In-depth analysis of the annual progress and competition pattern of Layer1 and Layer2

Original source: The Block

Compilation of the original text: Gu Yu, Chain Catcher

Original source: The Block

The explosive growth of Layer 1 is one of the most important developments in the encryption industry in 2021. Multiple emerging Layer 2 networks have launched a strong challenge to Ethereum, and multiple Layer 2 projects have also launched to join the competition.

In the recently released annual report of The Block, it conducts a detailed analysis of the competitive landscape of Layer1 and Layer2, and also elaborates on the technical and ecological progress of 10 mainstream Layer1 platforms.

secondary title

2021 Competition Overview

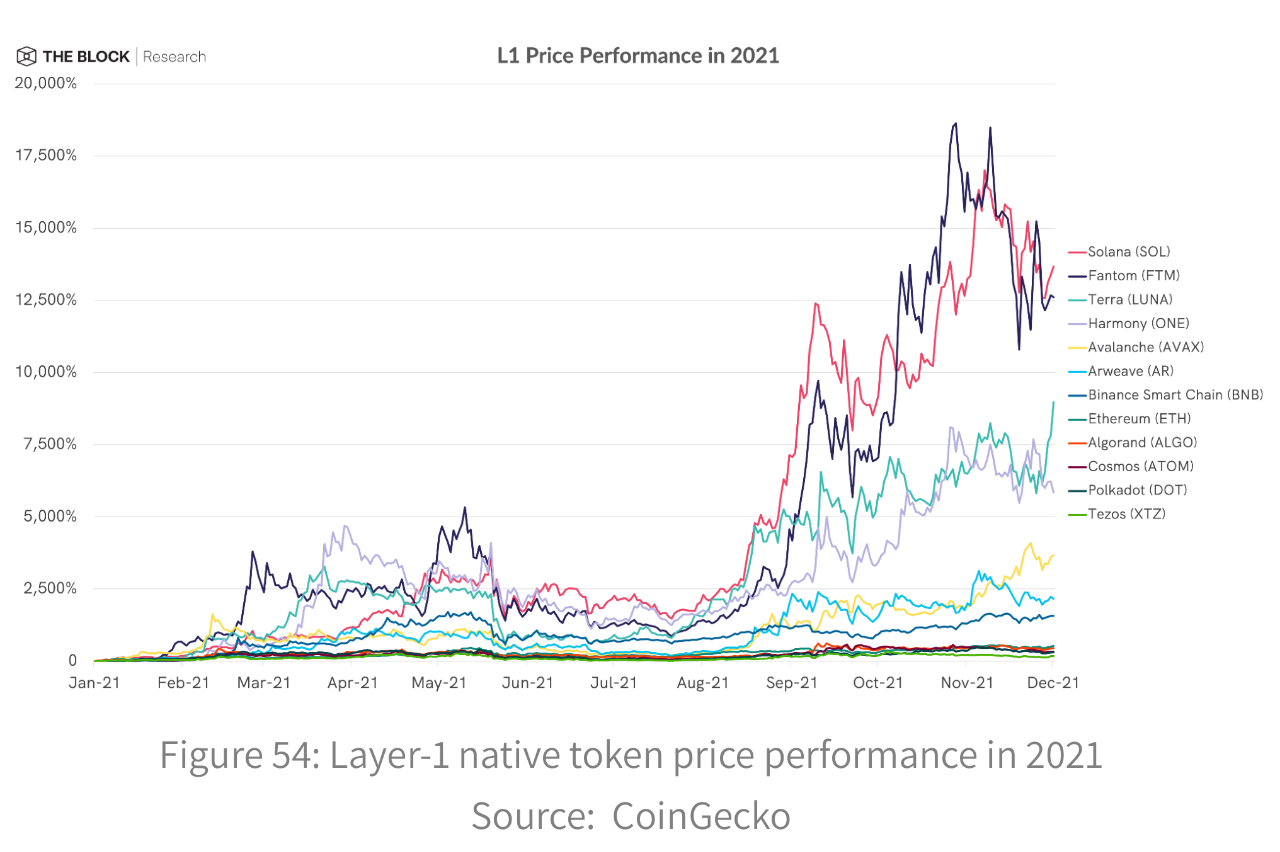

One of the dominant trends in 2021 is the growth of Layer 1 (L1) blockchains and their ecosystems, especially in relation to the growth of Ethereum, the current leading smart contract platform. As mentioned in our State of the Market section, Layer 1 protocols are among the breakout winners in the cryptocurrency market in 2021. Zooming in on the price returns of layer 1 platform cryptocurrencies relative to ETH, they have significantly outperformed the price returns of ETH, such as Fantom (FTM), Solana (SOL) and Terra (LUNA).

Leaving price and performance aside, the quantifiable user activity of L1s will increase significantly in 2021, mainly driven by the emergence of DeFi ecosystems on various L1 platforms. As the choice of DeFi protocols continues to expand, users are depositing record amounts of funds into decentralized applications such as decentralized exchanges (DEXs), lending protocols, yield aggregators, and derivatives exchanges.

On Ethereum alone, the total value locked (TVL) of DeFi protocols rose from about $16.1 billion at the beginning of 2021 to $101.4 billion on November 30, an increase of about 530% during the year. The TVL of DeFi projects in the L1 ecosystem has grown faster overall, adding more than $166 billion since the beginning of the year, an increase of about 974%. Although Ethereum still has almost all the capital locked in DeFi at the beginning of 2021, as of November 30, its share of DeFi TVL has dropped to 63%.

The emergence of the L1 alternative ecosystem occurs during a period of continued growth in the crypto market, including Ethereum. As ethereum transaction volumes continued to hit record highs between January and May, users of the largest smart contract platform began to experience network scalability challenges in early 2021 amid a surge in the broader crypto market. major problem.

In the first half of 2021, the average transaction fee on Ethereum rose to an all-time high, and during periods of extreme network demand, excessive gas fees and long confirmation times sometimes paralyzed users. Priority Gas Auction (PGA) bots and increased MEV activity since January have also contributed to the prolonged period of high gas prices at the start of the year.

In this environment of massive network demands and rapidly growing costs, relatively low-fee non-Ethereum L1s are starting to take center stage as users look for alternatives for the activities they typically perform on Ethereum. EVM-compatible chains like Binance Smart Chain (BSC) are particularly well-suited to onboarding large numbers of new and existing users, offering the opportunity to experiment in a new but familiar ecosystem without high capital cost barriers to entry.

Starting in February, the BSC ecosystem grew dramatically, peaking at a TVL of $34.8 billion on May 9th, which then represented about 26% of DeFi TVL. In addition to TVL, the number of daily users of BSC has also increased significantly, and the average daily transaction volume in May also hit a new high of 8 million times.

Nonetheless, BSC's explosive growth in 2021 provides a blueprint for other emerging L1s to build original DeFi protocols such as DEXs and lending platforms in the new L1 ecosystem, which may be attractive to active users and developers The essential.

Having said that, one of the biggest challenges the protocol continues to face right now is the issue of fragmented liquidity. Even with EVM compatibility, new L1 ecosystems looking to attract liquidity face an uphill battle, as users often need to have a compelling reason to move assets that may already be earning yield on another platform. asset transfer. It turns out that one of the best ways to attract liquidity providers is to simply incentivize them.

secondary title

Incentives and FundingIn the second half of 2021, the users and activity of EVM-compatible chains increased dramatically, due in part to the large increase in rewards offered by the L1 team and their funds. Perhaps the most notable of these projects is the Avalanche Foundation's "Avalanche Rush" project, which was launched on August 18 by distributing 10 million AVAX tokens (worth about 1.8 billion) to expand its DeFi ecosystem.

Since then, at least eight other L1 funds have announced incentive programs of $100 million or more, including the Fantom Foundation, Terraform Labs, and the Algorand Foundation.

Most projects are focused on promoting the growth of DeFi in their respective ecosystems, although the exact goals and scope of each project, as well as token distribution methods, vary.

The Avalanche Rush project is primarily a liquidity mining reward for ecosystem participants, while other projects, such as Fantom's 370 million FTM reward project, are more specifically aimed at financing developers. In the Fantom project, developers can use rewards as they wish, including liquidity rewards, if they meet certain performance standards over a period of time.

The Avalanche and Fantom projects both distribute funds in their native tokens, as do other projects including Hedera, Algorand, and Terra. Therefore, the amount of these reward programs can vary according to the market, especially when tokens are redistributed to a wider group of holders. These rewards typically come from the respective teams’ funding, provided by early investors through seed rounds or token sales.

