Data insight: How will the Ukrainian crisis and market sluggishness affect the NFT market?

Currently, many assets are being affected by the uncertain geopolitical situation in Ukraine. Understanding important parameters in the NFT market can help investors reduce risk and make highly profitable strategic decisions.

This article aims to explore:

How dependent are NFT prices on the cryptocurrency market?

How can data from other markets be used to make strategic investment decisions?

How have blue-chip NFTs fared during this crisis?

NFTGo core insights:

While the Ukrainian crisis triggered a drop in the overall market price, it also enabled the emergence of high-consensus projects.

NFT is based on ETH, while the psychology of most investors is U-based, and the crisis will trigger a double decline.

After this crisis, NFT is still on an upward trend, and its market value has increased by 33.3% from a month ago.

NFT itself is not driven by a single factor, but the multiple roles of subculture, community consensus, and self-expression.

first level title

secondary title

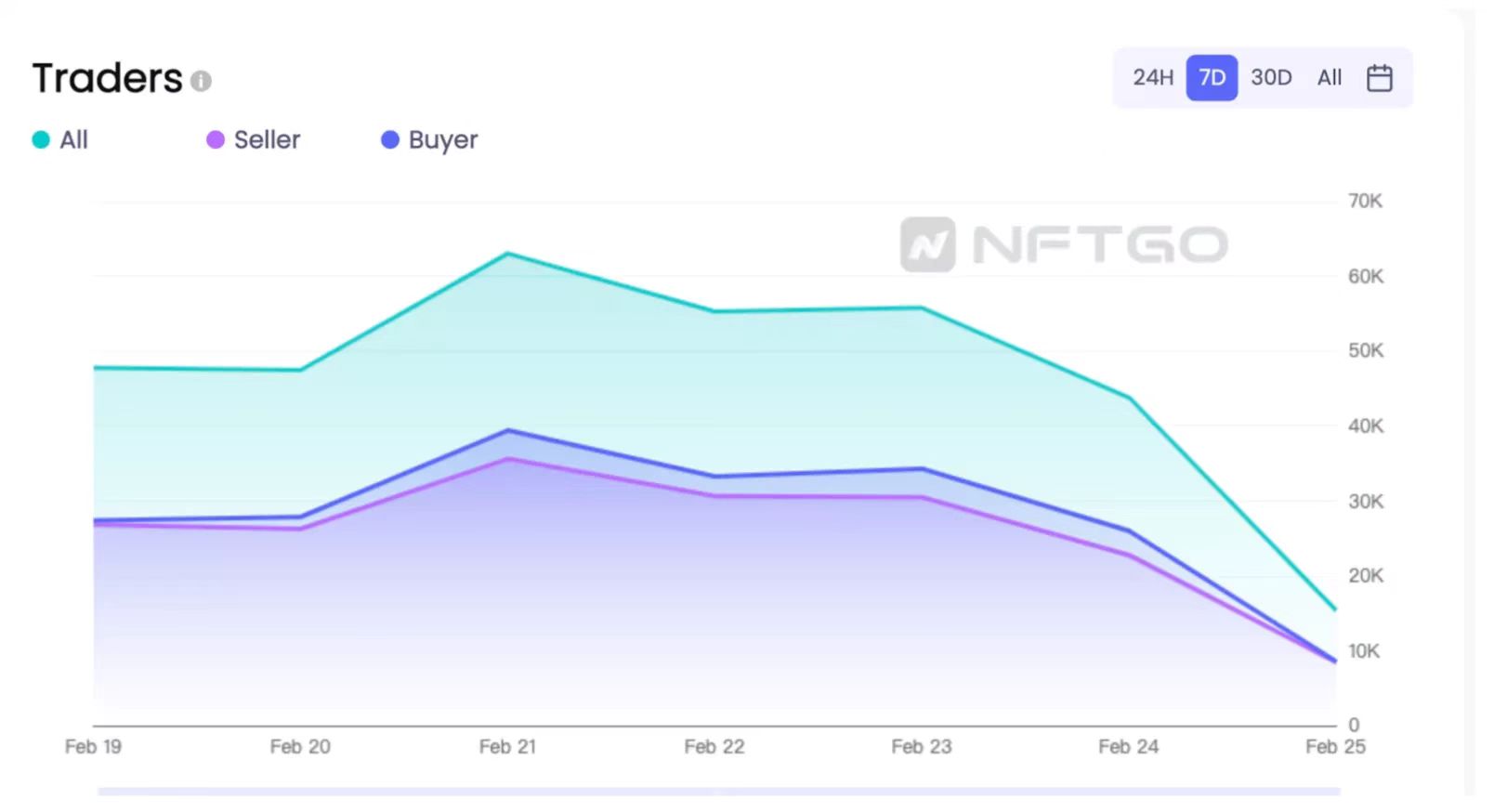

Part 1 - Macro Trends

image description

Cryptocurrency market capitalization chart, from CoinMarketCap (February 18, 2022 - February 25, 2022)

