Disassemble the successful models of ETH and Axie to analyze the network effect in Web3

Author: Sameer Singh

Web3 projects leveraging cryptocurrencies and NFTs incorporate several types of network effects, but those network effects are also relatively weak...at least so far.

Web3 has emerged as the defining technology trend for 2021—and network effects are at the heart of it.

Web3 has emerged as the defining technology trend for 2021—and network effects are at the heart of it.

First, do the background setting of Web3:

Web1.0 is the "read-only" stage of the Internet, users can obtain information online (such as Yahoo, Google);

Web 2.0 is the transition to a "read and write" phase where users can not only access information but also create it (eg Facebook, Wikipedia). An era where value creation shifts from companies to users - but within closed networks owned and operated by companies;

Web3 refers to the next phase of the Internet, where value is created by decentralized networks owned and operated by users. This will be enabled by a range of complementary innovations, including encryption protocols and NFTs.

The purpose of this post is not to unpack the possibilities of web3 or the complexities of the technology, but to focus on the nature of network effects in this era.

So far, I've been exposed to 3 of 4 unique network effect models - marketplace, interaction network, and platform - in various web3 projects. These web3 models have several common features:

Their network effects are natively layered, i.e. each project combines multiple forms of network effects.

They also have weaker and less defensible network effects than web 2.0 variants, at least so far.

I will explain these patterns with the help of two case studies - Ethereum and Axie Infinity, which are among the most successful web3 projects to date. They are also representative examples because their network effects share many characteristics with the wider web3 field.

