Re-enacting the Curve war, writing a new narrative for DeFi3.0

Original author: knower

Compilation of the original text: The Way of DeFi

Introduction

Original author: knower

Compilation of the original text: The Way of DeFi

Introduction

Much of economics leans toward the view that market participants act rationally almost all of the time. While economic models may sometimes reflect small deviations from actors' best interests, they do not account for the frequency of these irrational actions. Humans are so complex, engaging in infinitely different lives, that it's nearly impossible for any model to show these behaviors in a rational or efficient way—and that's the problem with economics. In this first paragraph, I want to clarify that I haven't studied that much in the field of economics, but I can say that I have read enough that if I get some angry DMs, I can easily To demonstrate what I'm saying -- let's move on.

I will not attempt to explain examples of irrational market behavior, as we are all too familiar with the latest developments in retail investing mania. It doesn't matter whether this can be attributed to the Dogecoin/Elon Musk effect or the rise of Robinhood - more people than ever are trying their personal fortunes in investing, leaving their collective net worth suffering. Rather than delving into an endless series of WallStreetBets posts about -75% accounts, I'd much rather examine the biases economists unknowingly employ that lead to the greatness of the Ponzi economy.

We are all familiar with the concept of a decision tree. Each of us is faced with countless choices in everything we do throughout the day. Choosing one over the other can have consequences that extend across the scale of an entire human life. nobody is perfect. We are constantly making mistakes and want our lives to reflect what our heads might be like. It is human nature to want to achieve something bigger than ourselves. Whether it's wanting to rule a country or live out the idealized fantasies you have in mind, this drive is inherent. You may be an accountant from Ann Arbor or a sixth grader in Japan, but your life is unique, dreaming up different scenarios that could happen on any given day.

While your immediate circumstances may require you to own a home and then pay the bills and buy groceries for your family, these are decisions you make out of necessity - they don't need to be calculated as it can be determined that the vast majority of markets participate Investors will not hesitate to meet these needs first. Barring any unforeseen circumstances, such as job losses or natural disasters, it can be assumed that the situation will remain normal."I guess I should say that I'm not as angry with economists as I am with economics in general. The truth is that these people are deluded into making these banal calculations to distract attention from the fact that it is almost impossible to generalize the irrational behavior and desires of a market designed to meet and fulfill the needs of more than 7 billion people. is impossible. No matter which way you spin it, a small group of people with Ivy League degrees cannot deconstruct the giant hive we call the global population, no matter how many times they break things down into assumptions about supply and demand."or"Because economic models are so important to any country engaged in international affairs, they can be hastily thrown together without taking into account"if

or

how about this

conditions that actually help anything important in the global economy. If it satisfies a country's leaders, then the job is done and you can move on to the next problem. Why do economists look for the impossible when they can do only what is required of them?

Like everyone else, these people are getting paid to do what they're supposed to do, and doing the impossible is a waste of time that pleases no one. It is not surprising that Ponzi economics rose from the ashes of economics to provide a new alternative to a dreary social science that somehow still exists today. Economics is boring and lacks everything that makes Ponzi economics interesting. I'm not saying a field like economics needs to have all the hallmarks of a rebase token or a Safemoon clone, but a little bit of that doesn't hurt. We've moved past a time of collective respect for government, because it's increasingly clear that the Emperor has no clothes and you'd be better off throwing your annual Roth IRA deposits into a locker on Tetranode. The trust in authority that we once had has waned over the past few years, as should be very obvious to anyone, and the economy has reflected this, giving us the likes of TSLA, GME, and DOGE gems. Ponzinomics meets TradFi, albeit a slightly different game than the Ponzi game we play in the crypto space.

In the field of Ponzi economics, there is no upper limit to fair play. Crypto does play its part in this game, but it is by no means the driving force of the school. Ponzi economics includes everything from 15-figure APY rebase OHM forks to Metaverse Catwoman. We are currently in a period of chaotic growth in the crypto space, as we find ourselves often relegated to a sandbox world of multi-million dollar jpegs and dogecoins, which is of no use to anyone committing a significant amount of their net worth to this magical Internet currency is a kind of contempt for anyone. Many people who are annoyed by these digs about cryptocurrencies because they are often exaggerated and often develop into personal attacks rarely really look at the space. Well, our critics are correct. Check us out.

If everyone on CT who directly or indirectly uses fans as exit liquidity gives me a bag of crap, I'm going to have to hire 10 people to get rid of the crap for me. The fact is, the crypto market is still PvP, and you better realize it sooner rather than later. Are we going to get together and cry and try to fix the problems we've created? of course not. No one will be ashamed this week as we present a metaverse strip club project with veTokenomics and a unique revenue sharing model to 50 VCs. It's just business.

