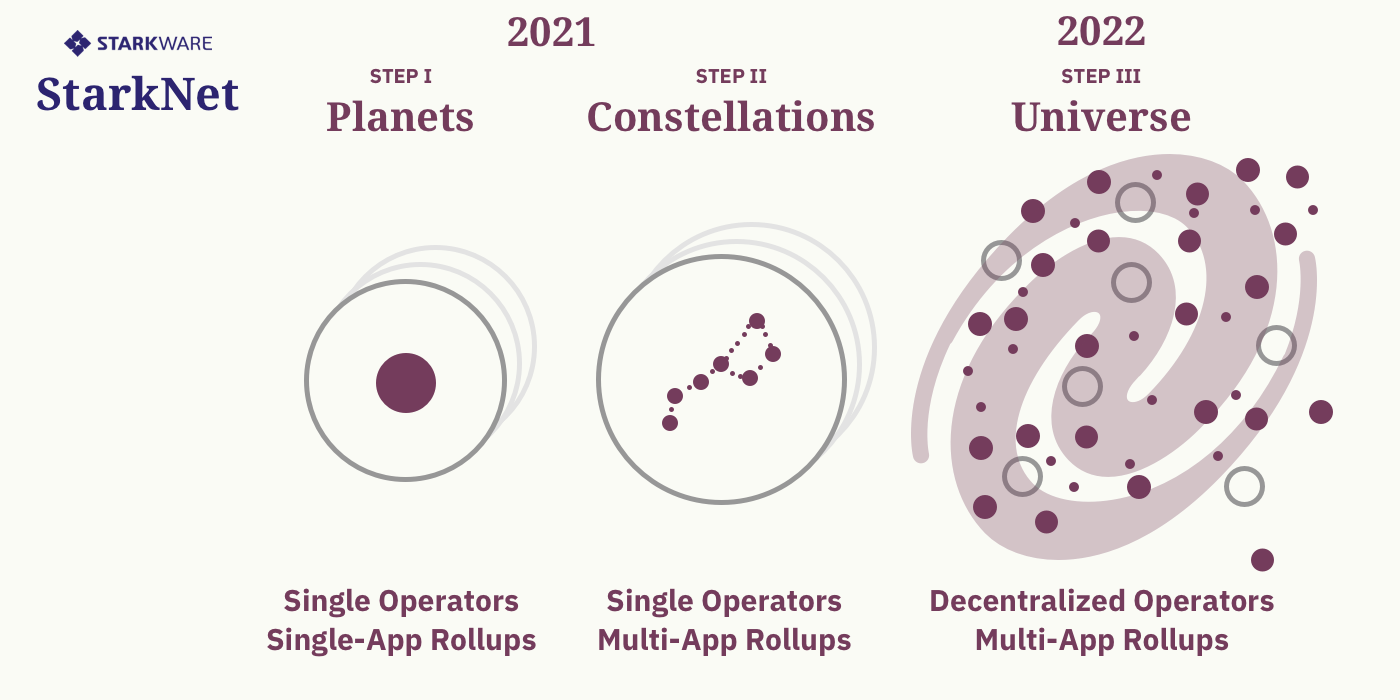

Similarly, StarkWare also uses ZK Rollup, but based on ZK-STARK. Compared with ZK-SNARK, ZK-STARK technology has made scalability, skipping the improvement of initial trust setting and anti-quantum computing, which leads to the lack of maturity at this stage, and the consumption of Gas fee is also higher. In addition, StarkWare uses the Cairo language. Once Turing is complete, it will be difficult to be compatible with EVM. To solve this problem, the StarkWare team developed the code translator Warp, which seamlessly converts Solidity smart contracts to Cairo. In addition, currently StarkWare has implemented dydx, Immutable, and Deversifi-specific ZK Rollup through StarEx.

