SupraOracles 2022 Blockchain Game Special Report

How Blockchain and Crypto Are Revolutionizing the Game Economy

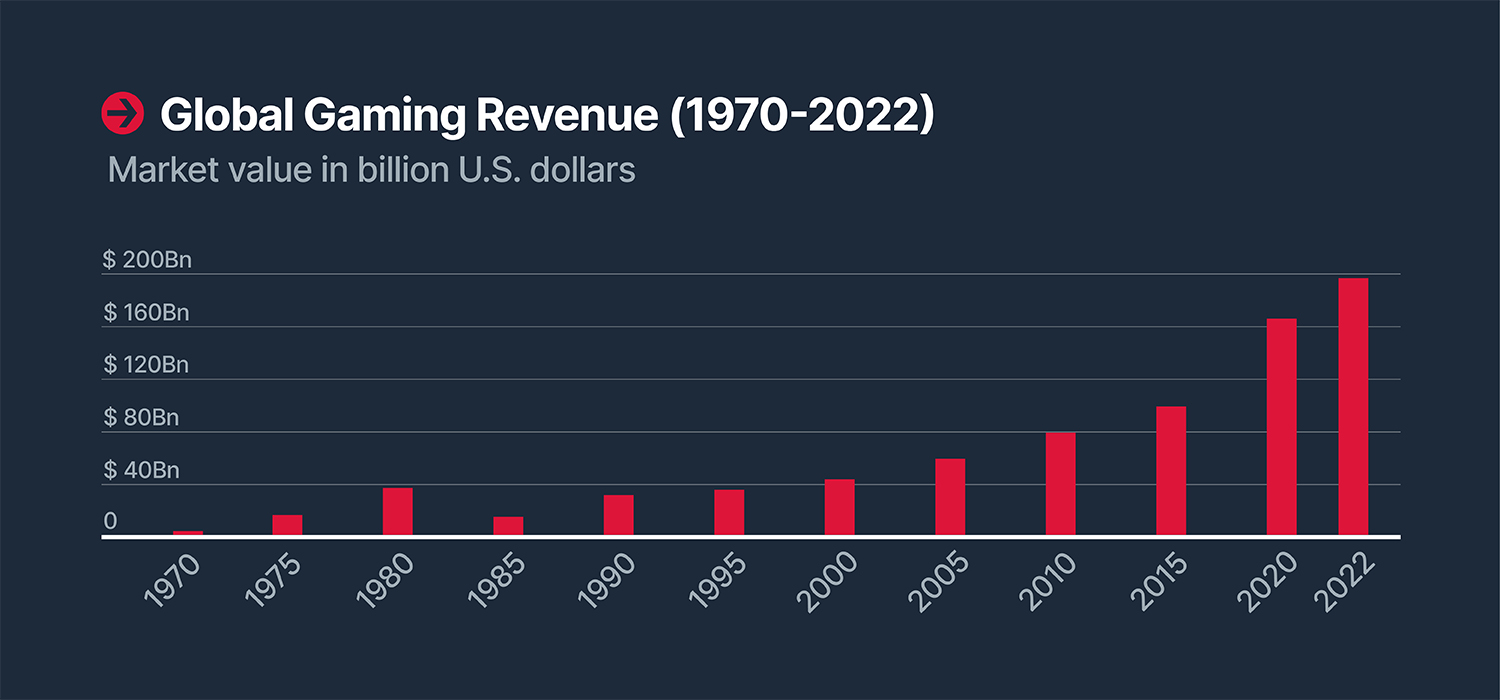

There's no denying that the video game industry is one of the largest and most profitable in the tech and entertainment industries today. It is estimated that more than one-third of the world's population plays some type of video game. With the current global video game market estimated at between $15-200 billion by the end of 2021, some estimates could actually be as high as $336 billion.

The global video game market is expected to grow incredibly to reach USD 545.98 billion by 2028, at a compound annual growth rate (CAGR) of 13.20% over the next 7 years.

