This article takes stock of the original cross-chain bridges of major public chains: under the coexistence of multiple chains, cross-chain becomes a rigid demand

Recently, Avalanche Bridge, the original cross-chain bridge of the avalanche protocol Avalanche, announced that it will airdrop about 880 GB tokens to the wallet address of each user who has participated in the interaction. After GB enters the secondary market, the highest price will reach $3.68, allowing each The value also shot up to $3,238. Currently, GB has fallen back to around $1.8.

The wealth effect brought by the airdrop has begun to make the market pay attention to the original cross-chain bridge section of the public chain, and the cross-chain protocol itself is an important tool on the chain at present. At present, in addition to the old blockchain network Ethereum, new-generation public chains such as BSC, Solana, Fantom, and Avalanche have begun to enter the market, and Ethereum’s second-layer expansion chains Aribitrum and Optimism are not far behind. Multi-chain coexistence is the current market Therefore, the interoperability of assets between chains also makes the cross-chain protocol a rigid demand of users on the chain.

There are currently two main ways to cross-chain assets:

Cross-chain aggregation application Swap(Original link"Swap tool goes to users' cross-chain needs"Cross-chain bridge

Cross-chain bridge——Provide a bridge channel between two different public chains, and host the original assets on this bridge. At the same time, one chain can obtain the asset transaction status on the other through the oracle function, and map it to the other in a 1:1 ratio. on a chain. The effect of the cross-chain bridge is to allow the two chains to circulate the same asset, and the cross-over assets are mapped from the original assets. For example, BETH is the mapped asset from ETH to BSC through the Binance Bridge cross-chain.

Although cross-chain protocols provide users with the convenience of on-chain interaction, security is still a concern. Due to the increase in the demand for transactions on the chain, the cross-chain funds of users hosted by the cross-chain bridge are also increasing. Therefore, it has become the favorite target of hackers, and the cross-chain bridge has become a high incidence of security incidents.

Within two months of July and August this year, there were 3 security incidents in which cross-chain applications were hacked. On July 11, the cross-chain application ChainSwap was hacked due to a smart contract vulnerability, resulting in a loss of about 8 million US dollars; On July 12, the decentralized cross-chain transaction application Anyswap v3 cross-chain fund pool was attacked, resulting in a loss of nearly 8 million US dollars; in August, the cross-chain protocol O3 Swap was stolen due to the network security issues of its infrastructure PolyNetwork, and the lost assets As high as 610 million US dollars, the scale of theft has set a new high for DeFi applications.

Compared with third-party cross-chain applications, public-chain native cross-chain bridges are endorsed by the security teams and official authorities of their respective public chains, and their security is relatively more trustworthy by users. It is also the preferred cross-chain method for users when assets cross-chain.

first level title

BinanceBridge

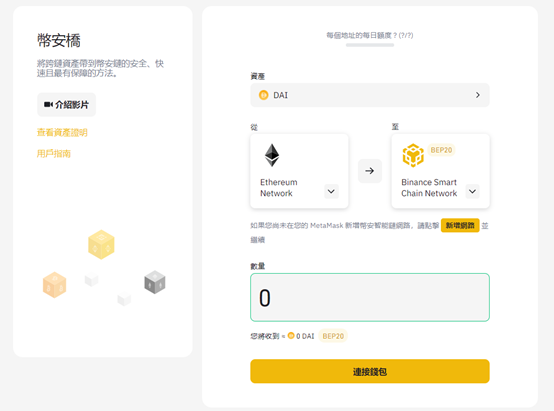

image description

BinanceBridge

The cross-chain assets supported by Binance Bridge include more than 60 mainstream assets such as USDT, DAI, and ETH. Users can move assets between BSC and Ethereum networks through the cross-chain bridge.

