Crypto Trader Ansem: Crypto Market Outlook for Q2 2022

Original title: "2022 Quarter II Market Outlook"

Author: Ansem

Original translation: @0xforeverever

Yo! What does it look like to be useful to the Internet? I almost decided not to write this post, and while not tweeting non-stop every day, I got bored pretty quickly, so during my break, I started posting my thoughts here. I'm also pretty sure we've bottomed out here, and honestly, I wouldn't be surprised if we had a bounce in most major markets into eom, painting a long lower line for these quarterly candles. If I can get most of it done and semi-coherent before heading to Barcelona for the AVAX conference, I'll probably post it so I can see it when I'm away from my computer. Otherwise, I guess I'm just writing this post to my future self for later reading. So, hello Q2. First of all, let me clarify that I am not a financial advisor and none of this is investment or financial advice, nor have I taken any of the 123 xyz series, it's just me spending too much time on the web with Wassie and Anime every day The literal form of what goes through your head as you delve into the wonderful microcosm of cryptocurrencies with your avatar.

If you're as left-leaning as I am on most macro issues, chances are you don't have a Russian invasion of Ukraine on your 2022 Bingo Card. When i sold some of my precious internet coins in november it was because i saw the risk taking place in the candlestick chart not because i had any idea of the underlying cause but because the fed might not be as Luckily for their printing presses. Incorporating macro analysis into my assessment of the cryptocurrency market is definitely a weakness for me that I plan to remedy in the future. So maybe the next time we have a global conflict, I'll be in the middle of the curve, not on the left. Anyway, with the exception of a few outliers, the first quarter was tough for most of the crypto market, but strangely enough, the worst of this downtrend wasn't isolated to the crypto market, because we also Saw many tech and growth stocks also get hit hard by global geopolitical risks and deteriorating macro conditions, while commodity and war stocks did well (S/o the homie Schiff). Many of these technical charts look identical to the blanket dips we saw during the first DeFi summer of 2020, and these were multi-billion dollar companies employing large numbers of people. Pray for those who enter 2022 short-term volatility.

Bitcoin’s relative strengths are especially important here, considering that this is the first time in Bitcoin’s history that its prop of value is fully on display to the world. Many Ukrainians who fled their home country due to the Russian invasion lost access to their traditional financial system after relocating, but as most native crypto folks know, it was trivial for them to withdraw their bitcoins. We've seen Canada restrict citizens' bank accounts because they took part in protests the government deemed unacceptable, and we've seen the Russian ruble lose 50% of its value against the dollar in a matter of days. There has never been a time when a non-sovereign currency like Bitcoin has been so important, and the charts reflect that reality. Also, we've seen some strength in the crypto market, seeing some midcaps go up 3-4x while the rest of the market is down, which reinforces my original thesis that we'll continue to see some The industry is in a bear market and we are in a bull market.

"Looking to 2022, we'll see if certain sectors continue to experience bear cycles amidst the macro bull cycles in crypto, or if we end up with another market-wide -90% drawdown like in previous cycles . The difficulty for traders is identifying what the current mispricing in the market is and how to take advantage of it and find which new trends are developing before the crowd does."

—Someone in Brooklyn before the preliminaries of New York Nights

Given the relative strengths of cryptocurrencies, I expect cryptocurrencies to lead the recovery if investor sentiment towards macro conditions improves. We've been hovering between 33k-45k throughout the quarter and we haven't made new lows since the day Russia invaded Ukraine, which is where many boom commodities like gold put local highs day. In my eyes, Bitcoin's 30k-60k range is a multi-year re-accumulation, and the next trend will be most similar to its rise to the previous 2017 high at the end of 2020. The question is how long this accumulation will last. Many altcoins are down more than 80% from their Q4 highs, some have fully retraced into their late 2020 bull market gains, but some have recovered much faster than others. Bullishness is out of favor here, just as bearishness is out of favor in November. I believe we have seen the peak of fear and uncertainty in the first half of the year and expect these accumulation ranges to break upwards in the second quarter, led by BTC and several outperforming altcoins.

the macro

the macro

From my short stint as a macroeconomic expert, I have identified four main things that would be bad for the market if they happened and were not priced in at current prices:

