How to NFT 1: The Environment of Non-Fungible Tokens

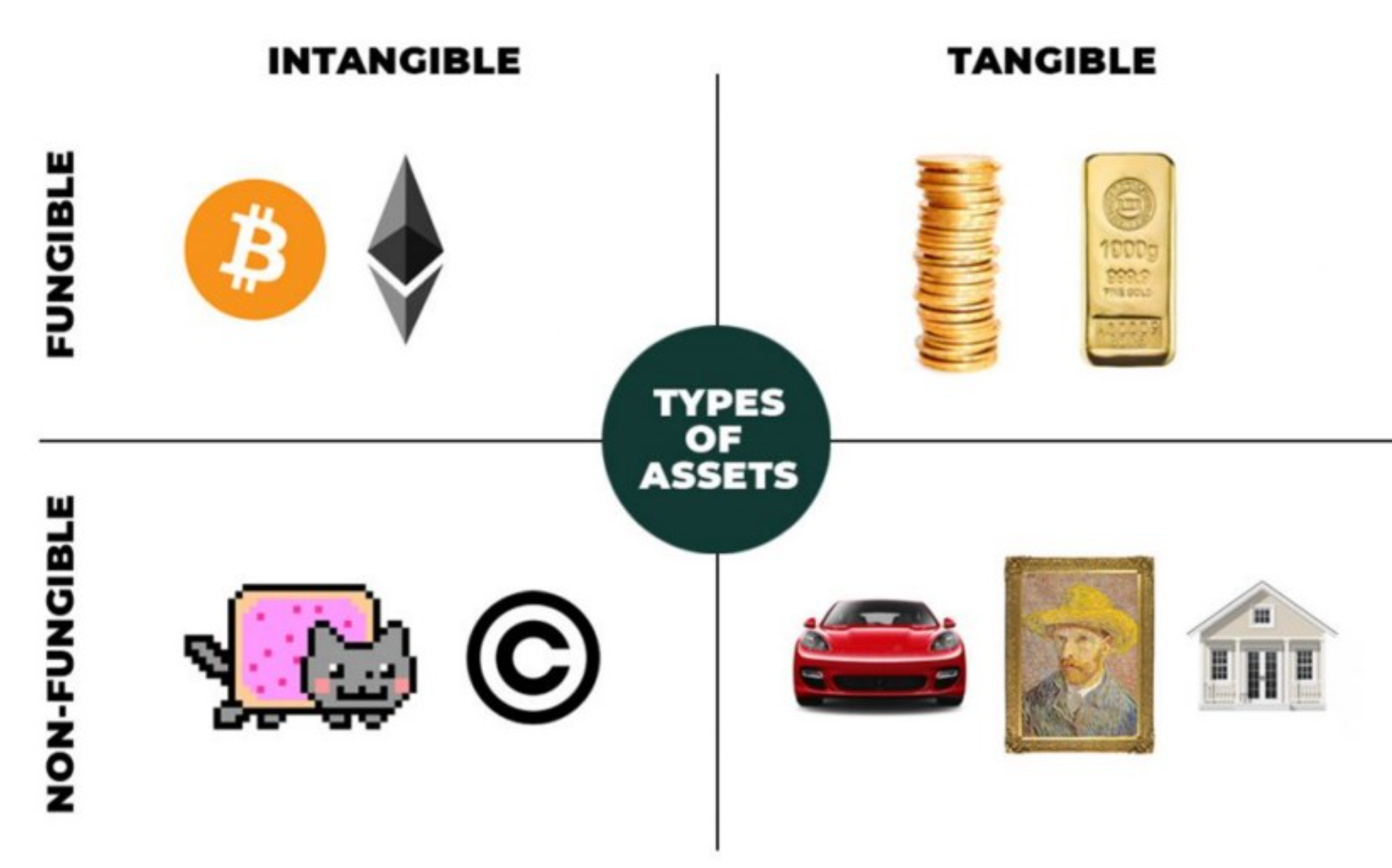

Simply put, a fungible item is an item that is interchangeable with another item. Money is a good example. A $100 bill is worth the same as any other $100 bill (or even two $50 bills). Despite minor differences such as serial numbers and dates of issue, banknotes are considered fungible because they are interchangeable and facilitate transactions in our daily lives.

