【Deribit Option Market Broadcast】0922——Falling and Falling

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

The decline continued. In the early morning, Bitcoin once fell below the integer mark of 40,000 US dollars, and Ethereum also fell below the key point of 3,000 US dollars. The trend of digital currency is weakening, there is no obvious support below the current price, and external factors are not yet clear, which is quite similar to the market atmosphere before 312.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

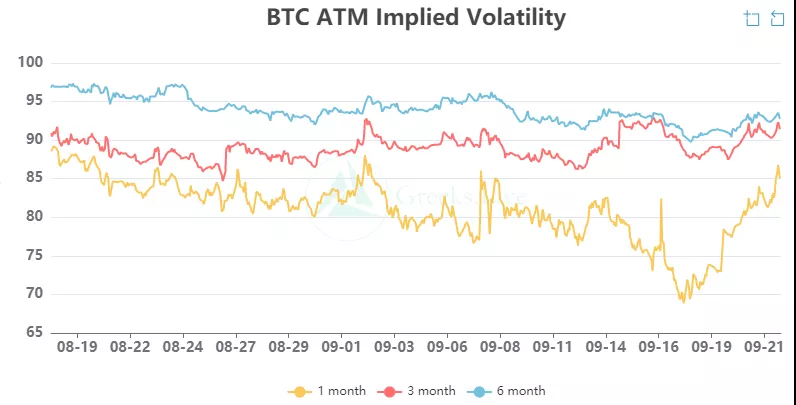

【BTC Options】

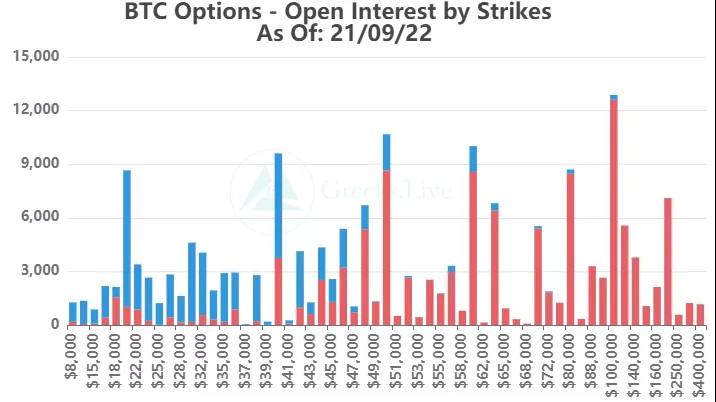

The option open interest was 185,000 contracts, worth $7.8 billion, and the option volume was 21,000 contracts.

【Historical Volatility】

10d 78%

30d 72%

90d 70%

1Y 79%

【IV】

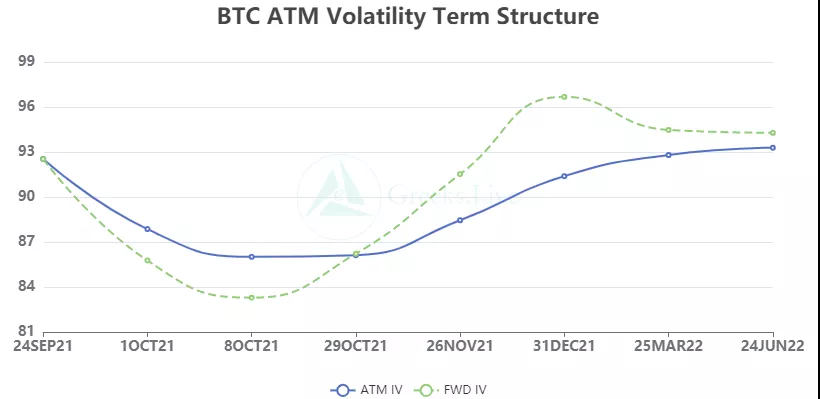

Implied volatility for each normalized term:

【Historical Volatility】

9/21:1m 84%, 3m 91%, 6m 93%,DVol 93%

Today: 1m 85%, 3m 91%, 6m 93%, DVol 94%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

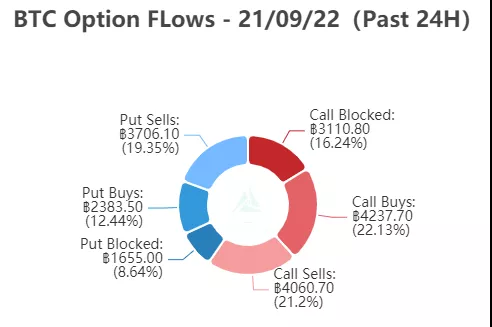

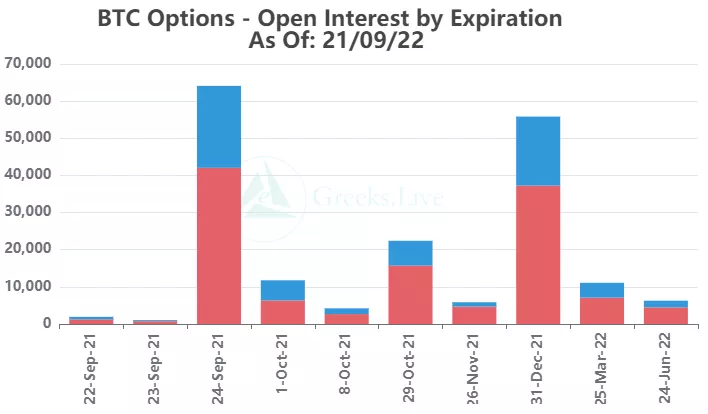

Judging from the Option Flows data, the option trading volume remained at a relatively high level yesterday. Under the strong market support, this week will be a week of high trading volume. The overall distribution of transactions has not changed much, and the call options are still the main ones. One change is that the trading volume of selling calls has shifted by 1,000 contracts to selling puts, indicating that the market has gradually started to buy bottoms. The transaction is concentrated within 24 days and will be delivered soon.

