Messari Report: Terra's ecological development will be the best in 2022, and UST will become the key to ecological expansion

Original source:Messari

Original source:

Key Insights:

LUNA's price return in the first 2.5 months of 2022 outperforms all other smart contract ecosystem tokens combined by a ratio of 7:1.

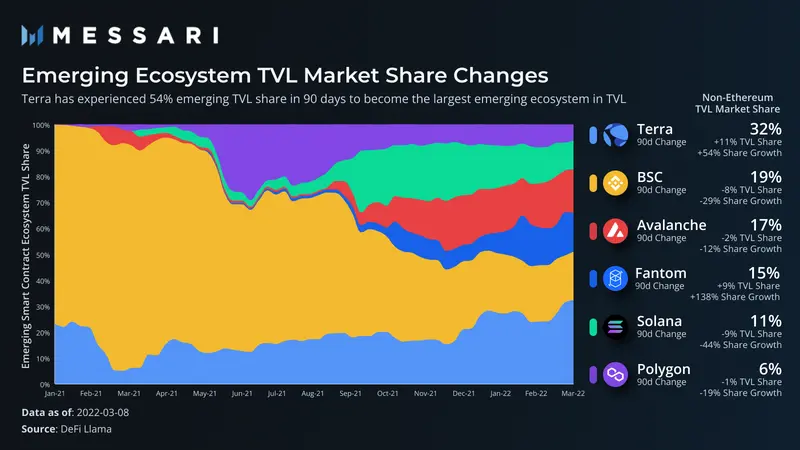

Terra's market share of TVL in the emerging smart contract ecosystem grew by 54% in 90 days and now accounts for a third of the emerging ecosystem's TVL.

Much of the increase in TVL came from the debt agreement, as Anchor grew TVL by $5 billion in 30 days. Those deposits were largely chasing Anchor's 20% yield, as debt grew by only a third relative to deposits.

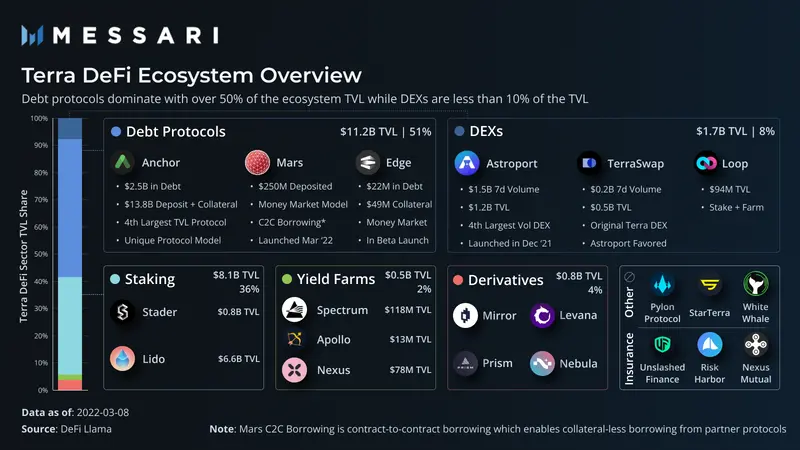

51% of Terra TVL comes from debt agreements, 8% from DEX, and 36% from staking agreements. About one-third of the TVL of other emerging ecosystems comes from debt agreements, and less than half comes from DEXs.

The recent launch of new structurally important protocols (DEXs and money markets) is a key source of future growth.

The main risk is the removal of Anchor UST deposits, which could lead to an oversupply of the UST market outside of the agreement.

The key opportunity lies in a native stablecoin that can be readily used to drive ecosystem growth, as most smart contract ecosystems are constrained by stablecoins - the Terra ecosystem minimizes this limitation.