On the other hand, vehicles, artwork, and property are examples of non-exchangeable items that are unique and cannot be exchanged for each other.

Think of two houses next to each other - they may live in the same neighborhood, share the same real estate developer, or even look identical from the outside, but they are not technically alike, nor are they interchangeable. Their decoration and interior layout may be different. One may be closer to a train station with heavy traffic, making it a slightly better value than the other.

Simply put, unlike two hundred dollar bills, the two houses do not have the same intrinsic value and therefore cannot be exchanged for each other, making them non-substitutable.

Homogeneous and non-homogeneous items are tangible items in the traditional sense. As our world becomes increasingly digital, non-homogeneous items are now becoming more common.

Over the past few years, we have seen the rise of fungible tokens such as Bitcoin, Ethereum and others. These items are intangible because they don’t exist in a physical form that can be felt or touched, just like your Instagram account only exists in digital form.

With the rise of smart contract platforms like Ethereum, the technology to create NFTs has matured. Examples of NFTs include avatar-like CryptoPunks and Bored Apes (bored apes), and even masterpieces by prominent artists such as Tom Sachs and Damien Hirst.

The easiest way to understand NFTs is to imagine Pokémon trading cards. Each Pokémon trading card is unique, and no two cards are interchangeable, as they may have different actions, rarities, and physical conditions.

You don't want to trade a brand new Holo Charizard card for a broken Rattata card. Although both cards are first edition copies, the Holo Charizard card is more sought after due to its rarity, abilities, and physical condition.

Note: Holo Charizard and Rattata are the names of characters in Pokémon.

Essentially, NFTs are digital representations of such items stored on the blockchain. NFTs allow us to digitally differentiate our Rattatas (Radas) from Charizards (Charizards). Beyond that, NFTs allow us to prove in an easy way whether our Pokémon cards are real, a problem so common with physical trading cards and collectibles.

Before we dive into NFTs, let’s think about how NFTs differ from fungible tokens like Bitcoin and Ethereum.

Homogeneous and non-homogeneous tokens

We keep talking about NFTs, but what exactly are they? Simply put, an NFT is a token with a unique identifier and additional parameters that allow you to store certain information on it. This unique identifier is what makes the token unforgeable. Additional information can be any information such as text, images, audio and video files.

Unlike fungible cryptocurrencies, NFTs are unique and not interchangeable. Since every bitcoin or ethereum is unified with little distinction, you can trade freely on cryptocurrency exchanges with little hassle.

But it is not very easy for you to trade NFTs, because no two NFTs are the same. Each NFT has its own unique identifier and characteristics, making each piece unique, even though they may appear similar on the surface.

Additionally, NFTs cannot be split into smaller pieces like traditional cryptocurrencies. For example, Bitcoin can be divided up to 8 decimal places. So NFTs are often illiquid and harder to sell because NFTs have to be bought in their entirety.

That said, there are projects that allow NFTs to be split into smaller fungible parts (discussed in Chapter 10). This gives users the opportunity to own a portion of an NFT rather than the entire block, lowering the barrier to entry for high-priced NFTs and improving the liquidity of these NFTs.

authenticity and efficiency

When it comes to NFT, verifying authenticity and transaction efficiency are pain points. For example, if someone ran away with the Mona Lisa and then tried to sell it, it would be difficult to verify its authenticity without bringing in an art expert. Thieves may make multiple copies and sell them to different buyers.

With digital art, it's easier to create copies and falsely claim a work as their own. Unlike the real world, there is no way to verify which digital image is the original. This is what NFTs do.

NFTs use smart contract technology to store and record unique information on the blockchain, which means that every time an NFT is created, only one NFT is verifiably present. NFT creators can also encrypt details such as rich metadata or secure file links, allowing people to create a variety of verifiable digital assets based on image, audio and video files. These technologies allow everyone to verify the authenticity of digital assets and simplify the process of determining ownership. It also allows for the safe, efficient and verifiable transfer of assets.

