Key Takeaways

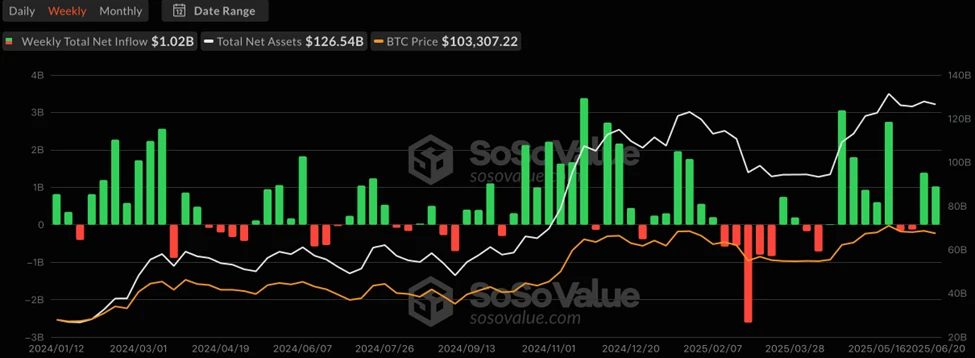

The total market value of global cryptocurrencies is $3.23 trillion, down 5.6% from $3.41 trillion last week. As of press time, the total net inflow of US Bitcoin spot ETFs is about $46.66 billion, with a net inflow of $1.02 billion this week; the total net inflow of US Ethereum spot ETFs is about $3.89 billion, with a net inflow of $40.24 million this week.

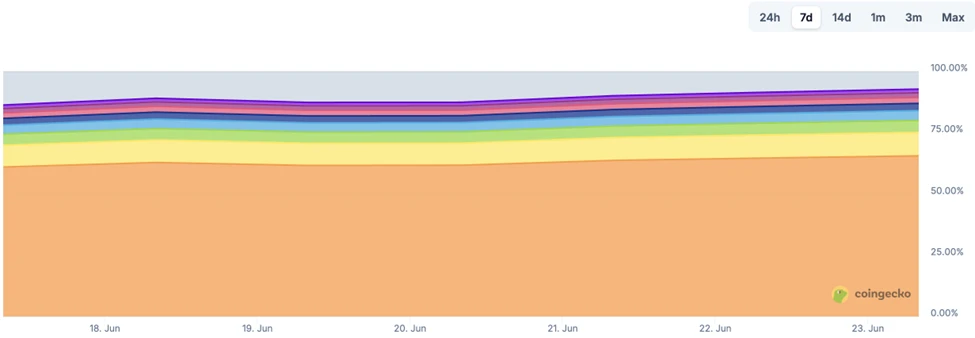

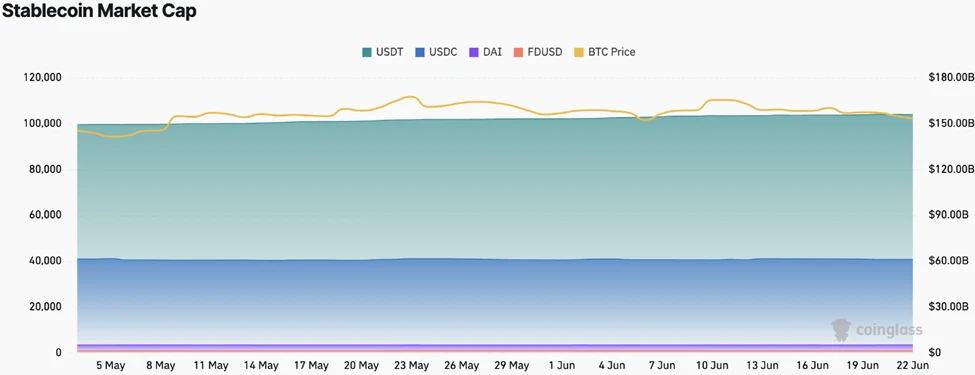

The total market value of stablecoins is US$248.5 billion, of which USDT has a market value of US$155.8 billion, accounting for 62.69% of the total market value of stablecoins; followed by USDC with a market value of US$61.2 billion, accounting for 24.62% of the total market value of stablecoins; and DAI with a market value of US$5.37 billion, accounting for 2.16% of the total market value of stablecoins.

