Looking back on Ethereum in 2021: Why is Ethereum the foundation of digital civilization?

first level title

Original translation: Block unicorn

Ethereum is the foundation of digital civilization

It is robust, safe and reliable, and it is the cornerstone necessary to support the digital cities built upon it. These cities are developing rapidly. Since Ethereum is open to all, many different users find reasons to build on it:

The market uses it as a financial infrastructure

Artists use it to imbue their work with permanence

Assets use it as a settlement layer

It is used by the community to manage shared resources

This year, Ethereum applications have exploded into the public consciousness. As the world began to understand the vision of a more decentralized internet built on Ethereum, the old term "web3" caught on again.

Just like in 2018, 2019 and 2020, the goal is to zoom out and reveal the bigger picture. We believe that,The most important developments in Ethereum this year are:

1. The arrival of Layer 2 - After years of development, the L2 protocol was launched on the main network and expanded the capacity of Ethereum.

2. Creator economy goes mainstream — NFTs are everywhere, artists use Ethereum to make billions.

3. Core protocol upgrades - The Ethereum R&D community has carried out multiple upgrades to prepare for the transition to Proof of Stake.

4. DAO crosses tipping point - DAO becomes a viable tool for community self-government, amassing billions in assets, and attracting new users.

first level title

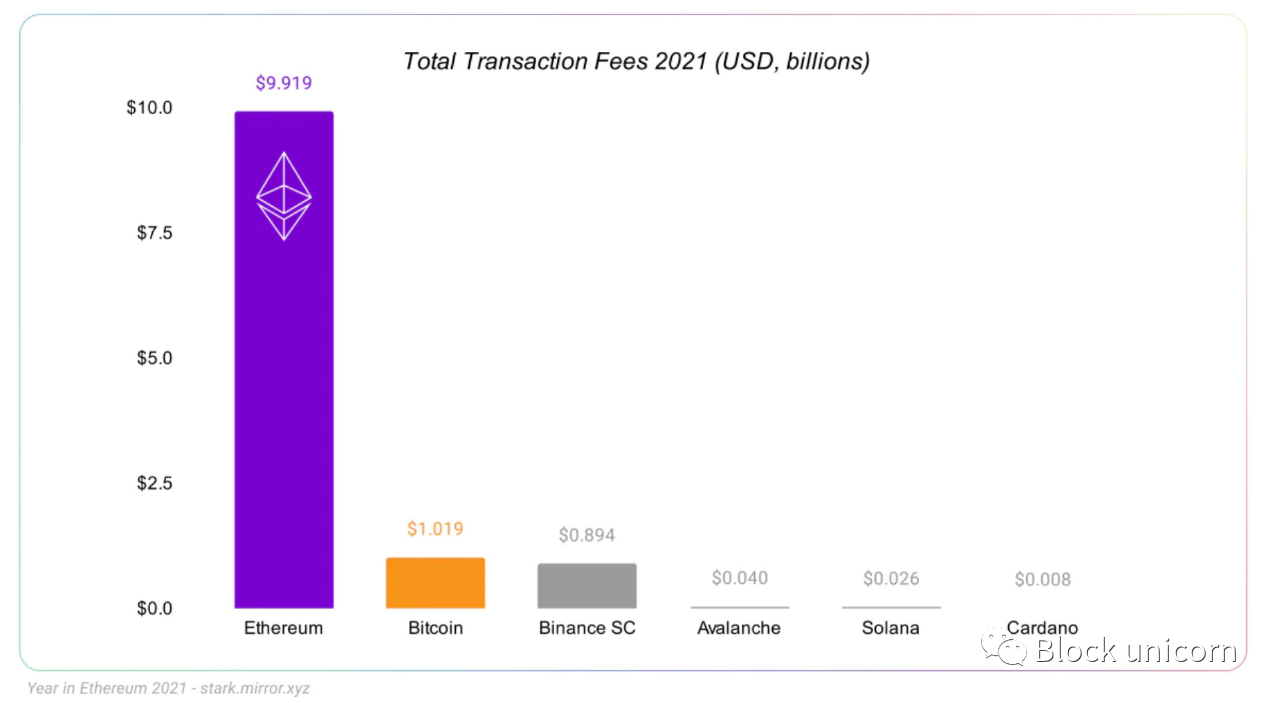

A. Which blockchains are people paying to use?

Ethereum is the most demanded blockchain in the world for the second year in a row.

The graph shows total transaction fees for selected L1 blockchains. This is the sum of all fees paid using each L1 - sending transactions or interacting with smart contracts. Collectively, they represent the value of the blockchain’s total “block space” — the blockchain’s total transaction capacity in a given year.

Total transaction fees are only one indicator, and taken alone, they are not a perfect representation of the value of a blockchain or its utility to users. However, it does show us the comparative value of each blockchain to its users. In a well-functioning market, it's worth what people are willing to pay for it.

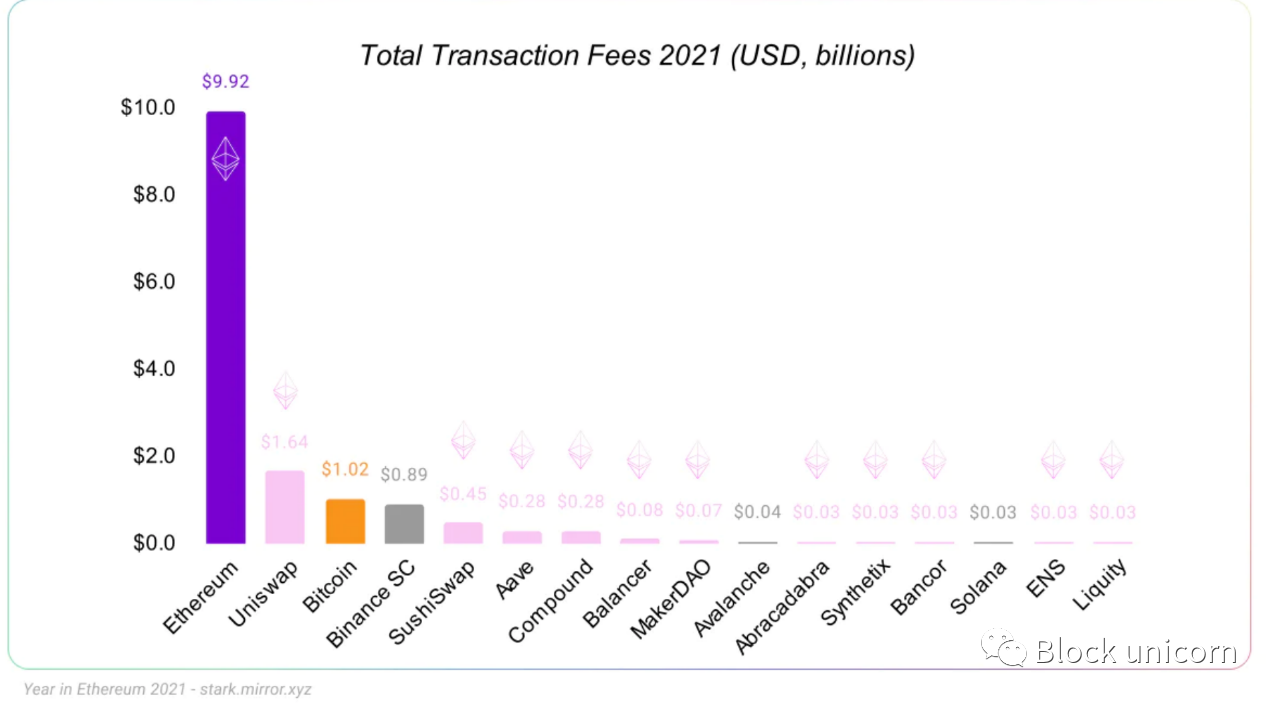

If we expand the comparison to include applications, L2 networks, and other L1s, we see the following:

Each pink entry is an application built on Ethereum, such as Uniswap or ENS. For these applications, the total fees here are not blockchain transaction fees, but other types of fees that users pay to use the application (such as fees paid to exchange liquidity providers).

Incredibly, in 2021, the value paid for using applications built on Ethereum exceeded the value paid for using all other L1 blockchains combined.

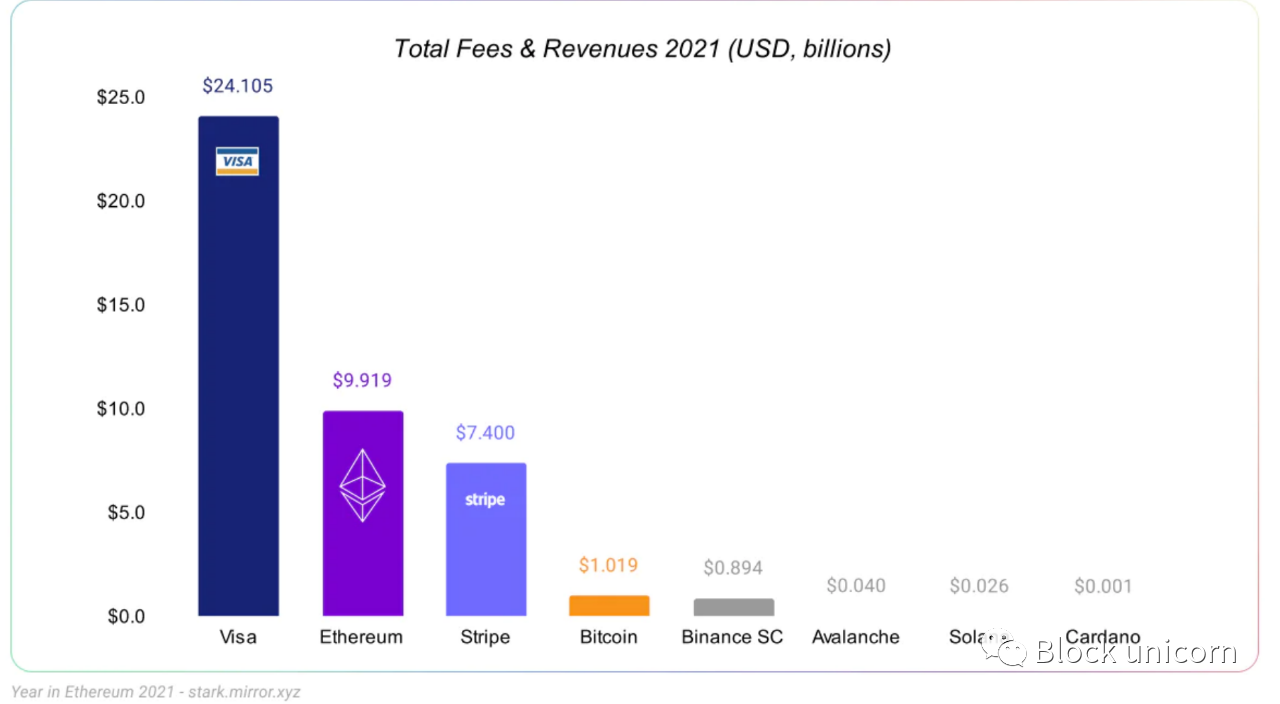

As demand for Ethereum block space continues to outpace all other blockchains, we can look elsewhere for meaningful comparisons. This year, we can compare the fees paid using Ethereum L1 to the revenues of payment networks like Visa and Stripe:

first level title

B. How much value has Ethereum moved?

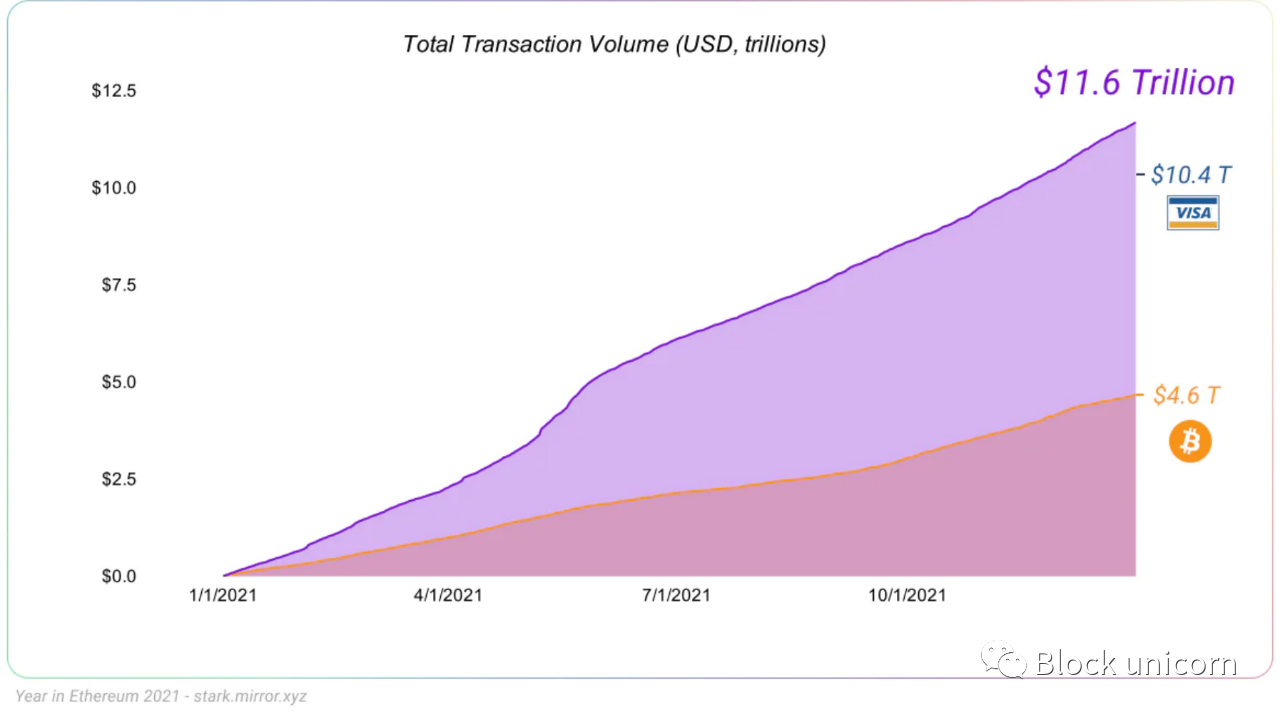

One of the simplest use cases of blockchain is to transfer assets,How much value has been transferred on Ethereum this year?Since surpassing Bitcoin in mid-2020, Ethereum continues to be the blockchain for settling the world's largest asset flows.

Ethereum data includes all major ERC20s with over $500 million in transaction volume. Bitcoin data includes USDT on Omni. Because we did not count all assets on Ethereum, this chart underestimates the total transaction volume on Ethereum. Data from Visa (annualreport.visa.com) and CoinMetrics (coinmetrics.io),

Ethereum Moved About $11.6 Trillion This Yearfirst level title

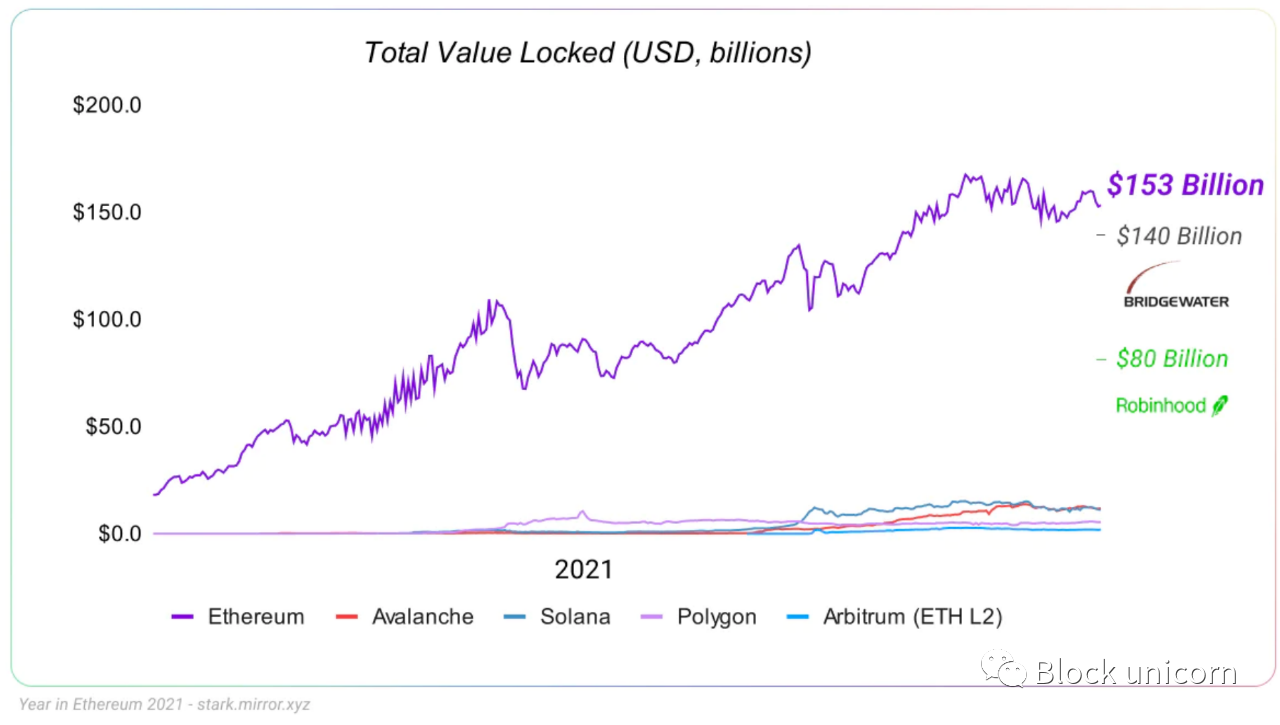

C. Value locked in DeFi

Finally, we can track the total value of all assets locked in DeFi protocols. “Locking” an asset in DeFi means that a user deposits some funds into the protocol, usually in exchange for a reward in exchange for the protocol using their asset — for example, as liquidity.

Ethereum’s DeFi sector continues to have the largest amount of locked assets, and by a wide margin.

Once again, we have to look outside the blockchain ecosystem for comparable data. In 2021, the total value of DeFi locked on Ethereum ($153 billion) exceeds the assets under management of Robinhood ($80 billion) and Bridgewater Associates ($140 billion).

1. Reach Tier 2

After years of research and development, the technology that will scale ethereum went live this year. The transaction capability of Ethereum is no longer a simple layer 1 capability of Ethereum.