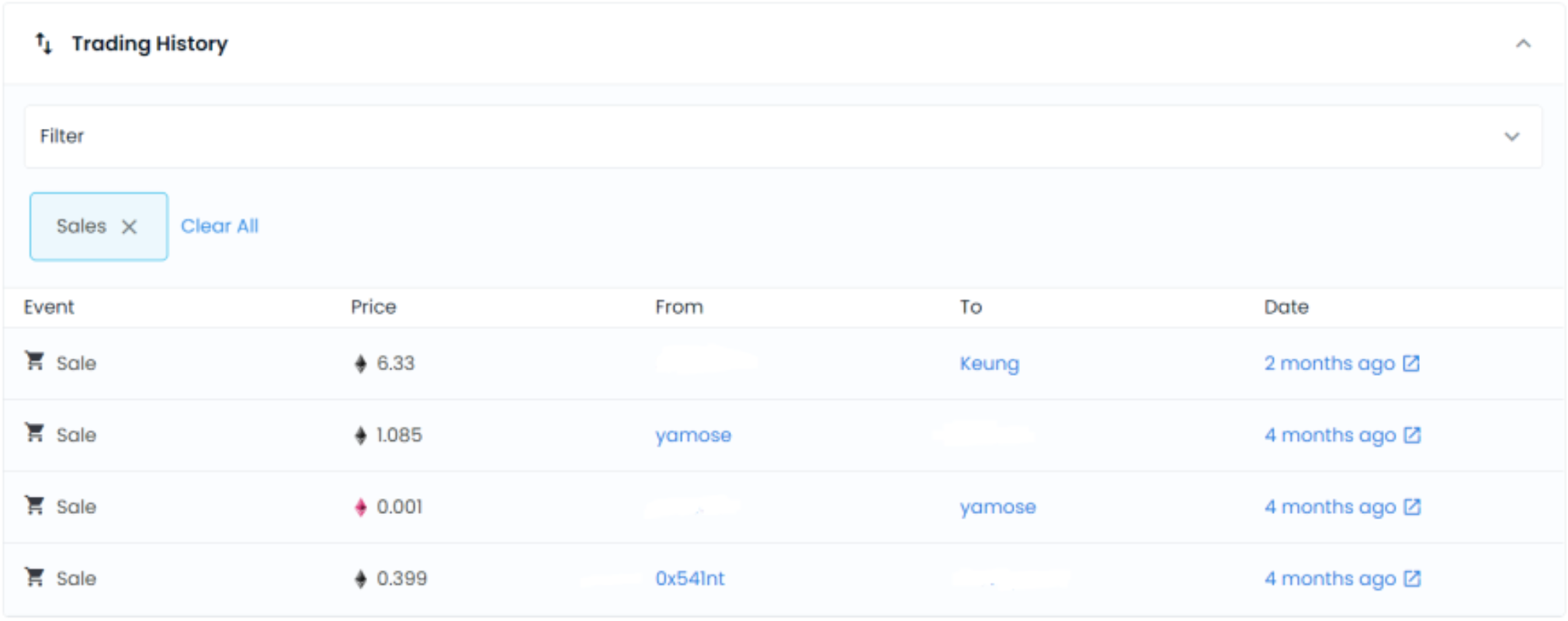

Through NFT, you can digitally prove the authenticity of assets, and artists can easily prove that a certain work is original. Additionally, you can verify the origin of digital assets through the blockchain. For example, you can easily track when an asset was first created and sold. You can then follow that trail down the list of past owners and see how much each buyer paid for the work.

NFT alleviates problems such as fraud and plagiarism, which is a common problem faced by all non-homogeneous commodities. Instead of hiring experts, we can use the blockchain to verify the authenticity of NFTs. Additionally, we can also verify that an NFT is part of a larger collection by checking that the contract addresses match.

NFTs are already disrupting many industries. For example, artists do not need an intermediary like an art gallery to market and sell their work. Galleries also charge exorbitant commissions of up to 50 percent, reducing an artist's net income. Through NFT, artists can sell their work directly to buyers on NFT marketplaces such as OpenSea.

NFTs are disrupting intermediaries

Artwork is just one example of how NFTs are disrupting intermediaries. Crucially, NFTs can tokenize anything, removing all kinds of inefficiencies beyond authenticity.

