What are the new "smart money" DeFi DAOs buying?

This article comes fromBanklesshq, Original author: Ben Giove, compiled by Odaily translator Katie Koo.

This article comes from

, Original author: Ben Giove, compiled by Odaily translator Katie Koo.

In the crypto space, “smart money” doesn’t have to be a hedge fund or asset manager, it could be a DAO.

These crypto-native entities with huge sums of money have some of the smartest crypto minds in the world working for them and managing their wealth. We also began to notice that they were the first source of funds to enter the market to “sweep” potential tokens.

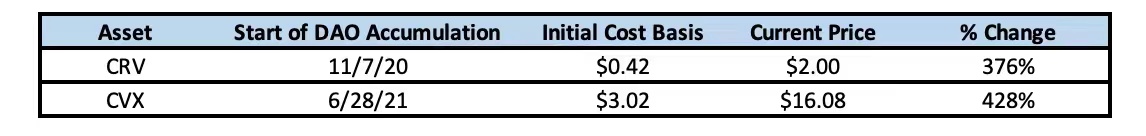

They start buying CRV at $0.42. It's over $2 now. (+376%)

They buy CVX for $3. It's over $16 now. (+426%)

So what will the DAO do next?

This article will lead you to dig deep into the treasure bag of "smart money"~

secondary title

What are DAOs busy buying?

There is a new type of market participant within DeFi.

This is not referring to the much-hyped TradFi agency. Instead, these increasingly influential entities are crypto-native, fully active on-chain, with operational experience and insight into DeFi.

This emerging force is the DAO.

DaoFi refers to DaoFi that emerged as a DeFi user and investor. DaoFi is a type of DeFi investor and the earliest source of funds for certain tokens.It makes sense to think of DAOs as "smart money". They are heavily funded non-indigenous entities managed by some of the brightest minds in the world, bringing together a high level of expertise.。

