From sky-high price pictures to sky-high text, what is the ultimate form of NFT?

image description

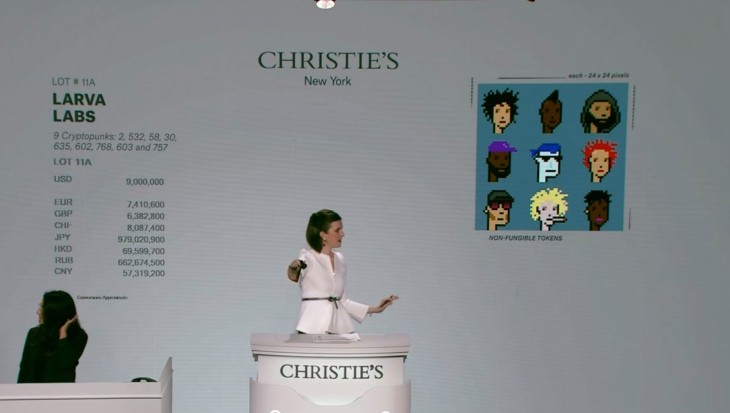

Christie's Auction of CryptoPunk Live

image description

curry twitter avatar

secondary title

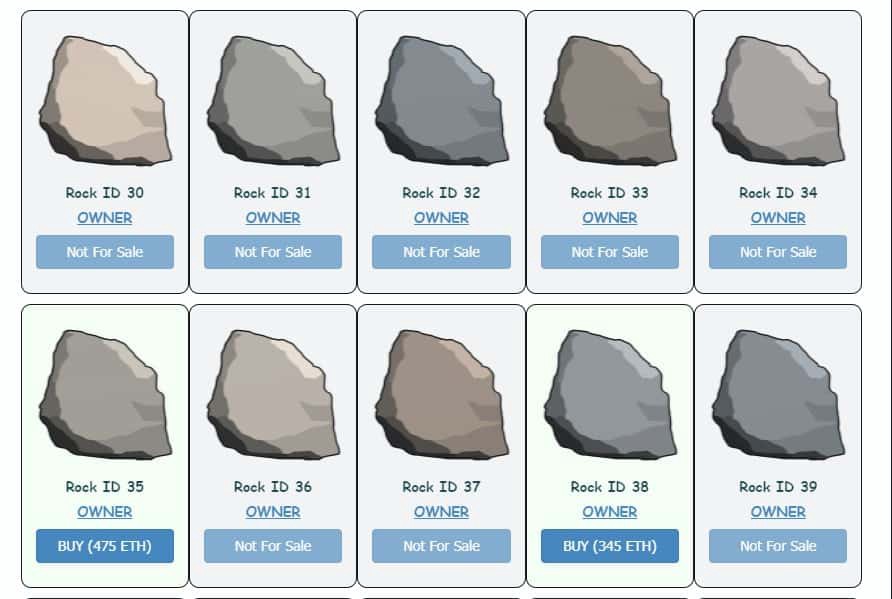

EtherRock

Reasons for the sky-high price of NFT

Even if the vast majority of people think it's a hype, a new bubble and a scam. But one question that has to cause people to think about it is:Why can't 99% of NFTs be sold at sky-high prices like CrytpoPunk or EtherRock?

The fundamental reason is that in the encrypted digital field where everything can be imitated and copied, everyone recognizes itsCreate value, the first isscarcity. CryptoPunk was launched in 2017 by New York-based software company Larva Labs. They make 10,000 CryptoPunk characters unique and tied to an Ethereum smart contract so that they can no longer be changed. And this behavior createsIt is the first "artwork" in human history that has an independent record and ownership mechanism for buying and selling.

When you look at two identically made bowls, one made yesterday and the other 1,000 years ago, the value cannot be compared. If this bowl is also identified as the earliest human bowl by authoritative archaeology, then this bowl will definitely be invaluable.The evaluation logic of this set of values has not changed in NFT.

