Data Analysis Why Curve is far ahead in the DEX track

Written by Footprint Analyst Zoni (zoni@footprint.network)

Date: October 2021

Written by Footprint Analyst Zoni (zoni@footprint.network)

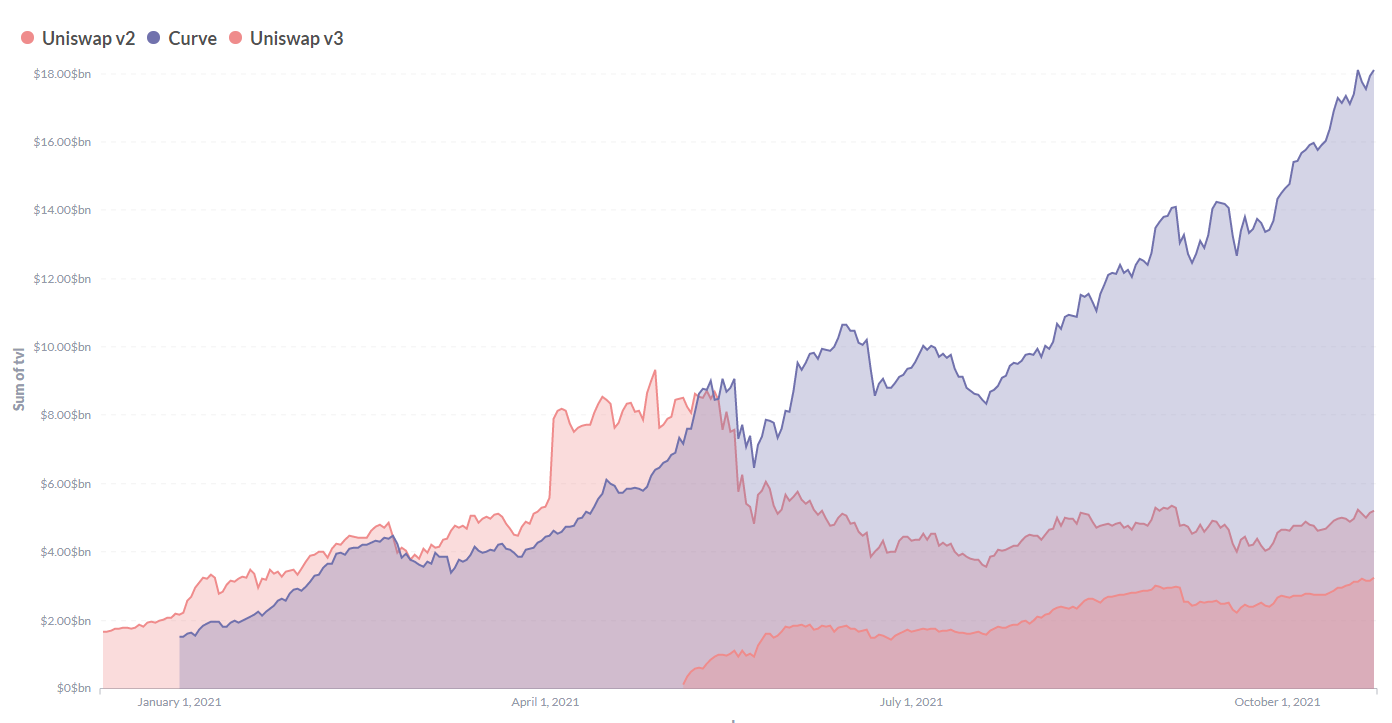

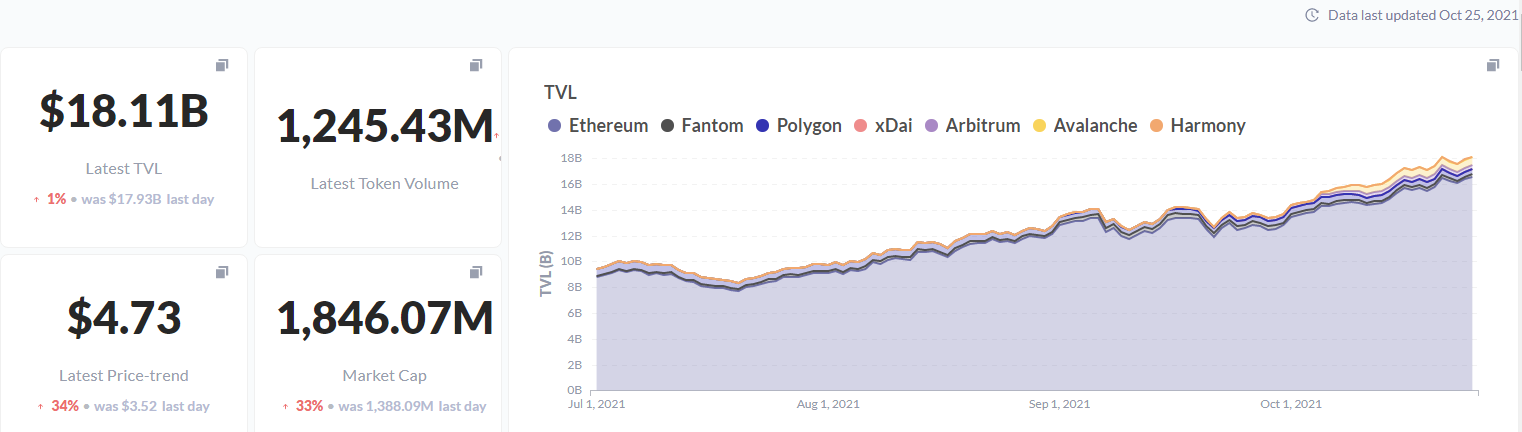

Before mid-May this year, Curve Finance (hereinafter referred to as Curve) only supported the Ethereum public chain network. At that time, the TVL had reached 9 billion US dollars, surpassing Uniswap, the leading DEX. Although Uniswap will also be upgraded to V3 at that time, the total TVL will gradually be distanced by Curve. On the one hand, it is because with the rise of layer2 solutions and other new chains, Curve has gradually completed the deployment of applications on multiple public chains; on the other hand, Ethereum still dominates about 88% of Curve's TVL.

