【Deribit Options Market Broadcast】0914——Fake News

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

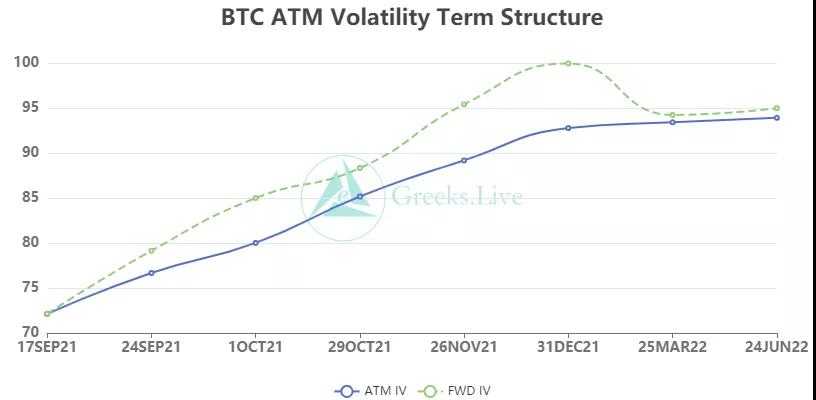

Last night, the false news of the cooperation between Wal-Mart and LTC drove the mainstream currency to rise, but it fell all the losses after it was confirmed to be false. The overall reaction of the option market is not great, and IV and trading volume have not changed significantly. False news is likely to be more frequent in the next period of time, and investors need to be more cautious.

【Market Heat】

The settlement price of Ethereum yesterday was 3,203 US dollars, and the price-to-currency ratio of Reddit fans was 331, and the annualized growth rate of fan interest in seven days was 44%

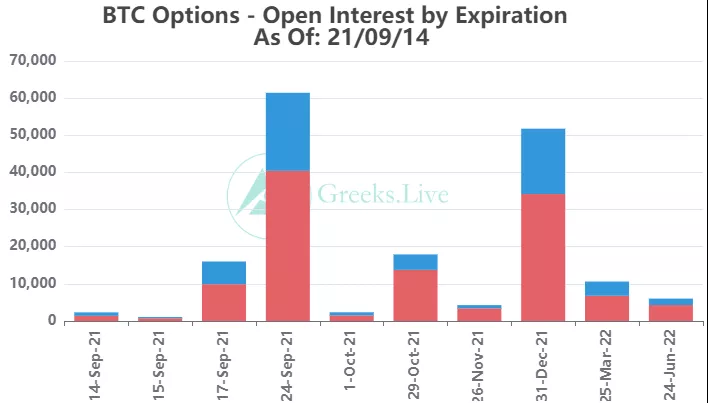

【BTC Options】

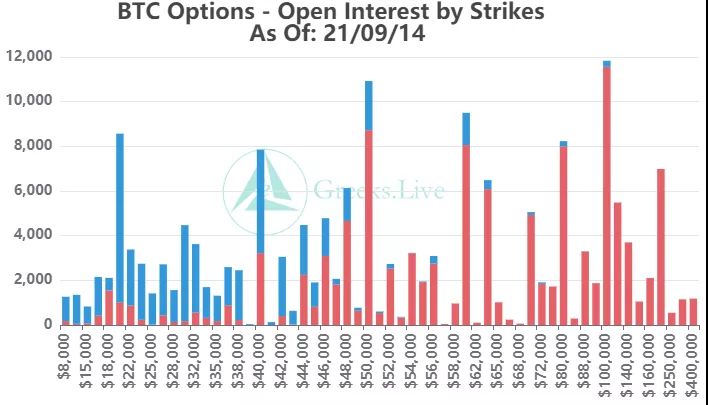

The option open interest was 173,000 contracts, worth $7.8 billion, and the option volume was 14,000 contracts.

【Historical Volatility】

10d 81%

30d 64%

90d 70%

1Y 79%

【IV】

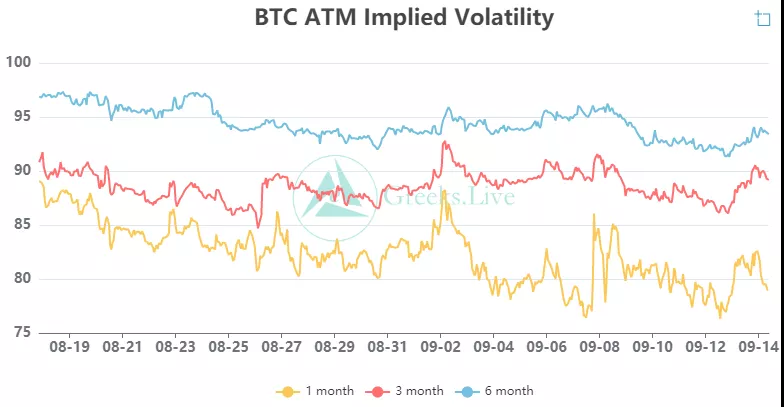

Implied volatility for each normalized term:

【Historical Volatility】

9/13:1m 84%, 3m 91%, 6m 92%,DVol 92%

Today: 1m 84%, 3m 91%, 6m 92%, DVol 92%

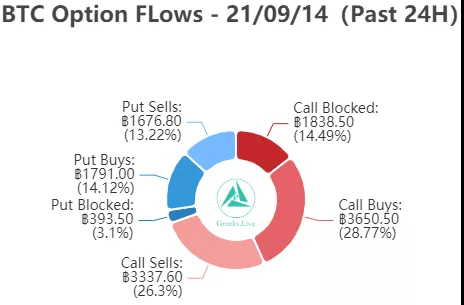

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

【Option position distribution】

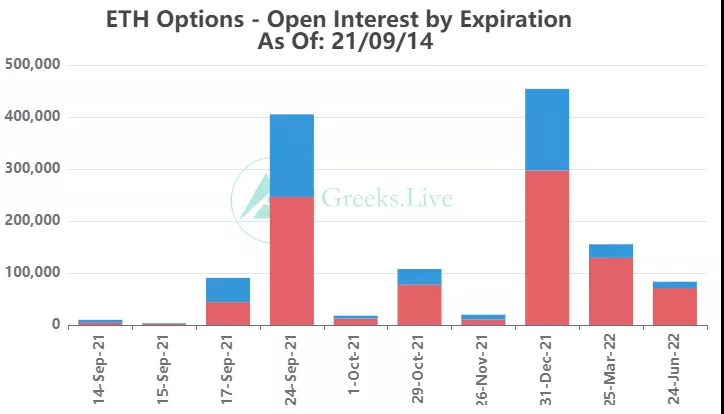

【ETH Options】

The open interest of Ethereum options is 1.35 million, worth 4.4 billion US dollars, and the trading volume is 73,000.

【Historical Volatility】

10d 102%

30d 90%

90d 93%

1Y 108%

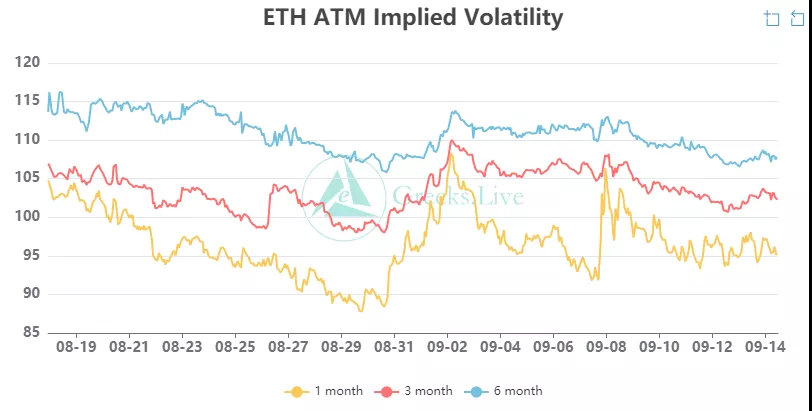

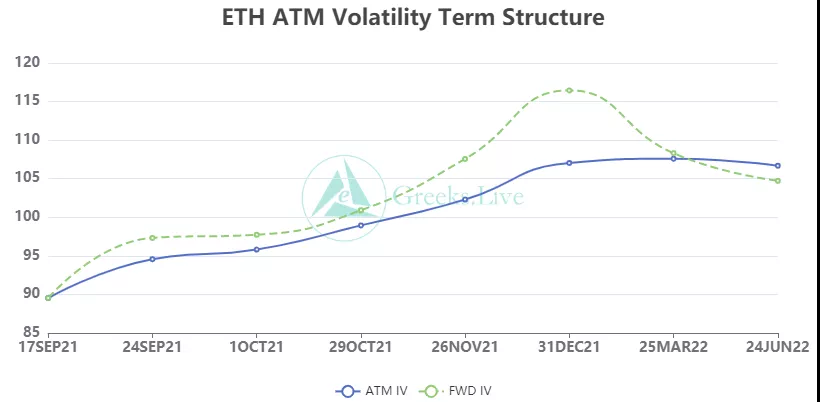

【IV】

Each standardized period IV:

【Historical Volatility】

9/13:1m 97%,3m 104%,6m 107%,DVol 106%

Today: 1m 99%, 3m 105%, 6m 107%, DVol 106%

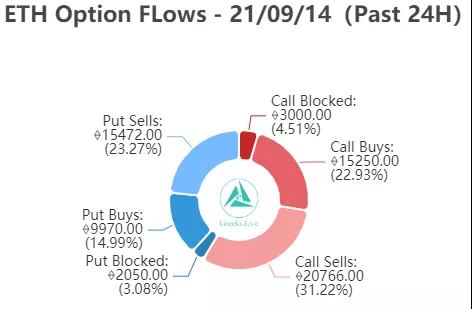

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

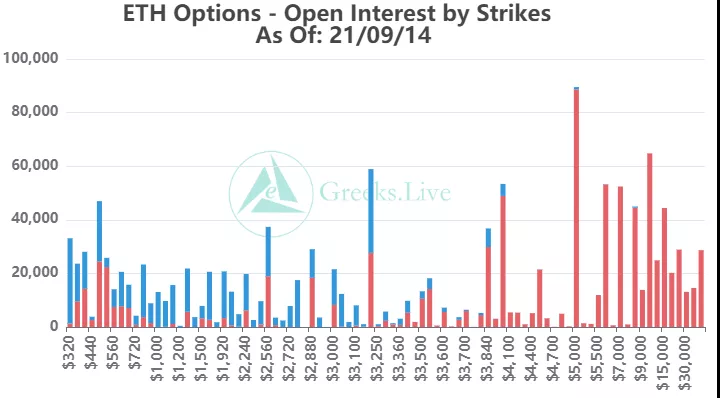

【Option position distribution】

From the perspective of Option Flows, the trading volume on weekends has risen sharply. It is more reasonable to exclude weekends from the measurement of trading volume, and the trading volume on weekdays is close to that of normal Mondays. There are fewer large transactions, and the volume of month-end call options sold accounts for a relatively high proportion, which is within the normal range for a market with less volatility.