CoinMix.Global 2022 Q2 Digital Market Analysis

At present, the overall environment of the cryptocurrency market has fallen sharply. Can it support Bitcoin to go bullish again?

1. Macro analysis

secondary title

1. The progress of the Fed’s interest rate hike and shrinking balance sheet

According to the minutes of the March meeting released by the Federal Reserve, the Federal Reserve believes that it may be appropriate to reduce the asset ceiling of US$95 billion (US$60 billion in national debt + US$35 billion in MBS) per month, and supports a phased adjustment of 3 months or a moderately longer period of time to achieve The upper limit of shrinking the balance sheet may start to shrink the balance sheet as early as May. Many Fed officials said one or more 50 basis point hikes may be needed, and many Fed members would have called for a 50 basis point hike in March were it not for the Ukraine conflict.

The market is betting that the Federal Reserve will raise interest rates by 250 basis points in 2022, and the tightening will be the most in nearly 30 years. Money market traders are betting the Fed will raise rates by 225 basis points by the end of the year. Taking into account the rate hike already implemented in March, this would mean a cumulative rate hike of 250 basis points for the year, raising the upper limit of the interest rate range to 2.75%, the highest level since the 2008 financial crisis. Not since 1994 has the Federal Reserve raised rates this aggressively in a single year.

Calculating according to the pace of shrinking the balance sheet of the meeting minutes, the largest scale of the Fed's one-year shrinking balance sheet will exceed 1.1 trillion US dollars. The balance sheet reduction is likely to begin in May and be capped in stages over three months. The total monthly shrinkage of US$95 billion is nearly double the scale of the shrinkage between 2017 and 2019, when the monthly limit was US$50 billion. The information released by the meeting minutes is consistent with the information disclosed by Fed Chairman Powell at the press conference after the March meeting. Powell said at the time that the current round of shrinkage will be faster and the opening time will be "much earlier" than the previous round.

After the outbreak of the new crown epidemic, in order to support the US economy, the Federal Reserve launched a large-scale asset purchase plan, which did not end until March this year. At present, the size of assets held by the Fed has swelled to 8.9 trillion US dollars. But even so, this shrinking speed is still not fast enough. If the Fed's QT program shrinks at a rate of $95 billion per month, it will be significantly lower than the Fed's bond purchase rate of $120 billion for most of last year.

Federal Reserve Governor Brainard said that the Fed may rapidly shrink its balance sheet as soon as May, and it is expected that the shrinkage of the balance sheet will be much faster than the previous recovery. The May adjustment would need to exceed neutral policy to keep inflation in check. The Fed can adjust policy at each meeting.

Fed Daly: The earliest possible start to shrink the balance sheet at the May meeting. San Francisco Fed President Daly said that in addition to raising interest rates, the Fed will also reduce the degree of policy accommodation by reducing its balance sheet. The Fed could begin shrinking its balance sheet as soon as its May meeting. Daly had previously suggested raising interest rates by 50 basis points in May.

St. Louis Fed President Bullard said he supports the Fed raising interest rates to 3%-3.25% in the second half of 2022. Even with financial markets tightening, the Fed is behind the curve in fighting inflation, Bullard said. Meanwhile, Chicago Fed President Evans and Atlanta Fed President Bostic were slightly more dovish. Bostic said it was entirely appropriate to move policy closer to neutral, but proceed with caution. Evans said a neutral rate could be reached by the end of this year or early next year, but doubted it would need to go further."Chris Zaccarelli, chief investment analyst at Independent Advisors Alliance, commented that the $95 billion monthly reduction target is a"A good start

