Paradigm: The perfect bottom-buying of Bitcoin based on strength, the road to the top of the new paradigm investment

Original Source: Overseas Unicorns

Original Source: Overseas Unicorns

Paradigm means Paradigm, a name derived from the conviction of its two founders, Matt and Fred, that blockchain and digital currencies represent a paradigm shift. Matt and Fred come from Sequoia and Coinbase respectively, have experienced multiple cycles of cryptocurrency, and have compatible and complementary crypto worldviews. They founded Paradigm, a cryptocurrency investment agency, during the 2018 bear market.

In March 2019, I told how Matt Huang and his father invested in ByteDance during its toughest round. If you don’t know this past and Huang Qifu’s legendary story, I suggest you read this article first:"He traveled to Beijing from Silicon Valley at the age of 24, met Zhang Yiming, invested in Toutiao and now earned 2,000 times."

Matt and Fred had started Paradigm by then, but I obviously couldn't have imagined what the organization would achieve in the next few years. Paradigm’s first $400 million fund has attracted endowments from Harvard, Stanford and Yale, the first time a cryptocurrency investment institution has been recognized by a leading endowment fund.

Over the past 3 years, they have perfectly bottomed out Bitcoin, capturing large unicorns like FTX, Fireblocks, and BlockFi. More importantly, Paradigm is the institution most deeply involved in project construction in the market. It made a bet when there was only one person in Uniswap, almost working with the founder to implement the agreement.Paradigm does not officially disclose its performance, but according to the Financial Times, as of the first half of 2021, Paradigm's first fund has achieved 200% IRR, and the asset value reached 10 billion US dollars at that time, with a return of more than 20 times.

How did Matt and Fred do it all? I found some answers from their encryption worldview and personality, Matt has a deep understanding of economics and financial systems, and Fred's real practitioner's perspective and understanding of cryptocurrency business models are also crucial.

Together, they constitute the strongest pair of founders in the field of cryptocurrency investment: the perfect bottom-buying of $4,000 in Bitcoin is Paradigm's famous work, but Matt and Fred are not lonely heroes in the bear market, and it is by no means luck. They learned from value investing guru Seth Karman and listened to what the market was telling them to buy. Project co-construction and research priority have become the distinctive features of Paradigm, but this is not a pre-planned strategy by Matt and Fred, but more of a natural extension of their crypto native talent-first strategy and helpful character.

Dare to bet at a high valuation is often an advantage of an institution's large management scale, and it is also the reason why it can expand its management scale.In 2021, Paradigm overfulfilled its new fundraising, with a single fund reaching US$2.5 billion, surpassing a16z's US$2.2 billion encryption fund and becoming the largest encryption investment institution under management.Paradigm is also on this road of investing in late-stage companies while digging up early ideas and helping to build them together. In 2022, when competition is escalating sharply, Paradigm's good investment taste, institutionalized combat capabilities, and persistent encryption worldview will still keep it ahead.

The following is the content of this article, and it is recommended to read it in combination with the following points.

01. Origin

Find the killer app

Compatible and Complementary Encryption Worldview

shifting paradigm

02. Fame

The market will tell you when to buy

Create Alpha with Teams

Investing in ideas and behemoths at the same time

03. Next step

good taste is essential

Towards Institutionalized Operations

first level title

secondary title

Find the killer app

On February 19, 2014, Forbes reported an exclusive that Sequoia Capital had "stealed" talent from Goldman Sachs and Twitter, bringing in a pair of young partners.

Andrew Reed is from Goldman Sachs. Companies such as Robinhood, Figma, Loom, Zapier, and SourceGraphe, which have been written by overseas unicorns, are all his investment cases in Sequoia.

That's Matt Huang from Twitter. After the media advertising analysis startup Hotspots he founded was acquired by Twitter, he stayed at Twitter in charge of advertising products.

Candidates interviewing Sequoia USA are usually required to submit a mock investment memo, Matt chose to write Coinbase.Although Matt was successfully selected, he could not prevent Sequoia from vetoing Coinbase twice. The tens of billions of dollars of the company was captured by Matt in another way, becoming a member of the Starling Ventures portfolio founded by his father Huang Qifu after his retirement.

Nevertheless, Matt Huang did not start to have a deeper personal relationship with his future co-creator Fred Ehrsam until 2017. After leaving Goldman Sachs in 2012, Fred Ehrsam became the co-founder of Coinbase, and in February 2017 he chose to resign as president and quit the $1.6 billion company.

On a weekend in February 2017, Fred discussed the concept of Metaverse with 10 executives from major VR-related companies such as EA, Unity, and Activision, and reached a consensus conclusion:The root of Metaverse is at the data level. VR can digitize the assets of the physical world into Metaverse, and the widely recognized data layer must be blockchain and cryptocurrency.

Soon, Fred published the article VR is a Killer App for Blockchains on his personal blog to spread this consensus to the public.

Matt Huang saw this article, and made a typical investor behavior - emailing Fred to chat about his VR business idea. After the conversation, Matt realized the uniqueness of the other party and was willing to invest in his next company or work with him in the future. In the follow-up, the two people also maintained email exchanges and continued to discuss cryptocurrency-related entrepreneurial opportunities.

The fit between the two is not surprising at all——"VR is blockchain's killer app" pretty much sums up Matt's investment thesis for his final year at Sequoia.

The first is the killer app of "VR". In the middle of 2017, Matt shot Limbix, a VR psychological counseling project, and led its $7 million A round of financing. At that time, the entire office of Sequoia seemed to be caught in the frenzy of VR.

Then there's "Blockchain," where Matt Huang at Sequoia drove investments in two cryptocurrency hedge funds, MetaStable and Polychain Capital. And Fred was one of the first investors of Polychain Capital.

Then there's "Blockchain," where Matt Huang at Sequoia drove investments in two cryptocurrency hedge funds, MetaStable and Polychain Capital. And Fred was one of the first investors of Polychain Capital.

ICOs allow everyone to be a "cryptocurrency hedge fund", so why make others charge management fees and carry? Matt has the answer to this question in 17 years:

"This statement is correct. But just like in the stock market, investment institutions (management of more than 100 million US dollars in stock assets) also have to submit 13F position reports.(But you can't copy homework, because) position size and entry time are very important."

Finally, there is the "killer app". After the VR boom subsided to a certain extent, Matt and Sequoia participated in Orchid Labs' $4.7 million seed round investment at the end of October of that year. open source blockchain project. Matt describes the project as "The First Killer Apps That Can Gain Broad Reach Outside of Bitcoin”。

Another killer application he shot is Filecoin, a distributed cloud storage network, whose total market value of tokens is currently close to 18 billion US dollars.

Both investments are in the form of future token agreements rather than traditional equity investments. Even at the peak of the 17-year bull market, Sequoia's partners were a little out of line for investing in this way.

But Matt has the confidence to do so—The direct cause of Bitcoin was the global financial crisis in 2008, which destroyed Huang Qifu's long-term asset management. We have reason to believe that Matt realized the uniqueness of cryptocurrency in the early days and entered this field.So he has enough experience to distinguish signal from noise:

“Once you spend enough time in the cryptocurrency space, there is a lot of real progress happening on the frontier. There are a lot of strong teams working on interesting problems, and I think it’s a very promising space to invest in.”

There is a huge amount of talent leaving Google and Facebook to enter the cryptocurrency space, which I think is a very positive sign. "

secondary title

Compatible and Complementary Encryption Worldview

In the article in 2019, I pointed out that Matt Huang's growth experience can be seen in the guidance of his family:

"Matt got a bachelor's degree in mathematics from MIT, and his father got a bachelor's degree in economics from National Taiwan University. After Huang Qifu went to Stanford, he found that the mathematics education in Taiwan University was very poor. He only took calculus in his freshman year, so he went to Stanford. When I was in graduate school, I took mathematics with the undergraduates, and in the third year, I spent all my time in the mathematics department.