In 2021, investment firms increased their investments in specific L1 ecosystems, whether through investments in specific projects or through native token sales. For example, as we highlighted in our Funding and M&A section, Solana Labs raised $314.15 million in June in a private token sale led by a16z and Polychain Capital. Avalanche also announced a $230 million funding round in September, led by Polychain Capital and Three Arrows Capital.

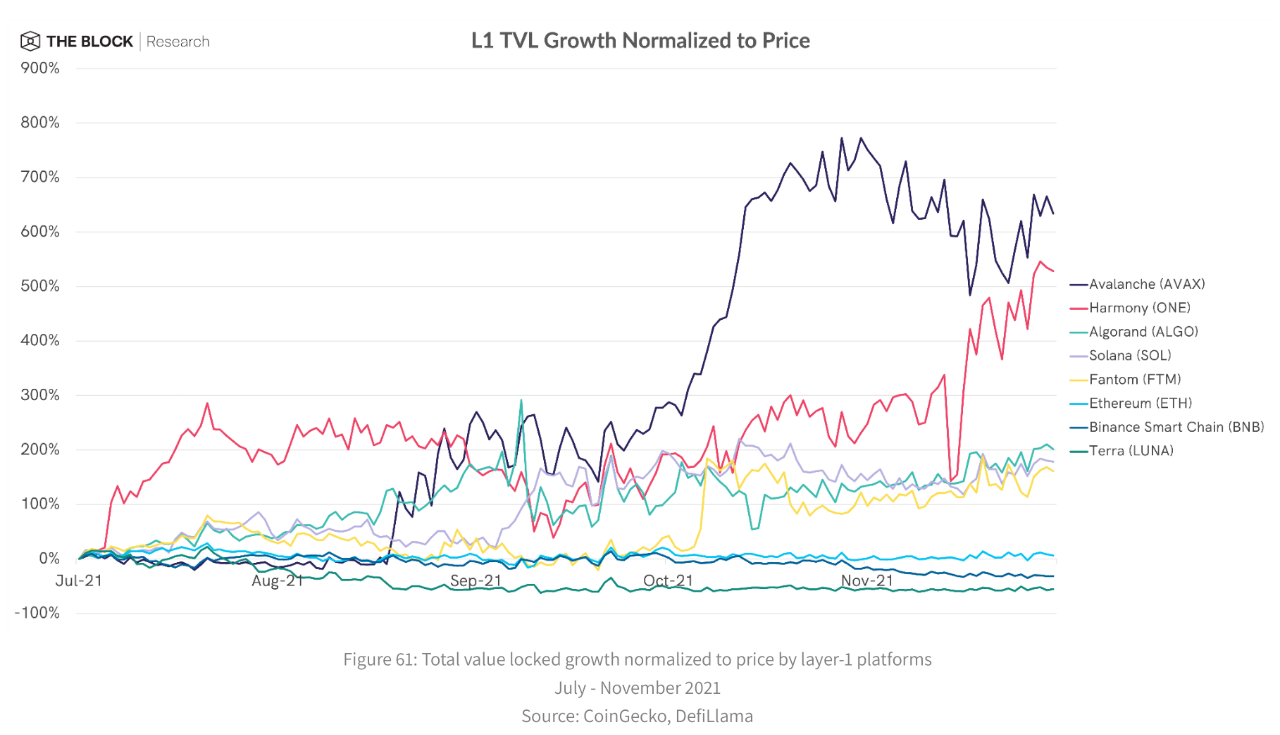

Regardless of the incentive token distribution or funding method, what matters most to every L1 team is the extent to which users and developers choose to invest time and money in their particular ecosystem. One way to measure this is to look at how the ecosystem TVL changes over time, which provides a general sense of the growth of DeFi protocols. However, as we have pointed out in previous reports, DeFi protocols in specific ecosystems often hold large amounts of native network tokens (for example, SOL on Solana), which increases the impact of token price changes on the overall ecosystem TVL Impact.Normalizing the ecosystem’s TVL growth by the price of the corresponding native token, we can get a relatively more accurate picture of how much new capital is entering the ecosystem, rather than dollar gains that are primarily determined by token price performance. Since the beginning of Q3, just before the wave of L1 incentive programs started, the price-normalized percentage increase in TVL in the Avalanche ecosystem outpaced that of other major L1 ecosystems. Interestingly, Avalanche's TVL took its first big jump right after announcing Project Rush, and it's been able to retain a good chunk of its TVL over the past few months.

Avalanche's success in attracting capital is partly due to the EVM compatibility of the Avalanche C chain, on which all DeFi protocols currently on Avalanche are built.

Since users and developers are able to interact with Avalanche using familiar Web3 tools such as Metamask and Solidity, the barrier to entry into this ecosystem is relatively low, especially for existing Ethereum users. Avalanche's growth in the second half of the year also benefited from the Avalanche bridge, which has significantly reduced the cost of the cross-chain bridge since the upgrade in late August. As of this writing, Avalanche Bridge has continued to offer AVAX airdrops to bridge users over $75, ensuring that Avalanche’s cross-chain bridge users can immediately start using the network without having to purchase AVAX separately as gas first.

secondary title

Competition in the Growing Layer 1 Ecosystem

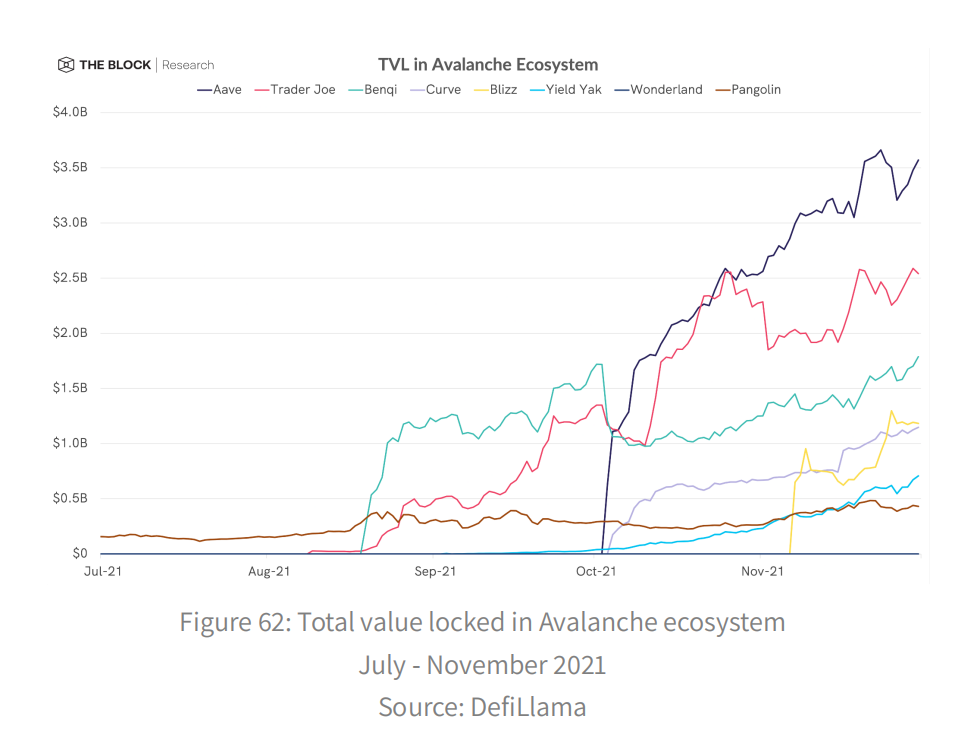

Coupled with Avalanche's EVM compatibility, the relative ease of transferring value from Ethereum to Avalanche fosters particularly strong competition in the growing ecosystem. For example, in Avalanche, Pangolin DEX is by far the largest TVL protocol, but Trader Joe, released in mid-August, shocked the entire ecosystem with its clean interface and liquidity mining rewards, and surpassed Pangolin's TVL in September .

For just over a month, Trader Joe and lending protocol Benqi have held the top spot in the Avalanche ecosystem's TVL rankings, with both protocols holding over $1 billion in assets by early October. However, in early October, the arrival of existing DeFi protocols from Ethereum, Aave, and Curve marked the beginning of a new phase of competition in the Avalanche ecosystem. Inspired by the new liquidity provided by Avalanche Rush, Aave's TVL swelled rapidly on Avalanche, surpassing Benqi and Trader Joe for the first time in just a few days of launch.A similar situation was seen in Fantom’s ecosystem, where TVL peaked at $6.2 billion on November 9. Like the Avalanche ecosystem, DeFi incumbents that have gained mass adoption on Ethereum are now starting to enter the Fantom ecosystem. As of November 30th, Curve has become TVL's fourth largest protocol in the Fantom ecosystem, initially launching on Fantom in June with CRV liquidity rewards.

