MetaFi: Decentralized Financial Tools for the Metaverse

Original compilation: TechFlow

Original compilation: TechFlow

Note: When Metaverse encounters DeFi, what kind of sparks will it produce? This is a report by Outlier Ventures on the comprehensive analysis and interpretation of the new concept of MetaFi, compiled by TechFlow Friends, a volunteer community of Shenchao TechFlow.

Since 2018, decentralized finance (DeFi) has gained momentum in the cryptocurrency community. While DeFi has garnered a lot of attention in the cryptocurrency space, its adoption rate remains relatively low, with less than 5% of all crypto assets being staked as collateral.

This article proposes that the main future growth of DeFi will not be driven by CeFi, but by what we call"MetaFi"way to release value. MetaFi, the decentralized financial tool of Metaverse.

What exactly is the metaverse? What is the value in it? How will DeFi combine with the continued innovation of cryptocurrencies to allow MetaFi to grow at scale?

secondary title

Metaverse needs Crypto

As mentioned above, the Metaverse is first and foremost an economic system,Meta-economy (Meta-Economy), its status can be higher than any digital economy, virtual world or game, and these should be considered as a single instance in the metaverse, or one of the subuniverses (Verse).

In fact, when the combined GDP of the meta-economy exceeds the GDP of the country for a long enough time, it will also enjoy a higher advantage than the economy based on fiat currency. We believe that at least the Open Metaverse is a version of an open and permissionless metaeconomy, enabled by what we collectively call Crypto. And in the absence of any other meta-economy today, our thesis is:The Metaverse needs Crypto, and Crypto is the Metaverse.

In our definition of the Metaverse, one can understand it through two main concepts:

1. Interface layer.End users can experience the Metaverse through a variety of hardware and software technologies, such as desktop browsers, mobile apps, or extended reality (XR), virtual reality (VR), and augmented reality (AR).

2. Financial computing layer.Where metaverse computing is performed, a decentralized, transparent, and democratic foundation can be established to determine the economic logic based on which end users exchange goods, services, and currencies. Developers can build metaverses on this basis. A good example is Ethereum, the protocol developers use to build smart contracts for decentralized applications, and the ledger that records transactions between end-users of the Metaverse.

In the context of the first point above, early interface layers may take many shapes and forms, and it is important to keep an open mind as we advance technologically and conceptually. So when we refer to the beginnings of metaverse development, we're usually referring to current experiences like games and virtual worlds, whether browser-based 2D or more immersive VR or AR.

The financial computing layer refers to the underlying technology that supports the Metaverse. As we describe in our Open Metaverse OS paper,We believe that the foundation (or core) of the financial computing layer will be based on technologies that can be classified as Web3.

We also believe thatAny digital realm in the Metaverse must be based on Web3 to provide fundamental property rights, interoperability, and permissionless value transfer across domains (or verticals) in the Metaverse.These technologies provide the impetus to develop a rich variety of applications and instances based on Web3.

In this way, the Metaverse provides a parallel economic system of decentralized ledgers that is global, transparent, and crypto-native. It provides the basis for a new type of digital-first economy, the seeds of which we have already observed through NFTs (Non Fungible Tokens) and game economies (such as Axie Infinity’s Play-to-Earn).

Due to its decentralized and permissionless nature, it innovates at an unrivaled rate of innovation that traditional systems struggle to keep up with. Therefore, especially in the context of DeFi,It is possible that the Metaverse thrives outside the purview of national regulators, or at least before national regulators do.

In addition, as we have observed in the past 12 months of 2021, DeFi has begun to gradually come under criticism and scrutiny from regulators in many jurisdictions. While the degree of regulation may have some positive market effects, poorly implemented regulation tends to stall innovation in favor of incumbent financial institutions. As far as DeFi is concerned, there are several parallels between its products and traditional financial assets.

Additionally, we argue that the Metaverse represents an informal economy whose products are often digital market commodities that may or may not be present in traditional markets. Just as one cannot regulate every aspect of global economic activity, the same will exist in the Metaverse. Given the exponential economic growth likely to occur in VR, AR, and XR environments, the scope of potential regulation is even more challenging, let alone enforced in the metaverse over time.

