Written by: Analyst Ashley.R

first level title

2021 - the first year of GameFi chain games

If 2020 is the first year of the outbreak of DeFi, then 2021 will undoubtedly be the first year of the outbreak of GameFi chain games.

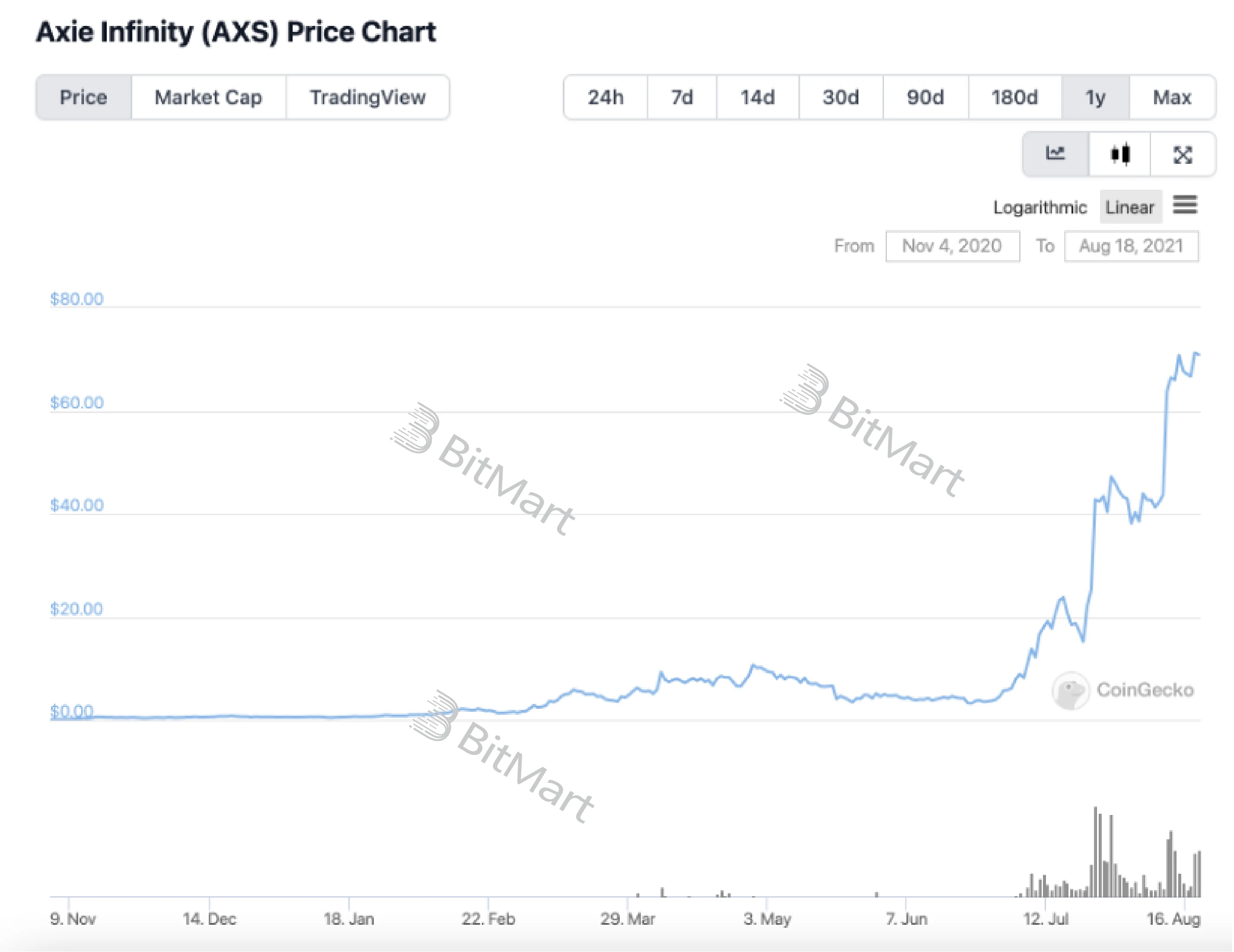

image description

Source: CoinGecko

Source: CoinGecko

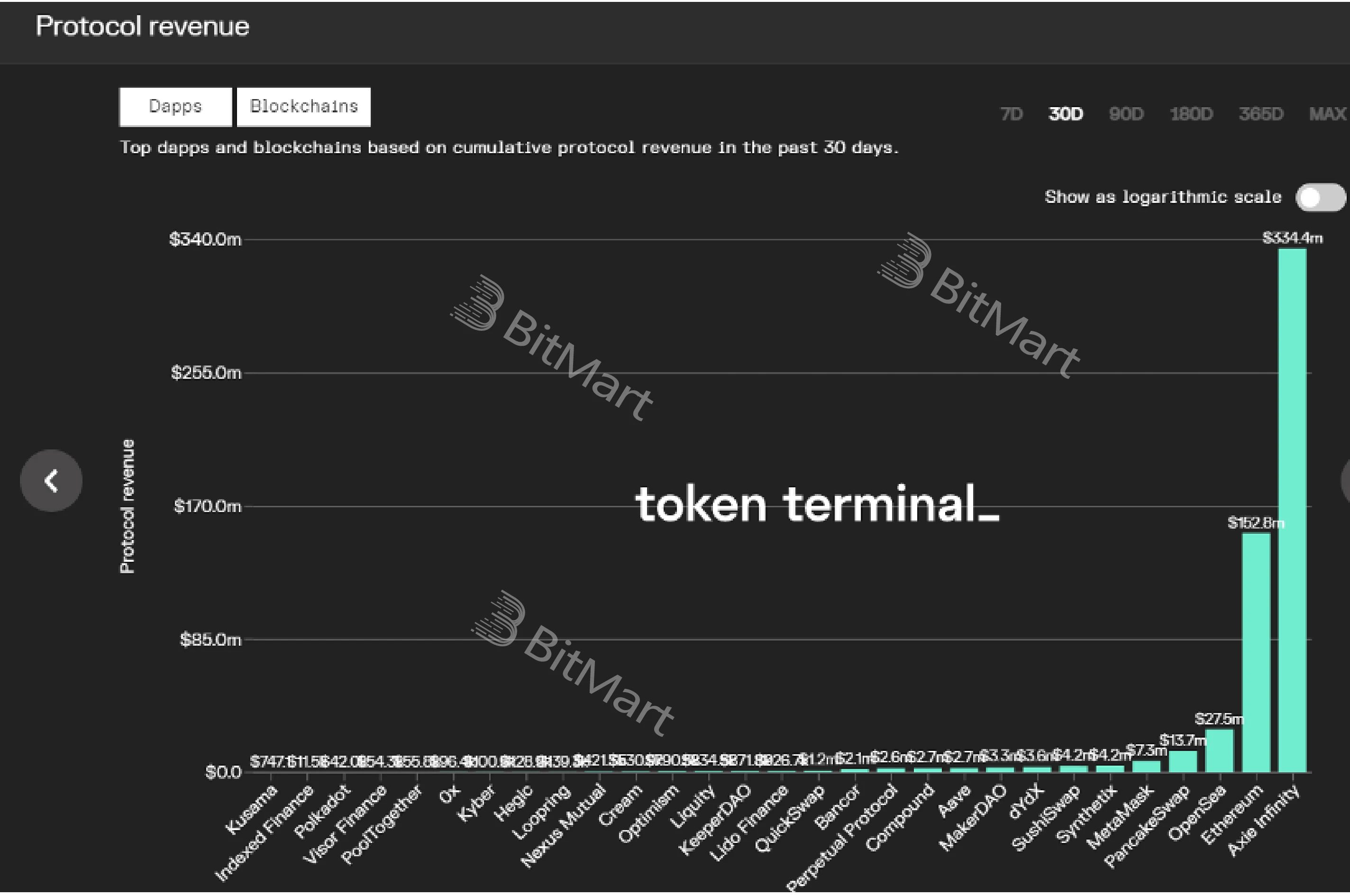

According to the data of Token Terminal, a DApp data statistics company, the income of the Axie Infinity agreement in July was 4.2 times the combined income of the 2nd to 10th agreement income of the entire network.

The monthly income of the representative works of blockchain games can already compete with the top traditional games.

August 17, 2021 dapps and blockchain protocol revenue in the past 30 days

secondary title

DeFi and GameFi

The development of chain games has gone through three stages: 1. Game coins are uploaded to the chain; 2. Assets such as game equipment and props are uploaded to the chain to confirm the rights in the form of NFT tokens; 3. The internal logic and core rules of the game are uploaded to the chain.

From 2017 to 2021, the phenomenon-level product Axie Infinity appeared in the chain game field, driving the GameFi model (DeFi+NFT+game), and more people noticed the play to earn play to earn model - while playing Earn, the token assets that players get in the game can be bought and sold. Axies Filipino players can earn more monthly in-game income than their own wages.

GameFi, Game Finance (adding financial elements to the game), or the more core model called Play to Earn, is essentially a capital game. GameFi is actually PoW+DeFi. By spending time and energy to obtain income through games, there is no need for original funds, while DeFi is based on the Proof of Stake (PoS) consensus mechanism, which requires original capital costs and obtains income through mining. The DeFi component in GameFi is mainly reflected in: NFT game assets are decentralized and can participate in providing liquidity and some pledge mining.