On September 1st, FTM rewards on Curve also went live, further promoting usage of the stablecoin trading protocol through Fantom’s rewards program. Interestingly, DeFi incumbents like Curve and Aave have been able to earn rewards directly from the Avalanche and Fantom rewards programs,

This highlights the desire of these L1 teams to attract established, well-known DeFi protocols to their ecosystems, possibly even at the expense of native protocols.

In fact, the proposal to deploy Aave on the Fantom network has been passed on October 18th, through such a strategy, Aave can receive FTM rewards and establish a deployment agreement in the near future.

In 2021, the battle for the dominance of DeFi protocols in the Fantom ecosystem is still fierce. In this year, Fantom's local DEX SpiritSwap and spookswap are Fantom's top DEXs, both in terms of TVL and volume. A clear trend in 2021 in these burgeoning DeFi ecosystems is the growing competition between protocols, leaving room for protocols to build significant network effects and communities.

As well-known Ethereum-native DeFi protocols are now starting to launch across many L1 ecosystems, these L1-native protocols are facing one of their biggest challenges to date, retaining and growing their user base. In a newer, smaller L1 ecosystem like Harmony, in the absence of a clear leader, DeFi protocols naturally have more opportunities to capture significant market share quickly.

With a relatively small user and capital base compared to the more popular EVM-compatible L1s, Harmony's ~$542 million ecosystem in TVL as of November 30 is poised as it continues to grow. Environments like Harmony's are also conducive to innovation, giving builders the chance to experiment with ideas in a smaller competitive environment.A notable example of this innovation is the DeFi Kingdoms (DFK) protocol, which has become the largest protocol on Harmony as of November 30, putting in $280 million in TVL, or about 51% of the Harmony ecosystem TVL .

As a DeFi protocol that includes an Automated Market Maker (AMM) based DEX and a non-functional marketplace with a gaming UI, DFK is a unique combination of gaming and DeFi in the crypto space today.

In fact, DFK's top position on the TVL Harmony leaderboard means that for many trading combinations in the ecosystem, DFK can provide the highest source of liquidity.

Nonetheless, DFK’s daily visits on Harmony have routinely surpassed SushiSwap’s over the past few months, clearly showing that new DeFi protocols have the potential to capture promising crypto in the relatively small but still growing L1 ecosystem. Meaningful share of user activity. The overriding question is whether DFK can ultimately maintain its dominance over more established protocols like Sushi in the face of future growth.

Currently, DFK continues to expand its lead over DeFi competitors in the Harmony ecosystem, and even Harmony’s decision in September to offer a token reward of $2 million to Curve users does not seem to be affected by DFK. Ultimately, although it is difficult to predict which scenarios will have the greatest success over time in L1 ecosystems, one thing is clear: the composition of these young ecosystems Big changes can happen in just a few short weeks.

secondary title

Beyond EVM - Optimizing Performance and Growth

In 2021, network demand and gas fees generally increase on Ethereum, and as users and developers seek low-fee alternatives with familiar UIs and concepts, EVM-compatible chains are well positioned to move from Ethereum to the rest of the L1 ecosystem. liquidity.

At the same time, the focus on L1 alternatives has brought renewed attention to non-EVM compliant blockchains and how they differ in terms of performance, security, and design. Compared to previous years, usage started to rise as various blockchains reached key milestones, and the unique characteristics of different network architectures, Sybil resistance, and consensus mechanisms were tested in production environments.

After the explosive growth of DeFi and the entire crypto market in early 2021, many L1 chains began to develop their own DeFi ecosystems, regardless of EVM compatibility or easy access to on-chain capital.

A flurry of product launches throughout 2021 also highlights that protocols tailored to specific blockchains can enable experiences that may not be possible elsewhere. One of the most obvious examples of synergy between applications and blockchains is Serum, an order book-based DEX built on Solana.

Typically, DEXs like Uniswap and SushiSwap have adopted an AMM design throughout DeFi, where passive liquidity pools allow traders to trade tokens based on the current ratio of the two tokens in the pool. In the AMM category, variations on the standard constant product design have emerged over time, but they all still rely on automatically rebalancing liquidity pools that lack some of the core functionality of traditional central limit order books . For example, when a user of an AMM places a trade, it essentially asks for a market buy, unlike a traditional order book where a matching engine executes trades when buy and sell orders overlap at user-specified prices.

Solana's exceptionally high throughput (estimated at 50,000 transactions per second) and low transaction fees compared to other blockchains enables Serum's on-chain order books to be implemented where other blockchains may not be feasible and costly function under the circumstances. In comparison, the throughput of Ethereum and Avalanche is estimated to be around 20 TPS and 4500 TPS respectively. This ability to take advantage of its technical specifications, enabling applications to benefit from deployments in its ecosystem, may be one of the reasons why Solana will be able to post huge growth in 2021.Despite being non-EVM compliant, Solana has amassed a TVL of $14.4 billion as of this writing, up from $153 million just 6 months ago, second only to Ethereum and BSC. Solana's TVL growth is significant, even normalizing it against the huge price appreciation in 2021, with SOL's price increasing from $1.84 at the beginning of the year to $208.71 on November 30th.

Solana’s DeFi ecosystem is largely dominated by its DEXs, which make up most of TVL’s top protocols.

Number one is Raydium Exchange, which utilizes Serum's order book, offering a trading experience similar to traditional centralized exchanges, while also offering a liquidity pool that allows users to trade on Serum.

As one of the first DEXs launched on Solana, Raydium has spent most of 2021 at the top of the Solana ecosystem TVL and currently handles most of the transaction volume in the ecosystem. Marinade Finance is a protocol that has seen considerable growth in recent months. It is a liquid staking solution for Solana that allows users to earn protocol fees by staking SOL in exchange for mSOL, which can then be used in the Solana ecosystem. mSOL is used throughout DeFi applications.

Marinade’s mechanics are similar to LidoFinance, a liquid staking solution that has seen considerable growth in the Ethereum and Terra ecosystems in the form of stETH and bLUNA. Interestingly, Marinade’s growth has continued despite Lido deploying its own stSOL liquid staking solution on Solana in early September. At the time of writing, Marinade's TVL of about $1.5 billion for staking SOL is much higher than Lido's $208 million.

Liquidity products like mSOL and stSOL derive much of their value from how well they integrate with other DeFi protocols in the ecosystem. If these products don't have sufficient liquidity or use cases, their value proposition drops dramatically compared to native SOL available across the Solana ecosystem.

While Solana has seen immediate benefits from the technical advantages of its DeFi ecosystem, it also sees significant growth in the NFT ecosystem in 2021, where factors like network throughput are not necessarily critical. Taking Solana's frequently fluctuating NFT base price as its current market price, as of November 30, the total market value of Solana NFT has exceeded $820 million.

The growth of the Solana NFT ecosystem in 2021 is due to some key infrastructure developments, one of which is the launch of the Metaplex NFT platform in June, which allows users to create NFTs on Solana and create their own stores or marketplaces. The timely arrival of Metaplex's contract ecosystem underpins the launch of Solana's major NFT marketplaces, such as Solanart and Digital Eyes, which are critical to the growth of Solana's overall NFT activity.

A notable aspect of rising NFT activity on Solana in 2021 is the interplay between Solana and Arweave, a decentralized storage solution that continuously backs up Solana's ledger data to its own blockchain via the SONAR cross-chain bridge. Regarding NFTs, Arweave also plays an important role as it is the default storage solution for all NFTs created through Metaplex. In fact, one way to visualize non-functional financial activity on Solana in 2021 is to look at transaction history on Arweave.

As the number of daily active users on the Solanart and Digital Eyes non-functional game marketplaces began to rise in late August, the number of transactions on the Arweave network also started to rise. Daily transaction volume also peaked on October 7, which coincides with a decline in active users on Solana's non-functional transaction marketplace since mid-October. As a whole, Arweave's unique symbiotic relationship with the Solana network is worth watching in the future, as the L1 network is expected to become increasingly interconnected over time.

The significant growth of the Solana ecosystem in 2021 can be attributed to a combination of several key factors, including overall growth in the crypto market, timely product and infrastructure launches, and funding. However, its meteoric rise throughout 2021 has not been without its challenges.