1. The situation between Russia and Ukraine has escalated to neighboring countries of NATO member states

2. The Fed is raising interest rates faster than the market expects

3. Putin thinks using nuclear weapons is a good idea

4. China enters the arena aggressively with their own imperialist pursuits

bitcoin

bitcoin

Bitcoin is at the center of its first midlife crisis. The supposedly safe haven of digital gold has traded as a risk-on asset alongside high-growth assets for most of its lifespan. Now in focus at a time of high inflation and global conflict. So, how will it behave? A lot of people called me stupid because I said that BTC will no longer be traded as a high-risk asset in the near future given its parabolic rise and massive fall over historical periods. In my opinion, this has changed in the past two years. In previous BTC cycles we have seen parabolic blowout tops followed by lower highs + lows until the timeline approaches the next halving and then we start the cycle all over again. In contrast, this cycle we have Bitcoin trading around the February 2021 highs for several months before selling off in May, then re-accumulating over the summer and retesting those early in the year in Q4 2021 High Point. We've established a 400+ day trading range in this area, unlike 2018's price action which was a streak of lower highs.

Ethereum

Ethereum

I have detailed most of my thoughts on Ethereum in a previous article, so I won’t elaborate here because nothing has changed. I still believe it is easy to find other tokens that outperform ETH when market risk is higher, and when market risk is lower I think BTC outperforms Ethereum here. For the merger, I think the biggest play is Lido, the liquid staking solution, because it largely benefits users who want to participate in ETH staking but still want to get their funds to be used in other parts of DeFi. They recently raised a funding round led by a16z, and they say they have used the service to stake their ETH. Lido is well positioned to support both institutional and retail investors through their services, as well as other L1s as they are multi-chain.

My friend @tolks1189 has done a great job with a nice recap of some updates in the ZK realm.

Overall cryptocurrency market

While the price isn't reflecting it, the amount of money and attention pouring into the crypto space hasn't slowed down at all over the past few months. We’ve seen many new funds spring up, crypto-native fundraising, collaborations between traditional and crypto-native companies, NFT partnerships, and more. There is no better source of daily information on cryptocurrencies than Darren Lau's The Daily Ape, and I still don't know how he keeps up with what's happening every day. A few notable things happened:

Consensus raised $450 million at a valuation of $7 billion;

Stripe adds support for encrypted businesses;

Immutable raised $200 million at a $2.5 billion valuation;

FC Barcelona Plans to Release Its Own Cryptocurrency and NFTs

Spartan Group Announces $200 Million Metaverse Fund

Bain Capital Ventures launches $560 million crypto fund

Alchemy raised $200 million at a $1 billion valuation;

FTX raised $400 million;

Sequoia Capital Launches $600 Million Crypto Fund

Honestly, there is too much news to attach here, and it is clear that there is a large group of people paying attention to the cryptocurrency market right now.

other aspects

Strange Clans' first NFT marketplace launched on JUNO.

Aurory white paper + game design released

Yuga Labs (BAYC) purchased the rights to Punks & Meebits, allowing users to control the intellectual property.

Q2 2022

secondary title

Cosmos:Osmo, Juno,LUNAtics and THORchads

If you've done a lot of allocation in the cosmos ecosystem, you haven't experienced most of the downtrends in the rest of the market. Osmo and Juno, as the two major cosmos altcoins other than Atom, are mostly in an uptrend, while other altcoins are down 80-90% from their all-time highs.

Osmo, as the main dex in the universe, has greatly benefited from the overall growth of IBC, especially since we are in the early days of cosmos DeFi. Unlike many other applications running on L1, Osmo is both its own chain and its own application, so it is not restricted like other AMMs. There are two main innovations that set it apart from other dexes, probably because it was designed as an AppChain specifically for this scenario.

Customized automatic market making and autonomous liquidity pool

secondary title

Vision of Osmosis

Also novel is Osmo’s recently launched hyperfluid staking, which allows users to bond and mortgage their assets in LP pools. The development team and community of Osmosis are very strong, and they are aligned with their core vision of IBC cross-chain functionality in the cosmos hub.

