How to carry out a wonderful encryption business narrative?

Author: Liquidity Wizard, Founder of Tokemak

secondary title

Preface & Quick View of Core Ideas

Editor's note: The article I chose today not only shared the interesting concept of "fluidity is bandwidth", but also has a lot to learn about "how to build a heuristic point of view\concept", in other words It is "how to make a wonderful narrative".

For encryption entrepreneurs, we can learn from it: how to make good use of "narrative" to improve the value recognition and product adoption of our own Web3 products.

For investors, we can understand how excellent narratives are constructed from this case, and use the predictive ability of narratives to help their investments instead of letting their investments be brainwashed and utilized by various narratives.

The core ideas of this article are as follows:

1. Web3 is the Internet of value, and the transmission of value is more important than the transmission of information

2. In the Web3 era, mobility is bandwidth

3. The exponential bandwidth upgrade has brought innovation and prosperity in the Internet age, and the upgrade of mobile bandwidth will lead to even more amazing innovation and prosperity

4. Tokemak is the engine of liquid bandwidth, playing the role of the underlying infrastructure in the era of liquid bandwidth

text:

text:

The Internet is evolving at a high speed.

This giant data exchange network known as the 'Internet' is evolving into an increasingly complex ecosystem where value can be exchanged in the form of tokens. Web3 will revolutionize economic systems, changing the way businesses operate, the way individuals work and organizations collaborate, and the way products are delivered and consumed. This decentralized economy requires electricity and a network (just like the internet).

Also, it requires blockchain.

Most importantly: it requires liquidity.

The essence of this article is a discussion on liquidity, why liquidity is not only the bandwidth of the future "Internet", but also the bandwidth of the entire decentralized economic system in the future. We will then briefly discuss Tokemak’s role in dramatically increasing liquidity bandwidth.

"Broadband mobility" is within reach.

To better grasp the concept of "liquidity is bandwidth," one should first understand what these two terms mean. We will start with the definition of bandwidth, because it is easier to understand, and then we will talk about liquidity.

Bandwidth

Network bandwidth refers to the speed at which data moves across the network. Therefore, higher bandwidth means greater data flow. In a world where users communicate with each other via the Internet, it is clear that higher bandwidth means a more developed Internet economy (think of all the hype surrounding the concept of 5G).

Bandwidth is measured in bits of information per second (bits/s). In the early days of the modern Internet, consumers used dial-up modems that transmitted data at 56 bits per second. This made possible early internet products like web pages and email.

The game changed rapidly when Ethernet arrived. Ethernet boosts bandwidth at speeds of up to 10 Mbit/s. This means Ethernet is 180 times more efficient at transferring data over the Internet than a dial-up modem. The era of high bandwidth and high-speed data transmission has arrived!

Things are changing even faster now that bandwidth is between 1-10Gbit/s (18,000-180,000 times more efficient than dial-up data transfer). This high-speed bandwidth unlocks a range of Internet products that would have been unimaginable with the low bandwidth of dial-up. Streaming services like Netflix, cloud-based gaming, and always-on servers in the cloud are all made possible thanks to increased Internet bandwidth.

fluidity

fluidity

Liquidity is a poorly defined concept. In DeFi/Web3, liquidity is used to refer to tokens (value) provided or stored in various scenarios. While there is nothing wrong with the everyday usage of the term, we will try to interpret it a little more deeply.

We want to define "liquidity" in a more targeted way, i.e. "the 'available liquidity' that can be used to exchange one token for another". In a sense, liquidity is the potion for trading and converting tokens. For example, I have ABC token and I want to trade or "convert" it to XYZ token, I need to interact with the liquidity.

In trading terms, I need to interact with the liquidity of ABC/XYZ by selling ABC/XYZ. Selling ABC/XYZ means I sell my ABC tokens in exchange for XYZ tokens.

Next, let's discuss the "good" and "bad" of liquidity, let's start with the bad.

Inferior liquidity is when you interact with it, you lose a lot of value, so "thin liquidity" is inferior liquidity. Thin liquidity occurs when there are not enough tokens available to trade. For example, you want to sell ABC for XYZ, assuming that every 1 ABC is currently worth 1 XYZ. If there aren't many XYZs available as liquidity, there will be an exchange premium for available XYZs. You would have sold 10 ABCs to get the 10 XYZs you would have received (at a 1:1 price).

Instead, you only get 8 XYZ in exchange due to illiquidity. By interacting with thin liquidity, you bought XYZ at a premium, losing a significant amount of value in the process (in the above case, losing 2 XYZ).

Prime liquidity, on the other hand, means that you retain most of the value when you interact with it. As you can imagine, "deep mobility" is premium mobility.