One of the biggest challenges for the Solana network in 2021 came in mid-September when the mainnet experienced a period of prolonged unplanned downtime that didn't fully resolve until about 17 hours after it started. Preliminary analysis of the incident revealed that during the Grape Protocol initial IDO, there was a sudden increase in bot transactions that overloaded the network transaction queue, followed by excessive memory consumption that resulted in the disabling of multiple nodes.Ultimately, node validators voted to restart the network, but before that, Solana’s DeFi protocol was at significant risk of failure, which could result in significant loss of user funds. Solana's 2021 network outage highlighted the unique challenges of creating a new blockchain ecosystem, especially when it is growing at such a rapid rate.

One of the issues is centralization, and Solana effectively trades throughput for decentralization because its validators are much more computationally intensive compared to other L1s.

During an outage event, validators were able to quickly reach consensus to fix critical issues, but it has also been argued that this centralization creates a centralized risk point for the network.

While the ultimate goal of an L1 like Solana is to achieve greater decentralization over time, blockchains are run by people, teams, and governance that are constantly innovating and allowing for system improvements. For a relatively new L1 chain, this means that occasional centralized action may be required early on to ensure continued success.

Blockchains today are ultimately evolving networks, a fact that is most evident in the case of network upgrades, where developer decisions can have a huge impact on the future of the network. These upgrades can help optimize many areas, including performance, growth, and security. For example, with the implementation of EIP-1559, Ethereum's London hard fork in August 2021 brought sweeping changes to the network's transaction fee structure and monetary policy.

Avalanche’s September upgrade also introduced new block-based fees to the c-chain, as well as a new congestion control mechanism designed to combat malicious MEV activity on the network. Sometimes upgrades are made to optimize growth, as we saw in the example of Tezos’ Granada mainnet upgrade in August 2021. Unlike most other L1 platforms, the Tezos blockchain can be upgraded through an in-protocol modification process that does not require a hard fork.

In the Granada upgrade, Tezos' consensus algorithm was replaced, the block time was reduced from 60 seconds to 30 seconds, and the concept of "liquidity baking" was introduced into the network. With this feature, Tezos governance effectively implements a native protocol mechanism to incentivize and attract liquidity to the network.

To enable liquidity baking, Tezos created a Fixed Product Market Maker (CPMM) contract that acts like a liquidity pool for AMMs like Uniswap. This contract encourages tzBTC to join the tzBTC-XTZ pool, continuously generating XTZ rewards, just like XTZ rewards to Tezos bakers (stakers). Since XTZ joined the CPMM pool, the price of tzBTC in the pool was artificially inflated, which incentivized arbitrageurs to add more tzBTC to the contract in exchange for relatively "cheap" XTZ.

Since its introduction, the contract has gained around $20.2 million in total liquidity as of Nov. 30, though growth has been relatively stagnant over the past few months. As we mentioned recently, one problem with liquidity baking contracts specific support for tzBTC is that tzBTC is relatively harder to come by for users who want to enter the Tezos ecosystem while remaining fully on-chain. To do this, assets must be bridged via a wrapper protocol and then exchanged for tzBTC.

Instead, users may choose to simply link the commonly used WBTC with wWBTC. As of November 30th, WBTC was about twice as liquid as tzBTC on Plenty. In fact, users may have little reason to remove their liquidity from the CPMM contract, thus limiting the effectiveness of liquidity incentives.

Even so, Tezos' unique approach to incentivizing liquidity directly through mainnet upgrades is a testament to how liquid today's blockchain architectures can be in adapting to changing market demands. In this fast-paced crypto industry, a protocol design that was a good fit for a particular L1 ecosystem a year ago often becomes obsolete after reaching a new level of growth or adoption. Therefore, for a newly launched or growing blockchain, the ability to implement necessary changes relatively quickly can be an important factor in remaining competitive and achieving continued growth.

In the early Columbus-4 Terra protocol, a portion of all LUNA burned to issue UST was redirected to LUNA stakers, as well as a community pool to fund general ecosystem initiatives. While this mechanism was initially beneficial in guiding the growth of Terra's young ecosystem, over the past year, supporting initiatives have emerged, such as Terraform Capital and the $150 million Ecosystem Fund, ultimately reducing the need for community pools. Therefore, Columbus-5 instituted a new mechanism for LUNA issuance tax, 100% of the issuance tax is destroyed when UST is issued, which creates a simpler and more direct relationship between LUNA and UST demand.

In the long run, this change is expected to put more deflationary pressure on LUNA as demand for Terra's UST stablecoin grows. Like Ethereum’s EIP-1559 upgrade, Terra’s 2021 Columbus-5 upgrade represents how L1s are actively adapting to growth in a rapidly changing market environment.

secondary title

Adapt to increasing connectivity in a multi-chain world

One of the main goals of the Terra platform is to expand the distribution of its UST stablecoin throughout the crypto ecosystem, regardless of the specific blockchain or protocol it is used on. In the Terra model, UST is issued during periods of growing demand, where anyone can choose to burn LUNA in exchange for UST equivalent at current market prices, effectively increasing the supply of UST.

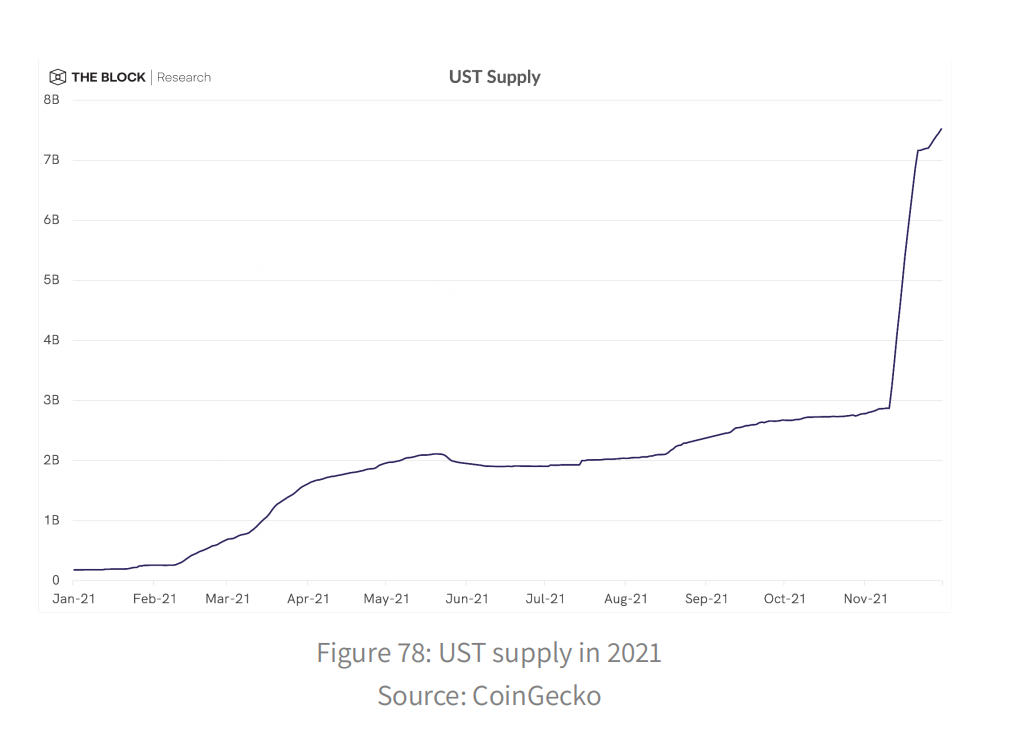

During 2021, the supply of UST has increased significantly, from about 182 million at the beginning of the year to about 2.7 billion on November 10, reflecting a steady increase in demand for stablecoins throughout the year.

As of November 22, the supply of UST has soared to 7.2 billion, an increase of about 4.5 billion in just 12 days. The latest increase in demand was not the result of a natural surge, but rather the passage of Terra Proposals 133 and 134 on November 9th, which specified that the Terra community pool established prior to Columbus-5 destroy 88.675 million LUNAs (approximately 4.5 billion at the time) within two weeks. Dollar). UST minted from scheduled LUNA burns is expected to be used for a number of initiatives, including funding Terra's native insurance protocol (called Ozone), purchasing collateral reserves for UST, and funding UST's multi-chain expansion.