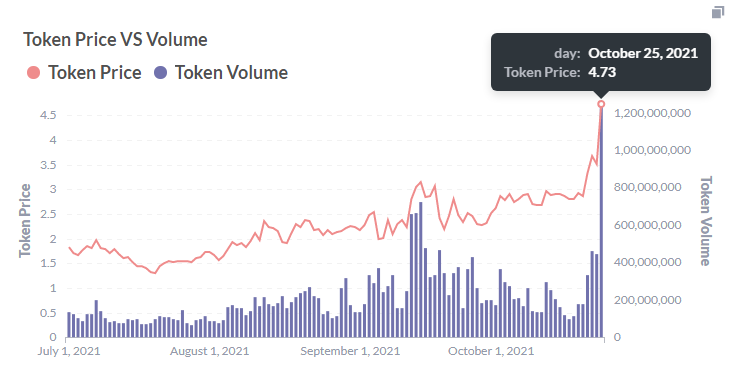

On October 25, 2021, Curve's TVL surpassed a new record of $18 billion.

image description

Source: Footprint Analytics - TVL of Curve & Uniswap

About Curve Finance

Curve was launched in January 2020, and its founder is Michael Egorov, a scientist from Russia. As early as 2016, Egorov founded NuCypher (a cryptocurrency enterprise that builds privacy-preserving infrastructure and protocols) and served as the project's CTO; Egorov is also the founder of LoanCoin, a decentralized banking and lending network. Thanks to the technical management of several encryption technology projects, Egorov's professionalism makes Curve very technical.

