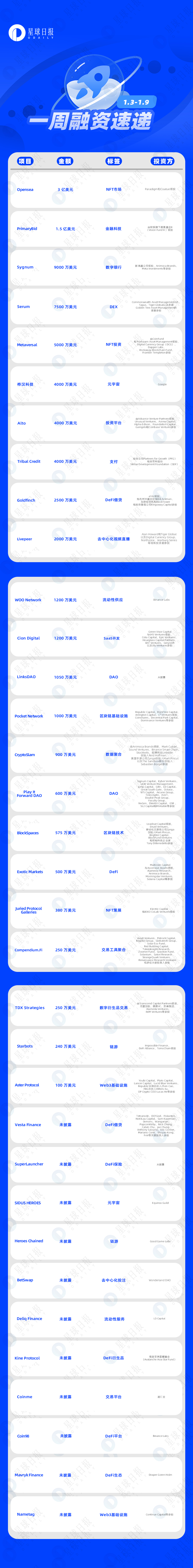

One-week financing express | 34 projects have been invested; the total disclosed financing is about 912 million US dollars (01.03-01.09)

According to Odaily’s incomplete statistics, a total of 34 blockchain financing incidents at home and abroad were announced during the week of January 3-09, a substantial increase from last week; the total disclosed financing was about 912 million US dollars, compared with last week’s data has risen.

Last week, there were two projects that raised more than 100 million yuan, including Opensea’s $300 million Series C financing with a post-money valuation of $13.3 billion, and British fintech platform PrimaryBid’s $150 million Series C round of financing. There are 12 companies with a financing amount of tens of millions of dollars, including the digital asset bank Sygnum announced that it has completed a financing of 90 million U.S. dollars at a valuation of 800 million U.S. dollars, and the team behind the Solana-based decentralized exchange Serum has raised 75 million U.S. dollars (this round of financing is still in progress). In progress, Incentive Ecosystem Foundation plans to raise another US$25 million), Metaversal, a company focusing on NFT investment, announced the completion of Series A financing of US$50 million at a valuation of US$181 million, etc.

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

The following are the specific financing events (Note: 1. Sorting according to the announced amount; 2. Excluding fundraising and mergers and acquisitions; 3. * is a "traditional" company whose business involves blockchain):

Opensea completes $300 million financing at $13.3 billion valuation led by Paradigm and Coatue

Opensea announced the completion of a $300 million Series C financing at a post-money valuation of $13.3 billion, led by Paradigm and Coatue. It is reported that the main uses of the funds include accelerating product development, significantly improving customer support and customer security, making meaningful investments in the wider NFT and Web3 community, and developing the team.

At the same time, Opensea also announced that Shiva Rajaraman, Meta's former vice president of business, has now served as the company's vice president of product. The company will continue to focus on lowering the barrier to entry for NFTs by introducing features that abstract away the complexity of the blockchain and simplifying the process to help people discover, manage and showcase their NFTs with better tools, analytics and demos. As previously reported, Opensea was valued at $1.5 billion in its Series B round of financing completed in July last year.

UK-based financial platform PrimaryBid closes $150 million Series C round

British fintech platform PrimaryBid is set to close a Series C funding round worth $150 million, sources said. It is reported that this round of financing was led by SoftBank’s Vision Fund II. PrimaryBid was valued at more than $500 million before financing. (Sky News)

Serum is financing $100 million and plans to expand NFT, metaverse and other businesses

The team behind Serum, a Solana-based decentralized exchange, is raising $100 million to expand its business. The Incentive Ecosystem Foundation (Incentive Ecosystem Foundation) is raising funds to hire staff and enter new product verticals, including "NFT, games, metaverse and DAO tools."

So far, $75 million has been raised through token sales, with participation from Commonwealth Asset Management LP, Tagus, Tiger Global, and executives from Golden Tree Asset Management.

JHL said that this round of financing allowed investors to obtain a series of different tokens at a discount of 15% below the market price, including Serum (SRM), Solana (SOL), Raydium (RAY), Bonfida (FIDA), Oxygen ( OXY), Maps.me (MAPS), and Liquid Finance (LQID), all part of the Solana and Serum ecosystems. Investors will also face a 6-year lock-up period, with a 1-year lock-up period and a 5-year linear release.