GameFi focuses on playing games, while DeFi focuses on mining. GameFi replaces the mining process in DeFi with games. Money is not a necessary condition, but time and energy are the key conditions for benefiting. Users have to play those characters and props, and win complex game levels and strategies to make money. Compared with mining, this path is much longer, so the project will have a longer life cycle. If the economic model and gameplay design of the game itself are more mature and perfect, the life of the game can be extended. Moreover, the DeFi project fee is only about 0.3%, while the GameFi project party earns more than 10 times more, and the fee reaches 3%+, and the project party itself has more capital flow to feed back the game.

According to DappRadar data, as of August 16, 2021, the number of blockchain games has reached 838.

Axie Infinity Development Roadmap Source: CoinMartketCap

secondary title

The advantages of chain games compared with traditional games

At present, many traditional games are free to play, including the highest-grossing Honor of Kings, the popular game Pokémon Go and the Japanese mobile game Ni No Kuni: Cross Worlds, which generated US$100 million in revenue in 11 days. Game developers Revenue is obtained by selling game props, but a drawback of this type of game is gradually discovered. You must spend money to continue to complete the level, otherwise you will be stuck.

But traditional games are not without innovators, such as Roblox, in which other developers and designers can make their own games and props, and sell them to other players in exchange for the proceeds of the virtual currency Robux. According to the data, 27% of game costs go to all game developers, 25% to app stores, 12% to investment and support for the platform, and 27% to the games themselves.

But traditional games are not without innovators, such as Roblox, in which other developers and designers can make their own games and props, and sell them to other players in exchange for the proceeds of the virtual currency Robux. According to the data, 27% of game costs go to all game developers, 25% to app stores, 12% to investment and support for the platform, and 27% to the games themselves.

However, traditional games have not opened up the system, so the transaction of game assets is hindered, and can only be traded within the game. Usually, traditional games only receive items or virtual currency rewards, and have no control. The game rewards in blockchain games are encrypted assets, which can be freely bought and sold on the chain. Play to earn games also open access to fiat currency deposits and use credit cards, which greatly reduces the cost and threshold of NFT games, and can attract players outside the circle.

In the field of traditional games, for players, centralized game companies will take away most of the game revenue, or because of centralization, it is difficult to protect the interests of players. In the field of blockchain games, most or even almost all of the income belongs to the players themselves, which is the most original attraction for players.

For game developers, due to the maturity of the industry, the concentration of oligopoly continues to rise. For example, Tencent and NetEase occupy half of the market share, and traffic and resources are monopolized by certain companies. At the same time, small and medium-sized game developers are under great pressure to survive, and the cost of acquiring customers is getting higher and higher, while there is little room for improvement in user payment rate and profitability. In the field of blockchain games, it only takes three to five years to really start to develop. Except for Axie Infinity, which broke out this year, there is still huge potential in other subdivisions.

Blockchain games hand over the initiative to players, reconstruct the relationship between developers and players, and have great penetration and development potential.