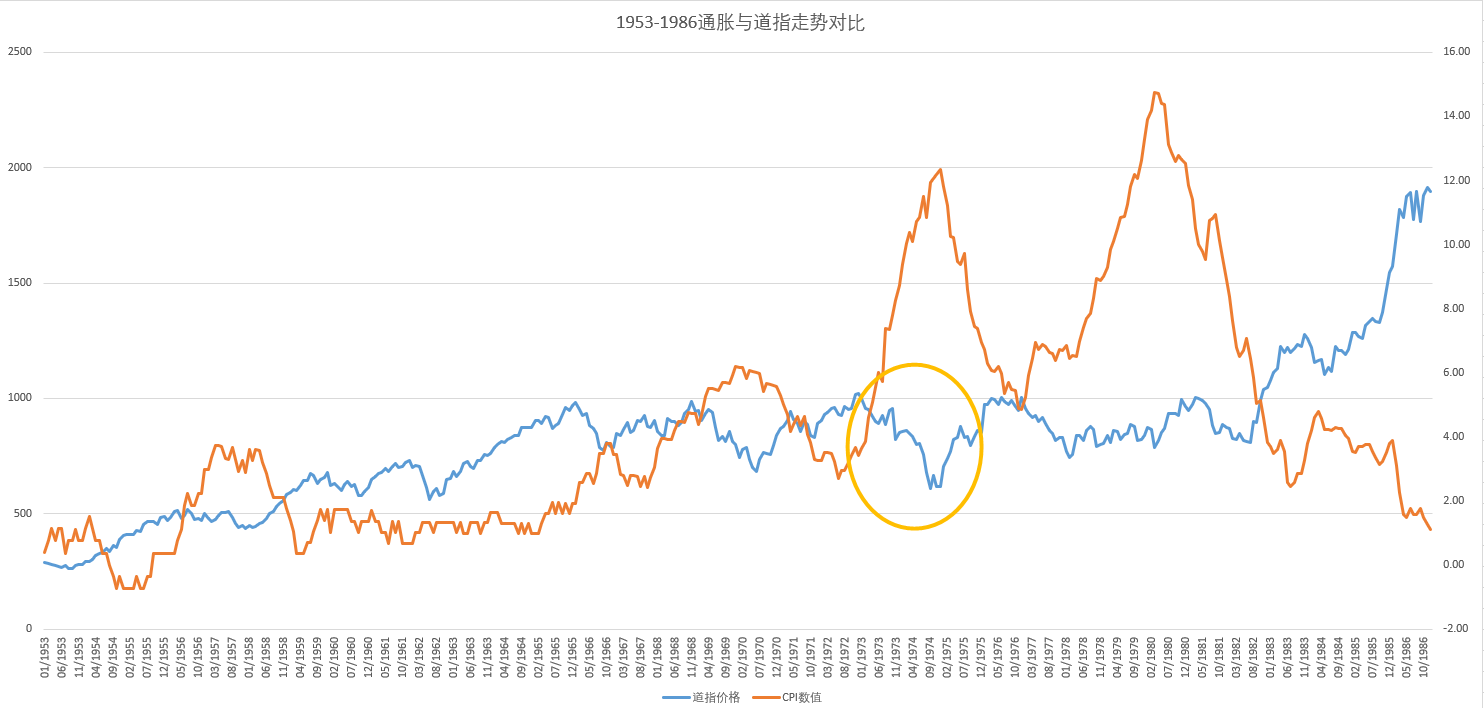

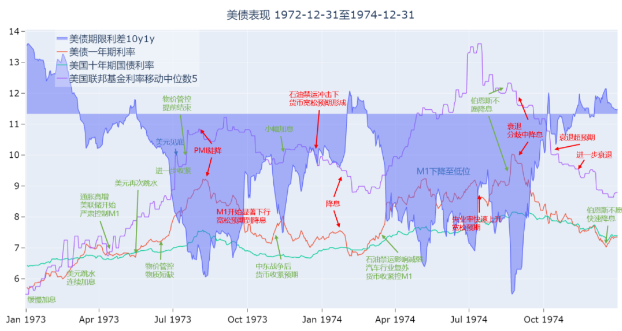

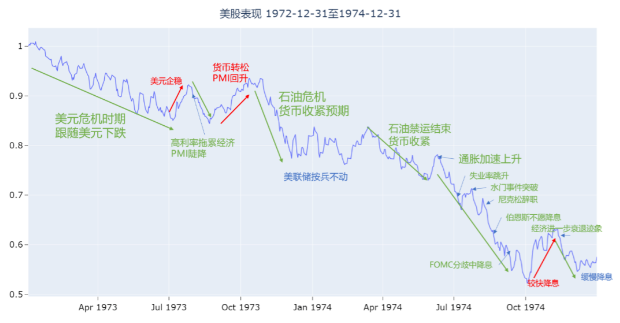

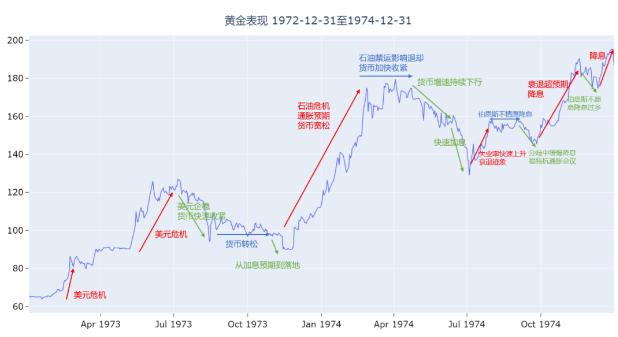

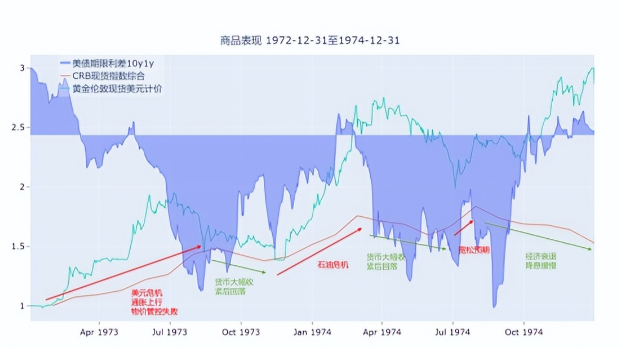

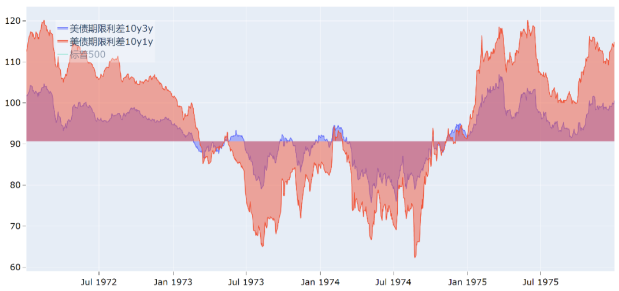

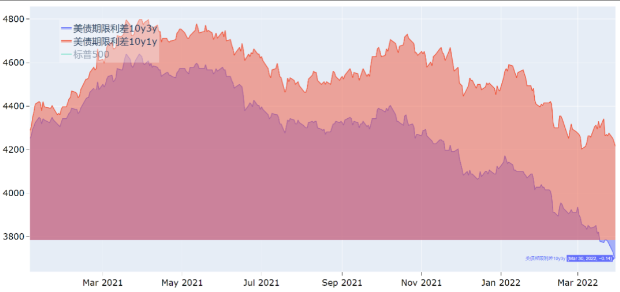

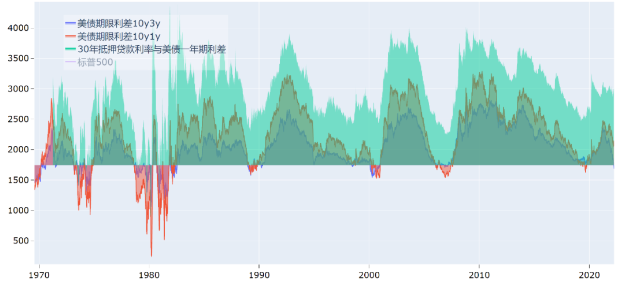

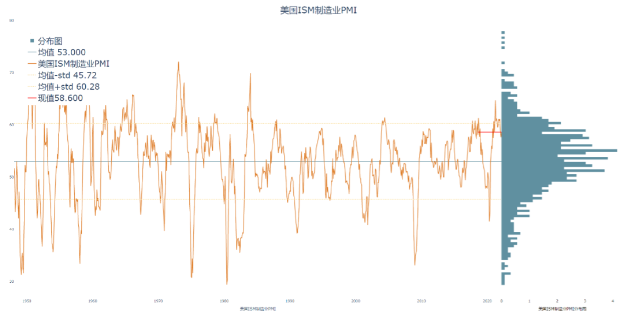

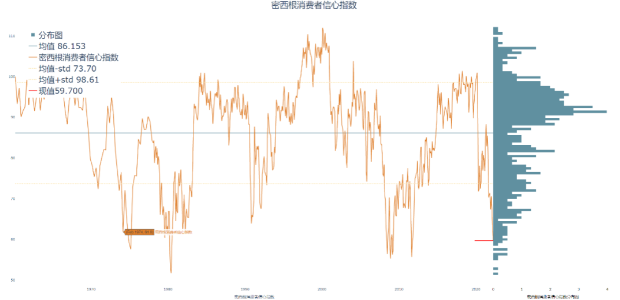

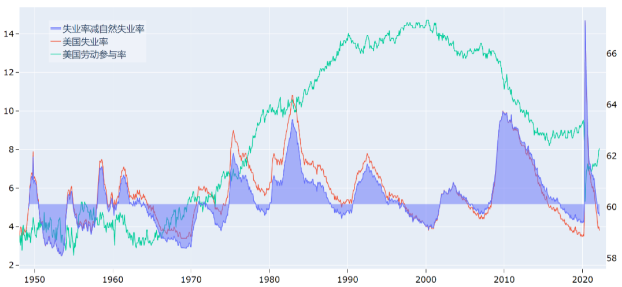

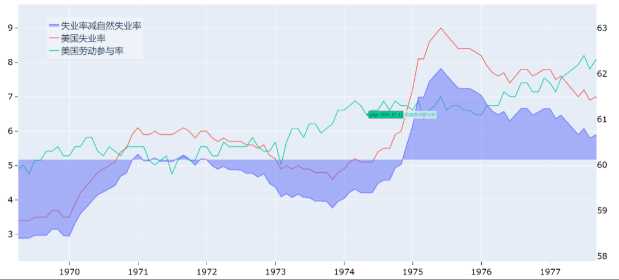

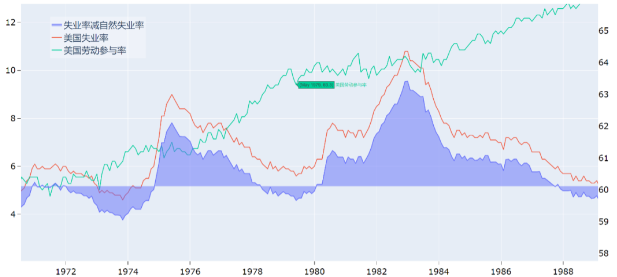

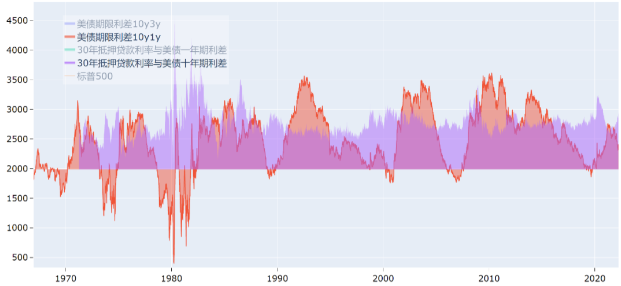

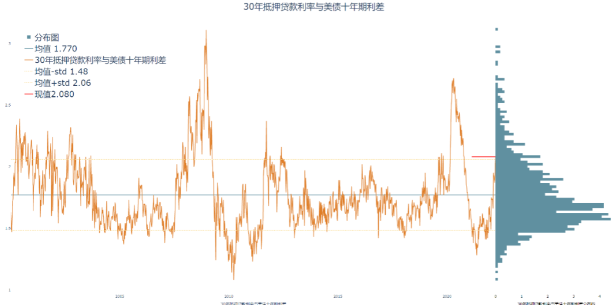

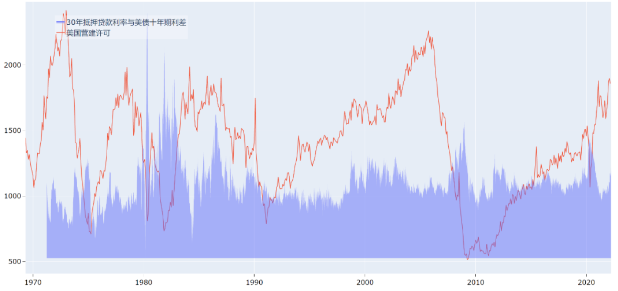

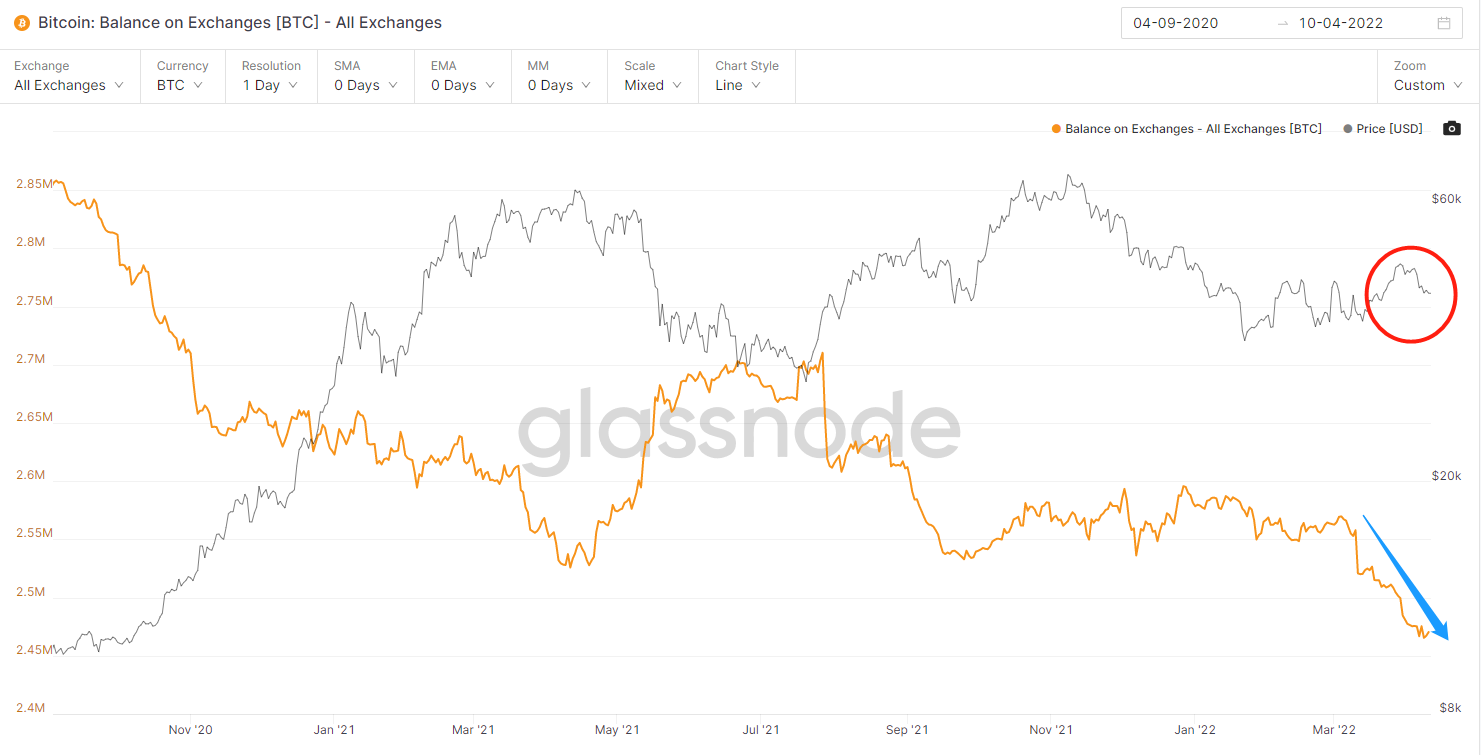

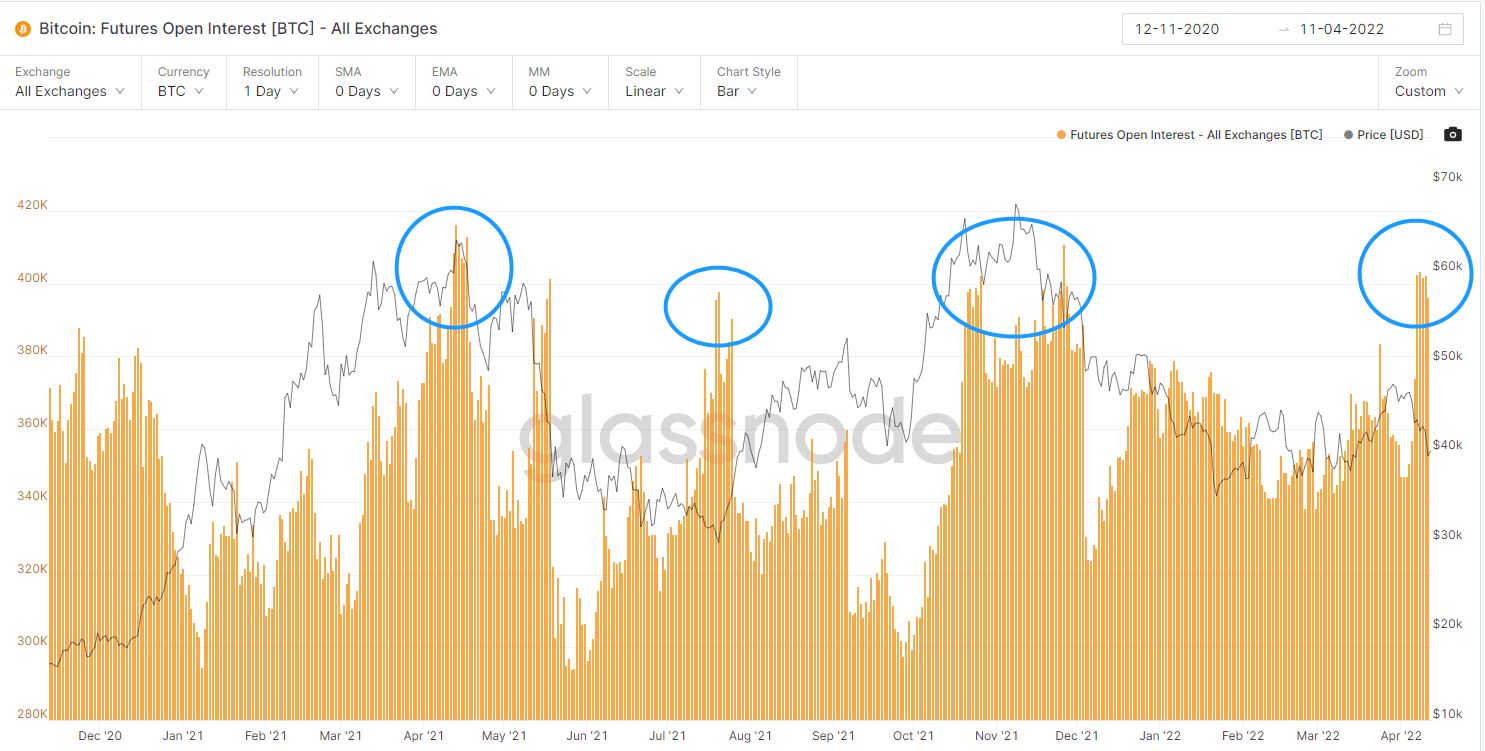

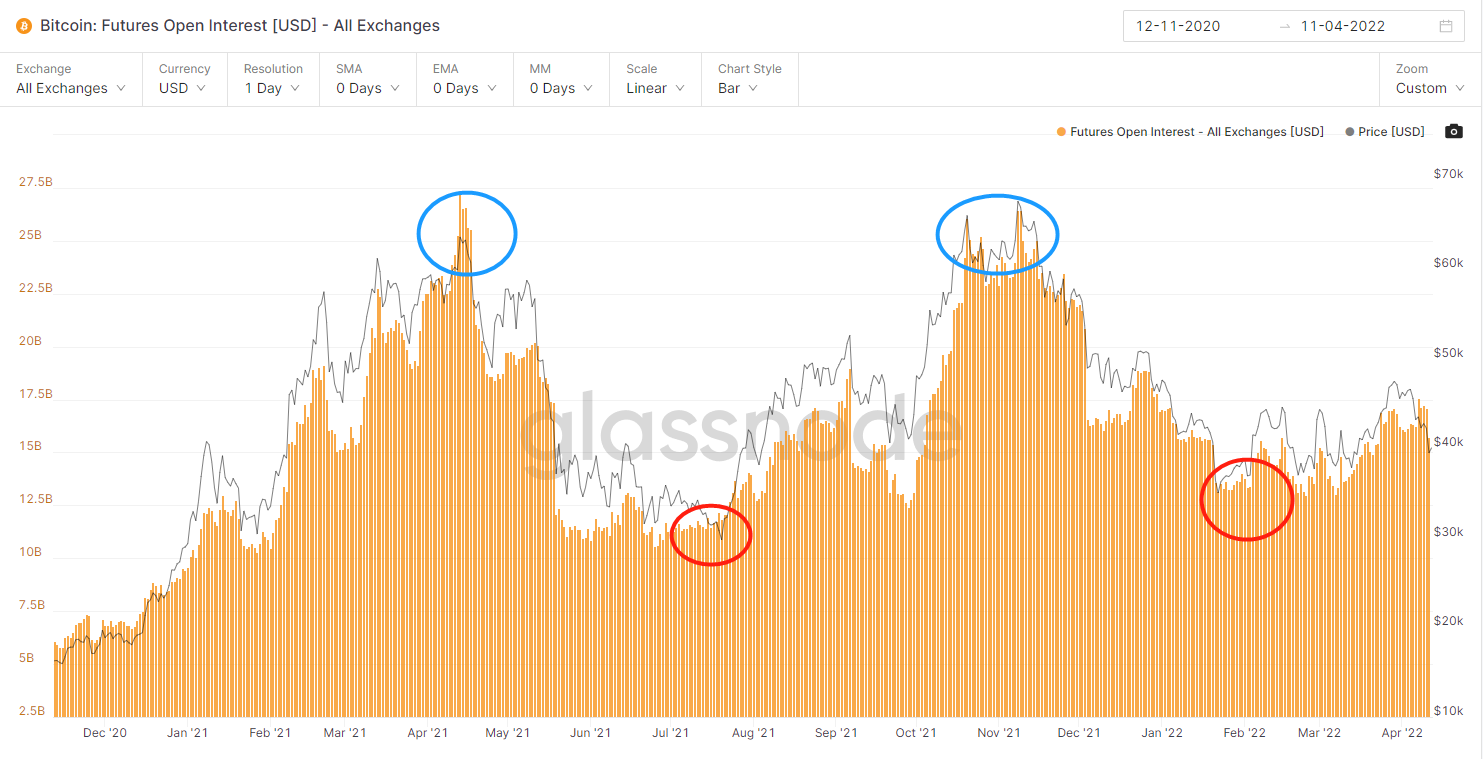

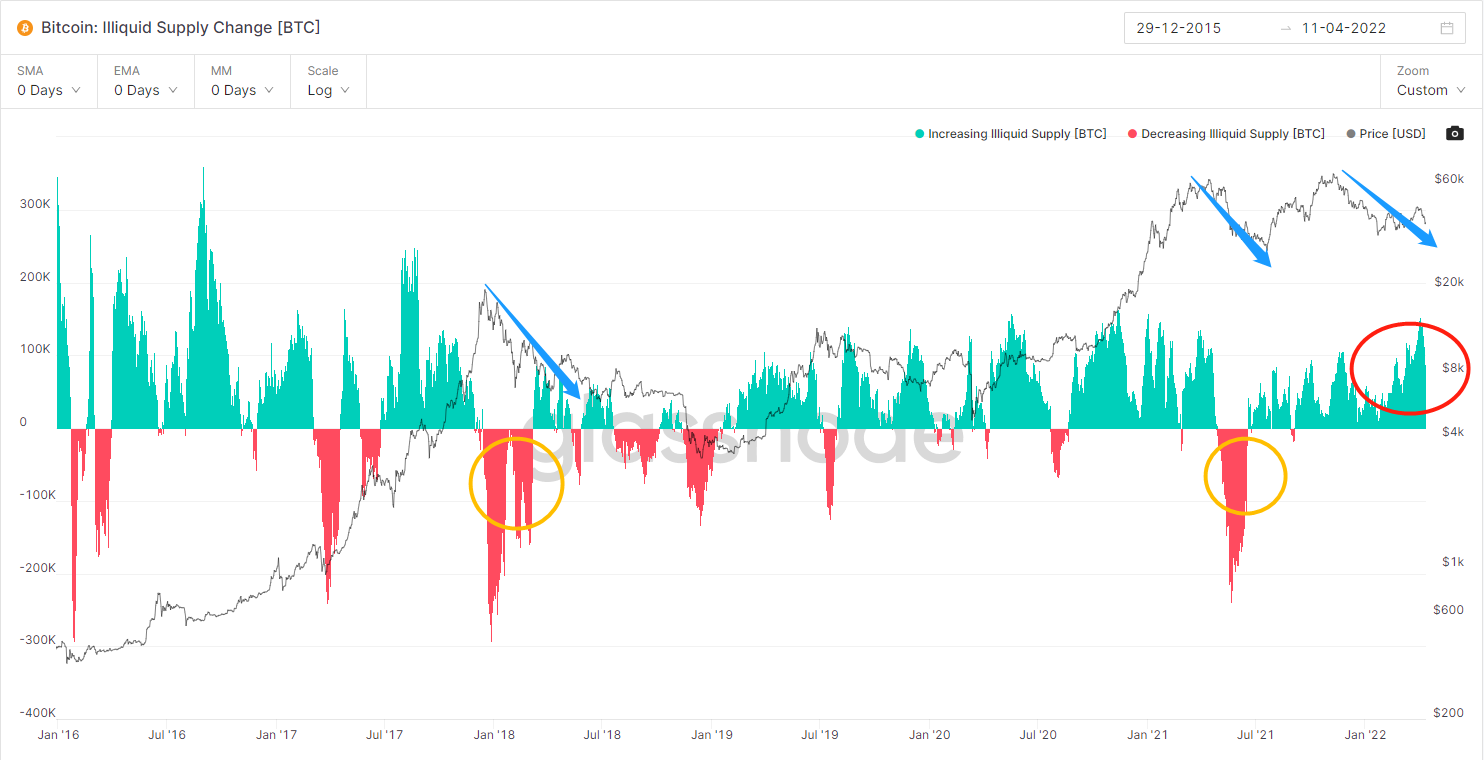

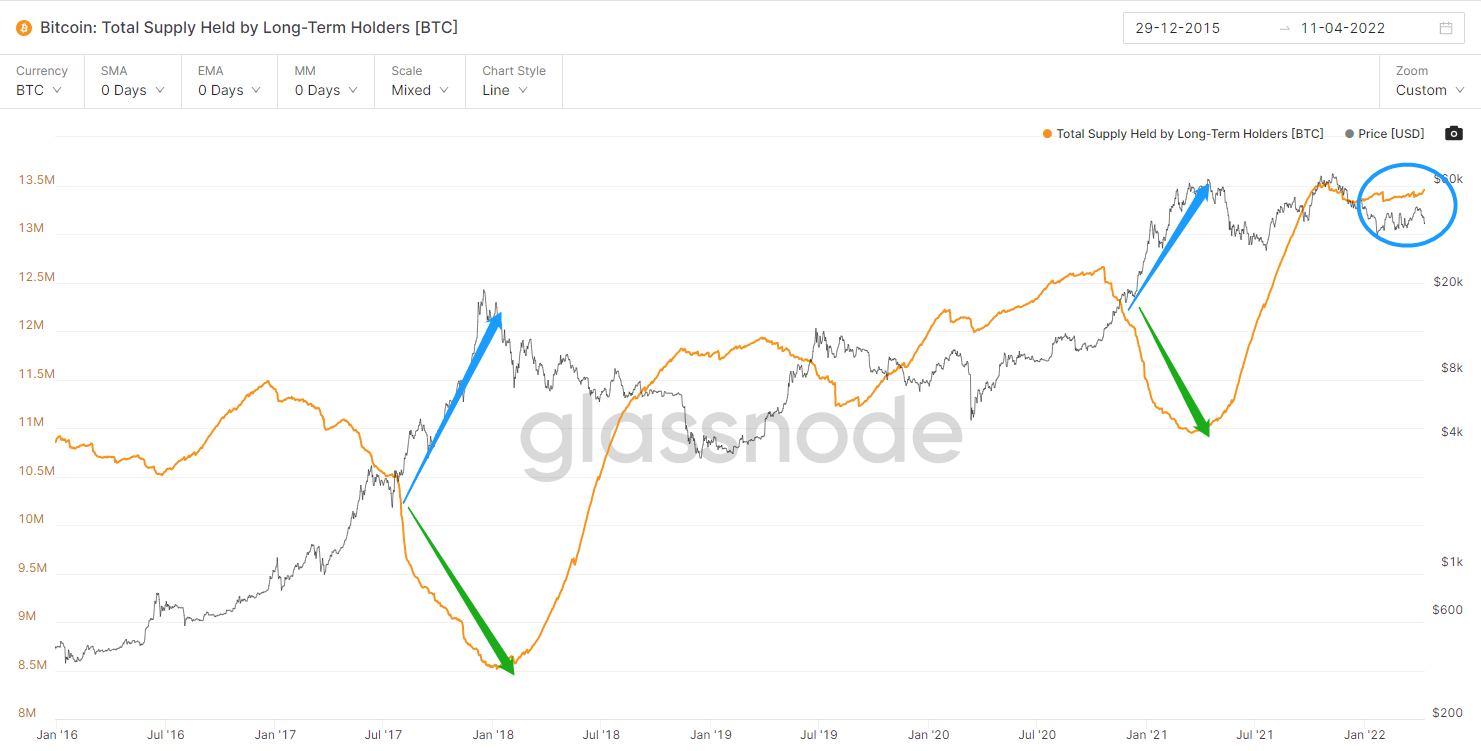

, but the Fed may need to cut spending at a faster pace to fight inflation. At the current rate, it could take more than 5 years (and possibly as long as 8 years) to liquidate all the securities held. Before that happens, we have a good chance of a recession that could force the Fed to add to its balance sheet again, so market distortions could persist for a long time.secondary title 2. The inevitability of the Fed raising interest rates and shrinking its balance sheet 2) The decline in employment rate caused by the epidemic is recovering. The latest number of initial jobless claims in the United States was only 166,000, the lowest since 1968. The number of Americans filing initial jobless claims for the week ended April 2 was 166,000, the lowest number since late 1968, and once again proving that the Fed will see a need to rein in soaring inflation. 3. Review the last period of great stagflation (the 1970s) 1) The necessity of reviewing the last stagflation period At the end of the 1960s, with the rise of Japan and Western Europe, the United States gradually lost its leading role in manufacturing, its trade surplus continued to decline, and it suffered a significant fiscal deficit due to war and expansionary fiscal policies. The global economy is entering a Compo recession. In the early 1970s, the United States adopted excessive fiscal and monetary policies in order to maintain high-speed economic growth. In 1973, the big inflation exceeded expectations, and geopolitical risks broke out. In 1974, the United States fell into stagflation. Looking back to the present, in 2020, the monetization of the massive fiscal deficit in the United States will promote economic recovery. Since 2021, inflation has continued to exceed expectations, and Kangbo depression has frequent geopolitical events (1973 Middle East War and 2022 Russia-Ukraine), and the Fed has entered an interest rate hike cycle. . The current macro-environment is the same as 1973 and 1974, the first round of major inflation in the Kangbo depression period. The in-depth review of the major inflation period from 1973 to 1974 will help us grasp the general direction of investment in the next one or two years. 2) The antecedents of the Great Inflation from 1970 to 1972 At the beginning of the end of World War II, the US economy was the best. Because it was not affected by the war, it became the leader of the global economic development in the past few years, but in the following days, because the United States brought many industries and technologies to Japan. In the 1970s, Japan's economy had developed very rapidly, and Japanese products with low prices and high quality began to replace American products in many industries and became the main products purchased all over the world. In the early days of World War II, the US's exports could account for one-third of the world's share, but by 1970, this market share had dropped to 15%, and, in 1971, the US began to experience a trade deficit. It can be seen how much impact Asian goods had on the United States at that time. Although Asian products replaced American products at that time, the global demand was still growing. That is to say, everyone was actually buying things like crazy, but they stopped buying American products. One data can show that the global export volume at that time, after removing the inflation factor at that time, could still grow by 12% throughout the 1970s. Therefore, when people all over the world stopped buying American products in a short period of time, many