Of course, the background of the Department of Mathematics also has some shortcomings. Huang Qifu’s recollection is: “Stanford changed my destiny. I learned very difficult mathematics in a short period of time, and I was able to use it to solve very difficult problems. Because I first asked an economic question, and then I went to find tools. People from the mathematics department have a lot of tools in their hands, but they don't know what questions to ask. '

So Matt Huang also spent a lot of time dealing with good problems during his college years.

During the summer vacation of his sophomore year, Matt worked as an intern at Goldman Sachs, doing real-time bond price prediction related work.

In the summer vacation of his junior year, Matt worked as a researcher in the School of Economics at MIT, studying Financial crises (financial crisis), Knightian Uncertainty (Knight's uncertainty) and Flight-to-Quality (safety investment transfer). And his father's fund had just encountered a financial crisis a year ago.

In the world of blockchain and cryptocurrency, Matt Huang is also accustomed to using economics to understand problems.

How to understand the tokens issued by ICO? Excluding the bubble boosted by speculators, Matt Huang believes that the Fisher formula can be used to analyze the pure utility value of an ICO token:

Note:

Note:

Fisher's formula is MV = PQ, where M (Money) is the money supply, V (Velocity) is the velocity of money circulation, P (Price) is the commodity price, and Q (Quantity) is the quantity of the commodity.

The economic value here can be directly understood as the value of goods, that is, 100 million tokens are exchanged for goods worth 1 billion US dollars.

What is the difference between Bitcoin and other tokens? This is usually an interesting question, as Jack Dorsey, the founder of Twitter and Block, is already a recognized Bitcoin maximalist in the community and has publicly opposed Ethereum many times. And Matt still seems willing to understand the difference from an economic point of view:

Bitcoin is seen as a store of value. Matt emphasized such a "tautologous truth that many people have not yet realized": for a currency to have value, people must be willing to hold it, which is a store of value.

Note:

Note:

The Malthusian Panic was a prediction by the British political economist Malthus who asserted in the early 19th century that the population would grow faster than the food supply. When this situation arises, starvation or war also follows.

Menger's intermediate goods are the "second-order, third-order, and fourth-order goods" proposed by Menger, the founder of Austrian economics. First-order commodities directly meet demand, such as bread, which requires second-order commodity flour and third-order commodity wheat to produce.

Why are people willing to buy art, especially digital art? The NFT craze in 2021 makes this issue more relevant. Matt thought earlier, and also introduced some economic concepts:

It can also be used for value storage. There is obviously a difference between Bitcoin and rare works of art such as Van Gogh's authentic works. Matt believes that in the post-cryptocurrency era, the remaining demand for art lies in the display of wealth.

When distinguishing the value of authentic works and imitations, Matt’s point of view is that art has a certain utility, but its value lies in the storage and display of scarcity and wealth. In the meantime there is a feedback loop here:Cultural resonance helps drive up prices, and vice versa.This explains why people are still willing to buy and hold a Crypto Punks image when it can be right-clicked and saved.

It seems common knowledge that rarer, more fortunately numbered NFTs are more expensive. But when Matt researched Crypto Kitty, he thought it represented a strategy of buying and holding "Schelling Points" to make a profit.

Note: A Schelling point is a game-theoretic concept that refers to people's propensity to choose in situations where there is no communication, either because it seems natural, special, or relevant to the chooser.

……

In the crazy bull market from less than 17 years to the beginning of 18, Matt's framework for understanding new things showed unique consistency. And Fred has reached a clever fit and complement with him.

Fred also believes that the Fisher formula is the best theory to measure the value of tokens - the tokens issued in this round of ICO are not stocks, they do not represent future cash flow; nor are they commodities, because although many projects claim to have a token burning mechanism , but are rarely implemented.

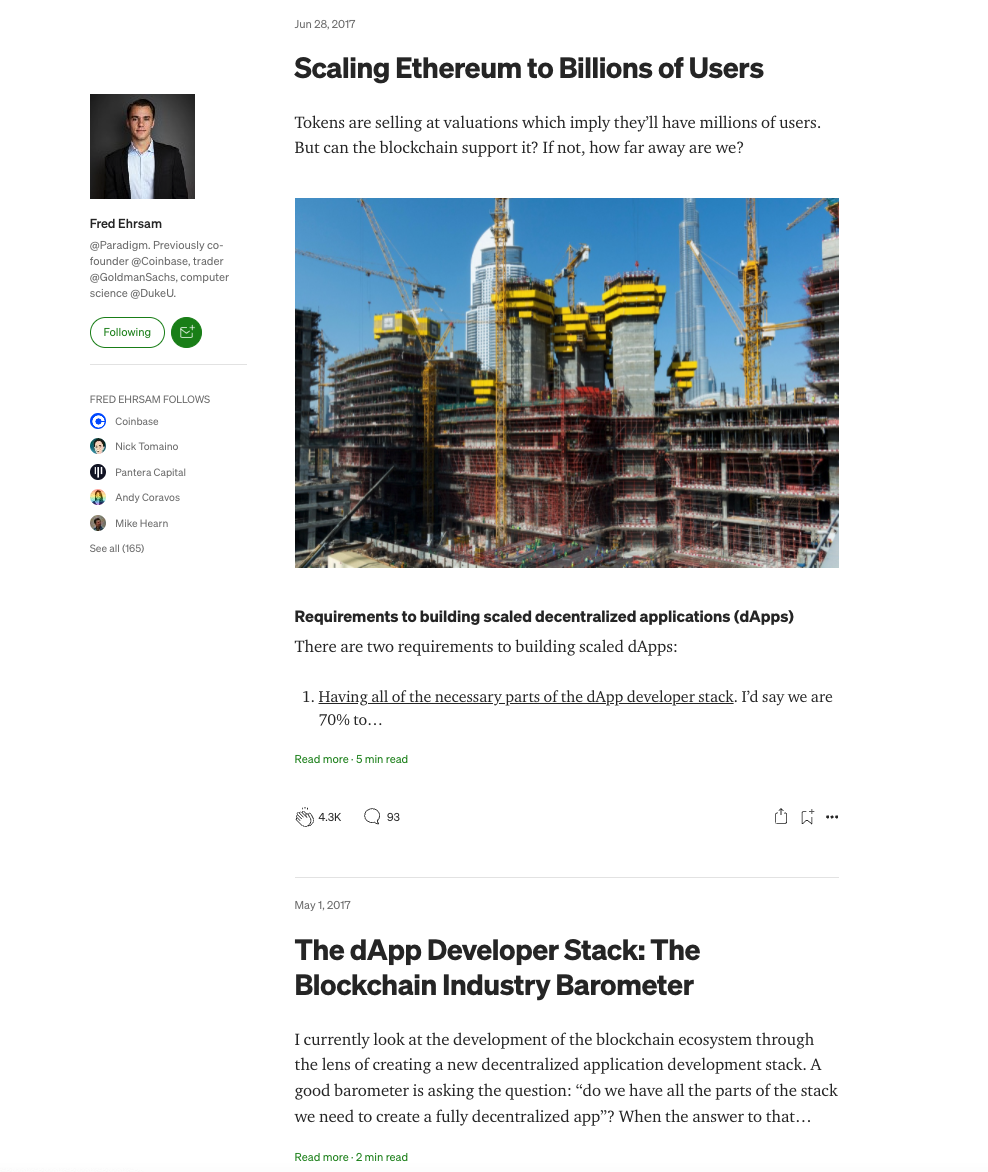

Compared to Matt, Fred is more active on practical issues. The following is his blog during that round of bull market:

He cares about Ethereum's expansion, governance, and developer ecology, and is more active in exploring entrepreneurial ideas such as forks, decentralized trading protocols, and blockchain trading platforms.