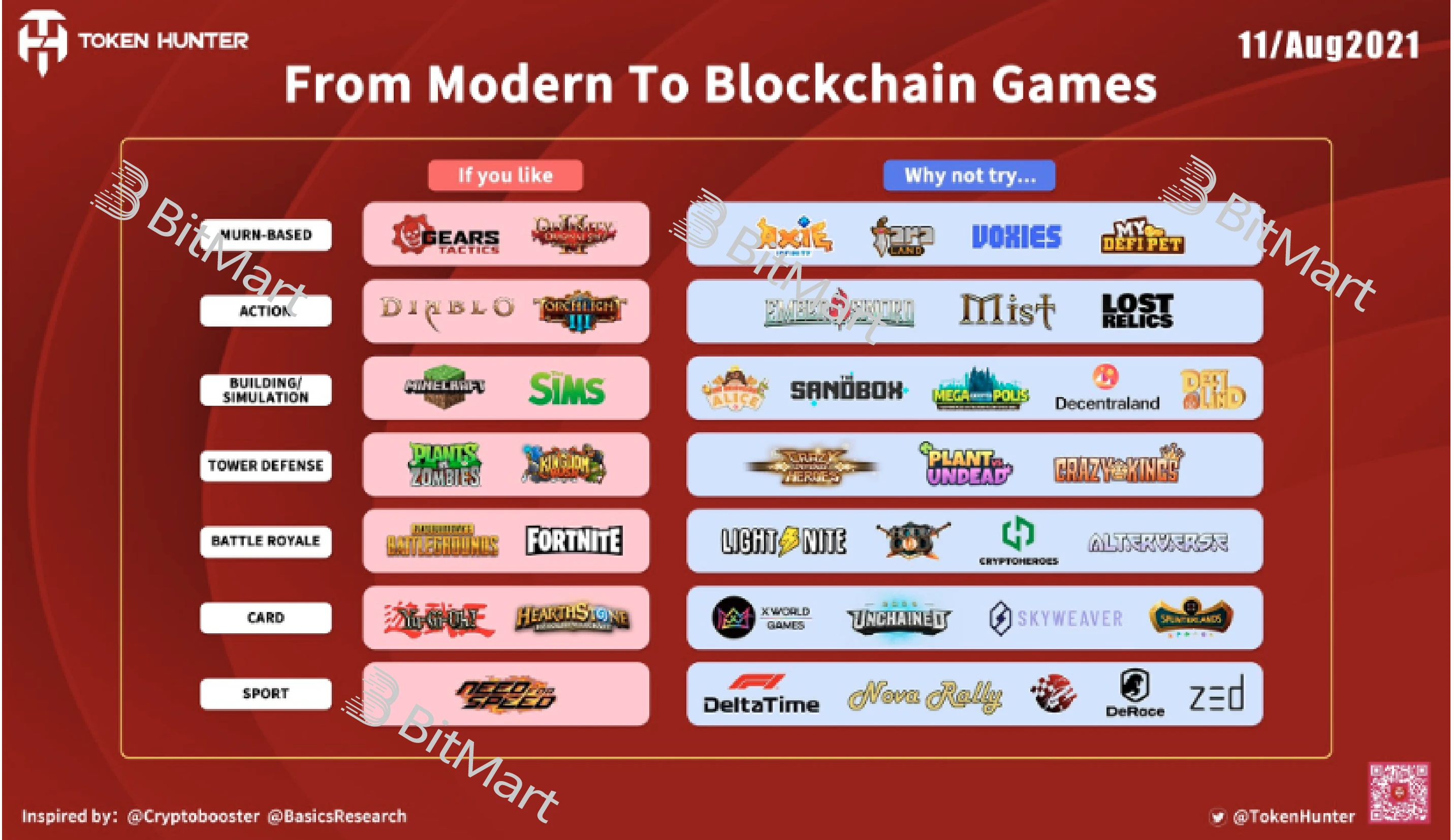

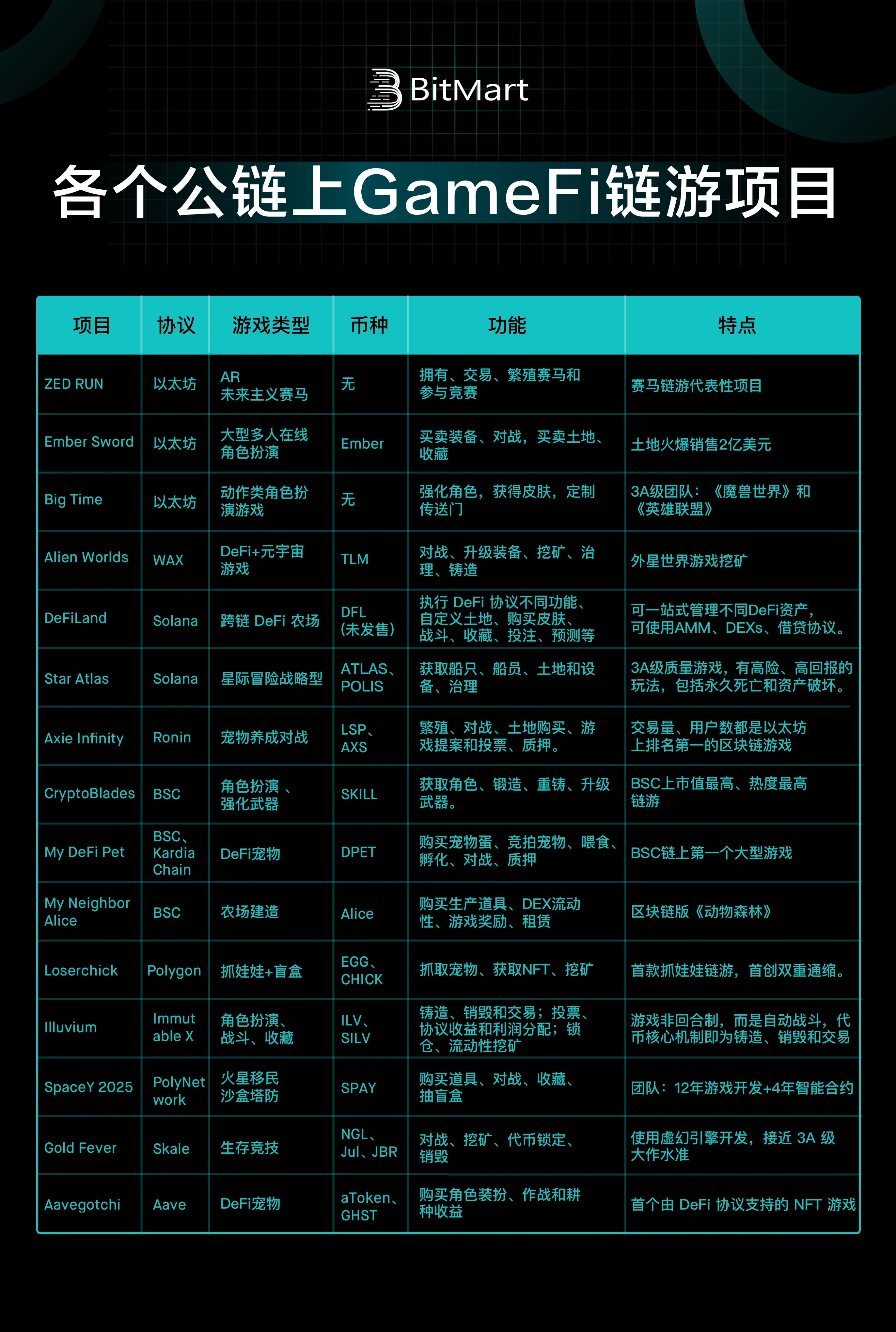

Chain games corresponding to different types of traditional games

secondary title

Source of Game Players - Game Guild DAO

Even if the underlying technology of the game has a breakthrough development and the richness of the game content is gradually increasing, without users, everything will become worthless.

The Philippine Game Association Yield Guild Games (YGG) proposed an Axie Scholarship (Axie Scholarship) project, which has three roles: Scholar player, manager, and YieldGuild guild organization. Managers are responsible for expanding and training newcomers. Guild organizations do not directly contact players, but mainly through managers.

Since the initial setting of the Axie game requires 3 Axie pets to start playing, the cost of hundreds or even thousands of dollars can dissuade most people, and the manager will use 3 Axies as a team to rent out to players who apply, so Players have little upfront cost and start earning SLP tokens in-game with 3 Axies. The income obtained by players is distributed according to the proportion of 70% for players, 20% for managers, and 10% for guild organizations.

Players can also let other players use their Axie through the YGG guild in the later stage, and get a certain share from the SLP they earn.

Games that YGG has invested or plans to invest in:

The guild organization model of YGG is not very difficult to imitate, and the encrypted game guild may gradually develop into a DAO organization. DAO is a decentralized organization based on a certain purpose that can organize people to invest or complete a certain purpose. It will promote the development of many blockchain games.

secondary title

The epidemic has inspired the most active market for traditional games-Southeast Asia

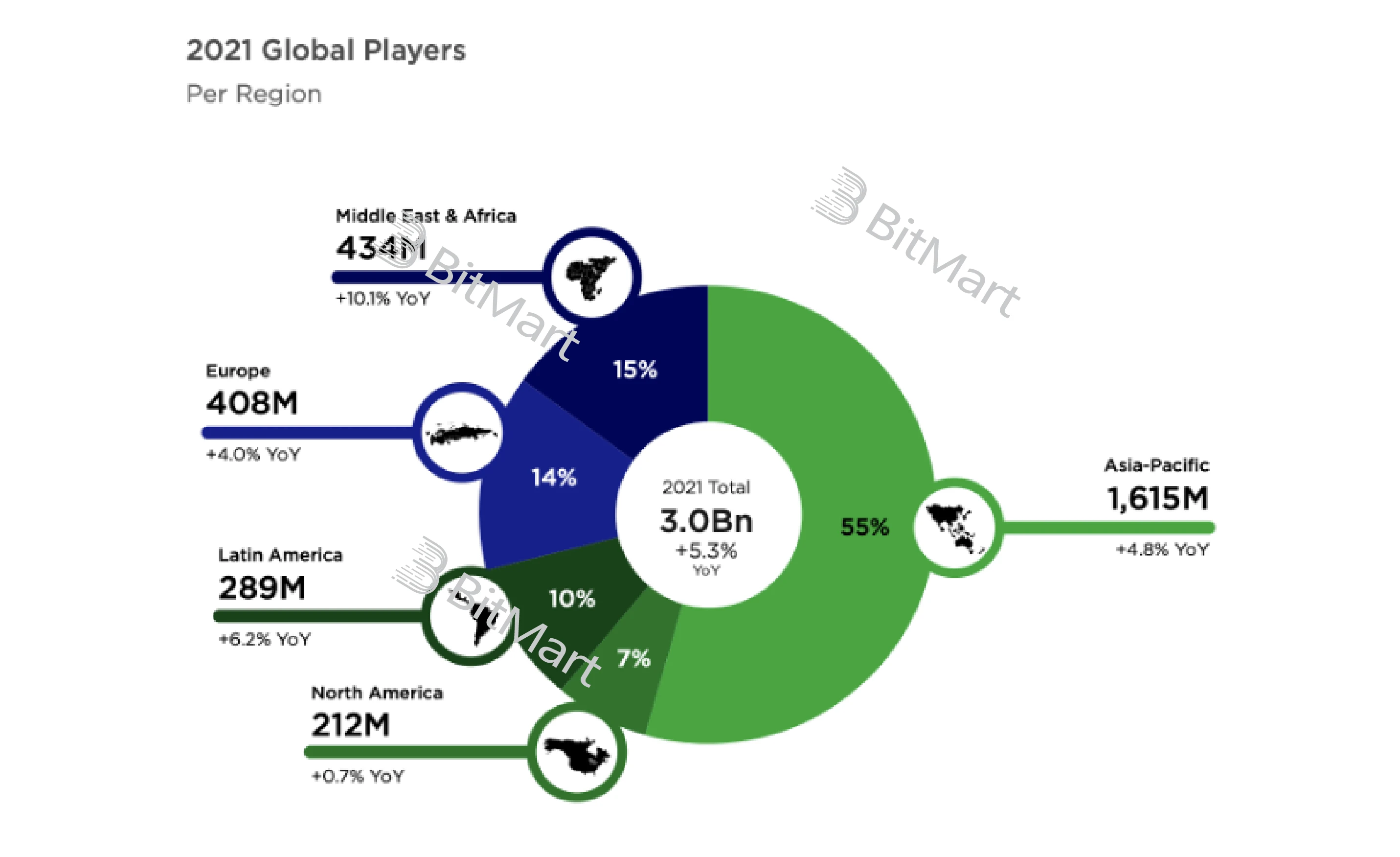

The Asia-Pacific region, including emerging markets such as Central and South Asia and Southeast Asia, has the largest number of active gamers in the world, accounting for 55% of the total number of global players, much higher than the number of players in other regions.