American companies became less profitable, and there were large-scale layoffs. Once layoffs were laid off, the unemployment rate rose. In this way, a vicious circle in economic growth began. On the other hand, since the U.S. dollar is the main currency of global trade, and people all over the world are buying and buying, the world’s demand for U.S. dollars has also increased sharply, so the credit expansion of offshore U.S. dollars has become faster and the currency multiplier is higher. . The explosive growth of international credit between 1973 and 1979 was the root cause of the global inflation of the 1970s. That is to say, the U.S. economy is not as good as expected at one end, and the currency at the other end is still increasing, so stagflation appears, and when the second oil crisis occurs, this phenomenon is directly pushed to a climax, and inflation becomes big inflation, stagflation , became a big stagflation. The reason why I say this is because the scene at that time is very similar to ours now. At present, the three major economies in the world, China, the United States, and the European Union, have different monetary policy rhythms, and there are differences in CPI. The situation is mostly similar. The reason why China's CPI is different is that the real estate regulation and the pig cycle are at the bottom stage. In 1973, the United States was in the overheating quadrant as a whole. Commodities soared, the stock market fell slowly, and debts were flat. The higher-than-expected increase in inflation is due to multiple factors such as high economic growth, excessive currency issuance in the early stage, weak fiscal discipline, and cost-end labor conference prices. The dollar crisis broke out in the first half of the year, and the Federal Reserve was reluctant to raise interest rates too quickly in exchange for price and wage control measures from Congress. The dollar, which lacks the support of interest rates, has fallen sharply many times. Commodities and precious metals rose sharply. U.S. stocks fell slightly following the pace of the dollar. In June, the Federal Reserve waited for Nixon and Congress to control prices and wages. However, after the Watergate incident, the price control conditions deteriorated sharply. There was a material shortage in the American society, and price control failed completely. The Fed had to tighten monetary policy significantly. The short-term rapid tightening of the monetary policy has stabilized the US dollar, and US stocks have also stabilized following the US dollar, suppressing the growth of commodities, precious metals, and currency. The economy declined in the next month, and the currency loosened. After the outbreak of the Middle East crisis in October, commodities ushered in a new round of surge, and the market’s interest rate hike expectations suppressed US stocks and gold. However, the Fed finally decided to hold back on supply-side events and cut interest rates as the risk of recession increased. In 1974, the U.S. went from overheating to stagflation. U.S. stocks plummeted. In the spring of 1974, the impact of the oil embargo gradually dissipated. In the face of high inflation and high currency, the Federal Reserve quickly continued to tighten monetary policy quickly. Commodities fell, gold fell sharply, and U.S. stocks fluctuated. In July, there were signs of recession in the United States, expectations of monetary easing rose, and gold rose. However, the new President Ford clearly rejected the price control measures, and the Fed had to face stagflation alone. Currency cut interest rates slightly and slowly in the tug-of-war between recession and recession. The U.S. economy is currently in an overheating zone, and the Fed is more behind inflation than the dovish Burns was in 1973. After the impact of the oil crisis faded in the spring of 1974, the Federal Reserve accelerated its tightening of monetary policy, and the 10y-1y interest rate spread quickly reversed from positive to negative. At present, the Federal Reserve is also in the critical window of observing the impact of the Russia-Ukraine crisis and further tightening the currency rapidly at any time. Longitudinal comparison of the current and 1974 monetary policy interest rates and interest rate differentials shows that the current pace of interest rate hike expectations and actual interest rate levels are still obviously insufficient to