Have you ever wondered why some key documents are still recorded on paper? This is because there is no way to verify that a certain digital copy is unique and trustworthy. NFTs will change that, opening the way for the creation of outstanding digital art, collectibles, in-game items, and even important documents like wills, passports, and land titles.

Examples of NFTs holding real-world assets can be seen in the work done by Centrifuge. Centrifuge integrates with MakerDAO to onboard non-digital assets as collateral through their app Tinlake. Tinlake turns real-world assets like mortgages into NFTs, complete with all the necessary legal documentation. On April 21, 2021, the company successfully executed its first MakerDAO loan of $181,000 by using a house as collateral, effectively creating the first blockchain-based mortgage loans.

Note:

Note:

MakerDAO: A smart contract system on Ethereum that provides Dai and derivative financial products, and is known as an encrypted central bank. Chinese official website:https://makerdao.com/zh-CN/

Centrifuge: A company that provides technology and services for MarkerDAO, and is committed to bridging real-world real assets to DeFi. Official website:https://centrifuge.io

Tinlake: A component of Centrifuge, by using it to finance real assets on DeFi.

History of NFTs

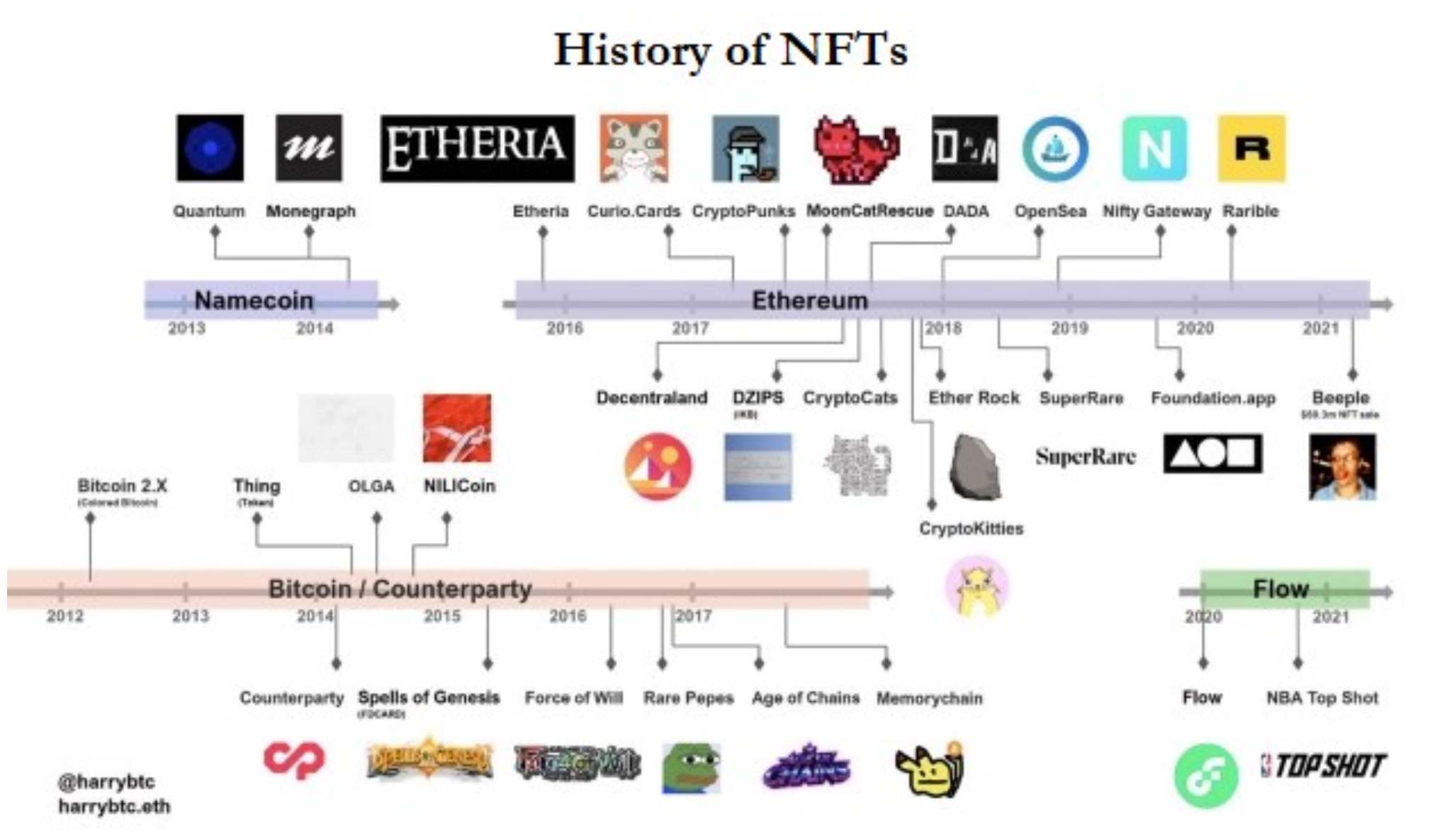

image description

Quantum

The first NFTs date back to 2012 and were designed on the Bitcoin networkColored Coins. Colored Coins is an experimental project to explore the idea of non-fungible tokens.

Several white papers have analyzed its functionality and praised it as an achievement that distinguishes it from Bitcoin transactions. But since it was created on the Bitcoin network, there are some technical limitations, since Bitcoin's scripting language requires sufficient consensus on its value.

Nonetheless, Colored Coins spurred further innovation and laid the groundwork for NFTs. Subsequent projects such as Counterparty (asset creator and decentralized exchange) reaffirmed the potential of putting real-world assets on distributed ledgers. What is clear is that developers need a more functional blockchain to showcase the full potential of NFTs.