image description

Source: newzoo

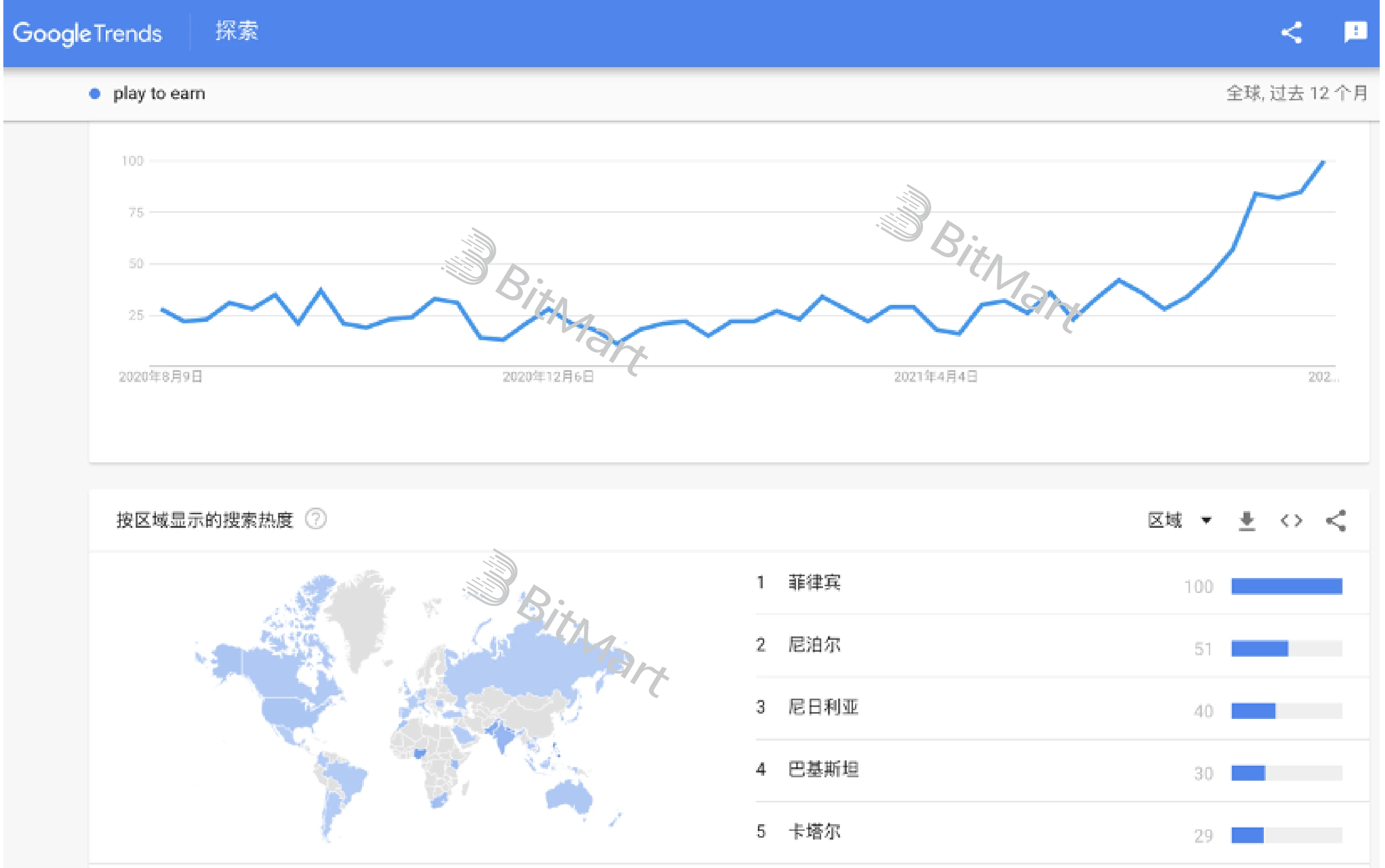

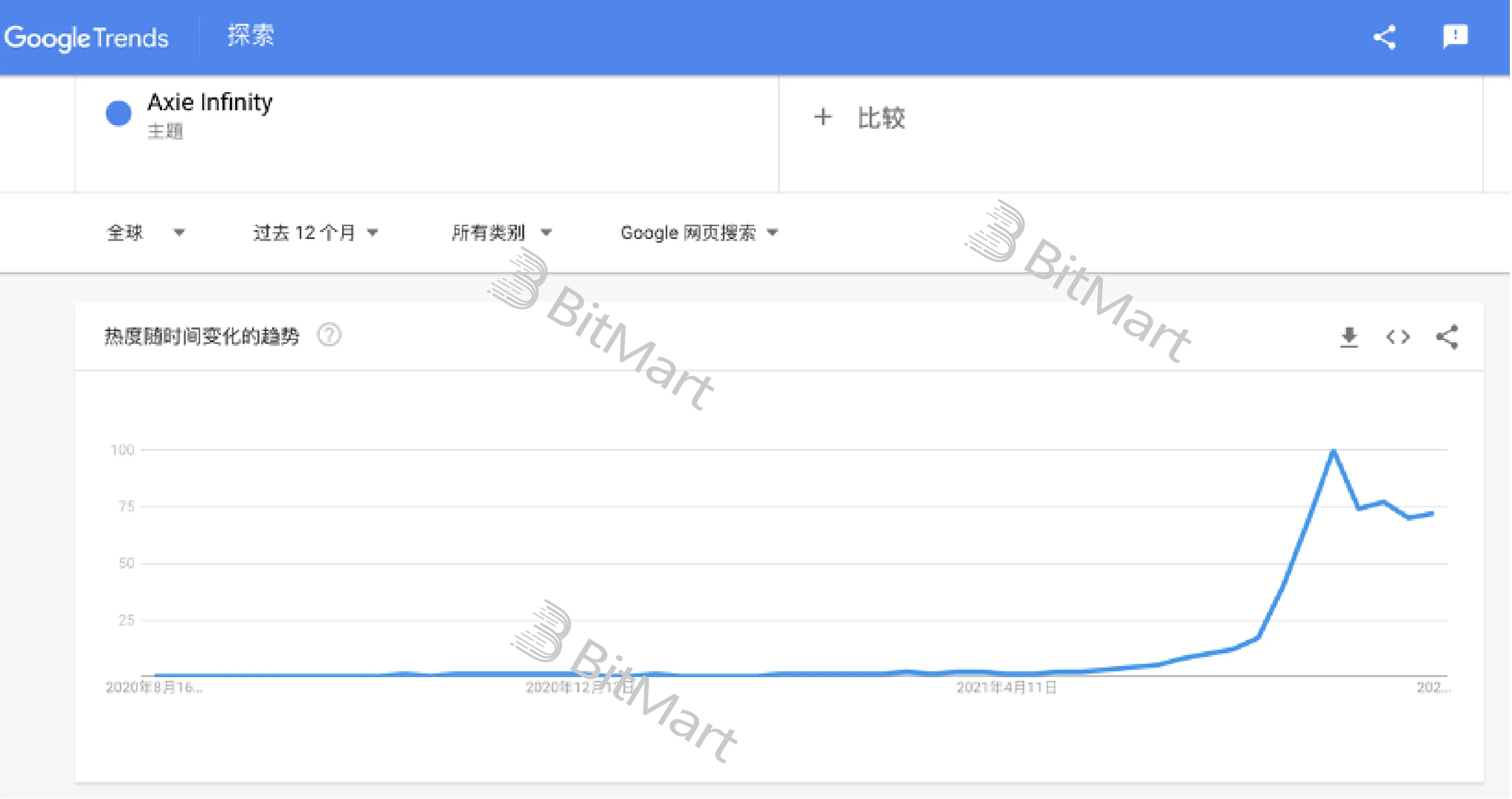

In the Google search trend, 100 represents the upper limit of search popularity. It can be seen that the popularity of the play to earn mode has continued to rise since May and June, and Southeast Asia and the Middle East are the most concerned.

In the search trend of Axie Infinity, the popularity began to gradually increase in late April, and the data reached its peak in mid-July, followed by a 25% drop and remained stable. Among them, the Philippines also ranked first in popularity.

According to data, the number of daily active users of Axie Infinity in July has exceeded 800,000, of which up to 60% of users are from the Philippines.

secondary title

The characteristics that blockchain games should have:

One is yield. The most essential difference between GameFi blockchain games and traditional games is the earning-while-playing model, but an immature economic model that cannot form a closed loop cannot bring long-term stable benefits to users.

The third is fluency. The infrastructure of blockchain games cannot be compared with traditional games. The throughput of traditional games is tens of thousands of TPS. Every game action of blockchain games needs to be packaged and broadcast across the network. The processing speed will definitely make players familiar with traditional games feel the gap.