We firmly believe that the DeFi component that fuels the growth of the Metaverse will enable unprecedented financial inclusion on a global scale.secondary title

The state of the digital economy

Today, there are billions of dollars of value trapped in proprietary online platforms such as social media (Facebook, Instagram or TikTok) or gaming (Fortnite and Roblox).

What we call Web2 aggressively builds a "moat" as planned, capturing these funds and users for as long as possible in order to extract as much "lifetime value" as possible for the benefit of shareholders.

usually,Web2 companies operate on the principle of shareholder supremacy, even or especially at the expense of users.In social media or free-to-play games, this value is primarily monetized through advertising, and the profits are generally not shared directly with the users themselves. Even Roblox, a company whose premise is that "creators will be able to monetize UGC (user-generated content)" has an estimated 25% of their user acquisition, and the same goes for the music streaming model and programming on YouTube.

The total value of the global digital economy is now estimated at $11.5 trillion, equivalent to 15.5% of global GDP. It has grown at 2.5 times global GDP and almost doubled in size (since 2000) over the past 15 years, with more and more of the population relying on the internet for their livelihoods.

If we focus on a subset of the digital economy - the digital creator economy, it is currently only a small part of the mainstream digital economy, but its core areas are growing. It includes publishing, gaming (skin creation), digital art, streaming, music, film, and more.

On the supply side, there are currently as many as 50 million content creators in the space, mostly made up of amateurs (46.7 million) and about 2 million professionals. In the digital creator economy, professionals can easily make $100,000 a month. However, most earn much less than that, income is still fluid, and payment for working through the system can take months to arrive.We believe that most of today's digital creator economy would not be considered part of the Metaverse, as value cannot be freely traded across platforms, and much of it is locked in the value of platform equity alone.

We further disassemble the limitations of the Web2 digital platform:

Limited inclusion:If we take the digital creator economy as an example, most creators in the traditional sense are not included in the economy, because the value they create is ignored, it is not within the control of the Web2 platform, and they gain from it income is not fixed. In short, unlike those who work in centralized companies and are paid in fiat currency, the existing financial system cannot assess the risks associated with lending to digital economy wealth gainers.

Dynamic terms and conditions:Participants in the traditional digital creator economy cannot trust highly centralized services to be credibly neutral, which poses a demonetization and de-platforming risk for both types of content creators.For example, when Only Fans abruptly bans creators of adult content, and platforms like Facebook and Twitter also regularly take down developers and their APIs.In practice, the rules of participation in these platforms are not clear, cannot be applied consistently, are not auditable, and may be changed at any time (unlike the code of a smart contract).

Isolated design:As mentioned earlier,Platforms make it difficult, if not impossible, for people to move value off the platform, directly or through cash, and exit their closed digital economy.secondary title

Web 3, NFTs and the Metaverse

In contrast, in the Web3 world of cryptocurrencies, DeFi, and NFTs, the entire paradigm revolves around users and their sovereignty:Their identities, data and wealth.

In Web3, evenData itself can also be a form of digital wealth and income. That is, while there are still platforms to help with the creation, discovery, or curation process, users have full control over their output and can freely transfer value between platforms, reselling, borrowing, and lending in a completely permissionless manner.property"property"。

Not surprisingly, we have seen from the early success of Web3 that when the moat is removed and transferability is possible, people will spend more time and money on their preferred platform, such as the blockchain game Axie Infinity. We have addressed this point in previous papers. In the long run,The Metaverse and its platforms (including most of Web2) will adopt the technologies and principles of Web3, not necessarily because it's the right thing to do philosophically, but because it's a good deal.

secondary title

Definition of MetaFi

For us, MetaFi is a catch-all term,Refers to protocols, products and/or services that enable complex financial interactions between non-fungible and fungible tokens (and their derivatives). For example, through MetaFi, individuals can now use fragmented portions of NFTs as collateral on DeFi lending platforms.

