Venture Capital DAO: A New Paradigm of Venture Capital in the Web3 Era?

Original Author: Alpha Rabbit

Original Source: Alpha Rabbit Research Notes

Original Author: Alpha Rabbit

Disclaimer: The content of this article is only for information display and sharing, and does not promote or endorse any operation and investment behavior. This article does not provide any investment advice.

Disclaimer: The content of this article is only for information display and sharing, and does not promote or endorse any operation and investment behavior. This article does not provide any investment advice.

core point of view

first level title

core point of view

In 1958, the United States "Small Business Investment Act" was passed, which officially allowed the financing and management of small start-up companies in the United States. This bill promoted the further rise of early private equity companies from a macro perspective.

With the development of science and technology, since Kleiner Perkins and Sequoia Capital in 1972, venture capital began to gradually participate in the investment of semiconductor companies and early computer companies.

In 1974, the U.S. stock market crashed, and the venture capital industry experienced a temporary downturn in 1974. The entire market was cautious about this new investment structure.

In the 1970s and early 1980s, the success of DEC and Apple made the market see opportunities to make money, so the venture capital industry developed further. There were only dozens of venture capital companies in the early 20th century. By the end of the 1980s , There are more than 650 venture capital companies in the market.

The emergence of the World Wide Web (Web1.0) in the early 1990s revived the field of venture capital. Many investors have discovered that many companies with great potential are gradually forming in this wave. Netscape and Amazon were both established in 1994, and Yahoo was established in 1995. These well-known companies have all received venture capital money.

Although the veteran venture capital giants will prove to the founders that their money is better in many cases, the sole proprietorship GP can have the opportunity to pull together a super team composed of other sole proprietorship GPs. The winning rate is higher.

The core goal of DAO is to provide a new decentralized business model for future enterprises. Through a set of programmable incentives, it can be distributed among Token holders. It is actually a new type of (online )organize.

Investment DAOs are usually managed and operated in the form of smart contracts. Of course, due to the investment involved, venture capital DAOs will also provide members with a DAO legal structure related to legal liability protection, and because the regulatory frameworks of different states in the United States are different, the legal registration of DAOs is also different. Arrangements will be made according to the regulations in the area.

Perhaps the power of DAOs will increase over time. However, other venture capitalists believe that the DAO venture capital model still lags behind traditional venture capital companies in terms of operational capabilities and efficiency.

first level title

History of Venture Capital

before world war ii

Early models of investment behavior similar to today's venture capital began with consortiums such as JPMorgan Chase, the Wallenbergs, the Whitneys, the Rockefellers, and the Warburgs. These families have invested in many companies. A typical example is that in 1916, the Wallenberg family founded Investor AB in Sweden, and became early investors in several Swedish companies such as ABB and Ericsson in the first half of the 20th century.

secondary title

After 1945

The establishment of ARDC broke the previous investment paradigm of family consortia. It is particularly worth noting that in 1957, ARDC invested in digital equipment company DEC, and DEC’s first IPO valuation in 1968 exceeded 355 million US dollars, which was 1,200 times higher than the original investment amount of ARDC.

After that, some early employees from ARDC continued to establish several famous venture capital companies along the line of their old employers, such as Greylock Partner and Fidelity Ventures, which were all established by early employees of ARDC.

secondary title

The relationship between macro support and venture capital industry development

The development of venture capital firms in the 1960s and 1970s was characterized by a focus on starting and expanding companies. But since the 1960s, the rudiments of today's private equity funds began to appear. What is this rudiment like?

Specifically: Private equity companies can gradually invest by organizing limited partnerships, in which investors act as general partners and investors act as LPs, who are mainly responsible for providing investment funds, that is, the source of fundraising.

secondary title

Venture capital and the tech wave

With the development of science and technology, since Kleiner Perkins and Sequoia Capital in 1972, venture capital began to gradually participate in the investment of semiconductor companies and early computer companies.

In 1973, as the number of new venture capital firms increased, the National Venture Capital Association (NVCA) was formed.

However, regardless of any industry, the development process may always encounter storms.

