Return 250 times in half a year, 8 experiences teach you how to invest in NFT

Original compilation: Captain Hiro

Original compilation: Captain Hiro

In the past 5 months, I have turned 1.3 ETH (worth less than $4,000) into $1 million by investing in more than 100 NFT projects during the entire market decline.

The following are the 8 most important lessons I have learned about investing in NFT, and you can do the same:

1. Time horizon: hold or speculate?

Before you invest in an NFT project, ask yourself: Am I holding this NFT for a long time? Or do I just want to fry and run?

If you want to hold a certain NFT for a long time, you should reserve the position for blue-chip NFTs that bring unique attributes in the industry (the proportion in the industry is less than 3%), while the rest of the NFTs should be bought for speculation (in The proportion in the industry is greater than 97%). According to my experience, I have speculated on more than 100 NFT projects, and I think only 3 of them are blue chips.

Why?

Why?

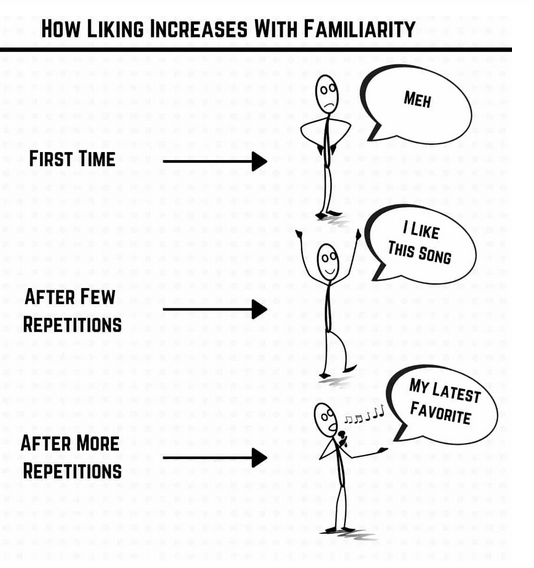

Because once you buy a certain NFT picture, you will take a look at it if you have nothing to do, and you will "love it for a long time" after a long time.

This is known in psychology as the "exposure effect" - you tend to develop a preference for things simply because you are more familiar with them.

The mentality of holding and speculating is completely different.

Speculation is about looking for aggressive marketing and audiences, taking into account short-term hype levels. Holding is more about the fundamentals of the team, community, and product (more on that later).

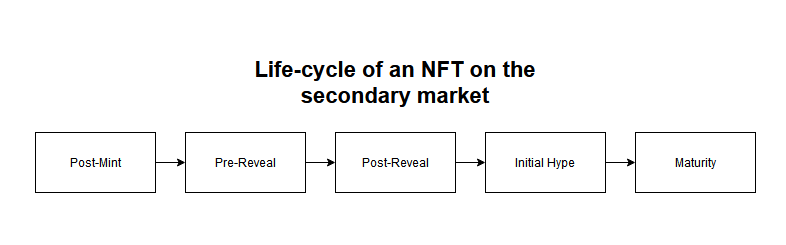

2. The life cycle of NFT

Most NFTs go through a typical lifecycle on the secondary market. At every stage, if the team messes up/rugs up/hype dies down, the NFT project has the potential to burp. Most sales usually happen after mint and later stages of hype (depending on circumstances like hype level).

If your goal in buying an NFT is to speculate, then you should sell when:

when the hype was at its highest, and

Sell as early as possible (because the project may die at every stage)

The hype price of NFT projects is usually the highest before the project is officially launched or during the initial hype stage. I would sell 60% of the NFTs during the pre-disclosure phase (or all if the project is bad), and the rest during the initial hype phase.

If your goal is to hold a certain NFT, then you should choose to sell it at maturity. This sounds simpler than it is because you are sitting on a lot of unrealized gains. I would choose to sell 25% of my portfolio's NFTs during the "initial hype" phase to gain more liquidity and maintain mental clarity, which will also allow me to treat the rest of the portfolio more rationally.

3. Blue Chip NFT

So what is a blue chip NFT? Blue Chip NFT is a project with all 4 main pillars:

excellent team

organic community

Good looking art and/or useful NFTs

legal partnership

holder base

excellent team

An excellent team refers to a team that has hard qualities (A+ level artists, software engineers, marketers, etc.), has the ability to execute quickly, participates in the community, and understands the operation of the NFT market. @AzukiZen is a prime example of this.

