Sanyuan×Dank AMA Record

Written by: Sanyuan Capital

Thank you for your attention to the latest AMA of Sanyuan Community, we are honored to invite you tonightPhilx Co-founder of Dank Protocol

welcome!

first level title

host:

host:

Quiet everyone, let's start today's activities

First of all, we asked Philx to answer questions about Dank in detail for us~

Let guest Philx introduce himself and the background of the Dank Protocol project~

Philx:

Hello everyone, I am Philx, the co-founder of the DANK protocol. Thanks to the organizers, event supporters, and partners in the Sanyuan community!

First of all, let me introduce that Dank is a license-free open source lending protocol based on Ethereum smart contracts, which aims to solve the problem of low capital efficiency in the DeFi market and build a fixed-income market. The fundamental goal of Dank is to allow all valuable encrypted assets to obtain diversified financial services and create a foundation for sustainable development.

We know that after the DeFi Summer in 2020, the entire market will experience explosive growth. According to the data from the DeFi data information platform DeFi Plus, the TVL of the DeFi market is about 92.8 billion US dollars.

Before 2020, the market size of DeFi was very small, but in just over a year, the TVL of DeFi grew rapidly to nearly 100 billion US dollars, of which the market size of lending accounted for about 30% of DeFi TVL. This is simply unimaginable scale in the past.

At present, the naked eye can see that the scale of the DeFi market is constantly increasing, but the vast majority of assets/positions on the market only exist in the space of floating interest rates. From the leading DeFi lending platform, we can see that due to the large size of its own funds, the deposited funds have been affecting the efficiency of funds. Of course, the efficiency of funds has also become a headache. (The efficiency range of lending funds for AAVE and Compound protocols is: 30%-45%)

Our team saw an opportunity: if the positions in the variable rate market are converted into fixed rate positions, it will not only solve the capital efficiency problem of the positions in the variable rate market, but also create a new income market: the fixed income market.

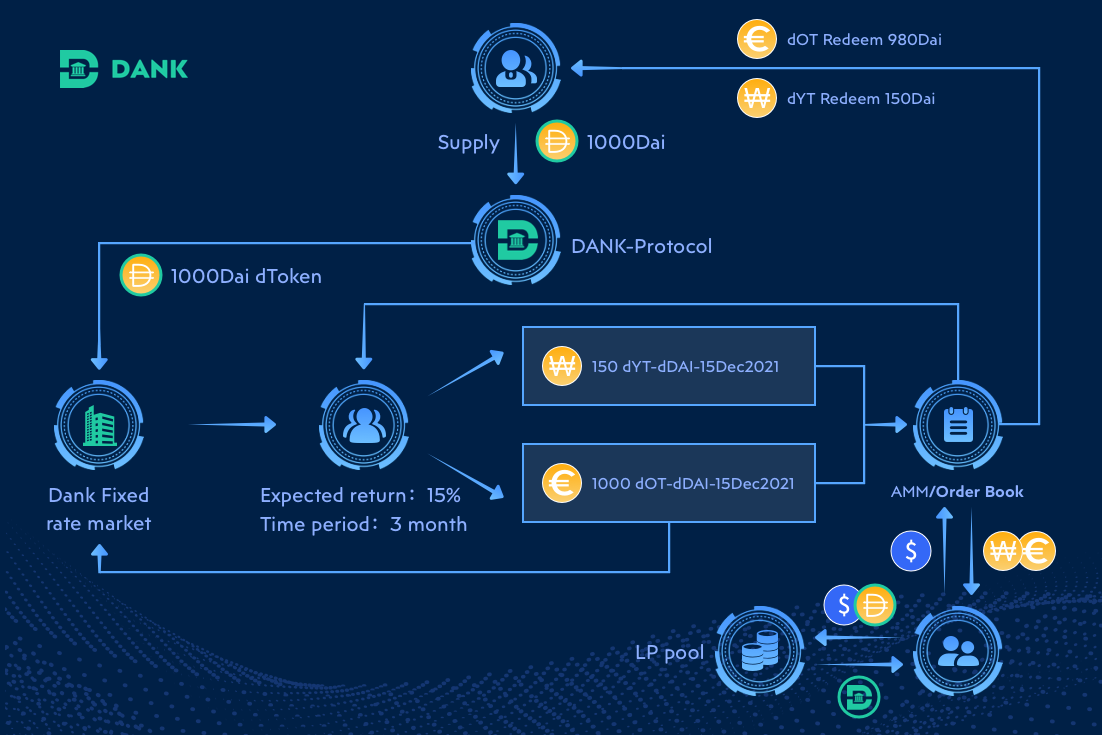

Solving the high probability of capital efficiency also solves the problem of capital income, so we created a derivative fixed income market on the basis of variable lending rates: the Dank protocol allows any user who uses the protocol to obtain depository receipts with variable interest rates d-token, and then through the forward interest rate contract swap model, the d-token forward income can be released at any time to obtain instant fixed income.

host:

host:The reason why the team chose the De-Fi track, or why they are optimistic about the De-Fi market?

Philx:In a nutshell, there are probably three simple reasons:

First of all, we believe that DeFi will be a sustainable financial foundation in the future, including the original intention of the DANK protocol.