The above briefly introduces Layer 2 and Rollup as one of the technical solutions. We believe that ZK Rollup, one of the directions of Rollup, has more obvious advantages and better scalability. Chains based on ZK Rollup may be updated in the future. widely used. But can the ZK Rollup chain really break through the encirclement of many side chains and Arbitrum and Optimism after the main network goes live, and occupy a position as high as its technical level? This article attempts to select and analyze the public chains with better performance in each dimension through four dimensions, and use this as a basis to speculate on the development potential of the ZK Rollup chain and give corresponding suggestions.

four dimensions:

1. Crypto Native

2. On-Chain Asset

3. Ecosystem

secondary title

Crypto Native

Encryption native refers to the core level of blockchain technology, such as conceptual breakthroughs and technological innovations. For example, Ethereum created a Turing-complete virtual machine, which expanded the blockchain from a Bitcoin payment network to various complex interactions, making concepts such as DeFi possible. There are many other public chains with unique technologies, novel concepts, and different attempts. We selected three public chains, Cosmos, Polkdaot, and Solana, as representatives of the encryption-native dimension, to illustrate how public chains can improve their own innovation or performance. Gain a place in the crypto-native space.

(1)Cosmos

Cosmos believes that the future is a multi-chain universe composed of blockchains focusing on different functional applications. Based on this idea, Cosmos has developed three basic components: 1) Tendermint consensus protocol, 2) Cosmos SDK, 3) IBC (Inter Blockchain Communication) cross-chain communication protocol, which solves the cross-chain problem and makes a multi-chain universe possible.

Cosmos simplifies the development process of blockchain applications, allowing developers to focus on the application itself without paying too much attention to the underlying protocol through a rich SDK and Tendermint engine. More importantly, Cosmos has realized native cross-chain, and each chain can conduct atomic-level transactions through the hub of Cosmos "Hub", realizing real cross-chain, instead of establishing funds in different chains like other mainstream cross-chain bridges Pool to achieve the so-called "cross-chain".

(2)Polkdot

Polkadot uses the main chain "relay chain" and fragmented "parallel chain" to achieve cross-chain. Each parachain communicates with other parachains by connecting with the relay chain, and each relay chain can support about 100 parachains. Polkadot uses Wasm as a meta-protocol, which allows parallel chains to define the logic and language of their own chains. They only need to provide their own state transition functions to the relay chain validators to execute and connect to the relay chain.

Polkdot applications can exist within a parachain or be deployed across parachains. Although the relay chain can connect parachains, the interface of the relay chain is limited, so the parachains need to use the auction method to bid for slots, which is often referred to as the "slot auction".

(3)Solana

Solana is designed to scale throughput while keeping costs low. To achieve this, Solana employs an innovative hybrid consensus model that combines a unique Proof-of-History (PoH) algorithm with a lightning-fast sync engine (aka another version of Proof-of-Stake, PoS).