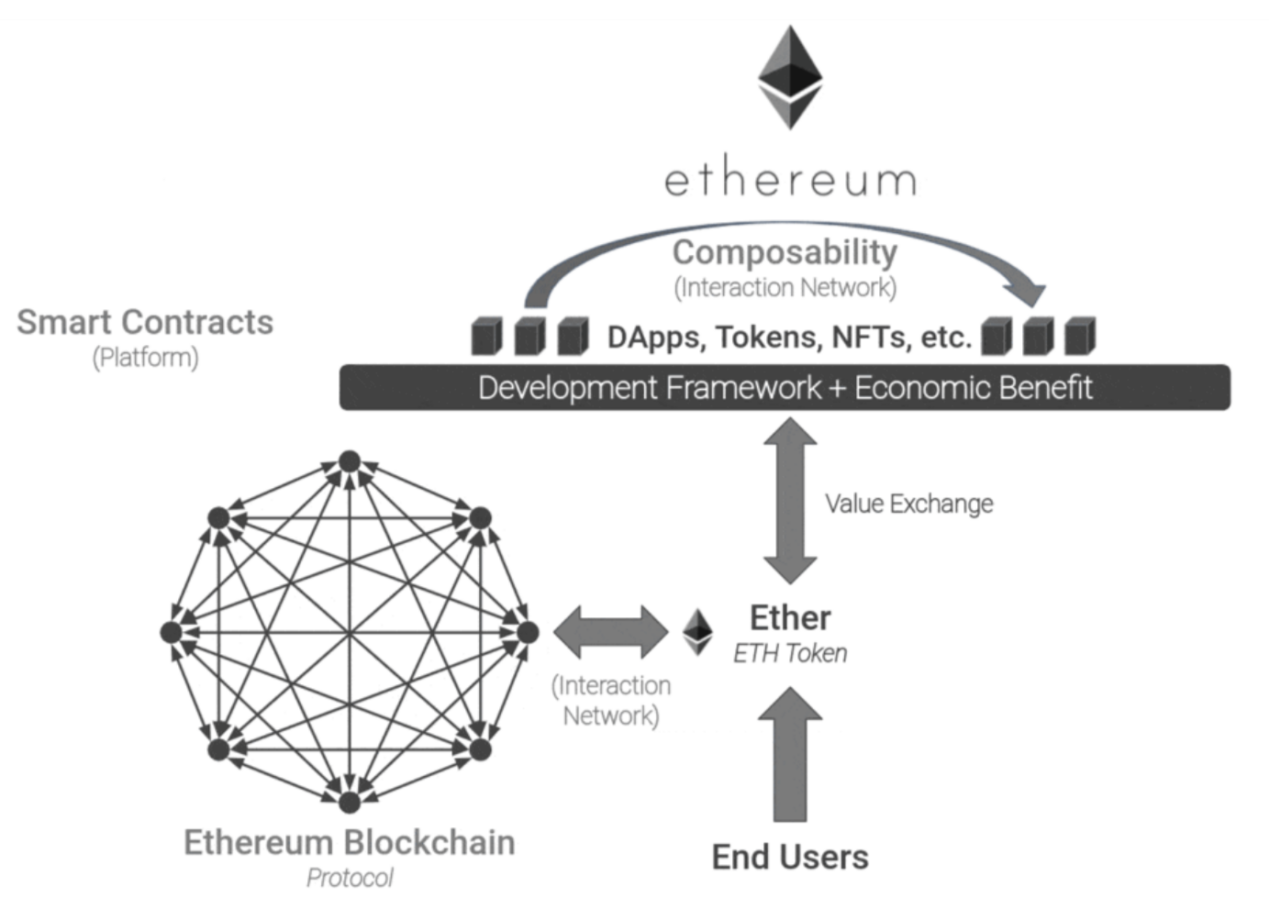

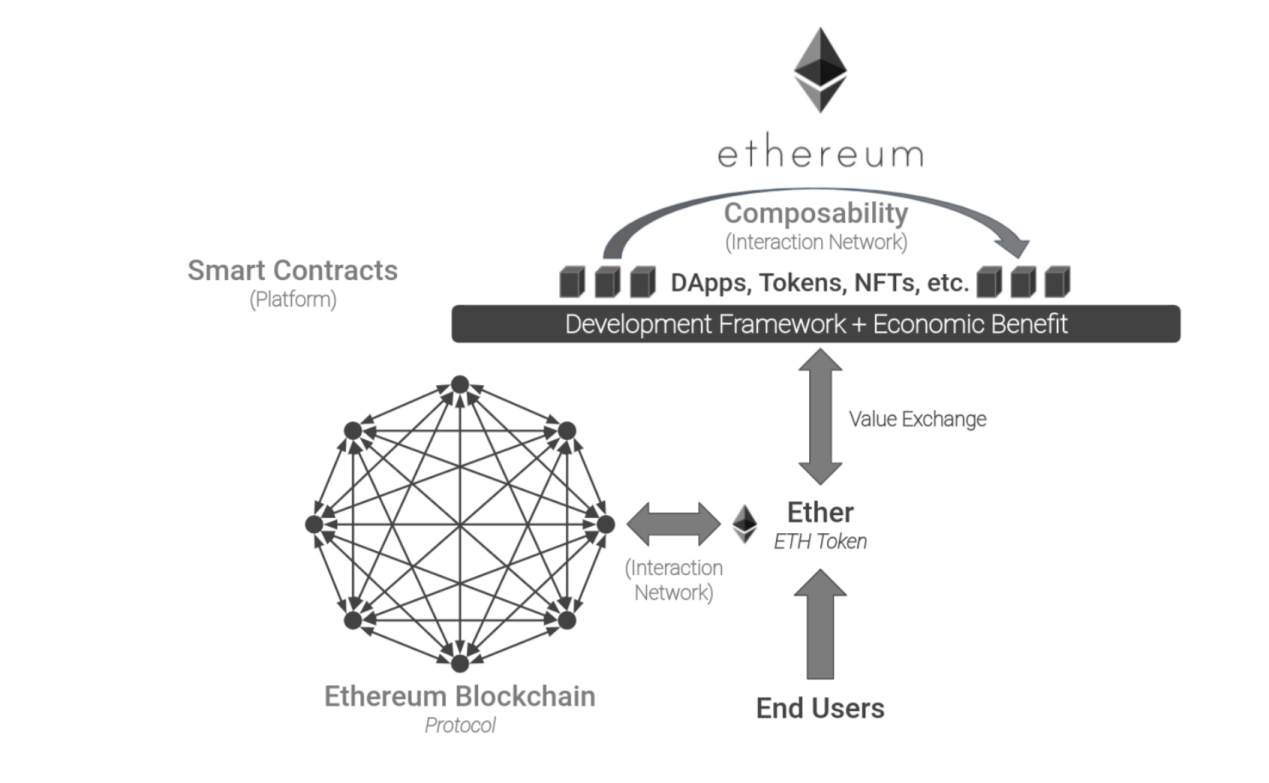

Ethereum: Layer 1 Protocol

Ethereum is often referred to as a Layer 1 protocol (capital "L"), i.e. it is the underlying blockchain "computer" on top of which other projects are created. The animation above shows three different types of network effects on Ethereum. Let's take a deeper look at them.