This fit and complementary crypto worldview is critical to creating an investment institution.

At the same time, the combination of Matt and Fred can leverage some actual "circle of friends" power - Matt has MIT's alumni network and resources in the financial world, and Fred represents the Coinbase ecosystem.

secondary title

shifting paradigm

Matt and Fred were so fond of using the word Paradigm (generational or paradigm) in their chats that it was requisitioned as the name of their institution.

On the Bloomberg podcast in November 2021, Matt Huang believed that the biggest problem for his organization is how to become a better native player in the new paradigm, because it may not be a good way to transfer the existing business model to the new platform.Real innovation is brought by native players under the new paradigm。

This idea is not new, and probably not original to Matt - his partner Fred first covered it in full in August 2017:

The greatest ideas in technological paradigm shifts are realized by the new paradigm, not by the players of the old paradigm;

Of the top 50 websites on the Internet today, only 2 are from before the Internet era (MSN and Microsoft);

Humans are "recombined" machines, we are good at absorbing knowledge from the world and applying it to new scenarios;

When the paradigm shift begins, all we know is the current world. So we will naturally draw inspiration from it;

Ideas that can only be supported by new paradigms are usually unprecedented, and we first have to regroup various ideas at this stage;

In new technological paradigms, the most interesting ideas are built slowly, often over many years;

In the paradigm shift of the Internet, we can observe many cases:

Search engines (Google, 1998) may not have been thought of before the idea of the Yellow Pages (Yahoo, 1994);

Unlikely to have crowdsourced knowledge bases (Wikipedia 2001) before moving encyclopedias (Encarta, 2000)

A p2p remittance network (Bitcoin, 2008) was also impossible before a centralized financial messaging network (SWIFT, 1974), and then a p2p computing network (Ethereum, 2014)

We all stand on the shoulders of giants;

So when evaluating blockchain ideas, the biggest question I ask myself is: Is this unique to the new paradigm?

There are a lot of things to think about in this set of expositions. For example, why is Fred so convinced that blockchain and digital currency are a paradigm shift?

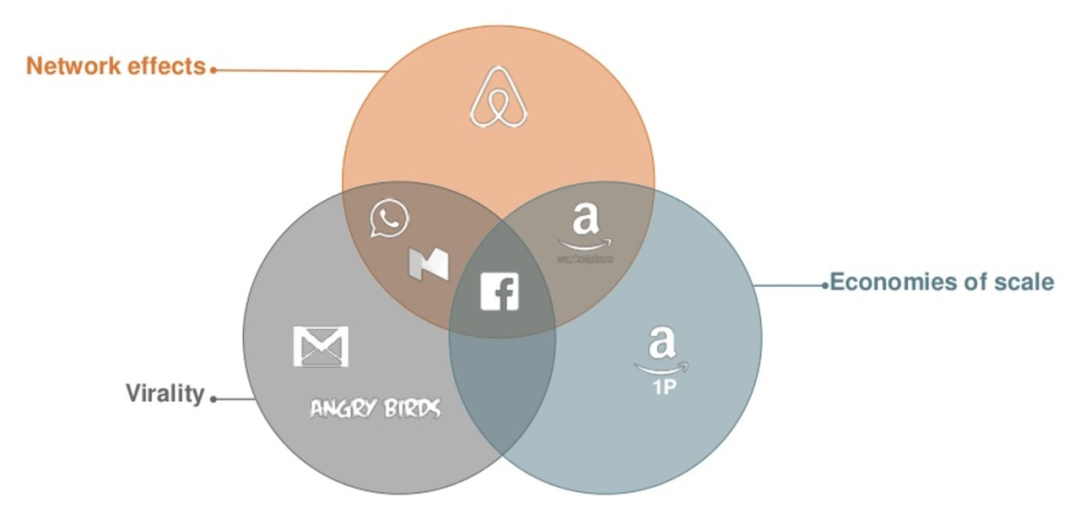

Blockchain as a technology alone may not represent a paradigm shift, but the way cryptocurrencies are played offers a set of possibilities that can challenge trillion-dollar companies like Google and Facebook. The network effect is the strongest moat for these Internet platform companies. Due to the "chicken or the egg" problem of bilateral platforms, almost no emerging platforms can shake them.

The cryptocurrency ecosystem provides "the only solution with real potential" that can solve the problem of cold startimage description

Fred's reflections in 2017

Fred summed up Satoshi Nakamoto’s worldview in this way: “Give incentives and people will come.”

When this is recognized, it seems that the way to invest in the cryptocurrency space should be a combination of tokens and equity - those companies that fit the above model obviously need to issue tokens, and investing in these tokens is more effective than investing in their physical equity means.

In October 2018, Matt and Fred finally closed Paradigm's first fundraising. They raised $400 million, not only from Sequoia, but also from Harvard, Stanford, and Yale endowments.

The structure of this fund is customized for the investment characteristics in the cryptocurrency field. Paradigm's first fund is open-ended, and there is no fixed investment period and exit period agreed between its general partners and limited partners. At the same time, the investable assets of Paradigm are also very flexible. About 60% will be allocated to digital assets, and the remaining 40% can be invested in the equity of early-stage companies.

Funds focused on investing in cryptocurrencies are nothing new, and Paradigm is unique in that it has raised money from a mainstream endowment for the first time. In the Forbes feature article, Garry Tan, an early investor in Coinbase, believes that the reason behind it is:

“Crypto is full of reckless people. Fred and Matt have a ‘wall’ between them and they are very cool and composed. "

Endowments of top universities have observed the turmoil in the digital currency market, but they need to find more stable venture capitalists to help them enter the field.