secondary title

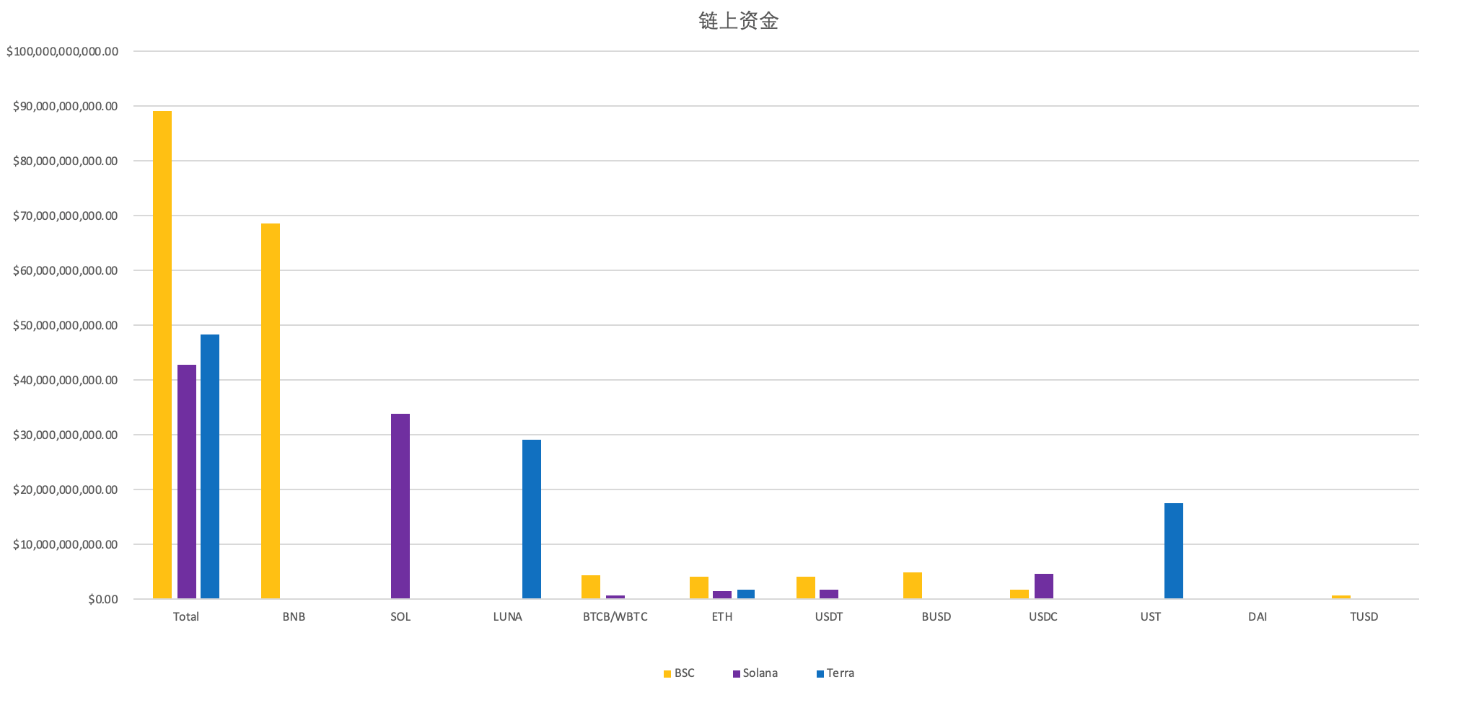

On-Chain Asset

On-chain funds refer to the collection of mainstream tokens with relatively stable purchasing power issued on the blockchain, such as BTC, ETH, BNB, USDT, USDC, DAI, etc. The number of high-quality assets on a public chain determines the space for capital expansion on the chain, because there is currently no universal credit mortgage method in the blockchain, and asset mortgages can only be used to increase leverage, and mortgaged assets usually All need to be high-quality assets to ensure security, so we chose three public chains with more high-quality assets on the current chain as representatives: BSC, Solana and Terra.