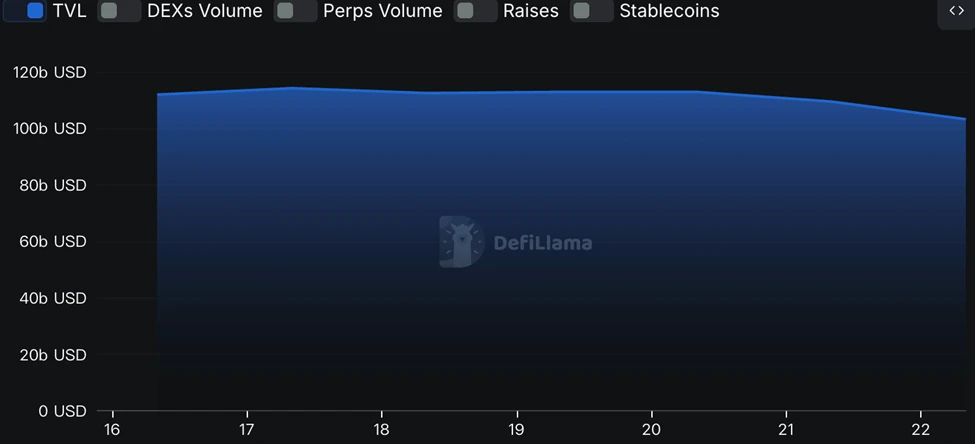

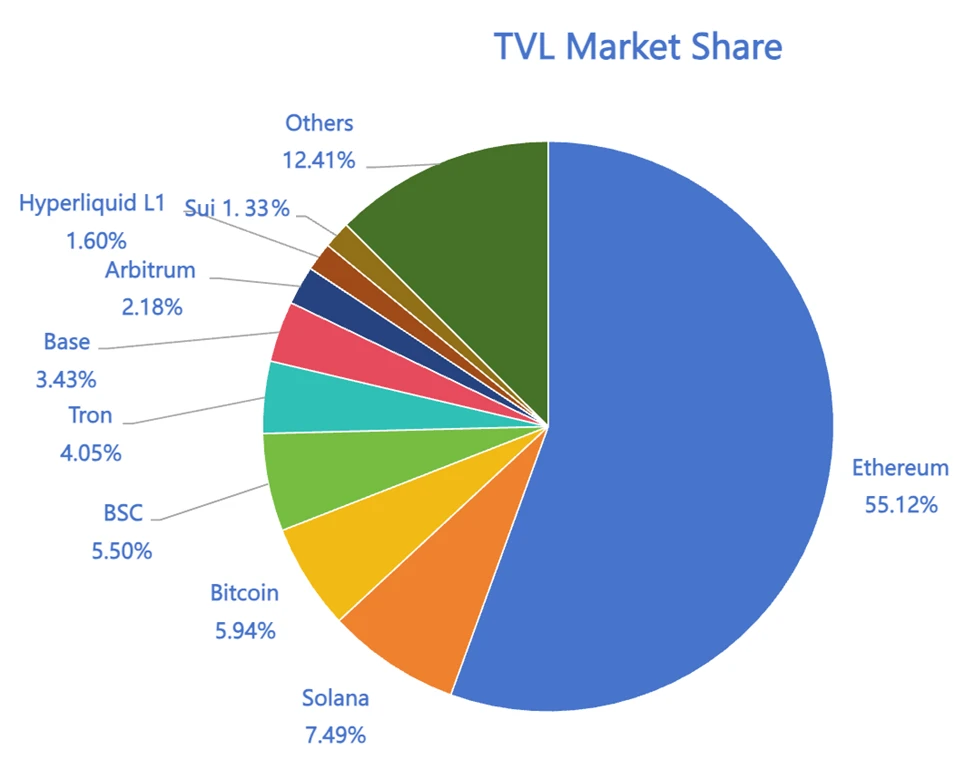

According to DeFiLlama data, the total TVL of DeFi this week is $103.2 billion, down about 7.8% from $111.9 billion last week. Divided by public chains, the three public chains with the highest TVL are Ethereum, accounting for 55.12%; Solana, accounting for 7.49%; and Bitcoin, accounting for 5.94%.