CRV and CVX War

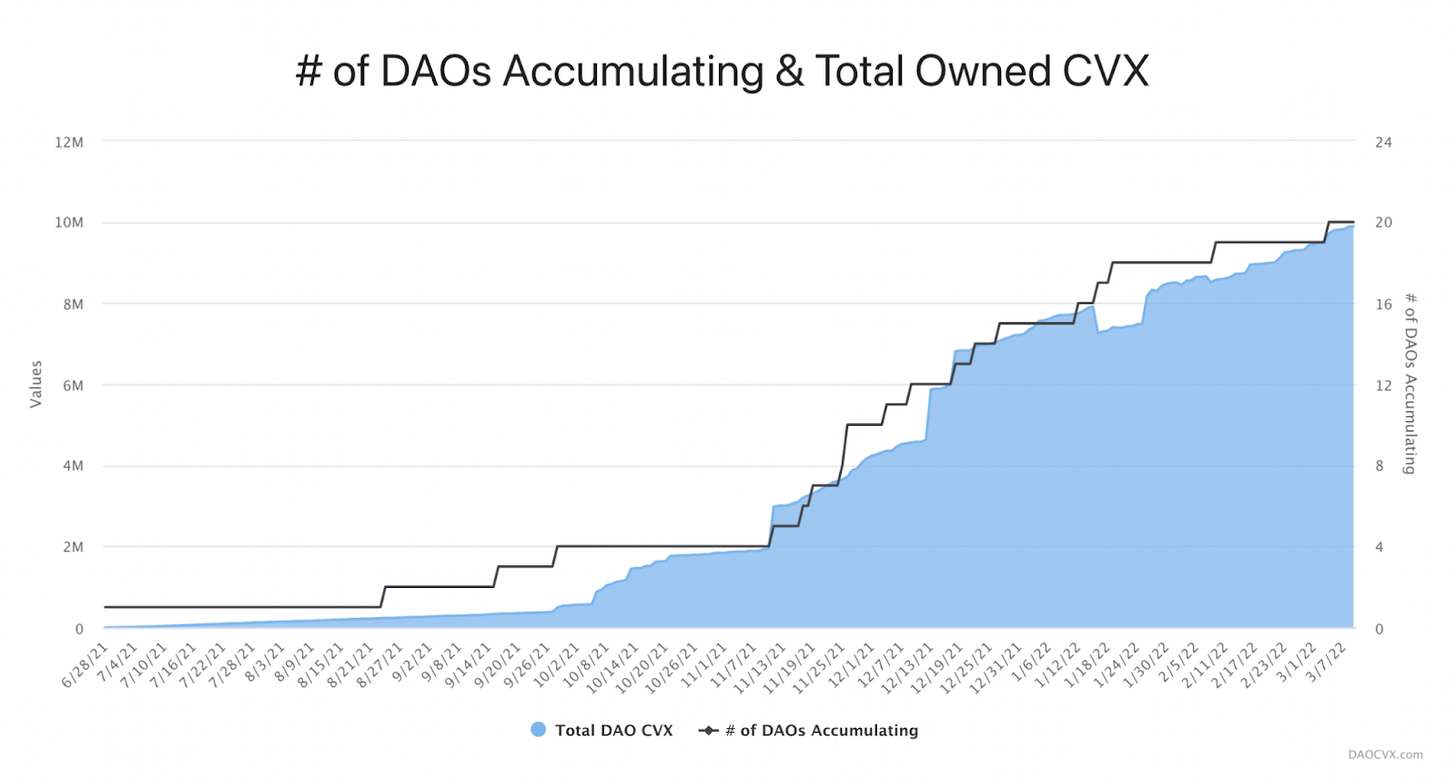

Beginning in Q2 2021, protocols like Yearn Finance, StakeDAO, and Convex Finance are all racing to accumulate and lock CRV tokens. These locked tokens exist in the form of veCRV. When liquidity is provided on Curve, holders are entitled to higher rewards and have the right to vote to determine the direction of CRV emission.

image description

Source: DAOCVX.com

Convex quickly won this "moat or Trojan horse" battle, hoarding a large number of CRVs. The target then shifts to CVX, as holders are empowered to micro-govern the CRV held by Convex.

CVX is now owned by 20 DAO token pools.

It is well known that these wars are waged by DAOs, but their cost basis is rarely discussed.

From the table above we can see that the DAO started accumulating CRV and CVX at prices well below the current trading price. The gains come despite the fact that both assets have fallen by more than 50% from their peak levels in January 2022. Interestingly, these moves were made in “broad daylight” for anyone to see in real time on governance forums, Twitter, and of course, on-chain.

The operation of these DAOs can be easily replicated.

Despite the small sample size, we can conclude that the DAO purchase was a buy signal for investors.

This begs some questions:

In addition to CRV and CVX, which tokens did DAO "sweep"?

Will more DAOs follow in the footsteps of early adopters?

Let's find out in the holdings of DAO together.

secondary title

List of DAO holdings

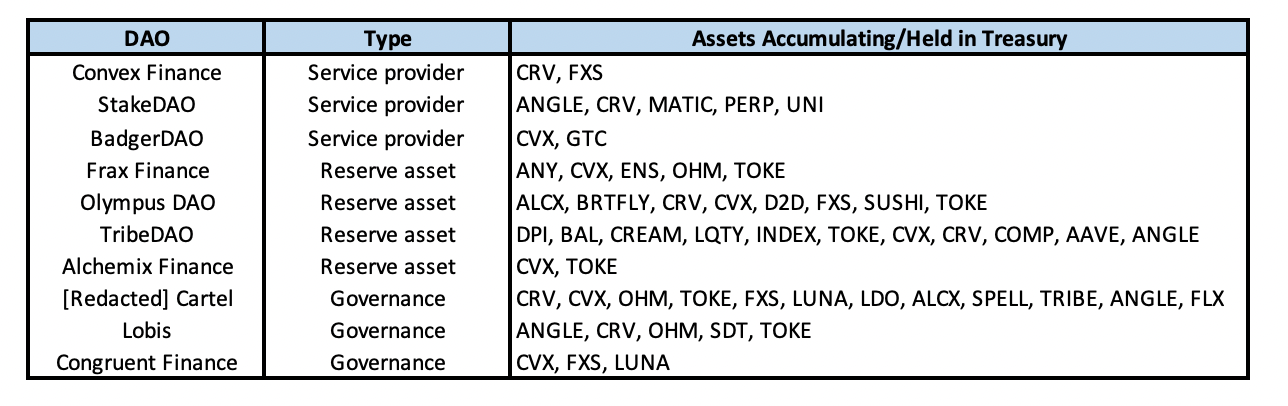

We will analyze 10 different token pools for DeFi DAOs.