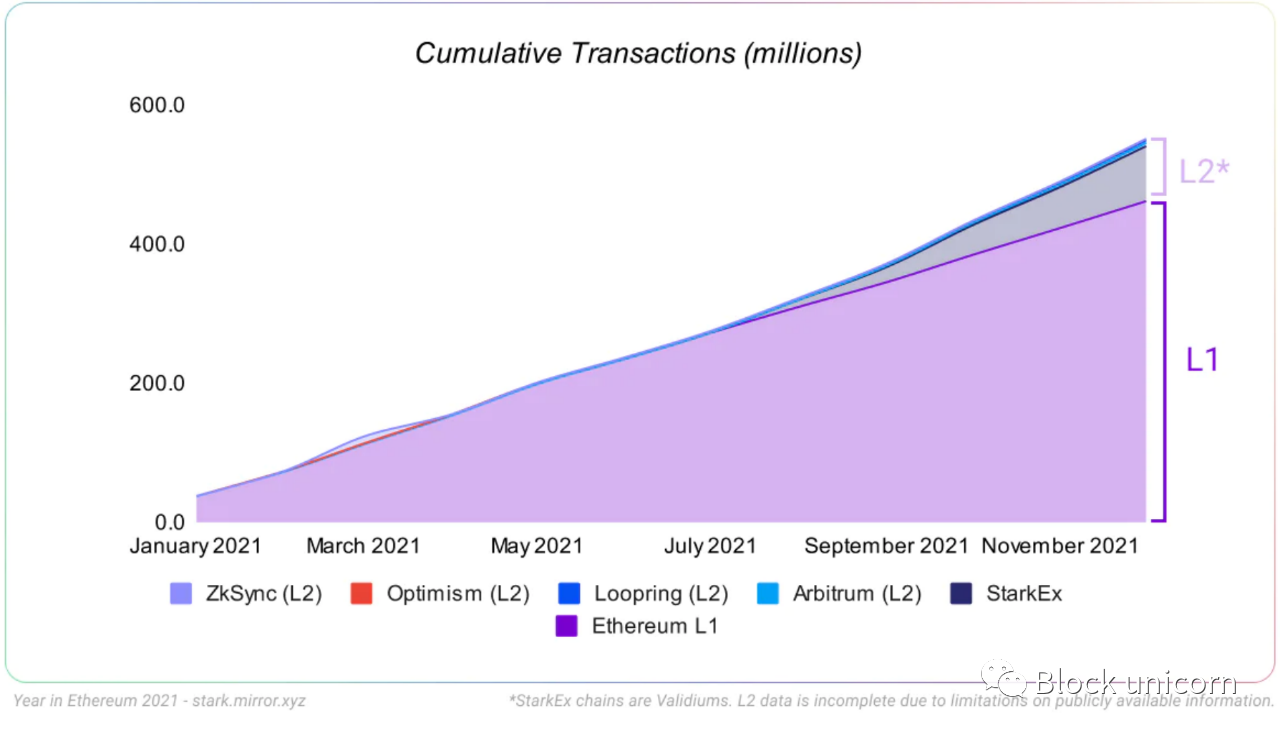

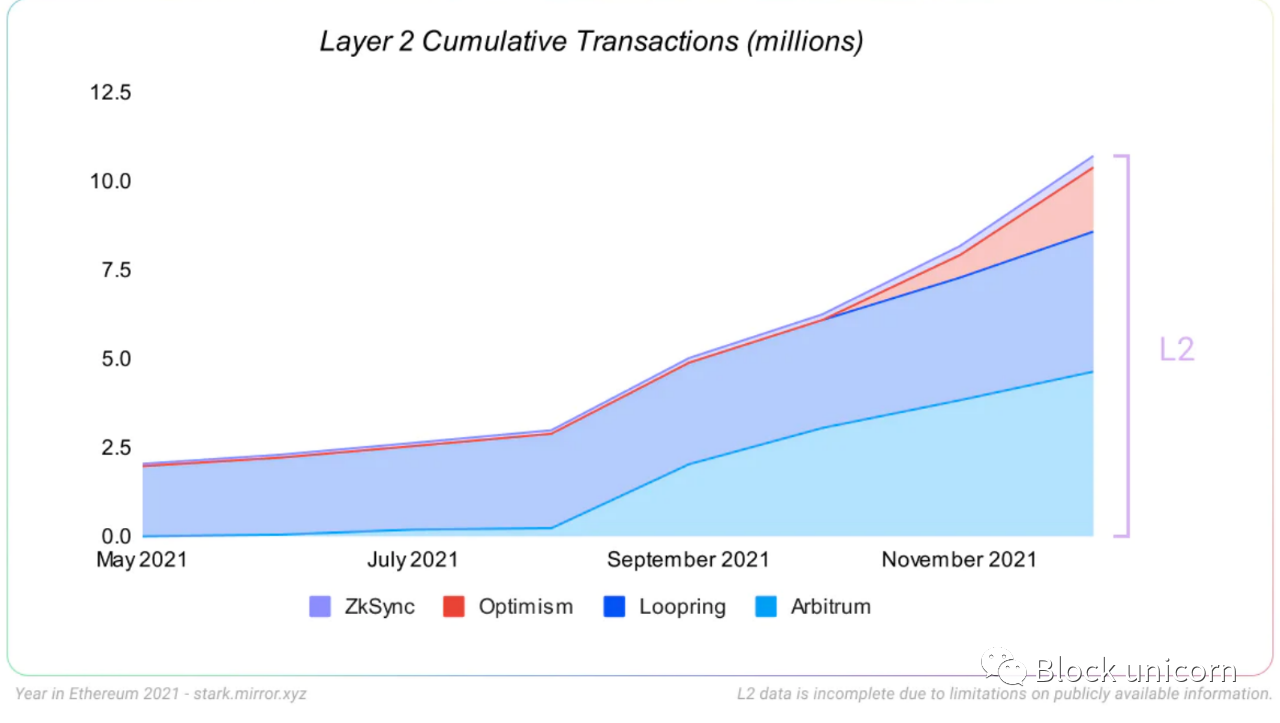

image description

L2 data is incomplete due to restrictions on publicly available information. All data here: https://docs.google.com/spreadsheets/d/1-Is51Do_AgatnUsoxo-Iy7B0clCyxf1VN_gDt8mtly4

This graph shows us the total cumulative transactions on Ethereum in 2021, including L1 and L2. In 2021, Ethereum's L1 is doing about 1.2 million transactions per day (or about 15 transactions per second). As the Layer 2 protocol came online, Ethereum's effective capacity began to increase, and the combined transaction rate (top of the chart) began to bend upwards.

All L2 protocols are still in the early stages of deployment, and some have not removed all temporary trust assumptions (see L2Beat for more information). There are also significant differences between the technologies grouped here. For example, StarkEx chains are technically Validiums, meaning their proofs are stored off-chain, not on-chain.

As L2 protocols continue to mature and gain market share, the L2 portion of the graph will grow until they far exceed the transaction capacity of L1. "Ethereum" no longer refers to a single protocol, but to a community of protocols sharing a common L1.

You may have read that Ethereum is expensive or slow, but that's only because people make the wrong comparisons. Ethereum is the first blockchain mature enough to build multiple production-ready L2s on top of it. While gas fees are still high for some use cases on L1, 2021 marks an inflection point for the future, with most users only interacting with Ethereum through L2.

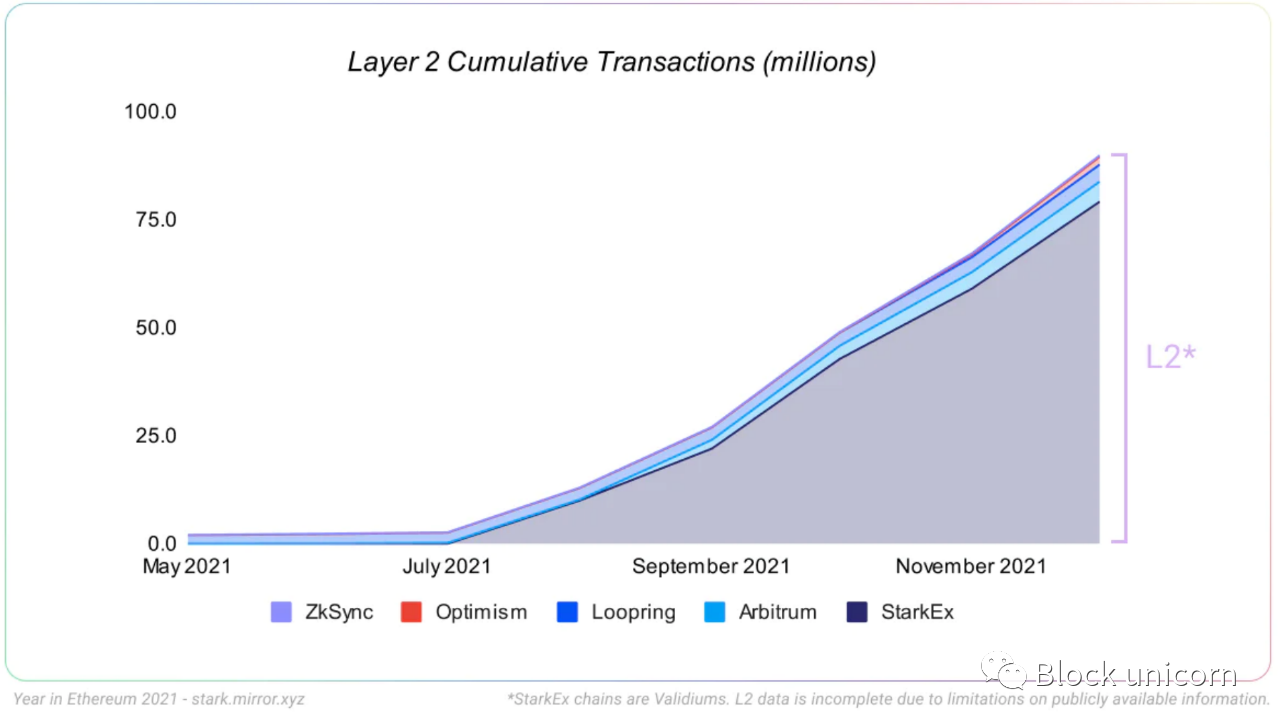

Currently, the lion's share of L2 transactions is done on application-specific L2 protocols called "ZK rollups". These are L2s specialized for certain types of applications, such as transactions or simple token transfers.

The ZK rollup ecosystem built on Ethereum has made progress in 2021:

Loopring launched the zkRollup decentralized exchange back in 2020. They completed the v2 launch in early 2021 and added support for NFT minting and trading in August 2021.

Matter Labs launched payment aggregation (zkSync) in June 2020, which is integrated into wallets such as Argent and applications such as Gitcoin (and continues to develop "zkSync 2.0" with EVM compatibility).

Aztec launched a private payment pool (“zk.money”) in March 2021 and added support for the DAI stablecoin in April.

include:include:

DeversiFi (decentralized exchange) launched rollup in June 2020.