From the on-chain data, in terms of daily trading volume, except for Sui Chain, which fell by 26.67%, the rest of the chains rose, with Aptos rising by as much as 2000%, TON and ETH rising by 122% and 70% respectively, Solana rising by 30%, and BNB Chain rising slightly by 8%. In terms of transaction fees, ETH rose by 150%, Solana, Aptos, and Sui fell by 43.68%, 23.22%, and 11.13% respectively, and BNB and TON fees were basically the same. In terms of daily active addresses, only BNB and Sui Chain rose, increasing by 38% and 13% respectively, while the rest of the chains fell. In terms of TVL, Aptos performed well, rising by 773%, Sui fell by 12%, and the rest of the chains fell by less than 10%.

New projects to watch: XFX is an innovative platform that provides underlying infrastructure for institutional-level cross-border settlements, aiming to eliminate fragmented liquidity, delayed settlement and hidden costs in global payments. BitVault is an institutional-oriented decentralized financial protocol that issues bvUSD, a capital-efficient stablecoin collateralized by Bitcoin derivatives, and its yield derivative version sbvUSD, aiming to provide an optimized solution for stability and liquidity. Nook is a crypto savings application that converts user funds into USDC and deposits them in protocols such as Moonwell, providing users with an annualized return of up to about 8 ‑ 9%, daily distribution, withdrawal at any time and no lock-up period.

Table of contents

Key Takeaways

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

4. Reference links

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.23 trillion, down 5.6% from $3.41 trillion last week.

Data source: Cryptorank

Data as of June 22, 2025

As of press time, Bitcoin’s market cap is $2 trillion, accounting for 61.9% of the total cryptocurrency market cap. Meanwhile, stablecoins’ market cap is $248.5 billion, accounting for 7.69% of the total cryptocurrency market cap.

Data source: coingeck

Data as of June 22, 2025

2. Fear Index

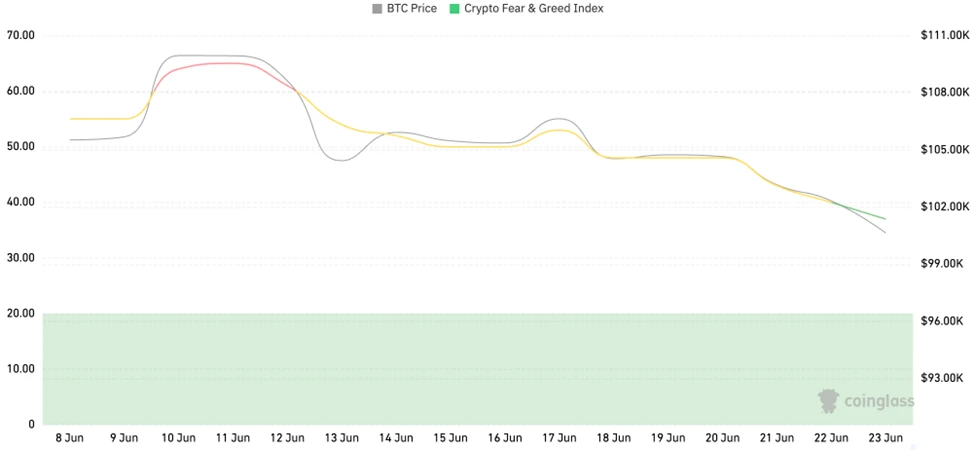

The Crypto Fear Index is at 37, indicating panic.

Data source: coinglass

Data as of June 22, 2025

3. Inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$46.66 billion, with a net inflow of US$1.02 billion this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$3.89 billion, with a net inflow of US$40.24 million this week.

Data source: sosovalue

Data as of June 22, 2025

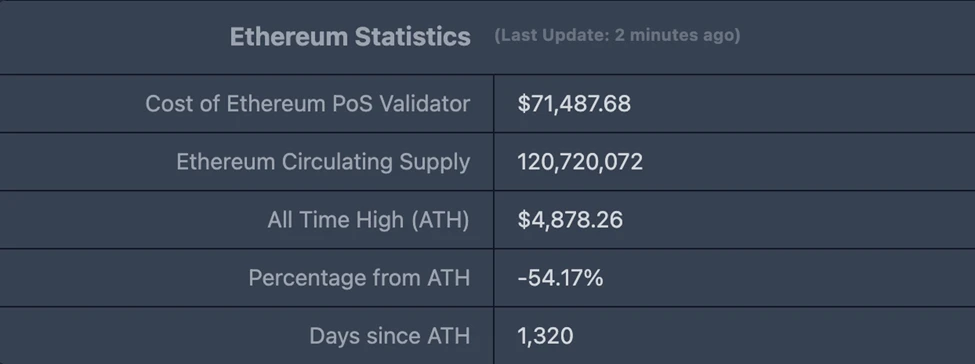

4. ETH/USD exchange ratio

ETHUSD: Current price $2,235.44, historical high price $4,878.26, a drop of about 54.17% from the highest price