When the Ethereum network launched in July 2015 and introduced programmable code through smart contracts, developers finally had a platform to develop NFT projects. One of the first NFT projects to appear on the Ethereum network wasEtheriaimage description

Etheria.world

image description

Source: HarryBTC. HarryBTC (this list is meant to be illustrative and not exhaustive as there are other NFTs not listed here).

It was also at this time that the development standards for NFT began to take shape. Prior to this, most fungible tokens on Ethereum utilized the ERC-20 standard (ERC stands for Ethereum Exposure Draft). The ERC-20 standard works well for many of the functions on Ethereum used to build fungible tokens, but it is not equipped to create unique tokens.

In September 2017, Github contributor Dieter Shirley proposedERC-721, to regulate token standards for unique tokens. The proposal aims to improve past iterations such as gas efficiency and enable the blockchain to identify unforgeable tokens.

It is also in this proposal that the first"NFT "this phrase. This new standard was later used by CryptoKitties, the first project to implement ERC-721. Since CryptoKitties, many NFT projects have followed suit and adopted the ERC-721 standard.

ERC-721 VS ERC-1155

Before the creation of ERC-721, older NFTs like CryptoPunks were built on derivatives of ERC-20, which today are considered hybrids. ERC-721 gradually became the most popular NFT standard, but in 2018, an alternative general NFT standard called ERC-1155 was created and introduced.

ERC-1155 aims to combine the functions of ERC-20 and ERC-721 into one NFT standard, while solving some inherent defects of ERC-721, such as higher gas consumption.

ERC-1155 is highly efficient, especially when doing batch transfers. For example, it can handle 10 NFTs in 1 transaction, while ERC-721 requires 10 separate transactions to transfer 10 NFTs. Due to the way it is programmed, the ownership history of an ERC-1155 token is more difficult to track.

Both standards have advantages and disadvantages and are designed for different types of assets. It’s worth noting that ERC-1155 is often seen as a semi-fungible standard because it allows smart contract interfaces to represent and control both ERC-20 and ERC-721 type tokens. Nonetheless, the core principles remain the same and allow non-fungible assets to be tokenized and authenticated on the blockchain.