Curve data performance

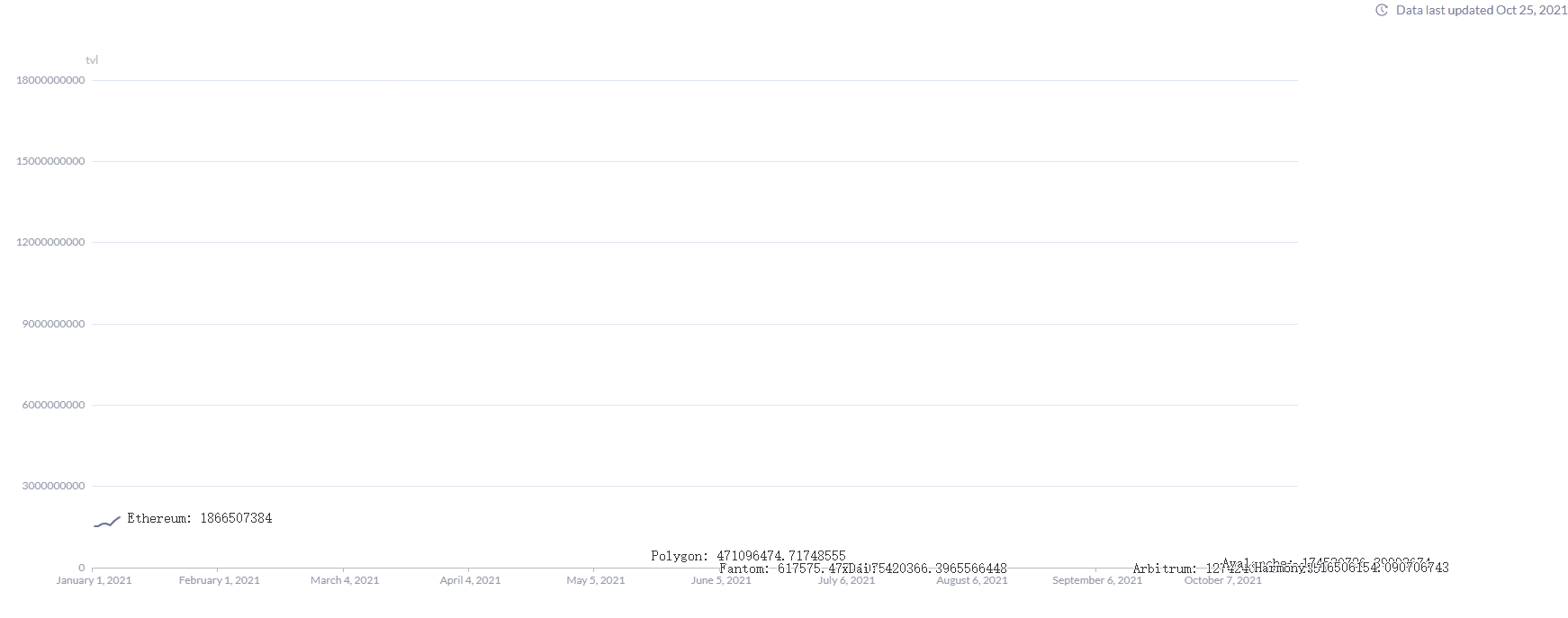

Source: Footprint Analytics - Curve TVL Cross-chain

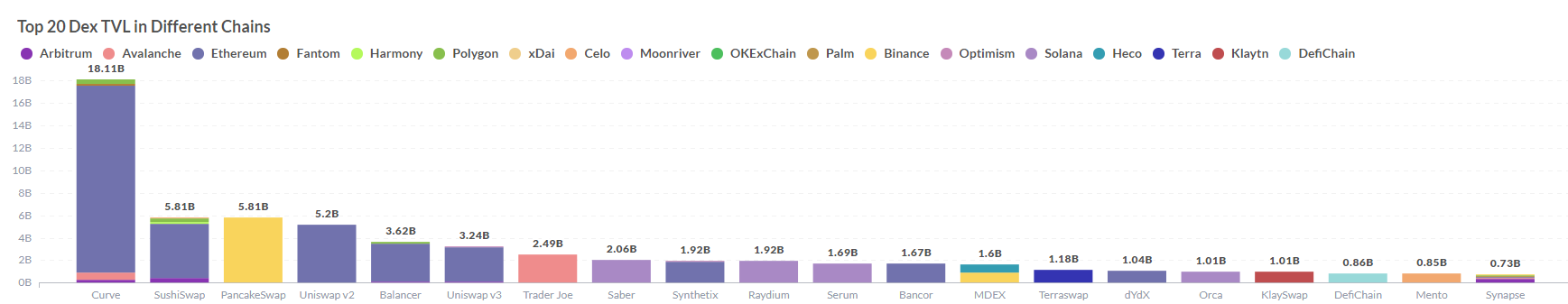

image description"Source: Footprint Analytics - Top 20 Dexs Dashboard