LUNA excels

With an orchestrated $11 million token price bet on Twitter, it's safe to say Terra has caught the attention of the crypto community. Note of course follows the price. And LUNA (the native asset of the Terra ecosystem) has moved away from the center of gravity of the price movement of the general smart contract platform and has firmly rooted in the moon. Over the past 30 days (March 14), smart contract tokens excluding LUNA and with a circulating market cap (CMC) of over $10 billion have fallen by 12%, while the price of LUNA has increased by more than 76% in the same period.

So what happened?

There are two core reasons driving asset repricing.

Risk reassessment: Adding BTC as a reserve asset: The Luna Foundation Guard (LFG) was formed to protect the UST peg. As an entity, LFG purchased over $2.2 billion in BTC using LUNA (by burning it to UST and then buying BTC with UST). In addition, there are 8 million LUNAs (about 800 million US dollars) that will be used for BTC purchases in the future. Therefore, the risk of a downward spiral scenario in the UST algorithm design is significantly reduced, leading to a reassessment of the LUNA asset price.

Increased usage and sound fundamentals: Anchor's solid 20% yield has attracted plenty of new users and capital as the broader market experiences falling prices and yields. As new USTs are minted, the LUNA supply is destroyed, leading to upward price pressure and significant growth in commonly used reference metrics like TVL.

With the risk of instability lessened, the main factor for continued success turns to fundamental adoption of the network and related applications, and UST more broadly.

The best way to estimate UST demand is to first decompose the relative growth rate of the entire ecosystem, then the TVL is more and more fine-grained, then the DeFi field, and finally the protocol. By understanding UST demand, the bullish and bearish cases for Terra can be accurately assessed.

TVL growth and comparison

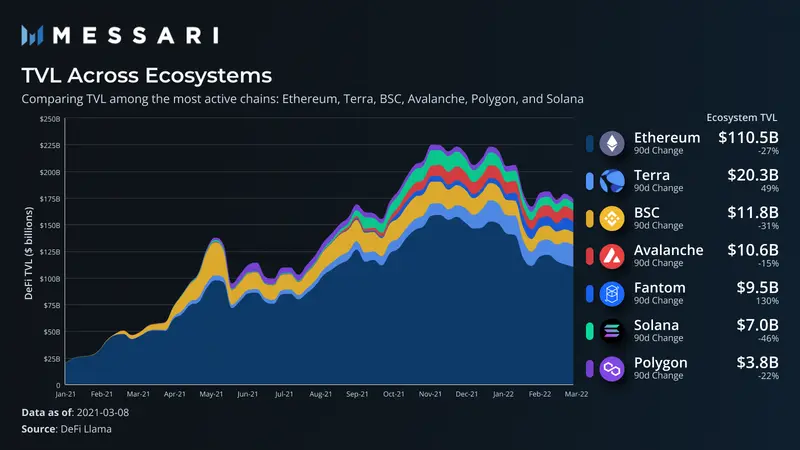

Since roughly the beginning of 2022, the TVL of the top smart contract ecosystems has declined, roughly reflecting changes in the market price of native assets. Fantom and Terra are the only two ecosystems with TVL growth in the past 90 days. The increase in Terra TVL (+49%) was mainly due to a significant increase in the price of LUNA and continued expansion of UST supply. As a result, the composition of the TVL share in the emerging smart contract ecosystem has changed, and Terra is now the largest ecosystem outside of Ethereum.