In 1974, the U.S. stock market crashed, and the venture capital industry experienced a temporary downturn in 1974. The entire market was cautious about this new investment structure.

In the 1970s and early 1980s, the success of DEC and Apple made the market see opportunities to make money, so the venture capital industry developed further. There were only dozens of venture capital companies in the early 20th century. By the end of the 1980s , there were more than 650 venture capital firms in the market, and at that time, almost every firm was looking for the next big target of success.

However, the overall IPO market cooled in the mid-1980s before the stock market crashed in 1987. At the end of the 1980s, the market experienced a series of phenomena including an oversupply of IPOs. Even because many investment managers at that time were inexperienced, the growth of the venture capital industry remained limited throughout the 1980s and the first half of the 1990s.

The emergence of the World Wide Web (Web1.0) in the early 1990s revived the field of venture capital. Many investors have discovered that many companies with great potential are gradually forming in this wave. Netscape and Amazon were both established in 1994, and Yahoo was established in 1995. These well-known companies have all received venture capital money.

Whether it is AOL Corporation, UUNet, Spyglass and Netscape; later Lycos, Excite, Yahoo, and CompuServe, Infoseek, C / NET and E*Trade, as well as the success of Amazon, ONSALE, Go2Net, N2K, NextLink and SportsLine, They are all legends of the times.

These legendary companies have brought huge returns to venture capitalists. The high returns and the excellent performance of each company in the first IPO have gradually caused an upsurge in the establishment of venture capital funds in the entire market.

However, the industry continues to move forward amidst twists and turns. In 2000, the dot-com bubble burst, many venture capital firms closed down, and the valuations of start-up technology companies plummeted. Over the next two years, many venture capital firms were forced to write off.

The cycle repeated until 2010 when the industry started to pick up again. In 2020, the total industry scale will reach 80 billion US dollars, and the hot spots pursued by some venture capital are gradually transitioning to what we call the Web3 era today.

first level title

Dynamic Changes in the Venture Capital Industry

After talking about the history of venture capital, let's take a look at the changes in the venture capital industry in recent years

Let's abstract these elements:

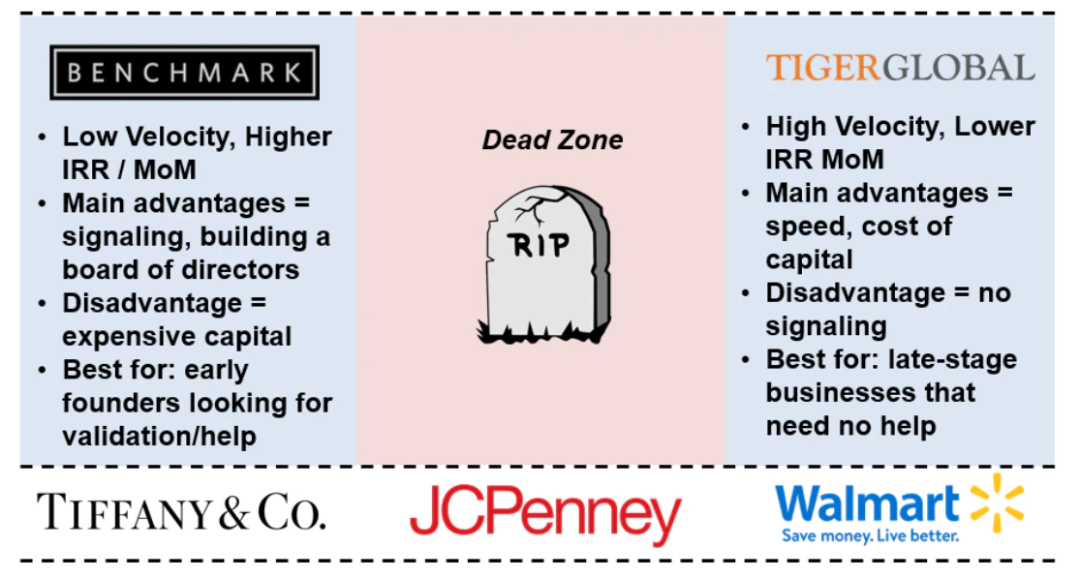

The gradual rise of individual GPs: How does venture capital win in the entire industry? Everett Randle made some points in the article "Playing Different Games": A venture capital institution can choose to become a star venture capital institution (such as Benchmark) or a low capital cost fund (Tiger), but if it is in the middle position , it may be more troublesome, as shown in the following figure:

image description

Image credit: Not Boring

To some extent, this is indeed the case for large funds with hundreds of millions of dollars.