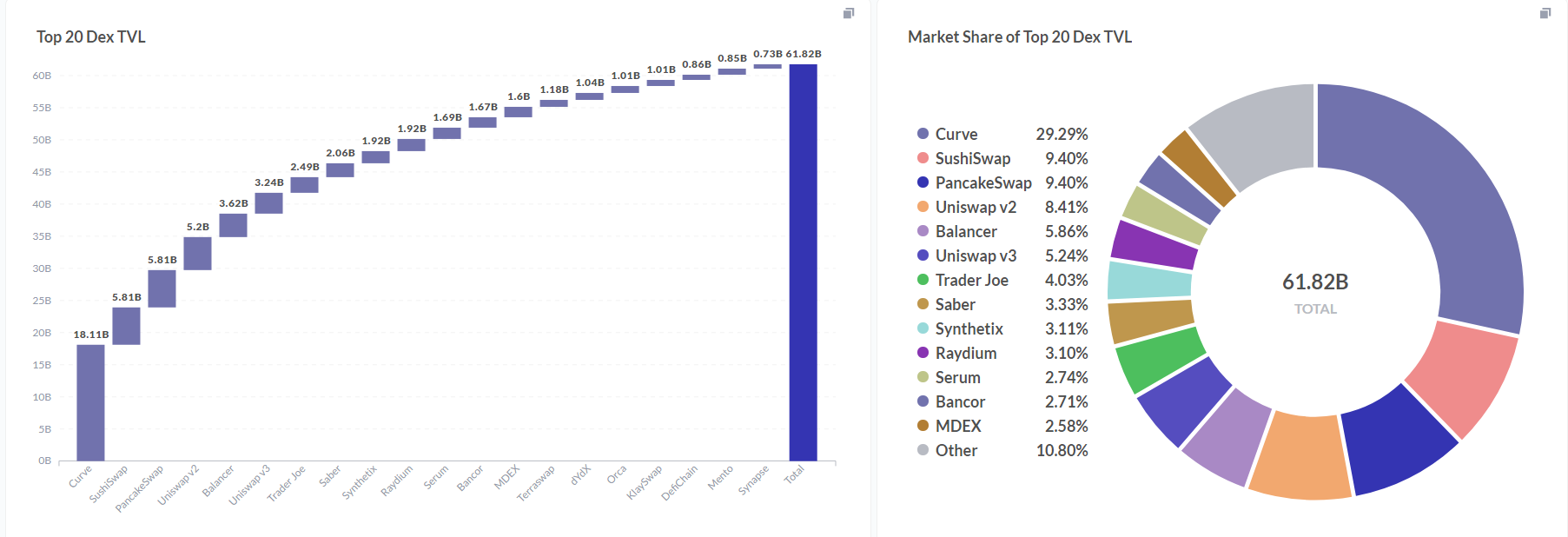

The top 20Dexes Dashboard" data shows that Curve is close to pulling away from the second-ranked Sushiswap with US$12 billion, accounting for nearly one-third of the total TVL of the DEX track.