ETHBTC: Currently 0.022163, the highest in history is 0.1238

Data source: ratiogang

Data as of June 22, 2025

5.Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $103.2 billion, down about 7.8% from $111.9 billion last week.

Data source: defillama

Data as of June 22, 2025

Divided by public chains, the three public chains with the highest TVL are Ethereum chain, accounting for 55.12%; Solana chain, accounting for 7.49%; Bitcoin, accounting for 5.94%.

Data source: CoinW Research Institute, defillama

Data as of June 22, 2025

6. On-chain data

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of June 22, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity of public chains and user experience. In terms of daily trading volume, only Sui Chain dropped by 26.67% this week, while the rest of the chains rose. Aptos rose significantly by 2000%, TON and ETH rose by 122% and 70% respectively, Solana rose by 30%, and BNB Chain rose slightly by 8%. In terms of transaction fees, BNB and TON remained unchanged this week, ETH rose by 150%, and Solana, Aptos, and SUI fell by 43.68%, 23.22%, and 11.13% respectively.

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the users trust in the platform. From the perspective of daily active addresses, only BNB chain and Sui chain increased this week, with increases of 38% and 13% respectively. The rest of the chains have all declined, ETH and TON have dropped by 26% and 27% respectively, and Aptos and Solana have dropped by 13% and 11% respectively. In terms of TVL, Aptos rose significantly by 773% this week, and the rest of the chains have all declined, Sui chain fell by 12%, ETH, Solana, BNB Chain and TON fell by 7%, 9%, 5% and 8% respectively.

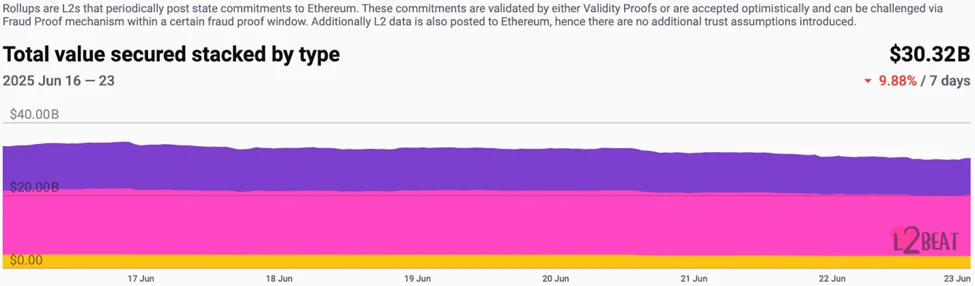

Layer 2 Data

According to L2B eat data, the total TVL of Ethereum Layer 2 is 30.32 billion US dollars, an overall decrease of 14.4% this week compared with last week ($ 35.41 billion).

Data source: L2Beat

Data as of June 22, 2025

Base and Arbitrum took the top spot with 35.2% and 34.12% market shares respectively, and their overall share declined.

Data source: footprint

Data as of June 22, 2025

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is US$248.5 billion, of which USDT has a market value of US$155.8 billion, accounting for 62.69% of the total market value of stablecoins; followed by USDC with a market value of US$61.2 billion, accounting for 24.62% of the total market value of stablecoins; and DAI with a market value of US$5.37 billion, accounting for 2.16% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of June 22, 2025