However, there is another category that will perform well in the market through completely different rules of the game, that is, Solo GP. Although the value provided by VC has become a commodity, its cost structure may not be able to support the business:

Specifically, the bullets (funds) held by venture capital institutions are actually a commodity, and there is also a dynamic balance. Usually, investment institutions also need fierce competition to dominate the deal. If a large venture capital fund cannot occupy a place in the fierce competition and investment of hundreds of millions of dollars, it is easy to lose the opportunity.

And those investment institutions that pursue extreme differentiation, whether it is a brand strategy that is high and high, or a low capital cost strategy, will also have their own opportunities.

Like individual creators, sole proprietorship GP, individual investors who invest in small funds or their own funds also have their advantages. Suppose you have a fund of 5 million US dollars, such as investing 100,000 US dollars in a start-up company, and its valuation will increase later. 250 times, even if the other investment of 4.9 million US dollars fails, and your fund can get at least 5 times the return, which will also satisfy the LP.

This type of Solo GP usually has strong individual energy, which lays a certain foundation for the subsequent collaborative venture capital model:

In many cases, the established giants of venture capital will prove to the founders that their money is better, but the sole proprietorship GP can have the opportunity to pull other sole proprietorship GPs together to form a super team. This kind of energetic organization will make the winning rate of startups higher.

The cooperation between individuals is faster than the competition between companies. In the future, more sole proprietorship GPs with explosive combat effectiveness may form a dynamic super team, compete to lead the investment in entrepreneurial projects, and provide individuals with stronger energy collection as a differentiated the fulcrum.

We already know that synergy improves the efficiency of the industry, and perhaps the same will be true for the venture capital industry in the future. So, what does this have to do with venture capital funding for DAOs?

first level title

Decentralized Autonomous Organization DAOBefore talking about this, let's talk about the specific definition of DAO:What are DAOs? Understand DAO as a decentralized organization based on blockchain and operating on the principle of smart contracts. Unlike traditionally centralized companies/organizations with managers, DAOs are usually composed of native Tokens (yes, that is Posted before

That Token Economics

Through computer programs and smart contracts, DAO internally automates the functions originally performed by humans, sharing risks and sharing rewards among members with common goals.

The core goal of DAO is to provide a new decentralized business model for future enterprises. Through a set of programmable incentives, it can be distributed among Token holders. It is actually a new type of (online )organize.

text

DAO's core features (parts):

Clear structure and roadmap: The organizational vision is jointly set by members, and members can control and decide the future of DAO.

Equal voting: All members can participate in important decisions by voting.

Pre-rule: Automate the decision-making process, which can eliminate human error and insider manipulation to a certain extent. The rules of DAO are abstracted by transparent computing programs.

Token - In many DAOs, having a Token belonging to the DAO is a factor that can determine voting rights.

Note: BTC may be the first fully functional DAO with programmed rules and functional autonomy via consensus protocol; miners and nodes vote through support.

first level title

Venture capital organized in the DAO model is emerging

Moreover, the venture capital DAO, which mainly invests in the encrypted track, has become a new model for Sourcing, meeting with entrepreneurs, and reaching deals.

Note: In the past, these investments were made by star investors and venture capitalists.

Invest in DAOs

As a result, the development of DAO has gradually begun to cover various community and business needs, and venture capital DAO and investment DAO have gradually become this new organizational model and a way for everyone to invest in early projects.

secondary title

What are the characteristics of investing in DAO?