image description

Source: Footprint Analytics - Curve Dashboard

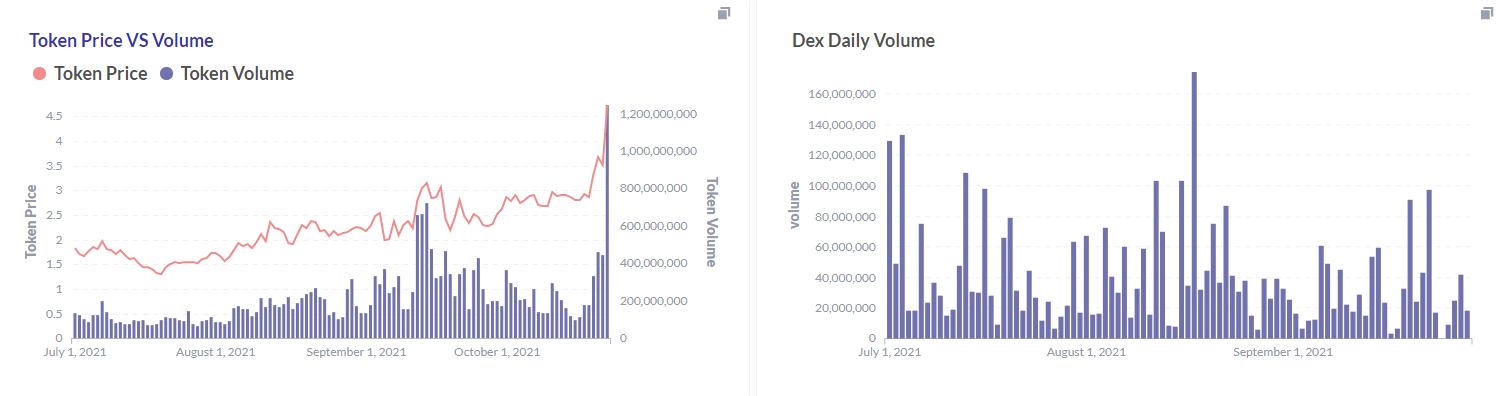

As the native token of the Curve platform, the price of CRV is stable at around $2. With the development of the multi-chain ecology, CRV shows an initial upward trend, hitting new highs repeatedly, and reaching a record high on October 25, 2021.

Curve Project Highlights

1. Low slippage and competitive transaction fees

image description

Source: Curve Whitepaper

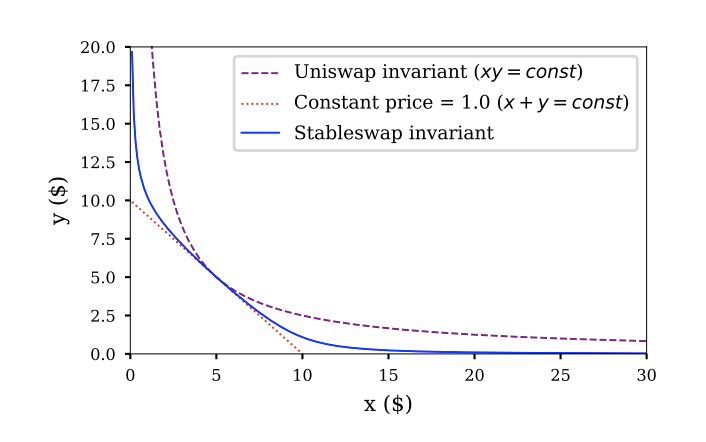

Based on the Uniswap AMM constant product formula (X * Y = K), Curve introduced an upgraded calculation formula called Stableswap. As we all know, Uniswap's AMM is an innovation of DEX, bringing DeFi into a new era. However, if a pool is not liquid enough, this algorithm can cause considerable slippage. Especially for stablecoins with little price fluctuation, most of the time they are around $0.9-1.1. According to the curve chart on the Curve white paper, in this price range, the curve of Curve Stableswap tends to be X + Y = constant, allowing two A currency fluctuates slightly in a range around 1.