image description

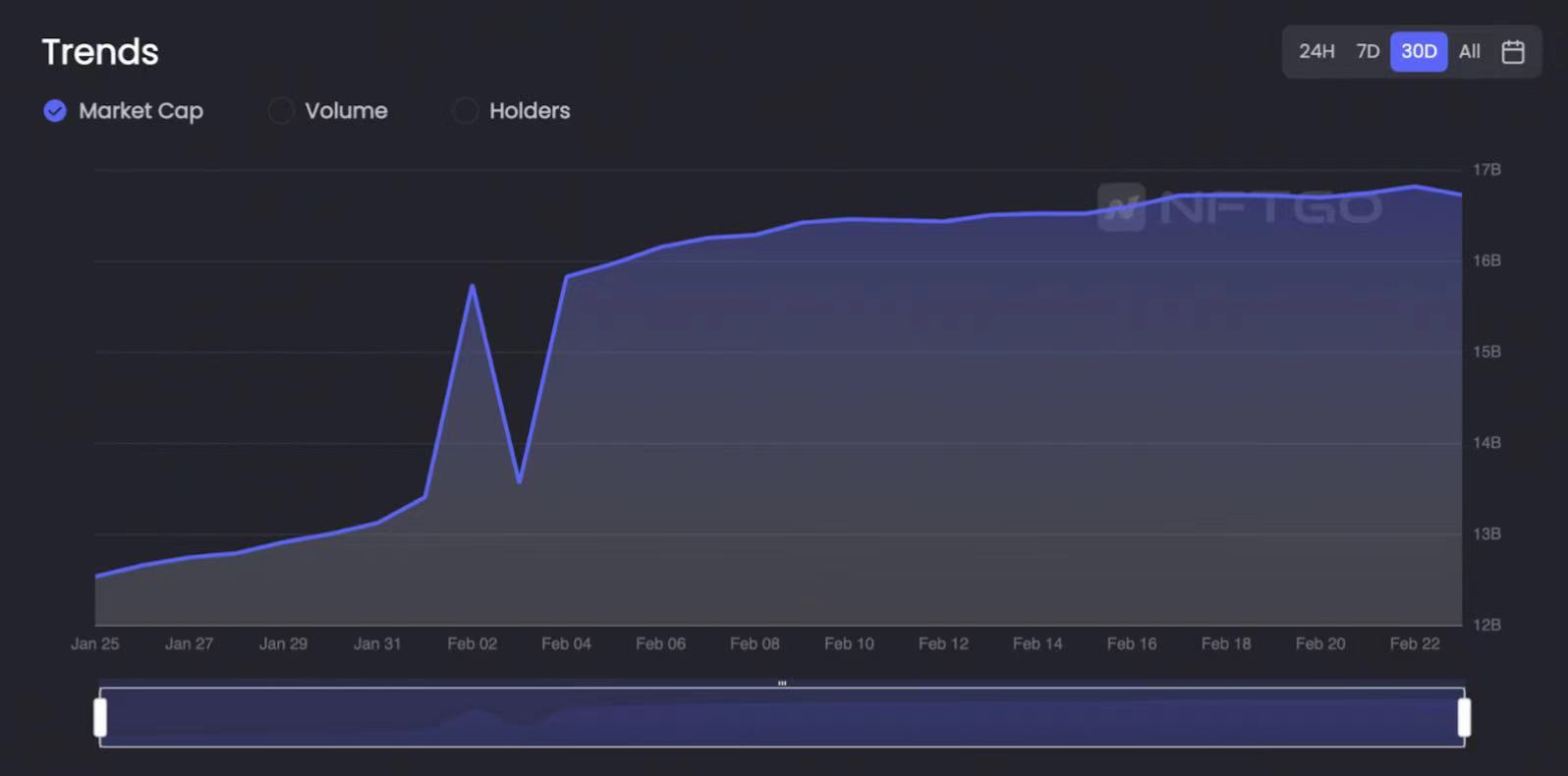

Data source: NFTGo.io

image description

Data source: NFTGo.io

secondary title