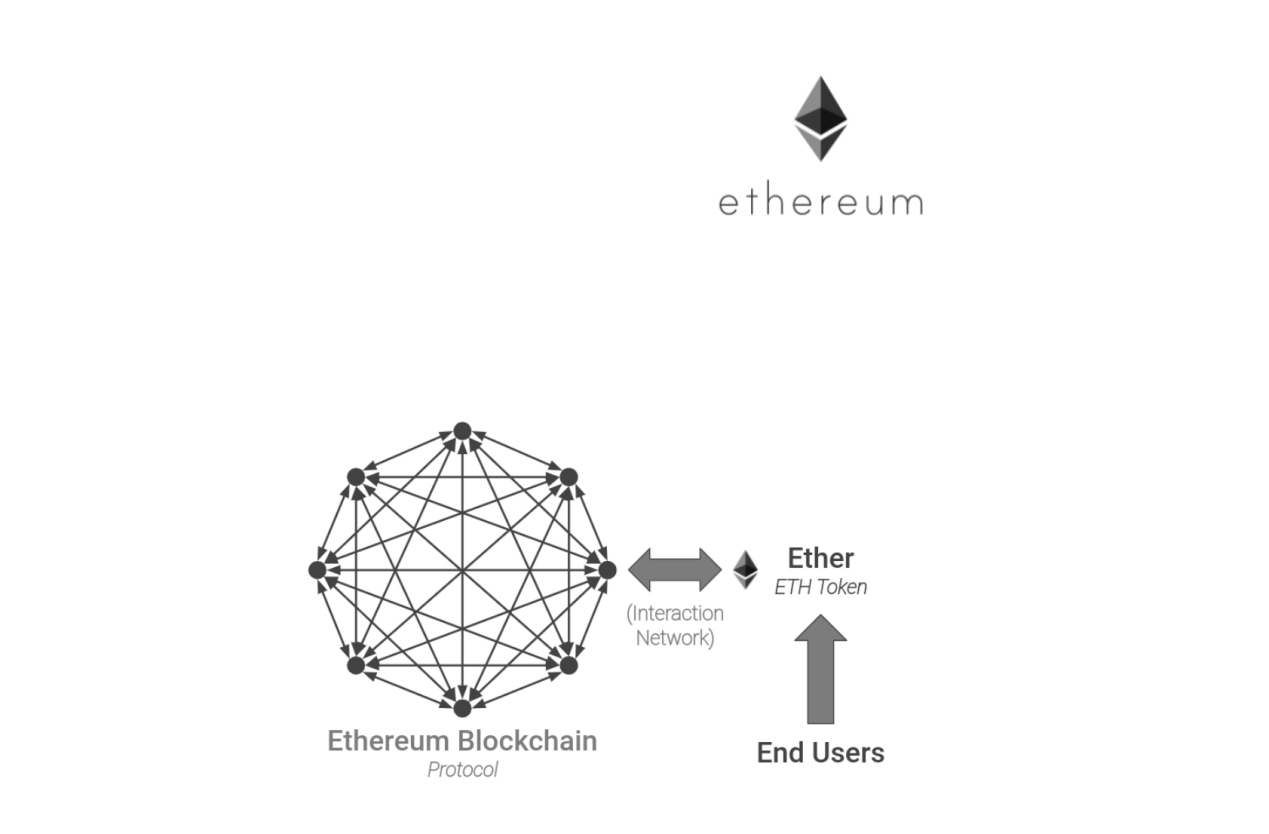

Network Effect 1: Ethereum Blockchain and Ethereum (Interaction Network)

The Ethereum blockchain is essentially an interconnected network of computers or nodes. These nodes validate transactions and "mint" new Ether tokens as rewards for their efforts. Adding nodes increases the throughput, or capacity, of the protocol—to support more token transactions and developer activity. At first glance, this looks like a simple one-sided network effect. But it's more subtle than it seems - because adding more nodes doesn't increase the value of the protocol to other nodes. If anything, it reduces the value of other nodes as there is now more competition to validate transactions and mint new tokens. However, adding more nodes increases capacity and thus value to buyers of ether. More token buyers increase the value of the ether token, thus making it more valuable for nodes to validate transactions.

In other words, these are cross-side network effects on two-sided interacting networks, with side-swapping built in (token buyers can also be validators and vice versa).

However, this network structure also presents several challenges: (1) unique forms of negative network effects, and (2) commoditization risks.

Let's first delve into negative network effects.Ethereum and other cryptographic protocols face the risk of network congestion, where too much activity can overwhelm the protocol's capacity, leading to high transaction fees and processing times. So, beyond a certain point, adding token buyers reduces the network's value to all other token buyers. This negative network effect does not exist in web 2.0 products. It is specific to encrypted and physical networks like telephony or broadband, where too much traffic can degrade speed or quality of service.

The second challenge here is commoditization risk.This is partly because the blockchain is identity-agnostic, i.e. the identity of each node is independent of other nodes or token buyers. Therefore, as the network expands, each new node adds less incremental value to the network. Compare this to the network effects of the original telephone network. Unlike blockchain protocols, phone networks are identity-centric, meaning you can’t reach a particular person if they don’t have a phone connection, even if someone else does. This means that the utility of the telephone network continues to grow as adoption increases - as it increases the number of specific individuals you can call. Instead, the network effect of a blockchain interaction network diminishes as it grows, i.e. it becomes less defensible. Competing blockchain protocols only need to become "big enough" relative to their transaction volume or activity to compete - leading to a sea of competing blockchain protocols and tokens.