This not only controls slippage to a sufficiently low level, but also improves the competitiveness of transaction fees. Currently Curve’s handling fee is 0.04%, which is about 1/10 of Uniswap’s.

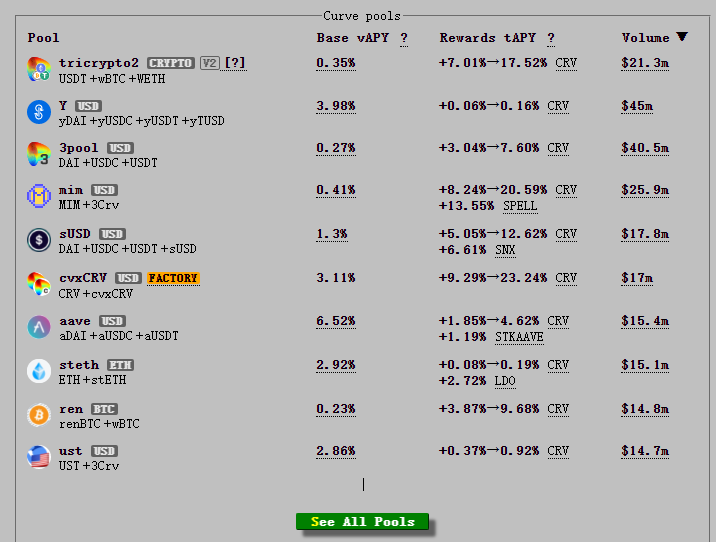

As mentioned above, Curve has currently deployed its application on 7 networks. Ethereum is the main network of Curve, and there are more than 80 pools for investors to choose from. Recently popular networks, such as Polygon, Fantom, and Arbitrum, offer an average of 10 pools. Some newer and immature networks have fewer pools.

image description

Source: Curve.fi

Investors can earn more than 3 forms of APY from Curve:

● Base vAPY (v stands for variable, variable): Calculated based on the transaction activity of today's transaction pool

● Reward tAPY (t stands for token, token): determined by CRV’s token price and reward rate

● Increase tAPY: Investors can increase the reward rate by purchasing and staking more CRV

● Additional APY: For some pools, platform tokens will be provided as additional incentives, such as SPEL for Min pools