first level title

secondary title

The market will tell you when to buy

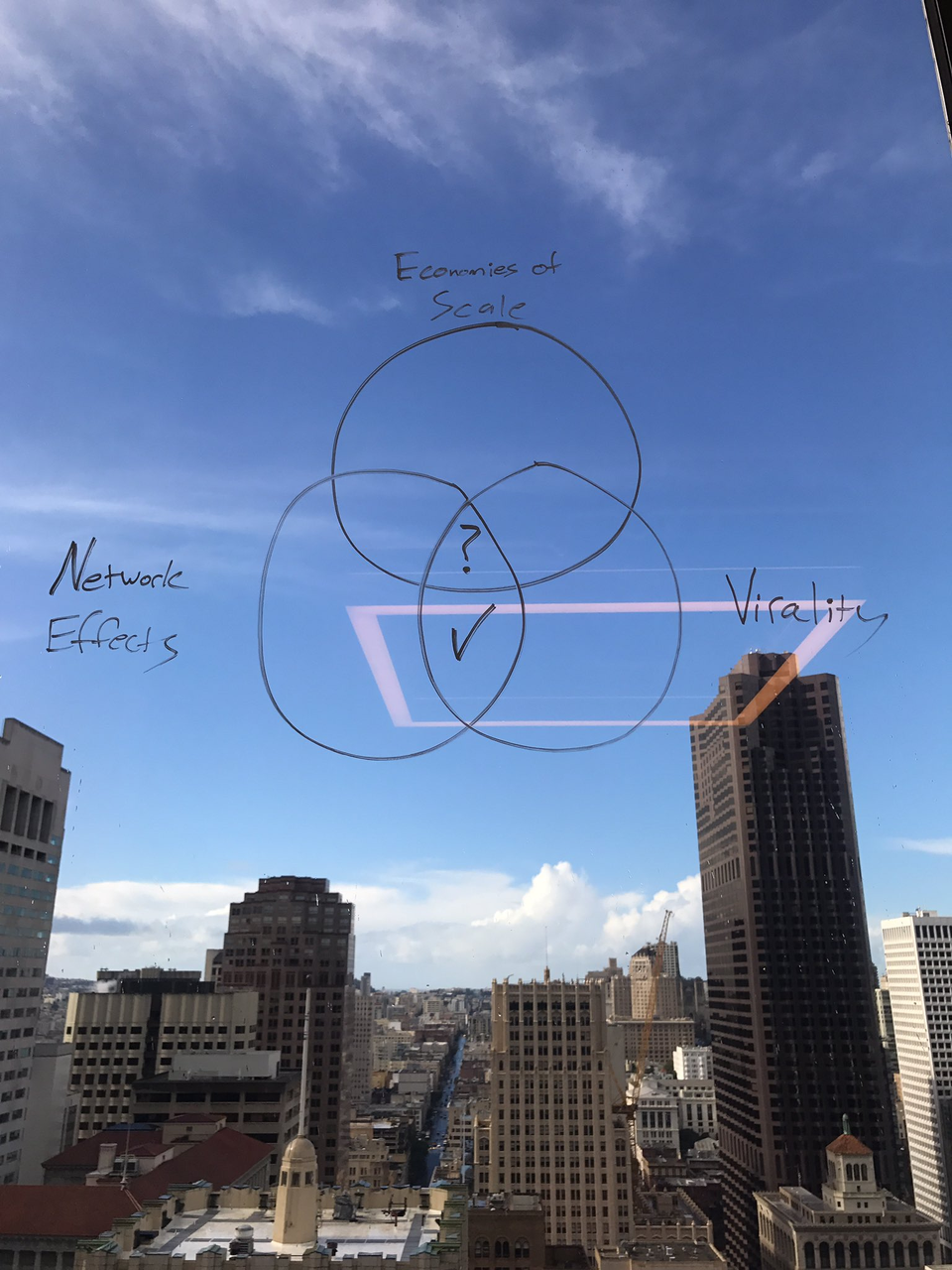

Why start a cryptocurrency investment fund in the second quarter of 2018? We must know that the price of Bitcoin fell below $10,000 at the end of January 2018, and the high point was nearly cut in half.

Some have interpreted the timing as a sad story, with Matt and Fred being portrayed as the lone heroes against the bear market and gloomy expectations. Others think that Paradigm's good luck hit a good time, and it ran into a bear market as soon as it was founded, so it can be a perfect bargain hunter.

The truth is:This is a point in time that Matt and Fred actively choose.

They didn't like the bull run in the second half of 2017 that much. Fred was not optimistic about the endless ICOs that could not be fully adjusted at that time. He thought it was obviously absurd for a project to predict all its future financing needs at the beginning. When the price of bitcoin topped $19,000 in December 2017, he and the Coinbase directors were confused and surprised.

Baupost is one of the highest net worth hedge funds in the US, even though it manages "only" $30 billion. Its founder, Seth Karman, is almost the spokesperson of value investing, and his book "Margin of Safety" is a classic of value investing. In the heyday of Huang Qifu's long-term asset management, he refused to buy shares, and believed that "long-term asset management does not consider unexpected events and desperately increases leverage is quite risky, as long as one serious mistake is made, it will be wiped out."

Probably for this reason,Seth Karman has become Matt and Fred's learning object and faith sustenance in this round of bull market.

In October 2017, Bitcoin broke through the $6,000 mark, while ICOs intensified. Fred shares how Seth Karman described the ".com" bubble in his shareholder letter:

The discipline of value investing is the only way to generate consistently good investment returns.

"You put .com at the end of the company and investors buy the stock," said one analyst, commenting on the behavior of Internet-obsessed investors.

Hundreds of Internet companies have gone public, valued in the billions, and have little more than a business plan.

Prices fluctuate so wildly that investors must be prepared for mark-to-market losses, and those who discipline themselves will be rewarded handsomely.

Baupost regularly holds 20%+ cash: we are always ready to have ample cash reserves to pick up any bargains that may come our way.

In January 2018, the first wave of retracement began, and the cryptocurrency hedge fund managers who exchanged Bitcoin for cash were complacent, which attracted criticism-traditional fund managers usually have too much cash. Unable to make trades to limited partners.

Matt Huang believes that these withdrawals did the right thing. He quoted a passage from Seth Klarman to express this point of view:

“I think there’s a trend in the modern world where people want their money to work hard and make it. I joke that our money looks nerdy by comparison. In my opinion, the market will tell you when to buy. "

When the price of Bitcoin halved in February 2018, the market made its noise.

Relieved, Matt and Fred set about launching their fund. Fred said on Twitter:

“Like the past 3 crypto ‘crashes’, it feels surprisingly good to watch prices drop. It makes it easier to focus on the real issues.”

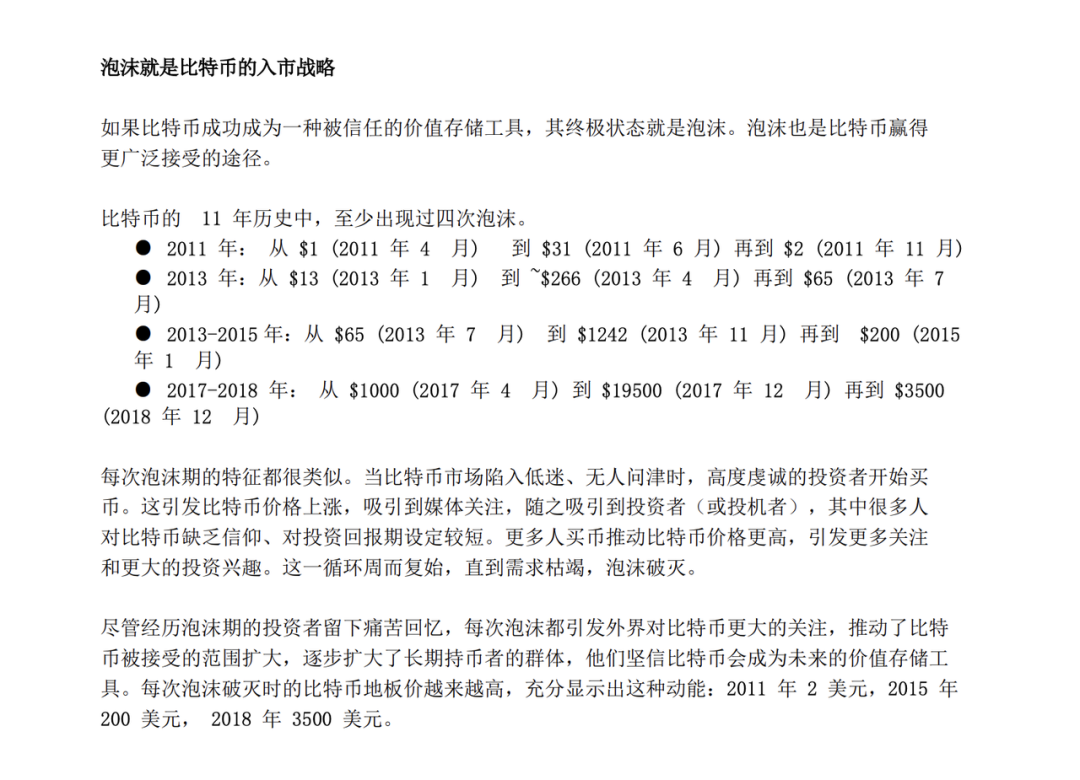

In October 2018, Bitcoin returned to $6,000, and Paradigm's funds also arrived. Then Paradigm made a pretty bold move - when the price of Bitcoin hit $4,000, they exchanged most of the $400 million directly into Bitcoin and Ethereum. This move may seem crazy, but the risk is not high:

image description

Evangelizing Bitcoin for Enlightened Doubters - Matt Huang

At the same time, they still retain the flexibility of investment - Ethereum can be directly used to invest in projects. Even if some assets can only be invested in U.S. dollars, Paradigm can withdraw funds at low cost through Tagomi, an exchange it already owns. So while making the above move, Paradigm still managed to invest in blockchain privacy solution StarkWare with US dollars, and established a relationship with a group of crypto genius scientists.