control inflation, and further tightening is on the way with the uncertain situation in Ukraine (as sharp tightening following the oil crisis in the spring of 1974). Against the backdrop of the Compo Depression, high inflation, high interest rates, and low consumer confidence will, as in July 1973 and mid-1974, cause the economy to show signs of recession and drag the U.S. economy into stagflation. At the point of recession, 1) it is necessary to wait for the Fed to realize the resilience of inflation first, and further accelerate the tightening of monetary policy, which is marked by a significant inversion of ten-year and one-year interest rates; 2) the raised interest rate will soon be reflected in the economy In terms of economic indicators, PMI and consumer confidence index are used as leading indicators; 3) The deterioration of the labor market will be the key to confirm the beginning of recession. After the signs of recession are confirmed by the market, the Federal Reserve's hawkish stance will be challenged, and the currency will either loosen or maintain restraint. According to Powell's latest statement, Powell's current position is similar to Burns' stagflation period in 1974, and he believes that solving inflation is a prerequisite for improving consumer confidence and promoting economic recovery. Therefore, after the emergence of this round of recession, it is expected that there will be similar slow rate cuts. The U.S. stock market will face a double kill with a sharp deterioration in the numerator and a superficial denominator. U.S. debt has turned from bearish to bullish. Precious metals fluctuated upward under the competition of interest rate cuts and hawkish stances, and the degree of upward movement was determined by the degree of easing caused by the degree of recession. On the whole, in the late stage of overheating, the Fed is on the verge of significantly tightening, and the bond market is flat. Precious metals and commodities may still rise further when the Fed’s tightening is insufficient. After the ten-year and one-year interest rates are significantly inverted, they tend to peak. Capture signs of recession in signals such as the labor market, PMI, and wages. After stagflation is confirmed, the stock market is expected to kill both the numerator and denominator (the numerator end represents the profit of the company, and the denominator end represents the risk-free interest rate). Falling back, if the recession is more than expected, the bond market will turn bullish and steep, and the precious metals will fluctuate upwards. If it is a mild recession, the shocks of precious metals may remain weak. 3) Tracking comparison of relative factors The index of consumer confidence has fallen to record lows, with recessions falling within a year of the first dip to that level in history. In terms of term spreads, the Federal Reserve lags behind inflation by a large margin, resulting in 10-1 lagging behind 10-2 spreads. The current spreads, real interest rates, and short-term interest rates will not put pressure on the market, but they also cannot stop inflation from rising. The next step The Fed waited for an opportunity to accelerate tightening after the decline in geopolitical uncertainty, and the 10-1 inversion, and then surpassed the 10-2 inversion, exerted pressure on the market. In 1974, the current PMI level was 5 months into a recession and 7 months into a recession. The labor force participation rate stopped rising in March and April 1974, and there were signs of recession three months later. At present, the labor market shows no signs of slowing down. Observing whether the labor force participation rate has stopped rising can also help verify whether the current labor market momentum is weakening. On the whole, the end of the third quarter and the fourth quarter are the windows to focus on observing signs of recession in the United States. On the whole, monetary easing or easing expectations during stagflation tend to drive gold to strengthen. The suppression of monetary easing expectations will bring a callback to gold. During the period of stagflation, Burns was hawkish, but the economic recession exceeded expectations and still had to moderately speed up rate cuts. The core assumption of Powell’s current acceleration of tightening also comes from the resilience of the economy and no recession. Monetary policy is still the