ImmutableX (NFT exchange) launched rollup in April 2021.

dYdX (defi trading platform) launches rollup in April 2021.

image description

L2 data is incomplete due to restrictions on publicly available information. All data here: https://docs.google.com/spreadsheets/d/1-Is51Do_AgatnUsoxo-Iy7B0clCyxf1VN_gDt8mtly4

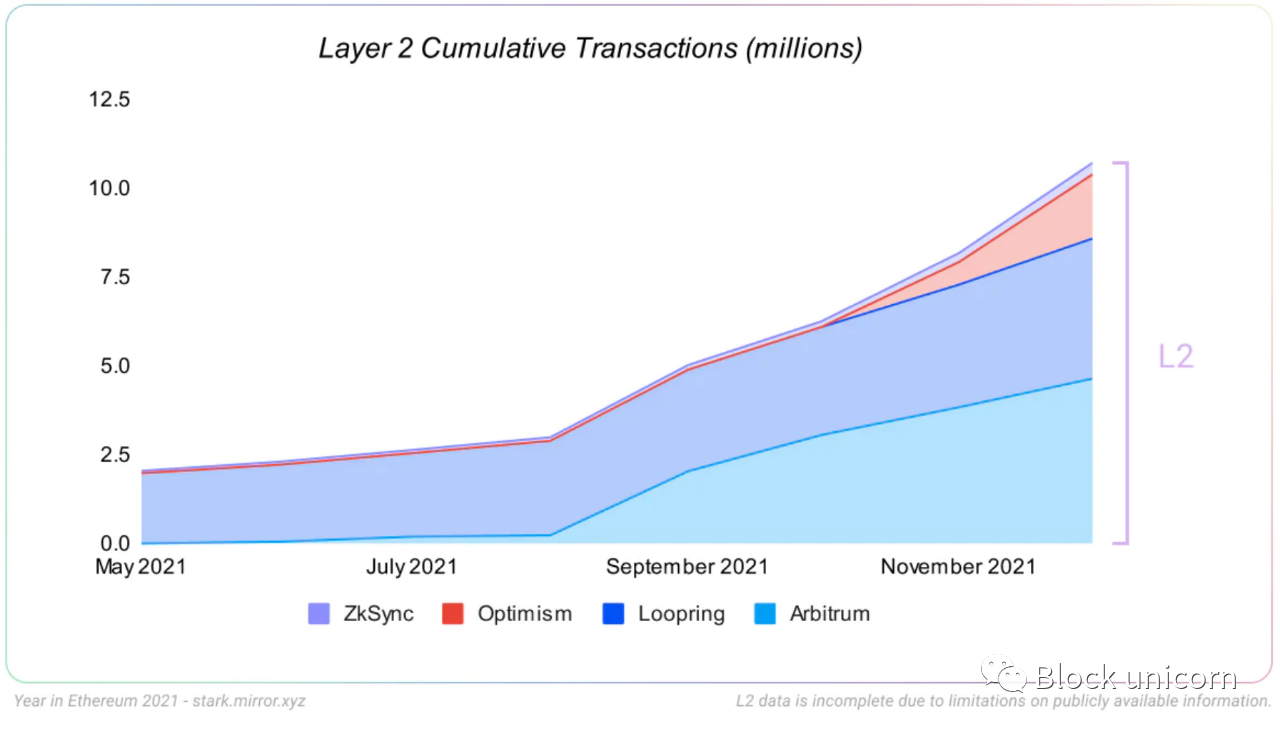

This year saw two important new additions to the Rollup ecosystem:Arbitrum and Optimism.

image description

L2 data is incomplete due to restrictions on publicly available information. All data here: https://docs.google.com/spreadsheets/d/1-Is51Do_AgatnUsoxo-Iy7B0clCyxf1VN_gDt8mtly4

Arbitrum launched on mainnet on May 14 and removed their whitelist on August 31. Optimism emerged a few months later, launching on mainnet on August 19th and removing their whitelist on December 16th.

As the L2 ecosystem grows, users deposit more and more funds into it. At the time of writing, there is about $6 billion in the L2 protocol.

Summary in context

For a decade, the crypto community has been working on scaling blockchains using "Layer 2" technologies. Bitcoin payment channels have been discussed as far back as 2012. While channels will eventually go into production on Ethereum as a relatively niche scaling solution, they cannot scale smart contracts.

In 2017, Vitalik and Joseph Poon proposed a new solution called Plasma. The basic idea is to extend Ethereum by creating independent blockchains that will be anchored to Ethereum, inheriting security through clever code and economic mechanisms.

This research direction has led to a new technique called "rollup". Based on the idea of Plasma, Rollups scales Ethereum by creating a unique L2 blockchain that can be cheaper and faster to use while still inheriting the security of L1.

Applications exist on the aggregated chain, and users interact directly with the aggregated chain. Behind the scenes, the protocol bundles (“summarizes”) everyone’s transactions and stores their records on Ethereum L1. These records ensure that these transactions benefit from Ethereum's strong security.

But there are two different ways to do this, leading to two different types of rollup designs: optimistic rollups and zero-knowledge rollups.

In zero-knowledge aggregation, cryptography is used to prove that a transaction is valid and this proof is stored on Ethereum. Most of the data can be discarded (meaning you don't need to store it on-chain), only a small amount of data remains. But it is enough to prove mathematically that the transaction works.

There are many application-specific rollups today, which we covered above. But generalized ZK (zero-knowledge) rollups are still a work in progress, being built by groups like Matter Labs, Starkware, Polygon Hermez, Scroll Tech, and the Privacy & Scaling Explorations group.

To simplify a complex topic: ZK rollups work by converting code that operates on rollups into special mathematical equations. This equation gives us a succinct proof of storage on mainnet.

It is much easier to define such an equation when the possible inputs are restricted. For example, if we are only going to do simple token transfers. These application-specific equations are easier to design.

In contrast, it is much harder to define equations that can take any possible code input and create proofs from them. This is the challenge of creating ZK rollups that can be used for general arbitrary code.

This "universal" computation (also known as "EVM equivalence") is easier to implement with Optimistic rollups.

Using Optimistic Rollups, L2 rollup chains leave bundled transaction records on L1. In most cases, however, the "proofs" that guarantee these results work don't actually run. The protocol is optimistic - it assumes that every block is valid, but we reserve the right to always prove it if necessary.

Because Optimistic Rollups need to save data so that someone can run a proof later, they need to post large amounts of transaction data on-chain (rather than tiny proofs that have been verified using zero-knowledge techniques). But because no new cryptographic innovations are required, fully generalized Optimistic Rollups (such as Arbitrum and Optimism) already exist in production environments today.

In either case, it means that you are pretty sure your aggregated transactions are final. If someone sends you ETH in the rollup, proof of that transfer exists on Ethereum, and you will always be able to withdraw that ETH to L1 if needed.

first level title

2. Ethereum’s creator economy goes mainstream

In a blog post last year, we noted that Ethereum’s “creator economy” was showing signs of growth. Cryptoart’s transaction volumes rose sharply in December, with signs that more and more artists are trying to capture the value of their work using the tools Ethereum provides them, and the ensuing year exceeded expectations.

image description

Note: Ethereum data is for 2021 and all other data are for 2020 due to public information limitations. All data documented here: https://docs.google.com/spreadsheets/d/1-Is51Do_AgatnUsoxo-Iy7B0clCyxf1VN_gDt8mtly4/

first level title

What is the creator economy?

Ethereum's "creator economy" is a set of tools, services, and marketplaces that enable creatives around the world to use Ethereum to earn money from their work.

To date, the internet’s “creator economy” has been dominated by large, centralized platforms. Most of these use a similar model, with platforms like YouTube or Spotify earning revenue from advertising or subscriptions, and then passing a small portion of that revenue on to creators.

This business model has turned Spotify into a $40 billion company. But that has always displeased most artists, who make a small cut of each stream. In 2020, only 13,400 artists earned more than $50,000 from Spotify (out of 1.2 million artists on the platform).

More artists work for free by posting their work on Instagram or Twitter, artists get paid for exposure, and platforms capture value.

Ethereum provides creators with new tools to monetize their creations. One tool in particular stands out: NFTs. A digital certificate representing ownership of any digital file, including artistic, musical, photographic, video or gaming items. In 2021, platforms such as OpenSea, Rarible, Foundation, Zora, and Mirror will enable artists to create, sell, and trade NFTs.

The NFT ecosystem is in a very early stage. Remember, a year ago, the NFT market barely existed. Today, the vast majority of transaction volume and users are concentrated on one platform (OpenSea). However, there are many projects working on launching competitors, including decentralized exchanges. As we know from the history of decentralized exchanges (“dex”) and the incredible growth of Uniswap, decentralized projects that put ownership in the hands of users can meaningfully compete with centralized incumbents. competition.

The rapid expansion of the NFT market has generated mainstream interest. Steph Curry, Eminem and Shaquille O'Neal buy Bored Apes. Adidas did the same, they also bought the digital land and released their own NFT collection. Budweiser, Paris Hilton, Trey Songz, Drake Bell, and the CEO of Shopify all registered ENS names and put them in their Twitter handles.

Aside from soaring NFT valuations and celebrity interest, the emergence of Ethereum’s creator economy marks a quiet revolution in our community.

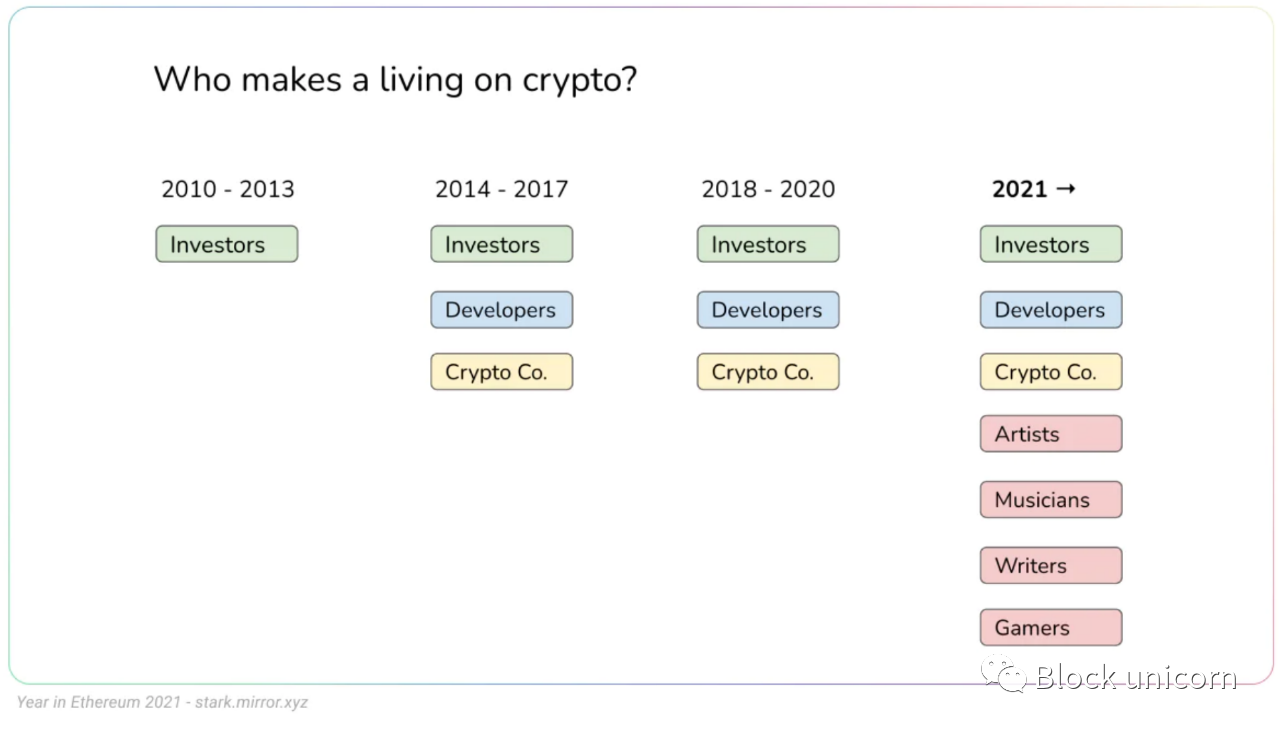

For most of the history of the crypto industry, most people who could make a living using these technologies fell into a few categories: investors, developers, or people who worked for crypto companies.

