Three minutes to understand the "algorithmic fixed interest rate" lending agreement Dank Protocol

Written by: Groot

Although for traditional financial market practitioners, fixed interest rate seems to be a bad interest rate choice, after all, for financial products, fixed interest rate means that the product lacks flexibility to respond to market environment and systemic risks ability. However, for the cryptocurrency market, which has been criticized for its high volatility since its inception, fixed interest rates have become an effective means of reducing risks.

first level title

What is Dank Protocol?

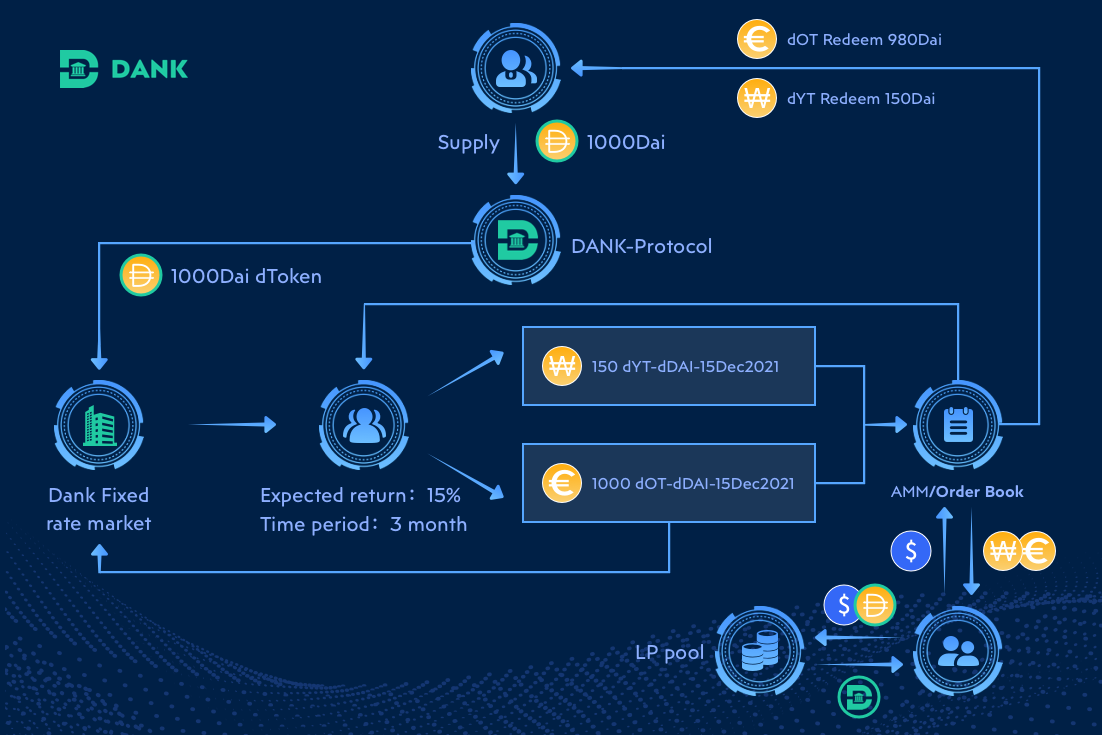

Dank is a decentralized open-source lending protocol based on Ethereum, and has innovatively launched an "algorithmic fixed interest rate" product, that is, based on the variable interest rate of the Dank protocol, a loan product with a constant interest rate is achieved through an algorithm, further It enriches the options of the fixed income market in the DeFi world and improves the efficiency of capital utilization in the DeFi market.

The key to the realization of this algorithmic fixed rate product lies in the forward rate contract swap model proposed by Dank based on the variable rate market. Users can use this derivative product to flexibly release the forward income attached to d-Token, and use this " Exchange" becomes an instant fixed-rate income. Holders of interest-bearing tokens can lock in future earnings in advance, and also have the opportunity to obtain additional profits. Products of this type offered by Dank also allow market participants to gain direct access to future profits without providing relevant collateral.

In addition, Dank uses two modes of order book and AMM to achieve fixed interest rate income more stably. The order book mode can improve the capital utilization rate of market participants and is an important way for users to accurately realize fixed interest rate income. The AMM in the agreement is mainly used to help liquidity providers avoid the negative impact of Theta (time decay) as much as possible, and is also used to help the liquidity market quickly convert floating profits into fixed income.

The structure within the Dank protocol is not complicated. Participants will play three different "roles", namely depositors, borrowers, and liquidators. Among them, the depositor deposits assets into the agreement, and once there is a borrowing behavior, the depositor can obtain a (fixed interest rate) return. Borrowers can borrow assets supported by the pledge agreement, and the loan interest is paid by the borrower. The liquidator mainly obtains income by helping the borrower to restore the positive liquidity of the account during liquidation, that is, after the borrower's account is liquidated due to violent market fluctuations, the liquidator can obtain the borrower's mortgage by helping the borrower repay part or all of the loan A certain percentage of assets are rewarded.

first level title

Some new explorations: NFT, L2

Dank launched NFT on the Ethereum layer-2 expansion network Polygon (Matic) soon after launching the public beta, in order to reward users who participated in the test and gave feedback. And Dank's attempts in NFT don't stop there. As mentioned above, Dank hopes to use the characteristics of NFT assets to carry out on-chain credit/identity ID in the Web 3.0 era. According to the official information, this credit certificate will be able to carry out unsecured loans on Dank in the future, which will become a brand-new credit loan method.

first level title

DANK Token Economic Model

The native token DANK is an important part of the governance of the Dank protocol. The total amount of DANK is 100 million, which can be used for voting and decision-making, and is the only certificate for community governance. In addition to this, DANK can also participate in the agreement, providing security and insurance for the agreement and depositors. Stakeholders and market participants will also receive benefits and fees from the agreement through DANK.

secondary title

The distribution ratio of DANK is as follows:

The team reserves 15%, which will be gradually released within 4 years;

Early investors (seed round) allocate 30%, which will be released gradually within 4 years;

50% of the protocol incentive rewards are reserved and fully released within 3-4 years;

2% is reserved for community promotion, which will be used for community building and brand marketing;

1% of NFT incentive rewards will be reserved for the cultural development of the community;

Advisors allocate 1% to reward advisors who provide constructive advice for protocol development;

team

team

text

summary

secondary title