DeFi Weekly | DeFi Weekly Important Data & Popular Projects, just read this article (9.7-9.13)

The DeFi Weekly Report is a column launched by Odaily in conjunction with the global DeFi incubator DeFictory, the blockchain marketing consulting company WXY, the data provider OKLink, and the content partner BlockArk. The four sections of market investment and financing information show important changes in the DeFi world in the past week.

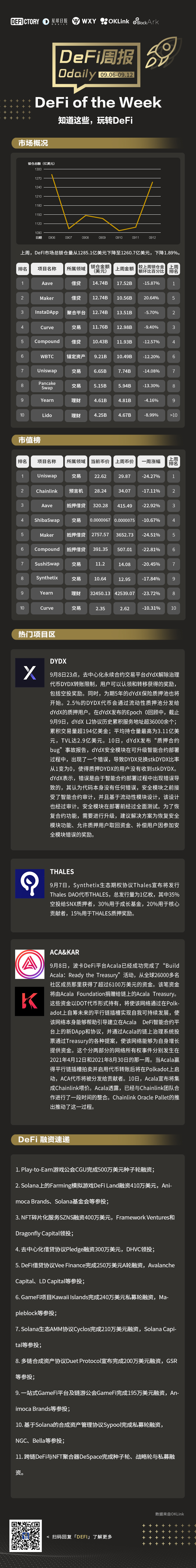

secondary title

popular items

DYDX

popular items

THALES

At 23:00 on September 8, the decentralized perpetual contract trading platform dYdX lifted the transfer restriction of the governance token DYDX, and users can claim and transfer the rewards obtained, including airdrop rewards. At the same time, the 5-year dYdX insurance staking pool will also start. 2.5% of DYDX tokens will be distributed to dYdX staking users through the liquidity staking pool. In the Epoch 0 review released by dYdX, as of September 9, the dYdX L2 protocol has historically accumulated more than 36,000 service addresses; the cumulative transaction volume has exceeded 19.4 billion U.S. dollars; the highest average open interest is 311 million U.S. dollars, and the TVL is 290 million U.S. dollars. On the 10th, dYdX released the "Pledge Contract Bug" accident report. During the deployment of the dYdX security module, an error occurred during the deployment of the upgradeable smart contract, which caused the ratio of DYDX to stkDYDX to change from 1 to 0, so that users who pledged DYDX did not receive stkDYDX . dYdX stated that the error was caused by an error in the smart contract deployment process. It believes that the code itself has no errors. The security module has been audited by the smart contract before, and it is based on the liquidity module design, which has also been audited. Security modules are thoroughly tested before deployment. In order to restore the function of the contract, an upgrade is required. The suggested solution is to restore the function of the security module, allow pledged users to withdraw funds, and compensate users for rewards for participating in the error of the security module.

ACA&KAR

secondary title

financing information

financing information

Play-to-Earn Game Guild CGU completes USD 5 million in seed round financing;

DeFi Land, a farming simulation game on Solana, raised $4.1 million, with participation from Animoca Brands and the Solana Foundation;

NFT fragmentation service SZNS raised $4 million, led by Framework Ventures and Dragonfly Capital;

Decentralized lending protocol Pledge raises $3 million led by DHVC;

Vee Finance, a DeFi lending protocol, completed its Series A financing of US$2.5 million, with participation from Avalanche Capital and LD Capital;

GameFi project Kawaii Islands completed a $2.4 million private equity round of financing, with participation from Mapleblock and others;

Cyclos, the Solana ecological AMM agreement, completed a financing of US$2.1 million, with participation from Solana Capital and others;

Duet Protocol, a multi-chain synthetic asset protocol, announced the completion of a $2 million financing, with participation from GSR and others;

The one-stop GameFi platform and the chain game association GameFi completed a financing of 1.95 million US dollars, and Animoca Brands and others participated in the investment;

Sypool, a Solana-based synthetic asset management protocol, completed its private equity round of financing, with participation from NGC and Bella;