dependent variable of inflation and economic growth, and the core issue still revolves around the prediction of whether the economy will decline and to what extent. a. Term spread b、PMI The current term structure of U.S. debt is similar to the level at the end of February 1973. The spread between the 10-year, 3-year, and 2-year interest rates has been inverted, and the 10-year and 1-year interest rate spread is falling from a high level. The current 10-3 interest rate spread is equivalent to 1973.02, and the 10-1 interest rate spread is higher than that of the year, mainly due to the fact that the Powell Fed has been more dovish than the Burns Fed in the second half of 1972 since last year, resulting in a year that is mainly included in interest rate hike expectations Interest rates are still low. At this stage, asset prices will not be significantly suppressed. In the next stage, monetary tightening will accelerate, the stock market will be under pressure, and commodities will peak. Wait for the 10-1 inversion, mortgage-1y to fall back to the end of 19 point. In the third stage, the currency was tightened too quickly and soared, suppressing stock and debt dealers. The 10-1 inversion has intensified, significantly exceeding the level of 10-2 and 10-3 inversions, and the mortgage-one-year treasury bond spread has fallen sharply. The U.S. February PMI is currently at 58.6, the same as in February 1974 (and a similar 10-2 spread). From March to April 1974, the US PMI was still at a level above one standard deviation in history. With the rapid rate hike by the Federal Reserve, the decline fell to 55.7 in May, and signs of recession appeared in July. The PMI fell again to 52.9 in August, and the PMI in September It officially fell into recessionary territory at 46.2. c. Consumer Confidence Index The latest Michigan Consumer Confidence Index in March was 59.7, which was equivalent to 61.8 in February 1974, both at extremely low levels under the impact of high inflation and the oil crisis. After the impact of the 1974 oil crisis faded, consumer confidence rebounded significantly, but fell again before the recession. May 2008 was 59.8, and the U.S. stock market began to decline at an accelerated rate in June. Overall, the current consumer confidence has reached the warning level, and the market has fallen into recession after 74, 79, and 08 levels. d. Labor market Unemployment rate is clearly a sign of recession. During the period of great inflation, the labor force participation rate leads the unemployment rate. Before the unemployment rate climbs, it often loses its early momentum. At present, the labor market is still extremely strong, the labor force participation rate is rising, and there is still a distance from recession. e. Real estate, credit 73-74, 78-79, 98, and 07 were all accompanied by a significant increase in the spread between mortgage interest rates and ten-year interest rates. At present, the spread has risen from the low point of the epidemic to one standard deviation above the average in the past 10 years. As credit conditions tighten, the spread widens further and US real estate tends to peak. 4), 1973-1974 to the current investment insight During the period of great inflation, before and after signs of recession are the core dividing line for the differentiation of asset performance characteristics, that is, the division between overheating and stagflation. During the overheating period, inflation grew at a high level, employment was relatively strong, PMI remained high, and the currency continued to tighten. In terms of asset performance, bonds were flat, gold fell significantly, and the stock market fell slightly. After signs of recession appeared, the Fed's hawkish stance was constrained by the extent of the recession, and the currency tended to become looser. Bonds are bullish, gold is rising amid the recession, interest rate cuts and the Federal Reserve's hawkish attitude, and U.S. stocks have fallen sharply. Based on our core judgment of Kangbo depression and big inflation, in the past few years, the long-term production capacity will be eliminated, the fiscal deficit will be monetized, the global economy will go from jointly expanding the cake to decoupling and sharing the cake, and geopolitical frictions will occur frequently. The inflation center will remain high. Increased volatility. It is difficult for this round of inflation to