But in 2021, things have changed.

This year, more people from new and very different professional backgrounds started using Ethereum to support their finances. By 2021, people will be able to make money using Ethereum without any pre-existing capital, no technical skills, no background in finance or investing, and no need to work at a crypto startup.

These creators are not just regular users, but core members of the Ethereum community that depend on it and have a significant stake in the ecosystem. This change has resulted in an influx of new people, ideas, communities, talents, perspectives, and concerns, changing the Ethereum ecosystem and impacting its future.

first level title

text

In 2021, the Ethereum community has made steady progress in transitioning to proof-of-stake with two major mainnet upgrades, bringing changes such as new fee markets and many small optimizations.

The research, development, coordination and implementation of these upgrades is carried out by independent teams around the world through open research and collaboration. As always, Ethereum is a bazaar, not a cathedral.

Most of the work is done by the team that builds and maintains the individual clients. Ethereum is the only blockchain with multiple independent teams actively building production client software.

User diversity has always been a priority for the Ethereum community, although it remains challenging in practice. Client diversity helps prevent bugs in a particular client that could destroy its monetary value, but also serves as a check on governance captured by the core developer bloc. Ethereum is a "spec-first" blockchain, meaning that the protocol's rules are independent of any particular piece of software or the collection of individuals maintaining that software. Anyone can implement the specification and build their own client to compete with existing ones.

This year, the user team and the larger R&D community made two substantial upgrades to the Ethereum mainnet: "Berlin" in April and "London" in August. These upgrades include several changes. Most notably EIP-1559, which reformed the Ethereum fee market (discussed in depth below), but also included key changes such as EIP-2929, which improved Ethereum's defenses against DOS attacks.

Teams also upgraded “Altair” to the “Beacon Chain” — a proof-of-stake chain that has been running in parallel to the Ethereum mainnet since December 1, 2020. Altair upgrades both enable light client consensus and update slashing and liveness incentives.

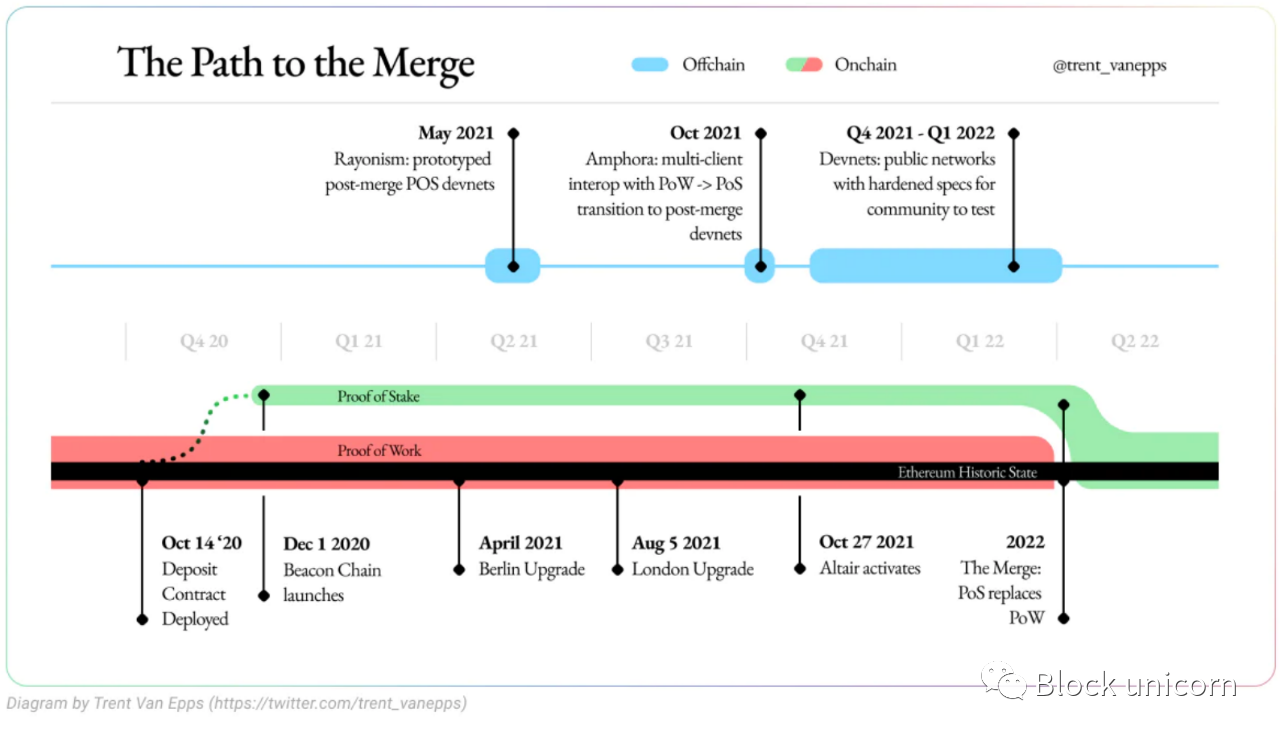

The backdrop to all this work is the ongoing progress toward a “merge” — the moment when Ethereum’s proof-of-work system will be shut down forever in favor of proof-of-stake (discussed in depth below).

Even during this time of change, the Ethereum mainnet continues to process and secure billions of dollars without interruption.

EIP-1559 - Fee Market Reform

On August 5th, EIP-1559 was launched on the Ethereum mainnet. The upgrade introduces several reforms to ethereum's "fee markets," a set of rules that define the marketplace where users pay to have their transactions recorded in the ethereum blockchain.

EIP-1559 has multiple goals:

Reduces the likelihood of users overpaying for their transactions.

Reduce transaction lag rate.

Enhances protocol security by reducing the likelihood of reassembly and making DOS attacks more expensive.

Burning a part of the fee can add value to ETH and improve the economic security of Ethereum.

As with most Ethereum protocol upgrades, this is the culmination of years of research, development, testing, and debate within the Ethereum community.A 2014 blog post by Vitalik shared early thinking, followed by an ethresear.ch article in July 2018, and a 2019 EIP (“Ethereum Improvement Proposal”) draft. Two years of analysis and discussion followed, including by Tim Lovegarden.