Game fluency - the underlying technology development of GameFi chain games

secondary title

The public chain is developing rapidly to solve pain points

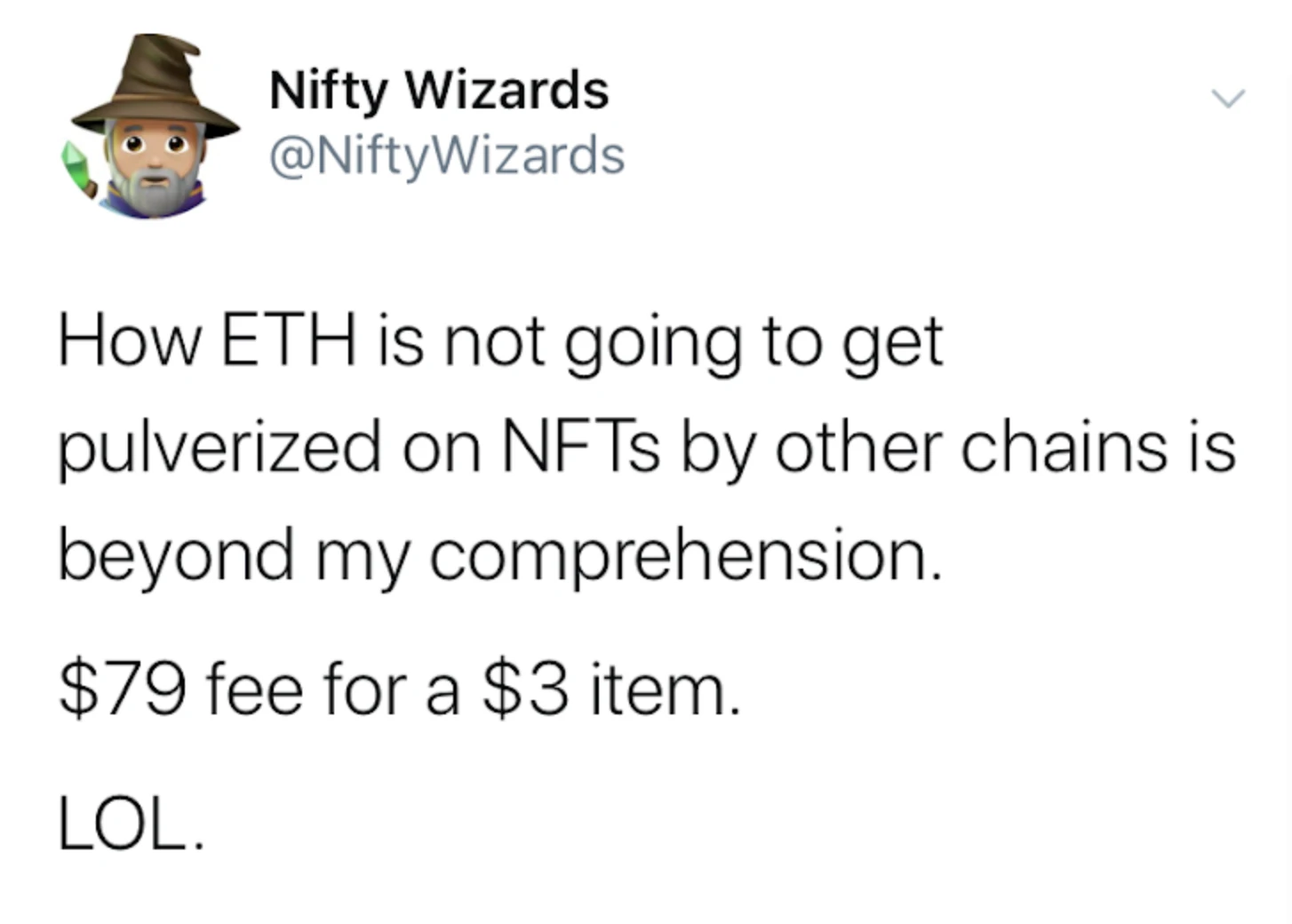

In 2017, Cryptokitties broke out, and the industry also saw the immaturity of the underlying public chain technology, which was a pain point that hindered the large-scale application and development of chain games within a few years. High gas fee costs, low performance and network capacity issues are always fatal. At that time, Ethereum could only support 15-30 TPS per second, and the number of delayed transactions waiting for confirmation remained at more than 20,000 per day. If you want to be confirmed first, players must pay a gas fee that is about 10 times higher than before. The biggest feature of online applications is the ability to interact, and the interaction cost of Ethereum is too high.

Some people once complained that they didn’t understand why some project parties issued NFT on Ethereum, and it cost $79 transaction fee to buy $3 goods.

In 2018, it will take a long time to complete the deployment of Ethereum 2.0. Some blockchain game project parties are still anxious that many public chains do not support NFT.

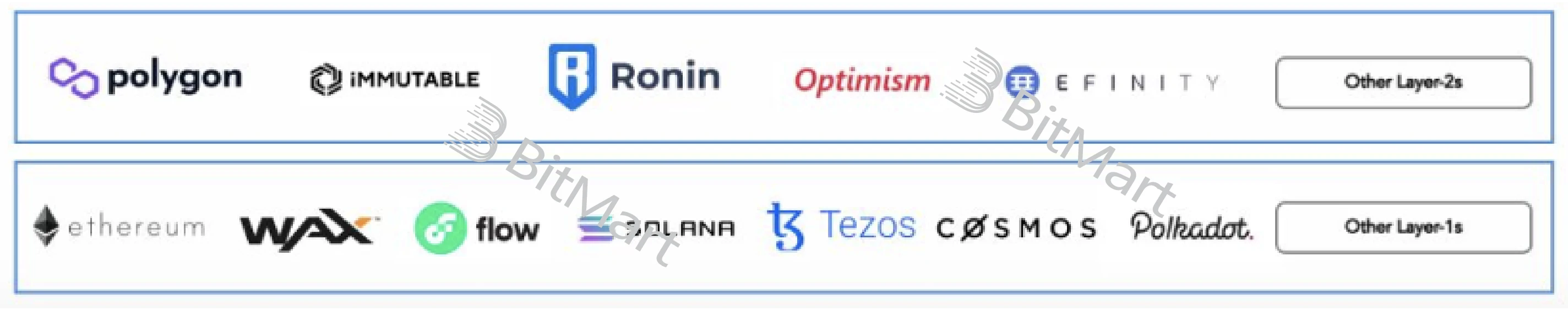

In 2021, not only will there be several Layer 1 public chains, but Layer 2 innovation chains will also occupy a place, and there will even be blockchains specially created for NFTs.

Layer 2 side chain representatives: BSC, Ronin, Polygon, Immutable X.

Source: MESSARI

secondary title

Layer1 public chain

Ethereum blockchain - the most powerful consensus

Representative projects: CryptoKitties, The Sandbox, Big Time.

secondary title

WAX Blockchain - The King of NFTs

WAX is not a general-purpose public chain, but a public chain that focuses on NFT. Based on EOS transformation, it follows the DPoS consensus mechanism. The theoretical throughput of WAX can reach more than 3000 TPS, and the gas fee is much lower than that of Ethereum. In the future, WAX will promote the connection of NFT assets on the chain between independent Dapps, which will help enhance asset liquidity. In addition, WAX is also working hard in the direction of cross-chain.

WAX is known as the King of NFT. With OPSkins (the operator of the worlds largest digital market), it has a user base of millions at the beginning of its establishment. In 2020, the NFT primary subscription on WAX will be sold out within a few minutes at the fastest, and its NFT secondary market transaction volume is 5 times higher than that of the primary market.

Relevant data shows that in the second quarter, the WAX chain became the market leader, and NFT sales have surpassed the total sales of Ethereum and Ronin. The number of WAX daily active wallets interacting with blockchain games grew 1,082% quarter-over-quarter to 306,707.

Representative projects: Alien Worlds, R-PLANET, PROSPECTORS.

secondary title

Solana blockchain - the most efficient public chain

Solana is a high-performance blockchain that does not use sharding, and may be the most efficient public chain.

1. It has a core innovative proof-of-history consensus mechanism (PoH), which can introduce a time system that other underlying technologies cannot do, encode time (history proof) into data, and sort transactions, so it does not need to be like other public chains It is necessary to communicate with each other to complete the consensus, reducing the consensus determination and message delivery time.

2. It adopts the GPU parallel processing mode for the first time. Other blockchains are single-threaded. Solana is the only multi-threaded blockchain that can transfer money in parallel.

Therefore, Solana has the advantages of high throughput, high scalability, low latency, and low transaction costs. The throughput of Solana can reach 50,000 TPS, up to 65,000, the block time is about 400 milliseconds, and the number of global nodes is close to 850 (it can be said that it is one of the most decentralized public chains except Bitcoin and Ethereum). Transaction costs as low as $0.00001 (barely).

Representative projects: DeFiLand, Star Atlas, Aurory.

secondary title

Flow Blockchain - a phenomenon-level project maker

Dapper Labs, the development team of the two NFT phenomenal projects CryptoKitties and NBA Top Shot, independently developed Flow, which is a public chain focused on adapting to NFT and games, which can not be fragmented on Layer 1 and create high scalability.

Ethereum decomposes transactions horizontally, classifies them according to transaction type, amount, and importance, and then processes them separately.

Flow decomposes transactions vertically. The method is vertical sharding + specialized division of labor, which separates the resource-consuming calculation process from the time-consuming consensus process, and classifies transactions and nodes according to the unique dimensions of Flow, and then according to the nature and capabilities of the nodes themselves. Assignments.

According to Flow’s official website, compared with traditional underlying technologies, Flow’s throughput is more than 50 times higher than that of traditional underlying technologies without affecting security or decentralization, its speed is significantly improved, and its transaction fees are significantly reduced. .

Representative projects: NBA Top Shot, MotoGP™ Ignition.

