How to Facing NFT Death Valley: 5 Mindsets for NFT Bear Market

Original author:The NFT Edge

Compilation of the original text: The Way of DeFi

Original author:

Compilation of the original text: The Way of DeFi

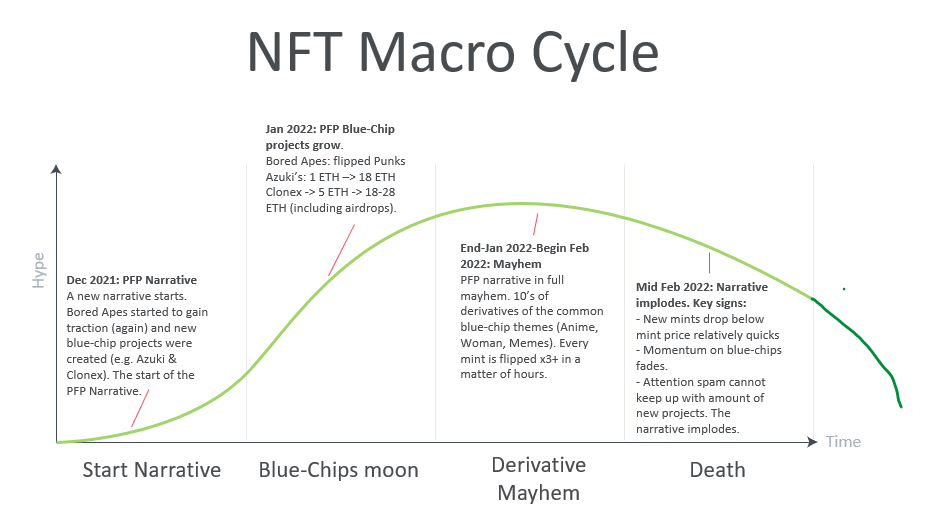

We are currently in the "death" phase of the NFT macro lifecycle.

Since I officially entered the currency circle in 2016, I have been struggling and experienced several rounds of bulls and bears.

When your favorite crypto V is wildly bullish, depressed, or constantly recommending NFTs to you, let's take a deeper look at how we can get through the "terrible" NFT death stage?

I hope you can get some useful experience from my views:

We will survive the bear market and enjoy the fruits of the next bull market.

Your mentality does require a big shift in a bear market compared to a bull market. If this content of mine can slightly change your mentality and make you more optimistic and confident, then I have achieved my goal.

Let's first talk about how to identify the death stage of NFT:

The Death Stage of NFTs

What is the death stage of NFT

1. The new NFT mint (minting) is either unprofitable, or quickly pumped and sold by buyers

2. The value of blue-chip projects that rose in the early stages of the NFT macro cycle experienced a sharp retracement

3. There used to be prosperity and chaos

Let's analyze the current situation of the NFT circle:

1. Most recent mints are underperforming or just breaking even (eg @idolTheIdolsNFT).

2. The floor price of @BoredApeYC (bored ape) has been overtaken by Punks, the floor price of BYAC has dropped to 40ETH, and the situation of other NFTs is similar.

3. Well, I don’t need to talk about this, we’ve seen the joy of NFT players.

5 Mindsets to Deal with the NFT Bear Market

Here are 5 mindsets that are critical to successfully navigating a bear market and reaping the fruits of a bull market:

1. Learn and learn to adapt

2. Be patient and don’t neglect innovative projects

3. Be curious and network, not fomo

4. Be confident, not arrogant

5. Learn to observe, don't blindly predict

1. Learn and learn to adapt

Humans have a unique ability to learn from past experiences. Once bitten by a snake, afraid of well ropes for ten years: When you were a child, when you touched a frying pan for the first time and got burned, you would never touch it again. Experience led to behavioral changes.

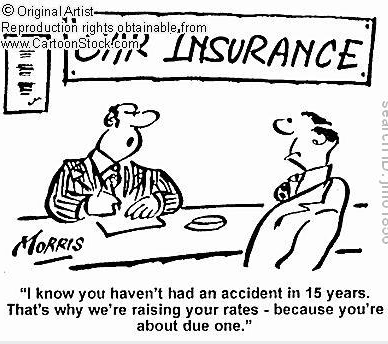

However, the market is a strange place, and you should not trust your own experience entirely.