Crypto and blockchain gaming is probably the fastest growing and most exciting trend in the video game and blockchain industry. The crypto gaming industry generated approximately $321 million in revenue in 2020 and exploded in 2021, with the market cap of some game tokens ballooning into the billions. Crypto game revenue in 2021 is difficult to determine, but it is likely to be well over $1 billion, considering that the current top 5 game coins have a combined market cap of $25 billion, and the total market cap of crypto game coins is currently close to $40 billion.

In this article, we'll cover a variety of information about the current state of the crypto and blockchain gaming industry, covering topics including:

How crypto games are shifting profits to players

The world's top game currency

The importance of gaming guilds

Massively multiplayer online role-playing games and blockchain games

Cryptocurrencies and NFTs in traditional games

Dynamic NFTs and Oracles in Crypto Games

How crypto games are shifting profits to players

Video game economics has traditionally been a one-way street. Players buy games, buy game subscriptions, and buy in-game items, with all profits and revenue going to the game creator. However, blockchain and crypto games are trying to change this economic model, allowing players to earn substantial financial rewards by participating in consistent games.

Through the rise of games such as Axie infinity, the issuance of in-game tokens, currencies, and NFTs, the income earned by individuals in many low-income countries from playing crypto games has replaced their full-time income, and some very lucky market participants have even become hundreds of millions of dollars. millionaire.

Top gaming coins and tokens 2021–2022

As of January 2022, the top gaming coins and tokens by market capitalization are:

Decentraland: $6.5 billion

Crab: $6.38 billion

The Sandbox: $5.56 billion

GalaOdaily: $3.52 billion

Flow (Dapper Labs): $2.95 billion

In the next few sections, we’ll take a deep dive into each gaming token, the gaming platforms they represent, and what makes them so popular with players and investors.

A crab

While this article focuses on the broad topic of crypto gaming, we would be remiss if we didn't first discuss Axie Infinity, the world's most popular blockchain-based gaming money-making game.

Axie, heavily influenced by Pokémon, allows players to breed animated pet characters called Axies that can engage in P2P (peer-to-peer) battles. Axies can be sold, traded, collected and staked to earn money. The Axie game world consists of two tokens, Axie Infinity Shard (AXS) and Smooth Love Potion (SLP). AXS is the main token of the game, and SLP tokens obtained by winning battles or completing missions need to be used to cultivate Axie.

While Axies are ERC-721 NFTs, they can be sold and traded in-game for AXS, easily convertible to Bitcoin, Ethereum or USD on many major exchanges. Some Axies have sold for unbelievably high prices in recent months. For example, Axie #643 sold for almost £230,000 (approximately $309,000) and is currently on the market for an astounding $623,328. Several other Axies sold for about $230,000 in August and September. Axie also allows users to buy land; a parcel sold in November 2021 for $2.3 million, one of the largest virtual land sales ever recorded.

Incredibly, the profits made by Axie players have caused some players, especially in developing countries like the Philippines, to quit their jobs in order to play Axie full-time. Many gamers report earning $300–350 per week from the game, far more than the average salary in many countries.

However, getting started with Axie can be expensive. It typically costs $1,000 or more to breed your first Axie, so many established Axie community members have begun funding players' first Axies by offering scholarships. Sponsors, who may not have the time or interest to play the game full-time, act more like investors, putting in startup capital while taking a cut of players' profits based on pre-determined deals.

Decentraland

Operating on the Ethereum blockchain, Decentaland is currently the largest in-game currency by market capitalization and the largest online virtual land game in existence. The game allows users to utilize its builder tool to create original art, challenges and scenarios, and allows them to participate in events and contests with prizes.

However, the game's main strategy is to allow users to buy and sell virtual land as NFTs on its marketplace. Each owner controls exactly what is posted on their parcels, and each parcel is identified by x and y coordinates, just like real-world properties. In addition to land, users can also buy real estate, wearable avatars, and even names, among other paraphernalia.

The prices of Decentraland NFT assets have hit record highs in recent months, with one virtual asset sold for a record $2.4 million in November 2021. As with most secondary market NFT sales on Decentraland, the sale was primarily done on NFT marketplace OpenSea's Decentraland Collection, which currently has nearly 100,000 NFT land and items listed for sale.