In addition, JHL also said that this round of financing is still in progress, and the Incentive Ecosystem Foundation plans to raise another 25 million US dollars. The foundation plans to use 15% of the new funds to develop the Serum ecosystem, and the rest of the funds will be used for Project Serum's growth plans, such as hosting hackathons and recruiting. (CoinDesk)

On January 6, the digital asset bank Sygnum announced the completion of financing of US$90 million at a valuation of US$800 million. This round of financing was led by Sun Hung Kai, with participation from Animoca Brands and Meta Investments. Sygnum plans to use the proceeds to develop new products for institutional clients, including yield generation and asset management solutions, according to the statement. As previously reported, in June last year, Sygnum launched the custody and trading of a series of decentralized finance (DeFi) tokens, including Aave, Aragon, Curve, MKR, Synthetix, Uniswap, and 1inch Network. Sygnum also added banking services to USDC. (BNN Bloom Berg)

Metaversal, a company focused on NFT investment, announced the completion of Series A financing of US$50 million at a valuation of US$181 million. The round was led by CoinFund and Foxhaven Asset Management, with participation from Digital Currency Group (DCG), Dapper Labs, Rockaway Blockchain Fund, and Franklin Templeton.

Headquartered in Miami, Metaversal launched in June 2021 and now has more than 750 NFTs, including works by digital artist Fewocious and a CryptoKitty from the RarePepe collection. Metaversal's portfolio includes Holaplex, a Solana-based NFT creation and sales platform, and the Tezos blockchain network. (The Information)

On January 4, Ennoconn Corp, a subsidiary of Hon Hai Group, disclosed that Google had spent US$40 million to obtain a 4.6% stake in the company, becoming its third largest legal shareholder. The two parties will join hands to enter the metaverse market. (NetEase)

Alto Closes $40M Funding Led by Advance Venture Partners

On January 6, Alto, an alternative investment service provider, announced the completion of a US$40 million Series B round of financing, led by Advance Venture Partners, with participation from Unusual Ventures, Acrew Capital, Alpha Edison, Foundation Capital, Gaingels, and Coinbase Ventures. Alto will use the funding from this round to expand access to the Alto IRA (retirement account) and Alto CryptoIRA platforms, accelerate the hiring of all internal teams, and continue to develop new products. It is reported that Alto provides users with a self-directed investment platform to invest their retirement account funds in alternative assets. Currently, Alto has nearly 20,000 fund accounts with nearly $1 billion in assets, 40% of which are dedicated to holding cryptocurrencies. In April 2021, Alto raised $17 million in Series A financing. (Yahoo)

Tribal Credit Completes USD 40 Million in Debt Financing, Partners for Growth and SDF Participate

Tribal Credit, a cryptocurrency-focused corporate payment platform, has completed a $40 million debt offering, funded through fiat currencies and stablecoins, to provide additional capital for the company's expansion of business services in Latin America.

Its hybrid debt round was funded by California-based investment firm Partners for Growth (PFG), and the Stellar Development Foundation (SDF), a non-profit organization that supports the development of the Stellar blockchain; PFG provided $20 million in fiat currency, and SDF Offer 20 million USDC.

Tribal said the company will use the funds to fund receivables from its client base throughout Latin America, specifically Mexico, Brazil, Chile, Colombia and Peru. (Cointelegraph)

Decentralized lending protocol Goldfinch completes US$25 million A+ round of financing, led by a16z

Goldfinch, a decentralized lending protocol, announced the completion of a US$25 million A+ round of financing, led by a16z, and well-known hedge fund manager Bill Ackman, encryption investment institution BlockTower, and investment management company Kingsway Capital participated in the investment.

Goldfinch also announced on Medium that it was restructuring. The company launched the Goldfinch Foundation to help the protocol move into its next phase of growth. The original team behind Goldfinch is spinning off to Warbler Labs, which will become an independent organization contributing to the Goldfinch community and the broader DeFi ecosystem.