In addition to the nice artwork from @steamboy33, @AzukiZen (@locationtba) has created a new token standard ERC721a and open-sourced it (https://erc721a.org). Unique elements like this show the quality of a team.

organic community

Whether or not a community's appeal is organic is important. On Twitter, many people hope that you can take over the NFT in his hand. Here are three differences between organic and inorganic communities:

Organic communities start off subtle and then grow exponentially; inorganic communities start off explosive.

The organic community talks about the quality of the item; the inorganic community talks about the price.

Organic communities tend to have users from different groups (check mutual followers/followers); inorganic communities mostly occur within a connected group. @BoredApeYC is a great example (in the beginning) of an organic community.

Next, let me talk about the NFT itself.

Good looking art and/or useful NFTs

We need to look for NFTs that have some form of utility (in games or airdrops), obviously high quality art or a meme factor. @AzukiZen's art is incredible and resonates with a whole bunch of people in the industry. Meanwhile, Mfers by @sartoshi_nft has meme elements.

Another example is Clonex, its author is @RTFKTstudios; it has good artistry, and NFT has high utility, can get all airdrops, and the team is constantly updating.

legal partnership

Partnerships don't mean much by themselves, but they become a powerful market signal and keep the community strong.

@RTFKTstudios, acquired by @Nike, has a bigger roadmap, and we often hear holders say, "If it weren't for the project and Nike partnership, I would sell this NFT now.

