The development of the Metaverse after the "Singularity Big Bang" and the overall data analysis of the Metaverse

foreword

first level title

foreword

The biggest difference between the metaverse project built on the basis of blockchain and the metaverse project based on centralized servers lies in the way of confirming the rights of digital assets in the metaverse. The core of the universe project research is to conduct research on the data related to the metaverse digital assets through the public chain data and the data provided by trusted third parties. Among the many derivative digital assets in the metaverse, the "land/space" assets are the most representative.

In this report, we use the data in OpenSea, the world's largest NFT trading market, as the data source, and conduct a more comprehensive analysis and research on the metaverse projects deployed on Ethereum. Mainly starting from multiple dimensions such as project transaction data, basic information, and project progress, a total of 26 Metaverse projects (about 3,000 NFT projects) with a historical transaction volume greater than 100ETH were screened out. Friends who are interested in Lianyuan Universe ecology provide some useful ideas.

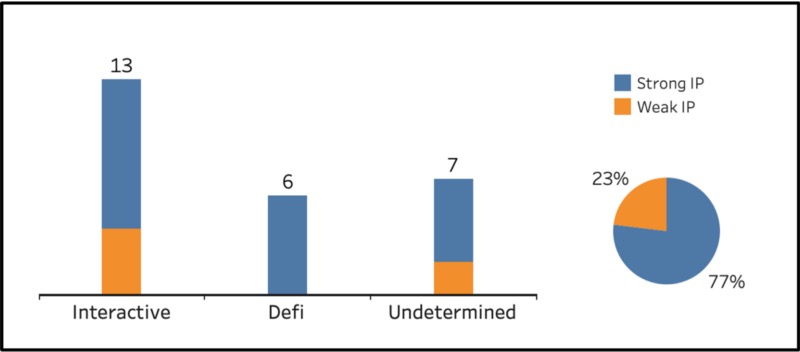

first level title1. Overall data analysisAccording to our current research projects, the existing3D Metaversemore than2D Metaverseproject,open metaverseProject is much smaller than planned but notopen metaverseProject, it can be seen that compared with the current fiery metaverse concept hype, there is still a certain lag in actual technology. At the same time, with its own clear worldview and storytellingStrong IP Metaverseproject, and the more open and inclusive

Weak IP Metaverse

The project is a 50-50 split. These are two different paths. Strong IP projects focus on building their own metaverse, while weak IP projects are more like an all-encompassing platform.

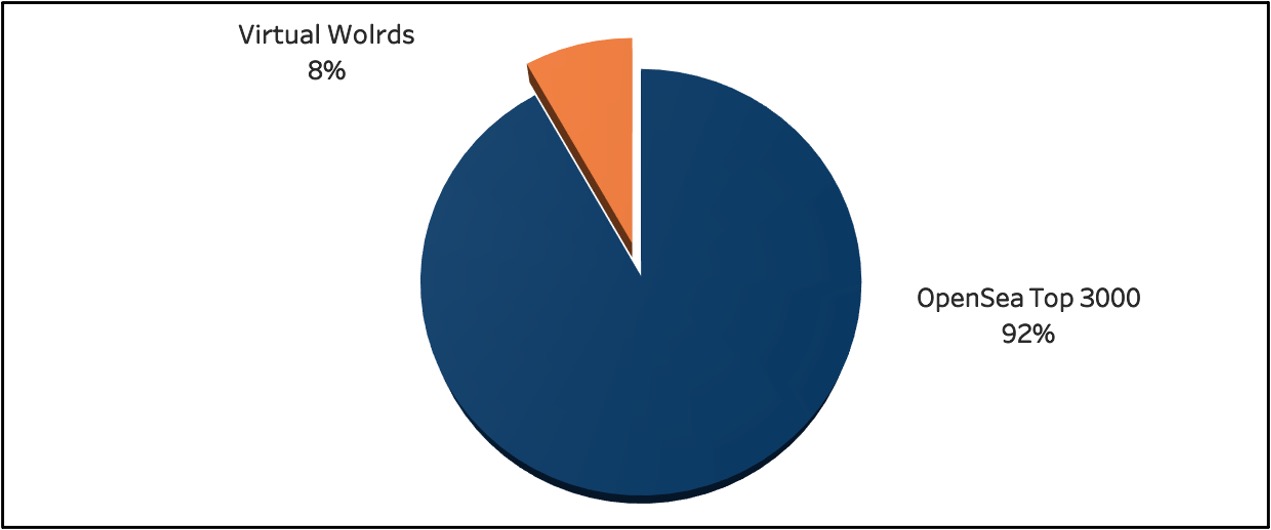

In this section, we selected the top 3,000 OpenSea Metaverse projects built on the Ethereum chain and issued land to do an in-depth statistics and analysis. The sample data mainly comes from the data on OpenSea in the middle and late March of each project.