Juno has positioned itself as the premier L1. Most of it is airdropped to atomic stakers, and its core idea is to be a community-oriented protocol focused on cross-chain smart contracts. With a much smaller valuation than most of the other L1s, Juno has a lot of momentum and upside if they can manage to be the first place outside of Luna to launch new types of DApps. I really don't like the recent Prop 16 governance proposal which suggested removing funds from an account because they apparently received staking airdrops at multiple addresses. I think restricting individual users in this way is a bad precedent and hope it doesn't pass, or at least be re-proposed to some extent.

From the first quarter report,"Terra Luna is the only place in the cryptocurrency space where you can directly bet on the growth of stablecoins and the growth of the L1 smart contract ecosystem. For this reason, LUNA is my favorite of all the largest L1s, and going into 2022, I bet their ecosystem growth, stablecoin growth, and overall IBC growth will propel them over the rest of the competition."

Anchor was one of the only apps to significantly increase its TVL on its platform in Q1, with a TVL of $15.7 billion, just behind AAVE at $3 billion. With the addition of new properties like sAvax and the release of Anchor v2, this The uptrend should continue. The Luna Foundation decided to buy Bitcoin to increase their reserves to back their stablecoin $UST, which will make Terra USD more resilient to market sell-offs and will also increase confidence in the ecosystem. A big part of Luna's growth phase at this stage is building confidence in their stablecoin, both with retail and institutional investors. They already have strong backing from big names like Jump, Alameda, and 3AC, and $UST has been able to hold the exchange rate during times of the greatest market volatility. As their coffers grow and $UST grows, the risk of decoupling becomes less. There are also systems being implemented to assess risks within the system. Like Kujira and Risk Harbor, there will be no betting on Do Kwon and Co this year. Since the growth of UST is directly related to the decrease in the supply of LUNA, this growth continues to have a significant impact on its price.

In addition to the growth of Terra USD, Terra's DeFi has also started to pick up. Astroport, Terra’s main dex, consistently trades over $200 million in daily volume, with liquidity comparable to Osmosis. Currently, most of the trading volume comes from the Luna-UST and bLuna-Luna pairs, but Astro should see more activity as more DApps are launched and popularized. There have been a few other innovative protocols launched in the Terra ecosystem recently that are not too competitive with existing DeFi protocols, so it will be interesting to see how much market share they can grab.

Thorchain (RUNE) is one of my favorite asset packs in 2021, alongside Solana. It's fallen out of favor over the past year after several hacks last summer, but developers continue to work steadily. The core focus of Rune is to be a cross-chain dex, allowing native exchange between different chains. Thorchain is designed to bind nodes to provide 3 times more Rune collateral than other assets to increase liquidity, so as the TVL in Thorchain grows, the demand for Rune also grows. To me, the most interesting part of the Rune community comes from Bitcoin holders, as they are generally not very interested in ETH or DeFi. It would be very beneficial to Thorchain and its future if it could tap into this target market. There is currently a large amount of BTC that is not earning any yield, and should be one of the most attractive value tools for those who really like to passively buy and hold low-risk yield. Rune has had issues with hackers in the past, so rebuilding investor confidence will be very important.

More recently, its launch of Thor Synths and the upcoming Luna Integration have been great catalysts for the conversation, as Luna has been doing so well, plus the connection between BTC holders and Luna holders will connect the most decentralized currency and the most decentralized stablecoin. In short, Thor Synth allows users to deposit Rune and receive a synthetic asset of their desired asset that already exists on Thorchain as an LP paired with Rune. Since these assets exist on the Thorchain blockchain, Thor Synth holders can benefit from lower fees and faster confirmations, while LP holders, since synth holders give up their Shares gain directed access to an asset to benefit from increased revenue. These are the first part of Rune's ThorFi offerings, which in the future will include borrowing/loans and savings accounts. Rune’s token economics are comparable to those of Luna, and both protocols are well positioned to continue attracting liquidity from the rest of DeFi.

