This article takes stock of the four most disappointing events in the encryption field in 2021

Written by: ANIRUDH TIWARI

first level title

SEC Rejects VanEck's Spot Bitcoin ETF

Bitcoin rallied to an all-time high of $68,789.63 on Nov. 10 after the U.S. Securities and Exchange Commission (SEC) approved ProShares’ bitcoin futures exchange-traded fund (ETF) in early October, according to data from Cointelegraph Markets Pro.In terms of organic volume, the ProShares Bitcoin Strategy ETF (trading symbol BITO) had the largest first-day volume of any ETF ever, showing just how much anticipation the BTC ETF launch is.

Soon after, on Nov. 12, the financial regulator rejected Van Eck’s proposal for a bitcoin spot ETF, causing bitcoin’s price to begin a downward spiral.

VanEck CEO Jan van Eck was not happy about the rejection.

We are disappointed by the latest news that the US SEC refused to approve our physical Bitcoin ETF today. We believe investors should be able to gain exposure to BTC through regulated funds and that a non-futures ETF structure is a better approach.

— Jan van Eck (@JanvanEck3) November 12, 2021

Since Cameron Winklevoss and Tyler Winklevoss tried to launch the "Winklevoss Bitcoin Trust" in July 2013, the work to obtain the approval of the spot ETF by the US SEC has continued for more than eight years. Even though all this time has passed and the narrative on cryptocurrencies has changed, Gary Gensler’s US SEC has yet to approve a bitcoin spot ETF.

first level title

Ethereum network: Gas fees out of control

The Ethereum network underwent a milestone upgrade in 2021: its London hard fork, which put Ethereum on a deflationary trajectory through Ethereum Improvement Proposal (EIP) 1559. As of this writing, 1.244 million ETH has been burned, worth over $4.96 billion.

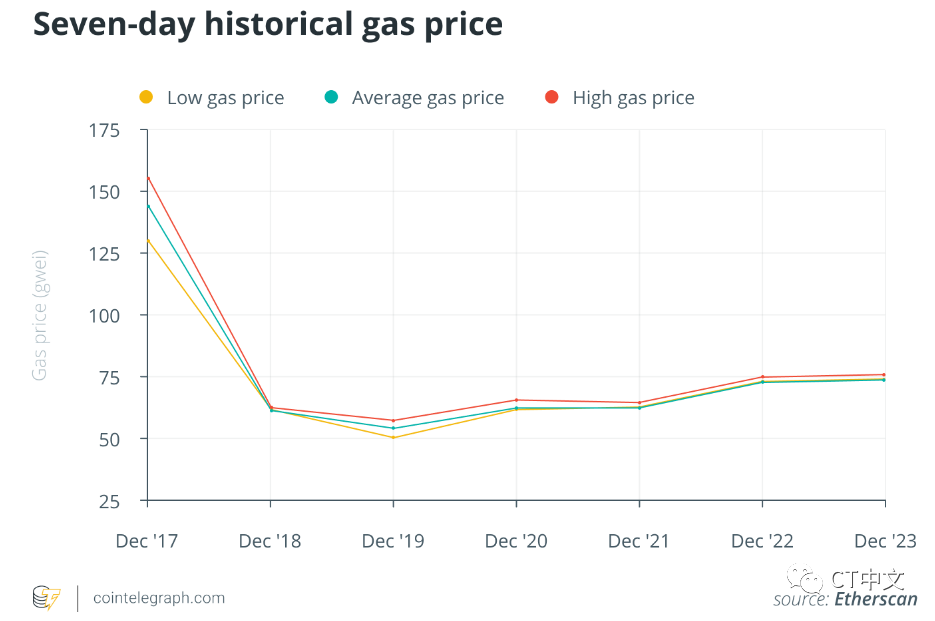

With the introduction of the burn mechanism, Ethereum’s gas fees also emerged given the increased use of decentralized finance (DeFi) protocols on the blockchain and the proliferation of Ethereum-based non-fungible tokens (NFTs) in the crypto world surged sharply. Gas fees continue to exceed 100 gwei, even into 2022. "Gwei" is the smallest unit of Ethereum, equal to 0.000000001 ETH.