spontaneously decline under the current level of real interest rates and interest rate differentials. The backward Fed will further accelerate interest rate hikes, just like in the spring of 1974, while suppressing bonds, stocks, and gold. The first stage: further accelerating monetary tightening is already on the way. The U.S. economy is currently in an overheating zone, and the Fed is more behind inflation than the dovish Burns was in 1973. After the impact of the oil crisis faded in the spring of 1974, the Federal Reserve accelerated its tightening of monetary policy, and the 10y-1y interest rate spread quickly reversed from positive to negative. At present, the Federal Reserve is also in the critical window of observing the impact of the Russia-Ukraine crisis and further tightening the currency rapidly at any time. In terms of term structure, the interest rate spread between the 10-year and 1-year interest rates is currently at 0.8, while the interest rate spread at the beginning of 1973 was at 0.73, which is very similar. However, during the positive period at the beginning of 1974, which experienced the dollar crisis and the oil crisis, the highest point of interest rate spread was 0.24. The current pace of interest rate hike expectations and the actual level of interest rates are still obviously insufficient to control inflation, and further tightening is already on the way. The second stage: high inflation, high interest rates, low confidence, signs of recession appear. High inflation, high interest rates, and low consumer confidence, as in July 1973 and mid-1974, will cause the economy to show signs of recession, and then drag the U.S. economy into stagflation. At the point of recession, 1) it is necessary to wait for the Fed to realize the resilience of inflation first, and further accelerate the tightening of monetary policy, which is marked by a significant inversion of ten-year and one-year interest rates; 2) the raised interest rate will soon be reflected in the economy In terms of economic indicators, PMI and consumer confidence index are used as leading indicators; 3) The deterioration of the labor market will be the key to confirm the beginning of recession. In terms of specific indicators: In May 1974, the PMI first fell from the previous high level of 59.9 in April to 55.7. In 2022, the PMI dropped from 61.1 in November 2021 to 57.6 in January, and rose to 58.6 in February. The initial value continued to rise slightly. In June 1974, the labor market deteriorated significantly, and the unemployment rate rose rapidly from the previous level of 5.1% to 5.4%. In February 2022, the unemployment rate is at a very low 3.8%, and the job market remains strong. The consumer confidence index fell from 72.1 in May 1974 to 64.4 in August. The current consumer confidence index in March 2022 has dropped from 70.6 in December 2021 to 59.7. The third stage: the see-saw between the degree of recession and monetary tightening during the period of stagflation. After the signs of recession are confirmed by the market, the Federal Reserve's hawkish stance will be challenged, and the currency will either loosen or maintain restraint. According to Powell's latest statement, Powell's current position is similar to Burns' stagflation period in 1974, and he believes that solving inflation is a prerequisite for improving consumer confidence and promoting economic recovery. Therefore, after the emergence of this round of recession, it is expected that there will be similar slow rate cuts. The U.S. stock market will face a double kill with a sharp deterioration in the numerator and a superficial denominator. U.S. debt has turned from bearish to bullish. Precious metals fluctuated upward under the competition of interest rate cuts and hawkish stances, and the degree of upward movement was determined by the degree of easing caused by the degree of recession. On the whole, the end of the third quarter to the fourth quarter is the key window for observing signs of recession. 