We will analyze and discuss sample projects from multiple dimensions such as project market share, transaction volume, project attributes, and transaction status in the past 30 days.

The current transaction volume ratio of Metaverse

image description

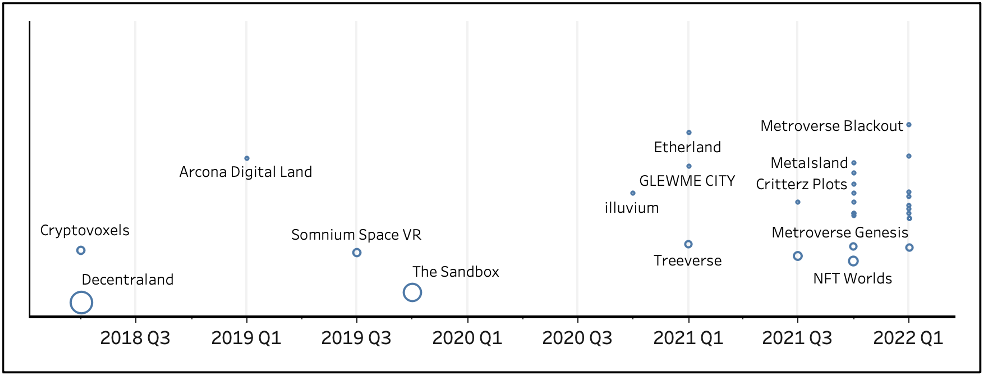

The launch date of each project (divided by quarter)

first level title2. Main Types of the MetaverseAt present, we divide the metaverse into three categories ("editable space or enter the space to play", "not yet determined" and "combined with DeFi"), and these categories are determined by the main functions of the project site.

We believe that the actual value that the Metaverse provides to its users depends primarily on the functionality of its lands

, because virtual land is the most important and expensive asset in most metaverses.According to the land attributes of the project, our definitions for the three types are:

You can edit the space or enter the space to play (Interactive): Can be edited independently, or open to explore plots

Undetermined: Currently the land has no practical use (or the function has not yet been launched)

Combination with DeFi (Defi)

: The land use is mainly for pledge mining, and there is no editing function for the time being

In addition to the three major types, we further classify projects according to their current openness ("strong" and "weak" IP) to estimate the degree of interoperability in the existing virtual space. In our view, digital identity is as important as digital assets, and the two often mean the same thing in the Web3 era. However, currently having a PFP does not mean that the PFP you have can be used as identification in most of the metaverse worlds, let alone an operational avatar.Our definition of IP strength is:

Strong IPWeak IP

: The world view is not clear or the original character attributes are not strong, and it is not difficult to access other project characters

image descriptionClassification statistics of each metaverse typeThe current market is mostly made up of projects with editable/explorable lands and a strong worldview.

Closed ecosystems seem to be the mainstream of the Web3 metaverse at the moment, which somehow goes against one of the core visions of the metaverse: high interoperability.

first level title

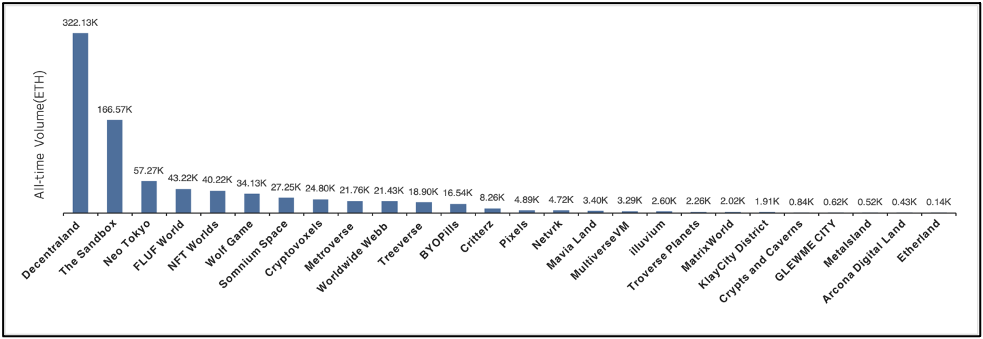

3. Trading volume and market value

image descriptionTransaction volume is usually a good indicator of the popularity of an NFT project, as it represents the amount of money spent on the project. As with the current Web2 social platform landscape, top projects are dominating the Web3 Metaverse platform: Decentraland's total transaction volume is almost twice that of The Sandbox, while the remaining projects only account for about 6% of the top 2 total transaction volume combined.