Let's go back to the example above. To recap, you want to sell 10 ABCs for XYZ, and the price of 1 ABC is currently worth 1 XYZ. If the current liquidity depth is good, in other words, there is a lot of XYZ available for exchange. In this case, you can get 9.9999 XYZ by trading. You still get a little less than 10 XYZ, which is the cost of acquiring liquidity. But you keep pretty much the entire value it had before the swap.

'Deep liquidity' means that value is preserved for users as tokens are traded. 'Thin liquidity' means that there is a lot of loss in value when tokens are traded.

In other words, when there is deep liquidity, you can trade at the market's price. With thin liquidity, trading prices can fluctuate wildly when you interact with it.

Who needs liquidity?

Having covered bandwidth and liquidity, we next need to understand why this is important and who really needs liquidity. One word: everyone. If this coverage is not broad enough, it should be said that all people and things need mobility.

The above discussion might lead to the impression that only traders should care about liquidity. In the world of Web3, this is more or less the case. All users interact with liquidity because all users need to interact with various token-based economic systems by depositing, withdrawing and exchanging tokens. Likewise, all protocols need to interact with liquidity, since protocols themselves buy, sell, and lend tokens in interaction with other protocols.

Let's look at a few examples.

Example 1: Yield farming

First, let's look at an example where a user wants to earn money. Users hope to earn income by staking ABC tokens. He is likely to start by staking ETH or USDC (or other stablecoins), so he needs to interact with the liquidity of ABC/ETH to obtain the initial ABC tokens for staking.

At the same time, he started to receive token benefits. Once he has claimed token proceeds, they may want to sell tokens to pay bills, buy items, or make other investments. Likewise, he will interact with liquidity to achieve his goals.

Example 2: Game

A game user wants to buy properties and an avatar in a new 'Play-to-earn' game. The game only accepts the in-game currency "ING". Users first need to interact with ING's liquidity to obtain ING. Next, the user uses ING to purchase real estate NFT and avatar NFT, and interacts with the liquidity again (this time the interaction is the liquidity of ING and NFT).

Example 3: Protocol Interaction

Many protocols have functions that convert their TVL to something else when certain conditions are triggered. For example, suppose protocol A interacts with protocol B to conduct hedging transactions when the price reaches a certain point.

When the condition is triggered, protocol A needs to take a certain amount of protocol token AAA and exchange it for protocol B’s token BBB so that it can interact with protocol B. A specific example is the liquidation of MakerDAO vaults when the value of the collateral falls below the minimum collateralization rate. When this happens, the MakerDAO protocol will sell enough collateral to pay off the debt, in addition to existing liquidation penalties.

Example 4: DEX

DEX relies on the liquidity deposited by liquidity providers so that its entire business model can operate. More liquidity deposited into the protocol means they can offer better transaction prices (less value loss for users). This in turn attracts users to trade here instead of going to other DEXs, which increases the trading volume of that DEX. An increase in trading volume, of course, means an increase in the revenue of this DEX.

After examining several examples of the use of liquidity in the Web3 world, we move on to the issue of liquidity bandwidth.

Liquidity = Bandwidth

Fundamentally, in this brand new "Internet of Value", liquidity is needed to do everything. Mobility thus functions as bandwidth in this world.

To recap, with the development of the data Internet, we need higher bandwidth to do more things and transmit more data. Low data bandwidth means that participants cannot transfer more data. You simply can't start Netflix until you have the internet bandwidth to reliably stream movies.

In the Internet of Value, more liquidity is a prerequisite for doing more and transferring more value. Thin liquidity means that participants do not transfer greater value because their value loss is too high. Imagine an economy where value cannot flow freely because every time it is moved, exchanged or transferred, value is dissipated. And this is the status quo of DeFi and Web3.

(Editor's note: The Internet of Value is a concept relative to the Internet of Information. The difference is that the former can load and transmit user assets in addition to information. The underlying technology of the Internet of Value is blockchain.)

Value transfer has replaced data transfer, and liquidity is the new bandwidth of Web3 networks. The problem is, current liquidity bandwidth is "thin" and unreliable. Let's take a look at how many tokens are currently idle and not being utilized as liquidity. The actual situation is: most.

Taking the ALCX token as an example, less than 20% of the ALCX circulating supply is used as liquidity on Sushiswap (a DEX that provides token incentives). This is not counting the additional illiquid supply, so the vast majority of ALCX tokens are not being efficiently used as liquidity. Note that I am not referring specifically to ALCX, on the contrary, this is the case for most coins.

The root cause of thin liquidity is that in the DeFi world, there is too much resistance for users to become LPs. For a normal token holder, there are three key reasons for their reluctance to provide liquidity:

User Experience Challenges

risk of impermanent loss

capital inefficiency

The source of the user experience challenge is that only high-end users will provide liquidity to Uniswap, Sushiswap or Balancer. Ordinary users are daunted by the complete set of interactive processes that provide liquidity.

