The founder of Outlier Ventures explains MetaFi in detail: DeFi in the Metaverse

secondary title

DeFi for the Metaverse

Introduction

Since 2018, decentralized finance ("DeFi") concept has been steadily developing in the cryptocurrency community. Built on the principles of wealth sovereignty, permissionless innovation and the promise of financial inclusion, the various DeFi protocols and applications are tasked with building a digital financial system that is more open than the system most people in the world still rely on today , more innovative, more efficient, less mining, and the latter is called CeFi or TradFi.

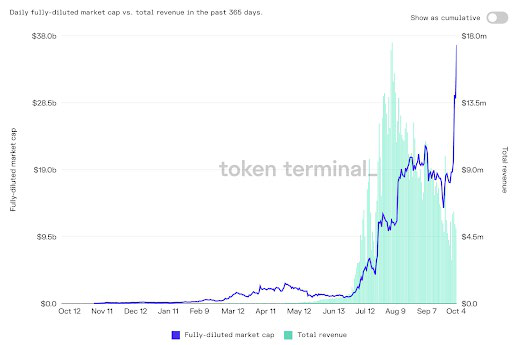

While DeFi has garnered a lot of attention in the cryptocurrency space, its adoption rate remains relatively low, with an estimated less than 5% of all crypto assets being used as collateral. In 2021, DeFi achieved an annualized monthly revenue of $4.6 billion, which is less than 5% of JPMorgan Chase's revenue last year. Additionally, DeFi is still largely limited to basic forms of lending and lending against stablecoins, ethereum, or wrapped bitcoin. While notable work is currently underway to build a bridge from centralized finance (CeFi) to DeFi—for example, introducing real-world and income-generating instruments as new forms of collateral—the increasingly hostile regulatory environment , low capital efficiencies, and the challenges surrounding managing counterparties all make this transition seem far-fetched.

In this paper, we propose that most of the growth in DeFi is driven not by CeFi, but by what we call"MetaFi "to unlock value in the Metaverse. Decentralized financial tools for the Metaverse. But what exactly is a Metaverse? What types of value exist in it? How will DeFi combine with the continued innovation of tokens and crypto assets to achieve MetaFi at scale?

herehereDownload and read the original paper and the updated primer.

first level title

Jamie Burke

CEO & Founder

The Metaverse is Crypto

As discussed, first and foremost the Metaverse is an economic system. A meta-economy, if you will, that enjoys a status above any one digital economy, virtual world, or game, and which should be considered a single instance of the Metaverse, or a separate of the segment. In fact, when the combined GDP of this meta-economy exceeds that of nation-states over a sufficiently long time frame, it will also enjoy supremacy over its fiat-based economy. We believe that an open Metavese, at least an open and permissionless version of this meta-economy, is enabled by what we may collectively call cryptocurrencies. With no other meta-economy today, you can, and we do, make the argument that:"The Metaverse is cryptocurrency, and cryptocurrency is Metaverse.

In our definition of Metaverse, people can approach it through two main concepts:

Interface Layer: The interface layer of Metaverse can be experienced by end users through various hardware and software technologies, such as desktop browsers, mobile applications or extended reality (XR), virtual reality (VR) and augmented reality (AR). (VR) and Augmented Reality (AR).

Financial Compute Layer (Financial Compute Layer): The layer that performs the execution of Metaverse calculations, implements a decentralized, transparent and democratic foundation, which defines economic logic, on which end users exchange goods, services and money, and Developers can also build on top of this. Ethereum is a good example of this as a protocol used by developers to build smart contracts for decentralized applications and a ledger that records end-user transactions in the Metaverse.

In the context of the first point above, the interface layer can take many shapes and forms in the early days, and it is important to keep an open mind as we advance technologically and conceptually. So when we refer to the dawn of Metavrese, we're usually referring to current experiences, such as games and virtual worlds, whether 2D browser-based or more immersive VR or AR.

