a16z "Open Sources" Its Token Delegation Process in Response to Transparency Questions

This article comes fromThe Block, original author: Ryan Weeks

Odaily Translator | Nian Yin Si Tang

Summary:

This article comes from

, original author: Ryan Weeks

Odaily Translator | Nian Yin Si Tang

secondary titleSummary:- a16z released more details about its token delegation program, revealing for the first time new beneficiaries such as Kiva and Mercy Corps.

- The Silicon Valley heavyweight venture capital firm called for more transparency in how influence is distributed among DeFi token holders.

Andreessen Horowitz (a16z) released new details about the firm’s efforts to influence DeFi projects.

June 24, a16z

Announcing the launch of a $2.2 billion cryptocurrency fund. The venture capital giant currently manages $865 million through two early-stage funds, and with the establishment of the new fund, its crypto assets under management (AUM) has exceeded $3 billion.In addition, a16z said it has recruited five executives to join its team, including former SEC director Bill Hinman, former Twitter, Google and Facebook communications director Rachel Horowitz, who served as Joe Biden (Joe Biden) and Hillary Clinton. Tomicah Tillemann, a senior advisor to Hillary Clinton, Alex Price, an investor, entrepreneur and computer scientist, and Brent McIntosh, Treasury Undersecretary for International Affairs.

At the same time, a16z has invested heavily in cryptocurrencies and DeFi, supporting some of the industry's most well-known decentralized protocols, including Uniswap and Compound, among others.

a16z Unlike traditional venture capital investments, investors in DeFi projects tend to accumulate the protocol’s native tokens.For example, as a major supporter of the DeFi platform Celo,

a16z owns a certain amount of Celo tokens. Tokens provide financial exposure and a means to influence project development by participating in governance votes.。

previously disclosedopen letterBut the practice has sometimes proved controversial. In July, Harvard Law Blockchain and Fintech Initiative from Uniswap treasury

Received a $20 million grant

Chris Blec, founder of DeFi Watch, claimed that the proposal was largely decided by a16z delegators. He published a letter to a16z

open letter

, calling for greater transparency about how the company commissioned the program.

secondary title

Allocation Governance

In a blog post published on August 26, a16z shared more details about its token delegation process, including a list of best practices, how to evaluate delegators, the legal mechanism, the composition of the company's existing delegation network, and future improvements idea.

The investment firm said the mandate was an effective way to contribute to the "long-term development of a higher quality governing body".

a16z went on to write:

"However, to truly exploit these advantages requires a 'robust' form of delegation. A mechanism that not only reduces apparent concentration, but also increases the quality and diversity of governing bodies. Perhaps most importantly, empowering each Delegators vote independently of token holders in whatever way they see fit."

The transparency proposal mentioned by a16z is also notable. It states that it will become increasingly important for the DeFi community to have access to information about “involved parties, potential delegation terms, delegator-token holder relationship, etc.”

Source: a16z

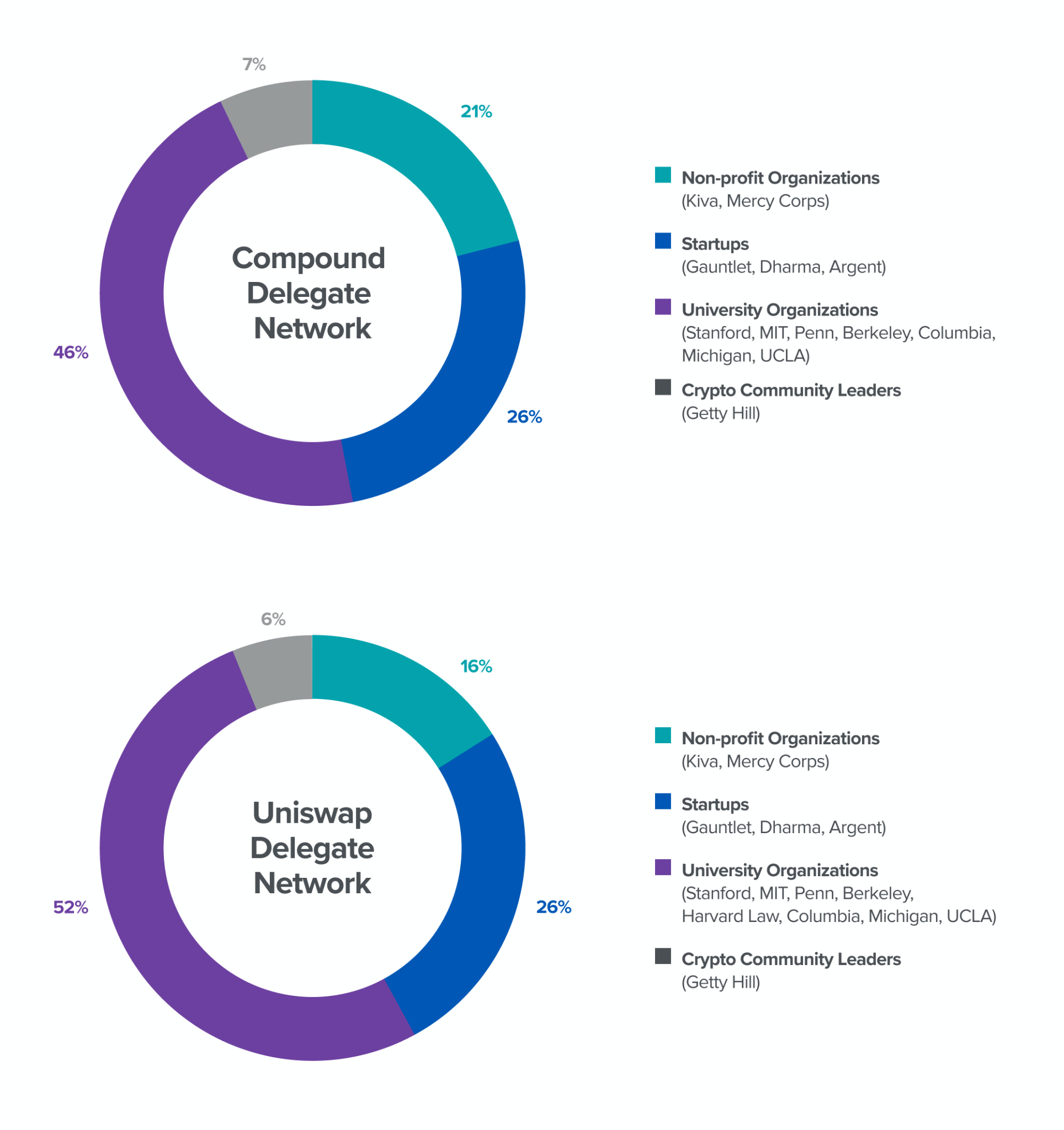

To that end, a16z published its current breakdown of the delegation network for Uniswap and Compound.

Breakdown data (see chart below) shows for the first time that microfinance firm Kiva and NGO Mercy Corps received tokens from a16z alongside university groups, startups and crypto professionals.