This list cannot include all DAOs, as there are hundreds of very smart and talented contributors on Ethereum. These 10 are representative of different portfolios that we will “unpack” in terms of their size, their eventual interest in acquiring various governance tokens, and their motivations for doing so.

The assets listed in the table below do not include popular token assets (assets holding more than $20,000) such as ETH, BTC, stablecoins, liquidity tokens, and native tokens. These assets are acquired in several different ways, whether through open market purchases, mining rewards, token exchanges, or seed round allocations.

The ten DAOs are divided into three main categories:

Service Providers: These DAOs are accumulating governance tokens in order to improve the quality of their products for users, such as increasing yields. DAOs that fit this description are Convex Finance, StakeDAO, and BadgerDAO.

Reserve asset issuers: These protocols are issuing some kind of reserve asset, either pegged to fiat or floating. These DAOs are hoarding various tokens to use as collateral, micro-governance rights, and/or to provide direct liquidity for the tokens they issue. The selected DAOs fall into this category and include Frax Finance, Olympus DAO, Tribe DAO, and Alchemix Finance.

Governance DAOs: These DAOs are hoarding tokens with the aim of accumulating governance power and influence in different important strategic agreements. These include [Redacted] Cartel, Lobis and Congruent Finance.

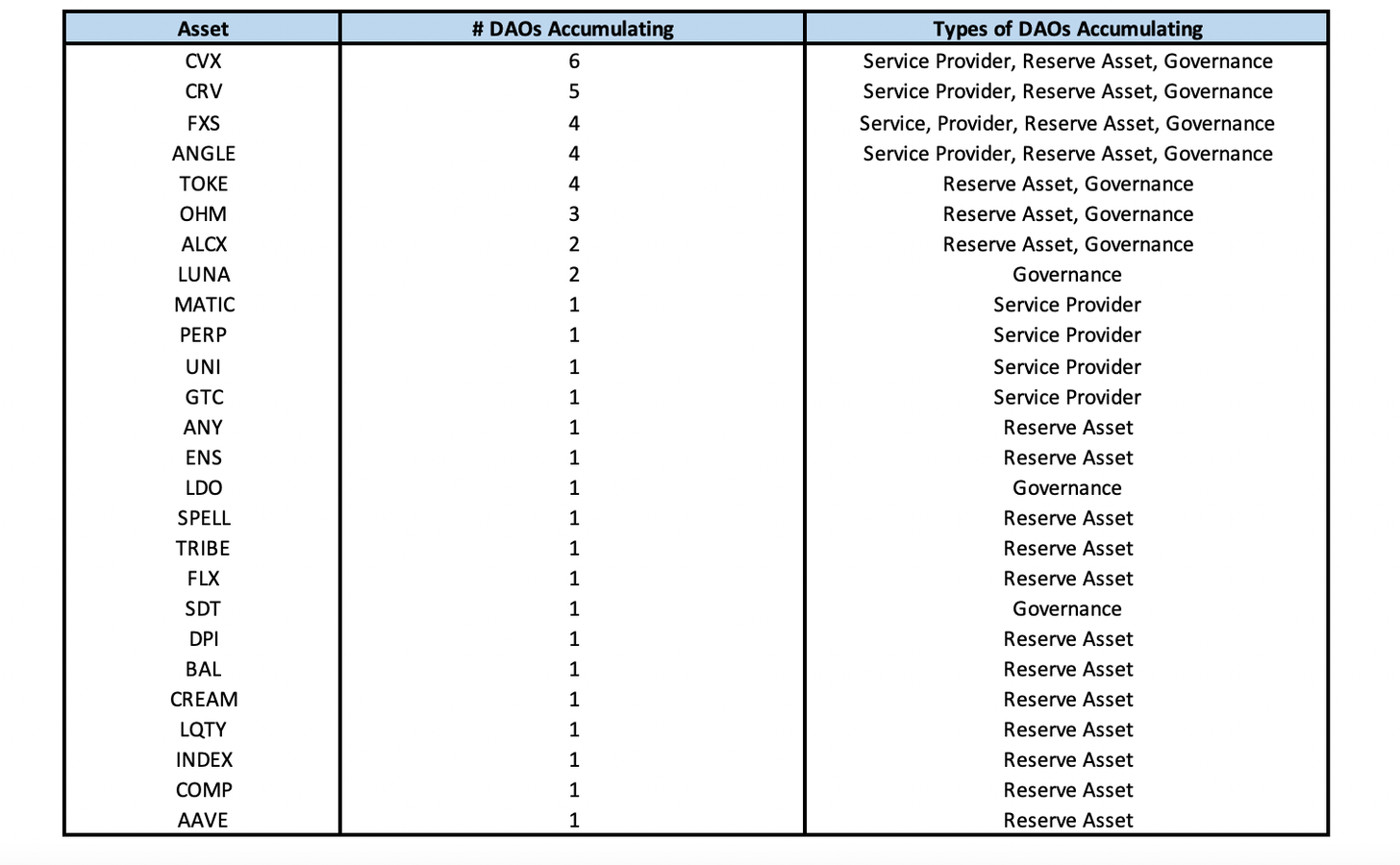

As we can see, there are 26 unique assets among the 10 DAOs on our list, each with at least two non-native governance tokens in their tokenbase.

Breaking down the data by asset, we can unsurprisingly see that the most common asset is CVX, which is held by 6 DAOs, and CRV, which is held by 5 DAOs. These three categories of DAOs only hold four assets, and they are two of them.

Looking further down, the fourth to sixth are FXS, TOKE and ANGLE. Tokens are held by Reserve Assets and Governance DAOs, while FXS and ANGLE are held by Reserve Assets and Governance DAOs and Service Providers.