secondary title

Layer2 side chain

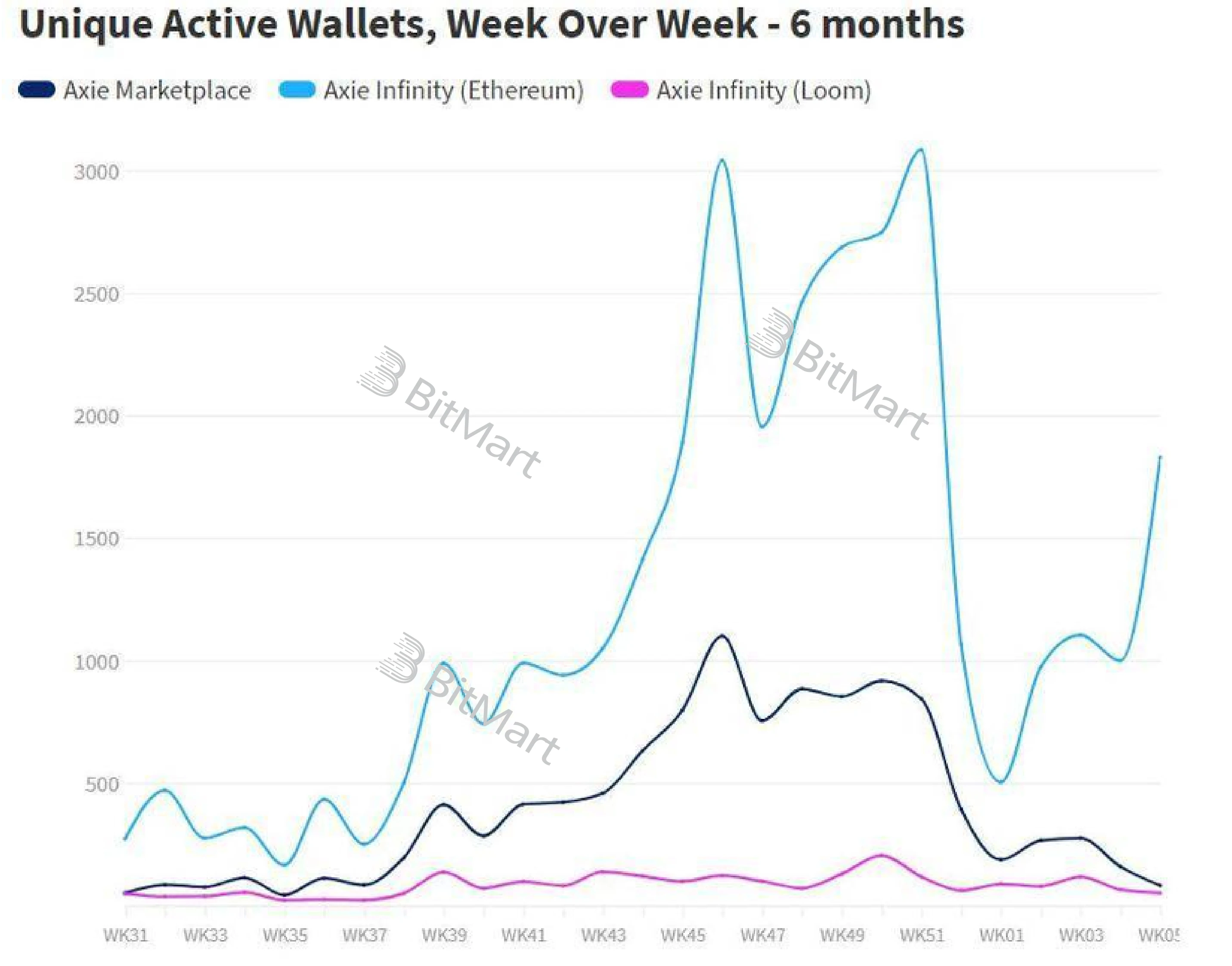

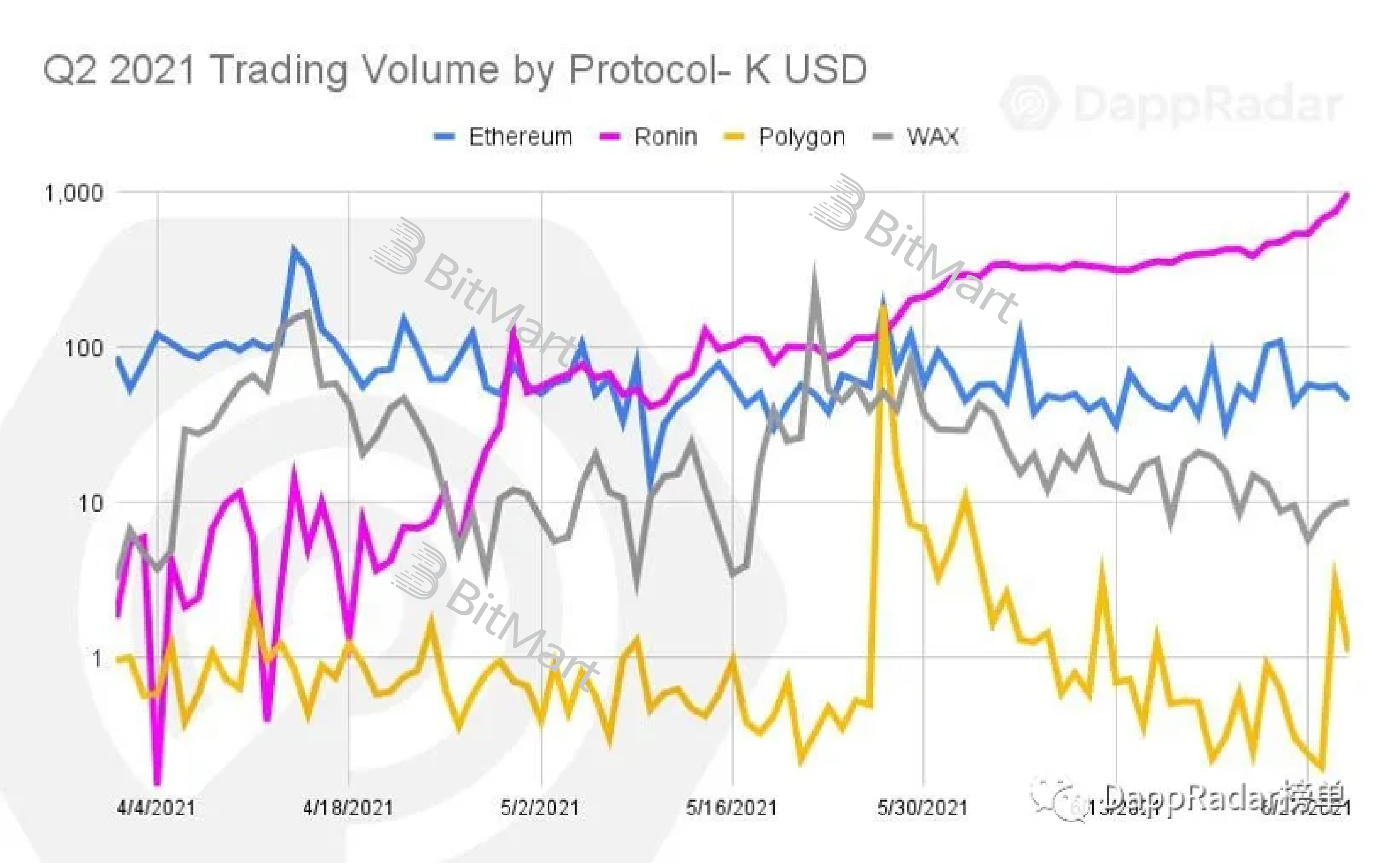

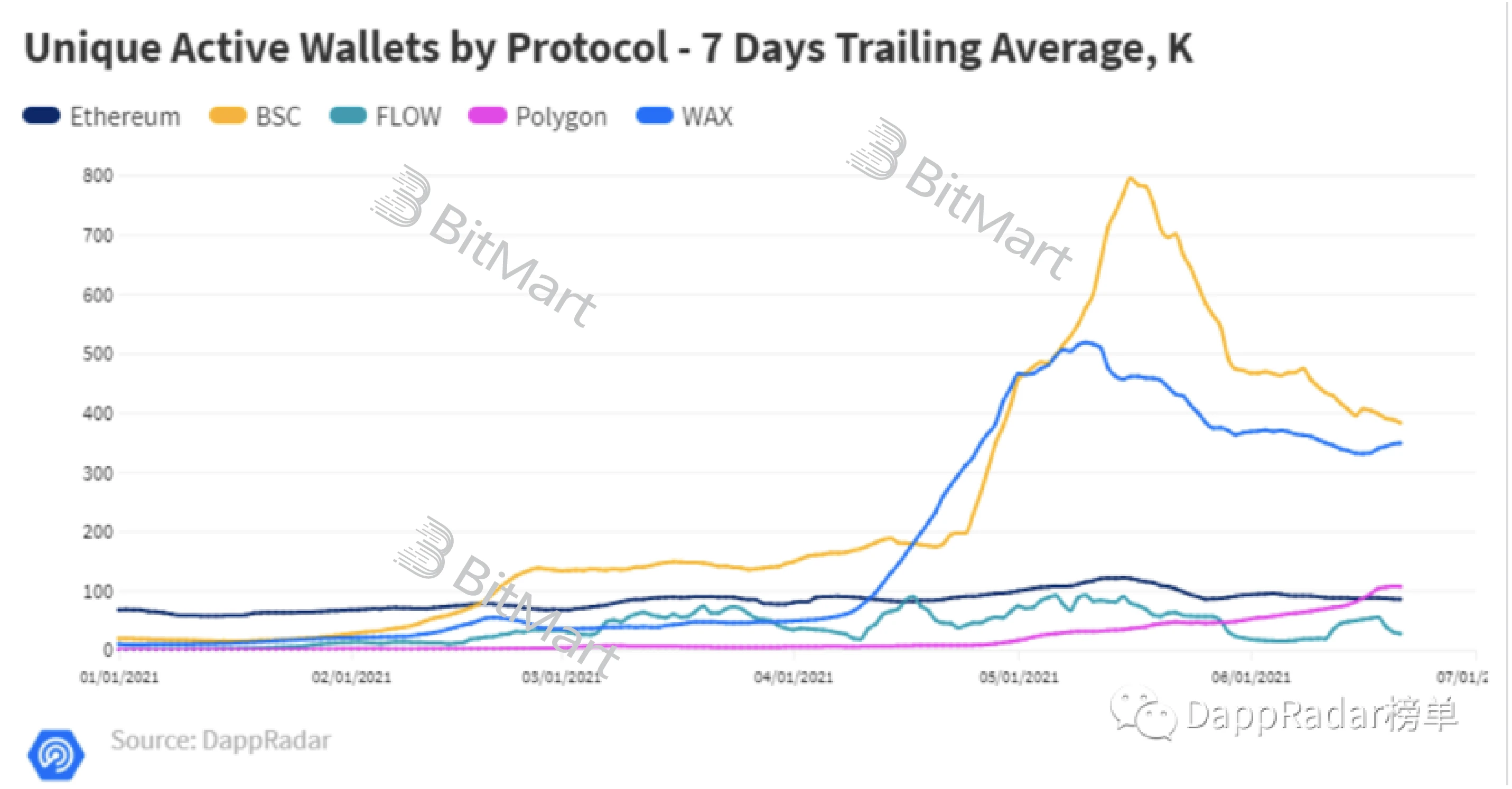

image description

Source: DappRadar

Transactions on the Ronin chain can be completed almost instantaneously, Gas fees are almost negligible, and Axie can be freely transferred between Ethereum and Ronin, which makes it easier for players to reproduce, thus promoting the number of Axie, breeding costs and market turnover. The growth will further promote the significant increase in the number of DAU, Axie currency holders and Discord members. Axie even negotiated with Discord officials to cancel the upper limit of 100,000 members. As of early August, the number of members has reached 680,000+.