Investment DAOs are usually managed and operated in the form of smart contracts. Of course, due to the investment involved, venture capital DAOs will also provide members with a DAO legal structure related to legal liability protection, and because the regulatory frameworks of different states in the United States are different, the legal registration of DAOs is also different. Arrangements will be made according to the regulations in the area.

However, the investment process for a VC DAO is different from a typical venture fund because each member of a DAO can act as a lead investor and make investment recommendations to the DAO. Investment decisions are also based on DAO voting results, not through the (IC) Investment Committee."According to the smart contracts of different DAOs, DAO members can have the right to "exit" or terminate participation in DAOs at any point in time, however, usually venture capital will require investors to stay in the fund for a certain period of time.

As an example, Joyce Yang, founder of Global Coin Research, argues that,The DAO of Global Coin Research aims to subvert the traditional VC model, and wants to democratize the investment in the encrypted track and provide opportunities for those who have never invested. However, for investing in new technology startups, as an emerging model, DAO has not been tested through the cycle so far. A large part of its popularity is because the market and top venture capital companies are optimistic about the encryption track and encryption startups. investment field.

"Reach a deal and get in touch with high-quality entrepreneurs", how to operate?

venture capital DAO

, is a group of individuals who are interested in the encryption track. These individuals can invest part of their own capital or DAO's capital in the early encryption field start-ups.

Typically, members of an investment-focused DAO need to:

① Buy DAO’s governance token in advance

②In exchange for tickets to enter the threshold, such as invitation-only Discord chat rooms, Telegram groups, or private events. On similar occasions, Sourcing and Deal can be achieved.

Taking the members of Global Coin Research (GCR) as an example, they have invested in more than 30 start-ups, and invested more than US$25 million in projects such as the Crypto interoperability protocol Aurora and the Web 3 management platform Coinvise.(In order to participate in transactions, individual DAO members must be accredited investors, usually defined as individuals legally authorized to purchase securities not registered with regulators)

a result:"According to GCR, as of December 2021, GCR estimates that the projects it invests in have an average return of more than 40 times, becoming liquid or market-marked projects.

According to Michael Steinberg, founder of venture capital firm Reciprocal Ventures:"。

With DAO, there is no threshold intermediary to prevent you from accessing the project, because this represents a fighting team.

community support

secondary title

community supportEntrepreneurs can benefit from their own interactions with DAOs. What are these benefits?First of all, from the perspective of crypto start-ups that are just getting started,

Acquire Users - Do Product-Market Matching", is a challenge that all entrepreneurs must face."Jenil Thakker, the founder of Coinvise, said that he has worked with GCR and another venture capital DAO "The LAO","

By co-hosting events with GCR, new members can join the Coinvise community, which will contribute to the development of Coinvise.

"More broadly, venture capital-based DAOs provide access to a wider network of people, which can help entrepreneurs get quick feedback on their projects."For Coinvise, a DAO infrastructure company, GCR helped the startup with product testing, including launching its GCR governance token using the Coinvise platform.

"According to Thakker, most VC DAOs even provide media, recruiting and legal services to support their portfolio companies.

YC:Orange DAO

first level title

Let’s talk about the Orange DAO of YC alumni:

image description

Image source: Near

Y Combinator: an incubator for Internet startups, and a well-known investment service platform for Internet startups in the United States.

Orange DAO, established in the fall of 2021, is composed of several YC alumni, and is committed to establishing a venture capital organization that can provide support for crypto startups. Up to now, Orange DAO has attracted thousands of YC alumni.

According to the official charter of Orange DAO: "Orange DAO is committed to helping start-up companies in the encryption track apply for venture capital, helping these entrepreneurs join Y Combinator, assisting in improving their leadership, and conducting recruitment and business guidance."

At present, there are more than a thousand founders in Orange DAO's Discord channel, many of whom are alumni from YC. Y Combinator has supported more than 3,300 companies. The effort is co-led by Ben Huh, who has entrepreneurial experience and helped lead YC's New City initiative in 2016.

The model of YC Tangerine (the nickname given to him by the author) DAO is that after verifying their identity by posting the wallet address to the HackerNews profile associated with YC, each member can mint a unique NFT (non-transferable) , to verify that they are indeed YC alumni and officially become participants of Orange DAO.