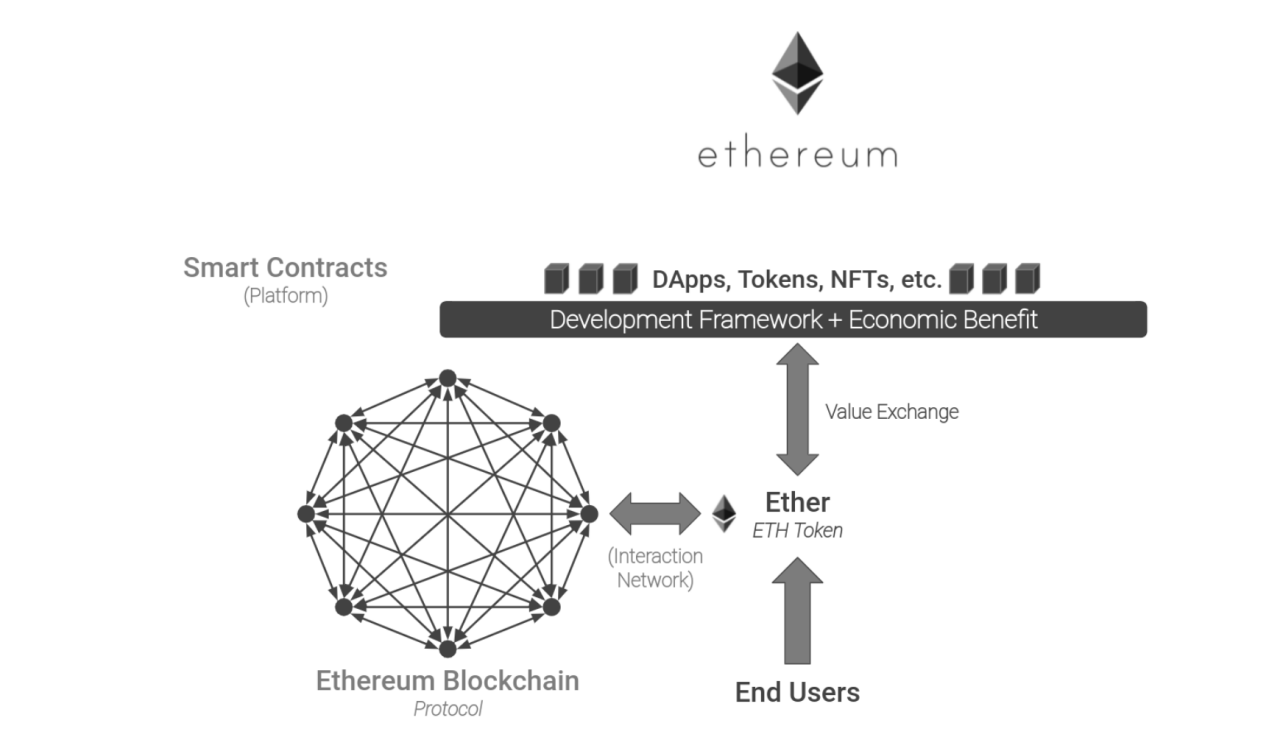

Network Effects 2: Ethereum Smart Contracts (Platform)

The ability to create and execute smart contracts or decentralized applications (DApps or "Layer 2") is the focal point of the Ethereum protocol. DApps are programs created on top of the blockchain that run automatically based on pre-specified conditions. End users need to obtain Ether to interact and transact with these DApps. As a result, adding a DApp developer to the Ethereum protocol increases the value of Ether to buyers. This shares many of the properties of the platform, but with a few key differences:

First, it doesn't have the "match" (or "app store") component that we see in Web 2.0 platforms such as iPhone, Salesforce, Shopify, etc. This is by design, as web3 emphasizes open architecture. However, this makes it harder for users to find suitable DApps, thereby weakening the network effect. Of course, third-party app stores can make up for this over time.

Second, there is no underlying product here other than ether. Platforms typically have an underlying product that users engage with the platform. This base product ultimately captures most of the value created by the platform. For example, the iPhone is the biggest financial beneficiary of the iOS App Store. Developers join the app store (the platform) to make the iPhone (the underlying product) more valuable to users. But in the case of Ethereum, the addition of developers only makes ether more valuable to buyers (see: Fat protocol). This has a direct impact on defensibility, as Ether is liquid and has zero conversion costs - users can always sell it and buy another token to access DApps built on another blockchain (e.g. Solana).

Imagine if you could turn your iPhone into an Android phone, Windows Phone, or BlackBerry with just a few taps and access their respective developer ecosystems. If so, the iPhone's platform network effects would cease to be a meaningful form of defense -- even if it would lead developers to innovate more rapidly. This is the boon and curse of layer 1 blockchain protocols.

These two factors have led to a wave of new Layer 1 blockchain protocols beyond Bitcoin and Ethereum — from Cardano to Solana and more.

Network Effect 3: Composability (Interaction Networks)

That's not to say Layer 1 protocols are defenseless. They do benefit from switching costs on the developer side. In large part, this is because of the composability of smart contracts, whereby developers are able to create new smart contracts by “remixing” components of existing smart contracts. This bears some resemblance to TikTok creators remixing other videos to create new ones. Think of it as another network effect (network of interactions) layered on top of the platform — the more smart contracts a protocol has, the easier it is for developers to build new ones. However, cross-chain composability, that is, the composability of smart contracts built across protocols, may weaken its impact on defensibility.

This brings us to actual DApps built on top of Ethereum and other Layer 1 protocols. Many of these utilize Non-fungible Tokens (NFTs) — simply, you can think of them as unique digital assets (such as collectible cards). Some of them—such as Loot, Bored Ape Yacht Club, and CryptoPunks—have spawned fascinating communities and behaviors. However, it is difficult to classify their network effects as their value and utility remain unclear. This is not uncommon in the earliest stages of a technology cycle - experimentation and hype always precede practicality. Other types of DApps already have clear network effects — one example is playing games, games where players can earn tokens by playing games. Let's take a look at one of the most prominent ones.