2021/8/9 Axie Infinity Discord

image description

The performance of the AXS token price is more intuitive: AXS price on April 24: $7.57, AXS price on July 26: $40.87.

Source: DappRadar

Source: DappRadar

secondary title

BSC blockchain - a hot spot for gold nuggets

Binance Smart Chain BSC is built on the basis of the Cosmos sidechain. It has high performance and low transfer rates, and is compatible with the Ethereum Virtual Machine (EVM), making it easy to access the Ethereum ecosystem. BSC introduces the Proof of Stake Authority (PoSA) consensus mechanism to reach a consensus by staking BNB and requires 21 validators.

Therefore, the BSC chain generates a block every 3 seconds, and the average gas fee per transaction is $0.05. On the blockchain impossible triangle problem, the BSC chain is an achievable alternative solution in terms of transaction speed and transaction cost.

BSC has a strong financial background, a large number of community users and project resources, etc., which are very helpful for the implementation of applications. The two rounds of acceleration plans proposed this year have gradually clarified that they will incubate GameFi track projects.

The disadvantage of the exchange public chain is that its growth is driven by some NFT projects with relatively concentrated lock-up volume and transaction volume, and the degree of decentralization is not in place, so it is also a hidden danger. In addition, the BSC chain has some network congestion from time to time, which is a problem that subsequent users have been concerned about.

Representative projects: CryptoBlades, My DeFi Pet, My Neighbor Alice, MOBOX.

secondary title

Polygon blockchain - the most comprehensive expansion solution

Polygon is the first Layer 2 solution aggregator on the Ethereum chain. It has good EVM compatibility. Projects based on Ethereum can be easily migrated over, and it is also compatible with Metamask. It has high scalability, transaction security, high throughput (7200+TPS), fast confirmation (average 1-2 seconds), and low transaction fee ($0.00004 per transaction).

On the premise of sharing the security of the Ethereum chain, Polygon expands through the side chain, which is both efficient and safe. At the same time, the expansion of the hybrid solution can lower the threshold for technology development.

Its biggest technical advantage is the diversification of expansion solutions. It has the most full-stack solutions, of which the four most important expansion solutions are Polygon SDK, Polygon PoS, Polygon Avail and Polygon Hermez, and they are continuously increasing. Expansion solutions with different availability, security and cost are suitable for different users.

Representative projects: Loserchick, Tea Virtual, Exeedme.

Source: Loserchick

secondary title

Immutable X blockchain - 0-fee expansion solution

Immutable X is a Layer 2 expansion solution based on Ethereum. The throughput can reach 9000 TPS, and the gas fee for casting and trading is 0. This chain can also provide NFT liquidity, so it is becoming more and more popular. Most of the NFT projects that choose this chain are concentrated in the game field.

The expansion solution adopted by Immutable X is ZK Rollup, which introduces the same batch zero-knowledge proof as the MINA blockchain, which allows transaction snapshots to prove past transactions, which compresses the amount of information required by Ethereum when trading or creating NFTs. So no need to pay gas fees.

Representative projects: Gods Unchained, Illuvium (online in the third and fourth quarters).

image description

Source: Illuvium

At the beginning of 2021, with the advent of the bull market, the DeFi ecology of Ethereum broke out again, but the network congestion and extremely high cost of the Ethereum network once restricted the development of DeFi, so other public chain ecology has a broad space for development. And after the sharp drop on 5.19, the data of DeFi fell back after the setback, and the outbreak of GameFi came into being.

According to the DappRadar report, since April, the number of active wallets on the WAX chain and the BSC chain has skyrocketed, distanced from several other public chains.

Polygon’s active wallet data also surpassed that of Ethereum in July.

secondary title

Rights and Security Issues

The NFT digital asset confirmation scheme is not perfect. In terms of digital asset chaining, there is no centralized credit institution endorsement, how to ensure that the ownership of assets is unique and certain, how to solve problems such as counterfeiting and repeated sales, there is no closed-loop complete solution for the time being.

This year, DeFi projects have frequently encountered security problems, and a large number of assets have been stolen by hackers. This has become a new issue that the industry has focused on. GameFi’s transaction volume of hundreds of millions of dollars has become a hot topic. If you successfully get out of the circle, you must be watched by many eyes. How to prevent security issues must be taken seriously.

In the end, the game carries a large number of players’ high-concurrency data, which requires high tps, safe and efficient underlying technology, and various plug-ins such as data security and distributed storage. The fluency of the game is crucial for players important user experience.

The possible development direction of the GameFi public chain in the future: interoperability between all platforms, the use of NFT across different ecosystems, and the interaction between all public chains and Ethereum.

Game Playability and Game Monetization (Economic Model)

game playability

game playability

Axie Infinity is a decentralized pet raising and turn-based strategy game, players buy, sell, trade, breed cute digital pets - Axie, and engage in pet battles with other players by winning battles and completing necessary tasks To obtain SLP tokens, by spending AXS and SLP to breed higher-level pets, both tokens and pets can be traded for profit. This game is similar to Legend of Sword and Fairy.

Axie Infinity has achieved explosive growth, and everything develops according to the law. The development model of chain games must adapt to the reality and transform. The cost of users’ wool is getting higher and higher. After game developers reduce the profit sharing space, how to keep players? Downsizing, or attracting new players, is an immediate challenge for blockchain games.

According to the Axie Infinity roadmap, AXS staking will be launched in Q3 of 2021, the AXS ecosystem will be opened in early 2022, and the virtual land gameplay will be launched in the first half of 2022.

The co-founder of Axie Infinity once mentioned in the AMA that other projects can provide some tokens to distribute to Axie game players to participate in the entire game token ecology; at the same time, they can also provide AXSSLP and players holding other currencies. Specific brand props, and then endow the props with more and rich functions to form a nesting doll model. Axie can cooperate with other games. Players can obtain specific items through cross-game, which enriches the gameplay of the game, attracts different users to both sides, revitalizes the games on both sides, and successful cooperation will cause a cluster effect.

After several years of development, blockchain games have added more attributes to NFT, such as battle mode, incubation, combination, cultivation, splitting, land sales, etc., but the game’s playability and exquisiteness are still not as good as the development Full-fledged traditional game.

secondary title

GameF turns to the model of DeFi+NFT+game+DAO/social

Many players have also gradually realized that many chain games are not really fun, but they persist because of profit. If blockchain games only focus on financing capabilities, there will be no long-term development.

Like traditional games, GameFi should gradually develop towards socialization, with the nature of DAO. Socialization in chain games is a rigid need, and it is also a link for GameFi to enter the metaverse.

economic model

economic model

As for the development model of blockchain games, Zhao Meijun, the founder of Abitchain, once said, “The combination of blockchain and games, the first is the blockchainization of game currency, and the second is the blockchainization of game props and characters. The third is the blockchainization of game rules.”

In the past few months, users in the Axie Infinity game have begun to buy and sell a large number of land NFTs. The price of these land NFTs ranges from a few hundred to tens of thousands of dollars. Kieran Warwick, the founder of the upcoming game project Illuvium Said that he has obtained more than 90 times the income by reselling the land.

image description

Axie land screen

Nearly 95% of the income generated by the player belongs to the player himself, and the remaining 4.25% is retained by the project party and will flow into its Community Treasury. However, only from this 4.25% income, Axie has generated income Hundreds of millions of dollars.