According to reports, Goldfinch is an open loan market, without collateral, and uses a decentralized loan underwriting process. The Goldfinch protocol extends credit lines to lending businesses that can draw stablecoins from Goldfinch pools and deploy funds to local borrowers. Goldfinch provides access to global capital, but leaves loan origination and servicing to lenders. Investors can deposit cryptocurrencies into Goldfinch pools to earn returns. When lenders pay Goldfinch interest, the money goes to all participating investors.

Goldfinch's outstanding loans have grown from $250,000 a year ago to more than $38 million. The agreement serves more than 200,000 borrowers in 18 countries. Goldfinch capital is used for a variety of purposes, including motorcycle rentals in Kenya and small businesses in Brazil.

In June last year, it was reported that Goldfinch had completed a US$11 million Series A round of financing, led by a16z, with participation from Mercy Corps Ventures, A Capital, Access Ventures, and Divergence Ventures. (CoinDesk)

News Livepeer, a decentralized live video platform based on Ethereum, completed a $20 million B+ round of financing. Alan Howard and Tiger Global, as well as existing investors such as Digital Currency Group, Northzone, and Warburg Serres participated in the investment. Doug Petkanics, co-founder and CEO of Livepeer, said the new round of financing is also equity financing, bringing Livepeer's total funding to date to approximately $51 million.

With the new financing, Livepeer plans to expand its market share. Petkanics said the project plans to release a massive upgrade called Confluence early this year that will move Livepeer's internal protocol from ethereum's base layer to layer 2 network Arbitrum. This will also keep the Livepeer Token (LPT) and core security mechanisms anchored to Ethereum.

In the future, Livepeer also plans to expand its capabilities across the media value chain, including video NFT support. It is reported that Livepeer is a decentralized video transcoding platform that converts video from one file format to another.

In July last year, Livepeer announced the completion of a $20 million Series B round of financing, led by Digital Currency Group (DCG), with participation from Coinbase Ventures, CoinFund, and Northzone. (The Block)

Binance Labs Announces $12 Million Strategic Investment in WOO Network

Binance Labs announced a $12 million strategic investment in WOO Network, a liquidity and trading supply platform. Binance Labs investment director Peter Huo said that the two parties will explore further cooperation on BSC.

It is reported that WOO Network provides liquidity for more than 40 institutions, exchanges, trading teams, wallets and decentralized applications. The company's products include WOO Trade, a platform for institutional investors, and WOO X, a trading platform focused on retail investors.

According to reports in November 2021, WOO Network, a liquidity provider platform, completed a US$30 million Series A financing, Three Arrows Capital, PSP Soteria Ventures, Gate Ventures, QCP Capital, Crypto.com Capital, AscendEX, AntAlpha, MEXC Global, LBank, Fenbushi Capital, BitMart, 3Commas Capital, TokenInsight Research, AVATAR (Avalanche Asia Star Fund) and ViaBTC Capital participated in the investment. (CoinDesk)

Cion Digital Closes $12M Seed Round Led by Green Visor Capital and 645 Ventures

Cion Digital, a developer of an enterprise-level SaaS blockchain orchestration platform, recently announced that it has completed a $12 million seed round of financing, led by Green Visor Capital and 645 Ventures, Cota Capital, Epic Ventures, Hourglass Capital Partners, BAT Ventures, Greycroft and Ulu Ventures participated in the investment.

The funds will be used to expand R&D resources and accelerate the launch of crypto tailored for financial services companies (lenders, RIA's, banks and neobanks) and large retailers (automotive, RV/marine, jewelry and luxury goods) financing and payment solutions, and expand the capabilities of the company's proprietary blockchain orchestration platform for use in other industries. It is reported that Cion Digital will increase its team size and launch an infrastructure platform, and set up a research and development center in Pune, India.

Cion Digital, an encryption infrastructure startup, is expected to launch the initial version of its platform in the first quarter of this year. The platform aims to provide encryption services to traditional financial institutions and registered investment advisory firms, among others. (Business Wire)

Pocket Network completes $10 million in financing, led by Republic Capital and others

Pocket Network, a blockchain infrastructure project, completed a $10 million strategic round of financing, led by Republic Capital, RockTree Capital, Arrington Capital, and C² Ventures, with participation from Coinshares, Decentral Park Capital, and Dominance Ventures.

