Foresight Ventures Weekly Market Report: Avalanche’s TVL Proportion Increases, NFT Market Trading Volume Cools Down

Summary:

Summary:

Avalanche's TVL share increased significantly.

This week's NFT trading volume fell as Looksrare's earnings fell, and Cryptopunks were active.

secondary title

The total lock-up volume of the public chain

secondary title

Proportion of TVL of each public chain

secondary title

ETH locked position situation

BSC locked position situation

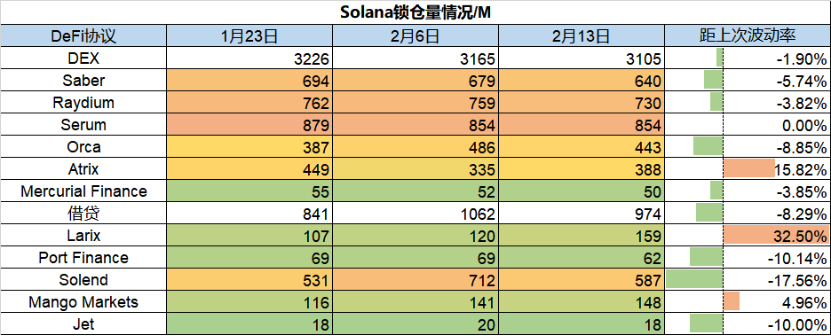

Solana lock-up volume

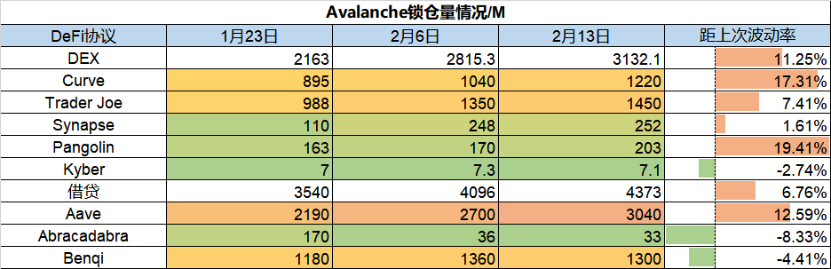

Avalanche lockup volume

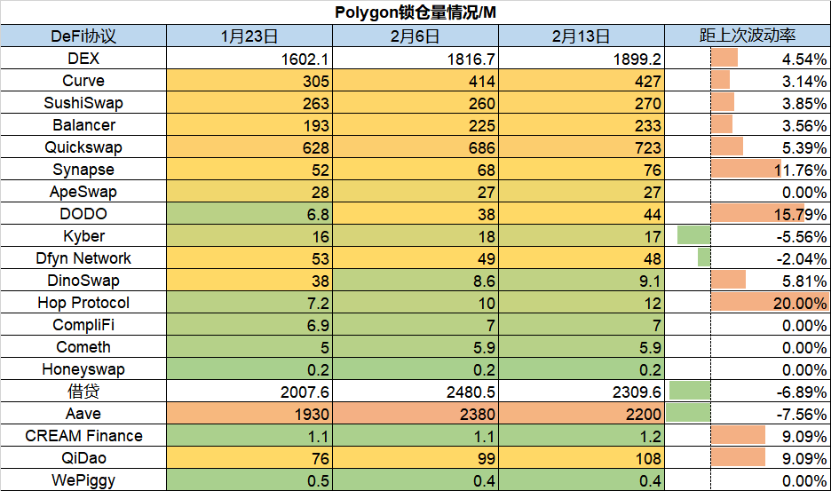

Polygon lockup volume

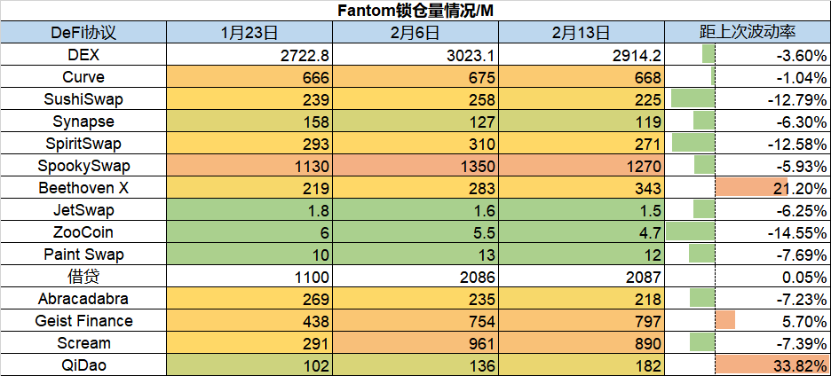

Fantom lockup volume

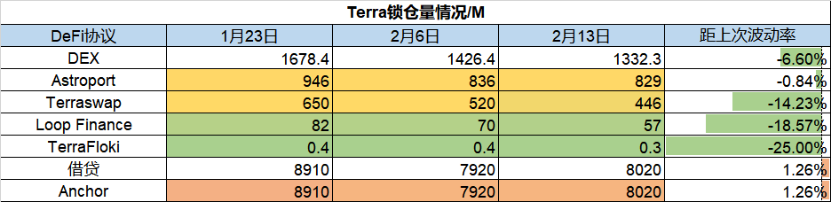

Terra lockup volume

This week, the TVL of the Avalanche ecosystem still showed strong growth, while the rest of the chains had little change. Among them, the protocols with better performance