Unlike many blockchain games, Decentraland is governed through a DAO (Decentralized Autonomous Organization). Additionally, Decentraland controls the MANA token, whose smart contracts have been discarded and allow (theoretically) full community governance.

According to Decentraland's website: "The Decentraland DAO owns the most important smart contracts and assets that make up Decentraland — land contracts, estate contracts, wearables, content servers, and marketplaces. It also has a large number of MANA wallets, which allow it to be truly autonomous , and provide subsidies for various operations and initiatives throughout Decentraland.”

The Decentraland DAO allows token holders to vote on a wide range of in-game issues, including:

Dates and details of land auctions

Which new wearable items are allowed and prohibited

What upgrades are allowed for land and estates

Who can join the game's management committee, referred to as the Council

Sandbox

When it comes to virtual lands in virtual worlds, The Sandbox is second only to Decentraland in popularity. Like Decentraland, players can purchase virtual land, however, The Sandbox differs in its overall gameplay as it emphasizes the use of physics and elements to create in-game items and experiences. Users can create original items using elements and materials such as glass, sand, water, soil, lighting, lava and even mechanical equipment.

The Sandbox's popularity is also fueled by its wide range of celebrity partner endorsements, including The Smurfs, Deadmau5, and Snoop Dogg, who invest in cosmic lands, host private metaverse parties, and regularly drop his own original NFTs in-game .

Perhaps most importantly, the Sandbox isn't just its own virtual metaverse, it's a platform where players can build their own video games in the sandbox without any coding or previous technical experience. Every game creator can cash out their games through the game monetization model, as well as create and market their own digital assets in the game.

In addition to raising funds through its popular SAND token, the Sandbox has attracted significant institutional investment. In November 2021, SoftBank led a $93 million funding round for Sandbox. Like Decentraland, The Sandbox is built on the Ethereum blockchain.

GalaOdaily

Gala Odaily is not a game. It is a platform built on the Ethereum blockchain, designed to allow game developers to easily create advanced blockchain games. Games currently under development on the Gala platform include:

The Walking Dead: Empire: The popular survival-based drama based on development. It's a personal survival MMORPG based on the popular TV series, developed by the popular gaming brand Ember Games.

Legacy: A business simulation game built by 22cans for PC and Mac.

Echoes of Empire: 4x space strategy game from game giant Ion Games.

Mirandus: A fantasy RPG by Gala himself.

Gala is currently operating in a semi-decentralized mode. Anyone who is licensed by Gala can become a licensed node operator to obtain local GALA tokens and limited edition Gala NFTs. Like the sandbox, Gala has seen significant outside investment in recent months. In December 2021, Gala announced a $100 million fund with a joint venture with C2 to help develop new games on the platform, with a focus on game monetization models.

While Gala currently runs on the Ethereum blockchain, it is in the process of transitioning to its own proprietary blockchain, GalaChain, which it says will offer "virtually free" transactions across the entire Gala game ecosystem.

Flow

A bit like Gala, Flow is not a game, but a custom blockchain designed for crypto and NFT game development. It has exceptional performance and is designed specifically to enable games and protocols that engage millions (if not billions) of users to buy, trade, and interact with NFTs on a regular basis.

Unlike traditional blockchains, Flow divides its consensus algorithm into four distinct roles, which is ideal even for beginners, as long as they have a reliable internet connection.

According to Flow's website:

“Validators can join Flow in one of four roles:

Collector nodes improve efficiency

Validator nodes guarantee correctness

Execution Nodes for Speed and Scale

Consensus nodes ensure decentralization”

Flow currently supports some of the largest NFT marketplaces and products, including the NBA Top Shot Marketplace, CryptoKitties, and digital collectibles from Dr. Seuss and the UFC.

Crypto, Blockchain, and MMORPGs

MMORPGs like World of Warcraft and Runescape, which we mentioned at the beginning of this article, are one of the largest segments in the video game market. For example, World of Warcraft has an estimated 116 million players as of December 2021, while Runescape has an estimated 48 million players between its original and classic versions. However, massively multiplayer online role-playing games have yet to catch on in the blockchain and crypto world — but that is slowly changing.