image description

image description

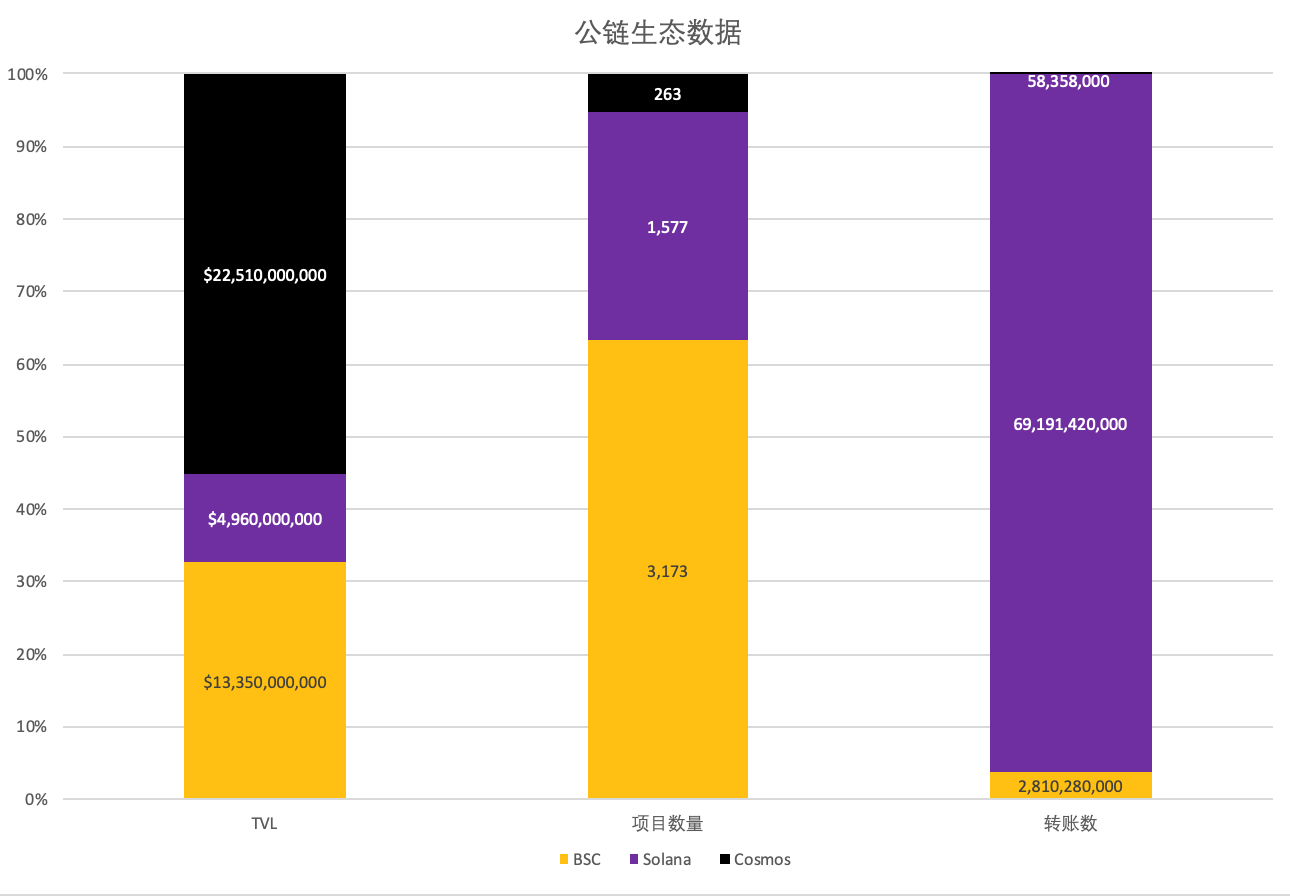

secondary title

text

text

text

text

text

image description

image description

text

text

text

secondary title

text

text

text

image description

image description

text

text

first level title

The Future of ZK Rollups

secondary title

Crypto Native

Looking at ZK Rollup from the perspective of encryption native, its importance is self-evident. Rollup plays an important role in Ethereum's move towards a modular blockchain to achieve expansion, that is, to hand over the consensus to the Ethereum layer, and transfer execution and data availability to Rollup for operation. Among them, zero-knowledge proof, as a well-recognized encryption-native solution, essentially compresses the amount of calculations while ensuring the correctness of data. The principle of the technical solution has been described in detail above, and the well-recognized results can be seen from the current fundraising situation of the two major ZK Rollups (StarkWare/zkSync) (see below for details).