For those equipped to face the UX challenge, they still need to understand impermanent loss and be willing to take that risk. Additionally, they need to provide market-making bilateral tokens, which makes them very capital inefficient for providing liquidity. For example, if they want to provide ABC liquidity, they need to own and provide both ABC tokens and ETH tokens in order to provide ABC/ETH liquidity.

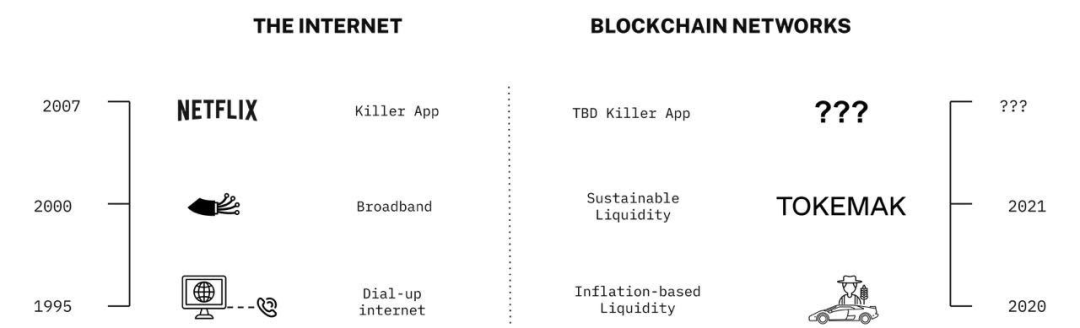

For all the above reasons, the current liquidity of DeFi is in the dial-up network era of the Internet, just because there is not enough liquidity to realize and support low-loss value transmission.

In addition, the existing liquidity of various projects is very unreliable. Projects with tokens generally incentivize their liquidity by producing tokens as rewards. This inflation-based liquidity is unsustainable and can be closed at any time. Stop rewarding? That protocol would lose liquidity. Keep rewarding? The value of protocol tokens will be diluted.

Neither is a good outcome.

Tokemak is a solution that aims to solve these problems by unlocking deep, reliable and sustainable liquidity bandwidth.

How Tokemak solves the liquidity problem

Tokemak is a tool that tries to accelerate the advent of the "Mobile Broadband Era". This bandwidth will unlock coveted Web3/DeFi/GameFi applications.

Tokemak's liquidity engine will power it all.

So, what is Tokemak?

Tokemak is the unified liquidity layer for Web3, across all DEXs, chains and layers. It removes the friction for users to become a liquidity provider and improves liquidity bandwidth across the board. The diagram below shows the functionality of Tokemak.

Starting at the top of the graph, any user or protocol can now provide liquidity by simply depositing their ABC tokens directly into Tokemak. They do not need to experience the experience challenges at the DEX level, nor do they need to bear the risk of impermanent losses.

They can deposit only the assets they own without pairing with other assets (ETH, USDC, etc.). In this way, Tokemak draws assets from the unilateral asset pool, transforming unilateral liquidity supply into bilateral liquidity in the market.

Users known as "liquidity guides" guide the distribution of liquidity in all DeFi. This distributes the "economic bandwidth" provided by Tokemak to provide liquidity to the entire crypto world, ensuring the liquidity of tokens and ensuring the success of DEXs, chains, L2 and stablecoins. Then, users and protocols can go to DEX and interact with the deep liquidity provided by Tokemak through buying and selling.

(Editor's note: "Economic bandwidth" is a concept proposed by Bankless founder Ryan Sean Adams. This concept emphasizes that the key to public chain competition is not "TPS", but economic bandwidth. Economic bandwidth is determined by the circulation of public chains or application tokens The market value and its transaction depth are determined. In short, it is determined by the token value and market depth of the public chain. For example: in the early days, synthetic assets in Synthetix, a synthetic asset trading platform, could only be generated through its token SNX as collateral , which limits the asset issuance ceiling and long-term growth of the platform, because the price of SNX and the market value of tokens are too low (insufficient economic bandwidth), and later Synthetix decided to include ETH in synthetic asset collateral, which takes advantage of ETH's huge economic bandwidth, The upper limit of the economic bandwidth of the Synthetix protocol has been increased by 78 times. Ryan Sean Adams believes that the difference between the economic bandwidth of ETH and BTC and assets such as USDC lies in its non-permissioned and decentralized free attributes.)

If you look at Tokemak's diagram again, you'll notice something very interesting. The supply layer is the same as the demand layer: its participants are composed of users and protocols.

future

future

So what happens when the limits of liquidity bandwidth are exploited? This is the final state of liquidity bandwidth, and Tokemak, as a liquidity engine, will fulfill the mission of promoting the entire network.

At this point, the potential of the decentralized economy will be fully unleashed.