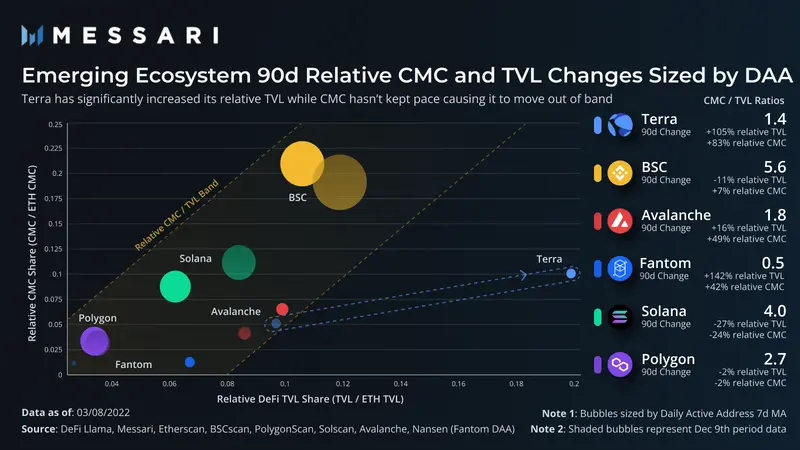

Even more impressive than Terra's 49% growth in TVL 90 days was its 54% increase in emerging ecosystem TVL market share. That market share now accounts for almost a third of the top emerging ecosystems. The strong relative performance has shifted Terra from CMC to the TVL band where emerging ecosystems reside.

When the CMC and TVL of emerging ecosystems are plotted against Ethereum's data, it becomes clear which ecosystems are gaining or losing ground regardless of overall market shifts. In general, up and to the right is good, meaning the ecosystem is more valuable relative to the market leader. Out-of-band on the left means investors are pricing in TVL growth. Meanwhile, an out-of-band signal to the right indicates that investors are skeptical about the sustainability of TVL, or, more optimistically, that investors are lagging in the appreciation of different mechanisms.

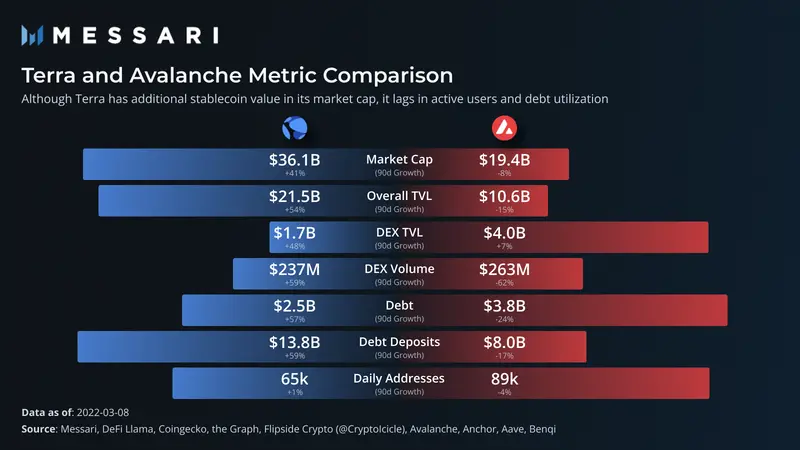

Over the past 90 days, Terra has clearly moved far out of band to the right. Even with Terra's 30-day price increase of 76%, its CMC has failed to keep pace with its relative TVL growth, implying that investors are either intentionally discounting TVL growth or inadvertently failing to grasp its competitive positioning. When comparing Terra to another well-known protocol, Avalanche, it becomes clear why Terra is undervalued on a TVL basis.

Avalanche has more daily active users, higher DEX TVL, trading volume, and outstanding debt. So why is the market cap and overall TVL almost half that of Terra?

Avalanche's DEX TVL of about $2 billion is located in the stablecoin swap protocol, serving a small transaction volume and a completely different stablecoin market. Since UST is a single native stablecoin, Terra does not need this excess of capital for asset-like swaps or peg stability. Therefore, from the perspective of the entire ecosystem, its DEX capital can be used more efficiently. Not to mention, LUNA gains additional value as a monetary asset backing UST.

Much of the underestimation reasoning is due to debt agreement statistics. Avalanche's debt utilization in Aave and Benqi is relatively healthy at just under 50% utilization (debt outstanding/deposits). Terra's primary debt protocol, Anchor, is unique compared to Aave and other money markets on the EVM chain. Utilization is about 20% of total deposits, which means more capital appears in the TVL statistics and is therefore not effectively being used as interest-earning debt. The underutilization of Anchor is due to the fixed deposit of 20% APY Anchor pays on UST deposits. Since there is not enough interest or staking income (collateral in anchors get staking rewards paid to depositors), deposit APY is paid out of protocol reserves, which is often an unsustainable model for debt protocols.