Pocket Network will use the funds raised to fund the development of its decentralized node network and also plans to use it to expand its operations into the Asia-Pacific region.

According to previous reports, Pocket Network is a blockchain cloud computing ecosystem for Web3 applications. It has recently integrated networks such as Solana, Ethereum, Polygon, Avalanche, Binance, xDai, and Fuse. Currently, there are more than 20 public chains and data Thousands of DApps are using its infrastructure.

In December 2021, the network's demand for Pocket Network surged, and its relay services increased from 3.8 billion in November to 5.5 billion, setting a new record. (Cryptobriefing)

On January 4, the decentralized autonomous organization LinksDAO announced that it had sold out its first NFT series, a total of 9,090, and raised $10.5 million for crowdfunding golf courses. It is reported that the mission of LinksDAO is to "create the modern golf and leisure club" and "reimagine the country club", providing sports-centric experiments in the thriving DAO ecosystem. The project plans to launch the governance token LINKS as early as 2022. According to OpenSea data, the floor price of LinksDAO reached 0.3 ETH, and the transaction volume reached 977 ETH. (Coindesk)

CryptoSlam Closes $9M Funding Led by Animoca Brands

On January 6, NFT data aggregator CryptoSlam received $9 million in financing, led by Animoca Brands, Mark Cuban, Sound Ventures, Binance Smart Chain, Stocktwits, Reid Hoffman, founder of recruitment website LinkedIn, and Mark Cuban, founder of Zynga, an American mobile game company Pincus and The Sandbox co-founder Sebastien Borget participated in the round. It is reported that CryptoSlam was established in 2018 to provide NFT cross-chain aggregation and data ranking. The newly raised funds will be used for recruitment programs, platform expansion. CryptoSlam is expected to launch a new product to allow developers to build enterprise NFT data APIs on the platform. (Yahoo)

News Play It Forward DAO (PIF DAO) announced the completion of $6 million private placement financing, Signum Capital, Kyber Ventures, UOB Venture Management, Jump Capital, GBV, LD Capital, Great South Gate, Octava, 975 Capital, Arcane Group, Tokocrypto, AU21 , Double Peak Group, Faculty Group, NxGen, DWeb3 Capital, GSR, SL2 Capital and Mintable participated in the investment. Co-founder Cholo Maputol said the funds will be used to expand the DAO’s scholarship program, expand its P2E panel platform, and fund some early investments in P2E gaming and infrastructure projects.

It is reported that Play It Forward DAO includes a guild of more than 40,000 players and 3,000 scholars in the Philippines and Indonesia, all of whom are managed through a P2E scholar management plan. The DAO has players in several P2E games, including Axie Infinity, Thetan Arena, Pegaxy, and Dragonary. (Cointelegraph)

Blockchain company BlockSpaces completes $5.75 million financing led by Leadout Capital

Tampa-based blockchain company BlockSpaces has completed a $5.75 million venture capital seed round led by Leadout Capital, Druid Ventures, Zynga founder Mark Pincus, Brighter Capital, BlockFund Ventures and Tampa Tech Enterprises Tony DiBenedetto participated in the vote. Additionally, BlockSpaces received a major strategic investment from an undisclosed fintech venture capital firm. Leadout general partner Steve Brownlie will join the BlockSpaces board of directors.

BlockSpaces CEO and co-founder Rosa Shores said, “We have been building the first layer of the platform with infrastructure components, and now we will expand to the second layer - API integration. We have had an extraordinary year, We will do a Series A round in 2022.” (Stpetecatalyst)

Exotic Markets Raises $5M Led by Multicoin Capital and Ascensive Assets

Exotic Markets, a Solana-based DeFi protocol, completed $5 million in private equity financing through a token sale, led by Multicoin Capital and Ascensive Assets, with participation from Alameda Research, Animoca Brands, Morningstar Ventures, and Solana Capital.

Exotic Markets co-founder Joffrey Dalet said the new funding will be used to strengthen the team and marketing efforts. Part of the financing will be used for market-making activities on the platform to help advance the launch of the mainnet in late February.