As we move toward a future of "broadband mobility," the very act of "imagining what that future looks like" becomes challenging in itself. While we know deep liquidity will enable reliable pricing and less exchange volatility, it’s the long-term implications that are truly fascinating.

Trying to imagine what will be born on the coming deep liquid bandwidth is as difficult as someone using dial-up Internet in 1995 trying to imagine Netflix streaming a video signal to a mobile phone. The future innovations unleashed by deep liquidity bandwidth will be more important than the innovations triggered by Internet broadband.

Nonetheless, I will try to anticipate a few examples of what I believe to be upcoming innovations based on broadband mobility.

First, consider how challenging it is for individuals in developing countries to obtain loans to make major purchasing decisions, such as buying a house.

In most cases, the financial infrastructure (i.e. banks) either doesn't exist or keeps people out. And in the new world of democratized finance with deep liquidity bandwidth, an individual's cash flow can be verified on-chain, and lenders around the world can provide loans or mortgages to this individual on demand. Smart contracts can instantly check the flow of funds and verify an individual's on-chain activity and transfer funds to his wallet the moment the person requests a loan.

Second, imagine an entrepreneur who has a great idea for a new on-chain startup but lacks the capital to get it off the ground. In the future, he will publish a brief business plan online and submit it to the first 'idea investors' using a token fundraising template. Both the individual and the protocol will look at the material, evaluate the merits of the idea, and fund the new venture at the seed (or pre-seed) stage. This simplifies the entire capital raising process into a job that can be done as soon as the idea and model are formed, which is every entrepreneur's dream.

Finally, imagine the world of GameFi and the Metaverse we're moving into. All people will own their identities, their data, and the cash flows associated with those data and identities. The giants of Web2 can no longer hold users. Based on deep liquidity, tokens used to pay and incentivize users can be distributed to individuals in real time on the blockchain. All forms of entertainment and gaming can distribute value and tokens to participants as users interact, buy, contribute and simply spend time in a virtual 'always-on' universe, much like in video games today Getting a high score is as easy as it gets.

All in all, the upcoming deep liquidity bandwidth will allow any value stream to flow freely without friction, middlemen or rent-seekers.

The future will be even more incredible and unimaginable than the examples described above. Entire economies will soon be running on liquid bandwidth, and you, here, have foretold this prophecy.

Editor's note: This article is a model of Web3 narrative, and its ultimate goal is to push Tokemak to the fore through the narrative of "liquidity is bandwidth" and provide more users (including ordinary users and protocols) and investors It has understood and recognized its value, and gained more adoption and investment, but the full text does not have a blunt sense of marketing. This article was translated and reprinted by many Chinese media in January this year. After reading this article, many readers accepted and even spread the concept of "fluidity is bandwidth" by word of mouth, and became very interested in the project.

This is the power of great storytelling.

So, what effective narrative methods can we extract from this article? might have:

1. Carefully chosen analogies

The role of analogy is to use familiar old concepts to help people understand and identify similar new concepts. The key analogy in this article is "bandwidth" and "liquidity". It is worth noting that the key step in connecting these two concepts and making the analogy credible is the two pre-inferences put forward by the author: "Liquidity reduces the loss in value transmission." and "Information Internet Transfer information, and the value Internet transfers value.” The establishment of this wonderful analogy is the basis of the full text.

2. Repeat key concepts

For key concepts, it should be repeated repeatedly and from multiple angles. If readers can only take one piece of information with them when they leave, that should be it. The key concept in this article is "Liquidity is bandwidth, and Tokemak is the infrastructure of liquidity."

3. Interested

In the narrative, there should be more examples that are closely related to the target audience and can empathize. The main targets of this narrative are users, investors, and protocol developers. The article gives the example of buying a house with a loan and project financing.

4. Moral Judgment and Sublimation

If possible, set up a moral imaginary enemy that the audience can empathize with in the narrative. The imaginary enemy in this article is the Web2 giant that holds users tightly. In addition, we should pay attention to the grandeur of the narrative and make good use of sublimation, such as the end of the article.

In addition, in addition to the above characteristics, a good narrative also has elements such as being easy to become social currency, spreading fission extremely fast, and gaining identity. "There are detailed descriptions.

In the application of narrative, project operators can gain recognition and dissemination through narrative rather than boring product introductions by learning the above skills; investors need to distinguish the difference between "narrative" and "objective facts", especially in In analogy narrative, it is necessary to clearly distinguish the difference between "analog" and "noumenon". For example, in the analogy of "fluidity is bandwidth", the performance of the public chain is actually more similar to bandwidth, and the Internet of Value is not just about the transmission of value, the transmission, storage, and verification of information are equally important. And there are many other elements that are as important as liquidity, or even more important.

Finally, if you are interested in Tokemak, you can read Mint Ventures' previous in-depth research report on the projectOriginal link。