On February 23, the network’s gas fees hit a yearly high of 373.8 gwei. Although gas fees appeared to be under control between May and August, there have since been several spikes that have been very unfavorable to retail investors in the DeFi market. This has also led to several DeFi protocols and investors opting for alternative blockchain networks such as BSC, Solana, Polygon, etc.

To address this ongoing problem, ethereum co-founder Vitalik Buterin proposed upgrading EIP 4448 and EIP 4490, which would serve as a temporary fix through a method called data sharding, which would cut down on zk-Rollup on the blockchain. cost.

first level title

Solana Network: Outages and DDoS Attacks

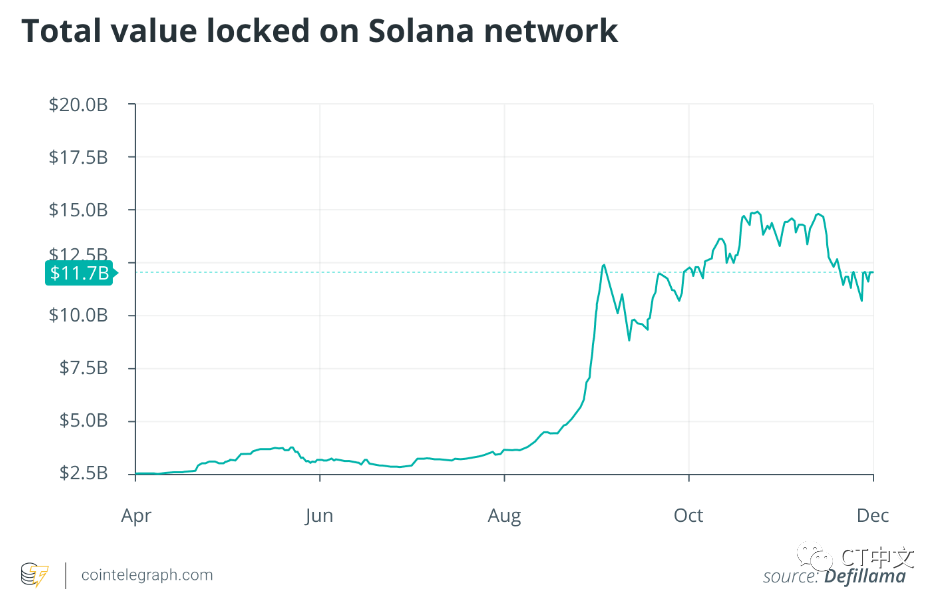

Launched in April 2019, Solana has rapidly grown into one of the leading blockchain networks with a total value locked (TVL) of nearly $12 billion. The network’s native token, SOL, has seen a nearly 130-fold increase in price, with a current price of around $180. The token hit an all-time high of $260.06 on Nov. 7.

However, at 13:46 PM UTC on December 4, the Solana network experienced an outage that lasted nearly six hours. The network’s mainnet cluster stopped producing blocks at slot 53,180,900, which prevented new transactions from being confirmed on the blockchain. The outage drew criticism from many traders and developers who took to Twitter to criticize the network.

DeFi Pulse co-founder Scott Lewis was among the critics, citing Serum’s order data as evidence of a lack of “real customer orders.”

This isn't the first time Solana has experienced an outage this year. Back in September, the network suffered a 17-hour outage between Sept. 14 and 15 due to a distributed denial-of-service (DDoS) attack on Grape Protocol’s first decentralized exchange offering on Sept. 14 . A DDoS attack is when a large number of coordinated devices or botnets clog a network with fake traffic in an attempt to take it offline.