secondary title

The three most common holdings

1. Frax Finance(FXS)

Now that we know the most common tokens in the DAO sample group, let's take a more detailed look at some of these tokens and understand why these assets were targeted by The DAO and their strategic importance.

We will focus on the three most widely held assets besides CRV and CVX: FXS, ANGLE and TOKE.

Number of DAOs holding this asset: 4

DAOs holding the asset: Convex Finance, Olympus DAO, [Redacted] Cartel, Congruent Finance

DAO type holding this asset: service provider, reserve asset, governance

Frax Finance is a stablecoin issuer whose FXS token acts as seigniorage, generates fees, provides elevated rewards to holders, and manages the protocol. Like CRV and CVX, FXS can be locked into veFXS, which gives holders the right to vote on the emission of different FRAX pairs on any decentralized exchange.

2. Angle Protocol(ANGLE)

DAO "sweeping goods" motivation forecast:

The utility of the FXS token is likely to drive the accumulation of volume in the three DAOs. Service providers like Convex want to lock up FXS to provide depositors with the highest possible yield, reserve asset issuers may be interested in locking up FXS to drive liquidity for FRAX-based trading pairs, and governance DAOs can use tokens to pass Voting sales generate cash flow for its token holders.

Number of DAOs holding this asset: 4

DAOs holding the asset: Stake DAO, Tribe DAO, Redacted Cartel, Lobis

DAO type holding this asset: service provider, reserve asset, governance

Angle, a stablecoin protocol, is currently issuing agEUR, which is pegged to the euro. ANGLE tokens play a key role in the protocol, and if acquired through liquidity mining rewards, may encourage DAOs to buy or hold tokens.

Like FXS, when ANGLE is locked into veANGLE, it will charge protocol fees, give holders the right to increase emissions, and can also be used to vote on track value weights. As with Frax, denominations can be set for any agEUR pair on any exchange.