5) The financial logic and impact behind the appreciation of the US dollar When the monetary tightening starts, there will be no impact in the initial stage. Therefore, we can see that in the history of many interest adjustment cycles, there was no change in the first few times, and even the capital market will continue to rise. Including the interest rate adjustment in March, expectations have been gradually released, and Nasdaq turned to rise instead. It's okay once and twice, but when continuous interest adjustments come, the impact will be very different. A mortgage of 10,000 yuan a month will make you add 100 more per month in the future. Of course, you will not feel anything, but when you add 500 more per month, you will start to feel uncomfortable. If there are more, it will be even more uncomfortable. This is the pain of continuous interest adjustments... So, after monetary tightening, over time, it will reduce corporate revenue and profits.... A year later, when profits are lower, the cost of overseas debt is also higher. Therefore, many companies will be unable to bear it... We will gradually see these phenomena next year. The exchange rate changes in almost every country in the world have never been just changes in the market, but also mixed with various financial games. The summary is as follows: a. The appreciation of the US dollar will increase the debt repayment pressure of companies with overseas debts; b. During the monetary tightening cycle, long-term interest adjustments will reduce corporate profits and increase the pressure on repayment; c. Energy Rising prices and appreciation of the US dollar will increase import costs for energy importing countries and increase the trade deficit. The increase in import costs and the rise in PPI will cause imported inflation in the importing country, and once inflation increases, it will accelerate the progress of monetary tightening again. Historically, whenever the U.S. dollar appreciates sharply and the adjustment of interest rates is superimposed, it will trigger crises in different regions. From 1980 to 1985, the U.S. dollar index rose from 85 to 152, and interest rates also rose, reaching 22% at one point. Currency tightening required Latin American countries to borrow money to maintain the exchange rate system, which triggered the Latin American debt crisis at that time. From 1995 to 2002, the U.S. dollar index rose from 80 to 120. At that time, the U.S. Treasury Secretary advocated a strong U.S. dollar policy and accelerated the sharp rise of the U.S. dollar against other currencies during 1995-1996, which also accelerated the Asian financial crisis in 1997. Appear. 6), the macro level anddigital currencydigital currency The financial logic of the market Economic stagnation, inflation, interest rate hikes, and economic recession are macro terms that need to be considered at present. Raising interest rates and shrinking the balance sheet will directly lead to a shrinkage of liquidity, and the rise of risky assets due to large-scale release of water will turn into a decline; but it is difficult to directly reverse the trend. I have seen this matter according to the time point, and the initial stage of interest changes (interest rate hikes and shrinking balance sheets) , the market will fluctuate, but will not reverse direction. This has been the case in many cases throughout history. In order to reduce inflation, the Federal Reserve’s stance and actions exceeded market expectations, and the market digested it through declines. The risk market will fall to a certain extent because of the intervention of institutions.bitcoinbitcoin The macro environment currently does not support US stocks to go bullish again, nor does it support the big pie to go bullish. The current rise is aimed at the rebound since the fall of 69,000. Don't wishful thinking about the strong unilateral rise in 2020 and 2021. 1. On-chain index analysisThe 1K-10K whales, which represent the main trend of the market, continue to reduce their positions in this round of rebounding market. On the one hand, it means that the current institutional game is increasing; It is consistent; the number of whales has also decreased as the market has risen, that is, the circulating chips have been transferred-the large ones have been transferred to the small ones. Figure: Changes in positions on the BTC chain image description Figure: Number of whales and BTC price trendSignificantly reduced, a new low in the stage, and fewer and fewer real negotiable chips. On the one hand, it shows that the consensus of the big pie is getting stronger; , the decrease in the balance of the exchange does not mean that the market will rise directly, but often after a sharp decrease occurs, there will be another wave of good rising prices. image