Some of the most popular MMORPG blockchains currently on the market include:

Sol Chicks

SolChicks is currently the most popular massively multiplayer online role-playing game blockchain game. It works a bit like Axie Infinity in that it allows players to breed, train, and buy playable NFTs, and battle them for rewards, which they can then sell. Players can also engage in multiplayer online battles (team versus team) to maximize potential rewards.

SIDUS

Sidus is a browser-based sci-fi action game that allows players to engage in galactic adventures and loot the galaxy for rewards. Players can train and upgrade NFT-based legions, and they can also engage in group battles with teams on the multiplayer battlefield and engage in one-on-one duels.

Players can also craft new game items and trade and sell them, as well as breed and train wild animals, farm resources, and even participate in interstellar councils.

Worldwide Webb

Worldwide Webb is a game based on a pixel art virtual world. Unlike other games, it allows gamers to import their own NFTs and use them as playable character avatars. The game is currently interoperable with popular projects like CryptoPunks, Cool Cats, ApeGang, HeadDao, CryptoToads, CyberKongz, and more. Just like in Decentraland, gamers can buy in-game land on OpenSea. Players can also participate in interactive NPC quests.

The importance of gaming guilds

Since the development of massively multiplayer online role-playing games such as World of Warcraft and RuneScape in the mid-90s, gaming guilds and clans have become an increasingly popular way for players to unite to take advantage of in-game economies of scale and take on team quests , and get more in-game currency to buy various upgrades.

However, before crypto and blockchain gaming, gaming guilds and clans were usually limited to one game and (with very few exceptions) did not generate any real-world profits. Still, crypto gaming guilds have exploded in growth over the past year, even receiving funding from real-world venture capital.

For example, in 2021, large venture capital funds like Andreessen Horowitz (a16z), Pantera Capital, and DeFiance Capital have led multiple seed rounds for gaming guilds. For example, guild Yield Guild Games raised an astonishing $22.4 million, while guild GuildFi raised an equally astonishing $6 million in seed funding.

Like traditional gaming guilds and clans, crypto gaming guilds allow members to increase their in-game economic status, but this time real money is involved. In many cases, guilds fund new player campaigns, allowing them to purchase necessary in-game tools and upgrades in exchange for a percentage of in-game revenue.

Furthermore, a major difference between traditional gaming guilds and crypto gaming guilds is that these new guilds are not limited to just one game; instead, they fund and support players to play various blockchain-based games in order to diversify their investments and maximize potential profit.

As we mentioned before, a classic example of a guild sponsoring a new player is the popular sponsorship ceremony in the Axie Infinity game, where the guild helps new players acquire expensive Axies (digital creatures) by renting out the guild.

Some analysts believe that guilds, rather than the games themselves, will be the real power players in the new cryptogame metaverse, as their endorsement (or lack thereof) of major guilds can make or break games. This leverage could help ensure that crypto and blockchain games remain fair and profitable for players, especially when it comes to tokenomics. For example, if a game's creator were to hoard tokens or unfairly manipulate the in-game price of an NFT, the guild could switch to a different game, potentially taking thousands of loyal players with them.

In addition to having a major impact on the nascent crypto gaming industry, some of the most popular crypto gaming guilds, including Merit Circle, YGG, and GuildFi, have begun issuing their own tokens. Some have even created DAOs to decentralize guild leadership and potentially prevent guild "whales" from dominating the guild, thereby creating a more inclusive environment for new players.

Currently the largest guild, YGG, has a market capitalization of $461 million, according to CoinGecko. While this is much smaller than the capitalization of the largest crypto games themselves, this may change in the future as guilds become larger and more popular.

Cryptocurrencies and NFTs in traditional games

Many traditional gaming companies are looking to jump on the bandwagon after seeing the astounding success and growth rate of crypto and blockchain games. Recently, the CEO of major game publisher Electronic Arts (EA) told investors in-game that collectible NFTs are “a big part of the future of our industry.” With over $100 billion in in-game virtual goods purchased in 2021 alone, it makes sense that many video game companies would decide to convert these items into NFTs to increase their scarcity and facilitate the creation of secondary markets.