Second, we believe that the development of all aspects of blockchain is bound to be based on DeFi finance, which is simply the economic activity center of all blockchain applications.

Finally, as a new financial form, DeFi is still a very early baby in terms of development compared to the scale of traditional financial markets.

host:

host:

Can you tell us about the fixed rate market in the Dank protocol? What do you think of the development prospects of fixed interest rates in the De-Fi market?

Philx:

Ok, Dank's fixed rate marketplace is an open source fixed rate protocol based on the Dank lending protocol. On the basis of the variable interest rate of the Dank protocol, a fixed interest rate controlled by an algorithm mechanism is innovatively adopted. Through the combined model of risk protection pool and order pool, users will have a more diversified income portfolio.

Dank's fixed rate market is the best tool for users to obtain stable risk exposure. In the market, holders of interest-bearing tokens will have the opportunity to obtain additional profits and lock in their future earnings in advance. At the same time, it allows traders to directly access future profits without using underlying collateral. After depositing the underlying collateral into lending agreements such as Dank, Compound, and AAVE, variable interest income can be obtained from the agreement. At the same time, users will also receive interest-bearing tokens of corresponding value (dToken, cToken, aToken, etc.). These tokens represent the right to redeem the principal and future forward returns. Dank, Compound, and AAVE are variable-rate based lending protocols that do not guarantee exact future returns. In order to hedge income fluctuations and maintain stable income expectations, Dank's fixed rate market is designed.

↓This is our fixed rate model↓

Core strengths: Dank's fixed rate market offers a variety of methods for fixed income; the order book model provides customization and high capital efficiency for all participants in the market (liquidity providers and receivers), ideal for precise fixed income users; AMM helps liquidity providers avoid theta decay, and also helps floating profits that need to be realized quickly be converted into fixed income through the liquidity market. On the other hand, the market uses a liquidity incentive method to help liquidity providers also profit. At the same time, innovatively adopt the Slippage Mining method to reduce system risk.

Core strengths: Dank's fixed rate market offers a variety of methods for fixed income; the order book model provides customization and high capital efficiency for all participants in the market (liquidity providers and receivers), ideal for precise fixed income users; AMM helps liquidity providers avoid theta decay, and also helps floating profits that need to be realized quickly be converted into fixed income through the liquidity market. On the other hand, the market uses a liquidity incentive method to help liquidity providers also profit. At the same time, innovatively adopt the Slippage Mining method to reduce system risk.

Fixed interest rate or fixed income occupies a very important position in the global traditional financial market. We can clearly understand this huge market by looking at the volume of US treasury bonds. The current volume of US risk-free treasury bonds alone is 28 trillion dollars. There is not much difference in the nature of finance. We believe that the market importance of the fixed interest rate market in DeFi is basically the same as that in traditional finance. Here are some of my thoughts on the future of DeFi fixed rate prospects:

With the gradual compliance of decentralized finance, more traditional capital will invest in the encryption field in the future, giving priority to stable exposure targets.

The basis of the interest rate swap market is one of the cores of future DeFi hedging derivatives.

The fixed interest rate market is an important way for DeFi to target a wider user group in the future.

host:

host:What is the difference between Dank Protocol and other lending platforms? What are the reasons for users to choose Dank Protocol?

Philx:

First of all, the underlying lending of the DANK protocol is consistent with Comp and AAVE, and it is also a variable interest rate lending agreement. Anyone can deposit, withdraw or borrow their own assets to obtain floating interest rates.

In terms of business direction, unlike COMP and AAVE, DANK is more focused on the fixed interest rate, capital efficiency and interest rate derivatives market. At the same time, DANK proposes a forward interest rate contract swap model based on the floating interest rate market. Users can Release the forward income of d-token to obtain instant fixed income.

I think users choose DANK first compared to other lending platforms:

Have better funding flexibility

More income options

Here is an example to look at, Bob deposits 1ETH in the DANK protocol, then Bob will also receive a deposit certificate minted by the DANK protocol: 1 d-ETH. d-ETH, like c-ETH (Compound’s certificate of deposit), represents the certificate of Bob’s principal deposit and floating income. At this time, Bob holding d-ETH seems to be unable to do anything except wait for uncertain income . In fact, we found that Bob who holds d-ETHD can make good use of this position. Think about it, if the properties of d-ETH are minted and split, that is, Bob splits his d-ETH into principal token+ Earning tokens, then Bob has the following flexible asset management methods.

Based on the principle of zero-coupon bonds, Bob can sell his own principal tokens at a discount without giving up the basic principal income rights. Bob can even continue to compound the principal tokens to obtain several times the capital efficiency and income rights .

If the variable interest rate market is active in the future, then Bob can release his income token in advance when the market confidence is positive. Bob does not sell his own principal token + income token, and engages in the business of providing liquidity based on the existing Dank's Fixed Rate Market to earn more handling fees.

host:

host:

We all know that security issues are of great concern to users. What guarantees will Dank Protocol provide in terms of the security of users’ funds?