Who pressed the red button?LinkIt's clear that there have been more sellers than buyers lately. Everything is panicking and the numbers are dropping. Unfortunately, that doesn't look like it's going to be a foregone conclusion anytime soon. Maybe we're in a bear market, maybe we're not. I'm still excited.

It’s easy to feel like nothing is happening in the DeFi space when tokens aren’t rising, but it only takes a look outside the echo chamber to realize how strong this community actually is. There are so many projects currently under construction that are doing completely unique things that I'd be a nutter if I tried to describe all of them. Instead, I'm going to share this completely safe

Link

, which you should click to navigate to @fomosaurus' page. And this is just the beginning, and now there are so many builders putting in the work, so I think it is definitely negative IQ to be bearish in the medium and long term. In order to define what DeFi 3.0 might be, we should perhaps go back to our humble beginnings and how we got here.Curve warsDeFi 1.0 features the creation of AMMs and a summer of food farms. Uniswap was (and still is) king, Sushiswap tried to overthrow the king and got knocked down, yearn finance rose, and DeFi TVL skyrocketed from nothing. Yield mining and farmers became jargon while the protocol struggled to stay relevant in an increasingly oversaturated space. Even today, a handful of protocols exist from this period.

From a historical perspective, DeFi 1.0 can be seen as the Wild West mixed with high APY and 2 pools. What I am trying to say is that no matter how bad DeFi is, there are some positives as well. These include a clean UI (not necessarily a smooth UX), the ability to swap token A for token B, yearn finance, and Curve wars (because they're fun). All of this is good stuff for the space, and we need more of it if we hope to eventually topple the TradFi monster.

The transition to DeFi 2.0 is taking a bit longer than you might expect, as the narrative doesn't really kick in until around October or November 2021. we may all be too familiar

And OHM forked, but let's dig into it again to figure out why this narrative was able to have such an impact on CT. The veTokenomics model was able to convince countless speculators that since tokens are basically needed by all protocols, they will rise. Also, OHM's outrageous APY spawned 10 million forks, nearly all of which failed. Ironically, the only fork of OHM that actually did well was Wonderland, but once one of their founders was found out to be a criminal, and people figured out that DAOs acting as SPACs wasn't as cool as it sounded , it all fell apart. Hey, even real SPACs don't do very well, just look at some examples from Chamath if you want to know. Protocol Posed Liquidity (PoL) is a sizable part of DeFi 2.0, as Olympus has been able to access huge sums of over $500M even though there aren't many protocols that can use that money to drive value back to token holders.

Although the DeFi 2.0 narrative faded quickly, I consider it a success. Not because I'm sold on CRV at the top, but because it's a perfect way to test CT's grasp of the narrative.

After I started posting about Curve Wars on Substack, hundreds of other writers much smarter than me started reporting on it, leading to a brief euphoria. The amount of time I've spent on all of this is a blur, and I can't believe it's already 2022. I won't try to go back in time to see how long the saying lasted, but it was popular, and it took off fast.

My whole TL and reply is $20 price target for CRV and $5000 price target for OHM, despite the fact that veTokens don't offer much for the common man. Yes, the protocol will pay them a lot of money, but why wouldn't they? Giving you a 40% APR on what veCRVglOHMcvxDPX tokens is an amazing deal when they are able to direct the Curve Gauge to the pool of their choice. While DeFi 2.0 eventually crashed along with the rest of the market, it was a very enjoyable time that got me into crypto - and I haven't looked back since.

While there were attempts to continue the DeFi 2.0 narrative (remember solidly?), they also failed, mainly because the tokens of DeFi 2.0 had already decayed considerably and no one cared about them anymore. This brief phase could be called DeFi 2.25, as the narrative is only dangled by the thread of on-chain derivative protocols and ve(3,3) tokens that no one is really asking for. For the sake of my sanity, it only makes sense for us to straddle DeFi 2.5 or 2.75 and go straight to 3.0.

If DeFi as a whole has done one good thing, it has taught the degens of the entire community how to continuously improve the process of grabbing funds from investors. We've been able to craft increasingly complex protocols that grab everyone's attention almost instantly. Whether it's a new DEX on Fantom operating as a fork of Trader Joe's, or a 23-figure APY rebase token on Harmony, we can do it. And, don’t act as if DeFi protocols haven’t gotten better marketing-wise, because there are plenty of protocols that are really interesting and offer very visually appealing websites. If we hope to drive a DeFi renaissance, then we need to step back and focus on serving those who can actually help us achieve our goals: the community.No, it’s not the kind of NFT project that asks you to provide your social security number to be whitelisted, but a community that’s really supporting DeFi and trying to innovate on the traditional ideas that TradFi gave us, and get everyone involved.Fat protocol pedestal papers and main pointsMost of this section will focus on what my good friend @0xSami_ wrotepedestal paper

and the ideas he expands on in this oracle. For starters, I'll briefly introduce

Fat Protocol paper

, the paper was first discussed (allegedly) by Joel Monegro in 2016.