Interestingly, another new feature implemented through the Columbus-5 upgrade is the transfer of LUNA/UST transaction fees to LUNA stakers instead of being burned as in previous mainnet versions. In fact, the impact of the recent LUNA burn on staking rewards can already be seen.

Since November 10th, the annualized rate of return on staking LUNA has more than doubled, and as of this writing, the expected annualized rate of return is approximately 10.4%. This increase in earnings is also expected to benefit Terra's two largest DeFi protocols by TVL — Anchor and Lido — which collectively hold $12.7 billion worth of TVL in the Terra ecosystem as of Nov. 30 9.9 billion US dollars.

Anchor's TVL consists primarily of bLUNA collateral issued by Lido, meaning that the recent increase in yield from staking LUNA on Terra will benefit users of both protocols and translate directly into further growth. In addition to growth and protocol monetary policy, Terra's Columbus-5 upgrade also launched an important new level of interconnection, activating the IBC transmission on October 21st.As a blockchain built using the Cosmos SDK, Terra can theoretically communicate on-chain with any chain in the Cosmos ecosystem via the Inter-Blockchain Communication Protocol (IBC). With the ability to transfer assets now, Terra takes another step forward in expanding the presence of UST, which is already available in other L1 ecosystems such as Ethereum and Solana. For the Cosmos ecosystem, activating Terra's IBC transport brings it closer to the vision of an interconnected system of IBC-enabled networks.At the time of writing, there are currently 25 IBC-enabled blockchains in the Cosmos ecosystem.

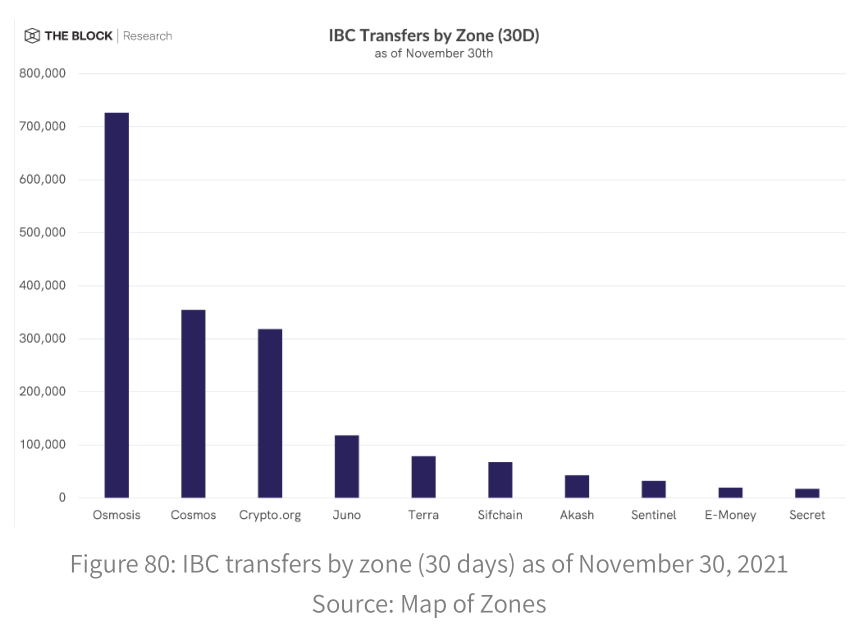

As can be seen from the number of IBC transfers, Osmosis is currently leading the active region on the Cosmos network

, followed by Cosmos Hub and Crypto.org. Since the launch of IBC in late October, Terra moved up to fifth on Cosmos' list of the most active blockchains in November.

Perhaps the clearest sign of Terra's expansion into the Cosmos ecosystem is the rise in liquidity of Terra's native assets on Osmosis. As the DEX with the largest trading volume and liquidity in the IBC network, Osmosis can be considered a litmus test for the general activity of the Cosmos ecosystem. As of November 30, UST and LUNA have accumulated a total of about $89 million in liquidity on Osmosis, second only to OSMO and ATOM, the native tokens of Osmosis and Cosmos Hub, respectively.

With increased liquidity, UST and LUNA are now among the most traded tokens on Osmosis, underscoring Terra's newfound presence in the Cosmos ecosystem. Right now, that's largely confined to Osmosis, which has seen tremendous growth since its release in June. Since then, TVL on Osmosis has grown to approximately $615 million as of November 28th, thanks largely to an initial airdrop to ATOM holders and OSMO’s ongoing rewards to liquidity providers. Osmosis' liquidity incentives are representative of some of the key differences between Osmosis and the Cosmos Hub, the AMM DEX originally conceived as a module.

Ultimately, Osmosis was launched as a standalone DEX on its IBC-enabled blockchain, citing the need for rapid iteration of its features, which would be limited by the relatively slow governance speed of Osmosis Hub stakers. In fact, signs of these limitations can be seen in the Hub's own DEX implementation, the Gravity DEX.

Launched on July 13, the DEX receives much less liquidity than Osmosis, with a TVL of around $34 million as of this writing. Although the DEX itself technically went live in July, the front-end interface for accessing the exchange through the Emeris hub did not roll out until more than a month later, underscoring the challenges for Cosmos when constrained by the hub’s proposal and voting process. The obvious difficulty in building applications for the ecosystem.As of this writing, there is still no additional incentive to provide Gravity DEX liquidity, a common feature in DeFi and Osmosis DEXs. Only recently, on November 9th, did the Cosmos Hub pass a proposal to add a budget and farming module, which would allow ATOMs to be allocated for specific purposes, and do this through a standard farming mechanism. However, the actual implementation of these modules is not expected until early 2022.

As one would expect, Osmosis’s liquidity incentives give it an edge over Gravity in attracting liquidity through the OSMO token, again demonstrating the effectiveness of rewards in promoting specific user behavior in DeFi.In the future, the Cosmos Hub's role in the broader Cosmos ecosystem will be more clearly defined as the central portal for interacting with IBC-connected chains.

For example, the Hub will oversee the creation of the Gravity Bridge, which will allow users to connect ERC20 assets from Ethereum to Cosmos. Like other ecosystems, this cross-chain bridge is critical to the general adoption of the Cosmos ecosystem, providing a straightforward way to transfer value from the most mature L1 ecosystems. In an upcoming Vega upgrade, the Cosmos Center will also add IBC router functionality, which will allow it to provide routing services for IBC-enabled chains and charge for it.

One of the biggest developments in the Cosmos ecosystem is the introduction of the Cosmos Hub's interchain security system.

Essentially, this would allow a parent chain like the Cosmos Hub to produce blocks for a child chain (such as an IBC-capable chain like Osmosis). While not expected to launch until Q2 2022, networks connected to the Cosmos Hub can inherit its security guarantees, reducing the overall security cost of IBC-enabled chains. In implementing this shared security model, the Cosmos ecosystem will start to look similar to the Polkadot network, which uses a master relay chain to finalize blocks for connected parachains. In 2021, the Polkadot ecosystem is like a field experiment, seeking to build an interconnected network secured by the relay chain.

Much of this activity took place on the Kusama network, which serves as a testnet for the Polkadot release, allowing rapid iteration of theoretical concepts in production prior to Polkadot deployment. One of the most important developments in the Polkadot ecosystem in 2021 was the first parachain auction held in Kusama in June.

Through a unique parachain slot auction process, resulting in parachains like Karura and Moonriver, users are able to see for the first time in real time what a network ecosystem built on Substrate can look like. Throughout the second half of the year, Kusama's parachain auctions brought valuable attention and funds to the winners, effectively allowing the market to select the most coveted financial origins and products. Crowdlending participants have locked hundreds of millions of dollars in KSM to support their favorite parachain projects, demonstrating the overall publicity of projects in the ecosystem, and interest fluctuating over time during the auction process.

So far, the trend of Polkadot’s parachain slots looks similar to Kusama’s story, with Acala and Moonbeam, the sister networks of Acala and Moonriver respectively, winning the first two slots.

In fact, in the construction of the L1 network in 2021, the use of EVM is very common, and even emerging DeFi ecosystems like Algorand seem to be seeking to learn from the experience of Ethereum, albeit from a slightly different perspective. In October 2021, the launch of Tinyman DEX is the biggest impact of this ecosystem on DeFi. Perhaps more importantly, though, it introduces algorithms and a virtual machine (AVM).

By developing the protocol's AVM-enhanced tools on Algorand, the network apparently hopes to replicate the success of the Ethereum EVM in launching its smart contract platform. As is often seen in other L1 ecosystems, the ability for developers to build DeFi primitives on the Kusama-connected network, backed by familiar Ethereum tools, facilitates rapid product launch and user acquisition. Moonriver is the best evidence of user activity, with a TVL of more than $350 million in the 5 months since its launch in June.