For university endowments and Sequoia, having Paradigm invest directly in Bitcoin and Ethereum would also be welcome. These institutions are restricted by their existing investment charters and cannot directly purchase too many bitcoins. And once Paradigm's investment strategy leads to losses, they can still divide the responsibility and deny this investment strategy.

This investment did not lose money, but became Paradigm's famous work - Paradigm became the institution that "buy bitcoin in the bear market".$4,000 Bitcoin quickly became a thing of the past, it was $8,000 in January 2020, reached $32,000 in January 2021, and dropped back to $36,000 in January 2022 after peaking at $64,000 Dollar.

The agencies liked Paradigm's strategy, pumping another $350 million into Paradigm in the process, nearly doubling the size of Fred and Matt's management.

secondary title

Create Alpha with Teams

On the way Fred was working on Paradigm, he accepted an invitation from the Wall Street Journal to review cryptocurrency hedge funds like Polychain Capital. His answer survived in that feature note in one sentence: “How much of [the investment performance of these cryptocurrency hedge funds] is luck, how much skill, and how much luck in disguise?”

Paradigm requires more skill when there is no bottom to copy.

On the official website, Paradigm describes its investment method like this:

“We take a deep hands-on approach to help projects reach their full potential, from technical (mechanism design, smart contract security, development) to operational (recruitment, governance strategy).”

This has become the outside world's impression of Paradigm, that is, it usually directly participates in the early construction of the project and adopts a research-first strategy.

But what is surprising is that the formation of this investment method is not pre-set, but Matt and Fred hope to build a Crypto Native fund, so they hope to recruit those Crypto Native talents, and the talent will soon join. Naturally changed the investment form of Paradigm.

Matt and Fred recount the process as guests on the podcast UpOnly:

"Top talents in the Crypto field are different from talents in the Web2 world such as Google engineers—they are usually anonymous or codenamed, so the core premise of Paradigm's model is to make this group of unique people willing to deal with it.

……

This is the advantage of starting a fund from scratch. Paradigm wants to do what it can to help those involved in ambitious projects in the Crypto space. This is revolutionary, we listen to and understand what they need, and then create jobs for outstanding talents.

Where do talented young people want to go? It may have been Goldman Sachs or McKinsey 20 years ago, Google in the past few years, and now it has become Crypto. Many people in the Paradigm team entered the Crypto world at the age of 12."

In fact, Matt once stated“Frankly, the willingness to recruit teenagers is part of Paradigm's alpha"。

Paradigm's first employee and investment partner, Charlie Noyes, was a "teenager". He dropped out of MIT after only one year. He was less than 20 years old when he joined Paradigm, and he started using Bitcoin when he was 11 years old.

Matt is very good at bringing in people he knows around him: Charlie knows Matt as an MIT alumnus, and Dan Robinson, the soul of Paradigm's research side, has known Matt for more than 20 years.Therefore, Paradigm did not recruit Dan because it decided to strengthen the research team, but Matt hoped that Dan could join, so he created a position for him—to contribute to the research and development of open source protocols and projects.

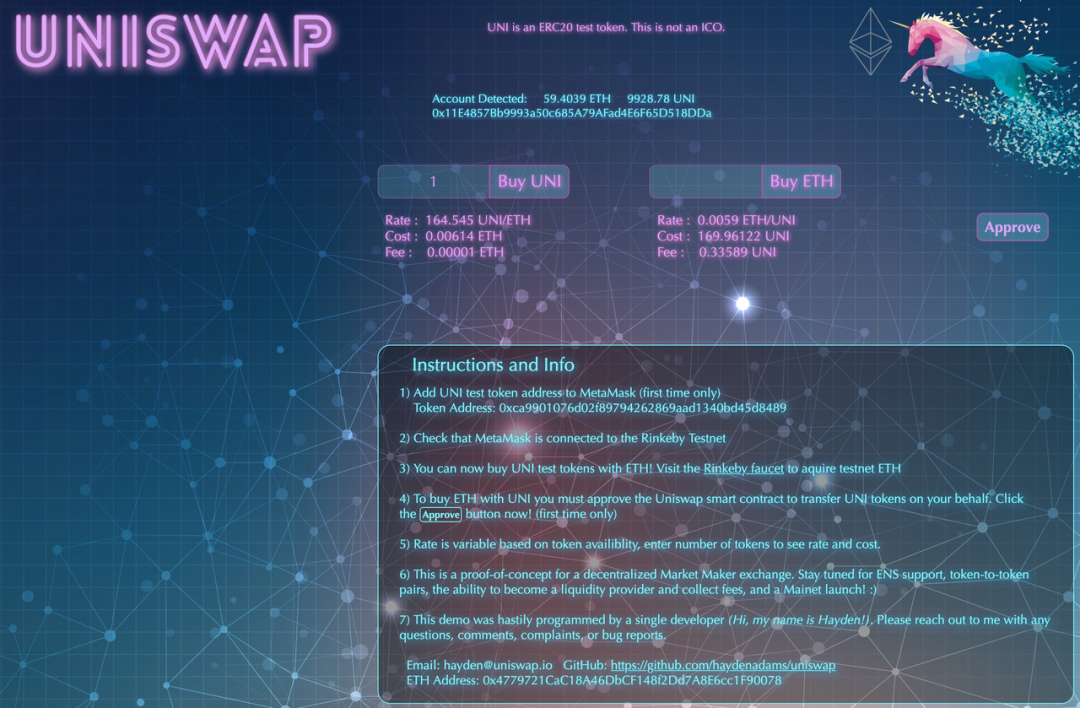

Putting a protocol researcher inside an investment firm sounds like a strange experiment. But it worked quickly, and Uniswap is the best example of this chemical reaction.

In April 2019, Paradigm invested $1 million in Uniswap as the lead investor in the seed round. Uniswap is a decentralized token trading protocol. The protocol exists entirely in the form of smart contracts on the Ethereum chain, and miners are responsible for matching and execution.

image description

Uniswap in 2017

Paradigm's funding and post-investment services helped Hayden build the company and hire its first two employees. In the A round in August 2020, the annualized trading volume of Uniswap increased from US$20 million 18 months ago to US$20 billion. New shareholders such as VersionOne also learned the value of Uniswap through Paradigm.

But more importantly, Paradigm's research team maintains a deep involvement in the development and use of the Uniswap protocol.

Dan is almost always lurking in the Uniswap Discord #support (help) channel, helping Uniswap solve many problems with liquidity and smart contracts.

Impermanent losses have always been a big problem with protocols like Uniswap that use automated market makers. No one inside Paradigm was able to get to the bottom of this, so Charlie made the question public in September 2020 seeking an answer. 3 months later, David White brought the solution to Paradigm. Another month later, Dave officially joined Paradigm's research team.