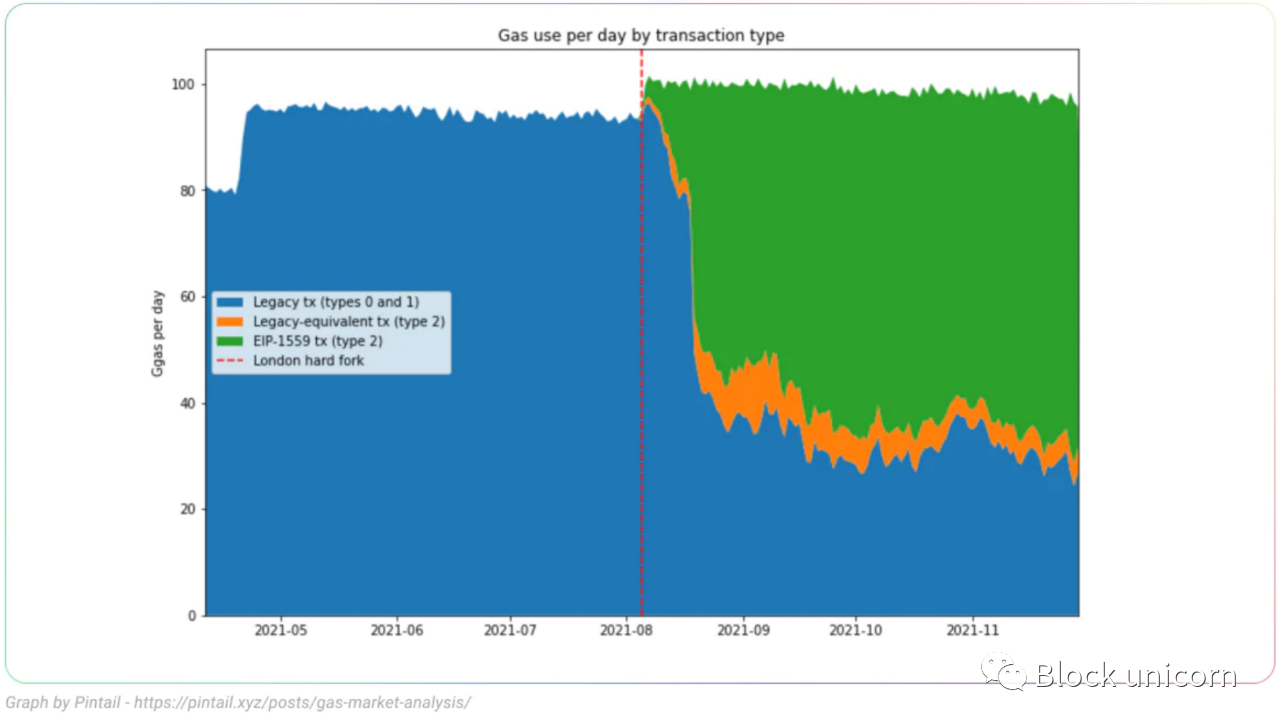

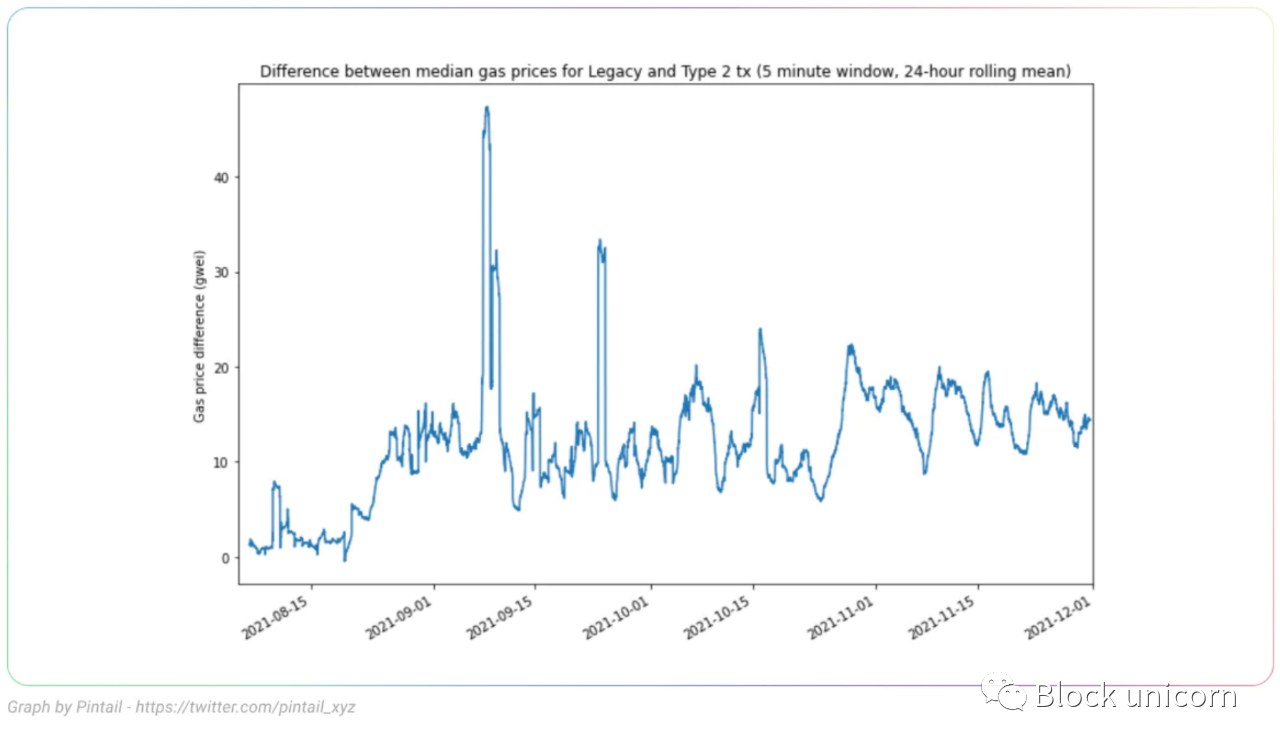

image description

Source: Pintail (https://pintail.xyz/posts/gas-market-analysis/)

This diagram shows the breakdown of Ethereum "Type 2" (tx using EIP-1559) and "Legacy" transactions. By the end of 2021, about 35% of transactions on Ethereum will still use "legacy" transactions. However, even legacy transactions can benefit from EIP-1559 because it improves how gas estimates are generated.

Many wallets and exchanges have enabled EIP-1559 transactions, including MetaMask, Rainbow, MyCrypto, Frame, Trezor, Brave, Coinbase (and Coinbase Wallet), Blockfi, FTX, and more.

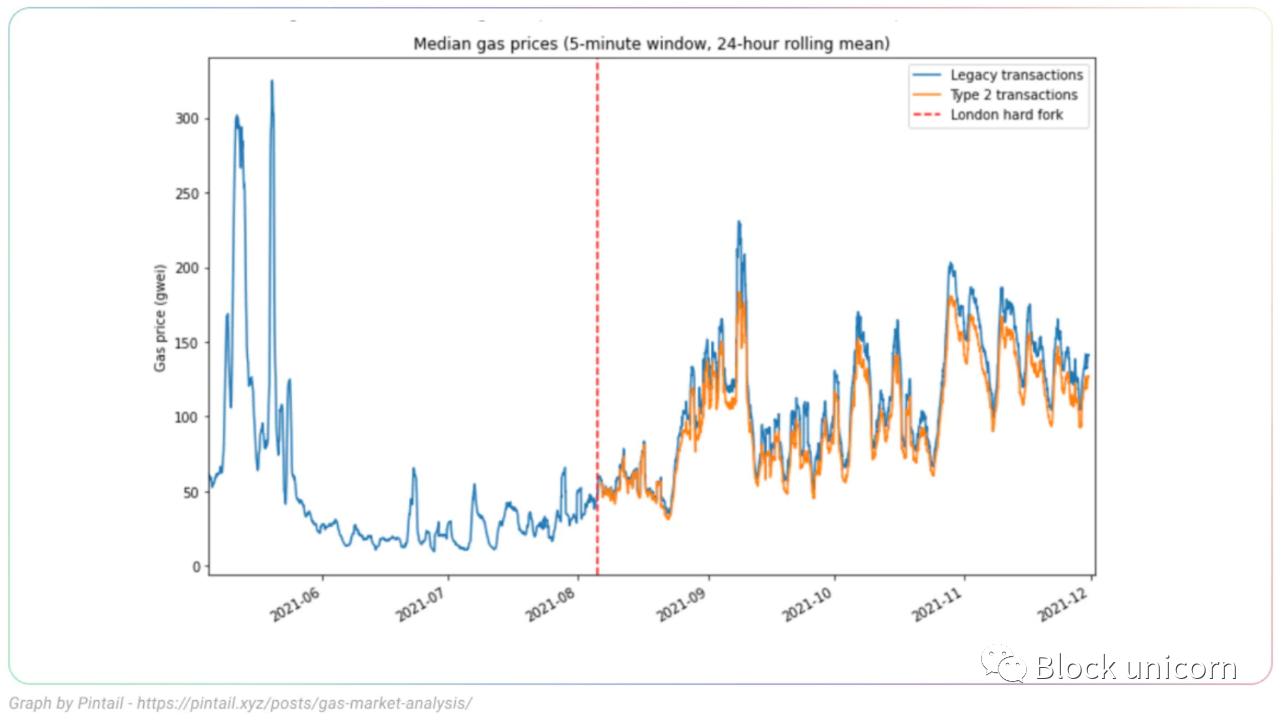

image description

Source: Pintail (https://pintail.xyz/posts/gas-market-analysis/)

image description

Source: Pintail (https://pintail.xyz)

This figure shows the benefits in more detail. The blue line shows the gas price difference between the two transaction types since EIP-1559 went live (the higher the line, the greater the savings). Traditional transactions are always 10-20 gwei more expensive.

EIP-1559 also seems to reduce the likelihood of transactions getting stuck without requiring users to pre-emptively pay overages for inclusion (which many users who are used to stuck transactions have been doing). If you're interested in learning more, see this article from pintail, this article from Coinbase, and this article from blocknative.

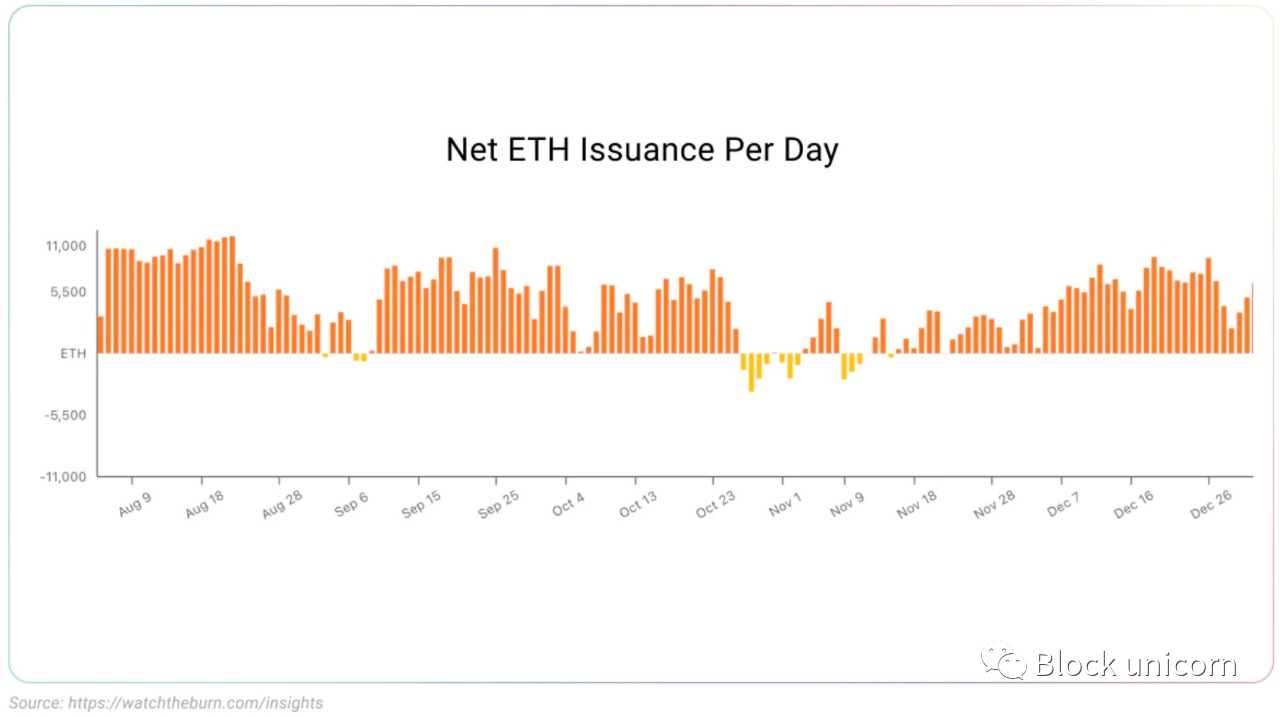

feel the burn

EIP-1559 also introduces a change whereby a portion of the fees each user pays to use the protocol is burned ("burned"). This means that each transaction removes a certain amount of ETH from the total supply.