In order to understand MetaFi, we must first emphasize two core principles that make DeFi possible:1) unstoppability, 2) composability; these two principles serve as a kind of"Currency Lego”, which could add up to form a highly innovative parallel financial system.

Developers around the world can openly participate and compete to deliver the highest yield, eliminating inefficiencies in a decisive manner. Just as importantly, regulators can only limit how the fiat-based systems they oversee can interact with DeFi, but not necessarily what happens in DeFi itself (as long as the projects and their teams themselves are sufficiently decentralized).

MetaFi brings these DeFi principles to the broader Metaverse through a mix of non-fungible and fungible tokens, combined with novel forms of community governance such as Decentralized Autonomous Organizations (DAOs). The combination of these different cryptocurrency primitives enables a full-fledged parallel economy, bringing hundreds of millions or even billions of users to the cryptocurrency ecosystem within the next decade. We believe 4 key trends in MetaFi will accelerate this process:

1. Development of financial instruments:In the past, the DeFi storage stack has been only mastered by a small part of the cryptocurrency developer community due to its technical complexity. However, with NFT platforms, creators and communities are able to more easily set the economic terms of creative exchange with users, from perpetual royalties to issuing their own community tokens. Fans and communities can also directly share in the financial success of their favorite products and cultural projects.

2. Financialize everything:Many people are dismissive of the speculative nature of cryptocurrencies, unaware that this is a feature, not a bug. Through MetaFi technology, the value of everything and its flow can be captured through digital assets, allowing an open free market to form long-tail values, and the discovery of real-time prices can unlock potential values that have not yet been realized on the Internet.

3. Improvement of DAO service stack:A mature DAO stack allows collective governance of purely on-chain digital and financial services without the services of corporations and centralized intermediaries such as banks. The main feature of DAO members is the ability to join and exit smoothly at will according to clear terms.

4. Interaction of risks:History has shown that incumbent financial institutions are often unable to assess risks in emerging markets; whether it is basic banking services or insurance. This has led to the mutualization of risks in communities, from farming communities to the shipping industry. From farming communities to the shipping industry, mutual ventures have traditionally been conducted through cooperatives. DeFi has brought community-based insurance provisioning tools to users, especially when combined with DAO service stacks.

5. Gamification of finance:Gen Zers are more interested in being financial intellectuals than previous generations. Therefore, many new banks provide new and interesting ways to help individuals arrange financial management, and provide educational platforms for people to learn financial courses more conveniently. This makes young people more willing and more likely to have access to financial products than their parents and grandparents.In addition to this, we are seeing an increasingly blurred line between meme and financial instruments, such as the cryptocurrency Dogecoin or the various "meme stock" offerings via Robinhood."secondary title

An in-depth look at NFTs as collateral

To truly understand whether digital representations can be used as actual financial assets for borrowing or lending, it is important to understand the security that NFTs serve as a form of collateral in DeFi. As we highlighted at the end of 2020, NFTs are generally less liquid than fungible tokens and can be increasingly used in DeFi protocols.