The fork problem faced by open source protocols is another major challenge for Uniswap. When Sushiswap was born, Uniswap v1 and v2 once seemed uncompetitive in terms of capital utilization and community building. In March 2021, the launch of Uniswap v3 is a beautiful turnaround. It retains the characteristics of Uniswap's permissionless, always-available, and peer-to-peer aggregated liquidity, while also introducing a centralized liquidity design that allows liquidity providers to simulate Any automatic market maker curve is very close to the traditional order book model in terms of experience.

Noah, the head of development of Uniswap, said on Twitter that Dan of Paradigm is the core contributor to the design of the Uniswap v3 mechanism: "He is the initiator of the entire upgrade, and it would be impossible to do it without him."

……

In the process of Paradigm's development, there are many such cases. At present, Uniswap is already one of Paradigm's most successful investment cases. In February 2021, the cumulative trading volume under the Uniswap protocol exceeded $100 billion. After the slump in the crypto market in early 2022, the total market value of UNI tokens issued by Uniswap still exceeds $6.4 billion.

If Bitcoin represents Paradigm's first victory, then Uniswap has verified another important capability of Paradigm,That is, become the earliest investor of the project, and then use your own team to create alpha。

Matt once described their thinking like this:

"Valuation of Crypto projects has always been a difficult problem. So entering the stage of the project is very important. We hope that we can be the earliest investors in the project. This is partly because we believe we have built a team that can help the project from the earliest stages. Compared with a website or an app, the update frequency of the protocol is much slower, so we think it is very important to get things right in the early stage, so we want to participate from the earliest stage."

Such a team has already been established. In July 2021, Matt announced the expansion of Paradigm's research team, and Dan began to serve as the research leader. Matt also revealed in the same article how each team member joined the team:

After Dan, Georgios Konstantopoulos joined us. Georgios is an engineer and researcher from Greece who has been a star engineering consultant on many of our portfolio projects.

When a pseudonymous anime character started discovering various security vulnerabilities (including 0x V2, Livepeer protocol, Authereum protocol, etc.), we knew we had to go after the legendary samczsun (the encryption genius white hat who joined Paradigm in October 2020, Responsible for the security of his investment protocols and projects, his codename is made up of 3 of the most famous names in the cryptocurrency field)

When we have a Uniswap research problem that no one can solve, we make it public as an open issue. Dave White came to us with the solution and joined the team shortly thereafter.

secondary title

Investing in ideas and behemoths at the same time

In Toutiao’s financing story, I summarized the characteristics of Sequoia China:

"Because of Shen Nanpeng's hunger, Sequoia not only has the courage to always be at the forefront, but also has the ability to rely on management scale to salvage cases like Toutiao, that is, it can invest in the most popular cases in the market, and dare to invest in big cases. A case most people don't understand.

This strategy of daring to enter at a relatively high price has not only succeeded in the headlines, but has also been repeatedly verified in other cases. This is the advantage of Sequoia's large management scale and the reason for its large management scale."

Matt and Fred also reflect similar ideas in investment operations,In their view, the most expensive price an investment can pay is a "crime of negligence," not a "crime of perpetration."Therefore, in addition to being able to enter Uniswap and StarkWare, which are still in the idea stage, Paradigm is also willing to participate in the big guys they have missed in the later stage.

FTX, the world's largest encrypted derivatives exchange, is a case in point. Paradigm did not capture it when it launched in May 19, and missed its A round in 2020, but participated in the investment in FTX in July 2021 with a high certainty of B round.

At that time, the valuation of FTX had reached 18 billion U.S. dollars, and more than 60 investors including Paradigm, Sequoia, Softbank, and Ribbit Capital invested a total of 900 million U.S. dollars. At the end of January 2022, Paradigm re-invested in FTX US, a single-country spin-off valued at $8 billion.

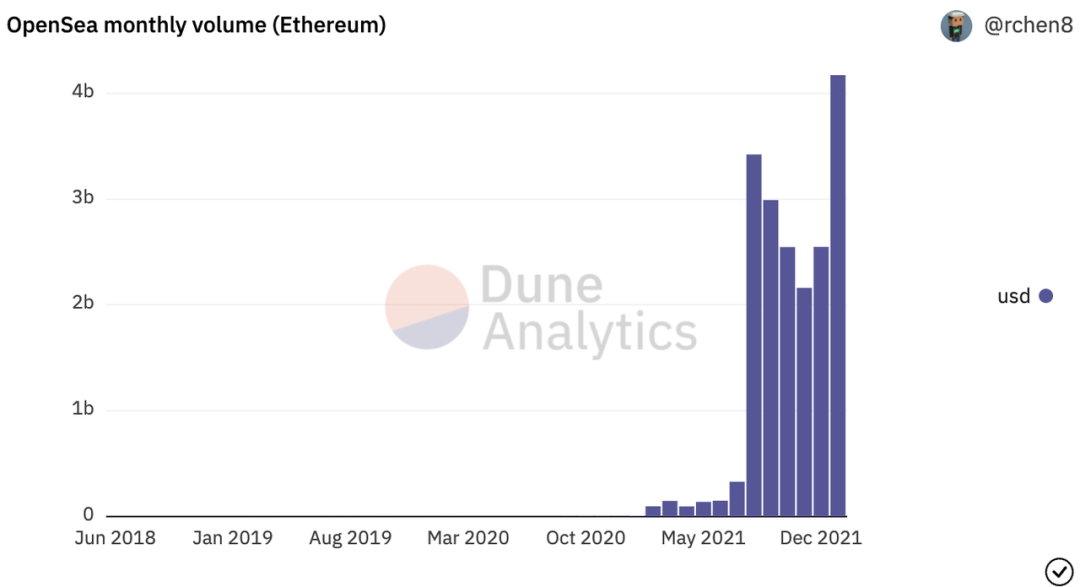

image description

OpenSea's monthly transaction volume change

In January 2022, OpenSea announced the completion of a $300 million Series C financing led by Paradigm and Coatue, with a valuation of up to $13.3 billion.

The latest example is Citadel Securities - which is a good example of why Paradigm, who is only 3 years old, can invest in these behemoths. Citadel Securities has a 20-year history and a solid reputation as a securities market maker. In January 2022, Paradigm and Sequoia jointly invested $1.15 billion in Citadel Securities at a $22 billion valuation.

The Information describes the strategic significance of the deal for both Paradigm and Citadel:

"Partnering with Paradigm and Sequoia, Citadel has access to the expertise it needs to delve into cryptocurrencies. Paradigm and Sequoia could also connect Citadel with other strategic partners to help build its crypto business. For example, both institutions have invested in the exchange FTX, and the start-up company Fireblocks that can provide digital asset self-custody services for market makers.

And if the SEC approves the digital currency, Paradigm and Sequoia Capital could secure a powerful new partner for their portfolio and reap the rewards of investing in a company that has the potential to become a major player in the crypto trading ecosystem."

As I once concluded,This strategy of daring to enter under a high valuation is "the advantage of a large management scale, and it is also the reason for a large management scale."

In November 2021, Paradigm announced the closing of its new $2.5 billion fund. This is the highest amount raised in the cryptocurrency field, even surpassing the $2.2 billion crypto fund launched by a16z in mid-2021.

It is unlikely that Matt and Fred will invest this fund in Bitcoin again. They choose to invest in two types of companies-those companies that Paradigm can participate in creating alpha and high-certainty later-stage companies, as Matt Huang expressed:

"first level title"

secondary title

good taste is essential

“‘Good’ and ‘Worth Investing’ companies are two separate types of companies”, Charlie described Paradigm's investment taste in this way when he was a guest on the Bankless show.