The Fat Protocol paper describes the relationship between a system and its applications. Taking the Internet and its largest application as an example, Monegro pointed out that Web2 is characterized by the situation of Fat application > Fat protocol. Giants like Google and Facebook have accumulated trillions in market value, while the infrastructure of the Internet just exists. Applying this to the crypto space, Monegro came up with the Fat protocol theory - that blockchains like Ethereum and Bitcoin (old post I know) can accumulate value like never before, building an infrastructure for small applications that will benefit from the success of the agreement.

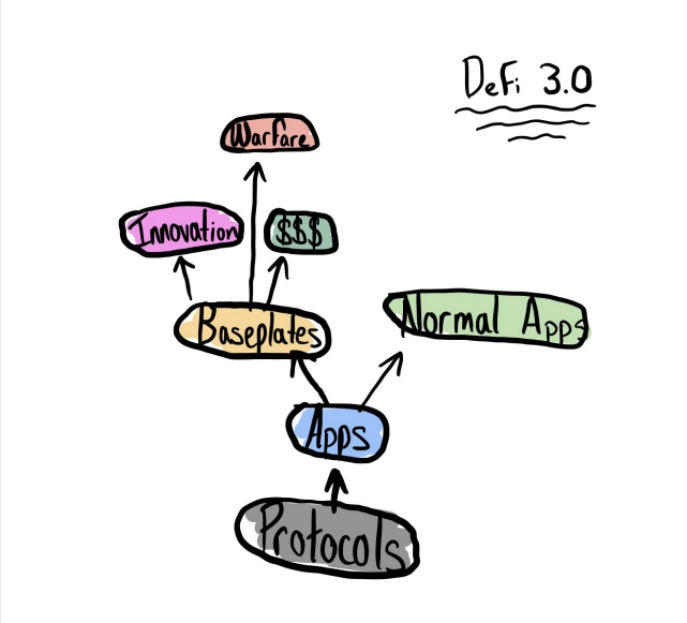

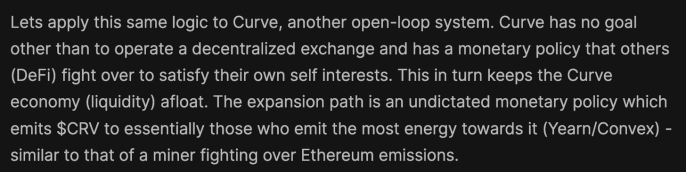

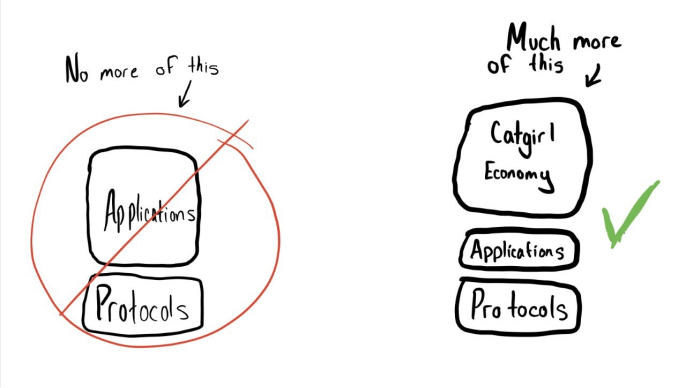

In Sami's words, protocols are too focused on value creation rather than value capture. An example of this is Curve Finance and their ability to capture value and bring it back to the protocol and token holders, while the protocol is trying to amass TVL without the means to scale. Curve is able to serve as a springboard (or pedestal) for protocols like Convex, providing an opportunity to accumulate value while still bringing it back to Curve. Sami describes this as the difference between an open-loop system and a closed-loop system. It can be said that we are optimistic about the cycle without opening.

"I thought all of this was really interesting because I never thought about the philosophy behind Curves and how they could be so powerful. Of course, incentives are good, but anyone can incentivize for a certain period of time and keep it relatively constant. Curve has maintained their moat and is neck and neck with Uniswap as the go-to place for stablecoin swaps. Deep liquidity and a boatload of incentives are the reasons for their success, but Curve has now moved beyond another app status - they've become a pedestal."

If you've played with LEGO bricks before, you know that the bottom of the base cannot be connected to the top of any other brick. This is intentional, as plinths are often very large and designed to support other structures. Curve Finance changed the game, leading me to inevitably send this article to LEGO asking for some updates to their bases - but let me explain.