Shortly after the second outage on December 4, the network suffered another DDoS attack on December 9, temporarily clogging the network, though it remained online throughout the attack.

Even though the attack has been blamed on Solana's basic design and use of a proof-of-history consensus mechanism, developers still seem confident in the network's potential. Solana co-founder Raj Gokal elaborated on the DDoS attack on Twitter:

If you're not helping the Solana community focus on these indicators, if you're lying or perpetuating a lie, if you're fighting over tiaras and bouquets at the haters' ball...

Save your tweets until you're ready to do the hard work of scaling cryptocurrencies.

Until then, go away.

— Raj Gokalᵍᵐ (@rajgokal) December 12, 2021

first level title

Binance Smart Chain Network: Security Breach

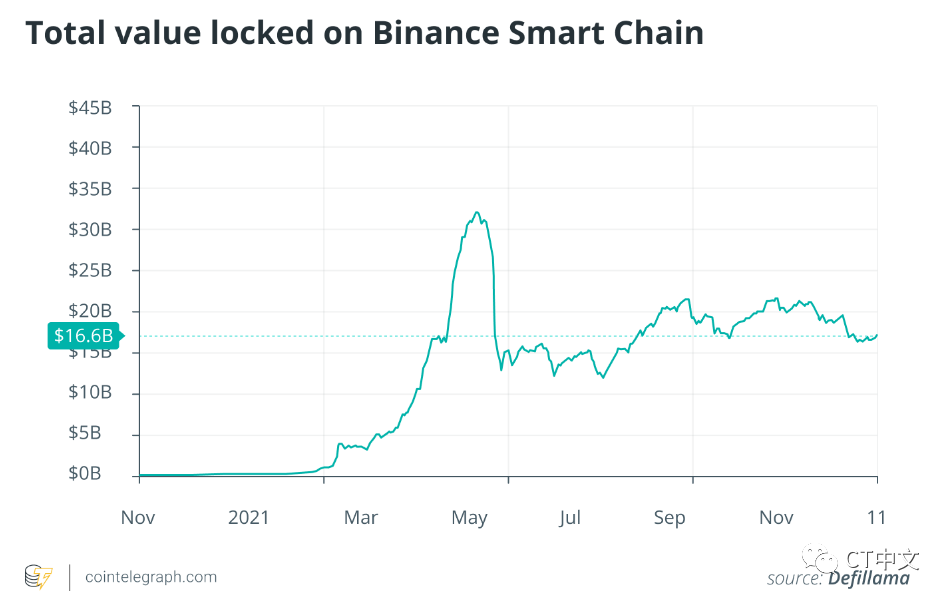

Binance Smart Chain (BSC) is a parallel chain of Binance Chain, both blockchains designed and maintained by cryptocurrency exchange Binance. The BSC was first announced in April 2020 and launched shortly thereafter in August 2020.

text

text

PancakeBunny: Flash Loan Bug Causes $200 Million Loss

Spartan Protocol: Vulnerabilities cost $30 million

Uranium Finance: $50 million stolen

Meerkat Finance: Rug pull results in $31 million loss

pNetwork: Hacked, Lost $12.7 Million in BTC

Bogged Finance: Flash Loan Bug Causes $3 Million Loss

BurgerSwap: $7.2 million lost due to security breach

Belt Finance: $6.3 million in losses

Considering that the above list is not exhaustive, it is safe to say that in the 18 months that the network has been in operation, there have been hacks and security breaches that have resulted in hundreds of millions of dollars in losses. In addition to these security breaches, the PancakeSwap decentralized exchange and Cream Finance were also subject to several phishing attacks.

first level title

there's a lot to look forward to

Although these events and issues have led to disappointment in the crypto community in 2021, it is clear that digital currency usage is growing higher than ever.

With innovations like NFTs, GameFi, and the Metaverse, the cryptocurrency space is mining the next big thing in art, gaming, music, and finance with innovations that will change the status quo of the industry.