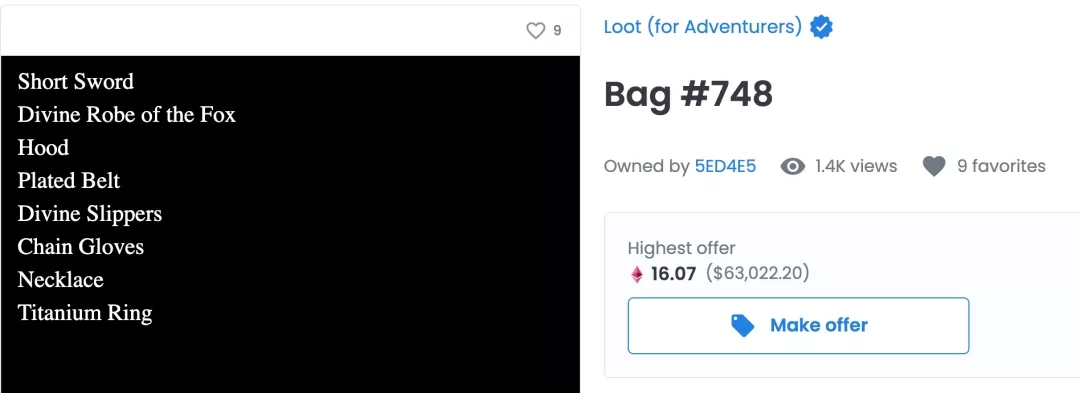

Recently, the text (TXT) NFT project Loot has become popular. From the perspective of originality, most people think it is the first text NFT and the first NFT that is not defined and guided by the creator or the team, and the value is achieved through the community. It is endowed by authoring the text from the bottom up. But in fact, it can only be regarded as the first creation on the Ethereum chain.image description

16 Loots worth about $63,000 in ETH

decentralizeddecentralized, provided 8 lines of text, and left the following stories to the community to create. But this decentralization is only relative. Loot can only mint 8,000 Loot, and the creator reserved more than 222 for himself as a reward, and due to information and capital advantages, most of the output is directly reserved by large investors. Compared with the fair distribution pursued in the early stage of cryptocurrency, the decentralization of Loot is not so pure.

We can see mainstream movers for NFTsFrom the pursuit of original value to the pursuit of the core spirit of decentralization in the encryption worldsecondary title