GameFi Returns vs DeFi Returns and the Metaverse’s Speculative Premium

Where does the yield of cryptocurrencies come from, and who are the users of these platforms? Mining has always been one of the most popular activities for new DeFi users, and it comes in many different forms, almost all of which have resulted in poor price movements for the associated tokens mined by new users. One of the questions I have been thinking about is what design will prevent this trend, or that it will appear in all DeFi applications that use token emission to incentivize users. Recently, with the launch of GameFi, I think we've seen a novel approach to determining the valuation of these tokens, as these games introduce a new group of users to the protocol. In order to compare GameFi and DeFi, we can first look at where the yield comes from in regular DeFi applications, such as dexes or lending/lending platforms. For most lending platforms, the rate of return mainly comes from three aspects:

1. Token emission

2. Speculators

3. Borrowers who use the agreement

A large number of DeFi applications are inherently inflationary because they pay users rewards in their native tokens, so some of the rewards come from these emissions. Also, there are always speculators who buy/sell these tokens, but rarely use these platforms. This doesn't directly affect your APR, but it does affect your ROI. If you are an early adopter of a platform, before it catches on, you benefit from more speculators betting on the future success of the project. Finally, borrowers who want to use leverage will pay variable interest rates to those willing to lend their assets. For mining on a dex, you can replace borrowers with fees associated with providing liquidity to LPs.

If an in-game economy is designed well enough that there are people playing the game beyond the basic users of the protocol, then it adds another layer of demand to the system that didn't exist before. With Axie, there is a group of completely independent users playing the game who have no previous connection to the cryptocurrency, but the system is not designed so that every user's demand for the protocol's tokens is positive. Most Axie players who rent Axies from guilds or other big players in the game will immediately throw out the rewards they get while playing, which is why the SLP charts are mostly just going down.

1. Token emission

2. Speculators

3. Borrower [loan agreement] or LP fee [dexes]

4. Players

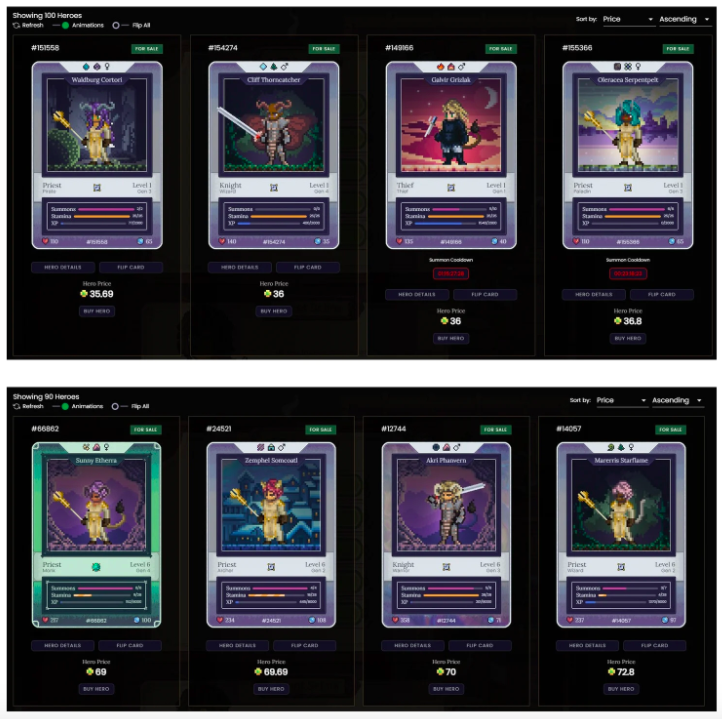

Players who actively participate in the game competition will be incentivized to buy and use tokens in the game, which is a reality that strictly speaking DeFi products will never exist. We haven't seen a game interesting enough to have long-term sustained players within the system, but if a game can create an ecosystem like this, it gives users the ability to increase their revenue by actively playing the game. DFK is the closest example I've seen, which is one of the reasons why I'm long-term bullish on DFK. An example in the DFK ecosystem is the different prices for heroes in taverns and higher level heroes. At present, the floor price of ordinary heroes is 35Jewel, while the floor price of heroes with 10/10 summons is 95Jewel, the floor price of level 1 heroes is 35Jewel, and the floor price of level 6 heroes is 69Jewel. Out of 41,000 heroes, a total of only 90 tier 6 heroes are listed on the market, compared to several pages for tier 1 heroes.