The financial computing layer refers to the underlying technology that powers the Metaverse. As we describe in our article "The Open Metaverse Operating System", we believe that the foundation (or core) of the financial computing layer will be based on technologies that can be classified as Web3 (or blockchain technology). We further believe that any digital realm in the Metaverse must be rooted in Web3 to provide fundamental property rights, interoperability, and permissionless value transfer across every realm (or vertical) in the Metaverse. These technologies provide the impetus to develop a rich variety of applications and use cases based on Web3.

In this way, Metaverse provides a global, transparent, crypto-native parallel economic system of decentralized ledgers. It provides the foundation for a new kind of digital-first economy, the seeds of which we have already observed through NFTs (Non Fungible Tokens) and game economies such as Axie Infinity’s Play-to-Earn. Due to its decentralized and permissionless nature, the speed of innovation is unmatched, making it difficult for legacy systems to keep up. So, especially in the context of DeFi, it is possible for the Metaverse to thrive outside, or at least before, the jurisdiction of national regulators.

In addition, as we have observed in the past 12 months of 2021, DeFi has been increasingly criticized and scrutinized by some regulators in numerous jurisdictions. While the degree of regulation may have some positive market effects, poorly applied regulation tends to stall innovation and favor the incumbent. As far as DeFi is concerned, several analogies can easily be drawn between its products and traditional financial assets. Additionally, we argue that the Metaverse represents an informal economy whose products are often digital markets for commodities that may or may not be mirrored in traditional markets. Just as one cannot regulate every aspect of global economic activity, the same is true of the Metaverse. Given the exponential growth of economies likely to occur in VR, AR, and XR environments, the potential regulatory landscape is even more challenging to oversee, let alone enforce in the metaverse long-term.

first level title

Status Quo of the Digital Economy

Today, billions of dollars in value are currently trapped in proprietary online platforms such as social media (Facebook, Instagram or TikTok) or gaming (Fortnite and Roblox). What we call Web2 has been actively and intentionally built"moat", to trap these values and users for as long as possible in order to extract as much as possible for the benefit of shareholders"lifetime value". Web2 companies operate on the principle of shareholder supremacy, even or especially at the expense of users. This value, in the case of social media or free-to-play games, tends to be monetized primarily through advertising, with profits generally not shared directly with users. Even with Roblox, whose entire premise is that creators are able to monetize their user-generated content (UGC), the percentage they earn is estimated to be only25%. This also extends to the music streaming mode and shows on YouTube.

The total value of the global digital economy is now estimated at $11.5 trillion, equivalent toGDP15.5%. Over the past 15 years, it has grown at 2.5 times global GDP, nearly doubling in size (since 2000), and more and more of the population relies on the internet for their livelihoods.

If we zoom in on a subset of the digital economy, the digital creator economy, it is currently only a small part of the mainstream digital economy, but its core areas are growing. This includes publishing, gaming (skin creation), digital art, streaming, music, film, and more. On the supply side, there are currently as many as50000000of content creators who are primarily composed of amateurs (46.7 million) and about 2 million professionals. Professional players in the digital creator economy can easily earn $100,000 per month. However, most earn much less, their income is irregular, and it can take months for funds to be received while they work their way through the system. We believe that most of the digital creator economy today would not be considered part of the Metaverse. Because value cannot be traded freely across platforms, but is mainly locked in the value of platform equity.

We can further break down the limitations of Web2 digital platforms as follows:

Limited Inclusion (Limited Inclusion):If we take the example of the digital creator economy, most of its creators are traditionally excluded from finance because the value they create is seen as intangible, out of their control, and the income from it is not regularly. In short, the existing financial system cannot assess the risks associated with lending to people with this income and wealth, compared to those who are employed by a centralized company and paid in fiat currency.