However, from an ecosystem-wide perspective, what seems unsustainable from a single-protocol perspective could be a successful bootstrap for a full-fledged network, both now and in the long term. To understand the entire Terra ecosystem, let’s break down capital by DeFi sector and protocol type.

Protocol Type Diagram

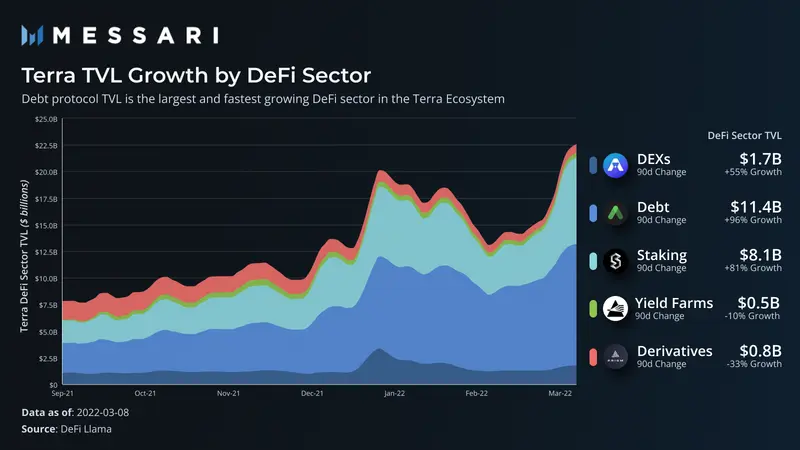

Debt agreements account for about half of the TVL of the entire network, with an increase of nearly 96% within 90 days, making it the fastest-growing DeFi field in TVL. Anchor's high-yielding deposit rates and lagging lending volumes are clearly the main drivers.

In addition to being the second largest segment in TVL, liquid staking protocols are also the second fastest growing segment, growing by over 81% in the past 90 days with the launch of Stader. Therefore, the TVL of liquid staking exceeds one-third of the TVL of the network. In contrast, both Ethereum and Solana have prominent liquidity staking protocols, accounting for 10-20% of the TVL of their respective networks, suggesting a higher relative adoption of the Terra ecosystem in this space. A big reason for this is that Anchor exclusively uses liquid collateralized derivatives as collateral, as opposed to protocols like Aave on Ethereum, which accept both native assets and collateralized derivatives.

With the TVL share of debt and liquidity collateral agreements being disproportionately large, there are certainly underrepresented sectors. DEXs on other networks account for 20-40% of TVL, while Terra DEX accounts for less than 10%. However, as mentioned earlier, having a single stablecoin in the ecosystem removes a significant portion of the usual DEX TVL on other chains dedicated to stable asset exchanges. Additionally, Terra’s DEX liquidity maintained strong growth during this period, reaching 55%.

debt agreement

Anchor

secondary title

As mentioned earlier, Anchor is the largest protocol on Terra and plays a key role not only in the ecosystem, but in the questioning narrative against the ecosystem.

While debt on the platform grew 57%, Anchor's total deposits nearly doubled in 90 days. These deposits are either UST in its Earn product or secured collateral for repayment. UST deposits earn a fixed interest rate of 20% p.a. and serve as a supply of outstanding debt. Mortgage assets (bLUNA and bETH) are liquid mortgage derivatives, whose mortgage proceeds are directly used for protocol reserves (and eventually flow into UST depositors). Debt can only be made against bonded mortgaged assets.