Over the past few months, on top of investing time doing in-game quests to increase your hero level, there has been about a 100% return, and that's before any advantage of high-level heroes like advanced quests or PvP. The only reason this premium exists is that players in the game value these NFTs more than other players. No other pfp project has this feature, you are able to make your assets more valuable by spending time in the protocol's ecosystem. It is speculators who affect the price of other NFT projects that are not empowered. NFTs that are included in a well-designed in-game economy will also benefit from having more empowerment. The more actively you play the game, the more you benefit. I've said over the past few months that I think the best rewards for DFK will come from leveling up your heroes and finding the best summoning strategy, because later on if people want to buy the best heroes in the game, other than paying the market Premium aside, there will be no way to recover lost time. The difference in these prices comes with the introduction of more incentives for stronger heroes in the game that will make farming in the liquidity pool more profitable for users, or increase their likelihood of getting rewarded with rare items from doing quests should continue to expand. One of the benefits of playing DFK is that the intricacies of the game are largely hidden from those who aren't actively studying the ecosystem and the mechanics. For example, most people don't know how much extra you can get by using a set of higher level gardeners on your LP, or how helpful having a set of miners is for early rewards, since you have no way of knowing the numbers, Unless you're playing the game and taking the time to figure it out yourself. I'm not going to do EV calculations here, but if you want to see the value of gen 0, check how many heroes in the tavern with 10/10 summons are also lv 5+ or higher.

Zipper in weekly updatesThere is a good analysis of the DFK hero market in , so you can more accurately see the distribution of heroes and how the inflation is doing as more and more people summon lower tier heroes.

One thing that exists in both DeFi and GameFi protocols is a speculative premium that will always be ahead of product development. Due to the dynamics of cryptocurrencies and how much outside capital enters the space during bull markets, market valuations often outpace the speed at which teams can achieve their milestones. The difficulty is determining how much of a premium there is currently to your altcoin holdings, and what the fair value of these projects will be once the pure speculators leave. Over the past few months, we have seen retail investors leave most of the alt market entirely, evidenced in part by Ethereum's recent extremely low gas fees, and the lack of a premium in derivatives.

The decline of cryptocurrencies at different levels

I've been talking about sector rotation play because I think the current environment is very different from the altcoins of previous years. You can no longer pray for your altcoin to get listed on bittrex and binance, but there are real differences in the fundamentals between these coins. The trend changes extremely frequently, and the market capitalization is very high. One could argue against this by pointing to the ridiculous dogcoin season we had last year in Q2 2021, but I don't think that's accurate either. Fundamental analysis of cryptocurrencies should also include participation demographics considering buying and selling of these tokens, besides, meme value and community enthusiasm is a very strong trend indicator (both up and down).

So let’s take a look at some different altcoins and their varying degrees of rallies from the past quarter to the past year. As I write this, I truly believe these are the ones that should bounce upwards, but it's important to determine which are the most resilient and which are likely to recover the fastest.

Super drop: Compound

307 days since the all-time high

It is down 89.9% from its all-time high.

COMP and many others"DeFi blue chips"There was similar price action after the first rise in the first quarter of 2021, and more precisely, most of them peaked in ETH around August 2020, so almost a two-year bear market.

Given that BTC and ETH have been volatile for months without making new lows, calls for another 90% drop from here seem unwarranted, but these wouldn't be the first coins I'd buy here.

Interestingly, ETH took 330 days to find a bottom after its all-time high in 2017, then traded sideways and started a new trend again.

General decline: DFK

62 days since the all-time high

It is down 85% from its all-time high and 71% from its yearly open.

Jewel and many other metaverse tokens were also crushed by the market, although it was not as bad as many early DeFi tokens, as these tokens were not in a long-term downtrend and outperformed the market in Q4 .

Haven't seen any signs of a revival for metaverse projects yet, DFK had a catalyst after eom launched Crystalvale (good news), but we'll need to see how the market reacts if we venture into it again.

Slight decline: BTC

126 days since the all-time high

It is down 52.4% from its all-time high.

Bitcoin fell like many other assets, but still outperformed 90% of altcoins and even some tech companies.

If we can get a (market) recovery in this quarter, it seems that BTC may lead the direction of this (market) recovery.