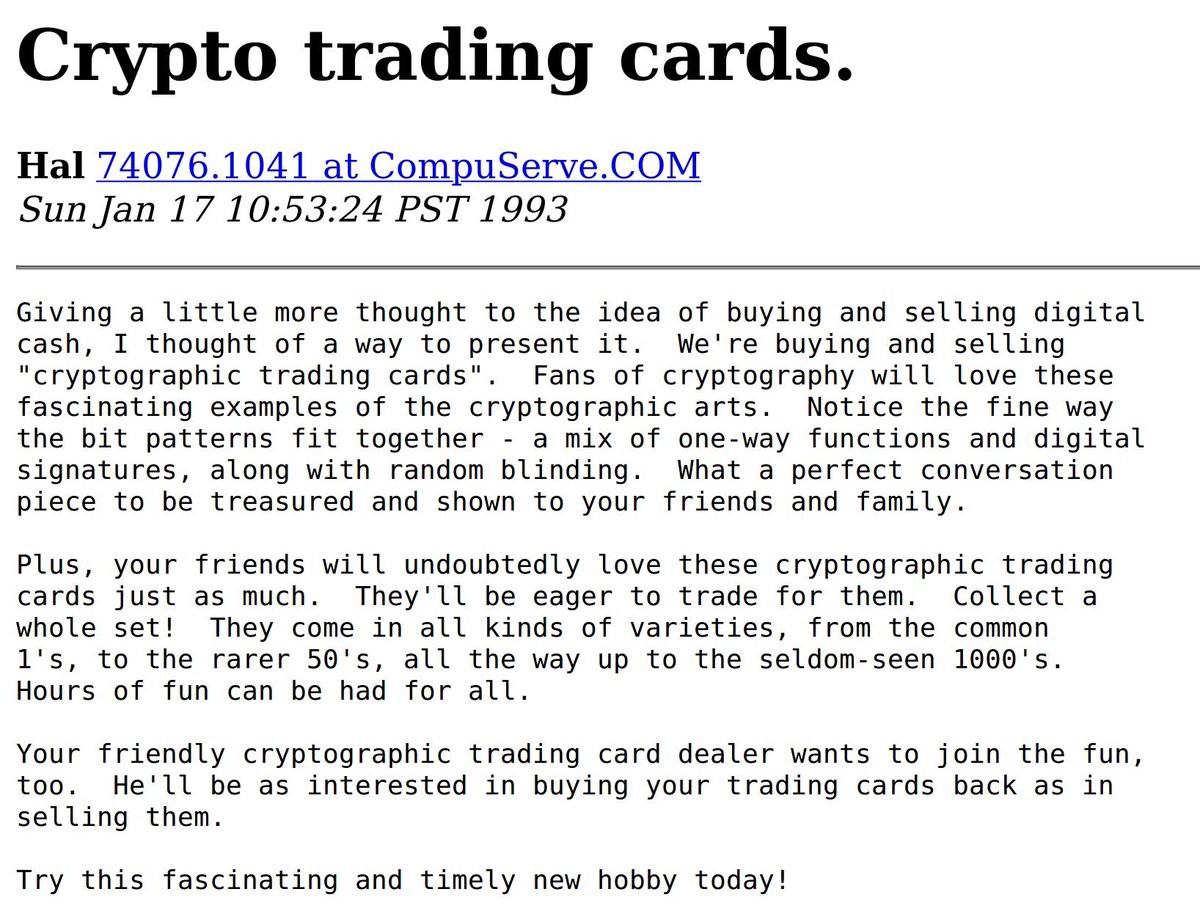

The prototype of NFT

image description

Hal Finney's description of NFT in 1993

Although this card was not really implemented at the time, we can infer that the password string representing the encrypted card cannot be randomly equivalent. Because random equivalents represent an infinite number and each one is exactly the same, there will be no collection value unless the hash result meets certain established rules, similar to the fixed PoW (workload proof) difficulty.

If there are no pre-set rules for valid hashes for cryptographic cards, the potential number is infinite, and one of the collectibles must be some kind of rare hash. for example:

“000000000000007f8c5aba11cf3b5e67a2”

“d01e14a7f8c5aba11cf3b025285e67a26687”

secondary title

The prototype of PoW-NFT

Let's move on to 1998, when Nick Szabo, the father of smart contracts, invented Bit Gold. In simple terms, Bit Gold is an "expensive encrypted gold computed at the expense of electricity."

proof of workproof of work: Proof of generating value through computing power. Bit Gold believes that a valid hash value must follow some established rules, such as the number of leading zeros in the hash result. Due to the unpredictability of hash values, the only way to find a valid hash is to repeatedly calculate it. Such a valid hash proves that its creator did expend computing power. Anyone who finds a valid hash will own that hash.

But Bit Gold determined that this effective hash"Fixed Difficulty", leading to inflation: With the advent of large computing power and the continuous improvement of computers, it will become easier and easier to generate effective hash values. This means that the scarcity of the hashrate will become less and less, so that a large number of hashrates will dilute the overall value.

In addition to the unavoidable inflation, since they are represented by a string of hash results, the cost of each Bit Gold is different, and the value between them is not the same, so they cannot be interchanged. But for currencies with large-scale daily payment settlements, fungibility is an absolutely necessary cornerstone. Saab failed to fundamentally solve the problems of inflation and fungibility, which directly led to the failure of Bit Gold, although it was only one step away from Bitcoin.