According to reports, Exotic Markets offers a range of structured products, such as pre-packaged investments, on a Solana-based platform governed by EXO tokens. (CoinDesk)

NFT curation website JPG completes $3.8 million in financing, led by Electric Capital and IDEO CoLab

News NFT curation website Juried Protocol Galleries (JPG) has completed a $3.8 million seed round of financing, led by Electric Capital and IDEO CoLab Ventures.

JPG is focusing on building infrastructure for NFT culture. The protocol allows users to curate their own NFT galleries and museums. The platform has successfully hosted a string of exhibitions in recent months, including “The Digital,” a generative art exhibition that debuted at Art Basel Miami last December. (CoinDesk)

Compendium.Fi, a trading tool aggregation suite, announced the completion of US$2.5 million in strategic financing. Axia8 Ventures, Petrock Capital, Krypital Group, Globatech Group, Solar Eco Fund, Red Building Capital, TokenInsight Research, Zoomer Fund, Graviton Fund, Solanium, Satori Research, StrangeQuark Ventures, Renaissance Research Ventures and several angel investors participated in the round.

The new financing will be used to support Compendium.Fi's continued development and expansion of its comprehensive trading tools platform and infrastructure expansion. It will also help the project conduct an IDO of its CMFI token on Solanium later this month.

According to reports, Compendium.Fi aims to create a “compendium” of trading tools for multiple ecosystems in one user-friendly application. (Cointelegraph)

TDX Strategies Closes $2.5 Million Funding Led by Transcend Capital Partners

A few days ago, digital asset institutional derivatives platform TDX Strategies announced that it raised US$2.5 million in Series A financing, led by Transcend Capital Partners, with participation from Gobi Ventures, Baboon VC, Twin Peaks, Alameda Ventures, and IWM Ventures. The new financing will enable TDX Strategies to develop innovative investment solutions for digital assets and expand the geographic reach of its product distribution. (coinphony)

According to official news, the Solana-based NFT game Starbots announced the completion of private equity financing of US$2.4 million, led by Impossible Finance, DeFi Alliance, and TomoChain.

Aster Protocol Completes USD 1 Million Seed Round Financing, Youbi Capital and Others Participate

Web3 metaverse aggregator and social infrastructure Aster Protocol announced the completion of a $1 million seed round of financing, Youbi Capital, Pluto Capital, Lancer Capital, Lucid Blue Ventures, Republic Asia partner Zhen Cao, FBG partner Hitters Xu, OP Crypto COO Lucas He et al. participated in the vote.

Lending agreement Vesta Finance announced the completion of angel round financing, Tetranode, DCFGod, Fiskantes, Not3Lau Capital, Sam Kazemian, 0xmons, Wangarian, PopcornKirby, Nick Chong, Calvin Chu, Jae Chung, Anthony Sassano, Eric Conner, Mariano Conti, Shuyao Kong, Feir Waiting for angel investors to participate in the investment, the specific financing amount has not been disclosed yet.

Vesta Finance stated that 0xMaki (co-founder of SushiSwap) has served as a strategic advisor to the project since its inception and has supported it in several ways. After this round of financing, DCFGod and Not3Lau Capital will join Vesta Finance as strategic advisors.

Vesta Finance is an Ethereum-based over-collateralized lending protocol, with an initial release expected in mid-January.

DeFi insurance protocol Degis will conduct seed round financing on SuperLauncher on January 7

The DeFi insurance protocol Degis will conduct a seed round sale on SuperLauncher at 22:00 on January 7, and plans to raise a total of 100,000 USD in BUSD.

In addition, the SuperLauncher platform will also be responsible for Degis' strategic round of sales, IDO, in the coming weeks.

It is reported that Degis recently released Litepaper. The second phase of the testnet will be released in January 2022, and the mainnet launch and IDO will be launched in February 2022.

SAWA Encryption Fund Syndicate Protocol Announces It Will Launch a Seed Round of Funding

On January 4th, SAWA encryption fund Syndicate Protocol announced that it will launch a seed round of financing. It is reported that Syndicate Protocol was launched by Private Launch Crypto Venture, which aims to provide potential investors with investment opportunities in NFT, DeFi, GameFi, Metaverse and blockchain companies by providing large and small capital investors with a large number of investment opportunities. (asiaone)

Equinox Guild Announces Investing in SIDUS HEROES, a universe chain game project

News Equinox Guild announced that it has invested in the metaverse chain game project SIDUS HEROES.