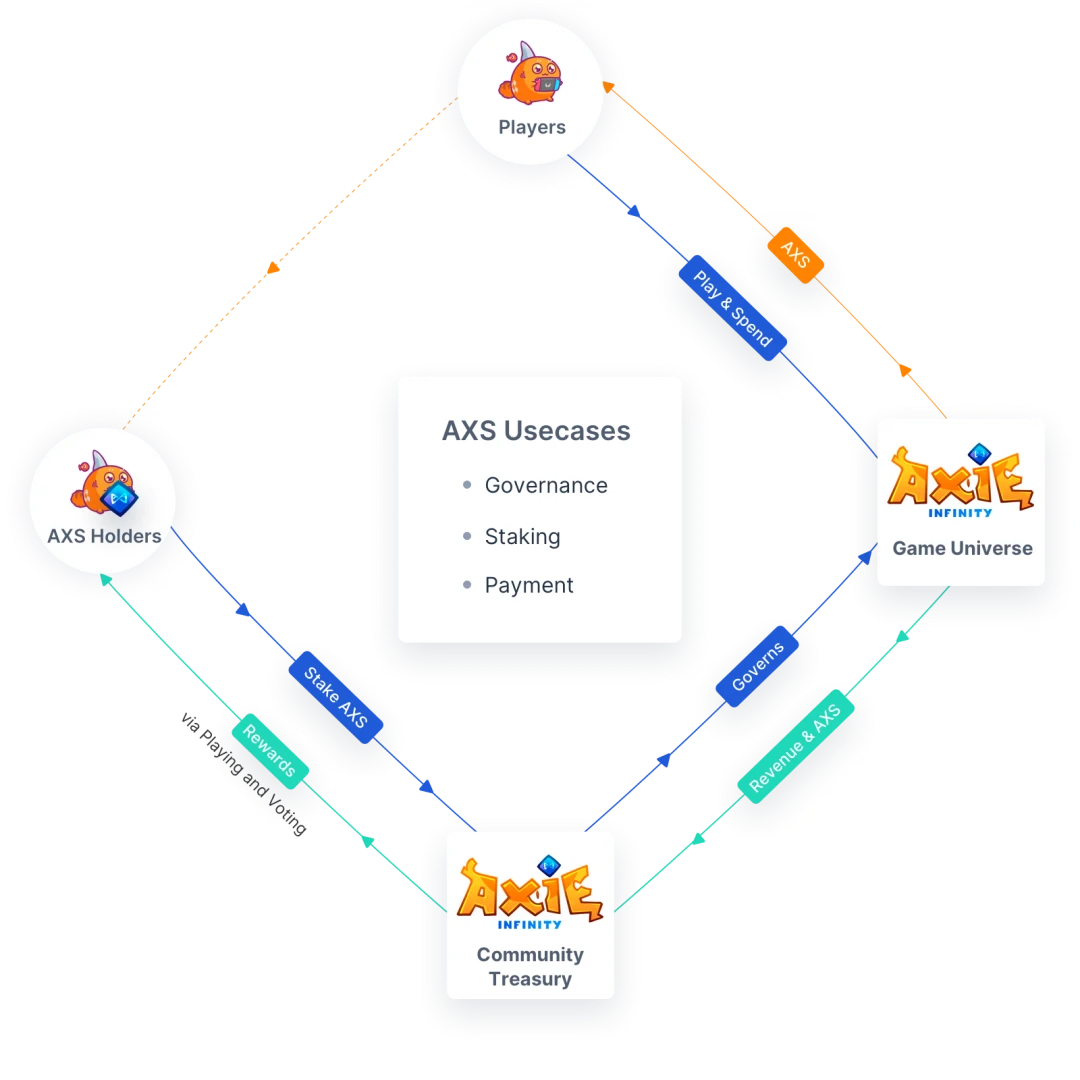

Axie economic model setting

Although the game Axie Infinity has a logical and self-consistent economic model, tokens generated by pet battles + tokens consumed by breeding pets together form a complete economic closed loop, whether it will develop smoothly as planned in the future still needs to be demonstrated in practice.

overbreeding

1. The starting point of the game is that players have the qualification to enter by purchasing Axie pet NFT. The entry of funds leads to an increase in the price of Axie pet NFT; 2. Players who want to breed and upgrade pets as soon as possible must buy more AXS and SLP, which leads to two The price of tokens has risen; 3. Because of the rise of tokens, the demand for tokens and NFTs has reached the maximum. Decrease; 4. Because of the decline in pet NFT profits, players no longer breed and upgrade pets, so the demand for SLP decreases and prices fall, and eventually the game stagnates due to lack of players.

The number of Axie pet NFT can be divided according to the level of scarcity, and there is a rule of breeding restriction, which can limit the growth trend of Axie pet NFT to a maximum value, making NFT become scarce and valuable again.

Axie Infinity essentially needs new users and new funds to increase the price of pets and tokens. According to the original setting, after a period of time, the cost of pet breeding is reduced to the players psychological price, and the player will return to the game for a round of cycles. But other GameFi-type blockchain games are also on the rise, and it is difficult to guarantee that players will not abandon Axie and seek other high-yielding games. Moreover, compared with traditional games that have been accumulated for decades, Axie Infinity has not yet formed a competitive barrier in terms of game playability, whether it is game strategy setting and image quality, let alone social attributes.

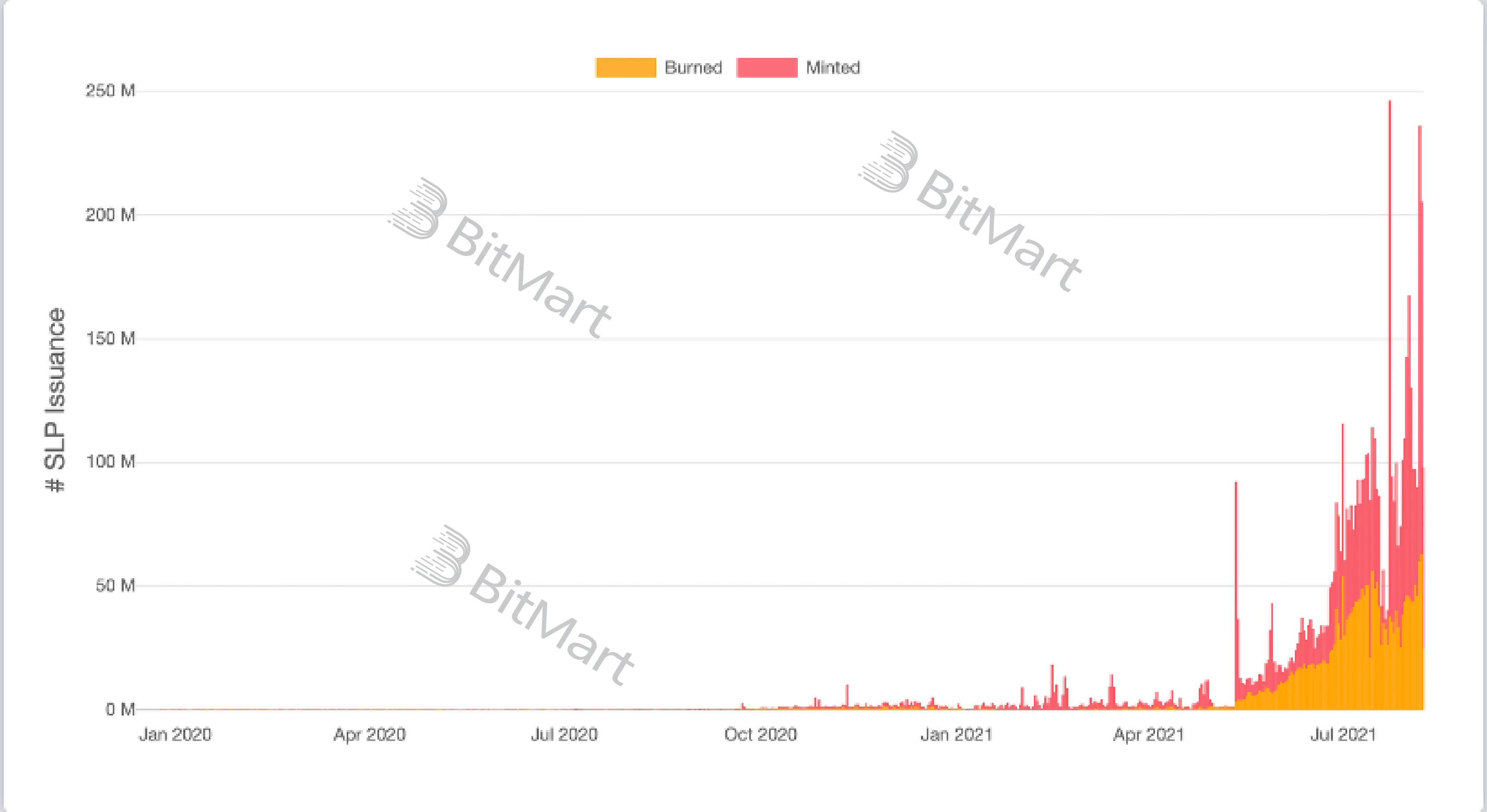

SLP oversupply

At the same time, Axie is currently facing another problem, the SLP output is too large. Its official website announced the current situation of SLP oversupply in early August, because users abused the PVE battle mode to generate too many SLP rewards, so the official announcement of the adjustment plan for the SLP acquisition method:

1. The number of SLP that the account can obtain in PVE every day is halved from 100 to 50.

3. The difficulty of obtaining PVP SLP rewards now increases at a steeper rate as the level of the animal trainer increases.

image description

SLP supply and demand

After entering August, a large number of SLPs have been produced in battles, and the number of SLPs used for breeding pets is far behind. This has caused an oversupply of SLPs, and the official has to regulate and maintain a balance. Otherwise, the price of SLPs will fall after inflation. It will cause asset losses to players who have spent the cost to breed pets, which will trigger a bad chain reaction.

The economic model of Axie Infinity, especially the price of AXS and SLP, is deeply affected by the encryption market, which is beyond the control of the game itself. Therefore, in order to improve the risk defense ability, the official has been considering constantly enriching the scene of the game and improving the Axie pet NFT itself. the value of.

For sustainable development, in terms of gameplay, Axie will launch several major upgrades in the future, including:

Workshop and Axie resource recycling (increasing NFT liquidity and income), land games (increasing gameplay), DEX on the Ronin chain (increasing AXS and SLP liquidity) and AXS staking (increasing AXS income). These measures can enrich the story, increase the income of the economic model, and keep the liquidity of assets uninterrupted.

According to Newzoos Global Game Market Report 2021, in 2021, the total number of global game players will exceed the 3 billion mark. It is estimated that by 2024, the number of game players will reach 3.32 billion, and the global game revenue will reach 218.7 billion US dollars.