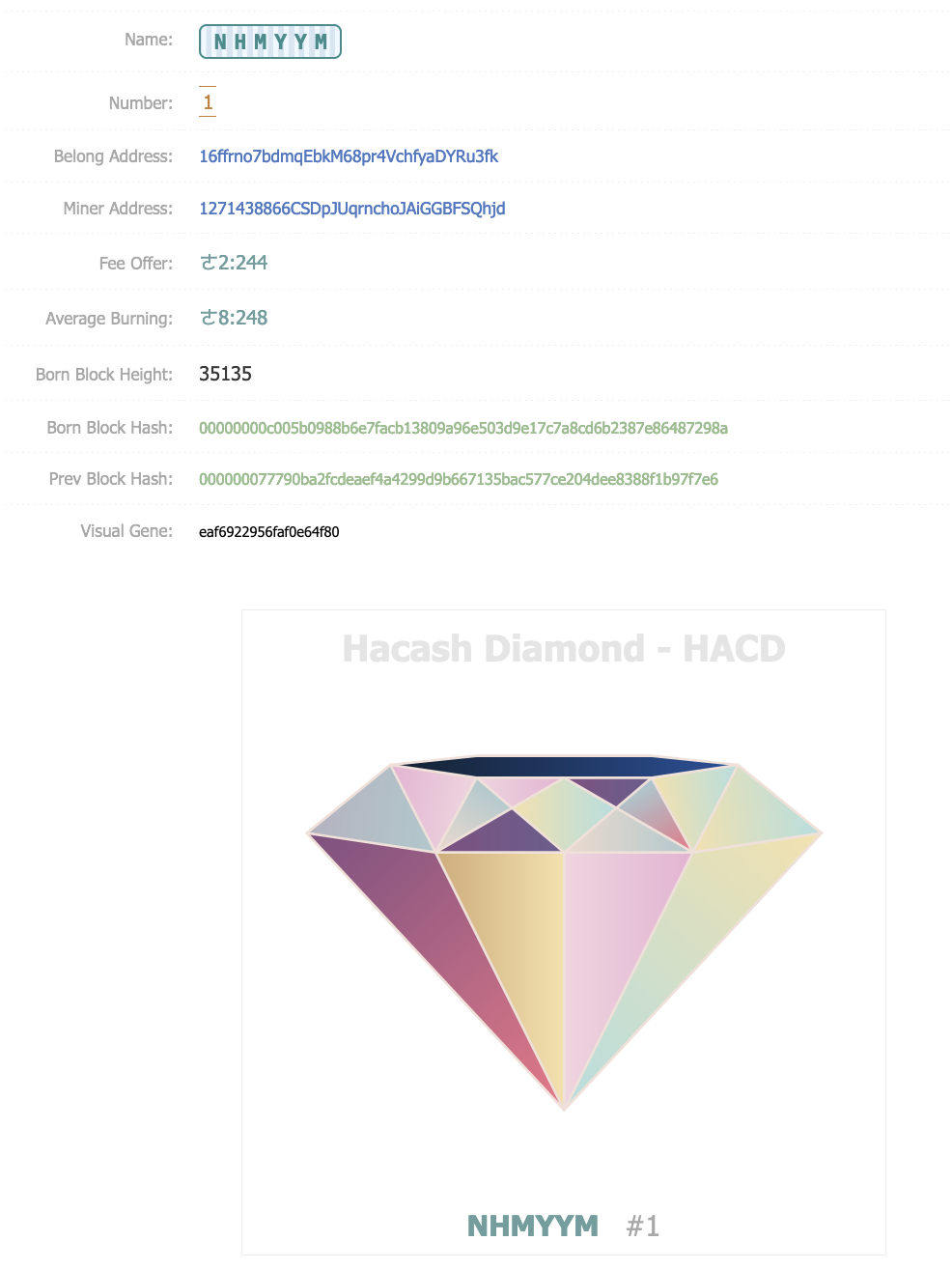

After more than 20 years, the project closest to Finney's encrypted trading card concept and Saab Bit Gold was realized in a white paper called "Hacash: An Encrypted Currency System for Real-time Settlement of Large-Scale Payments" in 2018, and in May 2019 On May 16th, the block height 35135 on the Hacash chain generatedThe first with a text NFT:"NHMYYM"secondary title