Philx:Regarding security, the security of the protocol can be said to be the most important part of the entire protocol, which is the foundation of the protocol. In fact, our team has been thinking about how to bring asset security to users. Here are a few points to show our emphasis and actions on security:

From the perspective of protocol security, the protocol has been cooperating with leading audit institutions to check the security performance of our code, and also conducted related testing activities to report bugs in the protocol. In addition, in order to maximize and maintain the bottom line of security, we are also preparing to integrate Openzeppelin's newly hatched Forta-a real-time threat detection protocol for smart contracts.

Regarding the risk control and safety of asset liquidation, under extreme market conditions, some liquidity may shrink sharply, resulting in the inability to liquidate certain currencies. For the safety of users' assets, the Dank protocol reasonably limits the maximum deposit market size of a single currency with high risk, and only deposits can be made for specific tokens to obtain income but cannot be mortgaged to ensure the security of the protocol.

Guarantee vault, after the Dank protocol goes online, guarantee funds will be launched successively to deal with extreme situations and protection measures.

host:

host:

Can you talk about the project's token? What are the benefits for investors to hold tokens? What are the areas of use?

Philx:

Well, DANK is the native governance token of the DANK protocol, and its main use in the future is the governance of the protocol, including: delegation, voting, parameter setting, revenue transfer, protocol upgrade, etc.

Regarding token holders, we have not defined the benefits or priorities in advance, but owning and holding Dank may have more initiative and influence in community governance, because we have a community/protocol Incentivize the treasury, and once the community is fully governed, it will be completely dominated and defined by the community.

host:https://dank-protocol.gitbook.io/docs/faq/governance

host:

Can you tell us about the current progress of Dank Protocol? Any good news to share with our users?

Philx:

host:

host:

Can you introduce the development path of Dank Protocol and your expectations for the future?

Philx:

In fact, we have no way to fully define an established route regarding the development path. With the transition of governance rights from the initial team to the community, the subsequent development of the Dank protocol will be completely determined by community governance. The general planning of the protocol, the main path here is divided into two perspectives:

First of all, from the perspective of the deployment framework of the Dank protocol, a multi-chain deployment method will be adopted to expand various marginal effects, mainly focusing on Layer 2 and EVM chains.

Secondly, from the perspective of the Dank protocol business, it mainly explores new boundaries around basic lending, fixed income markets, and on-chain credit, and is committed to being a free, open, and uncensored sustainable leading financial entity.

secondary title

host:

host:

Next, I will leave time to everyone. If you have any questions about Dank, please feel free to ask questions~

Community question:

Someone can package and sell the usufruct in advance to the market (Dank's Fixed Rate Market) to obtain a fixed income. If the market is not good, will the income of the usufruct become negative? And there is no one to answer the situation.

Philx:

Once the income right is circulated in the market, the seller has already obtained immediate income. Simply put, the held unexpired income position has been released to the market in advance. Regarding whether the income will be negative, of course not, this is a forward income position that will not return to zero or negative.

Community question:

What do you think is the biggest challenge for Dank on this track in the future? How can we successfully break through and become the top lender? There is also Dank, if you have a public account, please send it to us for attention.

Philx:

group.Twitterandtelegraphgroup.

Community question:

Can you tell us 1-2 cool features that set Dank Protocol apart from its competitors?

Philx:

documentdocumentto find out

Community question:

Which public chain is DANK currently on? Do you have plans for other public chains in the future?

Philx:

We mainly revolve around L2 and other compatible EVM chains

Community question:

As a small investor, how can I obtain benefits in the Dank Protocol project? How many ways are there?

Philx:

You can pay more attention to our fixed interest rate sector. Simply put, you can use small funds to leverage large capital gains. For example, Bob does not have $10 million in capital to lend to earn interest, but in the fixed-rate sector, Bob only needs tens of thousands of dollars in capital costs to leverage $10 million in income.

Community question:

Which is Dank Auditing Company? and which oracle price to use?

Philx:Okay, let me disclose this in advance, and it will be officially disclosed in the next two days.

At present, our audit partner is Certik, and the subsequent version will be Openzepplin. For the oracle, we mainly use the data of Link, and we will also support the predicted price of Uni V3 in the future.

Community question:

Now many people are paying attention to your posting pictures, what are the developments in the NFT field in your project?

Philx:

Identity on the chain, future web-based credit foundation, and scenario applications in the metaverse, we have an NFT that can be kept in mind.

Community question:

How important is community to you? Are community needs considered?

Philx:

In terms of development, it should be said that it is as important as protocol security. Without a community foundation, Dank cannot be achieved.

Community question:

Can you announce the VCs of Dank's investment institutions? And what is the current valuation?

Philx:Stay tuned, we can't judge these things ourselves.

Community question:When will DANK be launched, can you tell me?

Philx:

host:

host:

Thanks to Philx for bringing us a lot of information about the Dank project. Due to time constraints, today's AMA is over here

secondary title

About Dank Protocol

secondary title

For more information on Dank, please visit:

Official Website: https://dank-protocol.com/

Twitter Twitter: https://twitter.com/Dank_Protocol

Telegram: http://t.me/DankProtocol

Discord:https://discord.gg/3gZKTsZh