Imagine a main pedestal resting on a table. Let's call this the protocol layer, and to further simplify, let's call this first layer base Ethereum, because everyone loves Vitalik, and DeFi starts on Ethereum. On top of the pedestal, you might have some blocks put together, and some more on top, forming a little fortress -- these are our applications, protocols that live on Ethereum (the pedestal). While many protocols can happily exist forever and maintain profitability and high TVL, there are also protocols that are able to transcend this status and become the pedestal itself - this is Curve Finance. Imagine that the Curve is a pedestal of its own, stacked on top of the LEGO bricks we placed on the previous pedestal.

Wait, you just said it's impossible--

"I know, but we're breaking down barriers and writing history, give me some time to explain. Curve has surpassed the status of an app and become a protocol of its own, as we have seen Convex and yearn ride on Curve's success and benefit from Curve's deep liquidity and market share. Convex, yearn, and other Curve-related protocols are built on top of the Curve base with additional Lego blocks that are built on top of the Ethereum base. Take a look at this nice picture my graphic designer made for us to observe the separation between normal and benchmark applications in DeFi."

Isn't that amazing? Not only can an application evolve into its own protocol layer, but other protocols can also evolve on top of it and eventually replicate the process if they themselves can generate open loops. Here's a passage from Sami's article that describes the situation better and more coherently than I can.

So, what's next for DeFi protocols? I present to you the idea of an illiquid governance token.

But wait, illiquidity is bad because --

Ahhh, give me a moment. We've seen the evolution from liquidity mining incentives to high APY rabase tokens that translate into PoL - what if we combined these into a token that offered users absolutely no way to cash out? Whales control DeFi because they can migrate from protocol to protocol thanks to the liquidity of reward tokens like cvxCRV, or liquidity pools that are prone to drying up. But that's bad for minnows because they don't have the portfolio size to play at that level and get caught in an upstream battle with asymmetric information. If the protocol can align incentives among stakers by offering revenue-locked (rl) or governance-locked (gl) tokens, then users can easily show their trust and long-term belief in the protocol. These tokens can still accrue value, providing those brave enough with a future share of income and success on many waves of wealth and misery. Protocols will advertise a high APY to get investors' attention, just to reveal that they're not for anyone to make a quick buck - they're for people who are really into the technology. This could perhaps be called ve(3,3)^2, since the protocol could implement a valve mechanism, or perhaps we should ditch ve(3,3) entirely.

Currently you can lock your CRV for up to four years, but the rewards are fluid and users can opt out of reinvesting, providing a small incentive to skew. I believe the solution to this is to weed out those who just want money.

Yes, I know the crypto space is a place where 99.9% of people come to get rich, but what if we can do both in the long run? Wouldn't it be nice to lock coins into a protocol you trust instead of opening 25 tabs and constantly refreshing the Dexscreener to make sure your protocol isn't broken or wiped 75% of your TVL in a single transaction ? Yep, four years is a long time for anything, especially when it comes to locking up your tokens in a protocol that hasn't even existed for four years before you come running to my DMs Middle time. I'm absolutely certain that the protocol could allow users to choose a lower time frame and even see the lock-in token market, like what happened with the DeFi kingdom's JEWEL token.

While all this may seem hyperbolic, I don't think it's beyond the realm of possibility. DeFi lacks new narratives, and reviving the community-oriented aspects of DeFi will definitely bring attention back to the entire track. Maybe I'm dreaming too big, but I think by replicating the Curve model and creating something for the protocol to scramble for, we can actually start building something bigger than ourselves. That being the case, we should probably change the name of DeFi to something like OpenFi, as recent developments show that we are not as decentralized as we should be. If that's a protocol name, then I'm sorry, it's just catchy and I like it.

Anyway, maybe this is all a daydream on my part. Curve Wars was an interesting era, made a lot of money, had a more optimistic timeline, and my substack era was at its peak. It's entirely possible that DeFi 3.0 will be something vastly different from what I've been discussing, but I'd love to see anything new emerge. If you're a protocol struggling to adapt to a narrative twist, maybe adopt some new symbolic principles and emphasize community. This also seems to work well for NFT projects.

no free lunch

Unfortunately for all of us, right now it's just a chain of thoughts. Given that 99% of CTs believe everything will return to zero, none of this may come true. Cough, don't listen to them.

If I could offer you guys 100x new stock, I probably wouldn't because of the SEC. But suppose I could give you some DeFi token codes that have been seriously overlooked in the past month, would I????

Regardless of whether this argument holds true, I am very bullish on the future of DeFi, probably more than ever. I'm seeing a ton of innovation happening with AMMs and derivatives, more people than ever are getting DeFi support, and a general lack of bullish sentiment on the timeline means we're long overdue for a pump -- But I guess we'll have to wait and see.