Circle Doubles Valuation After SPAC Deal Terms Update

This article comes fromDecrypt, by Liam J. Kelly

Odaily Translator | Nian Yin Si Tang

This article comes from

Odaily Translator | Nian Yin Si TangAnnounceIn about six months, Circle's valuation has doubled.

Announcefirst announcedReached new deal terms with special purpose acquisition company (SPAC) Concord Acquisition Corp, valuing Circle at $9 billion, up from $4.5 billion announced in July 2021.

Concord and Circle in July this year

merger plans, valuing the stablecoin issuer at $4.5 billion at the time. All parties involved are now the same as in the original deal, except that the two companies have updated the terms to replace last summer's arrangement.

Circle said in a press release that the latest valuation is partly related to the continued growth of its dollar-pegged stablecoin USDC.

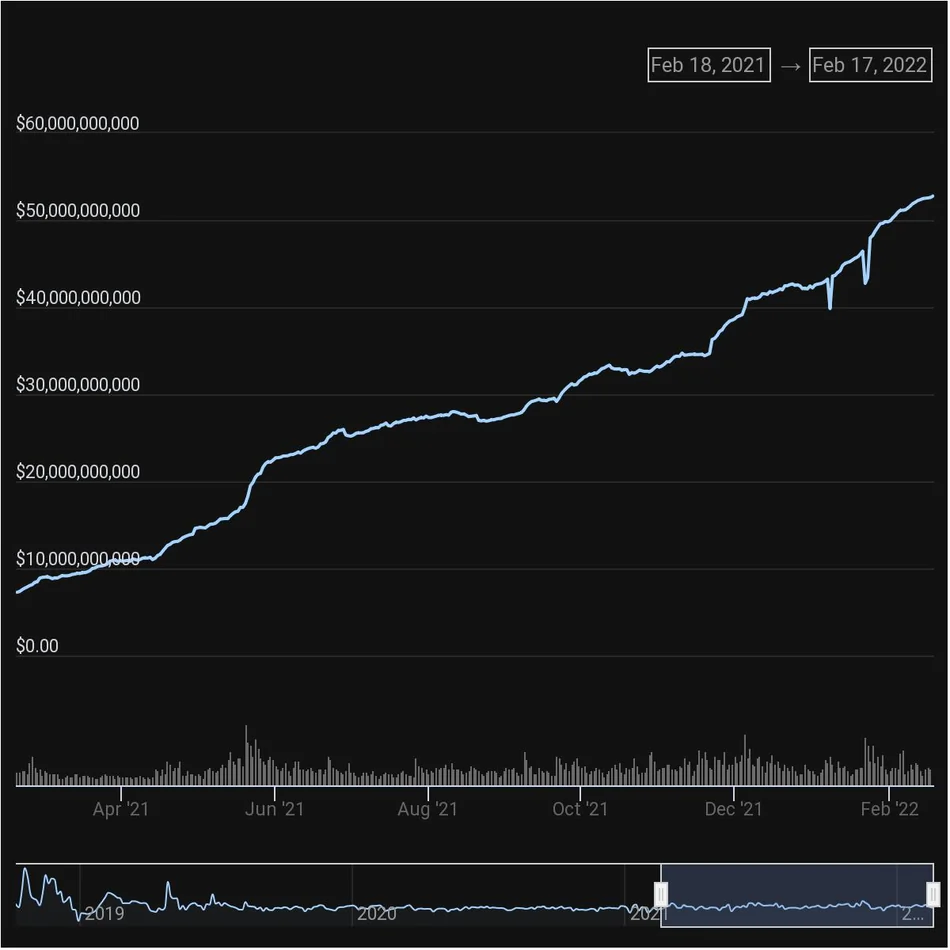

USDC currently has a market cap of just under $53 billion, according to data provided by CoinGecko. In July 2021, when Circle and Concord first struck a deal, that figure was $25 billion — roughly half of what it is worth today.

image description

Bob Diamond, chairman of Concord Acquisition Corp and chief executive of Atlast Merchan Capital, said the valuation update was driven in part by Circle’s growth.

"Circle's rapid growth and world-class leadership are fueled by its regulatory-first mindset and commitment to building trust and transparency in global markets. We believe our new transaction is attractive as it retains Concord's The ability for public stakeholders to engage with this great company," said Diamond.

Despite USDC's impressive growth, it still falls short of Tether's USDT, which currently has a market cap of nearly $79 billion. USDT is the largest stablecoin in the industry, but like USDC, it is not immune to criticism.

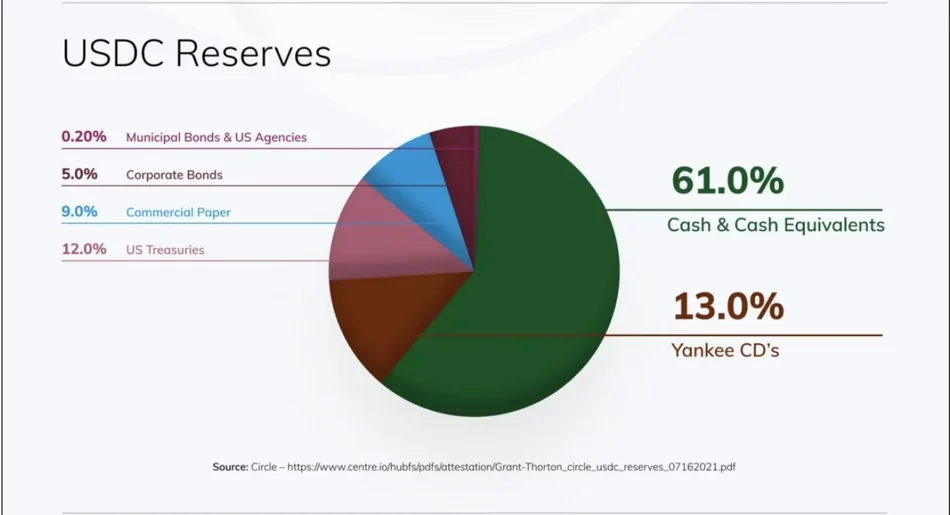

secondary titleSkepticism over Circle and Tether stablecoinsTwo of the largest stablecoin issuers in the cryptocurrency space have come under frequent fire for claiming that every stablecoin floating in the market is backed 1:1 by the U.S. dollar.

Only 61% are cash or cash equivalentsdisclose. The remaining 39% is a hodgepodge of Treasurys, Yankee certificates of deposit, commercial paper, and various bonds.

Things are not much better for Tether. Around the same time, Tether

disclose