【Deribit Options Market Report】0913——IV up

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

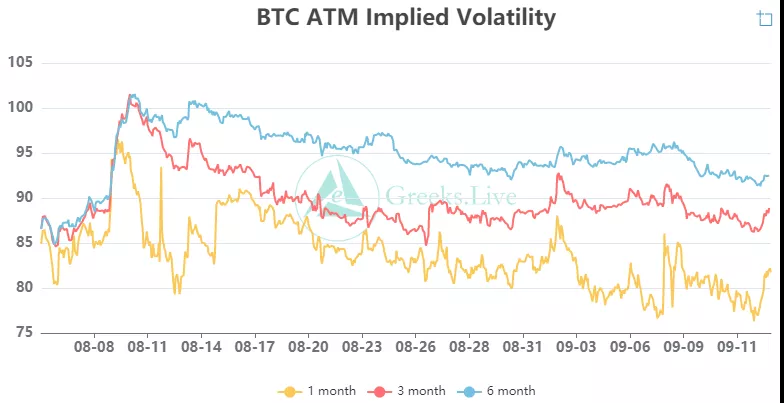

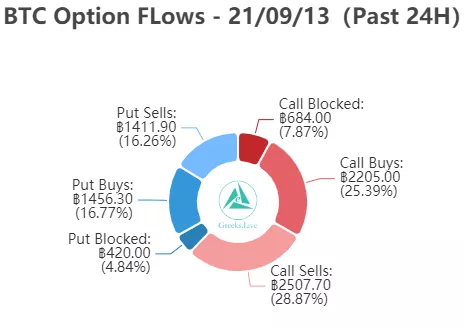

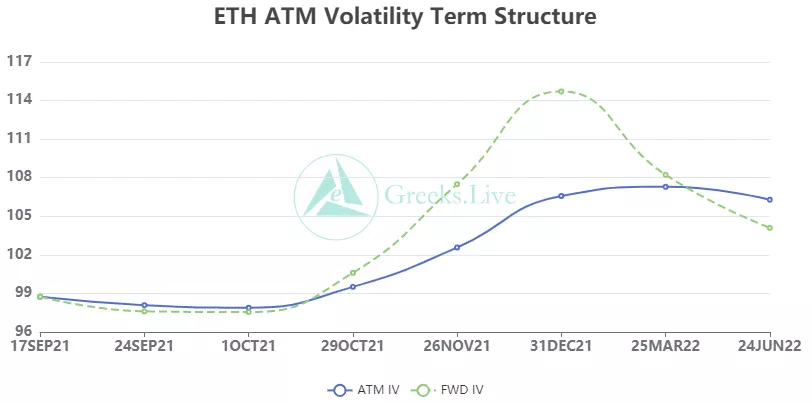

Bitcoin IV began to rise last night, and the increase was close to the level during the 7-day plunge. However, the market has not fluctuated too much, and the data has not changed. At the same time, there has been no change in Ethereum IV. It seems that some people are buying short-term average bullish and ultra-short-term average bearish.

【Market Heat】

The settlement price of Ethereum yesterday was 3313 US dollars, and the price ratio of Reddit fans was 335, and the annualized growth rate of fan interest in seven days was 55%

【BTC Options】

【Historical Volatility】

【Historical Volatility】

10d 82%

30d 69%

90d 73%

1Y 79%

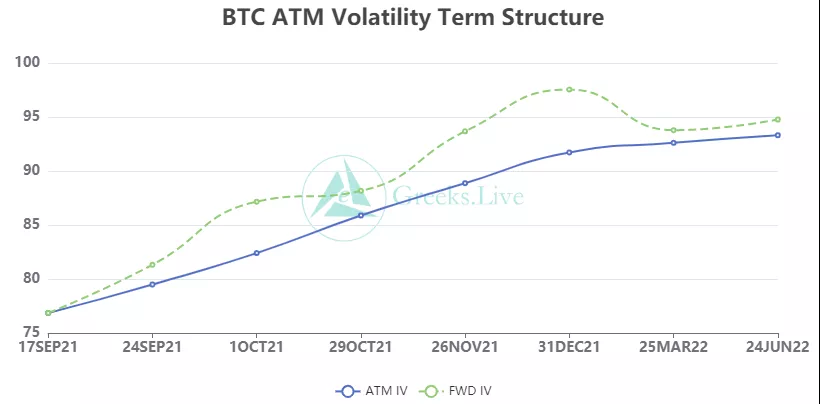

【IV】

Implied volatility for each normalized term:

Today: 1m 84%, 3m 91%, 6m 92%, DVol 92%

9/12:1m 82%, 3m 89%, 6m 92%,DVol 90%

Today: 1m 84%, 3m 91%, 6m 92%, DVol 92%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