Nearly one-third of Moonriver's TVL is currently locked in Solarbeam DEX, a platform that provides liquidity and rewards native token SOLAR. A key aspect of the Solarbeam protocol is that it integrates a cross-chain bridge between Ethereum and Moonriver, powered by the Anyswap protocol.

In a sense, the collaboration between Bifrost and Karura is reminiscent of the core of today's mainstream DeFi protocols - composability, and the complexity of supporting tokens between different chains. At the same time, the introduction of new cross-chain technologies, such as the XCM format adopted by Polkadot and Kusama, is also accompanied by unforeseen risks, which are often difficult to predict.

For example, the Karura and Kusama ecosystems faced a major problem on October 12 when an attacker stole 10,000 KSM worth approximately $3.2 million from Kusama's parachain account. This vulnerability may be due to the Kusama network upgrading to v2 of the XCM messaging standard, while its parachains still use XCM v1. In response, the administration quickly banned the XCM transfer and passed a proposal that would allow them to force the transfer of the stolen funds back to Kusama’s parachain account. Incidents like this, along with the drastic measures taken by Karura and Kusama governance, underscore the level of risk that remains in a largely unaudited environment that has undergone major iterations.

secondary title

Major Developments in Cross-Chain Bridges

The emergence of cross-chain bridges in 2021 is one of the most important developments to facilitate the rise of various L1 ecosystems and the current multi-chain landscape. As the primary means of transferring assets between different chains in a permissionless manner, these cross-chain bridges have become an important gateway for enabling the seamless flow of capital throughout the crypto ecosystem. Likewise, tracking activity around cross-chain bridges is now an effective way to assess usage and interest in certain ecosystems, both in the short and long term.

Perhaps the biggest example of the central role of cross-chain bridges in today's crypto space is the dramatic rise in assets wrapping Bitcoin on Ethereum. Since the beginning of 2021, the number of BTC wrapped on Ethereum has increased from about 140,000 to 3.166 million today. Calculated at the current BTC market price, this means that the BTC assets on Ethereum have increased by about 10 billion US dollars, which is likely to be used as a production asset in DeFi protocols.

Most bitcoins on Ethereum exist as WBTC, which can only be issued by centralized custodians such as CoinList and Alameda Research. Other wrapped BTC assets, like renBTC, are backed by a decentralized network of nodes, but they are still backed 1:1 with actual BTC.

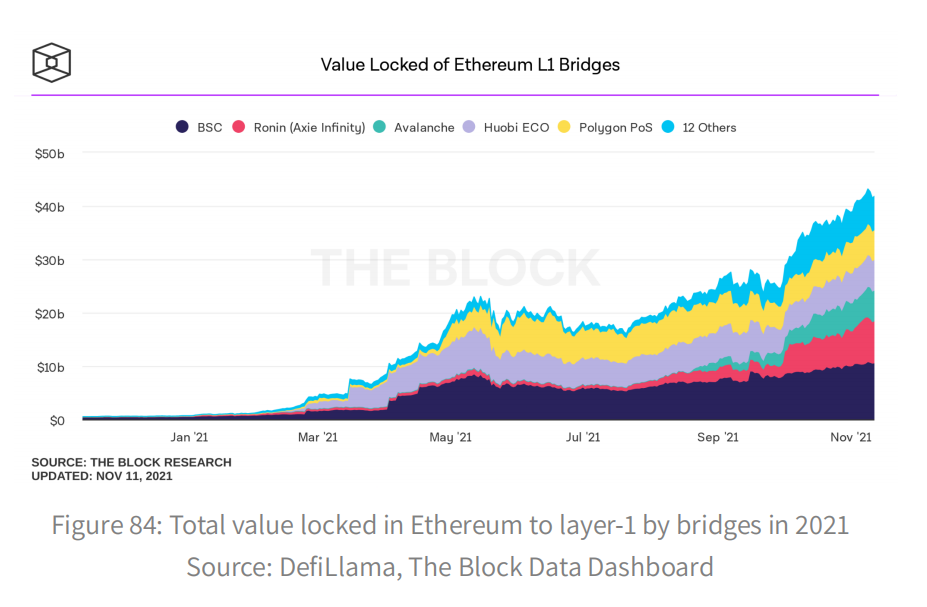

The best way to assess movement between L1 ecosystems is not just to look at the growth of wrapped assets, but to look at the total value locked in the cross-chain bridges connecting the various ecosystems. In 2021 in particular, a significant amount of capital will move from Ethereum to other L1 chains, as DeFi players seek to invest in early-stage protocols emerging on other chains, as well as take advantage of attractive yields that may be found in the broader DeFi space.

According to the statistics of smart contracts on Ethereum, the TVL of cross-chain bridges will increase significantly in 2021, from $667 million at the beginning of the year to $32 billion on November 30. Among the various cross-chain bridges from Ethereum to other L1s, Binance Bridge has become the largest cross-chain bridge, with a TVL of about $10.4 billion as of November 30, reflecting BSC's ambition to become the second largest smart contract platform rise. Cross-chain bridges will take many forms in 2021, with different implementation methods and degrees of decentralization.

For example, Binance Bridge is one of the most centralized cross-chain bridges because it is fully managed by Binance. When users send assets through Binance Bridge, the assets are actually sent directly to Binance Exchange, where they are still issued as BSC-compatible wrapped assets. While there is already a central point of failure when it comes to asset custody, the Binance Bridge is not entirely permissionless, banning users with US IP addresses, highlighting some of the major issues centralized bridges have for DeFi. Other cross-chain bridges, such as the Avalanche Bridge, have also implemented additional security measures in an attempt to better protect these now billion-dollar assets.

In 2021, the analysis of capital flows to and from cross-chain bridges has become a particularly meaningful indicator of capital flows to specific ecosystems. For example, another cross-chain bridge reflecting its 2021 target chain growth is the Ronin Bridge, through which players of the popular game Axis Infinity must pass to enter the Ronin sidechain and interact with the game.

Throughout 2021, among DeFi protocols, leading P2E game Axie Infinity has seen some of the most explosive growth, jumping from 581 average daily users in January to 121,000 average daily users in November. This growth can also be seen in the TVL growth of Ronin sidechains, from about $31 million at the beginning of the year to $7.9 billion on November 30th.The specifications of most bridges currently deployed are similar to ChainSafe's ChainBridge protocol, which uses a "lock and issue, burn and release" mechanism. In this model, the tokens transferred through the bridge are locked in the bridge contract, and the equivalent tokens are generated on the target chain. When the wrapped tokens are sent back across the bridge, they will be minted on the target chain and released from the bridge contract on the source chain. This approach works well in most cases, as it provides an easy way to issue assets during transfers without changing the circulating token supply.

However, the main drawback of this mechanism is that it requires bridge escrow of transferred assets, which can create a fragile single point of failure.

If the cross-chain bridge contract is compromised, it could lead to the theft of funds and render the wrapped tokens off the bridge worthless. One of the cross-chain bridges that use a non-custodial mechanism for cross-chain bridge transfers is the Anyswap protocol, which became popular in 2021 as the main cross-chain bridge between Ethereum and Fantom.

Anyswap combines liquidity trading with a normal issue/burn mechanism where intermediate tokens like anyUSDC are used to eliminate the need for bridge custody. In the example of an exchange, a user who connects USDC will deposit it to any exchange, which will issue any USDC 1:1 on Ethereum and then burn it immediately, triggering any USDC issuance on Fantom. It then uses the anyUSDC:USDC liquidity pool on Fantom to swap the wrapped USDC on Fantom. Under this mechanism, transferring assets does not require bridge custody, only sufficient liquidity is required.

A notable example is that on October 6th, Geist Finance was launched on Fantom, accompanied by abnormally high liquidity incentives, resulting in a large amount of capital pouring into the Fantom ecosystem through the Anyswap: Fantom bridge. In just four days, the bridge gained over $3 billion in deposit liquidity, most of which went into the Geist Finance protocol.

Capital was quickly pulled out of the Fantom ecosystem as returns on new lending protocols dropped rapidly, and the bridge lost about $1.8 billion in TVL just two weeks after peaking TVL. As cross-chain bridges become an increasingly important source of value and activity in an increasingly multi-chain world, users may start looking for cross-chain bridges that offer the ideal combination of speed, security, and decentralization.