This creates a mechanism to add value to ETH - an important part of the broader vision of making Ethereum the most secure blockchain in the world.

Ethereum's consensus mechanism depends in part on the value of ETH. Under PoW this is because miners are paid ETH for securing the network, while under PoS this is true because stakers are both paid ETH to secure the network and because they need to stake ETH to provide this security sex.

Burning a portion of the fees creates a relationship between usage of the protocol (transaction fees) and the value of ETH itself (by reducing supply). Since August, 1.32 million ETH have been burned in 2021.

merge

merge

Migrating from Proof of Work to Proof of Stake has been the earliest vision of the Ethereum community. While Proof of Work may have been necessary to initiate the first experiments in blockchain design, in the 12 years in between it has become clear that better designs are possible. The design is more secure and does not consume excessive energy, resulting in a strong economic security.

Ethereum's proof-of-stake system is the culmination of more than 7 years of research and development. Why did it take so long? Since the process began, the Ethereum community has been reluctant to compromise on decentralization.

Although different proof-of-stake systems exist on other chains today, most of them make significant concessions in terms of decentralization. They rely on some form of delegation, meaning that the actual role of block validation is concentrated in the hands of a small number of stakers.

While some communities settled, Ethereum innovated.New technologies and advancements in technology make Ethereum maximally decentralized and secure. Advances in BLS signatures used in Ethereum PoS have enabled tens of thousands of nodes to participate in consensus, meaning that Ethereum's PoS does not require delegation. Thousands of individual validators participate instead of a handful of professional staking organizations.

At the same time, the design of Ethereum keeps the technical requirements for Staking low. Low enough that anyone with a consumer laptop can stake at home and be in a similar position to professional staking services.

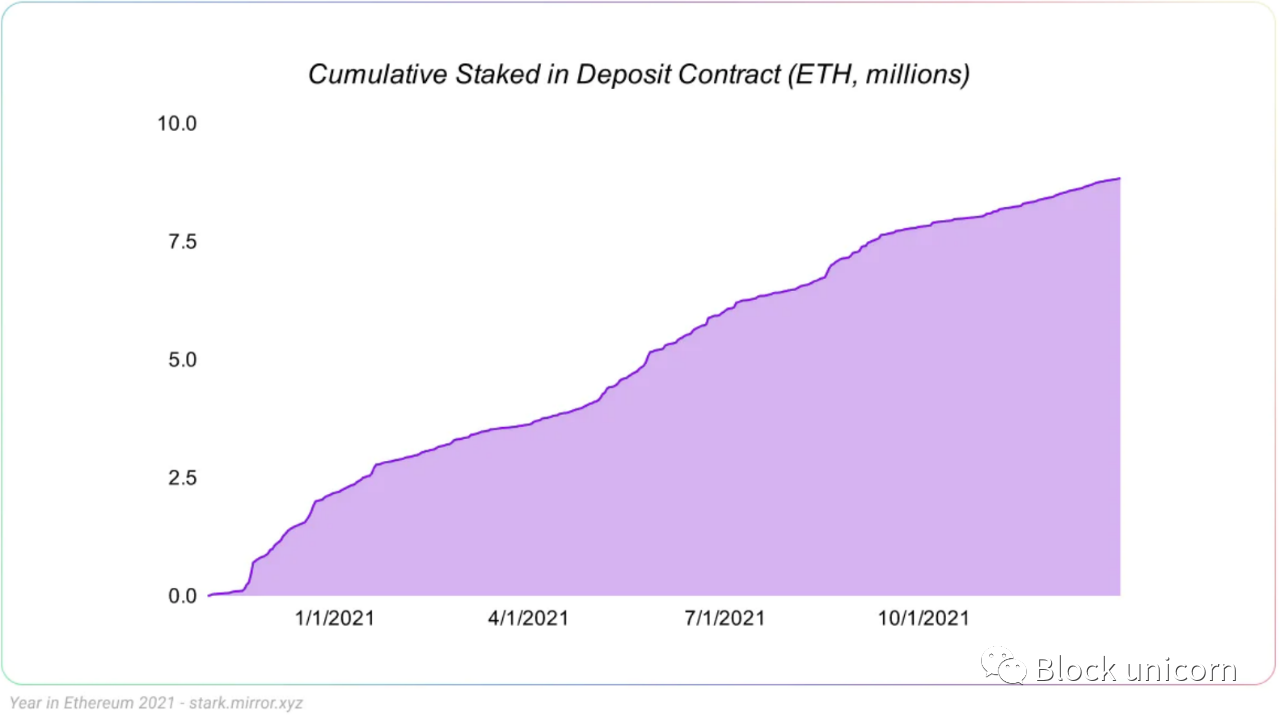

Ethereum’s proof-of-stake system is live — it just hasn’t been used to secure any user activity. The Beacon Chain — Ethereum’s proof-of-stake mechanism — has been live since December 1, 2020, and has been running without any major issues.

image description

Source: @Carvas (https://dune.xyz/queries/252741/473336)

image description

Source: (https://twitter.com/trent_vanepps)

With the Beacon Chain buzzing, the Ethereum community passed several milestone mergers:

In April, the Rayonism project saw developers hack together a simulated merged testnet, as well as some early sharding designs.

In October, client teams gathered in Greece for an Amphora retreat that spawned a short-lived multi-client testnet.

In November, the Kintsugi testnet continued with a long-term multi-client testnet based on the latest specification.

Once the specification is finalized and the new testnet is widely used by end users and application developers, the existing testnet will be used to conduct a trial run of Merge.

Assuming these trial runs go well, the focus will shift to the final step: executing the merge on mainnet and ending proof-of-work forever.

Client Diversification

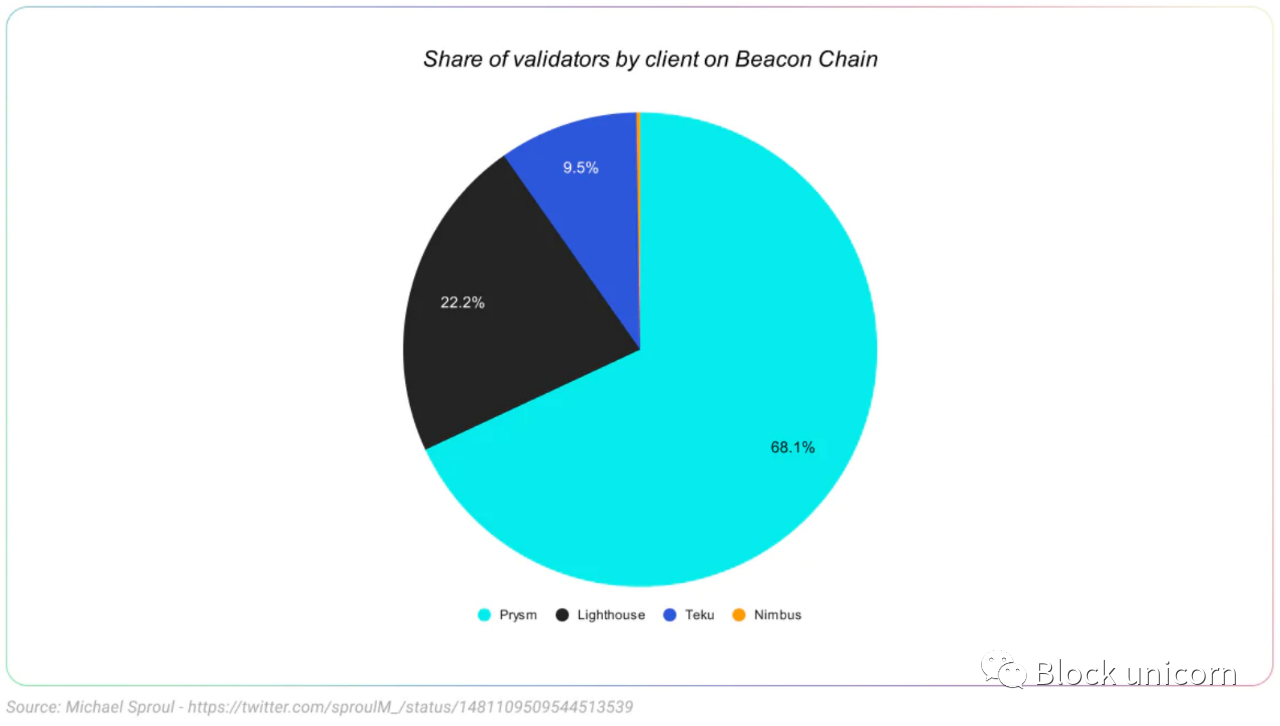

image description

Source: https://twitter.com/sproulM_/status/1481109509544513539

Ideally, no client should own more than 33% of the network. If each individual client falls below this percentage, it reduces the risk of bugs found in clients affecting the network.

Desirable client diversity is a theoretically achievable goal: Ethereum has 4 excellent staking clients (Lighthouse, Nimbus, Prysm, Teku), and a fifth candidate (Lodestar) recently emerged.

It would be beneficial if no client owned more than 50% of the network before the merger. Without much introduction, in the (unlikely) event of a chain fork, staying below 50% clients will provide a safety buffer for client developers to resolve issues without a massive slashing event.

It's in everyone's interest to move toward better client diversity—even the developers of the majority of clients. To their credit, Prysmatic Labs recognizes this fact and is working to reduce their majority.

Staking Ecosystem Expands

Ethereum's proof-of-stake allows everyone, from amateurs to institutions, to stake ETH and participate in securing the network. An ecosystem of services, tools, infrastructure and applications has grown as the stakeholder community has grown:

Rocketpool is the highly anticipated decentralized staking protocol launching in November 2021. Rocketpool is a protocol that allows users to deposit ETH and share staking rewards without having to manage any staking infrastructure themselves. In short, users of the protocol securely deposit their ETH into a network of individual node operators coordinated by the Rocketpool protocol. The decentralized staking protocol is an important infrastructure for cultivating a healthy staking ecosystem. At the time of writing, 74K ETH has been staked to Rocketpool.

Lido is also a staking protocol, but with additional trust assumptions in its current implementation. By January 2021 (2 months after the launch of the beacon chain), 100K ETH is pledged by Lido. By the end of the year, 33,000 unique depositors had staked 1.6 million ETH worth $13 billion on Lido Recently, Lido has made good progress in terms of customer diversity across the network of operators serving the protocol.

