【Deribit Options Market Broadcast】0915——Steady

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

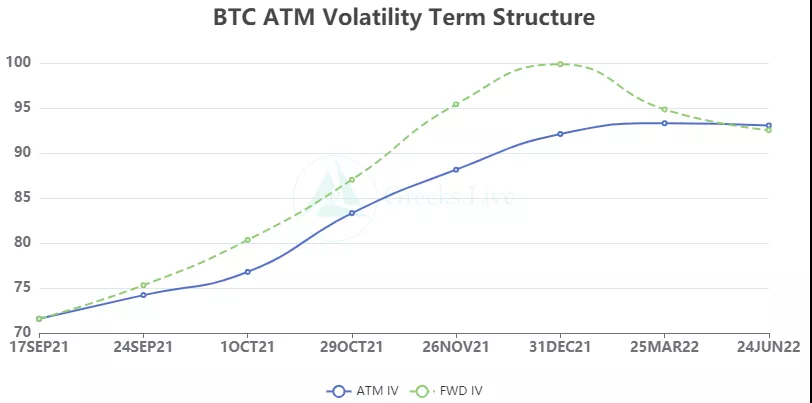

Yesterday was a day when mainstream currencies rose in an all-round way, but the option market was unmoved, and the short-term IV even fell, and the main term did not change much. Due to the high gas cost of Ethereum, the current market hotspot will choose a cheaper public chain. But yesterday's sol downtime hit the public's confidence in the emerging public chain, and ETH is still the king of smart contracts.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

【Historical Volatility】

【Historical Volatility】

10d 86%

30d 66%

90d 70%

1Y 79%

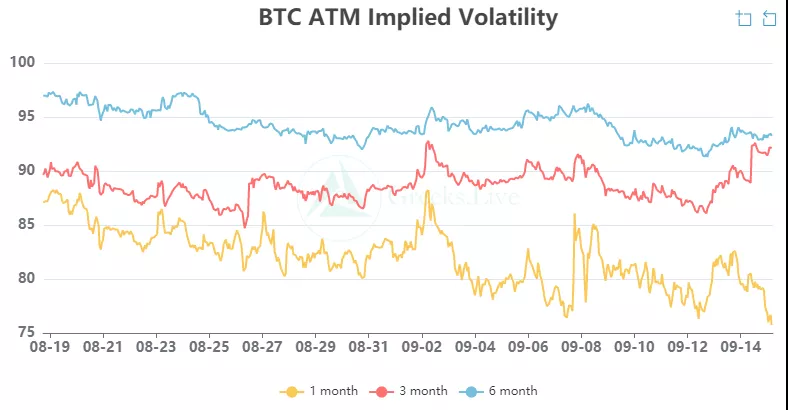

【IV】

Implied volatility for each normalized term:

Today: 1m 81%, 3m 91%, 6m 93%, DVol 91%

9/14:1m 84%, 3m 91%, 6m 92%,DVol 92%

Today: 1m 81%, 3m 91%, 6m 93%, DVol 91%

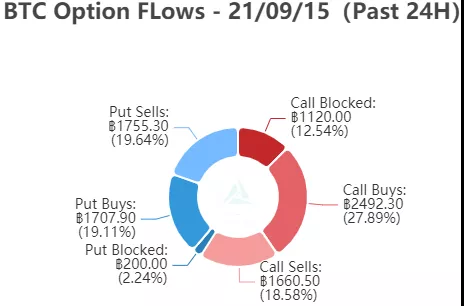

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

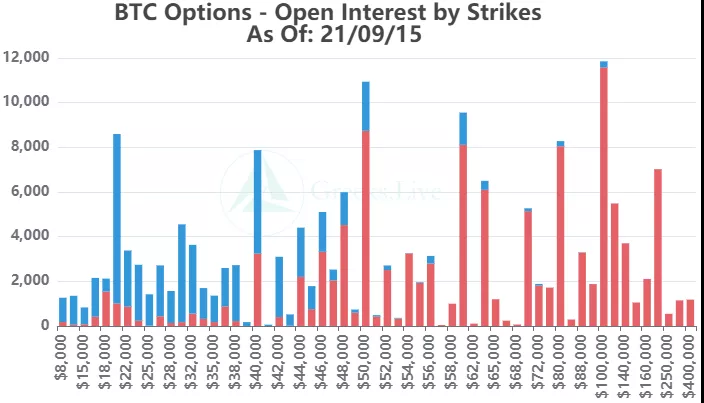

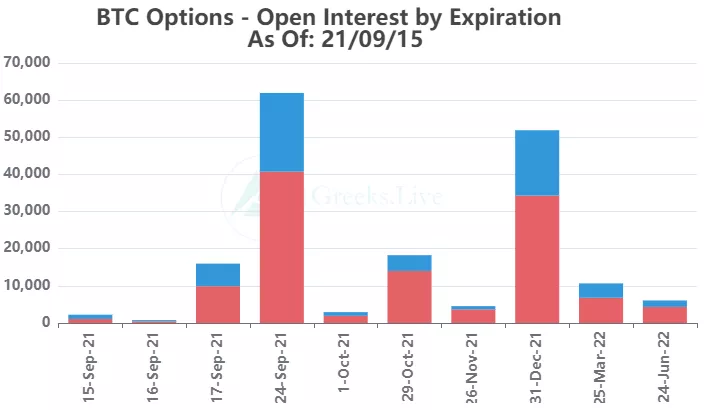

【Option position distribution】

【Option position distribution】

【ETH Options】

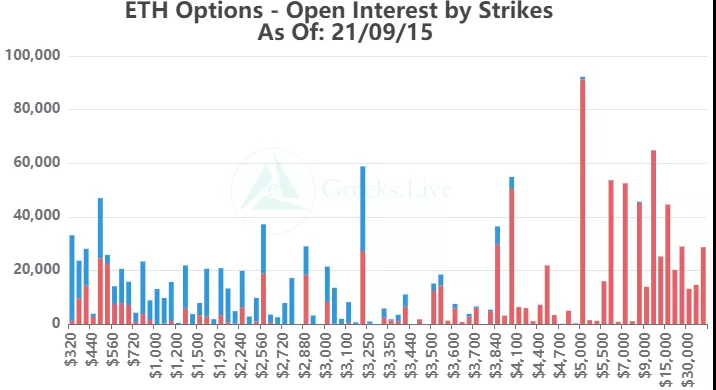

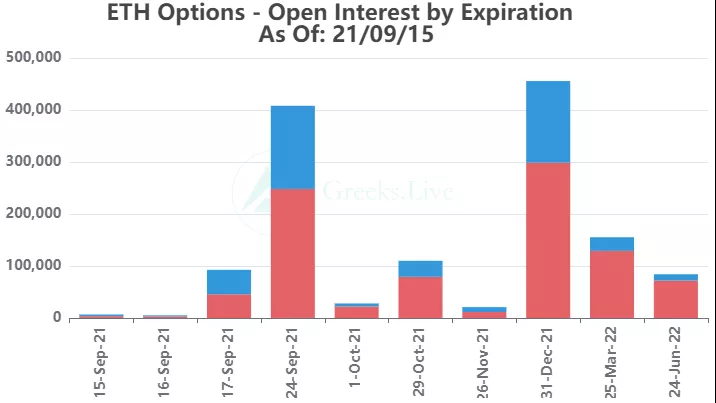

The open interest of Ethereum options is 1.37 million, worth 4.7 billion US dollars, and the trading volume is 59,000.

【Historical Volatility】

10d 103%

30d 90%

90d 93%

1Y 108%

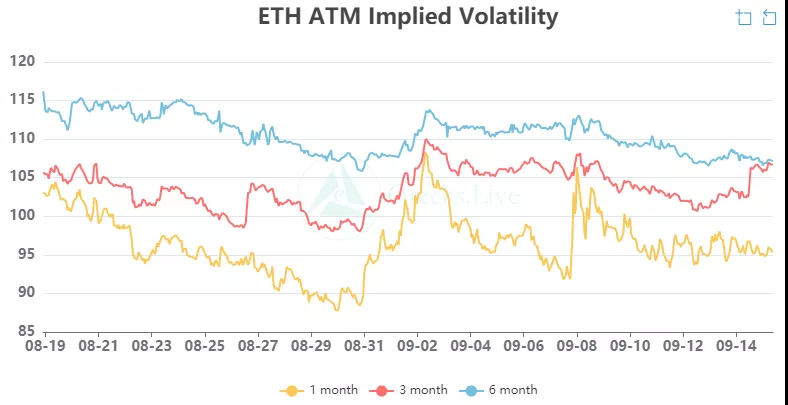

【IV】

Each standardized period IV:

【Historical Volatility】

9/14:1m 99%,3m 105%,6m 107%,DVol 106%

Today: 1m 98%, 3m 105%, 6m 107%, DVol 106%

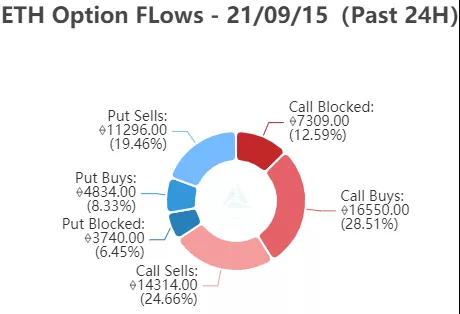

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

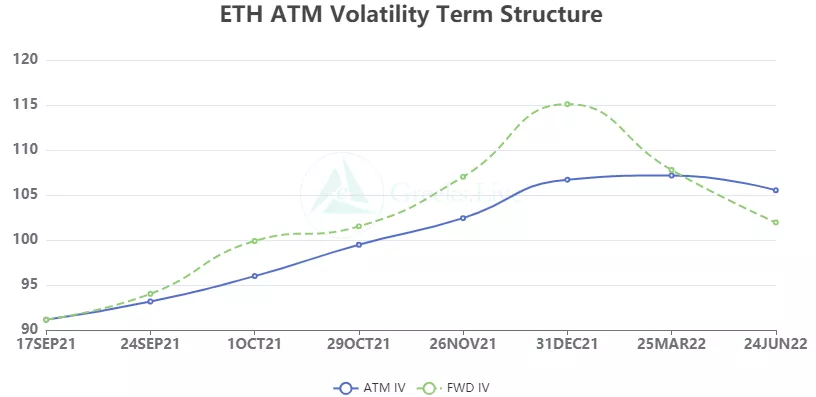

【Option position distribution】

From the perspective of Option Flows, the volume of bulk transactions has picked up, with 7,300 bulk call options and 3,740 bulk put options, both of which are higher than the recent average level. It is still necessary to wait for opportunities in the less volatile market.