These may look similar to the AnySwap protocol, which also recently announced support for non-functional bridging. Another cross-chain bridge also provides non-functional bridging and is starting to gain traction in many chains. For example, the Wormhole V2 bridge, which uses a unique universal cross-chain messaging protocol, could theoretically allow any asset transfer between chains.In the future, this common messaging format will technically allow assets residing on one chain to be used in DeFi protocols on another chain without leaving the source chain. In a way, cross-chain bridges essentially represent a subset of the oracle problem, where providers are always looking for an ideal compromise between speed, accuracy, and security.

With the growing need for permissionless asset transfers between more and more L1 ecosystems, cross-chain bridges are right in the middle of the future of cross-chain DeFi.

In the future, it is unclear whether a bridge will eventually serve most cross-chain transfers. One thing is for sure: the road to eventual cross-chain interoperability will be littered with potential solutions of all shapes and sizes. In the end, the only way to arrive at the best cross-chain solution is to let the market decide for itself.

secondary title

Optimistic rollups

Development of Layer 2 Scaling Solutions for Ethereum

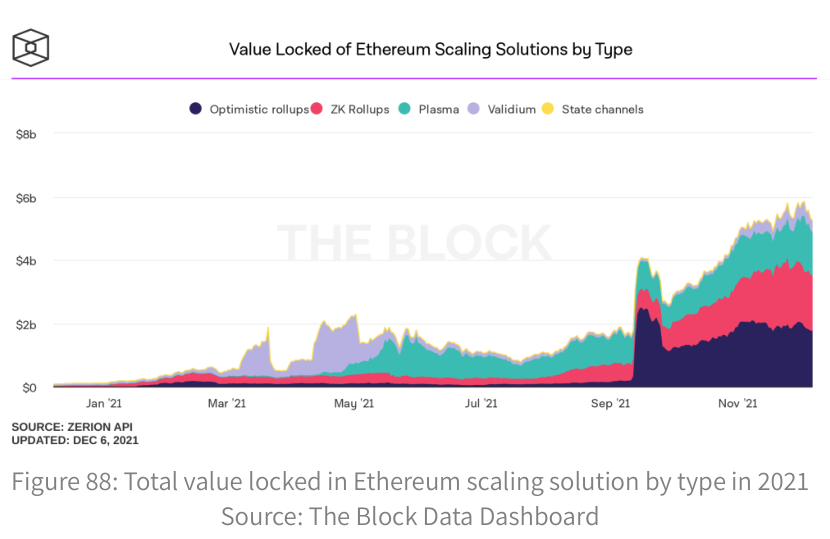

As layer 1 chains continue to threaten Ethereum’s dominance as a smart contract platform, Ethereum has advanced its infrastructure by leveraging layer 2 technology rollups. There are currently two types of rollups in the market, namely Zero-Knowledge and Optimistic, both of which currently exist on the Ethereum mainnet. Even without a token launch, Layer 2 has witnessed a significant increase in TVL, which may continue until 2022. With Ethereum 2.0 shard chains scheduled to launch in 2022, coupled with the possibility of token distribution, rollups will see greater adoption in 2022.

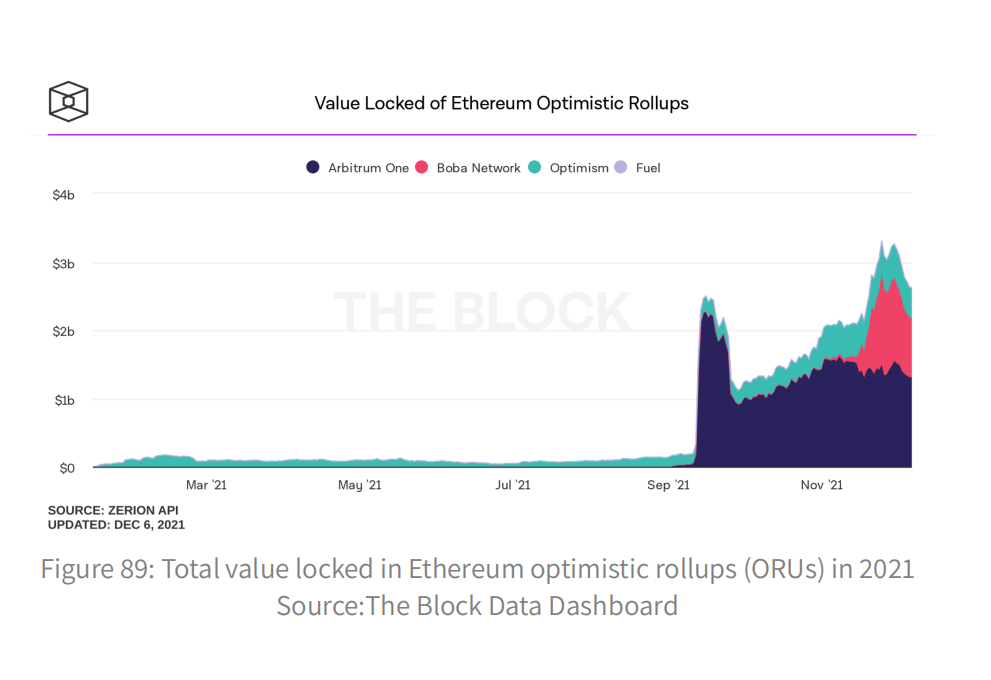

Optimisticrollups (ORUs) have significant growth in 2021. Since the Arbitrum and 0ptimistic mainnet launches on May 28 and June 22, ORUs have grown in both TVL and user metrics. At the time of writing, Arbitrum and Optimism have locked value of $2.6 billion and $400 million, respectively.

User metrics for both Arbitrum and Optimistic are up. While Optimistic did launch Synthetix earlier, its mainnet came after Arbitrum. That is, Optimistic and Arbitrum have roughly the same growth in terms of unique addresses, but Arbitrum has significantly higher peak transaction throughput than Optimistic. However, both Arbitrum and Optimistic are essentially able to boast similar transaction throughput, suggesting that Optimistic will be poised to grow once it starts allowing decentralized applications (DApps) to be deployed permissionlessly.

Arbitrum and Optimistic have very different stances on DApp deployment: Arbitrum actively seeks as many DApps as possible, while Optimistic strictly follows whitelist requirements for DApp deployment. This brings a larger ecosystem to Arbitrum than Optimistic. Since Arbitrum has significantly more DApps than Optimistic (58 instead of 6), the DApp Advantage graph below lists only Arbitrum's notable protocols.

Arbitrum has seen significant growth through Curve, Balancer, and SushiSwap. More notably, Abracadabra has also seen rapid growth in TVL, due in part to the rapid rise in the price of its native token, SPELL. These DApps have been dominating Arbitrum’s TVL and will likely continue to do so in 2022.

Optimistic, on the other hand, is largely dominated by Synthetix. This is partly because Optimistic only has 6 DApps at the time of writing. As more DApps are deployed on Optimistic, there is a good chance that Synthetix's dominance will eventually decline.

Beyond that, there are two notable ORUs gaining significant traction in the final quarter of 2021, namely Boba and Metis.

At the time of writing, Metis only has a testnet DEX, while Boba already has a functioning bridge and a native DEX called OolongSwap that can be used for real transactions. The Boba Network airdropped their native Boba tokens to OMG token holders on November 12th. This led to a lot of speculation on the OMG token price prior to the airdrop. More notably, the OMG perpetual contract’s funding rate on Binance reached -2.4% every two hours, and the price of OMG plummeted after the airdrop snapshot. It is unlikely that there will be another airdrop using this model.

Zero-Knowledge rollups

That is, after the BOBA token airdrop, it saw a sharp increase in TVL, mainly due to the increase in TVL of BOBA's native DEX OolongSwap. OolongSwap has a liquidity mining incentive mechanism, which quickly attracted a large amount of funds to provide liquidity. In other words, a large part of OolongSwap's funds may be mercenaries, and once the benefits are no longer attractive, they may leave the ecosystem.Another competitor worth mentioning is Metis DAO, whose native token, Metis, rose in price after the BOBA airdrop. Going forward, it is unlikely that any L2s will repeat the airdrop of tokens in the manner that BOBA did, given that it distorts market prices somewhat. That said, the two largest ORUs will likely end up having to issue some form of token.

Zero-Knowledgerollups (ZKRs) have seen incredible growth in 2021, growing from a TVL of $43.5 million on January 1, 2021, to $1.9 billion now locked in ZKR solutions.

Validium, a scalable solution that leverages validity proofs but stores data off-chain, has also seen TVL grow throughout the year, albeit not as dramatically as ZKR.

