【Deribit Options Market Report】0919——This week's options summary

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

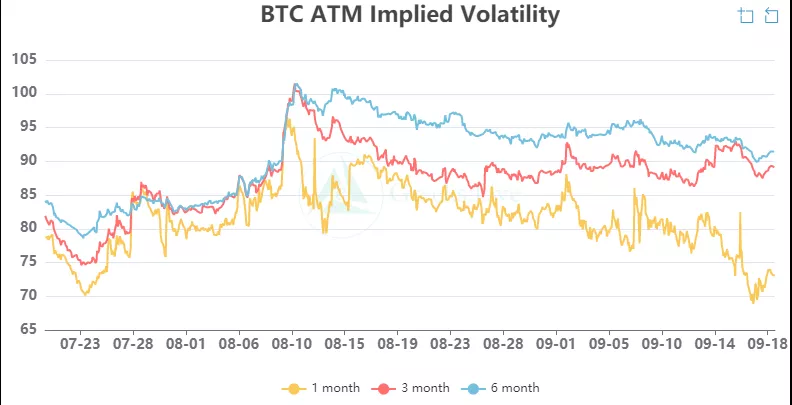

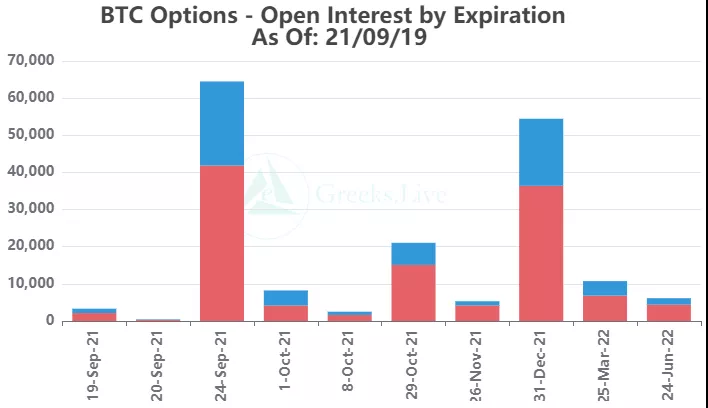

The mainstream currencies rose by more than 10% in the first half of this week, and entered a sideways market in the second half. Although the overall price trend has risen, IV has continued to drop sharply. Entering the quarterly delivery week, market volatility will generally decrease, coupled with the suppression of institutional rebalancing, unless there is a huge market, the options market will generally be relatively stable.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

【Historical Volatility】

【Historical Volatility】

10d 46%

30d 66%

90d 70%

1Y 79%

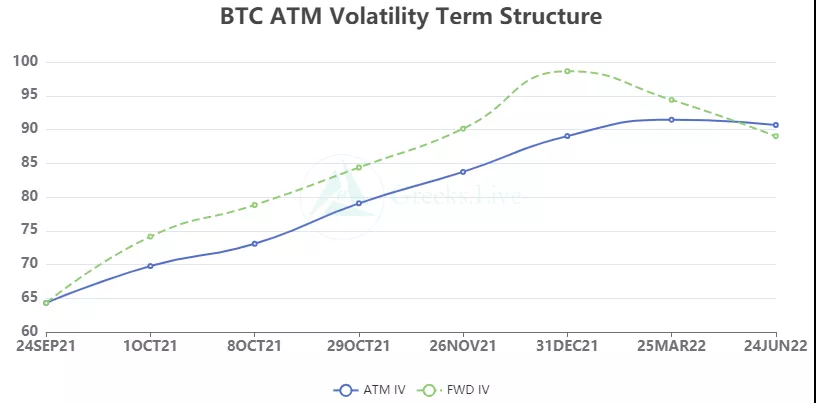

【IV】

Implied volatility for each normalized term:

Today: 1m 77%, 3m 88%, 6m 91%, DVol 85%

9/18:1m 74%, 3m 87%, 6m 91%,DVol 81%

Today: 1m 77%, 3m 88%, 6m 91%, DVol 85%

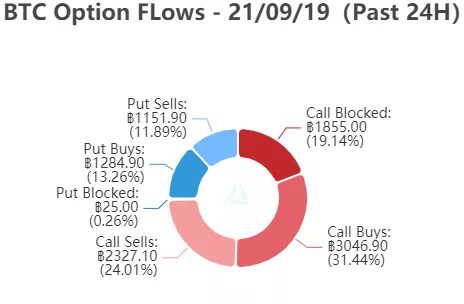

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

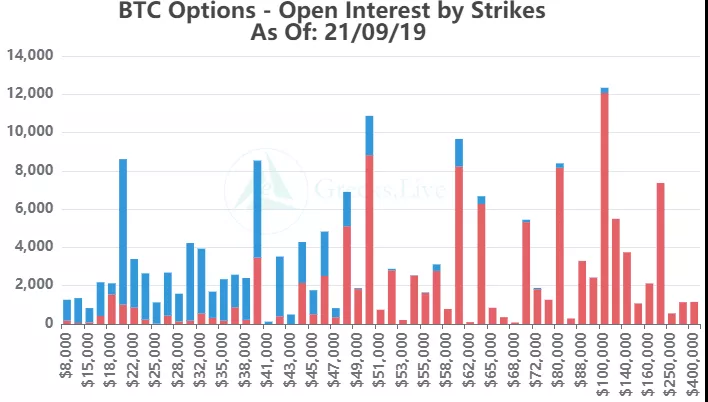

【Option position distribution】

【Option position distribution】

【ETH Options】

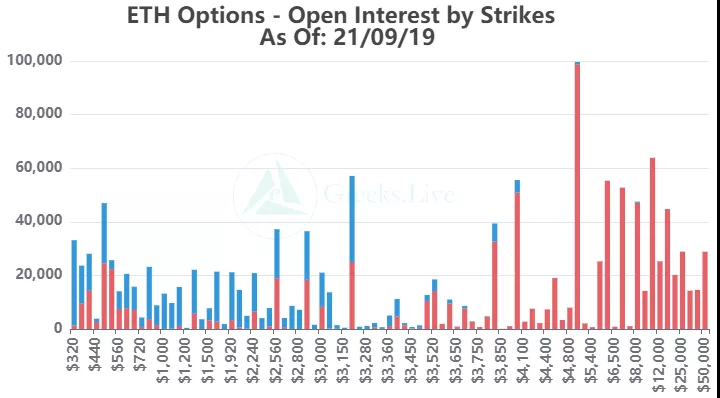

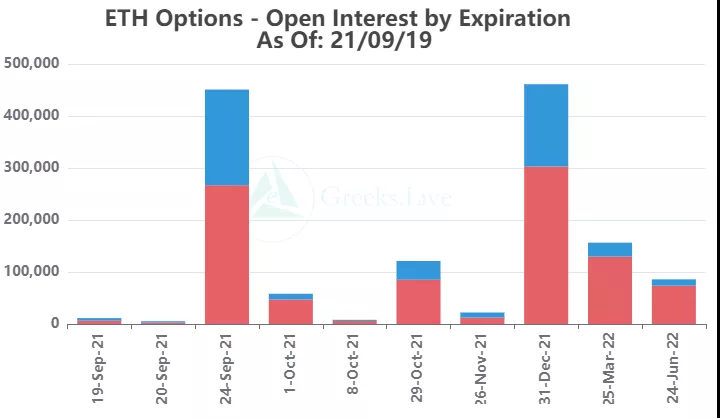

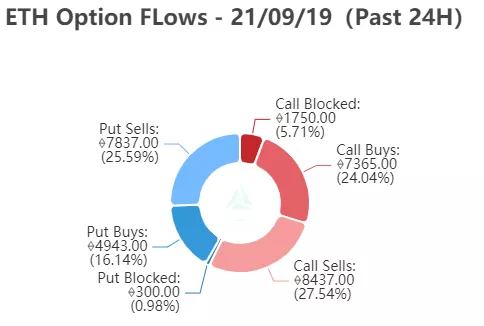

The open interest of Ethereum options is 1.38 million, worth 4.7 billion US dollars, and the trading volume is 30,000.

【Historical Volatility】

10d 76%

30d 88%

90d 92%

1Y 108%

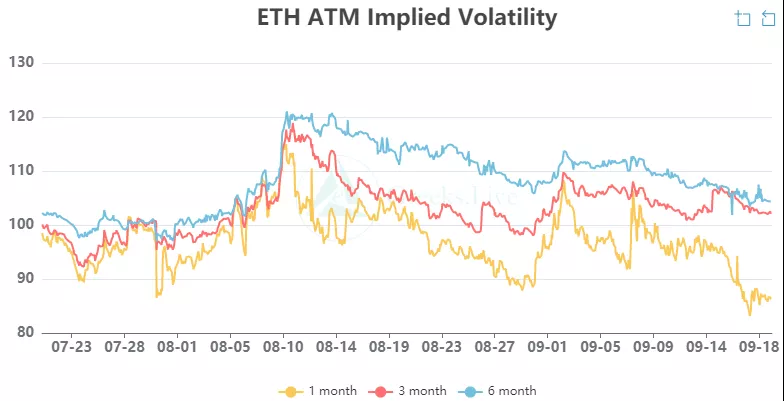

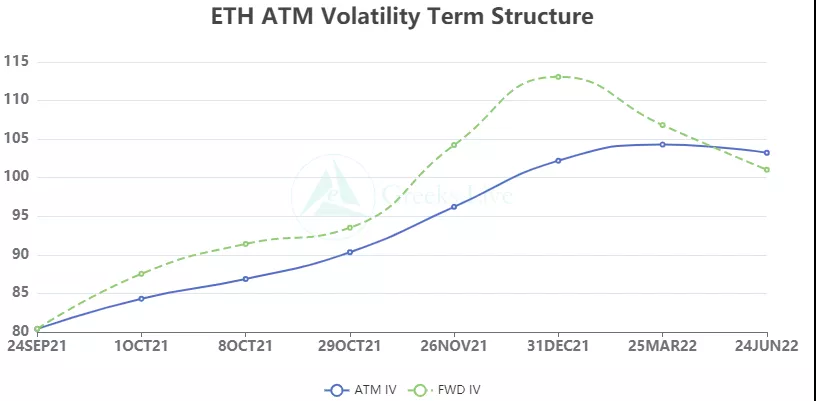

【IV】

Each standardized period IV:

【Historical Volatility】

9/18:1m 90%,3m 102%,6m 105%,DVol 98%

Today: 1m 89%, 3m 101%, 6m 104%, DVol 97%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

From the perspective of Option Flows, the block trade is cold. Yesterday’s block trade was 17,125 + 5,875, and today’s volume was 1,750 + 300. I once thought I was dazzled. The trading volume of long call options decreased less than that of other directions, and the distribution of final transactions was close to that of yesterday. The options volume is low this week, and the price trend of Ethereum is not strong.