This distribution is a typical example of the "long tail effect", which means that the market will focus on mature and high-volume leading projects, and this effect will be further amplified over time.

image descriptionOpenSea ranking distributionThe number of projects in the OpenSea 500 accounted for about 56% of the total number of projects in our survey scope, and their combined historical transaction volume accounted for nearly 98% of the total number of this survey. This distribution shows that

, and this ranking range can almost represent the overall market capacity.

Although the OpenSea ranking reflects some of the relative rankings between projects, it is only a comparison based on transaction volume, and it does not reflect current valuations. By using the 30-day average price of NFT and combining the market value of the project's circulating tokens and the market value of NFT, we get a comparison of the total market capitalization among projects.

image descriptionTotal market value of the projectThe overall distribution of total market capitalization is broadly similar to the overall distribution of trading volume, but the difference between the top 2 projects has narrowed, and the token market capitalization has a large percentage of both.

However, under the comparison of the total market value, the Matthew effect is also obvious or even stronger

It is worth noting that individual projects (such as: KlayCity District) have risen sharply in the statistical rankings of this survey after including the market value of tokens. Perhaps due to project strategy or economic model, the total market value of the project is almost composed of the market value of tokens. Please refer to the following for the specific situation of each project.

Considering the first-mover advantages of some projects, in the following chapters we will analyze the transaction data of each project in the past 30 days to further understand the specific situation of the projects in the metaverse ecosystem and the connection between these transaction data .

image description

30-day volume vs. average volume

Decentraland has seen some stagnation, with its trading volume in March at around 81% of its monthly average. Some newer projects performed well in March. Some representative examples are: the transaction volume of MultiverseVM was nearly 4 times higher than the average, and the transaction volume of NFT Worlds was nearly 2 times higher than the average. .

Including the two projects mentioned above, approximately 45% of the Metaverse worlds traded more than their monthly average in March. The factors driving volume vary by project, but the vast majority of projects in this report are concentrated in certain 30-day price/volume areas.

30 day median

In a sample of 57 projects, only 18% exceeded both the 30-day median price and volume. Each of these statistical outliers outside the median has its own bright spots. We believe these projects will lead the overall market environment and will pay close attention to the further development of these projects.

first level titleArcade 、 Hangout The current Web3 metaverse space is still very young, it can be said that it has just started. Although the current market share of the entire metaverse space is low, and many projects seem to be incomplete, we are optimistic about the future of the Web3 metaverse, because many projects are still in the iterative process, and there are many more new projects Already or plan to join the tide of Web3. From the moment we completed the data collection, there are many new projects that have popped up and have shown great potential. We will continue to pay close attention to the development of the entire space, and conduct in-depth research on more interesting new projects in the future, such asOthersideetc.

Founded in 2020, ABC Studio is an R&D-driven company in the NFT field. Our team has been conducting research on blockchain since 2017, including blockchain games and NFT. Whether Metaverse and Web 3.0 have become the focus, we aim to provide a platform for crypto enthusiasts to better understand the market rhythm and join the wave of Web 3.0. That's why we found the "ABC Studio" brand.

Partner

Odaily is a 4-year-old Web3.0 information platform, focusing on DeFi, metaverse, NFT and other vertical fields, covering news information, data research reports, technical interpretation, exclusive depth and other content.

NFTGo

A professional data aggregation platform focusing on the NFT field. The existing main functional sections include NFT giant whale tracking, NFT Drops, NFT market data visualization, and NFT project rankings.

NFT Labs

It is one of the earliest and most influential NFT media in China, focusing on NFT ecological research, with dozens of original research articles and over 10,000 fans. At the same time, NFT Labs will be committed to creating a Web3 portal and aggregating the NFT ecosystem.

A professional data aggregation platform focusing on the NFT field. The existing main functional sections include NFT giant whale tracking, NFT Drops, NFT market data visualization, and NFT project rankings.

Golden Finance

DeGame

The decentralized blockchain game aggregation platform provides players and investors with a one-stop gaming experience. In DeGame, players can download, review and discover the most exciting new games, and investors can obtain professional and exclusive analysis on market trends. Our mission is to build a vibrant global community of game enthusiasts and grow into the world's No. 1 NFT game platform.

Twitter:@abcstudio_hk

Discord:discord.gg/KWxSsexaaw

Medium:abcstudio.medium.com

Website:www.abcstudio.io