The protocol’s income comes from pledge proceeds on mortgaged assets and interest paid by borrowers. The disproportionate growth of UST deposits (+187%) relative to these two sources creates an unstable system as depositors' APY remains constant regardless of income generated through debt or staking. The difference between revenue and interest payable on deposits is made up by the agreement reserve, which is now close to $1 billion after LFG injected its latest $450 million in February. At current deposit levels, reserves alone can fund about 2-3 months of deposit interest or about 6 months of projected borrower interest and mortgage returns. In order to continue to fund deposit rates, these reserves need to be constantly replenished from external parties.

Of course, everyone close to the project already knows this. Some recent proposals suggest tweaking token economics and adding new collateralized assets (more staking revenue), but none of the solutions are a panacea. It takes too much extra income to maintain deposit rates.

Anchor's excess UST supply needs to be absorbed by sources of demand other than LUNA redemptions, which is where recently launched and upcoming protocols come into play.

Mars

Mars recently launched in March following its Lockdrop and Liquidity Bootstrap Auction (LBA). Structurally, the protocol functions more like a traditional money market similar to Compound than Anchor's unique model. However, unlike money markets like Compound, Mars offers contract-to-contract (C2C) lending, meaning whitelisted protocols can borrow and borrow from Mars without depositing collateral in the money market (known as the Red Bank). Instead, the collateral is in an external smart contract with an established credit limit. Although this feature will only be available for leveraged yield farming at first, there will be more unique use cases once the framework is established.

secondary title

DEX agreement

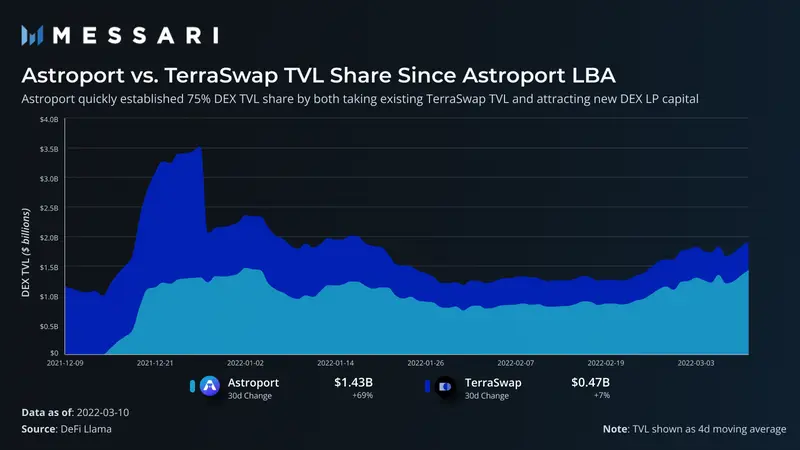

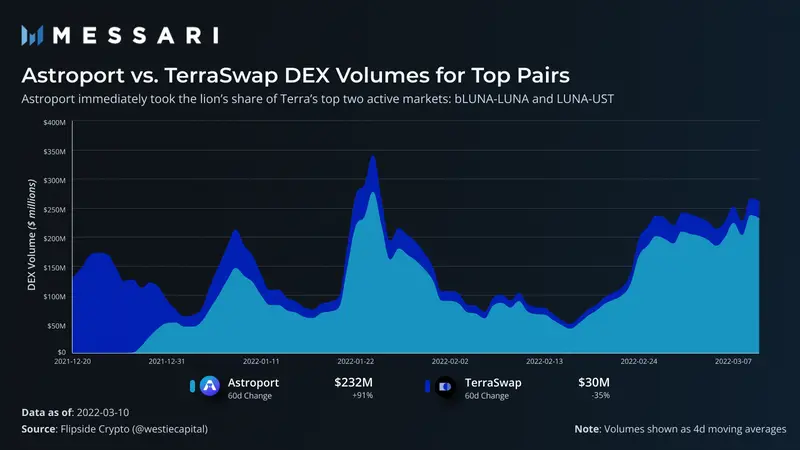

TerraSwap was the long-time leading DEX on Terra, but since Astroport launched in December, things have turned around. Almost immediately after launch, Astroport controlled the majority of DEX liquidity.