secondary title

On-Chain Asset

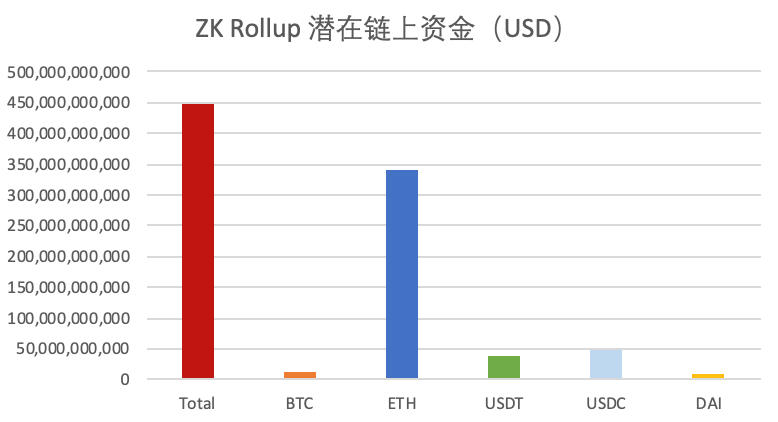

In the second part, we can judge the on-chain funds of ZK Rollup from the stock funds on Ethereum. There is no doubt that the mainstream currency with relatively stable purchasing power on Ethereum is the most among all public chains with smart contracts, not only the market value of ETH has always been stable in the second place among all cryptocurrencies. Secondly, mainstream USD stablecoins such as USDT issued by Tether, USDC issued by Circle, USD stablecoins Dai and MIM based on digital currency collateral, and various algorithmic stablecoins such as Frax and Fei, and BTC’s anchor currency such as WBTC, HBTC, renBTC, the above-mentioned mainstream coins with absolute purchasing power on the chain, the main public chain currently in circulation is still in Ethereum.

image description

secondary title

Ecosystem

The birth of Ethereum, due to its first-mover advantage over web3.0, has produced the most mature blockchain ecology in the world, whether it is from developer ecology, infrastructure and project ecology, or even users in Ethereum Ecology, all in the blockchain public chain.

For ZK Rollup, in addition to the funds on the chain, whether the growth of the ecology can attract the current high-quality web3.0 projects on the first layer of Ethereum to migrate their main activities, funds locked, and users to their second-layer network , will be the top priority.

Secondly, whether the Gas Fee for user usage can be reduced to the level of BSC/Avalanche or even Solana will determine whether ZK Rollup can attract back the funds and traffic spilled from Ethereum in mid-2021.

Finally, from the development history of the public chain, whether the public chain can have exponential on-chain transaction growth depends largely on the narrative stories of new forms, such as DeFi in 2020, NFT, GameFi in 2021, etc.

Therefore, with the exponential growth that ZK Rollup will bring to Ethereum, whether a new form of web3.0 products can be launched will also be a key factor for whether ZK Rollup can lead Ethereum to a new high. The following we focus on zkSnyc / The current ecology of Starkware is described separately.

In terms of zkSync, judging from the fundraising news disclosed so far, there are a large number of excellent web3.0 projects investing in it, and several CEXs have also announced the opening of coin withdrawal channels based on zkSync; more importantly, it can be used in zkSync Any token to pay for its fees without buying ETH or a custom token like MATIC. This feature will make zkSync’s use threshold compared to other Layer2 or even other public chains.

In addition, in order to reduce the difficulty of development for developers, zkSync2.0 has emphasized that developers can use Solidity through its zkEVM and compilers to achieve 99% EVM compatibility, which allows DeFi to be developed in zkSync2. 0 seems more likely to happen at scale.

As for Starkware, StarkEx was launched in June 2020 as its Layer 2 scalability engine, allowing the creation of application-specific ZK Rollups powered by Cairo and STARKs. At present, there are dydx, Immutable, Deversifi, and Sorare based on StarkEx’s running projects. The current locked amount on the chain has reached $1.16B, and more than 140 million transactions have been processed, with a cumulative transaction amount of more than 518 billion U.S. dollars.

image description

image description

(Image Source:https://medium.com/starkware/on-the-road-to-starknet-a-permissionless-stark-powered-l2-zk-rollup-83be53640880)

ZK Sync:TVL $122 M;total transactions 7,264,107; ecological projects 85

Starkware:TVL$1.16B; 145M Tx

secondary titlehttps://zkScan.io/、https://starkware.co/starkex/)

