"Deribit Option Market Broadcast" 0916 - The big players are here again

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

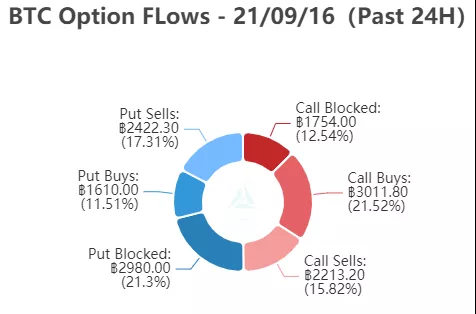

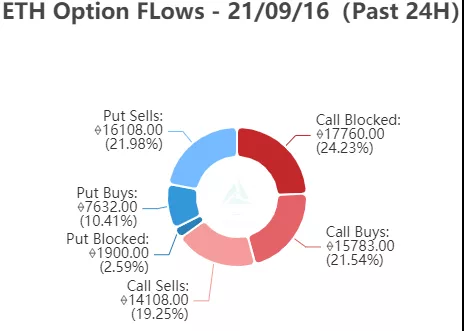

The mainstream currency has risen for two consecutive days, and market confidence is picking up, and there are also some differentiations. The large number of bearish transactions in Bitcoin increased, mainly in contracts with 10% out-of-value contracts in the next month, while a large number of call options were traded in Ethereum, with a large transaction of 6,000 contracts each for $5,500 call and $5,000 call on October 10, and the big players came again Do bull market spreads.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

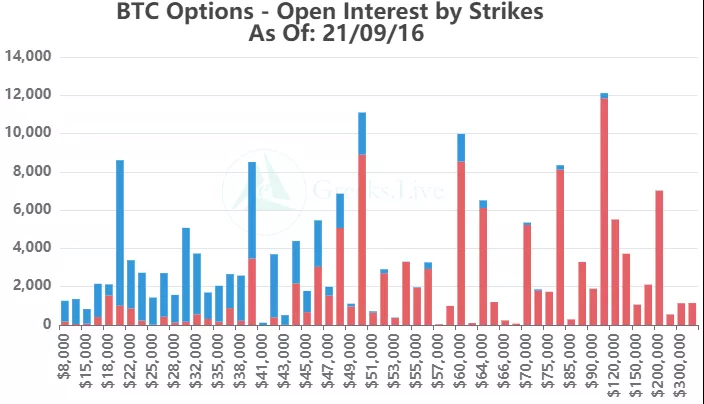

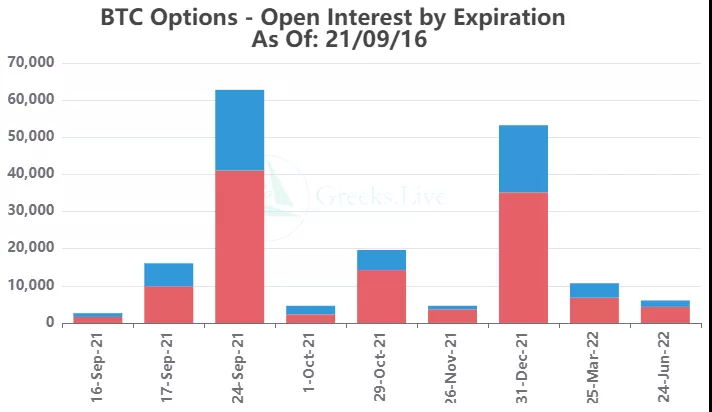

【BTC Options】

180,000 options are open interest, worth 8.7 billion US dollars, and 14,000 options are traded.

【Historical Volatility】

10d 87%

30d 66%

90d 70%

1Y 79%

【IV】

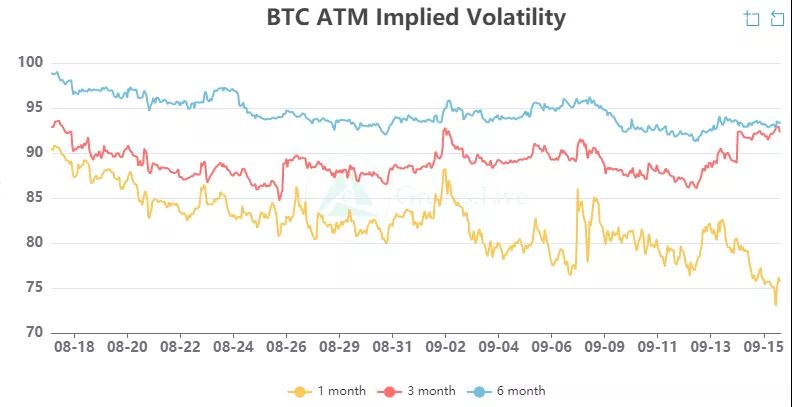

Implied volatility for each normalized term:

【Historical Volatility】

9/15:1m 81%, 3m 91%, 6m 93%,DVol 91%

Today: 1m 81%, 3m 91%, 6m 93%, DVol 91%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