description Figure: Exchange balance and BTC price trendIt is still running at a low level, indicating that the market has enough purchasing power to launch a round of rising prices, and what is lacking is themes and opportunities for speculation. image description Figure: Stablecoin supply ratio and BTC price trendThe current futures contract open interest (BTC number settlement) is near a record high, indicating that the current leverage ratio is high. According to historical laws, high leverage is often accompanied by high volatility. From the logic of the counterparty to increase the position down, one party needs to close the position and the leverage is reduced. A short-term inflection point can only appear; calculating the position from the futures contract USD also increases the position downward, indicating that the recent market is the spot trend driven by the futures. It also shows that the futures drive the structural market, and the greater probability of the spot push is the continuous momentum of the waves The market is currently driven by futures. Figure: Futures open interest (BTC unit) and BTC price trend image description Figure: Futures open interest (USD unit) and BTC price trendFrom the perspective of the big cycle, the change of Bitcoin's illiquid supply from a net increase to a net decrease often means a bull-bear conversion, 2017bull marketThis is true for both the 2021 bull market. And during the bull market, the illiquid supply is mainly a net increase; during the bear market, the illiquid supply is mainly a net decrease. At present, the supply of illiquidity is still increasing on a net basis. This data shows that the structural market of rising and rebounding is still there. image description Figure: Comparison of illiquid supply changes and BTC prices since 2016During the rising bull market in 2017 and 2021, long-term holders are cashing out on a large scale on the way up, and indicators and prices show a trend of scissors. However, the rise of BTC from 29,000 to 69,000 has not seen the large-scale reduction of holdings before. It shows that long-term holders believe that the current decline is a short-term behavior, and there is room for upward adjustment of BTC after a prolonged period of time. (Some analysts regard the one-sided hoarding behavior of this indicator as evidence that the market is bullish. Looking at history, this is a non-objective behavior) Figure: Changes in long-term holdings and BTC trends since 2016 2. Analysis of price patternsIt is temporarily running in the channel, and there is still support near the lower track of the channel, that is, around 35,000, but the dead cross of the MACD indicator is downward, and the dead cross at the monthly line level is rare. There have been two times in history (2018, 2019) and both fell and adjusted for several months in the later period , and hit a new low, corresponding to now, that is, the low of 33,000 in January will be broken (referring to historical trends, falling below is a high probability event). image description Figure: BTC monthly trendNear 29000 is the double intersection position of the adjusted low point and the upward trend in 2021, with strong support. 3. Study and Judgment of ETH Large StructureLooking at the historical trend, ETH rose for 5 quarters, then adjusted for 8 quarters, and rose again for 8 quarters. This quarter is the third quarter since the high point of 4800. Even if this quarter falls again, there is no need to panic too much. From the historical situation, the ETH quarterly line has been negative for two consecutive quarters, and the downward adjustment for two consecutive quarters has also brewed opportunities for rising, and the timing of the decline is also in line with the cyclical law. image description Figure: ETH quarterly trendObviously, there are two characteristics. One is that the monthly MACD indicator is dead cross, and the probability of reversing after one month of adjustment is relatively small (this has been demonstrated in the BTC analysis); . Figure: ETH monthly trend 4. Conclusion 1. Raising interest rates and shrinking the balance sheet will not lead to a direct reversal of the market trend, and quantitative changes will only achieve qualitative changes to a certain extent;secondary title

2. Research and judgment on the large structure of BTC

secondary title

secondary title

secondary title

first level title