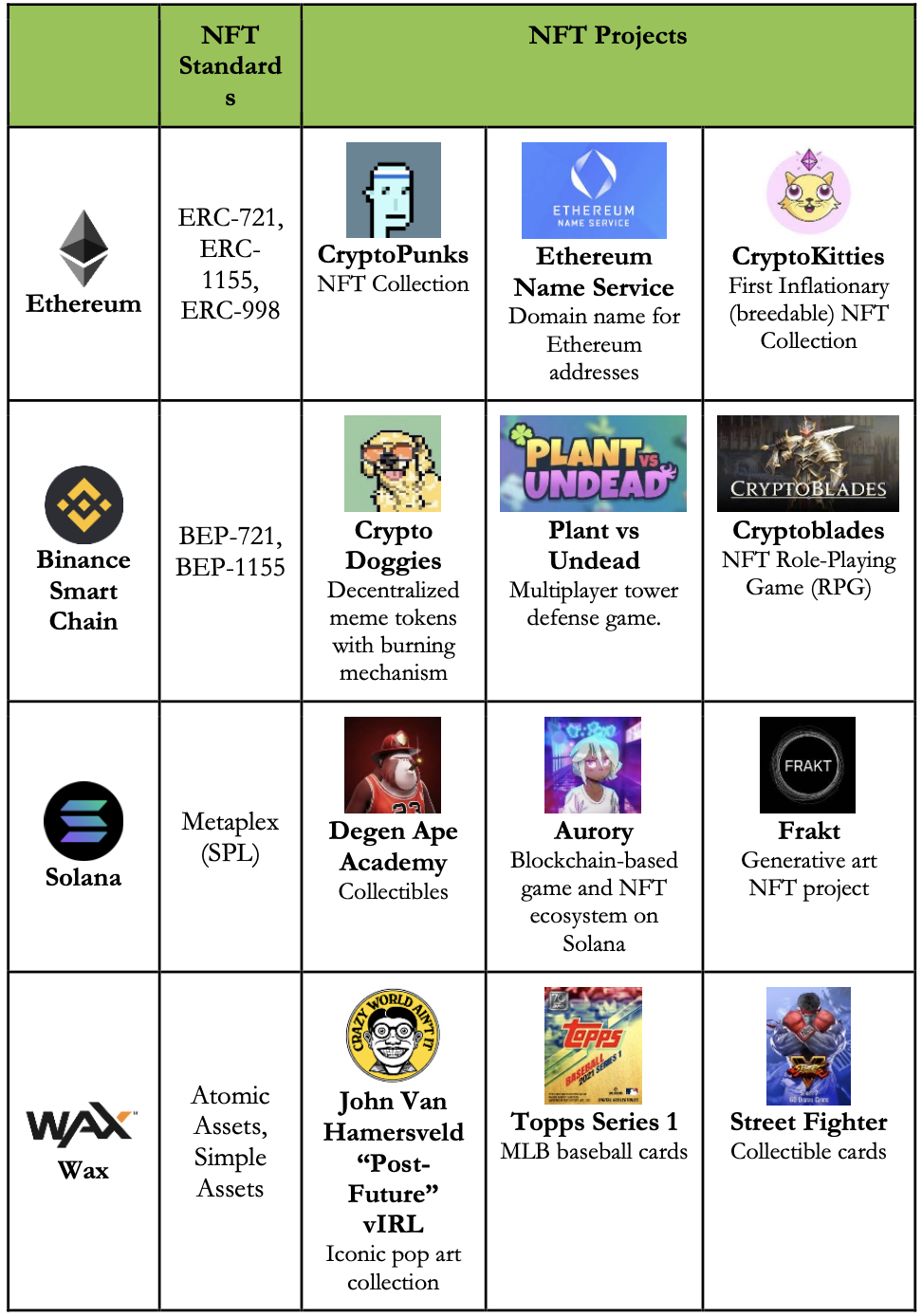

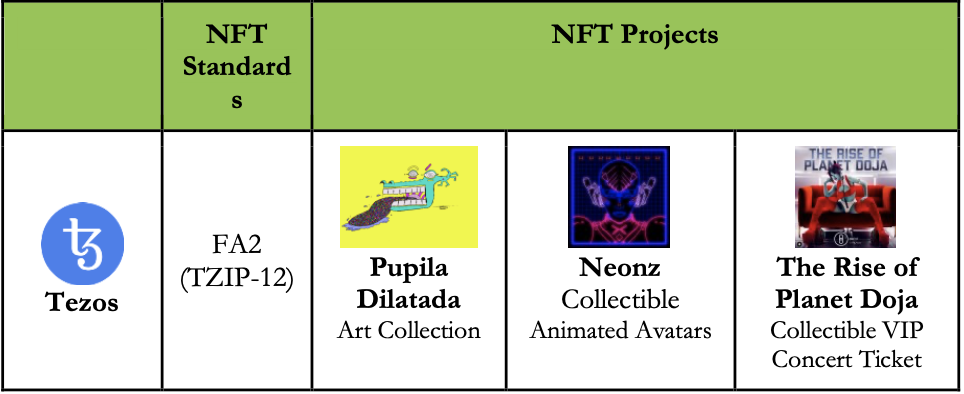

NFTs on other blockchains

Blockchain is a public playground for decentralized applications. Anyone can create anything on the blockchain network, but this also means that there are no requirements or standards to adhere to. For example, we can build a slide out of plastic, but another person might build a slide out of a different material such as cement. Due to its decentralized nature, there is no uniform standard.

ERC-721 and ERC-1155 are clear examples of different NFT standards on Ethereum. However, we are now in a multi-chain world, and each blockchain has its own NFT technical specifications. Below is a (non-exhaustive) list of different NFT standards and NFT projects on other blockchains.

You might be wondering if it is possible to bridge and move your NFT between various blockchains. For example, on Ethereum, bridging is currently possible, but experimental in Ethereum's Rinkeby testnet.

In the not-too-distant future, you should be able to bridge NFTs on Ethereum Virtual Machine (EVM) compatible chains that use a similar ERC-721 token standard, such as Binance Smart Chain and Polygon. On the other hand, non-EVM compatible chains such as Solana, which use the SPL NFT standard, will need to build new infrastructure before you can transfer your NFTs over.

How big is the NFT industry?

The NFT industry is full of innovations. New use cases emerge every day, expanding our imagination for NFTs. However, correctly classifying the industry is difficult as there are many different interpretations.

In this book, we focus on NFTs themselves, i.e. the different use cases of NFTs, rather than the infrastructure or complementary parts of NFTs. Based on this approach, we can roughly divide the industry into eight segments:

1) art

2) music

3) Collectibles

4) Games

5) Sports

6) Metaverse

7) Tools

8) Finance

image description

Source: CryptoSlam

image description

Source: CryptoSlam

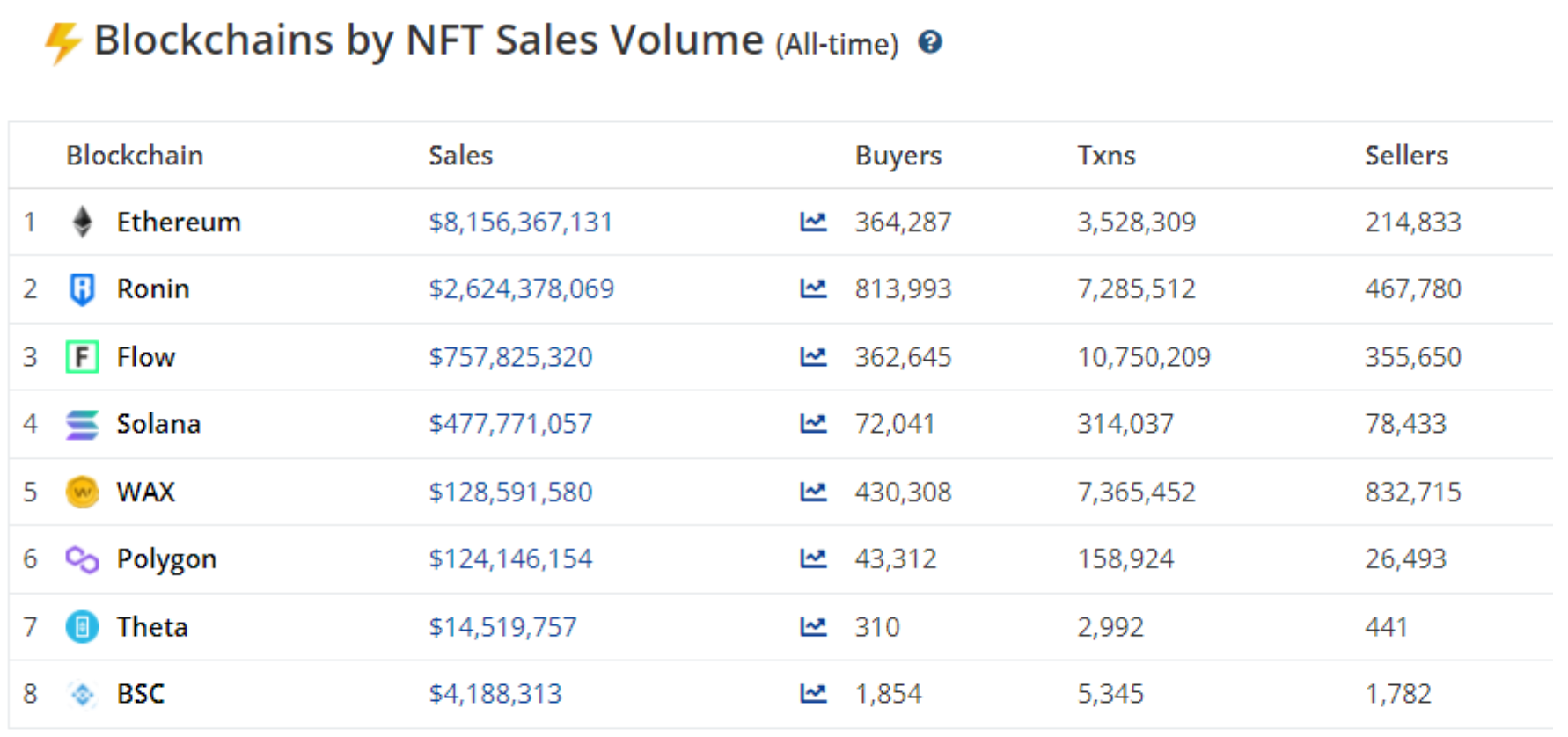

Ethereum’s total sales exceeded $8 billion, far exceeding other chains. This is followed by Ronin, the sidechain of Axie Infinity. However, we are starting to see more and more NFTs being minted and sold on other blockchains such as Binance Smart Chain, Polygon, and Solana.

Still, it’s worth noting that the above numbers are only an estimate, as some chains such as Tezos are not tracked on CryptoSlam, which means the overall NFT industry could be much bigger than it appears. Also instrumental and financial NFTs are not being tracked by CryptoSlam, possibly because they are less popular as speculative investments and make up a smaller percentage of the overall NFT market.

Aside from the usability of the project, one of the main reasons project owners and investors choose different blockchains to mint or invest in NFT projects is on-chain costs. For example, if an NFT on Ethereum costs $50, the gas fee will tend to be higher than the cost of the artwork itself. In addition to cost, some blockchains are faster and more accessible to users than others. Some popular non-Ethereum NFT projects include horse racing game Zed Run on Polygon, and Degen Ape Academy on Solana.

Compilation: Bibabu

Recommended reading:

1、Fungible v Non-Fungible Goods: https://www.investopedia.com/terms/f/fungibles.asp

2、Example of DeFi + NFI + Real World Assets: https://medium.com/centrifuge/investing-in-your-first-tinlake- pool-how-to-dyor-5b79cf88861c

3、Understanding the Hype Behind NFTs:https://www.coingecko.com/buzz/understanding-the-hype-behind-nfts

4、History of NFTs: https://medium.com/@Andrew .Steinwold/the-history-of-non- fungible-tokens-nfts-f362ca57ae10

5、Coding Explanation of ERC-721:http://erc721.org/

6、NFTs then and the Future:https://www.linkedin.com/pulse/brief-history-nfts-look-future- brad-bulent-yasar/

7、Bridging NFTs:https://anyswap.medium.com/anyswap-nft-cross-chain-bridge- alpha-f4ad72ee74da

By Benjamin Hor, Khor Win Win, Shaun Paul Lee, Dillon Yap, Chin Yi Hong

Published by: CoinGecko

Compilation: Bibabu