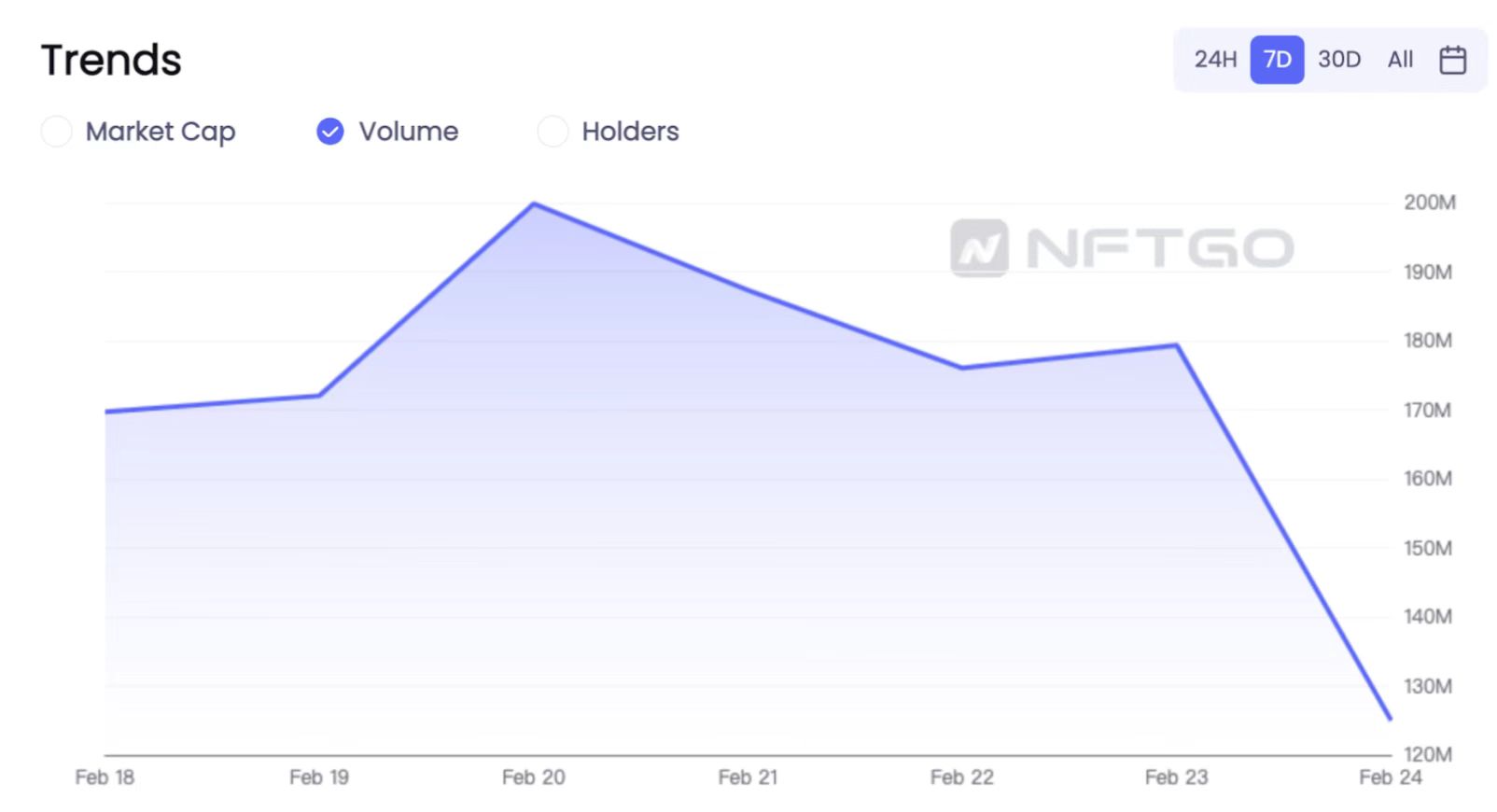

Volume Trend

image description

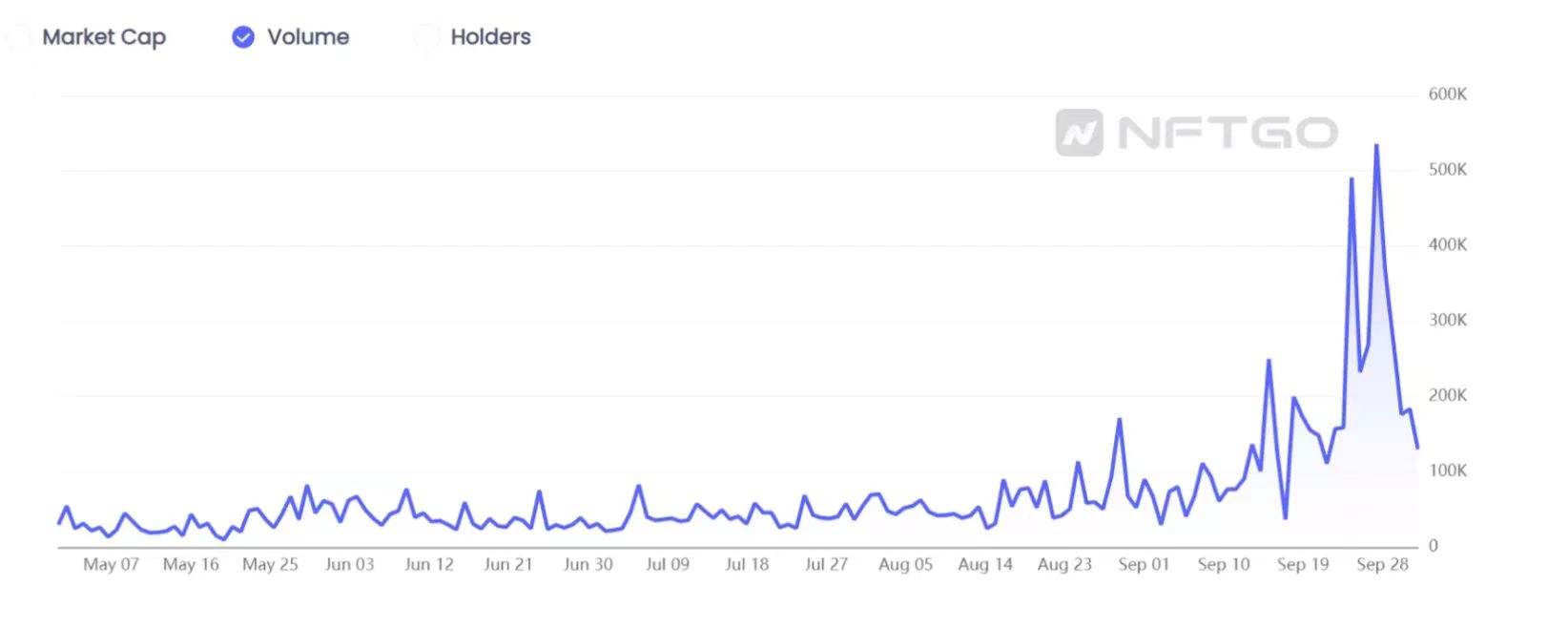

NFT trading volume from June to August 2021 (Source: NFTGo.io)