Astroport continues to dominate marginal DEX liquidity flows and now accounts for over 75% of all DEX liquidity on Terra. This rapid growth was not zero-sum, and overall DEX liquidity increased during this period. This growth shows that while Astroport did absorb significant liquidity, it also attracted new capital.

For the top pairs in the ecosystem (LUNA-UST and bLUNA-LUNA), a more uneven story unfolded. After trading went live in late December, Astroport accounted for almost 70% of the trading volume of these currency pairs, and now it has almost 90% of the trading volume share.

Overall, volume on Terra is currently fairly concentrated in two major pairs: LUNA-UST and bLUNA-LUNA. Astroport has been a top five DEX in crypto since early March, almost exclusively from these two pairs. While volume concentration is certainly a risk, it is also an opportunity. As the ecosystem builds, DeFi tokens like ANC and ASTRO are gaining share of trading volume, and other currency pairs are likely to follow suit. Astroport has shown strong adoption in several major markets and has great potential as more ecosystem tokens come online.

secondary title

pledge agreement

pledge agreement

Liquidity staking plays a relatively important role in the Terra ecosystem. Staking protocols have a higher share of TVL than other ecosystems due to deep integrations built in. Other ecosystems have retroactively adopted liquid staking, while Terra's largest protocol has incorporated it natively into the protocol design.

Stader is roughly one-tenth the size of Lido on Terra, with over $700 million in TVL. Its staking spin-off is LunaX, which currently lacks the major integration Lido built (ie Anchor). However, it is looking at integrations with other lending protocols such as Edge. Stader has also launched a product called “degen vaults,” which are packaging strategies utilizing its LunaX derivative tokens.

secondary title

derivative agreement

Derivatives and synths are relatively rare on Terra. Mirror is a synthetic protocol that gives users exposure to traditional assets like Apple stock. It started out as a cornerstone of the ecosystem but has since waned in popularity. Its TVL share fell below 3% from 35% in August. However, the industry is growing, largely thanks to Prism.

Prism is a recently launched protocol for refactoring assets into yield components and principal components. When LUNA's Staking revenue value is separated from its core utility value (principal), it can achieve a mature and efficient financial ecosystem. For example, principal tokens can be sold to prevent price movements in LUNA, while proceeds are still captured in yield tokens. Likewise, variable future yields can be sold in the form of yield tokens for a fixed upfront price. This form of trading interest rate derivatives is definitely a huge market (over $500 trillion, according to Prism) in traditional markets.

Derivatives in general remain a growth area for Terra, especially if the PoS chain develops a large market for its ongoing rate.

UST adopts

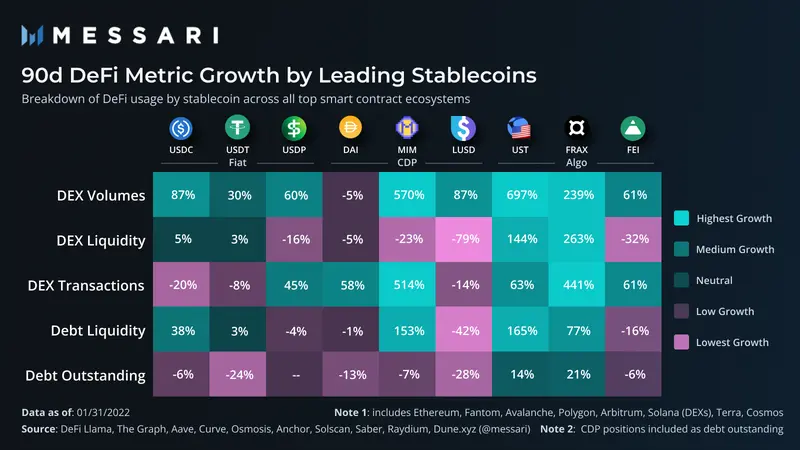

Terra's ultimate success lies in the adoption of UST, both within the growing Terra ecosystem and into a broad range of other on-chain DEXs. UST is the clear decentralized stablecoin frontrunner in several categories: it is the largest in supply (over $15 billion in circulating supply); it is the fastest growing in circulating supply (up 30% over the past 30 days); And, it has the fastest growing usage among various DeFi metrics.