At the same time, the ecosystem of staking tools is growing

The StakeHouse community released eth-wizard (a CLI installer for hobbyists) and Wagyu (a one-click Eth2 staking installer).

Existing node hardware providers Dappnode and Avado expanded their Ethereum staking offerings.

Stereum launched an open source node configuration tool.

first level title

4. The DAO crosses a tipping point

One of Ethereum's earliest dreams was to enable:Decentralized Autonomous Organization (DAO), because Ethereum allows anyone to write arbitrary rules in the code, we can use these rules to design organizations or governance systems that allow a group of people to make decisions together through voting or other mechanisms.

The DAO ecosystem had a breakthrough moment of his year. A simple but viable technology stack comes together to enable existing DAOs to get their jobs done, while new entrants push the boundaries of what a DAO can be and who can be a part of it.

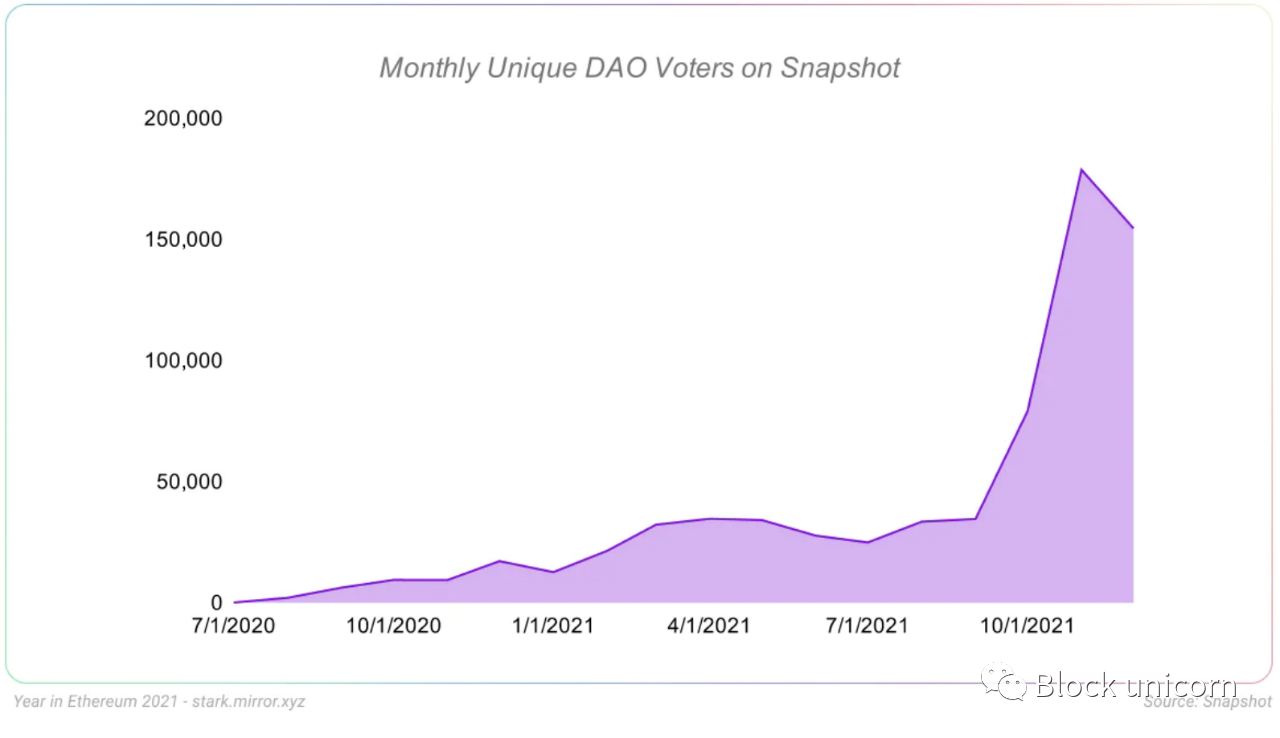

image description

Source: Snapshot

Today, there are hundreds of DAOs that view daily activity, pay membership fees, build products, and vote on the use of shared funds. DAOs on Ethereum collectively manage over $16 billion worth of assets.

But first: what is a DAO?

"DAO" is used to describe large-scale structures. Generally, a DAO refers to any group of people using a blockchain such as Ethereum to collectively manage something on-chain. Sometimes that's money (like ETH or tokens in the DAO treasury fund), but it could also include NFTs, parameters of on-chain protocols like MakerDAO, or all of the above.

While The DAO has existed on Ethereum since 2016, these early experiments were more of a science project than a real product.

But in the past few years,DAOs become a practical necessity. The first major driver is DeFi protocols, which want to be credibly decentralized — handing control of their protocols to a user base that votes with tokens (“governance tokens”).

The basic structure pioneered by protocols such as Compound in 2020 has become the de facto standard since the launch of many DAOs such as Uniswap in September 2020.

In 2021, the growth of DAOs is notable because it happens outside of the DeFi protocols that were the first major entrants. These DAOs are beginning to demonstrate the breadth of the design space to on-chain organizations.

Ethereum Naming Service (ENS). First launched in 2017, ENS is a decentralized naming protocol that allows users to create a simple username (yourname.eth) that can be used as an Ethereum account, receive non-ETH cryptocurrencies (including Bitcoin), or as a web URL . In 2021, ENS launched a DAO to manage certain parameters of the ENS protocol, and a community fund to support the ENS ecosystem.

Constitution DAO (People). In just a few days in November, strangers from across the internet collectively raised $44 million to buy a copy of the US Constitution. In total, 17,521 different accounts have donated to this effort. The project garnered mainstream coverage and sparked a frenzied live broadcast in which a bewildered group of auctioneers was mediating a bidding war between representatives of the new organization Internet and the old financial world.

PleasrDAO started with a tweet and quickly grew into an investment club. PleasrDAO is exploring a different part of the DAO design space—not a mass organization with tens of thousands of members, but a relatively small investment club where members pool their funds to make joint purchases. Notably, PleasrDAO has purchased some high-profile cultural assets such as Doge 1/1 or the unreleased WuTang album.

Friends with Benefits (FWB) is an online social community where membership comes in the form of ownership of $FWB tokens. This token is used to control access to various online and offline spaces: chat groups, meetups, dinners, parties, etc.

MakerDAO started out as a DAO, but then established some traditional organizational structures in 2018. MakerDAO is the creator of the DAI stablecoin, the first decentralized stablecoin on Ethereum and one of the most successful DeFi projects to date. This year, MakerDAO completed its promised return to decentralization by shutting down its foundation and handing over control of the Maker protocol to a DAO governed by its token holders.

DAO is a very general toolkit that allows a lot of design space. With private keys and smart contracts, we can design almost any arbitrary system through which humans collectively manage on-chain assets and protocols.

As a result, we see a wide range of uses for DAOs. Soon, it may be difficult to discuss them as a useful category. DAOs are a means for protocols to meaningfully decentralize themselves away from founders' control, a tool for online communities to quickly and seamlessly pool funds to achieve a common goal, a new kind of social network, and a new way to collectively fund public goods Way.

The growth of DAOs this year has been fueled by a set of easy-to-use application tools.Many DAOs use a simple combination of tools. For on-chain smart contracts, most use a fork of the Compound system. Voting itself is handled by projects like Snapshot, and discussion and debate of individual proposals takes place in forums, much like Discourse.

In 2021, the range of tools available to create and manage DAOs expands:

Mirror has launched a set of tools to help people create a "media DAO": co-publishing and owning content created on Mirror.

Coordinape breaks away from the Yearn community and provides a framework for distributed teams to collaboratively determine compensation for work done by DAO members.

Rabbithole has launched tools to onboard new users to DAOs and develop the skills and credentials to work for DAOs.

Far-sighted governments have created new legal structures to simplify DAO formation and reporting, as in Wyoming.

As DAOs scale to meet the needs of the millions of people around the world who want to use them, there is no shortage of problems and challenges for DAOs to overcome. A few key challenges on which we hope to make progress in 2022:

Today, most DAOs use some form of token voting. This means that decisions are made based on the proportion of ownership of certain "governance tokens". Coin voting systems have a number of known disadvantages. Anti-Sybil experiments like Proof of Humanity and BrightID offer a way to build governance systems based on individuals rather than tokens.

Look for management structures and work systems that enable distributed teams to meaningfully build products and coordinate actions.

Legal systems can be very slow to adapt to new forms of productive human activity, and DAOs are no exception. The lack of a clear legal framework can pose risks for DAO members. Jurisdictions around the world continue to work on this - see this paper by David Kerr and Miles Jennings for recent work in the US.

first level title

5. Go!

As with every year, there is too much going on in the Ethereum ecosystem to be summed up in one blog post. But Ethereum is much bigger than the above 4 themes - some other developments in 2021:

Identity: Ethereum Name Service (ENS) sees breakout growth to hundreds of thousands of users, hundreds of integrations, and a new DAO community treasury ($1.9B) to fund continued ecosystem development. Proof of Humanity and BrightID were used as anti-sybil mechanisms, using Ethereum standard logins gained traction, and having Ethereum identities became fashionable.

Gaming: Axie Infinity has staggeringly grown to 2.9 million users, making it the most successful game ever built on Ethereum. New crypto organizations like the Yield Guild are sparking interest in the gaming ecosystem for earning money by playing. Skyweaver launched on Polygon, Dark Forest released v0.6, and continues to build a cult following around its crypto-native on-chain strategy game.

Public Good Funding: CLRFund (a protocol that lets anyone run their own CLR) completed their trusted setup ceremony and facilitated multiple funding rounds. Gitcoin continued their successful CLR product with over $24 million raised throughout the year. Optimism conducted an experiment to retroactively fund public goods, and the Ethereum Foundation launched a client incentive program to sustainably fund client development and maintenance. A new public goods organization - 0xPARC - was launched to focus on application-level innovation.

2021 has been a bullish year for the Ethereum community, with the ecosystem passing major milestones and Proof of Work coming to an end.

When the market is moving in your favor, it's easy to feel like a winner, and it's even easier to get distracted. But the city won't build itself - see you on the other side of proof of work.