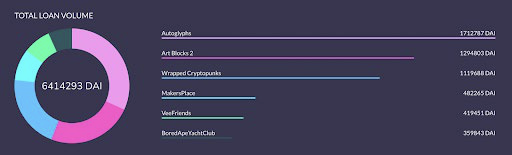

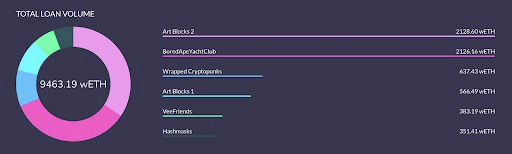

image description

image description

Total DAI Loans on NFTfi on December 13, 2021

MetaFi Framework

MetaFi Framework

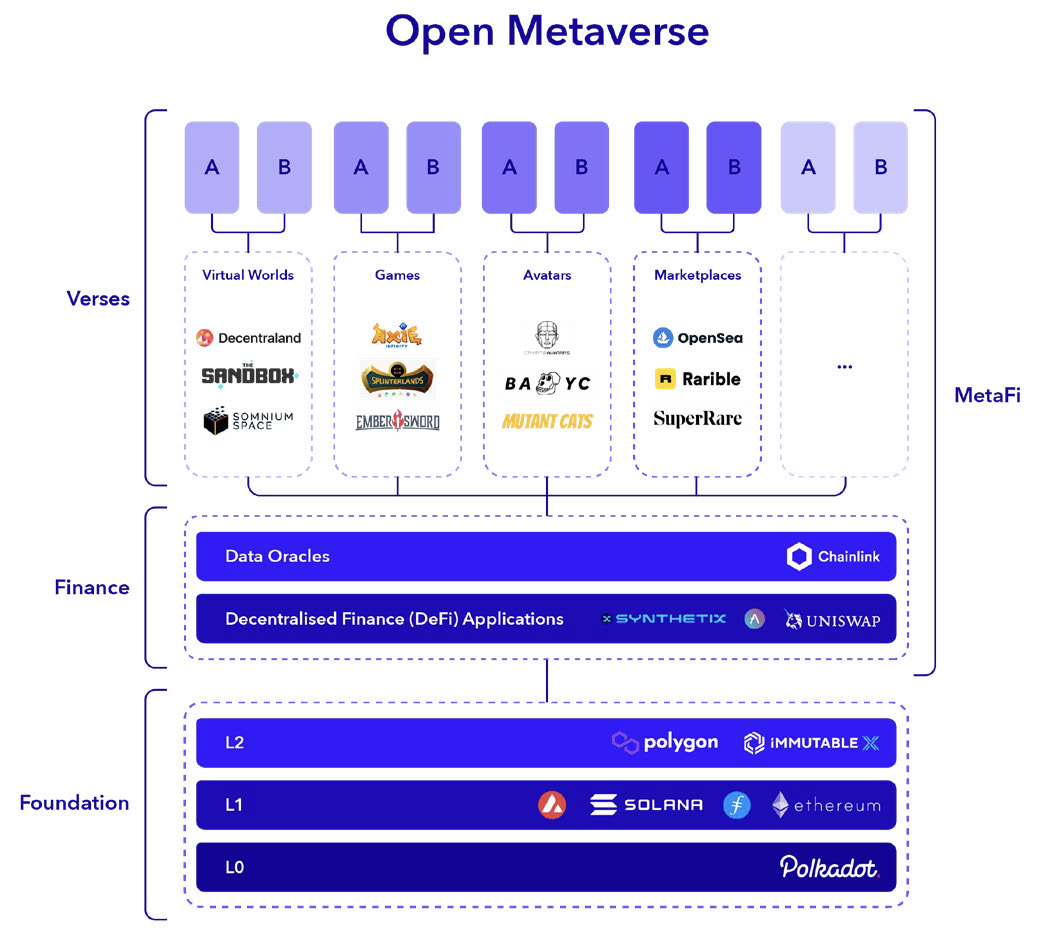

In order to understand MetaFi in the Metaverse, we first visualize the main components of the Metaverse (visualized with a diagram). We use the previous Open Metaverse OS framework, which looks at the layers applied in the Web 3 stack of the Metaverse.

Metaverse (pictured below). This figure mainly consists of three parts.1) Layer 0, 1, and 2 as the foundation; 2) DeFi; and 3) Universe (application) (Verse).

1) Basics

This segment consists of core frameworks (or protocols) labeled Layer 0, Layer 1, and Layer 2, such as Polkadot, Ethereum, and Polygon.

These core frameworks allow applications to be built on top of them due to shared application logic and security; they also have a unified communication layer (permissioned via execution and consensus respectively, but also bridges and similar cross-chain technologies), So horizontal value transfer can be achieved. The horizontal axis labeled Open Metaverse and its associated components should be included in apps designed to provide an experience inside the Metaverse. If an application is not merged with this core layer, the application will be siled, the economic and creative value in the application will stagnate and then disappear, and finally the application will not be financially inclusive.

We can see something similar in the legacy world, where services that are not incorporated into the wider ecosystem fade away because they do not remain competitive to the end user.