3. Tokemak(TOKE)

DAO "sweeping goods" motivation forecast:

Although agEUR is not yet as attractive as FRAX, its $129 million market cap is only 4.4% of FRAX's. If the number of adoptions of ANGLE increases, it is very likely that the demand for ANGLE will increase among these three types of DAOs.

Number of DAOs holding this asset: 4

DAOs holding the asset: Olympus DAO, Tribe DAO, Redacted Cartel, Lobis

DAO type holding this asset: reserve asset, governance

Tokemak is a decentralized market-making protocol. The protocol's native token (TOKE) is used within the protocol as a means of distributing and directing liquidity to different tokens and exchanges.

DAO "sweeping goods" motivation forecast:

Like FXS and ANGLE, TOKE is likely to be demanded by both reserve assets and governance DAOs because of its ability to control liquidity flows. A reserve asset DAO may wish to hoard tokens to increase the liquidity of the tokens it issues, while a governance DAO may sell its holdings to those interested in building a token reactor or directing more liquidity to their tokens bidder.

secondary title

1. Redacted Cartel(BRTFLY)

Potential DAO future target assets

Now that we’ve discussed the most widely held assets, let’s review some of the assets on the list that may be targeted by more and more DAOs in the future.

Number of DAOs holding this asset: 1

DAO holding the asset: Redacted Cartel

DAO type holding this asset: reserve asset

One potential target asset for the DAO is BRTFLY, the governance token of the Redacted Cartel. As a fork of Olympus DAO, Redacted aims to accumulate governance capabilities across various strategically important protocols. Redacted has over $46 million worth of assets and at current market prices their largest holdings are CRV, CVX, OHM, FXS and TOKE.

BRTFLY is currently using a rebase model similar to its parent DAO, but will soon move to a dual-token model. These new tokens rlBRTFLY (BRTFLY that locks in revenue) and glBRTFLY (BRTFLY that locks in governance) will split the cash flow from bribes and the micro-governance of tokenbase assets, respectively.

DAO "sweeping goods" motivation forecast:

2. Index Coop(INDEX)

The main reason DAOs started accumulating BRTFLYs was to gain the micro-governance authority that glBRTFLYs have. With a growing stake in many of the strategically important assets mentioned in this article, glBRTFLY could become a popular micro-governance token among DAOs seeking to reap the benefits of holding these tokens.

We are already starting to see DAOs interested in BRTFLY, and Olympus recently proposed adding BRTFLY to its whitelist of strategic assets.

Number of DAOs holding this asset: 1

DAO holding the asset: Tribe DAO

DAO type holding this asset: reserve asset

Index Coop is a decentralized asset management company responsible for creating thematic indices such as GMI, DPI, MVI and leveraged products such as ETH 2x-FLI. While INDEX is used for governance within the INDEX Coop DAO itself, like glBRTFLY, token holders are granted micro-governance rights over the assets held within the INDEX Coop offering.

While this feature is currently only available for DPI, it could theoretically be applied to all categories under the Coop purview.

DAO "sweeping goods" motivation forecast:

3. Balancer (BAL)

Like glBRTFLY, the main reason DAOs may be interested in hoarding INDEX is the broad microgovernance rights that are and will be within the purview of tokens.

We've seen Tribe DAO take advantage of INDEX's micro-governance capabilities. The DAO holds 100,000 indices (approximately $463,000 at current prices) which they use to help launch their stablecoin FEI on Aave. Considering the utility and value that FEI brings from TVL's listing on DeFi's largest money market, it's not out of the question that other DAOs will follow suit.

Number of DAOs holding this asset: 1

DAO holding the asset: Tribe DAO

DAO type holding this asset: reserve asset

As with Curve, the driving force behind potentially large-scale accumulation of BAL is the right to control future emissions, i.e. the liquidity of a given mining pool. This could drive demand for tokens among service providers, reserve asset issuers, and governance DAOs.

Summarize

secondary title

Summarize

DAOs are the smart money of DeFi, and they are very active in the market. As we can see, these DeFi-native entities are holding and hoarding far more than CRV, and they have also set their sights on other assets of strategic importance.