image description

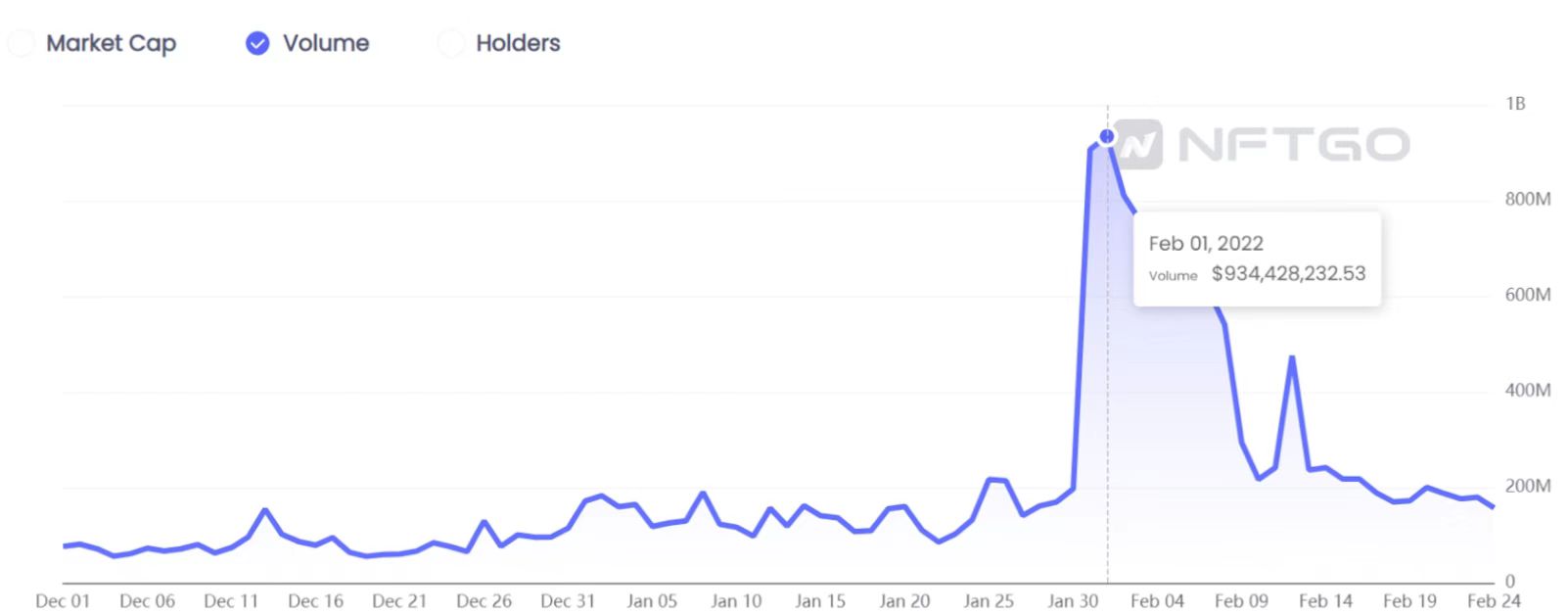

Data source: NFTGo.io

image description

image description

secondary title

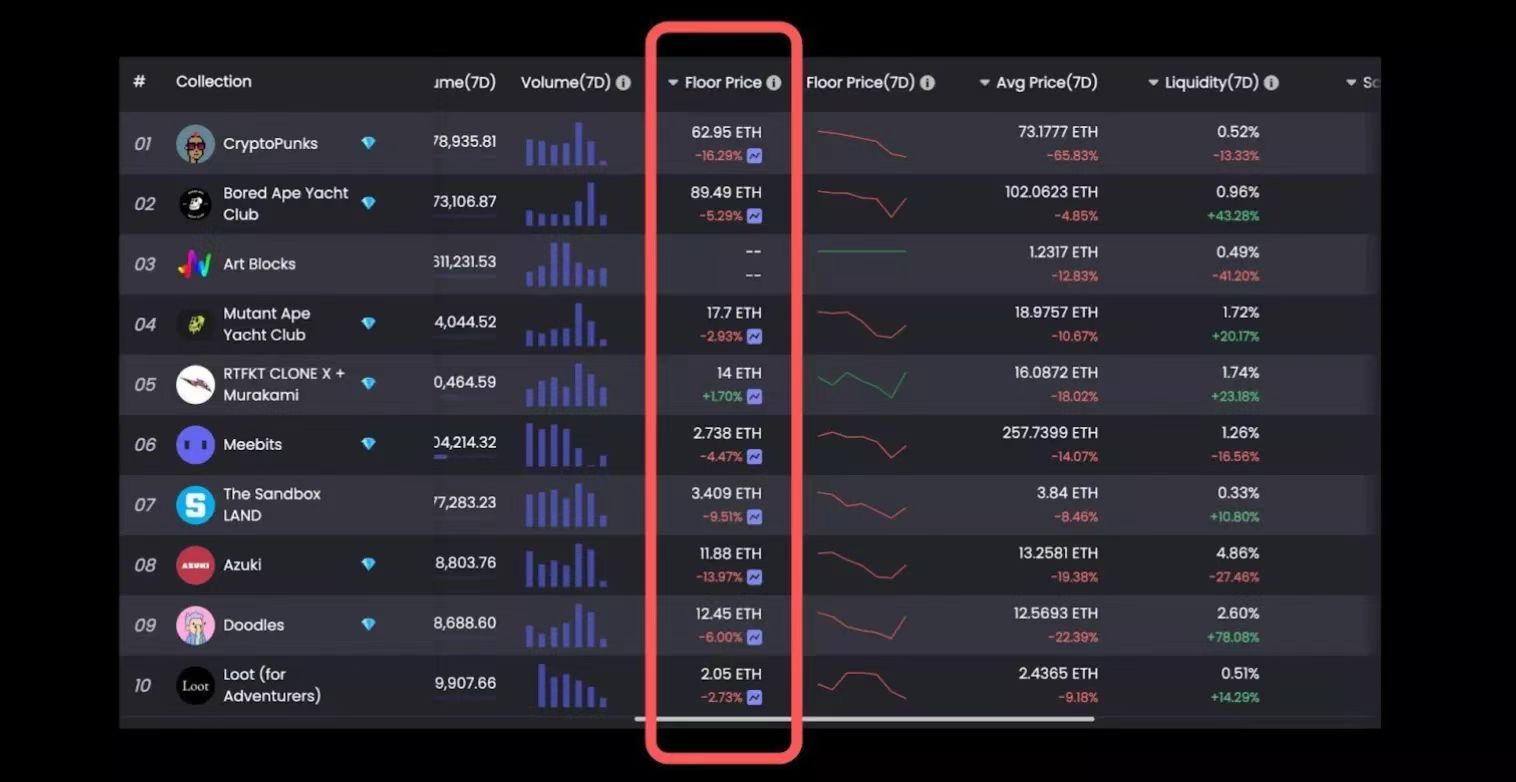

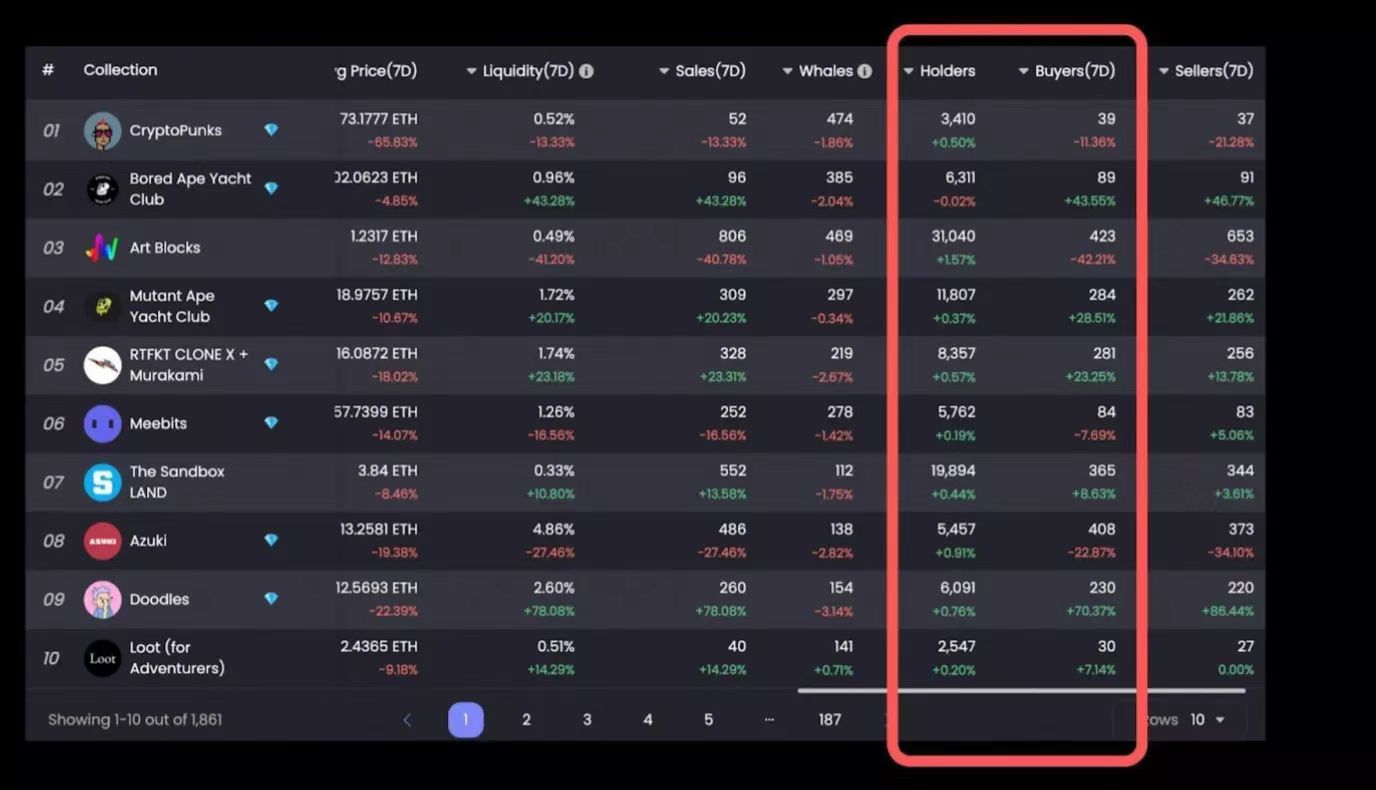

Part II - Micro Trends

image description

Data source: coinmarketcap

image description

Data source: NFTGo.io

image description

Data source: NFTGo.io

Unlike the encrypted market where assets usually have a 1/1 relationship, the decline of some NFT projects provides room for other projects to benefit. According to the data of NFTGo, it can be seen that the funds flow of BAYC sellers, a large number of BAYC holders shipped, and then they bought other blue-chip NFTs. It can be seen that some big funds in the market are optimistic about the market prospects of the new blue-chip NFT.

image description

Data source: NFTGo.io

This trend shows that while some NFT projects have had low liquidity during this period, others have largely outperformed NFTs. Doodles has a little less than 1% liquidity, almost double that of second-place BAYC. There is another interesting phenomenon: when the average price drops and the floor price reaches 9ETH, the most traded ones are not floor price NFTs, but some relatively better-looking NFTs with prices of 10ETH or even 12, 14, and 16ETH.