include DODO on the ETH chain and QiDao, a lending protocol on the Fantom chain. QiDao is a stablecoin lending protocol. Users can obtain MAI stablecoins by pledging token assets without paying interest.

secondary title

Changes were small this week.

secondary title

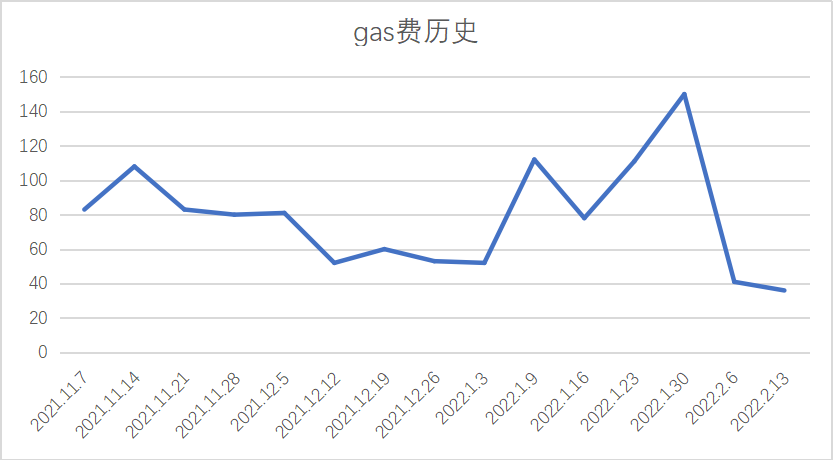

The current on-chain transfer fee is about $5.7, and the current Uniswap transaction fee is about $19.3. The gas fee level continues to decrease, and the activity further decreases.

NFT market overview:

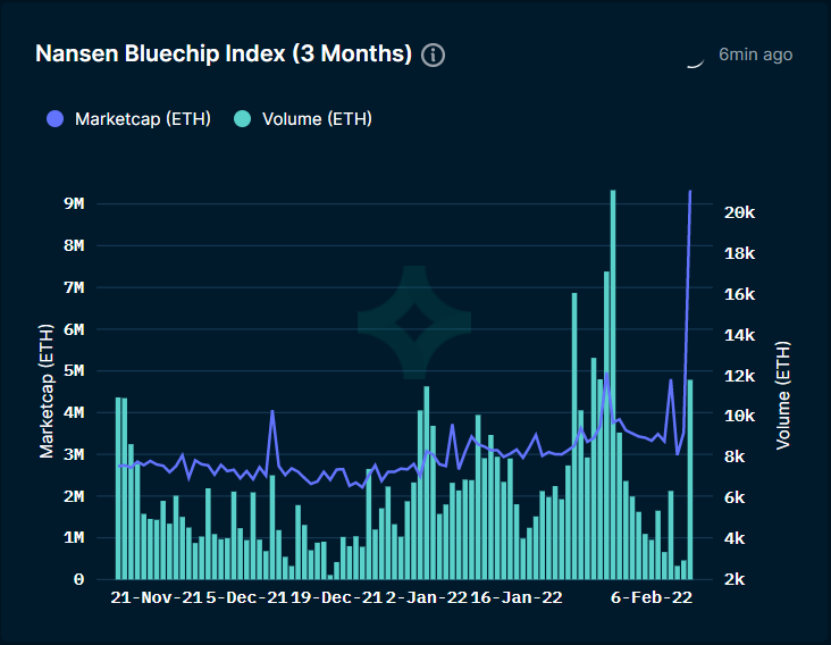

NFT market value and trading volume:

secondary title

NFT price changes and rankings:

This week's NFT trading volume was reduced by Looksrare's revenue reduction, but on the 12th, the CryptoPunks trading activity was active, which greatly increased the trading volume of the NFT market. There are two main things that have recently affected CryptoPunks:

first level title

The latest financing of the project