First PoW-NFT: Hacash Diamond

HACD creativity through settingandandbidding auction mechanismimage description

The first HACD: NHMYYM

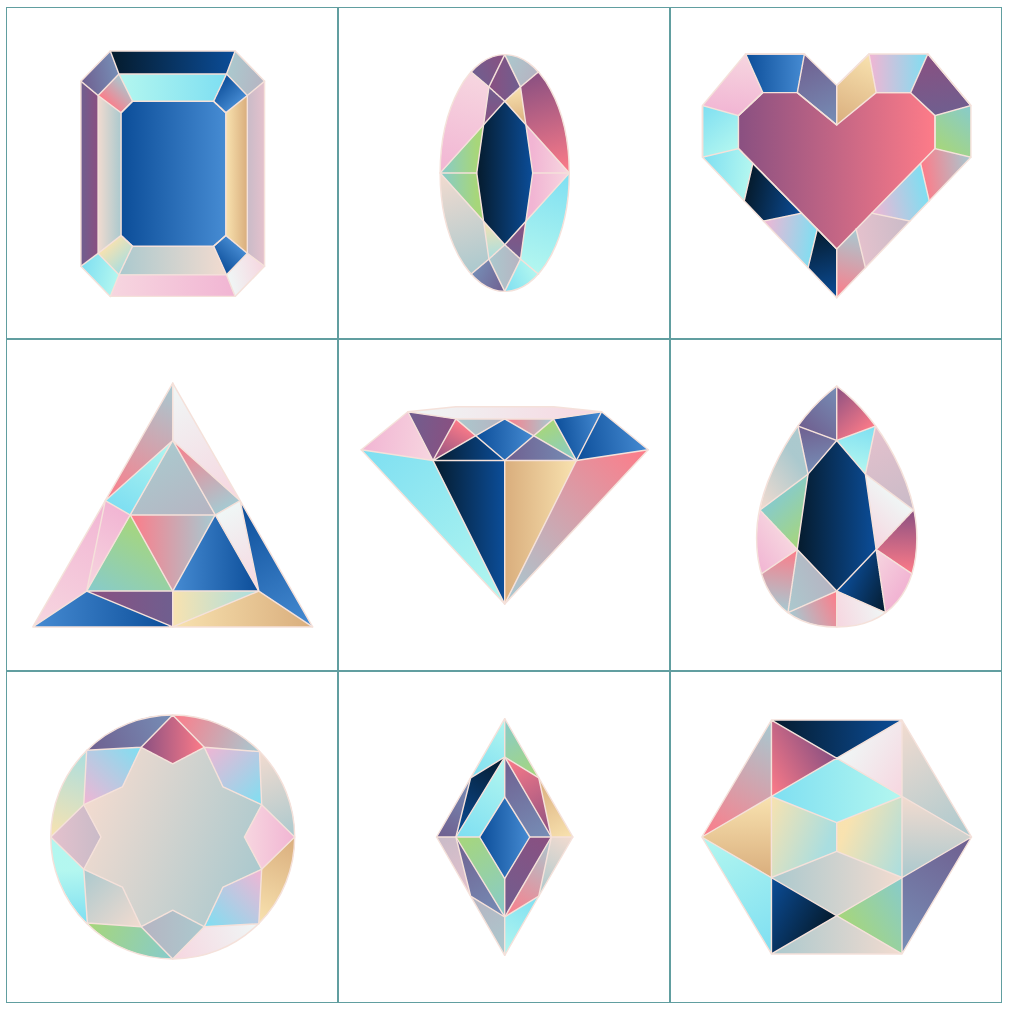

With the development of HACD, on August 11, 2021, the community proposed the HIP-5 visualization proposal. Added diamond vision to each HACD. Every diamond is unique and comes in 9 different shapes, 16-17 facets and 16 colors to achieve. In addition to the "tapered diamond" in the middle of the picture below, there are 8 other special shapes that appearThe probability is only 3%. ifSolid Color Alienimage description