Dynamic Terms & Conditions:Participants in the traditional digital creator economy cannot trust the credible neutrality of highly centralized services, which has the potential to lead to demonetization and de-platforming of content creators on both sides. For example, when Only Fans abruptly banned adult content creators), and platforms like Facebook and Twitter regularly deactivate developers and their APIs. In practice, the rules for participating in these platforms are not clear, not consistently applied, not auditable, and can change at any time (unlike the code of a smart contract).

Isolated Design (Siloed by Design):first level title

Web 3, NFTs and the Metaverse

In contrast, in the Web3 world of cryptocurrencies, DeFi, and NFTs, the entire paradigm is around users and their sovereignty: their identity, data, and wealth. In Web3, even data itself can be a form of digital wealth and income. This means that while there are still platforms helping the creation, discovery or curation process, users are in full control of the output and can freely transfer value between platforms, reselling, borrowing and lending in a completely permissionless manner. In short, transferability is a fundamental"property"。

Not surprisingly, we saw in the early success of Web3 that when the moat is removed and transferability is possible, people will spend more time and money on their preferred platform, such as blockchain gamesAxie Infinity. This is what we articulated in our previous paper. In the long run, the Metaverse and its platform (including most of Web2) will adopt Web3 technologies and principles, not necessarily because it is philosophically correct, but because it is good business.

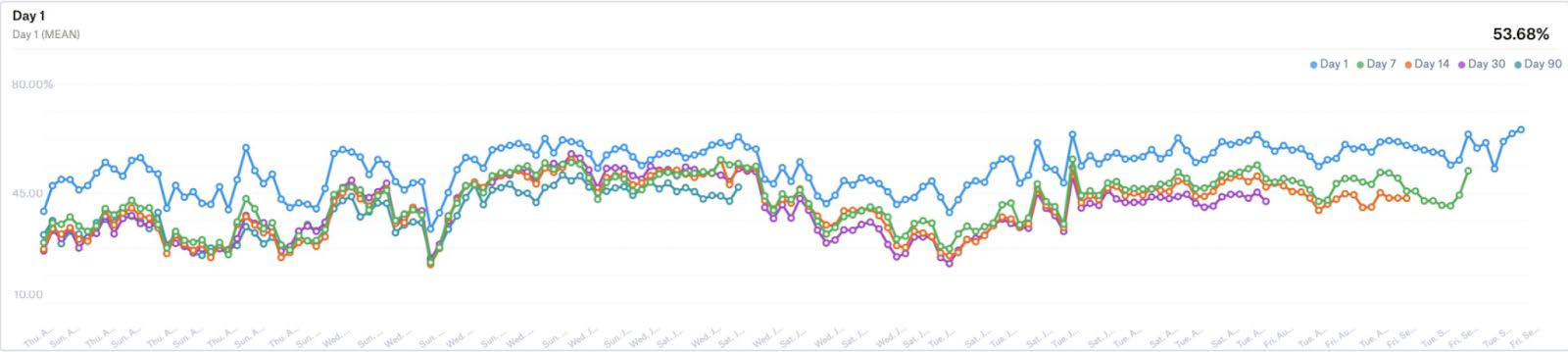

(Axie Infinity user retention via @Jihoz_Axie)

first level title

Define MetaFi

For us, MetaFi is a protocol covering all protocols, products and/or services that enable complex financial interactions between non-fungible and fungible tokens (and their derivatives). Today, for example, through MetaFi, individuals can use a portion of an NFT as collateral on a DeFi lending platform.

To understand MetaFi, we must first emphasize two core principles of DeFi. Two core principles of DeFi make it possible. It is: 1) unstoppable; 2) composable. For developers, it is a"money lego"in the form of a highly innovative parallel financial system. Developers around the world can participate openly and compete to deliver the highest yields while ruthlessly eliminating inefficiencies. It's also important to note that regulators can only limit how fiat-based systems they oversee interact with DeFi, not necessarily what happens in DeFi itself—that is, as long as the projects and their teams themselves are adequately decentralized.

MetaFi brings these DeFi principles to the broader Metaverse. By mixing non-fungible and fungible tokens, combined with novel forms of community governance, such as decentralized autonomous organizations (DAOs).