holder base

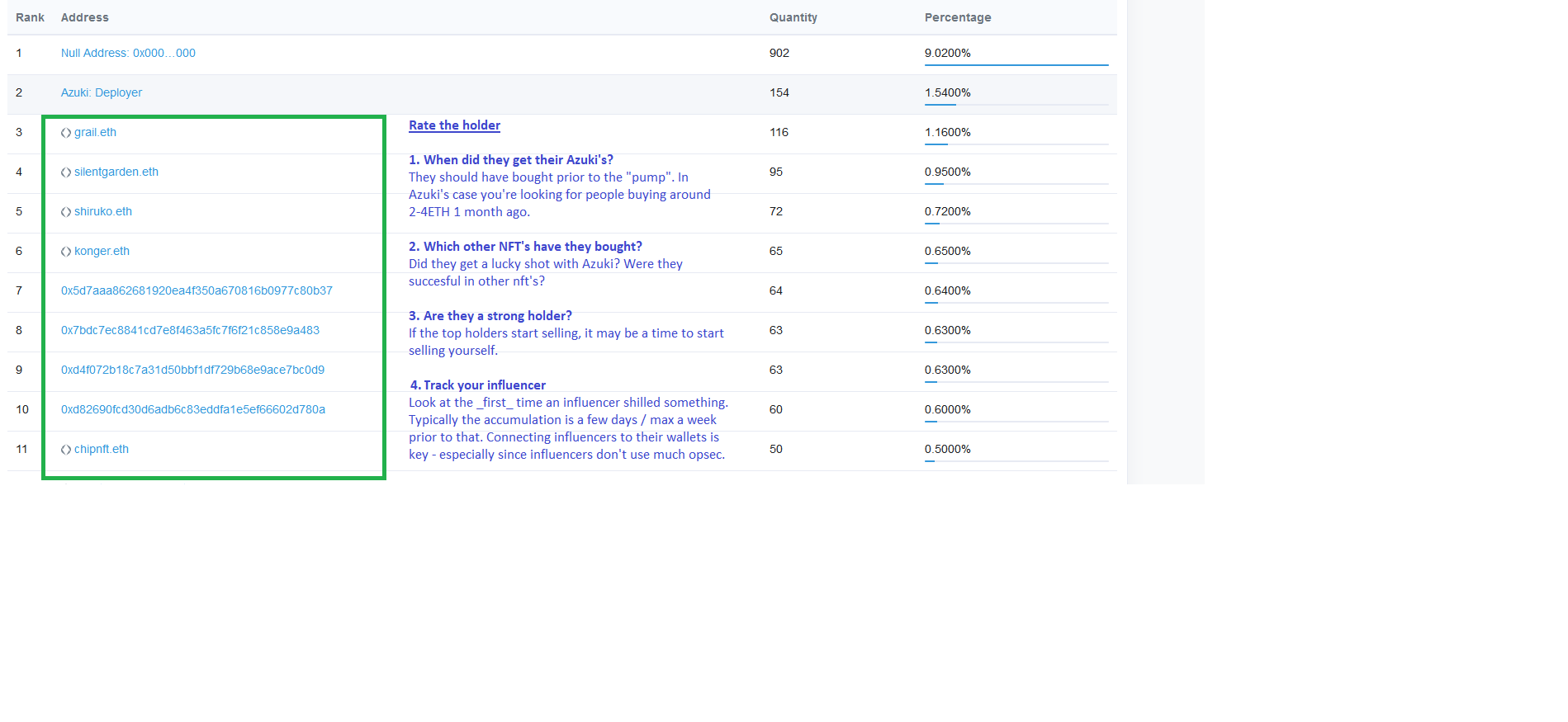

The point is simple, you need a majority of your community to hold the NFT for its price to rise, especially whales. You can go to @etherscan to browse the list of top holders of NFT projects in your hand to see if they have diamond hands.

4. Never hold NFT derivatives for a long time

Any project that garners significant attention (@BoredApeYC, @coolcatsnft, @AzukiZen, @RTFKTstudios) has its fair share of spinoffs. It's easy to think "these look about as good as the original, or as good as the original, and I'm going to hold this thing for a long time".

Do not do this!

Derivatives are often ideal for quick hype (before selling), but never for long-term holding. As mentioned above, if the price of derivatives rises, be careful of the pure exposure effect and the false increase of paper wealth.

5. Tools

For investing in NFT, tools are crucial, especially when minting coins (mint), you must have hand speed. The first is to install an older version of @MetaMask. You can go to Metamask's Github to see the previous versions in the Release. I recommend Metamask 9.8.4.

Metamask 9.8.4. has the old gas-gwei settings screen, so it will get you faster than someone using the newer version of Metamask. Of course there are also robots that are faster, but I don't use these.

WARNING: Do not accidentally uninstall your current Metamask, make sure you have a backup of your mnemonic and pkeyS.

For real-time feedback on sales/minting, historical graphs on volumes and sales, rarity viewers, alerts, etc. I recommend everyone follow @NFTNerdsAI https://nftnerds.ai or if you need the mobile version @mobyinsights https:// moby.gg.

Real-time minting information is the key to early entry into an NFT project. You can filter by the number of NFTs and the amount minted, and quickly perform due diligence on the profile of the above parameters. Usually, you have to do a "lite" version - time is of the essence when dealing with new minting.

Here are some free tools:

A free rarity viewer might do the trick. @Rarity_Sniffer https://raritysniffer.com

One of my favorite sweep floor tools is: @gemxyz https://beta.gem.xyz

If you want to know more about tools, please let me know, I will open a separate topic on this.

6. Don’t trust those crypto big Vs, pay attention to creators

With a few exceptions, crypto influencers have one purpose: to exploit their followers for their own benefit.

@zachxbt does a great job on this, follow him and read his threads.

@zachxbt

1/ I've had a few requests like this, but here's the main thread, including all the different threads I've created in this space so far.

It is listed in descending order and will be updated periodically.

readread

However, crypto influencers do have ties to the project. Don't follow them, use them instead. See who the big Vs you follow are following, and see if there are any creators who have entered NFT. Establish contact with these creators, and you have to enter the NFT project in advance.

7. Wallet Tracking

Believe in yourself, but also verify. See what's going on with a project's top holders on @etherscan.

For example, for @AzukiZen: https://etherscan.io/token/0xed5af388653567af2f388e6224dc7c4b3241c544#balances, learn all about these holders (see image below for criteria) and add them to your @etherscan alerts.

8. The macro cycle of NFT

In addition to the single project life cycle mentioned in the above tweet, there is actually a macro cycle of NFT. The macro cycle of NFT is the key to profitability. When you enter the early stage of the macro cycle, the risk is gradually increased, and when you enter the late stage of the macro cycle, the risk is gradually reduced.

Obviously, the best time to invest in NFT is when the narrative begins in stages and when there is the greatest risk.

It's also the hardest, because you're trying to predict what will happen to the project's narrative. Once a project starts word of mouth, it can become riskier, and I made most of my profits during the blue-chip NFT boom phase and NFT derivatives chaos.

Original link