So what does a good investment look like? Charlie thinks Uniswap and Maker are typical good investments. If you remember the chaotic ICO era in 2017, you can find resonance in this passage from Charlie:

"(The situation at the time) is like you open a candy store, then print a token yourself, and then claim to only accept payment in this token. People in the market can exchange your tokens for other currencies, but your tokens are illiquid. However, no matter how successful your candy store is, the token's monetary properties will not become stronger, nor will it be universally accepted. No one makes this kind of token anymore."

And Uniswap is based on an idea that can only be realized by blockchain and cryptocurrency (using a function such as X*Y=K to complete automated market making), the team's idea is very long-term, and it can be imagined A future of innovation.

The tokens under these agreements are also more valuable, and they can really generate income. A part of Uniswap’s transaction fee for each transaction will be distributed to the holders of UNI tokens. The prices of these tokens have become part of the Discounted future benefits of the agreement.

The algorithmic stable currency project Ampleforth was interpreted by Charlie as a typical "bad investment". He thinks the project is an accounting trick — most assets have a fixed supply and a variable price, while Ampleforth does the opposite, expanding and contracting supply to keep the exchange rate against the dollar constant.

For Matt and Fred, the way they choose "good investments" is by picking the right people to build projects that will blow up in 10 years. This is especially difficult in cryptocurrencies because cryptocurrencies are inherently liquid, but the things that really matter can really take 10 years to build.

In the choice of business model, Fred still maintains his credo in 2017, and only invests in ideas that are unique to those new paradigms.

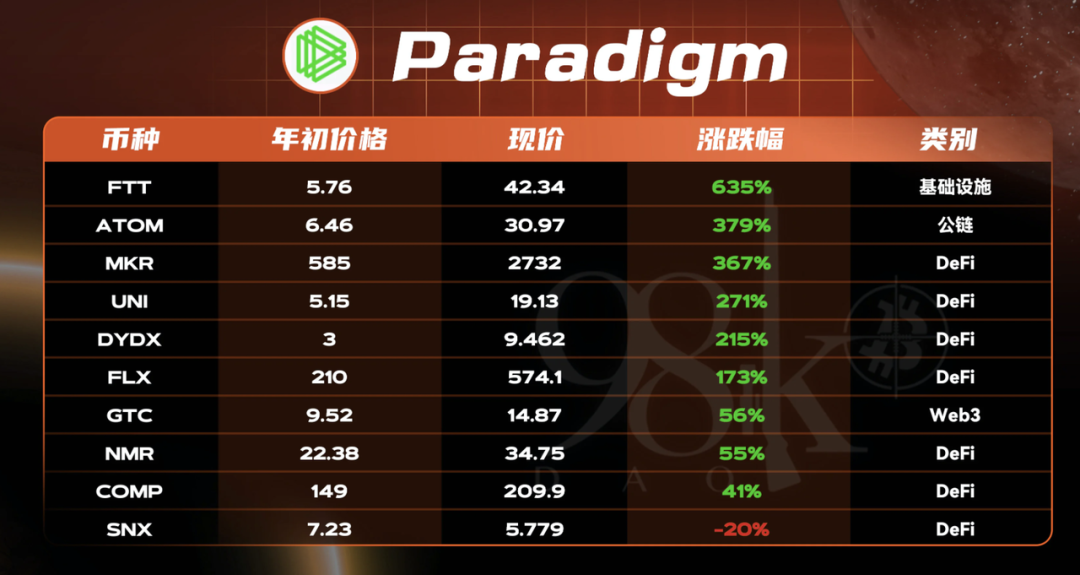

image description

image description

(Data as of December 31, 2021)

These 4 directions very clearly reflect Matt and Fred's investment taste:

DeFi:Public chain:

Public chain:They are excited about Ethereum, but they also maintain a positive attitude towards other public chains. Fred began to pay attention to other public chains such as Tezos in 2017, and believes that the ecological development of the blockchain does require different public chains to be tried

infrastructure:Fred built Coinbase during a bear market and a crippling lack of infrastructure, so he can easily understand the importance of FTX and how important infrastructure like Fireblocks and Chainalysis are for new entrants - if Coinbase started Fireblocks, they will directly purchase rather than build a self-hosted hope

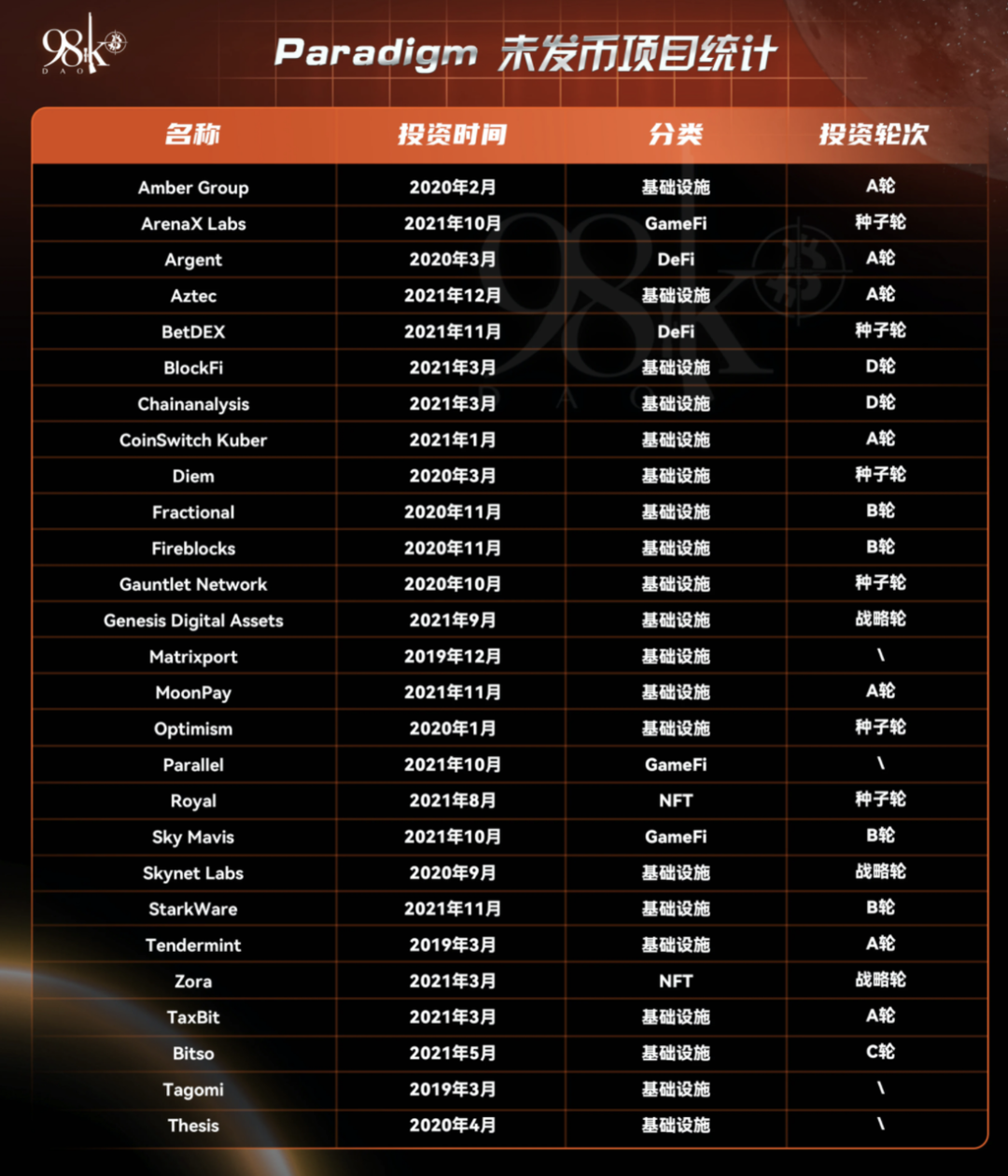

Web3:image description

image description

(Data as of December 31, 2021)

After Paradigm completed the new fund raising of US$2.5 billion, The Information summarized the next investment direction it revealed:

"secondary title"

Towards Institutionalized Operations

The success factor of an investment institution is not only the investment vision, a16z has fully proved this point, and Paradigm is also trying to make itself more institutionalized.