2) DeFi

This part consists of small financial applications that can be used in the above-mentioned core protocol. These applications can be called "money Lego", which are considered unstoppable applications and enable complex financial dynamics through smart contracts.

3) universe

This section consists of a group of realms, or parallel universes, that make up the Metaverse as a whole. Verticals such as virtual worlds must be connected to the base layer on the basis of compatibility and free value transfer.

secondary title

The basis for supporting horizontal growth

As we described above, the fundamental building blocks include core frameworks (or protocols), labeled Layer 0, Layer 1, and Layer 2 (such as Polkadot, Ethereum, and Polygon). Here, protocols often facilitate modularity, meaning that each component (L0, L1, and L2) serves the other in some way.

A straightforward and well-known example is Ethereum, a Layer 1 framework that provides smart contract functionality. This means that the framework provides custom logic that can be used to create a range of different computer programs and run them in a decentralized manner. Similar to Bitcoin's approach to decentralization, but in addition to the decentralized aspect, Ethereum also provides what we call smart money or money programmable through smart contracts.

For simple conceptualization, we only focus on layer 1. Since Ethereum provides a unified layer to develop various applications through smart contracts and smart currencies, it has proven to be a framework that can provide revolutionary services to the financial world (as DeFi has also proved).

This concept of unity means that any smart contract on the Ethereum network, as long as it is programmed, can interact with each other, which has played an incredible catalytic role in the interoperability between services and games based on Ethereum.

secondary title

MetaFi Activity Collection

virtual reality:

virtual reality:A virtual world is a digital space for social, business or gaming purposes that may or may not mimic the real world and its physical phenomena. When imitated, they often include rare elements represented by NFTs, which can be freely purchased, traded and constructed. The most notable examples include The Sandbox or Decentraland.

As a component of NFT, virtual land is closely related to the virtual world's in-game currency and/or governance tokens, which means that users can use tokens to purchase virtual world assets and vote on improvement suggestions.

game:

game:We can define games as digital activities primarily used for entertainment. Games in the Metaverse are unique in that they often include an earn-as-you-play element, whereby users or gamers are paid in tokens for their contributions to the game.This creates an entire in-game economy where capital is connected to labor to generate value.

avatar:

avatar:Avatars are specially designed for users to create unique digital identities, including interoperable 3D avatars in various metaverse spaces, and are often mass-produced as generative PFP (Profile Picture Projects).

banana shop"banana shop"It can be used for upgrading, changing names, buying equipment, etc., and can also be used for breeding (breeding a new kong costs 600 banana tokens).

equipment:Gear are digital items that can be displayed in the metaverse, they are currently the most valuable in the game, but will expand to other metaverse categories in the near future. More and more designer brands are using NFT to tap into the global market of 2.7 billion gamers. Players can now own unique skins designed by top fashion brands and showcase their taste to millions of people online. For example, Balenciaga cooperated with Fortnite to design 4 sets of virtual clothing, and Burberry cooperated with Mythical Games to launch fashion works represented by NFTs.

market:Marketplaces are digital places that match supply and demand, allowing us to discover more NFTs and facilitating better price discovery. Marketplaces like OpenSea, Superrare, and Rarible allow users to freely trade and issue NFTs directly. In this way, these NFTs can be used as financial assets. The subdivision function allows high-value NFTs to obtain liquidity by dividing them into fungible tokens and then owning them in proportion. The combination of the segmentation function and the binding function is particularly popular, which can effectively form an index fund solution for a specific category of NFT, for example, the platform NFTX and Beeple's B20 index. The boom in NFTs has led to a surge in market transactions. OpenSea's 30-day trading volume in January 2021 was only $1 million, and in November 2021 it exceeded $2 million.

NFTs that generate revenue:NFTs can generate revenue in two ways: indirectly or directly. Indirect yield generation involves using NFTs as collateral for loans and then reinvesting the loaned funds at a higher interest rate, NFTfi allows the use of NFTs as collateral for loans.