UST's growth continues to expand both within and outside the Terra ecosystem. Since adopting UST in October, Osmosis’s second largest token is UST, and it is by far the largest stablecoin on the DEX. Recently, the ZigZag exchange on zkSync accepted a proposal for its market makers to remove USDC and USDT liquidity and instead focus on listing the UST currency pair. Bitrue, the sixth largest CEX, also announced that it will make UST the underlying asset for 71 trading pairs.

Terra has attracted a wide range of critical views, from its being a new paradigm to its ending in an inevitable death spiral. A key fork in the road between the two views is the assumed UST demand once the Anchor subsidy is scaled back. Understanding current and potential sources of UST demand is critical to assessing the probability of each argument occurring.

secondary title

bearish

Given the relative size of UST in Anchor, no other existing UST market is large enough to absorb capital outflows. So the natural trend is to either swap to other stablecoins, or redeem LUNA. If there is enough UST outflow and redemption, then LUNA will face huge downward price pressure. UST holders redeemed, fearing lower future value, as LUNA price drops signaled a decline in confidence in redeeming the asset. The subsequent sale of the redeemed LUNA further facilitated the process for the next UST holder to follow suit and eventually led to a death spiral. This phenomenon is called reflexivity, and when it's down, it's the devil of all algorithmic stablecoin designs.

secondary title

see more

The bullish argument claims that, given the rapid growth of the Terra DeFi ecosystem and the widespread adoption of UST by exchanges and other Layer-1s, there will be enough demand to absorb Anchor outflows by then.

All things considered, Terra's DeFi ecosystem is still young. Two of the most popular applications have been launched in the past few months, and these applications serve as basic primitives that lay the foundation for many more applications. DEXs on other chains account for about 20-40% of TVL, but Astroport is currently only 5% and growing rapidly, about 50% in the past 30 days. Mars is certainly poised to grow in a similar fashion. If we assume the two protocols grow to the same relative size on other layer 1s, then around $3-6 billion in additional TVL would be required. And, that's before looking at other sources of demand or assuming general ecosystem growth.

Another by-product that all young protocols face is the distribution of large untapped liquidity incentives. Other protocols have incentives to gradually release Anchor UST reserves over time, avoiding supply shocks. For example, Astroport recently received 20% APR (net of incentives) and an additional 10% LP incentive (for a total APR of 30%) on its LUNA-UST pair. Similar yields exist in DEXs and will continue to attract the employed portion of Anchor deposits that pose the greatest supply shock risk.

More generally, this approach of first incentivizing a stable supply and then building a protocol is a unique and effective way to grow a Layer-1 ecosystem. Most emerging and established ecosystems are constrained by stablecoin supply - such constraints do not exist in the Terra ecosystem. Terra actually has a large number of stablecoins ready to provide liquidity, and has a scalable model to inject new stablecoins that do not suffer from regulatory bottlenecks. In the long run, this could prove to be a strong differentiating characteristic as the Terra ecosystem and cryptocurrency in general continue to grow.

final thoughts

Despite skepticism, it is undeniable that the Terra ecosystem is growing significantly. UST's rapid growth allows Terra to uniquely expand its ecosystem. With most of Terra's DeFi ecosystem coming online in the near future or in the near future, timeliness may create enough demand to mitigate Anchor's inflated deposit levels. Going forward, the Terra ecosystem will be heavily impacted by discussions in the Anchor community about its deposit rate, adoption growth of Astroport, Mars and other DeFi applications, and how UST can be adopted in external ecosystems.