Earlier news, SIDUS HEROES announced that it has received the support of 50 top VC funds in the field of blockchain games, as well as the support of more than 200 funds and business partners from related fields, with a total financing of 20 million US dollars. Its partners include Animoca Brands, Polygon, OKEx Blockdream Ventures, Arkstream Capital, Spark Digital Capital, AU21 Capital, HashKey, etc.

Good Game Labs Invests in Blockchain Card Game Heroes Chained

Heroes Chained, a fantasy action RPG card game using the "Play and Earn" mechanism, announced that it has received investment from Good Game Labs. It is reported that Good Game Labs is the investment arm of the innovative game center Good Games Guild (GGG).

Wonderland DAO Invests in Decentralized Betting App BetSwap

Avalanche-based algorithmic currency marketplace Wonderland has made a seed investment in Polygon-based decentralized betting app BetSwap. The move marks one of the first instances of a community-governed crypto project investing in a DeFi protocol.

Users who pledge assets on the Wonderland platform will receive relevant tokens after the issuance of BetSwap tokens. BetSwap.gg allows users to become bettors on various markets such as sports. Its BSGG token allows holders to receive discounted platform fees and participate in platform governance.

According to an article published by Wonderland, its DAO allocated a total of more than 2 billion BSGG tokens to hold wMEMO worth $18.337 million. wMEMO is a freely tradable token that represents the amount of TIME (Wonderland’s native token) pledged by users. (CoinDesk)

LD Capital Invests in Avalanche Liquidity Service Agreement Deliq Finance

Deliq Finance, an Avalanche-based liquidity service agreement, announced a partnership with LD Capital and received investment from LD Capital.

Avalanche Asia Star Fund's strategic investment in Ethereum-based decentralized derivatives protocol Kine Protocol will allow Kine Protocol to further expand and provide users with access to derivatives transactions and cross-chain liquidity. (Crypto Daily)

According to previous news, the Avalanche Asia Star Fund was established, and the first phase of 20 million US dollars was used to build the Avalanche ecosystem.

MoneyGram Makes Strategic Minority Investment in Coinme

MoneyGram has announced that it has made a strategic minority investment in cryptocurrency cash trading company Coinme, taking a 4% stake in it. In May, MoneyGram said it would allow customers to buy and sell bitcoin for cash at 12,000 U.S. retail locations through a partnership with Coinme. The companies also plan to take other steps to increase the value of the agreement, according to a release Wednesday. The deal will close Coinme’s Series A funding round and help support its international expansion, among other growth plans.

Binance Labs Announces Strategic Investment in Coin98 to Develop DeFi in BSC Ecosystem

News On January 5th, Binance Labs announced a strategic investment in Coin98. Coin98 will accelerate the development of the platform through this strategic investment, and build a DeFi platform including the NFT market, token issuance platform, and AMM on the Binance Smart Chain. infrastructure, and enable everyone to access DeFi on BSC to contribute to the BSC ecosystem. To support Coin98's long-term vision, Binance Labs will provide the team with the required technology, consulting and incubation services. It is reported that Coin98 is an all-in-one DeFi platform that builds a full set of products, including Coin98 wallet, Coin98 exchange and Space Gate cross-chain bridge for cross-network migration of tokens.

Draper Goren Holm Invests in Tezos Ecological DeFi Project Mavryk Finance

Draper Goren Holm announced his investment in Mavryk Finance, a DeFi ecosystem project based on the Tezos blockchain network.

According to the official website of Mavryk Finance, Mavryk Finance is committed to launching a set of decentralized financial products on the Tezos blockchain. Currently, through decentralized pricing oracles and a Tezos-based decentralized governance system (DAO), it provides users with multiple Asset-backed loans, multi-collateralized soft-linked stablecoins and other services. (Finyear)

According to the official news, Nametag completed the seed round of financing with a valuation of 30 million US dollars, and Continue Capital and others participated in the investment. Funding is used to create a robust, standard Web3 social layer on top of the Internet's traditional Web2 architecture. In the coming months, Nametag will support more chains, release the Nametag API, and release the NT token.