The operating principle of the cross-chain bridge is to lock a certain amount of original assets first, and then package the original assets into cross-chain assets according to the ratio of 1:1. Taking assets cross-chained from Ethereum to BSC as an example, when a user wants to withdraw the assets (BETH) cross-chained to BSC to Ethereum, the encapsulated assets (BETH) will be destroyed according to the transferred amount, according to 1:1 Generate native assets (ETH). On the BSC chain, the cross-chain assets from Ethereum usually appear in the BSC ecology in the form of encapsulated assets, often marked with B at the beginning, such as BETH and BDAI are encapsulated assets mapped 1:1.

first level title

AvalancheBridge

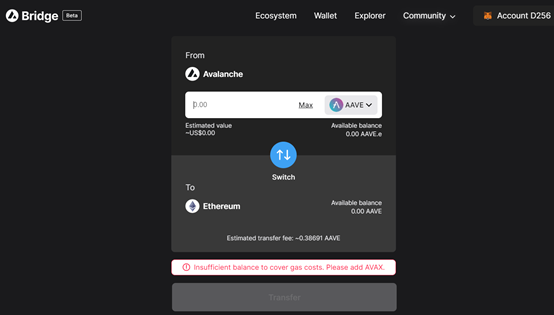

image description

AvalancheBridge

Through Avalanche Bridge, users can interoperate ERC-20 standard assets with Avalanche's C-chain. Currently, only ERC-20 assets are supported for transfer between Ethereum and Avalanche, and native assets on the Avalanche chain are not supported for transfer to Ethereum. It should also be noted that the AB bridge does not support native ETH or BTC, but the encapsulation assets such as WETH and WBTC can be transferred through the bridge.

In the Avalanche ecology, the Ethereum ERC-20 assets cross-chained from the AB bridge are marked with the suffix ".e". For example, DAI.e is the form of DAI cross-chain to the Avalanche network.

first level title

Terra Bridge

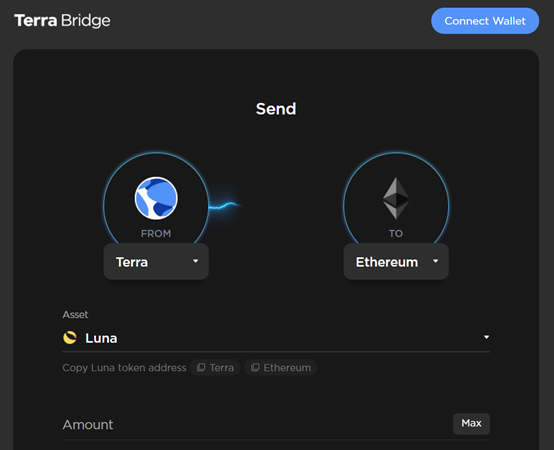

image description

TerraBridge

Terra Bridge currently supports the intercommunication of Terra native assets in Binance Smart Chain BSC, Ethereum, and Harmony (ONE) networks. Currently, it mainly supports LUNA, ANC, stablecoin UST, and synthetic stock assets (mBABA, mCOIN, mGOOGL, etc.) in the Terra ecosystem. ) and synthetic assets (mBTC, mETH) and other original asset transfers.

It is worth mentioning that the minimum cross-chain asset value supported by the BSC cross-chain bridge is around 360 USDC, the AB bridge cross-chain value limit of the Avalanche protocol is higher than 75 US dollars, both chains have a minimum cross-chain amount limit, and the Terra Bridge bridge There are no restrictions on the number and value of assets, and 1 LUNA can also be transferred to other chains supported by the bridge.

first level title

Wormhole

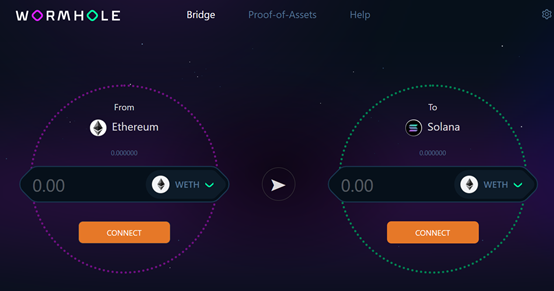

image description

Wormhole

Since Solana’s native token is the SPL standard, before the appearance of Wormhole, when user assets want to be converted with other blockchain network assets, the usual operation is to first sell the SPL assets on the Solana chain to the centralized exchange FTX , and then buy other on-chain assets; when entering the Solana ecosystem, users also need to first buy SPL assets through FTX, and then recharge to the Solana chain.

