Q3 investment up to 49, Coinbase Ventures said these areas should not be missed

Odaily Translator |Announced by the Coinbase Ventures team on the official Coinbase blog。

2021 Third Quarter Summary Report

Cumulatively, 90% of Coinbase Ventures' invested capital has been invested YTD 2021, reflecting the accelerated pace of Coinbase Ventures in its fourth year of operation. 50% of the unique new "Logos" in its portfolio will also appear in 2021.

first level title

Motivation and Philosophy

Ultimately, Coinbase Ventures sees cryptocurrencies as a rising tide, with ecosystem growth pushing all players, including Coinbase, to "lift all boats." Traditional strategic interests such as business partnerships and potential M&A are great, but Coinbase Ventures sees them as icing on the cake.

first level title

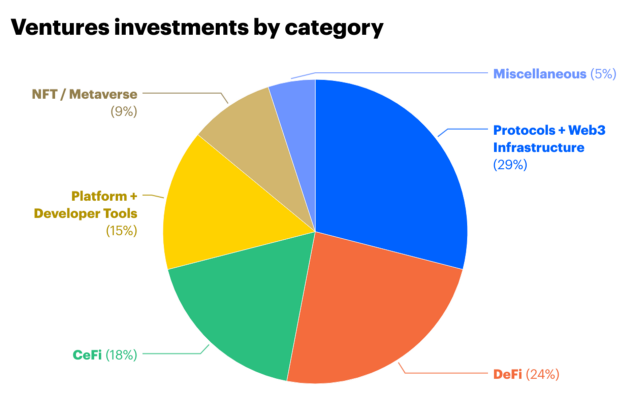

investment category

Specifically, among the six major investment categories of Coinbase Ventures, protocol + Web3 infrastructure (29%) accounted for the largest proportion, and other categories were DeFi (24%), CeFi (18%), platform + development tools (15%), NFT+Metaverse (9%) and others (5%).

first level title

In its most active quarter to date, Coinbase Ventures saw significant developments in US CeFi, Layer 1/Layer 2 (L1/L2), cross-chain protocols, and Web3 tools. Here are some of the main themes observed by Coinbase Ventures:

secondary title

Regulators and centralized players dig deep into the cryptocurrency space

Regulators became more visible in the third quarter, as the U.S. Securities and Exchange Commission (SEC) and the Treasury Department, as well as the international Financial Action Task Force (FATF), stepped up their engagement across the crypto ecosystem. This creates some form of regulatory risk for early protocols and teams. On the other hand, BTC, the largest crypto asset by market capitalization, was positively supported and a BTC futures exchange-traded fund (ETF) received SEC approval. Coinbase Ventures believes this will allow potential capital to enter the crypto market, resulting in significant trading volume, inflows and interest.

At the same time, banks, fintech firms, and broker-dealers began to further integrate cryptocurrencies into their products with the support of Coinbase Prime, Coinbase Cloud, and other third-party platforms. All in all, the crypto industry has made huge strides in maturity and institutional adoption over the past quarter.

secondary title

The multi-chain ecosystem is developing rapidly

After years of developing solutions aimed at alleviating Ethereum’s bottlenecks, scaling has finally come to fruition with the rise of a series of layer 1 and layer 2 ecosystems. The current main momentum lies in solutions that leverage EVM (Ethereum Virtual Machine) compatibility, allowing users and developers to migrate to new environments with relatively low switching costs. Users can use their existing wallets to access EVM compatible L1 such as Avalanche; or sidechains/L2 such as Polygon, Arbitrum, Optimism. Solidity smart contracts can also typically be copy-pasted to any EVM-compatible L1/L2, which facilitates the deployment of popular DeFi applications across multiple chains.

While EVM-compliant applications written in Solidity had the most traction at L1 and L2 in Q3, other ecosystems are bringing more expressive programmability to desktop programs. New Primitives focusing on more familiar programming languages like Rust (Solana, Polkadot), Golang (Cosmos) and Move (Facebook Diem, Flow) may bring a new wave of Web 2.0 to the industry Developer.

secondary title

Better Web3 UX coming soon

In Q3, Coinbase Ventures saw further development of Web3 tools that will simplify the Web3 interaction experience. XMTP is leading the standard for messaging across Web3 addresses. Spruce is standardizing on "OAuth" (Open Authorization), which will allow users to securely share digital credentials, private files and sensitive media content with Web 3 applications. Snapshot makes it easy to access governance forums and decisions across DApps.FortaAt the same time, a lot of work is being done to create additional security for Web3 applications. OpenZeppelin's decentralized project

Progress is being made on real-time security monitoring of smart contracts, with the goal of providing more transparency around smart contract code execution, error detection, and ultimately real-time protection against hacking. Likewise, Certik is offering “quick and easy” automated auditing tools to help DApps launch faster on the market.Syndicate(among other projects) aiming to become a "Crypto AngelList" by creating a decentralized investment protocol and social network.

secondary title

NFT 2.0 and Crypto Gaming Are Booming

Q3 also saw a lot of development focused on tools for NFT creators that will ultimately expand the range of NFT use cases and audiences, while creating new social features.