CommunityCommunity

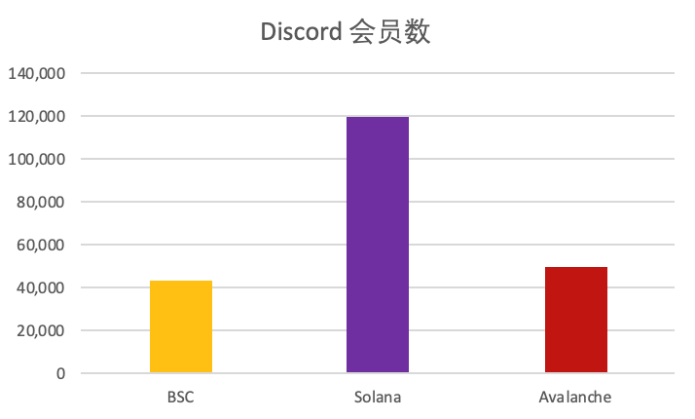

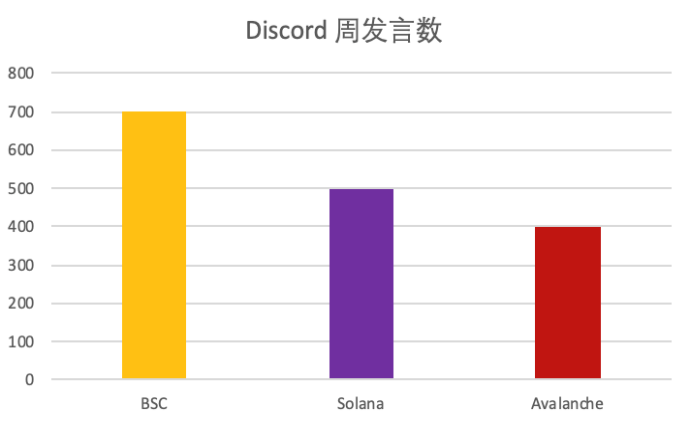

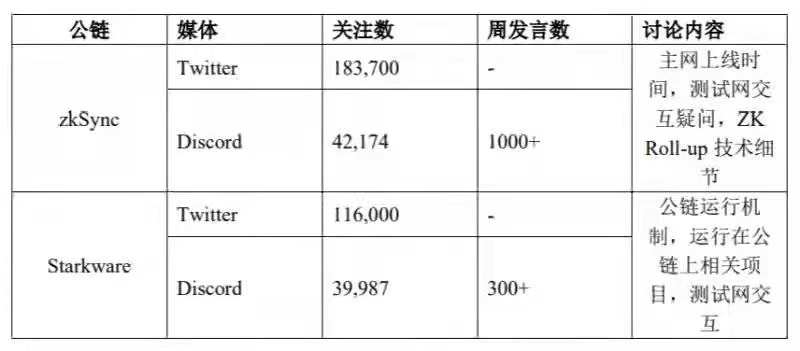

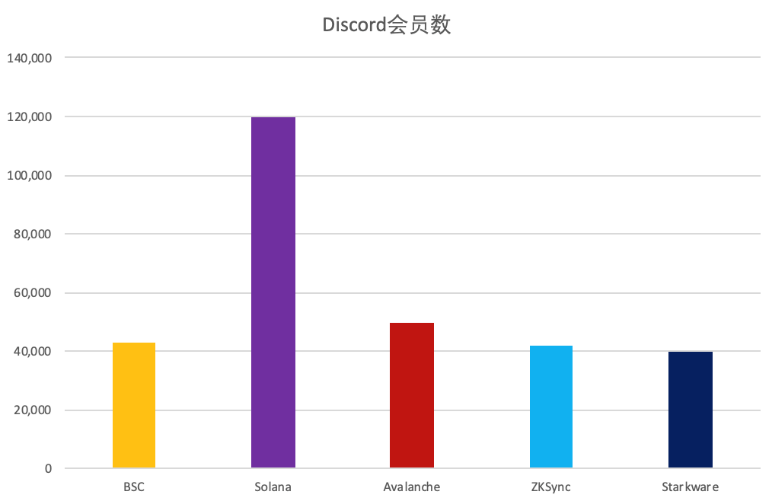

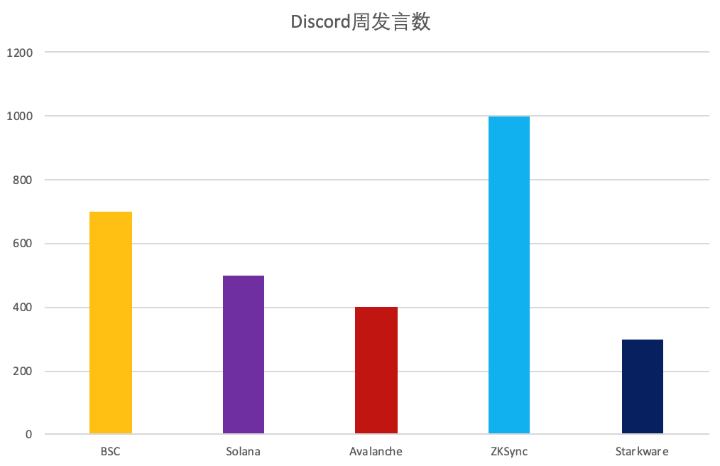

In terms of community, the two major projects of ZK Rollup are already close to BSC, Solana, and Avalanche in terms of community activity indicators such as the total number of people on social media, the number of speeches, and message content. Even in terms of the number of speeches on Discord, zkSnyc is even ahead of Other public chains, all of which are built before the main network is launched.

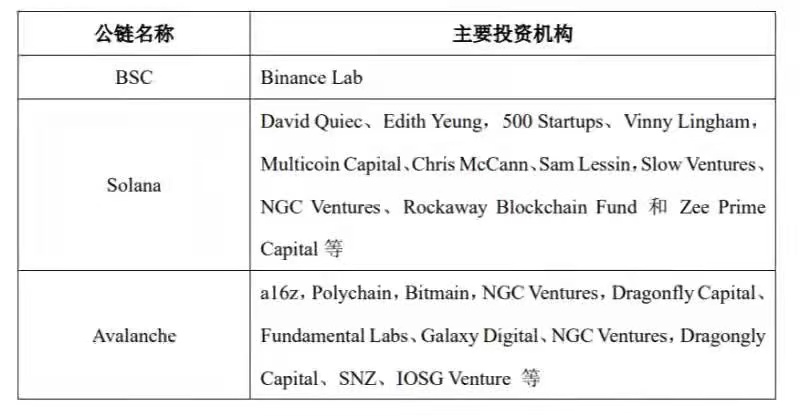

From the perspective of investment institutions, in March 2022, StarkWare is conducting the latest round of fundraising with a scale of 6 billion US dollars, turning over its past investors. This is definitely a super advanced level of financing, except for Ethereum founder Vitalik , there are well-known top investment institutions in the currency circle such as Paradigm, etc., and Sequoia Capital, which is already famous in the web2.0 era.

image description

text

text

Because the technical advantages of ZK Rollup have attracted much attention, it can also be seen from the above chart that the two king projects of ZK Rollup are also sought after by a large number of investment institutions. The special feature is that many of zkSync come from exchanges and web3. 0 project side, it is not difficult to see that many well-known centralized exchanges and web3.0 projects are quite optimistic about ZK Rollup.

Finally, ZK Rollup has proved to us that it is feasible to exponentially reduce the Gas Fee used in Ethereum and greatly improve scalability. Op Research is very much looking forward to ZK Rollup bringing the Ethereum community and users an opportunity in the foreseeable future. If all goes well with the brand-new Ethereum, we can boldly imagine that web3.0 products with large-scale applications will be within reach.

Reference

https://www.pcmag.com/encyclopedia/term/layer-2-blockchain

https://www.preethikasireddy.com/post/a-normies-guide-to-rollups

Binance (BNB) Blockchain Explorer:https://bscscan.com/

https://explorer.solana.com/

https://terrasco.pe/