Orange DAO is not the first attempt to create an alumni fund to tap into the well-connected network of YC founders. Back in 2017, hundreds of YC alumni helped launch the Vanguard Fund, a more traditional venture capital program designed to leverage the expertise of past YC founders to close deals.

At the end of the day, DAOs are a collective force, not individuals. Some people think that DAOs are the next evolution of companies because they abstract many visions and rules into code.

DAO startup Syndicate helps these groups get off the ground and navigate complex regulatory issues. Papper helped the ConstitutionDAO team navigate the complexities of Sotheby's bid and helped guide Huh's efforts in the early conversations surrounding Orange DAO. The structure of the Orange DAO is somewhat unusual, part of an effort to experiment with the type of organization that complies with securities laws.

The fund that actually backs the startup is a separate legal entity called the Orange Fund, run by Huh and several other general partners. The entity has closed an initial fund and invested in about 30 startups, including DeFi startup Goldfinch.

The DAO itself is run through committees — an effort to organize its 1,000 members into smaller working groups. Huh believes that an essential element of the Orange DAO structure is to find ways to reward members who do more work in individual transactions, rewarding internal governance tokens. However, there are also claims (source Techcruch) that the organization is not necessarily transparent about how the fund's performance will translate into returns for DAO members. However, the GP of the Orange Fund stated that it will contribute the spread in the fund to the Orange DAO.

The effort was originally titled "YC Crypto DAO," but as its ambitions have expanded, the group has worked hard to adopt its own unique brand, resulting in a new name and a new mascot — a bespectacled pixelated Big oranges, nicknamed "abundant returns."

secondary title

DAO+non-DAO: the future of integration

With so many cases mentioned above, we have to start thinking about a question, will DAO replace traditional venture capital institutions one day?

As the market capitalization of cryptocurrencies grows to $3 trillion, many investors and venture capital funds are frantically chasing this booming industry because they can generate amazing returns, and different investment-oriented DAOs have gradually formed different characteristics. These include Komorebi Collective, which invested in female founders, and FlamingoDAO, which invested in female founders."Some people think that cryptocurrency venture capital is a full-time job. Venture capital firms are typically very active, highly involved, and have significant time and resources devoted to portfolio companies.

Perhaps the power of DAOs will increase over time. However, other venture capitalists believe that the DAO venture capital model still lags behind traditional venture capital companies in terms of operational capabilities and efficiency.

As far as I can see, projects value DAO's individual member strength and cooperation ability, but still the vast majority prefer traditional funds to dominate the rounds.

But as DAOs gain increasing market share on the startup capital table, a hybrid model appears to be taking shape, combining the community-driven ethos of DAOs with the deep pockets and operational expertise of venture capitalists.

"Investing in DAOs also comes with risks associated with cryptocurrencies, such as regulatory scrutiny, mismanagement of DAO accounts, or untested technical flaws. The investment track record of individual DAOs is also important, helping more established DAOs stand out from the crowd."Entrepreneurs should choose those investors who are most aligned with their vision and give them the best chance of success. If the DAO can do it, that's fine too."

in conclusion

first level title

in conclusion

DAOs are a recent innovation in the crypto community, and venture DAOs are a unique use case. Venture DAOs have shifted the paradigm of operating investment funds onto the blockchain, bringing a level of transparency to an otherwise opaque process.

However, regulations have not kept up with the definition of DAO and legal entities, which is also a potential risk and one of the reasons why many DAOs currently adopt a hybrid model that combines traditional legal entities with on-chain DAO governance. Still, despite all the hurdles, the success of MetaCartel Ventures and The LAO shows that VC DAOs do have a place in the cryptocurrency ecosystem.

Advantages of venture capital DAO:

Let more people participate in early investment

Provide strategic funding for new projects

financial diversification

Consolidate network effects within blockchain protocols

Democratize investment decisions and expand deal sources

Disadvantages of venture capital DAO:

Regulations: legal, safety and tax, are a major consideration

Limitations and risks of smart contracts (hacked, difficult to modify, buggy)