One of the most notable highlights in the ZKR space was the launch of dYdX which uses StarkEx to scale transaction throughput. The exchange also launched a governance token, which led to an increase in TVL from $96.5 million on September 8 to $930 million by the end of November, serving as the main driver of ZKRs TVL growth. Other ZKR projects include Loopring, ZKSwap V2, zkSync, Aztec, and Polygon Hermez, all of which have grown in value since the beginning of the year, with the cumulative value of TVL increasing from $40 million at the beginning of the year to $943 million at the end of November.

While the value locked in Validium has not grown as dramatically as the ZKR version, notable non-functional projects Sorare and ImmutableX both use StarkEx. Similar to dYdX, ImmutableX announced their utility token on July 22, which can be used for governance or for rewards. This resulted in Immutable X being the highest TVL Validium project at the end of the year, at almost $350 million. During the year, ZKSwap V1 actually had the highest TVL, but is no longer used due to the release and success of V2.

Both StarkWare and Matter Labs are pioneers in the field of validity proofs. In 2021, StarkWare has pushed StarkNet Alpha to the mainnet on November 29, with the purpose of building a complete layer 2 for users and developers, connecting back to the mainnet through ZK-STARKs.

Matter Labs announced that their zkSync 2.0 will use zkEVM, an EVM-compatible compiler. Likewise, both companies are looking at creating a hybrid data availability where users can choose whether data is stored on-chain or off-chain, developing Volition and zkPorter as their solutions to merge the two forms of data storage.

secondary title

The Competitive Landscape of Layer 1 Platforms and Scaling Solutions in 2022

Much of the discussion around L1 and L2 platforms in 2021 has focused on scalability, especially as crypto and NFTs become the new mainstream focus, with Ethereum transaction fees and usage reaching record highs. In theory, L1 and L2s have different technical constraints and security guarantees. In fact, they currently function similarly from a user experience standpoint. In order to take advantage of the speed and cost improvements of L1 and L2 chains, users must first connect their funds from an L1 chain such as Ethereum.

Therefore, like L1-to-L1 cross-chain bridges, cross-chain bridges to L2s can also serve as a valuable indicator of the amount of funds flowing from L1 to a particular L2. For example, TVL on the Optimistic bridge has grown from about $47 million at the start of the third quarter to about $517 million as of November 30. While experiencing more than 10x TVL growth in the past few months, Optimistic Bridge's TVL still pales in comparison to other major L1 cross-chain bridges such as BSC, whose TVL was approximately $31 billion as of November 30.

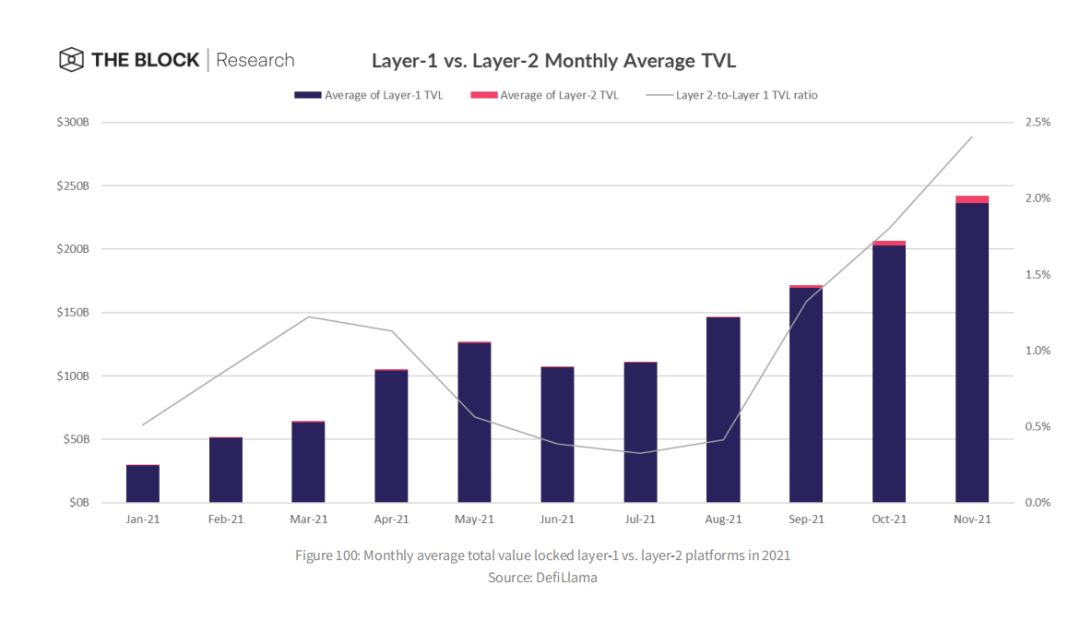

At present, the advantage of L1s is to act as the host of a larger overall protocol ecosystem, as well as key infrastructure features, such as oracles, cross-chain bridges, centralized exchange support, application support, etc. This fact is evident when comparing TVL in L1 and L2 protocols, suggesting that DeFi activity currently dominates on L1s over L2s.

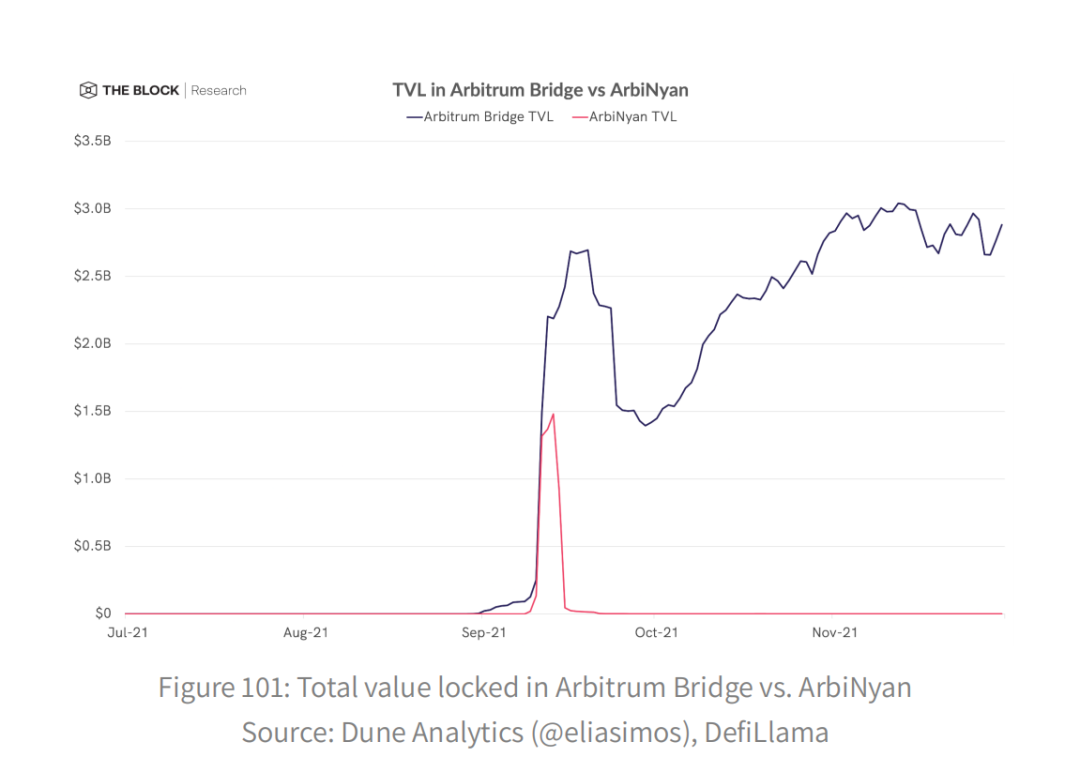

At the same time, the growth of L2s also showed increasing traction. Typically, this growth can be partly explained by the introduction of liquidity incentives starting to emerge on L2s. For example, when ArbiNyan on Arbitrum launched in early September, token inflation and APYs were very high, which led to a lot of mercenary capital entering the Arbitrum ecosystem for quick gains, but leaving quickly.That said, the TVLs of Arbitrum and Optimistic are still growing significantly. Arbitrum's TVL has continued to grow since early September, despite the rapid inflow and outflow of ArbiNyan funds into Arbitrum. Currently only a few applications exist on Optimistic, but it is very likely that in 2022 more DApps will run on this L2, which will put Optimistic on the same growth trajectory as Arbitrum.