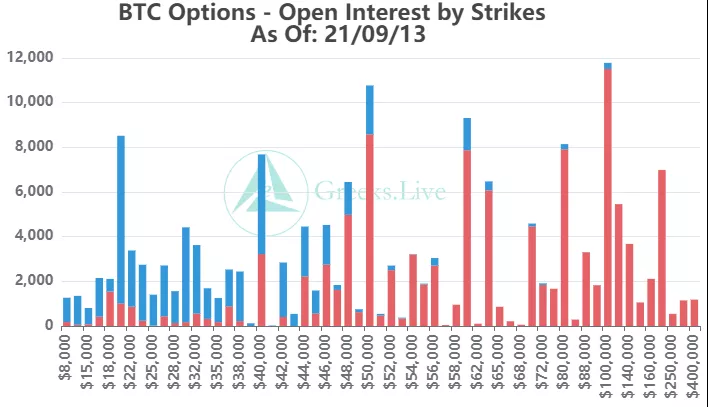

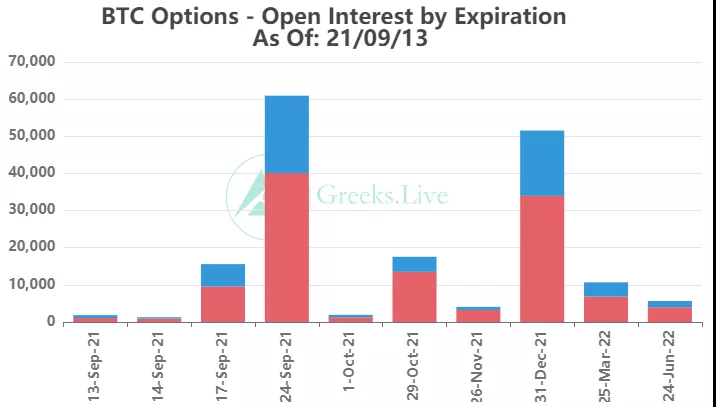

【Option position distribution】

【Option position distribution】

【ETH Options】

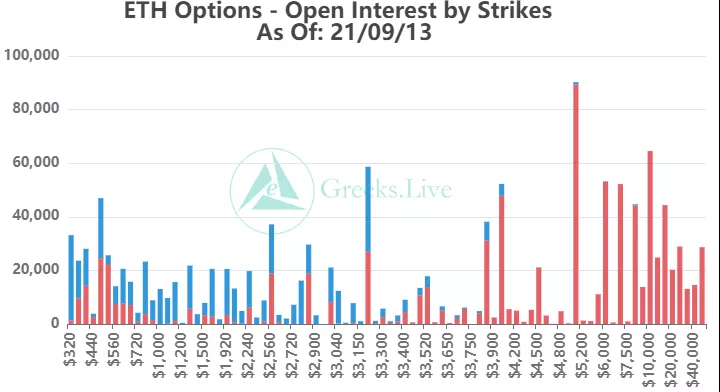

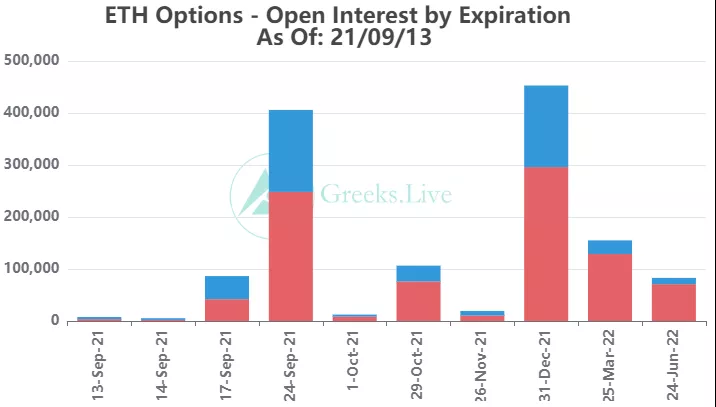

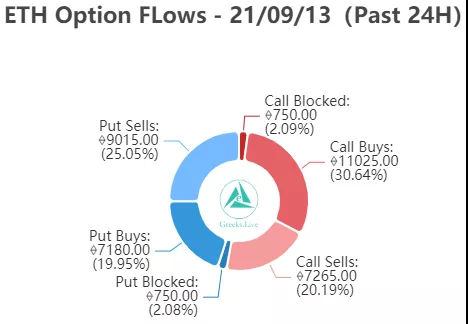

The open interest of Ethereum options is 1.33 million, worth 4.4 billion US dollars, and the trading volume is 40,000.

【Historical Volatility】

10d 117%

30d 91%

90d 93%

1Y 108%

【IV】

Each standardized period IV:

【Historical Volatility】

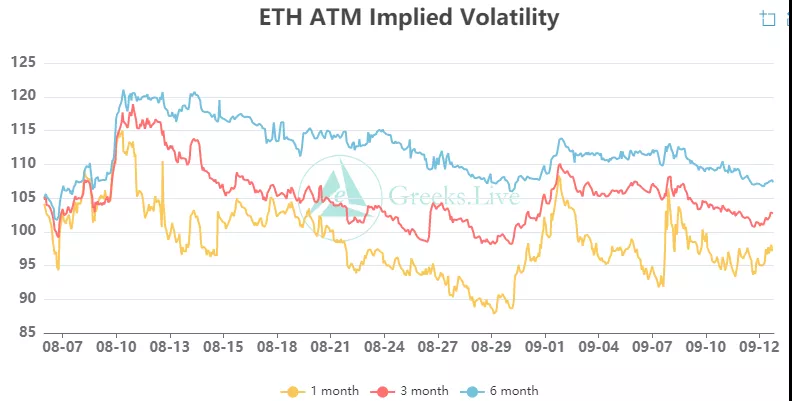

9/12:1m 97%,3m 104%,6m 107%,DVol 105%

Today: 1m 97%, 3m 103%, 6m 107%, DVol 107%

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

From the perspective of Option Flows, the trading volume on weekends is relatively low. The rules of Ethereum are different from those of Bitcoin. Sundays are always lower than Saturdays. The total trading volume of call options and put options is relatively balanced, and there are few large transactions.