Furthermore, in the past few months,An ongoing trend is for NFT-first projects to add a native token, adding another yield-generating element to their NFTs.Ether Cards is launching its Dust tokens, distributed to each existing Ether Card based on the rarity of the Ether Card. Dust tokens can be used to enter sweepstakes to win blue chip NFTs. This part overlaps with avatars, i.e. CyberKongz and SupDucks can also be considered revenue-generating NFTs.

Access Tokens:It can be both fungible and non-fungible tokens, allowing holders to obtain various forms of value, through proximity to a certain community, specific people or the form of tokens minted in the future. A good example is The Bored Ape Yacht Club, a collective of 10,000 ape NFTs, owning which not only gives holders access to the Discord community, but allows them to speculate on the future value of The Bored Ape Yacht Club buy and sell.

secondary title

current limitations

There is still a lot of work to be done before MetaFi starts to realize its true potential. More specifically, the current state of MetaFi still faces several limitations that need to be overcome in order to bring about widespread acceptance:

1. NFT evaluation.In order to be able to buy, sell, or borrow against NFTs, holders need to know the value of their NFTs. NFTfi solves this problem. Users can list their NFTs as collateral on the NFTfi website, and lenders will provide loans to borrowers based on the value of these NFTs in their eyes. Appraisals are essentially done by the lender, not a disinterested third party.

2. Legal and management issues related to fragmentation.If you divide an NFT into 100 shares and distribute them to different people, especially when the NFT has rights such as voting rights or income rights, who can do what, when can do it, and how to manage these rights? not very clear.

3. Standards across blockchains.The current metaverse is no longer built on Ethereum only, it is also built on different layer 1 or layer 0 blockchains, which are still not 100% interoperable. This means that the immutability of value is inevitable in the short term.

In order to fully unlock the value of DeFi to the metaverse, NFT needs to be easily inserted into the DeFi protocol. For example, NFT needs to be able to be traded, borrowed, lent, and reversed. Although today’s DeFi is currently only applicable to homogeneous tokens , but we expect new ways to connect NFT and DeFi.

1. Fragmentation of NFT.This means dividing a non-fungible token into many fungible tokens. One can think of the shard part as a share of NFT ownership. For example, meme creators can use asset creation platforms to create memes, fragment them into highly homogeneous tokens, and trade them using DeFi DEXs such as Unsiwap. Notable NFT fragmentation projects include Fractional and DAOfi, among others.

2. NFTization of DeFi.This means upgrading DeFi protocols to allow them to accept NFTs as a form of collateral. For example, creators can create assets in virtual worlds and use them as collateral to borrow on platforms like Centrifuge or Pragmafy.

3. NFT as a derivative.secondary title

Looking to MetaFi 2022

In conclusion, MetaFi, or Metaverse Finance, is an all-encompassing term referring to protocols, products and/or services that enable complex financial interactions between non-fungible tokens and fungible tokens (and their derivatives) . It includes the basic building blocks of the blockchain space (e.g. as the basis for layers 0, 1, and 2), DeFi stacks, and various universes.

MetaFi inherits two core features of the DeFi protocol:Unstoppable and composable. Its development is driven by key trends such as the mutualization of risk, the gamification of finance, the development of financial instruments, and the improvement of the DAO service stack.

Hopefully we have now analyzed that MetaFi in its current form is still nascent. While some of its capabilities are mind-boggling, we are only now beginning to understand what it might do in the medium to long term. However, based on what we are seeing in the market and after examining the catalysts in detail, we expect to see the following developments in the short to medium term:

1. The combination of different MetaFi categories and the creation of entirely new categories, such as users creating games in virtual worlds, having their own economies, or generating non-homogeneous assets such as equipment or avatars.

2. To improve the user experience/user interface of the financial MetaFi project, VR elements may be added. For MetaFi to be truly successful, it needs to be more widely understood and better experienced by ordinary people.

3. Further innovation of DeFi 2.0 will be transferred to MetaFi, Similar to the kind of innovation we saw in Olympus DAO, Alchemix, we need better solutions to solve the fragmentation problem of NFTs, especially related to legal and governance issues, and the NFTization of DeFi.

Original link