The combination of these different cryptocurrency primitives enables a mature parallel economy to bring hundreds of millions, if not billions, of users to the cryptocurrency ecosystem within the next decade.

We believe this process will be accelerated by 4 key trends in MetaFi:

Development of financial tooling:Previously, due to the complexity of its technology, the DeFi stack has been the preserve of a small segment of the cryptocurrency developer community. However, through NFT platforms, creators and communities will be able to more easily set the economic terms of creative communication with users, from perpetual royalties to issuing their own social tokens. Fans and communities can also directly share in the financial success of their favorite products and cultural projects.

Financialization of everything:Many people speak contemptuously of the speculative nature of cryptocurrencies, failing to understand that this is a feature, not a bug. Through the use of MetaFi technology, the value and flow of all things can be reflected in digital assets, thereby forming an open free market, realizing the long-tail of value, discovering prices in real time, and releasing unrealized resources on the Internet. potential value.

Improvement of the DAO services stack:A full-fledged DAO stack will allow collective governance for the provision of purely on-chain digital and financial services without the services of corporations and centralized intermediaries such as banks. The main characteristic of DAO members is the ability to join and exit smoothly according to their own judgment and clear terms.

Mutualisation of risk:History has shown that incumbent financial institutions are often unable to assess risks in new, emerging markets; whether it is basic banking services or insurance. This has led to the mutualization of risks in communities, from farming communities to the shipping industry. From farming communities to the shipping industry, mutual ventures have traditionally been conducted through cooperatives. DeFi already brings community-based insurance provisioning tools to users, especially when combined with DAO service stacks.

Gamification of finance:Gen Zers show greater interest in becoming more financially literate than previous generationsinterest. As a result, many neobanks offer new and interesting ways to organize your personal finances, and educational platforms offer handy financial courses. This makes young people more willing and able to access financial products than their parents and grandparents. Beyond that, we are seeing a blurring of the lines between memos and financial instruments, such as the cryptocurrency Dogecoin or the various offerings via Robinhood."meme stocks", people are more assured of investment and transactions in Internet culture.

A deep dive into NFTs as collateral

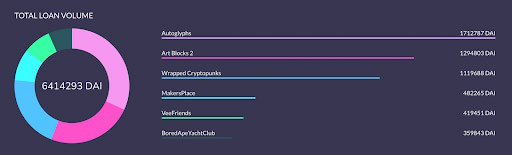

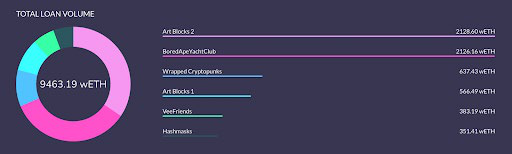

image description

image description

image description

image description

(All wETH loan volume data in the NFT market is as of 13/12/2021)