Down but recovering (up): Thorchain

301 days since the all-time high

At the lowest point, it was still 85% away from the historical high, but it rose by about 150% from the bottom. This year is the green market time (referring to the coins that have been rising this year), but only for a very small number of coins.

From the summer of 2021 to the present, there are other altcoins that have tested their bottoms, some rebounded more strongly, RUNE has some basic catalysts (good news) to help it, it seems that now is a good time ).

Close to ATH: Terra Luna

5 days since the all-time high

At its lowest point, it was down 58% from its all-time high, and it is currently down 14% from its high.

LUNA has led the recovery (referring to rising) in the recent market trend towards the overall sideways price trend, and has shown absolute strength in the top 10 tokens, and its market capitalization has surpassed Solana.

If we can see a continuation of the market trend, expect this performance (referring to the rise) of LUNA to continue, because LUNA also led the recovery after Axie last summer.

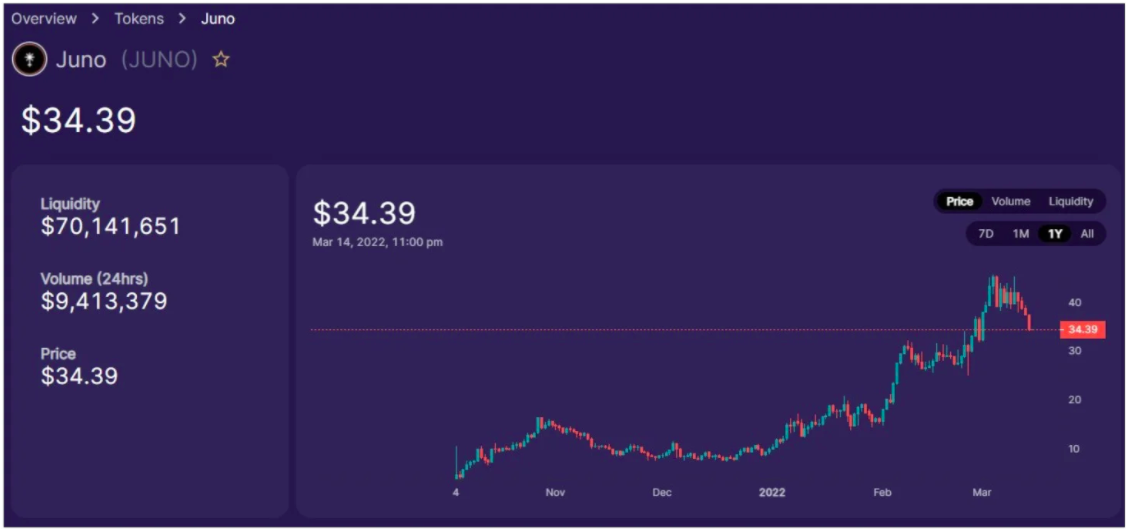

No drop: Juno

10 days since the all-time high

It is currently down 22% from its all-time high.

One of the few altcoins that has been on an upward trend for most of the year, at its peak it was 4x the bottom of the year.

in conclusion

in conclusion

Q1 Reflection

Be more cautious when realizing your lack of edge [i.e. lack of macro knowledge].

More concentrated betting, less spread out without strong bias.

Use hedging more diligently, and hedging trades are even more important when the market as a whole is bearish.

AppChain appears to be the current meta, with stronger token economics than regular governance tokens.

favorite trading pair

long Luna / short Eth

long Rune / short Fantom

long BTC / short Doge

long Avax / short ONE

Some bold predictions for this quarter:

BTC reaches 60K again

The ETH/BTC exchange rate is below 0.055

Anchor's TVL exceeds AAVE

Astroport surpasses Pancake Swap in average daily trading volume

ETH gas stays low as people are more on ALT L1 and start using rollups

10+ AVAX subnets launched, attracting new users

Solana becomes a major hub for on-chain perps and options

Original link

Axelar

LayerZero

FuelLabs

Agoric

Celestiums

Starknet & L3s

Danksharding

Katana

Drift Protocol

Argent mobile / Phantom mobile / Keplr mobile

Risk Harbor

Ragnarok

Catalog on Ren Protocol

KyberSwap on Arbi

Pokt v2