Axie Infinity: The Play-to-Earn NFT Game

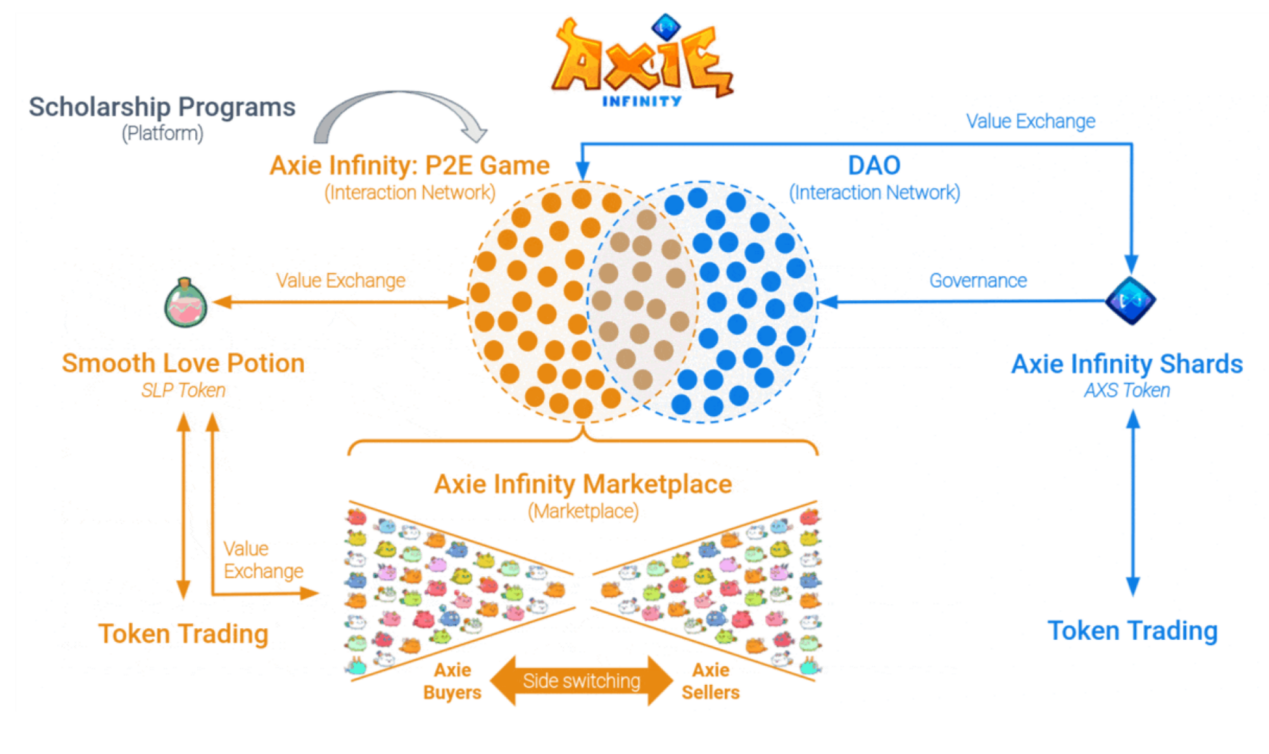

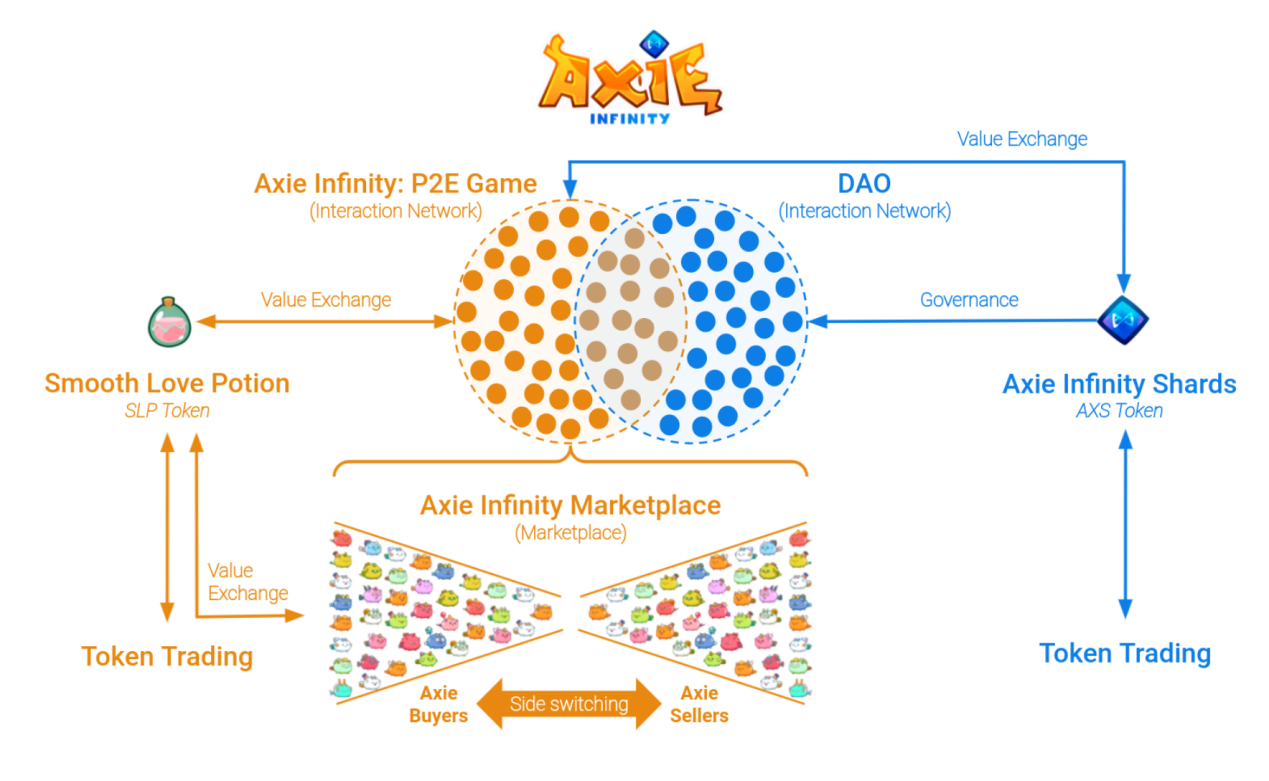

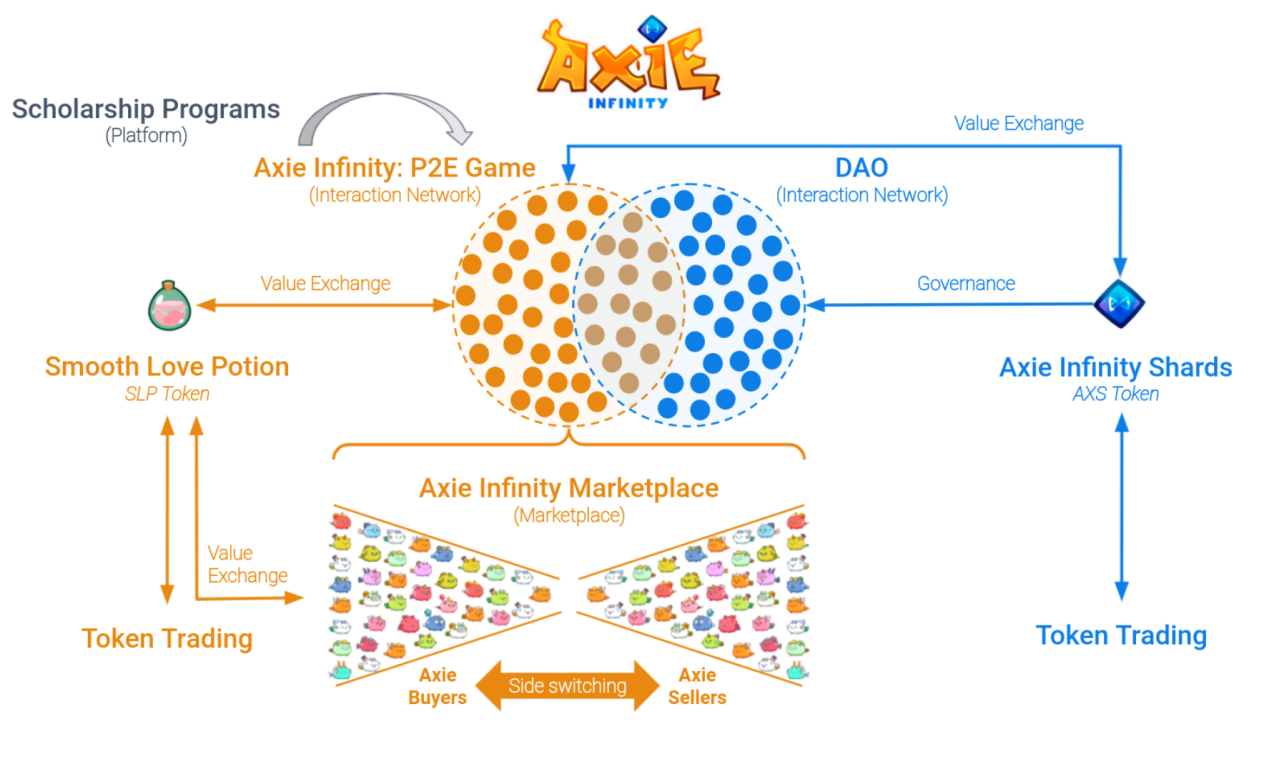

Axie Infinity is the largest earn-to-earn (P2E) game with over 2.2 million monthly players as of November 2021. As you can see in the animation above, Axie Infinity combines four different network effects:

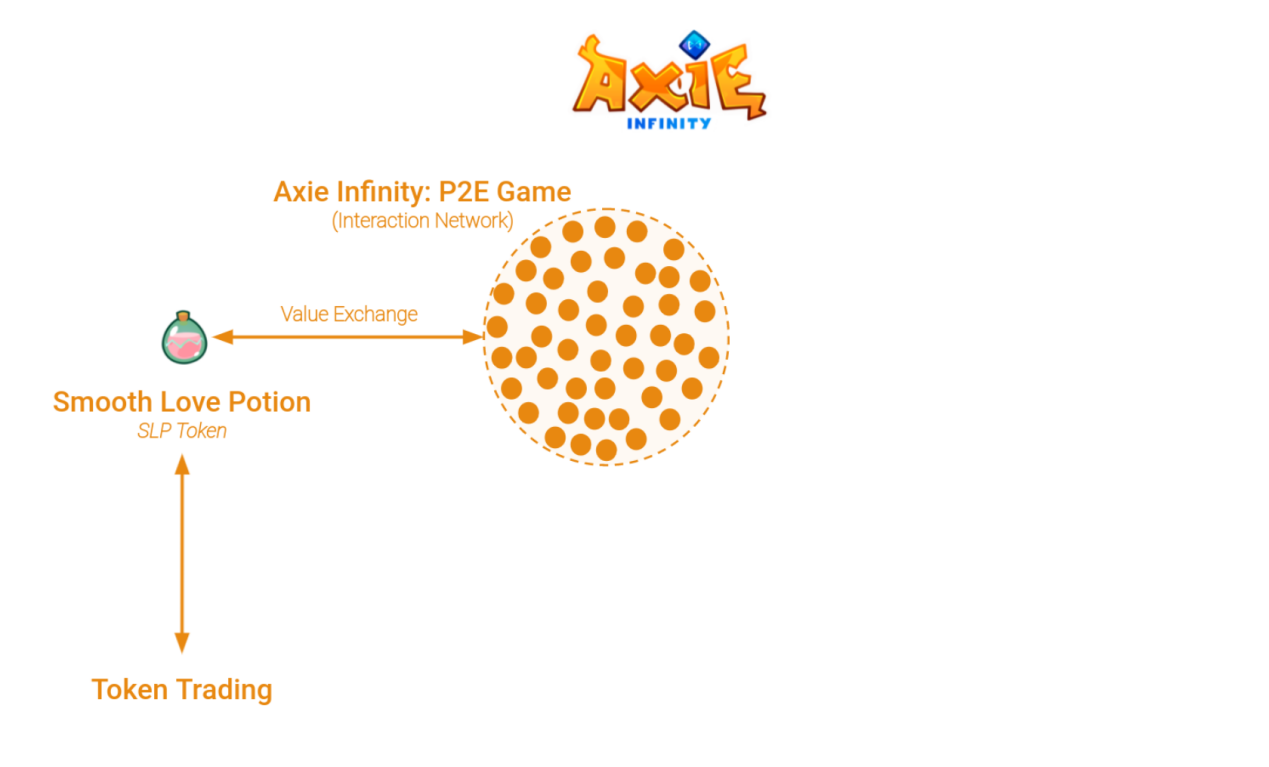

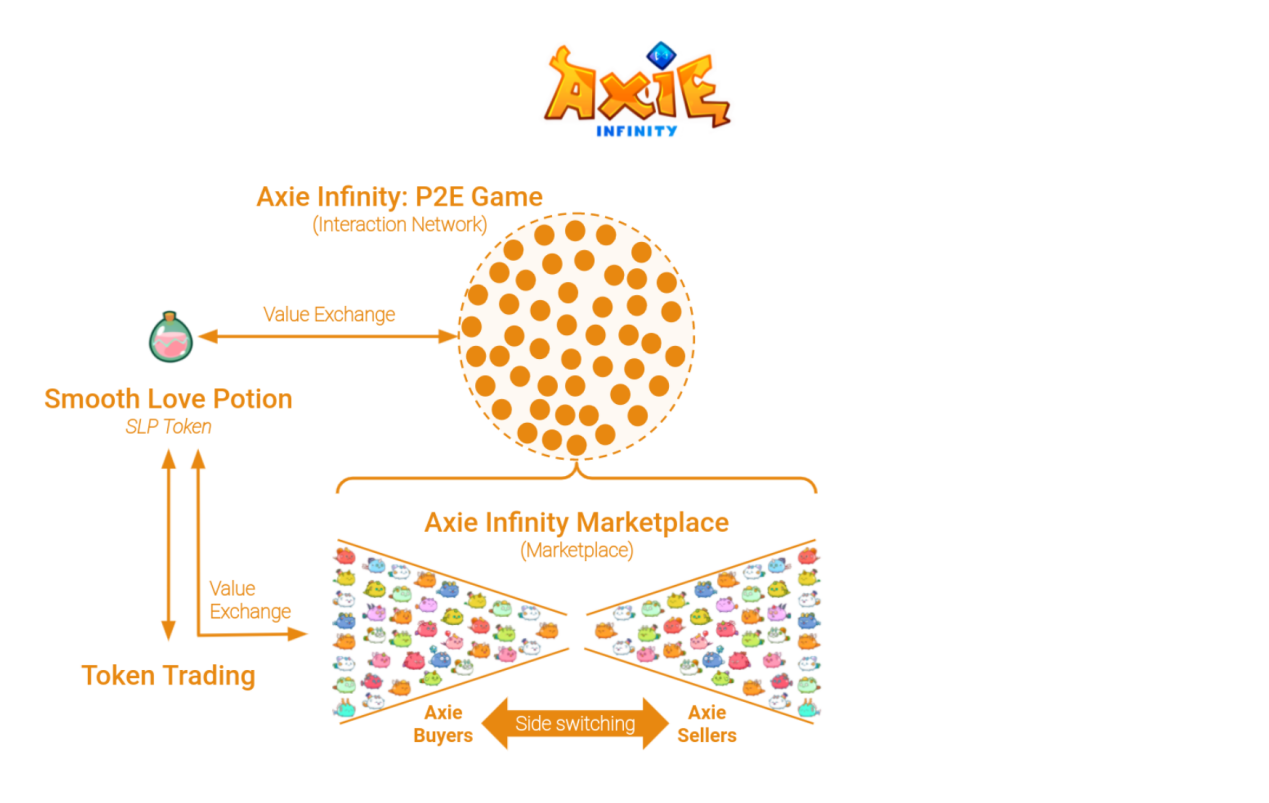

Network Effect 1: P2E Games (Interactive Network)

The game has some similarities to Pokémon - players aim to breed, fight and trade creatures called Axies. Each Axie has a unique set of attributes and types, which can make it more or less effective against other types. Players earn SLP tokens as rewards for winning battles and other in-game challenges. These tokens can be traded or sold, creating an income stream for players - the revenue part of the game.

Obviously, this is a multiplayer game, making it an interactive network similar to Minecraft and Fortnite - more adoption gives you more opportunities to discover, fight and trade with other players. Therefore, the ability to make money is also related to adoption. However, it's also identity-agnostic -- the identity of each player doesn't matter. Therefore, increasing player adoption does not increase the game's utility or monetization potential. This has a direct and negative impact on the defensibility of this network effect.