During a market downturn, traders have many options. The price drop is a double-edged sword, and it will also make buyers with firm beliefs enter the NFT ecosystem.

image description

Data source: NFTGo.io

image description

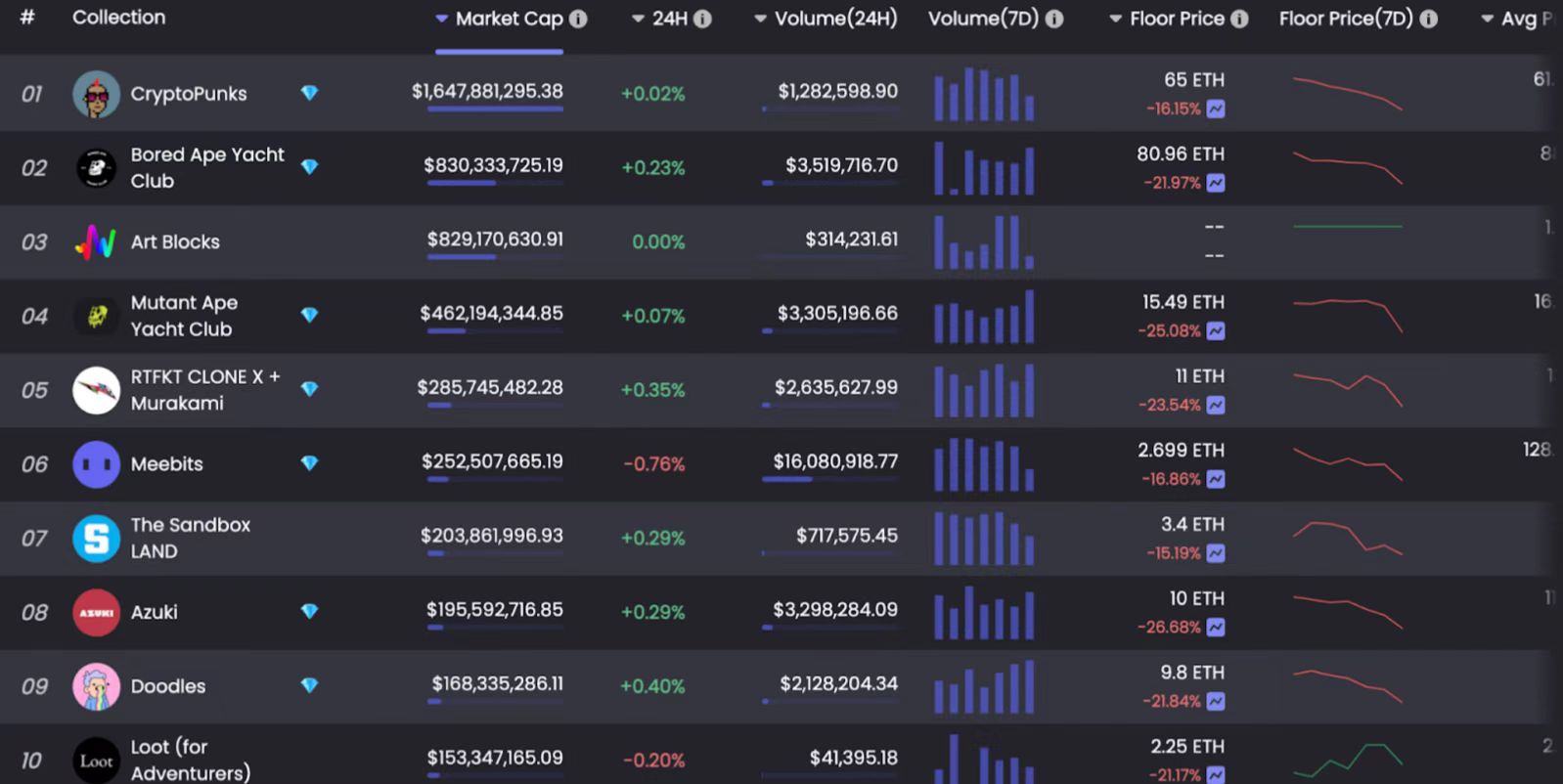

secondary title

The specific trend of NFT

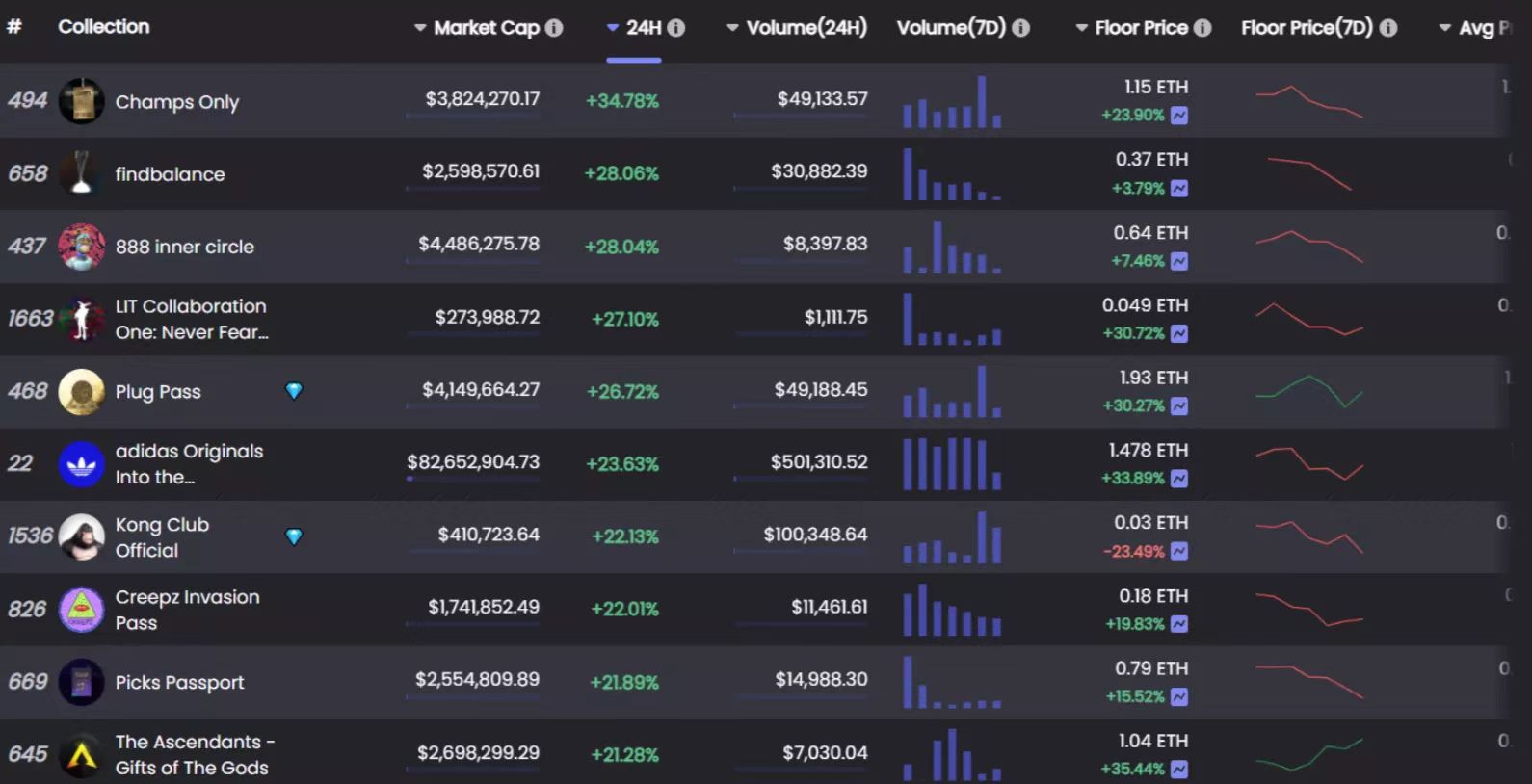

image description

Data source: NFTGo.io

The NFTGo ranking above shows that the market value of some NFT projects has seen impressive and substantial growth on February 26, 2022. Such massive growth is a hallmark of the uniqueness of the NFT market. Unlike other financial products, NFT involves culture, art and community. Some NFT holder communities have weathered times of crisis without losing hope in the projects they hold.

The recent success of artist communities such as Mfer is that they represent a subculture. In an interview, Markus of the Invisible Friends project attributed his success to a weaker presence on the internet. They keep the innocence of children in their hearts and are not interested in the materialized world. Holders of such projects have a strong psychological identity with the community culture itself, and this is also a self-expression of the holders, that is, how I define myself.

in conclusion

in conclusion

There is an assumption that while the crisis has affected the cryptocurrency market to a large extent, it will take longer for the NFT market to react to it. For better or worse, cryptocurrencies are an important part of the NFT transaction process many times. But the difference between NFTs and fungible, single-purpose cryptocurrencies may be the key to their success during the crisis. Emerging NFT projects have the potential to impact the crypto market as an independent scene. Although the current situation has affected short-term financial returns to some extent, the development of the market has not slowed down.

Looking ahead, NFT is likely to be affected to some extent by other industry trends, but the magnitude of this impact ultimately depends on the community and market participants. Similar to other markets, NFTs are not driven by a single factor. On the contrary, the combination of different forces inside and outside the market dominated by internal factors will determine the future direction of the market.