However, the integration of NFTs into traditional games is still in its infancy. Most recently, gaming giant Ubisoft announced that it will begin introducing NFTs to its popular game Ghost Recon. These NFTs, called "numbers," will initially be released as game items, including equipment, weapons, and vehicles. Each item has its own unique serial number, and each player can only own one of each item, potentially increasing its scarcity over time.

Ghost Recon's NFT will be built on Tezos, a proof-of-stake blockchain, which Ubisoft hopes will allay concerns about the impact of NFT minting and transfers on blockchain environments such as Ethereum, which has yet to fully move from Proof-of-Work is transitioning to its planned Proof-of-Stake model. While these NFTs can be resold, they are not dynamic and do not affect gameplay, which may reduce their popularity as NFTs directly affect the game in many (if not most) blockchain and crypto-native games. Gameplay.

Zynga, creator of the popular social media game Farmville, is also planning to enter the NFT market, announcing plans to sell thousands of NFTs in 2022.

While some traditional gaming companies have chosen to ride the wave, others have been more cautious. Valve recently banned blockchain games from running on Steam, and Xbox and Epic Games (creator of Fortnite) announced they have no plans to include NFTs or cryptocurrencies in future products, citing concerns about gamers being exploited.

These concerns are not entirely unfounded. For example, fans of the popular online game Neopets began protesting the release of NFTs in October, urging players to boycott the game until the project was cancelled.

Whether NFT issuances will increase user excitement or cause a backlash from gamers may largely depend on how they work within the gaming ecosystem. If NFTs, tokens, and cryptocurrencies are deemed to increase financial incentives for users, such as in game models where games such as Axie Infinity make money, they may be considered net benefits to users. However, if NFTs are released at exorbitant base prices, and if gamers have little chance of earning money from these offerings, they could be viewed as greedy cash grabs by video game developers only interested in increasing profits.

Dynamic NFTs and Oracles in Crypto and Blockchain Games

If there is one common thread between almost all blockchain and crypto games, it is NFTs. Most of these NFTs are static, meaning they remain the same over time. However, dynamic NFTs, that is, NFTs that may change over time or external circumstances, are likely to start gaining popularity. For example, Ubisoft's weapon NFT release mentioned above is actually a dynamic NFT, and will change its nature every time it is transferred or sold to a new user.

In addition to being affected by in-game factors, in-game dynamic NFTs may also be affected by external real-world events. These may include news events, token prices, weather data, political events or other factors. For example, an NFT in a military strategy game might change based on the strength of real-world armies or other similar factors. Since blockchains are usually closed systems and it is difficult to obtain external data, these dynamic NFTs usually need to rely on oracles, that is, third-party software providers, to bring real-world off-chain data into the blockchain. Oracles can be centralized.

Related Reading:

Related Reading:

Gaming Industry Nearly Twice as Large as Reported, at $336B.

Video Game Market Size, Share & Trends Analysis Report By Device (Console, Mobile, Computer), By Type (Online, Offline), By Region, And Segment Forecasts, 2020–2027. Grand View Research.

Gaming: Cryptocurrency in the Gaming industry. TripleA.

Shen, M. (2021, Dec.) Crypto VCs Are Making a Big Bet on Gaming Guilds. Why?.

(2021, Dec.) Gaming Coins. CryptoSlate

Peters, J. (2021, Dec.) Ubisoft is bringing NFT gear to Ghost Recon. The Verge.

(2021, Nov.) Top 10 Most Expensive Axie Infinity NFT Ever Sold. NFT’s Street.

Shumba, C. (2021, Nov.) A plot of digital land just sold for $2.3 million on Axie Infinity, as the real-estate race heats up across the metaverse. Markets Insider.

Howcroft, E. (2021, Nov.) Virtual real estate plot sells for record $2.4 million.

Decentraland DAO: The virtual world in your hands.

Leblanc, W. (2021, Dec.) Gala Games Announces $100 Million Blockchain Fund Alongside New Play-To-Earn Games From Peter Molyneux, Will Wright, And More.

The Source of MMO Data: MMO Populations. MMO Populations.

(2021, Dec.) Top 5 MMORPG Blockchain Games. Altcoinbuzz.