In fact, early data suggests that growing player adoption creates network congestion and reduces earning potential—a negative network effect. This presents a great opportunity for other P2E games to compete and poach players. So it's no surprise that alternative P2E projects like Splinterlands are gaining popularity. Upcoming projects such as Illuvium and Blankos Block Party are also seeing strong interest.

Network Effect 2: Axie Marketplace (Marketplace)

Axie Marketplace is the second layer of Axie Infinity network effects. The name is pretty self-explanatory - it's a marketplace where players buy and sell Axies (and other in-game items). This isn't much different from a web 2.0 marketplace with a side switch such as Poshmark. The resulting market network effects reinforce the game's interactive network effects. Players cultivate more Axies and increase the diversity of in-game items, thus making the game more valuable and attractive.

One factor to keep in mind is that Axies are NFTs. This means there is nothing stopping players from selling their Axies on another NFT marketplace, such as Opensea (which itself is a web 2.0-style marketplace with strong network effects). However, each Axie has unique properties - making the Axie supply very diverse. And because Axie Marketplace is integrated with games, it's easier to aggregate the "long tail" of unique Axies and in-game items than third-party marketplaces like Opensea. As a result, Axie markets have 40% more traders than Opensea as of November 2021.

Due to the differentiated nature of its supply, the marketplace component of Axie Infinity is highly defensible, i.e. the Axie marketplace will likely remain the go-to destination for purchasing in-game items. However, it is only defensive if the game remains engaged, i.e. it cannot prevent players from transitioning to other P2E games.

Network Effect 3: DAO (Interaction Network)

Axie Infinity was originally created by the Sky Mavis team. However, with the help of another token called Axie Infinity Shards (AXS), Sky Mavis aims to transfer the governance of Axie Infinity to a Decentralized Autonomous Organization (DAO). My countryman Atomico Angel Sarah Drinkwater described DAOs as "group chats with shared goals and money" - an accurate summation. To simplify things, holders of AXS tokens will be part of a group (or DAO) that governs and votes on the future roadmap of the Axie Infinity project—essentially acting as a distributed governance team.

This is another form of interactive networking where identity affects defensibility. In this case, the importance of user identity depends on the size of the network. In the early days of a DAO, all participants know and trust each other - so identity matters. The addition of users adds variety of perspectives and impact to the Axie Infinity project. But as more and more people acquire AXS tokens and enter the ecosystem, DAOs can scale from a handful of participants to thousands or more. At scale, adding more AXS holders does not add any value to the project. In other words, the value of a network effect flattens out or asymptotically over time, making it less defensible.

However, DAOs have other benefits. Ownership and the ability to vote on the project's future can introduce another form of defense - an emotional attachment or tribal loyalty to the project/community's success (and the failure of others). This is a psychological switching cost, not a network effect. But in this case, it may be a more meaningful form of defense than network effects themselves.

Network Effect 4: Axie Infinity Scholarship Program (Platform)

The final network effect layer of Axie Infinity is tied to its derived ecosystem. In order to play Axie Infinity, players need to buy 3 Axies from the Axie Market -- the cheapest of which costs about $200. This is a significant investment for many players, especially those from emerging markets. To lower this barrier to entry, "scholarship" programs popped up, "renting out" Axies to aspiring players. Those players then give the program a cut of the revenue they earn from the game -- not too different from a student loan.

The increase in the number of scholarships increases the accessibility of Axie Infinity to new players. The increase in aspiring Axie Infinity participants increases the market potential of the scholarship program. This has some characteristics of a platform, with Axie Infinity as the underlying product.

However, this isn't exclusive to Axie Infinity. Many of these programs, such as Yield Guild Games, have expanded to other P2E games, such as The Sandbox. So the network effects here are still weak and not a sustainable source of defense.

These case studies are just two of many interesting crypto and web3 projects. However, many of their network effect models are also present in the web3 space - relatively weakly defensible native layered network effects. This leads me to two initial hypotheses:

The first possibility is that in this day and age, true network effects are no longer a meaningful source of structural defense. Rather, defensibility will depend on the tribal and psychological switching costs of each project community. While I can't dismiss the possibility, I'm skeptical. The psychological switching costs are real, but this explanation masks the amount of innovation that is yet to come in this era. Furthermore, Axie Marketplace and Opensea show that powerful network effects are still possible – even if they are now reminiscent of web 2.0.

The second possibility is that we are too early in the web3 cycle to achieve a sustainable defense - similar to Yahoo in the early days of web 1.0 and Myspace in web 2.0. In other words, most projects are still experimenting with web3 capabilities. And the long-term winners—with stronger, more reliable network effects—will emerge only after this phase of experimentation. This is my preferred conclusion.

If point 2 is the most likely explanation, we need a broad framework for evaluating network effects in upcoming web3 projects. They certainly have interesting nuances, but the basic questions that define them remain the same:

Interaction: How do users interact with others?

Network Effects: Does adding one user increase the value of all users?

Scalability: In what way does each new user affect value? Are there any restrictions?

Defensiveness: How does this change as adoption grows?

These questions are critical to assessing the potential of web3 projects. Those who combine the power of web3 with a more powerful network effect layer may be the biggest winners of this era.