【Option position distribution】

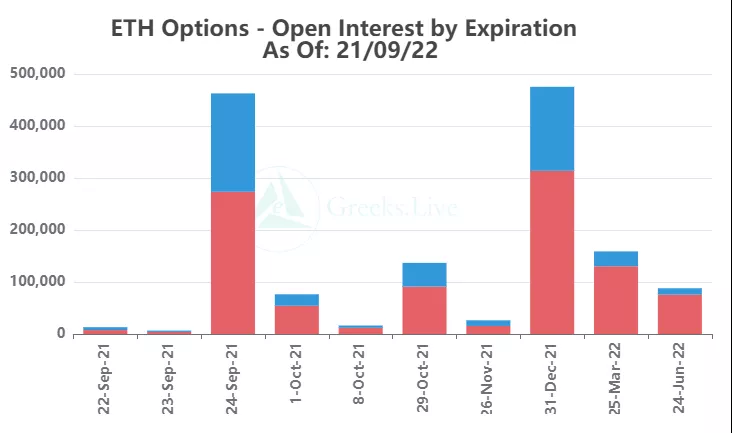

There are about 64,000 options in September, and about 12,000 in the next week.

Judging from the data of the ratio of OTC transactions to total transaction volume, the proportion of OTC transactions in Dabing rises with the bull market and decreases with the bear market. Historically, the ratio has a clear trend before and after the bull top, before the bull top: an upward trend; after the bull top: a downward trend.

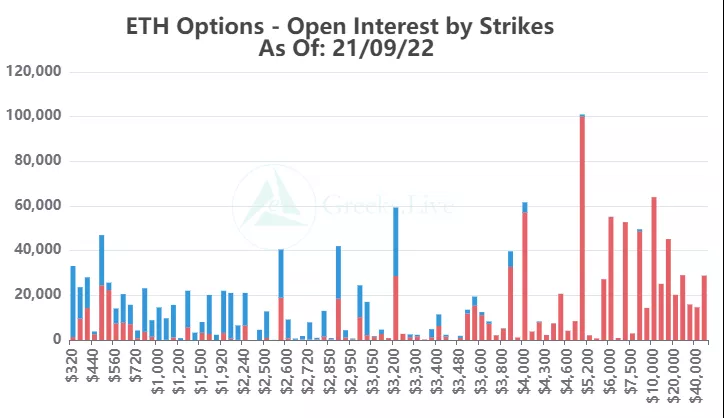

【ETH Options】

The open interest of Ethereum options is 1.46 million, with a value of 4.2 billion US dollars, and the trading volume is 120,000.

【Historical Volatility】

10d 105%

30d 98%

90d 90%

1Y 108%

【IV】

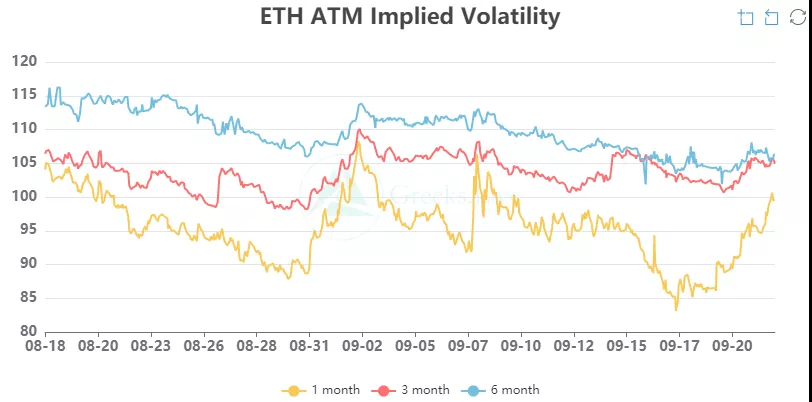

Each standardized period IV:

【Historical Volatility】

9/21:1m 96%,3m 105%,6m 107%,DVol 103%

Today: 1m 102%, 3m 105%, 6m 106%, DVol 110%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

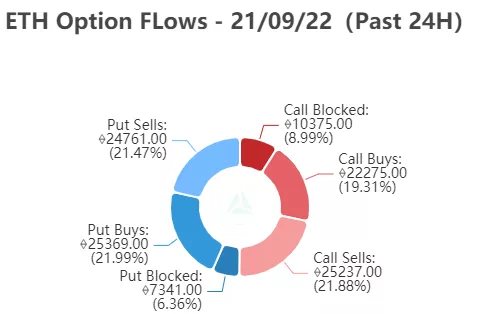

From the perspective of Option Flows, the sales volume of Ethereum put options decreased slightly, and the volume of options in other directions remained the same as yesterday. Among them, the volume of put options due at the end of the month was still as high as 17,000, and the volume of put options due in the next month was also as high as 13,000 Zhang, and the strike price of the transaction is even more out of value.