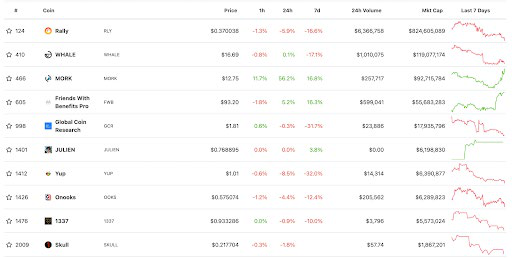

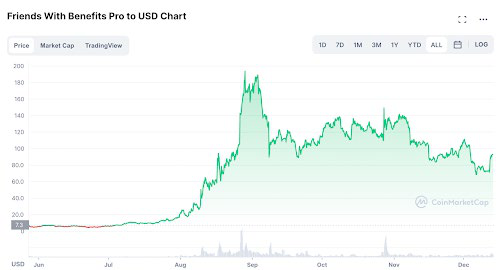

image description

image description

first level title

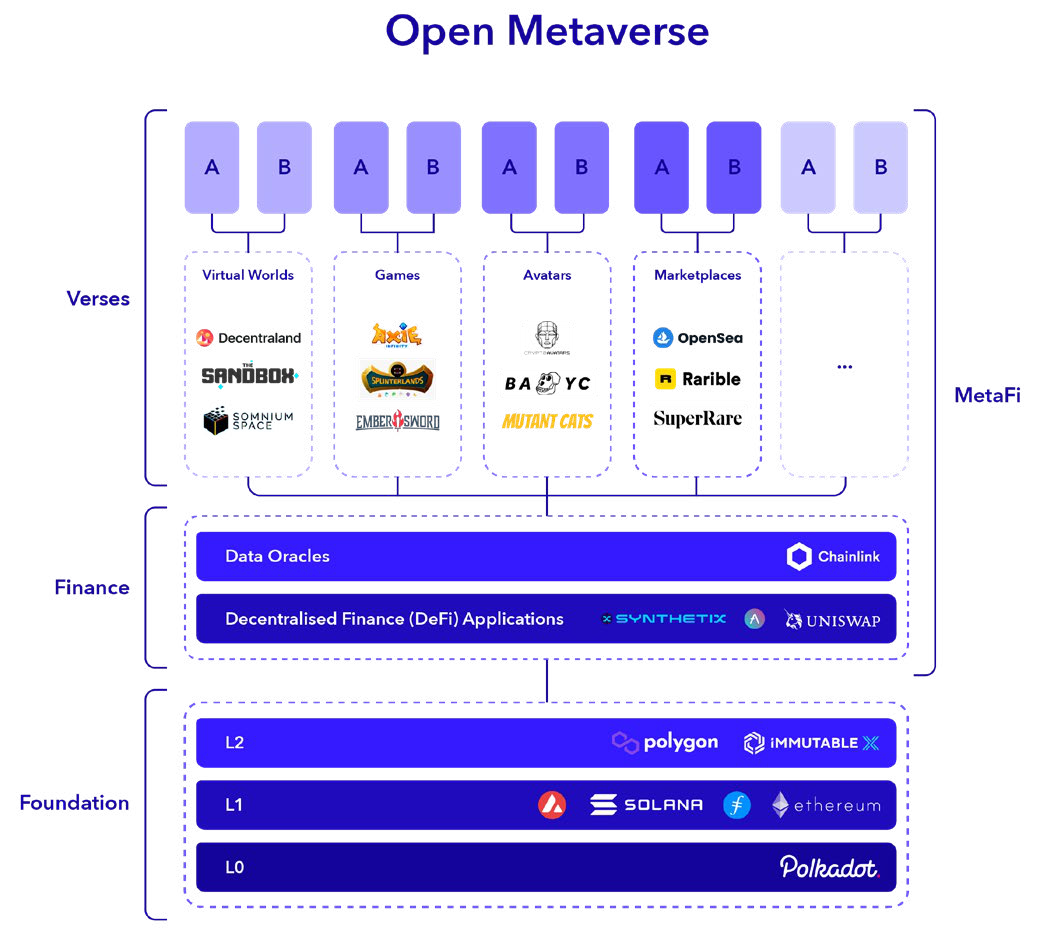

MetaFi Framework

secondary title

1. Base layer

secondary title

2. DeFi

This part consists of small financial applications that can be used on the above-mentioned core protocol. These applications can be considered as"Currency Lego"secondary title

3. Node

first level title

The improvement of infrastructure has contributed to the "horizontal expansion" of the Metaverse

first level title

Various MetaFi activities

As we said, with the development of MetaFi, the number of various application ecosystems and their respective definitions are still changing. However, we try to give definitions to some core activities, as follows. Remember, these categories are enabled by DeFi applications, data bridges, and various base layers, as in the Open Metaverse diagram above.

virtual reality:game:

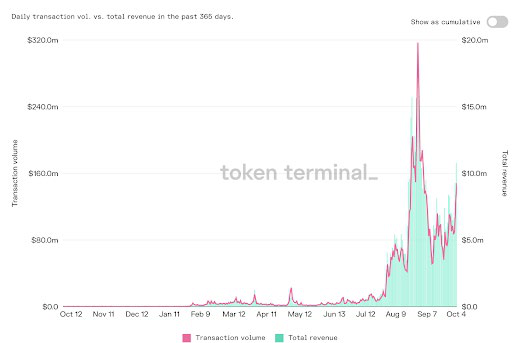

game:We can define games as digital activities primarily used for entertainment. What sets Metaverse games apart is that they often monetize the game, that is, users or gamers are paid for their contributions to the game. This leads to the economic model throughout the game, where capital is connected to labor to generate value. Axie Infinity is probably the most famous Metaverse game and one of the leaders in gaming, both in terms of users (nearly 2 million monthly active users) and protocol revenue ($2.5 billion annualized). However, well-designed P2E 2.0 games have also appeared on the market, such as racing games such as Zed Run or Battle Racers, collectible card games such as Splinterlands, and even open world role-playing games such as Embersword. Since the beginning of this year, the popularity of blockchain games has skyrocketed. Almost half of all active wallet addresses are involved in games, and the top 10 most popular blockchain games have a combined 4 million monthly active users.

avatar:Avatars are specifically designed for users to create unique digital identities, including interoperable 3D avatars that can be used in various metaverse spaces, and these avatars are often mass-produced as generative PFPs (personal profile pictures). PFPs, which can be considered as “entrance tickets” to famous social clubs, are usually in the form of NFTs, but in order to enhance their functions, clubs generally also issue governance tokens, which include functions such as governance rights or other benefits. High-profile projects like CyberKongz and SupDucks distribute native tokens to holders of their NFTs (certain rarities). Taking CyberKongz as an example, by holding a genesis kong in the case of CyberKongz, 10 banana tokens can be obtained every 24 hours. These tokens can be sold on Sushiswap, or at"banana shop"It is used for upgrading, changing names, or buying wearable equipment, etc., and of course it can also be used for breeding (you need to burn 600 bananas to breed a new King Kong).

Wearable device:market place:

market place:The trading market is a digital platform that matches supply and demand, providing a place where various NFTs can be traded, and users can bid each other. Marketplaces such as OpenSea, Superrare, and Rarible allow users to trade freely and issue NFTs directly. In the trading market, these NFTs can be used as financial assets. NFT fragmentation allows high-value NFTs to be divided into FTs, thereby improving their liquidity. Fragmentation and bundled sales are particularly popular, effectively forming a solution to the problem of NFT primary market sales - index funds, for example, platforms NFTX and Beeple's B20 index. The boom in NFTs has led to a surge in market transactions. OpenSea's monthly transaction volume in January 2021 was only US$1 million, but in November 2021 it exceeded US$2 billion, an increase of 2,000 times.

Earning NFTs:NFTs can generate revenue directly or indirectly. Indirect yield generation involves using NFTs as collateral for loans and then reinvesting the loan funds at a higher interest rate. NFTfi allows NFTs to be used as collateral in the form of loans. Direct yield generation can be achieved by combining NFTs with yielding DeFi LP tokens. Charged Particles aims to provide a platform to add these DeFi elements to NFTs. Additionally, there has been a trend over the past few months of more and more NFT projects launching their own native tokens, adding another yield-generating element to their NFTs. This effectively created a social token economy such as Loot, whose venture gold currency launched shortly after NFTs. EtherCards is launching its Dust tokens, distributed to each existing card based on its rarity. Dust can be used to participate in sweepstakes to win blue-chip NFTs. This segment has crossovers with the avatar category, and CyberKongz and SupDucks can also be considered profitable NFTs.