【Option position distribution】

【ETH Options】

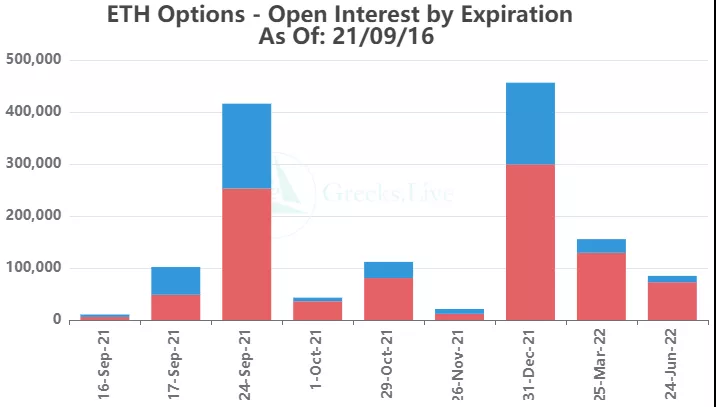

The open interest of Ethereum options is 1.4 million, worth 5 billion US dollars, and the trading volume is 70,000.

【Historical Volatility】

10d 107%

30d 90%

90d 93%

1Y 108%

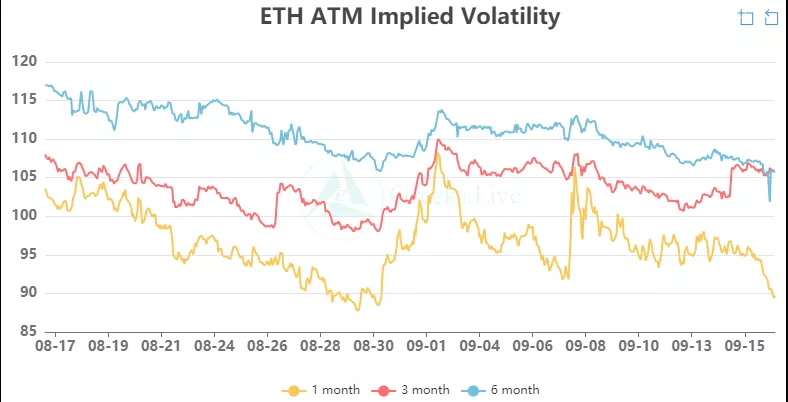

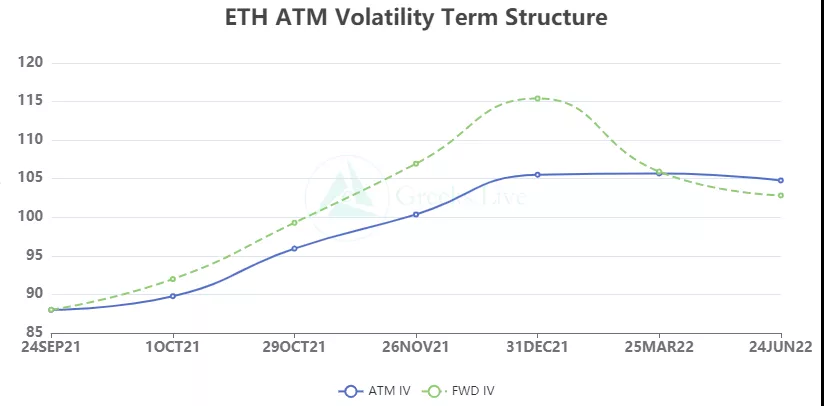

【IV】

Each standardized period IV:

【Historical Volatility】

9/15:1m 98%,3m 105%,6m 107%,DVol 106%

Today: 1m 95%, 3m 104%, 6m 107%, DVol 103%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

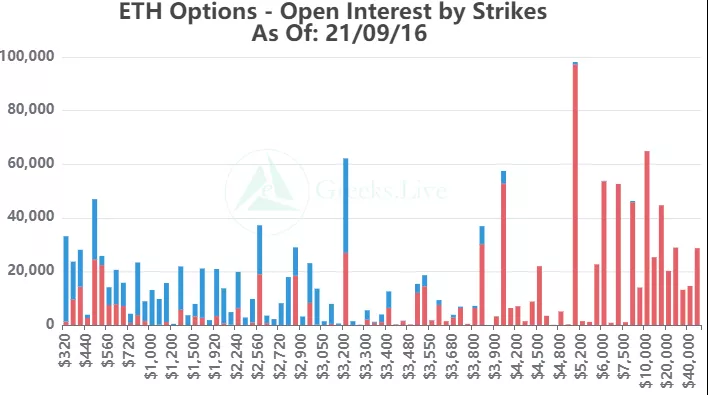

【Option position distribution】

From the perspective of Option Flows, the bulk trading volume has risen sharply. Unlike Bitcoin, which is mainly traded bearishly, Ethereum is dominated by bulk call options, with 17,760 traded, accounting for 24%, which is much higher than the recent average level. Among them, the two prices of 5000 and 5500 on October 10 sold 6000 contracts each. It should be that the big players made a bull market spread.