This complex operation limited the user experience of the Solana chain until the emergence of the Wormhole bridge, which allows users to directly convert Ethereum ERC-20 assets into assets under Solana’s SPL standard. When the user withdraws the SPL assets from the Solana chain to Ethereum, it can be directly converted into ERC-20 standard assets without going through the deposit and withdrawal steps of the centralized exchange, which simplifies the user's operation process.

first level title

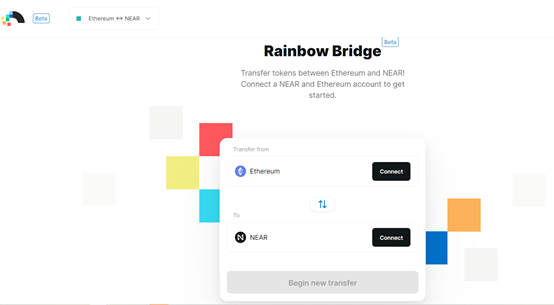

RainbowBridge

image description

RainbowBridge

Rainbow Bridge is more convenient to use because it has optimized the account system. Usually, when the user's assets cross-chain, the wallet needs to be switched to the target network first, and it is generally only supported to connect to the same wallet address. But in Rainbow Bridge, users only need to log in with the Near account, and then they can fill in the address and amount of wallet on the chain they want to transfer in or out, and Rainbow Bridge will automatically perform this operation. The process is like using encryption on the same chain It is as convenient as currency wallet transfer.

first level title

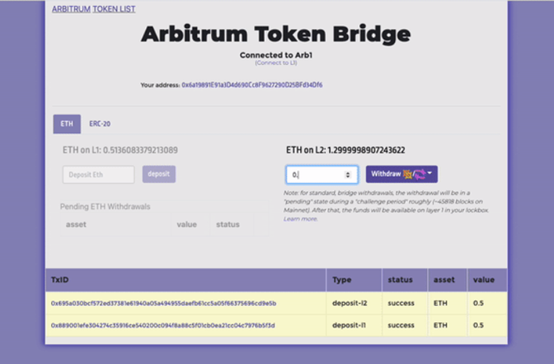

AribitrumBridge

image description

AribitrumBridge

Currently, Aribitrum Bridge supports the transfer of ETH and ERC-20 assets between Layer1 and Layer2, and the handling fee is settled in ETH.

first level title

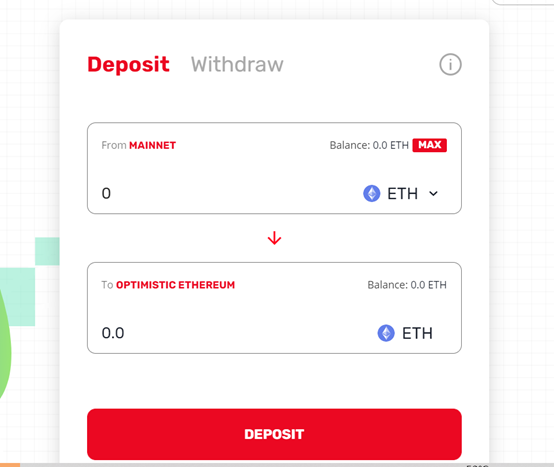

OptimismGateway

image description

Optimism Gateway

In terms of user experience, its interface is a bit like Uniswap, a decentralized exchange. Users only need to select the assets deposited in Optimism and click the deposit button to directly transfer assets between Layer1 and Optimism chains.

first level title

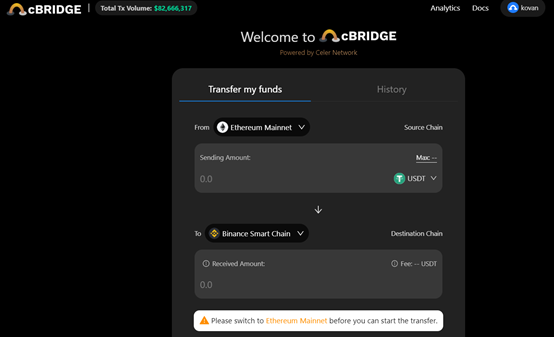

Multi-chain cross-chain bridge cBridge

image description

cBridge

cBridge itself is one of the tools of the Layer 2 ecology, so it also naturally supports cross-chaining of user assets with the Ethereum expansion network Optimism and Aribitrum. More importantly, on cBridge, assets between Layer1 and Layer2 can be transferred instantly without delay.

This means that when you withdraw the deposited assets from Optimism and Aribitrum to Layer 1 through cBridge, once the withdrawal instruction is issued, the assets can arrive immediately, and there is no 7-day withdrawal period limit. It is this cross-chain instant transfer function that makes cBridge stand out among many cross-chain bridges and is welcomed by users on the chain. Since its launch in July this year, users' cross-chain funds on cBridge have reached 82.66 million US dollars.