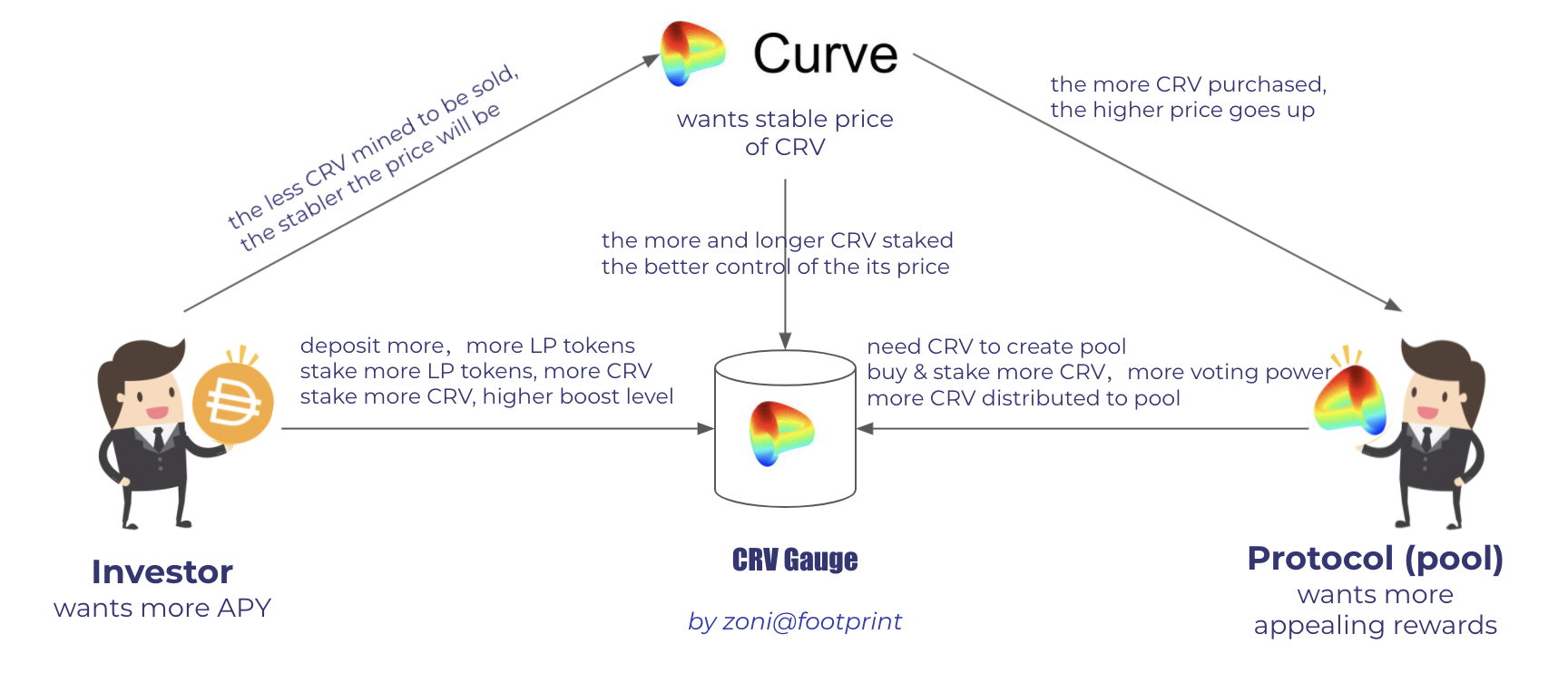

Curve's Project Governance, or DAO, utilizes CRV (reward token) and veCRV (governance token) to positively stimulate and connect investors, protocol parties, and the Curve project itself.

Graphic source: zoni@footprint

image description

Graphic source: zoni@footprint

● For investors, the APY mechanism will stimulate him to deposit more stablecoin assets and pledge more CRV (instead of "mining, withdrawing and selling") to obtain more CRV rewards. Pools with high reward rates are attractive.

● As for the protocol party, it requires higher voting power to offer an attractive reward rate, which leads to an increased demand to buy CRV in the open market.

● As for the Curve project itself, it cares more about two things: the total value locked on its platform, and the price growth of CRV. These two goals can be achieved by introducing more pools, more attractive rewards, and achieving better CRV price control (sell less, buy more).

According to Curve official data, the average lock-up time of CRV is more than 3.46 years. This number provides great confidence for investors to invest (deposit and pledge), and for the agreement parties to open new pools on this platform for drainage. Curve's disclosure of this number is also an implicit incentive.

Footprint will conduct a closer dissection of Curve's APY mechanism in the next article "How Investors Can Get Multiple APYs in Curve". It allows investors to understand the mechanism behind it more objectively before investing.Footprint's Curve's real-time dashboardCurve's real-time dashboard

, in order to display the key indicators of the project in a clearer way, such as the total TVL of the cross-chain, the price trend of the token CRV, the transaction volume and the relevant statistics of the pool. Anyone can use Footprint's data to build their own dashboards to give you a better view.

WeChat public account: Footprint Blockchain Analysis (FootprintDeFi)https://www.footprint.network/

Discord community:https://discord.gg/3HYaR6USM7

WeChat public account: Footprint Blockchain Analysis (FootprintDeFi)

About Footprint Analytics

Footprint Analytics is a one-stop visual blockchain data analysis platform. Footprint assisted in solving the problem of data cleaning and integration on the chain, allowing users to enjoy a zero-threshold blockchain data analysis experience for free. Provide more than a thousand tabulation templates and a drag-and-drop drawing experience, anyone can create their own personalized data chart within 10 seconds, easily gain insight into the data on the chain, and understand the story behind the data.