Right of way token:These tokens can be either fungible or non-fungible, giving holders access to various forms of value, either in the form of community rights of passage, or in the form of a future minted token. A good example is The Bored Ape Yacht Club, a collection of 10,000 ape NFTs, owning an NFT not only gives holders access to the community's Discord, but also allows them to buy and sell members of The Bored Ape Yacht Club right.

first level title

Limitations Today

There is still a lot of work to be done before MetaFi can begin to realize its true potential. More specifically, MetaFi currently has several limitations. Currently, MetaFi has several limitations that need to be overcome in order to bring about a significant wave of adoption. Adopt a wave.

NFT appraisals: In order to be able to buy, sell, or borrow against NFTs, owners need to know the value of their NFTs. NFTfi solves this problem by enabling users to list their NFTs as collateral on the NFTfi website, and lenders can extend loans to borrowers based on what they think their NFTs are worth. Appraisals are essentially done by the lender, not by an uninterested third party.

Legal and governance issues around fractionalization: If you divide an NFT into 100 pieces and distribute them to different people, especially if the NFT has rights such as voting rights or income rights, It is not always clear who can do what, when, and how those rights will be administered.

Standards across blockchains: Now that the construction of Metaverse has surpassed pure Ethereum, on different Layer 1 or Layer 0 blockchains, these blockchains are still not 100% interoperable , which means that the islanding of value is inevitable in the short term.

In order to fully release the value of DeFi to Metaverse, NFT needs to be easily plugged or pluggable into DeFi protocols. For example, NFT needs to be traded, borrowed, lent, and reversed. Although today's DeFi is currently only suitable for homogeneous tokens, we hope to have new ways to bridge the bridge between NFT and DeFi:

Fractionalization of NFTs: This means splitting non-homogeneous tokens into many homogeneous tokens. We can think of these scores as a stake in NFT ownership. For example, meme creators can use asset creation platforms to create memes, differentiate them into highly homogeneous tokens, and trade them using DeFi DEXs like Unsiwap. Well-known projects that differentiate NFTs include Fractional or DAOfi, etc.

NFT-ification of DeFi (NFT-isation of DeFi): This means upgrading the DeFi protocol to allow it to accept NFT as a form of collateral. For example, builders can create assets in the virtual world and use them as collateral to lend on platforms like Centrifuge or Pragmafy.

first level title

MetaFi 2022

In summary, MetaFi, or Metaverse Finance, is an all-encompassing protocol that refers to protocols, products and /or service. It includes the basic building blocks of the blockchain space, such as the foundation of layer 0, layer 1 and layer 2, the DeFi stack and various verses. MetaFi inherits 2 core features of DeFi protocols; it is unstoppable and composable. Its development is driven by several key trends, such as the mutualization of risk, the gamification of finance, the growing availability of financial instruments and the DAO service stack.

Hopefully we've made it clear by now that MetaFi in its current form is embryonic. While some of its capabilities are mind-boggling, we are still only scratching the surface of the possibilities it will unleash in the medium to long term. However, based on what we are seeing in the market and through our accelerator, we expect to see the following developments in the short to medium term:

The combination of different MetaFi categories as well as the creation of entirely new categories, such as user-generated games in virtual worlds, with their own economy, or generating unforgeable assets, such as wearables or avatars, etc.

Improve the user experience/user interface (UX/UI) of the financial MetaFi project, possibly adding elements of VR. For MetaFi to really take off, it needs to be understood and more perfectly experienced by ordinary people.

A further innovation in DeFi 2.0 is the move to MetaFi, similar to the kind of innovation we saw in the Olympus DAO, Alchemix. We need better solutions to solve the differentiation problem of NFTs, especially to meet the legal and governance issues, and the NFTization of DeFi.

Improving the underlying technology, such as layer 1, which will reduce transaction fees, increase throughput, enable scaling, and generally make applications running on blockchain protocols easier to use.

JOIN US: APPLY NOW

If you're a founder working at MetaFi, we want to work with you. Apply to join Basecamp, our dedicated Metaverse accelerator, where our team of experts will help you launch, fund and grow your MetaFi startup through our strong network of Web 3 investors, founders and partners.