HACD visualization

It is worth mentioning that the diamond color is determined by the 6-letter and 11-digit hash of HACD. This should be NFT historyFor the first time, use text to create NFT from bottom to topimage description

Community Creation of HACD Text

And this bottom-up, decentralized spirit runs through all aspects of HACD. Before the creation of the first HACD, the founder disappeared inexplicably just like Satoshi Nakamoto, leaving only the white paper for the developers in the community. There is no capital manipulation, no big boss endorsement, and the community operates and participates spontaneously. Each HACD is mined out of computing power and bidding costs like Bitcoin. There is no pre-mining and no developer rewards.No one has free chips to cut anyone's leeks in HACD. But the price of this completely decentralized and spontaneous operation is that it develops very slowly and is unknown.

In addition, HACD is not only the originator of text NFT, but also the closest to the Finney encrypted trading card.The first PoW-based NFT. This means that the way to obtain HACD is through mining like Bitcoin, and there is no pre-mining reservation for HACD, and all people use CPU to compete to mine HACD from scratch.

In addition to the competition of computing power, when a large number of HACDs are dug out at the same time in a block, a token HAC on the Hacash chain is required for bidding settlement. The HACD with the highest bid will be packaged, and the unpacked HACD will be discarded. , waiting to be dug out next time.

The number of the entire HACD is limited, with a total of 16,777,216 pieces. If the increase in difficulty is not considered, it will theoretically take at least 800 years to be mined. However, as the difficulty of mining continues to increase, in fact it will never be possible to mine HACD. expectedIn 2025, only about 100,000 HACDs will be in circulation on the market.

In addition, in the face of extreme situations such as the NFT market crash, when the demand for HACD in the market drops, the output of HACD will drop immediately or stop directly, ensuring itsScarcity based on market demand.

image description

The original words of Satoshi Nakamoto

secondary title

NFT ultimate form

After reviewing the development history of NFT and understanding the characteristics of HACD, we seem to be able to draw a summary of the ultimate form of NFT:

Contains a certain aspect of innovation, with original value

Fair distribution, with latecomers can continue to participate

Complete community participation drives the formation of value and shapes marketization

Expensive computing power cost mining, forming a fair value to rely on

Possibility of bottom-up, decentralized secondary creation

Limited but not overly rare, enough people involved

Have a certain visual appreciation value, not just artistic value

Hacash Diamond is the first text NFT. Each HACD has a unique diamond vision. The number is limited but not too rare. It is also the first NFT based on the PoW mechanism. It has the same decentralization as Bitcoin and is the closest Finney's vision of NFT in 1993 and Saab proposed the realization of BitGold, perhaps this is the ultimate form of NFT.

Looking back, the hot hype in the current NFT field has basically been exhausted, leaving only the PoW-NFT track that has not yet been discovered. At present, the market value of cryptocurrencies represented by PoW is still the absolute mainstream, so will PoW also become the absolute mainstream in the NFT field that focuses on pure value storage? HACD has hit the hot spot of TXT-NFT three years in advance, so will HACD hit the next possible hot spot again: PoW-NFT?

The rise of a concept will bring a bubble, and when the bubble bursts and the tide recedes, which NFTs are swimming naked, and which NFTs rely on the creation of value, rely on the decentralized community, and rely on the value support of PoW, like non-NFT bits As the currency continues to prosper and develop, time will be the best answer.