For example, if I cast the dice 10 times in a row, I can get 6 points each time. Now you ask me to roll the dice again, and you say "if you can roll 6, I'll give you $5, and if you can't, you'll give me $5," and I'll gladly accept it, feeling ecstatic that making money is like It was as easy as breathing, and yet I failed to roll a 6 on the next few rolls of the dice and lost all my money.

This example is an example of how you would behave in a bear market after a bull market.

When you are at the peak of the bull market, almost any NFT you buy will rise, and when you are in a deep bear market, almost any NFT you buy will be cut in half or even return to zero.

Back to the real market, one and a half months ago, we would find all NFT projects that can be mint mint at least 2 times. Every solid NFT item you hold will sell for more than 3 times the price.

But you must realize that such good things only happen at the peak of the bull market, and these past experiences no longer have reference significance for the death stage of NFT. Once the death phase begins, no matter how good an investor you are, you won't be able to make money over and over again.

Probabilistically speaking, during a bull cycle you had an 85% chance of being right, now you have a 10% chance.

As things stand, the only way to win: is not to play at all.

Don't stick to the market dynamics you learned (sometimes subconsciously) during a bull market.

Of course, we still have to learn new market dynamics and keep improving our skills (your skill network, fundamental research, etc.).

2. Be patient and don’t neglect innovative projects

The previous stage of the bull market (derivative chaos) was incredibly exciting. People chatted in the group until 3:30 in the middle of the night every day, and the pace of the narrative was fast.

But the dying phase must be slow, it doesn't happen in a day or a week, it takes months, sometimes years.

We are used to constantly trying every new NFT project, looking for the next NFT that can double mint or invest. Then step by step, the funds in my hands are getting less and less, and the value of NFT is getting lower and lower.

People who lose all their money in a bear market don't lose it in a day or two. This is because they have been investing and their strategies have not yet adjusted to how to deal with the death stage of NFT.

I am a patient person and this comes naturally to me. However, I am somewhat pessimistic about the market right now.

At the same time, a bear market can make it easy to overlook upcoming innovations, which has similarly cost me some early gains in the past.

The key here is to be patient, but still open to new innovations.

3. Be curious and network, not fomo

That means you stay active, keep up with new developments, keep up with people, find out what people are passionate about, and more. Also don’t get carried away with every new NFT you see, you want to keep a large portion of your positions in ETH and stablecoins.

The dying phase is also a great opportunity to connect with other people. Your favorite crypto influencer/founder will keep sending messages during the bull market. At the same time, they hardly message during the second half of the death phase. In a bear market, you have many opportunities to connect with valuable people.

4. Be confident, not arrogant

It takes humility to realize that a large part of your success comes from the market environment, not your own skills.

But that's okay, I'm here to make money, not to pat my ass and leave.

Recognizing that a large part of your success is due to the market, which is no longer there, can put you in a better position in a bear market.

Of course, this does not mean that you have to lose faith in the market. Believe in yourself, you can succeed, you must do it.

5. Learn to observe, don't blindly predict

There are many people trying to predict the market.

“I predict the next wave of NFTs will be about art; I predict the next wave of NFTs will be about game NFTs.”

Come on, stop predicting the future and start observing.

What should you observe?

Observer:

What are people getting excited about in Telegram groups and Discord?

What are the articles people write about?

What is the developer community doing?

In 2018-2019, the only thing alive is the DeFi development community. We have all seen how DeFi exploded in 2020-2021.

At the same time, we also need to observe the market:

Does a news announcement cause a price increase?

Is mint profitable for the past 7 days?

How are blue-chip NFT projects (such as BAYC, Punks) performing?

Is the entire cryptocurrency market in a down phase or an up phase?

When looking at the market, remember to think about the law of averages:

If 1 mint is performing well, it doesn't mean anything.

But if the past 8 mints have all turned profitable then this could be the start of a new trend and maybe you can deduce that a new narrative is forming.

Going back to the macro cycle of NFTs, the beginning of the narrative is often missed by many, and this is of course excellent timing. But predicting the start of a narrative is very difficult, and it is still very profitable to watch the start of the narrative and jump into it right afterward, and it is much easier.