Matt, Fred, Charlie, and Dan may be the agency's external stars, but a big part of keeping the agency running internally is its COO, Alana Palmedo. In an interview with The Block, she said:

"Matt and Fred presented a larger strategic vision, all based on the fact that Paradigm is not a traditional venture capital firm. Paradigm has always believed in the importance of working alongside builders."

Up to now, the heads of various important functional positions of Paradigm have been filled in succession:

In December 2020, Paradigm hired Dan McCarthy as its Talent Partner. He was previously responsible for executive recruitment in San Francisco and Shenzhen at Lime. His addition positions Paradigm to help its member companies build world-class teams.

Jim Prosser joined Paradigm in mid-2021 and is responsible for its public relations and communications. He previously served as the managing director of Edleman, a world-renowned PR agency, and then worked as a business manager in the direction of communication at Google, Twitter and SoFi.

The addition of Prosser has expanded the scope of Paradigm's post-investment services, allowing the stories of its member companies to win the support of the media. He believes:

"Paradigm cares about founders who support the development of cryptocurrencies. I also spend time building Paradigm's own communications strategy - the agency is young and needs to establish itself and show the world that we have innovative ways to support our member businesses."

In addition, the role of Kevin Pang, who joined Paradigm at the same time as Prosser, is even more interesting. He is currently serving as Paradigm's head of transactions. He previously worked at Jump Trading for 9 years, responsible for options related trading operations and strategies.

COO Palmedo explained this somewhat rare recruitment for venture capital institutions:

"We want to be an active participant in the market, but the transaction service providers on the market cannot provide us with the services we want. So we are building the trading tools ourselves."

Pang built a set of internal dedicated trading tools at Paradigm, which enabled the team to deeply participate in the decentralized financial market, directly participate in project voting, governance, and help guide the liquidity of new tokens.

According to the team data on the official website, Paradigm's current talent echelon is already very abundant:

Matt and Fred are the two founders, and there are 4 senior managers at the CXO level below. Then 5 investment partners, 5 research team members. Its support team beyond investment and research has reached a scale of 20 people, covering talent, communication, engineering development, operations, legal affairs, finance and administration.

Although Paradigm has always emphasized that it pays more attention to its member companies than competitors, its talent formation obviously has potential opponents like a16z as benchmarks.

Another track that a16z is betting heavily on is regulatory relations. Paradigm seems to lack a matching voice in this regard. Its chief policy officer, Gus Coldebella, left after a year on the job. But Paradigm still has Matt Huang's relationship in the financial world and Fred's network in Coinbase-Coinbase can already be regarded as the cryptocurrency company that is best at communicating with regulators in the world.

secondary title

smart minds still questioning

There are still some of the brightest minds questioning the promise of cryptocurrencies.

Charlie Munger is a typical representative of traditional investors. At the Berkshire Hathaway annual shareholder meeting in May 2021, Munger slammed Bitcoin, which he believed to be a "financial product fabricated out of thin air" and that the current craze was "disgusting, And against the interests of civilization."

Matt and Fred deal with such conservatives with ease - and Munger misses the internet too.

They argue that due to the peculiarities of the cryptocurrency space (the speculator price of using token incentives to leverage network effects), smart people should be asking good questions, rather than claiming that the whole thing is a hoax.

Signal Foundation's Moxie Marlinspike they see as the latter. Moxie is a very experienced cryptographer, and his recent article "My First Impressions of Web 3" sparked many discussions on the Chinese Internet in January 2022. Before that, he expressed similar concerns about decentralized exchanges,It is believed that the centralized method still has faster speed and better user experience.

This is what Fred has considered when he deduced the relationship between cryptocurrency and network effects in 2017. In the traditional Internet world, in addition to network effects, there are economies of scale—the server is a huge fixed cost in the early stage, but the marginal cost in the later stage is negligible, and the service will become more and more stable and fast.

image description

Slides that got Fred thinking: a16z report on network effects

Therefore, the focus of the debate between practitioners and investors is the extent to which decentralized and centralized solutions should be integrated.

In addition to these two types of people, those who fully understand digital currencies but are still unwilling to enter the market are afraid of regulatory risks.

Despite these skeptical voices, both old money and new money are frantically pouring into the cryptocurrency track. They see that the returns of cryptocurrency-related assets have outperformed other alternative investments in the past few years, so they are willing to allocate.

a16z raises new $2.2 billion cryptocurrency fund, retains its above-average fees of 2.5% management fee and 25% carry

Sequoia Capital has also changed its structure to an open-end fund and has shown strong interest in participating in the cryptocurrency space

Cryptocurrency hedge fund Multicoin Capital hits $250 million in third fund under management

……

Looking at the cycle of 5 to 10 years, the current capital influx is not considered crowded.In the bull market of 2017, Fred believed that the cryptocurrency market at that time was a "dirty big casino", and the market he envisioned in 2027 would be "using the wisdom of the crowd, providing the purest data, and everyone can't live without it." open place".

This 10-year vision is slowly being realized. In 2021, already 16% of Americans own digital assets, while 55% of Americans own stocks. Since the scope of digital assets has surpassed the hard-core financial bills, the emergence of a society where everyone owns digital assets can be expected in the future. At that time, the number of users in the encrypted world can reach billions.

Plus, people are spending more and more time in the digital world, socializing on Twitter and Discord, entertaining and consuming in Warcraft and Fortnite. Fred is still positive about what he said in Feb'17 that blockchain is the only way to secure ownership of digital assets, and once people realize how limited their digital asset rights are in today's Internet, they will accelerate Enter the world of what is called Web3.

Will competition among funds hinder Paradigm's performance?

Paradigm has faced tougher competition. In the bear market that began in 2018, industries such as climate change and medical health attracted high-quality talents, and the encryption field seriously lacked the inflow of high-quality talents. Everything has changed in 2021. Cryptocurrency itself is a low-threshold entrepreneurial field. Talents from various fields such as crypto-native, traditional Internet, and financial technology are constantly entering the crypto field. The number of entrepreneurs faced by each fund has also increased. by an order of magnitude.

Back to the competition among funds, Matt and Fred's unique crypto worldview, investment outlook and personality will still become their trump cards to attract investors.

Spencer is the CEO of Amplitude, a customer behavior analytics company now public with a $4 billion market cap. A story he tells illustrates Matt's consistent personality well:

"At the time, I hadn't been selected for YC, and I was still in the idea stage. But I have a classmate at MIT, his name is Matt Huang. He just started a startup and gave me a bunch of advice.The advice was nothing in return for him, just to help me orientate and understand how to build a business.

Without his help, my trial and error phase might have been prolonged and I would never have gotten out. For about a year after that, he called me a few times a week, even though I was nobody at the time. It's unbelievable what he's done, and I feel very lucky to have benefited from it."

After understanding Matt's personality of being willing to help entrepreneurs, Paradigm's practice of writing contracts with the project seems very natural.

The outside world also has reason to believe that Paradigm can continue to make similar innovations and lock the best founders in the fiercely competitive cryptocurrency field.