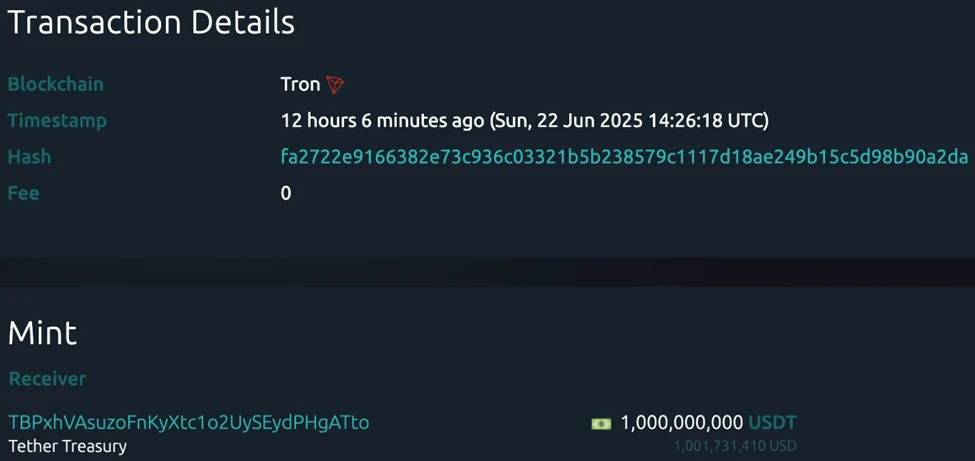

According to Whale Alert data, USDC Treasury issued a total of 640 million USDC this week, and Tether Treasury issued a total of 3 billion USDT this week. The total amount of stablecoins issued this week was 3.64 billion, up 62.91% from the total amount of stablecoins issued last week (1.35 billion).

Data source: Whale Alert

Data as of June 22, 2025

2. Hot money trends this week

1. VC coins and Meme coins with the highest growth this week

The top four VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of June 22, 2025

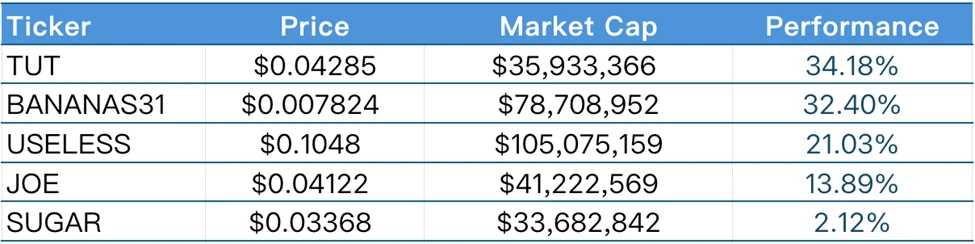

Top 5 Meme Coins That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of June 22, 2025

2. New Project Insights

XFX is an innovative platform that provides underlying infrastructure for institutional-level cross-border settlements, aiming to eliminate fragmented liquidity, delayed settlements and hidden costs in global payments. The platform allows financial institutions, market makers and payment processors to achieve real-time account arrival, direct access to wholesale liquidity, and provide transparent and auditable transaction reports through stablecoin and fiat currency channels. XFX architecture is high-performance and modular, supports dashboards, APIs and OTC services, and has SOC 2 and ISO 27001 level security compliance controls.

BitVault is a decentralized financial protocol for institutions. It issues bvUSD, a capital-efficient stablecoin collateralized by Bitcoin derivatives, and its yield-derivative version sbvUSD. It has institutional-level lending authority, dynamic interest rate setting, multi-asset collateral mechanism, and permission pool transaction control, and aims to provide an optimized solution for stability and liquidity.

Nook is a crypto savings app founded by a former Coinbase engineer that converts user funds into USDC and deposits them into protocols such as Moonwell. Built on Base, it provides users with an annualized return of up to approximately 8 ‑ 9%, daily distribution, withdrawal at any time, and no lock-up period.

3. New trends in the industry

1. Major industry events this week

On June 21, CoinSwap, a new generation of decentralized exchange focusing on V2 model transaction dividend distribution, officially launched its mainnet and simultaneously launched the token IDO. CoinSwap creates an ecological closed loop where transactions are consensus and participation is profit through recommendation binding, dynamic profit sharing and deflation repurchase mechanism. The total amount of its governance token COIN is 10 billion, and it plans to eventually reduce the total amount to 1 billion through fee repurchase. The platform has completed the deployment of the BNB Chain mainnet, supports multi-wallet one-click transactions, and is committed to becoming a key infrastructure connecting DeFi transactions with real asset flows (RWA).

On June 21, Redbrick (BRIC) trading was opened. Eligible users can use Binance Alpha points to claim 900 BRIC airdrop tokens per person on the Alpha event page within 24 hours after the start of trading. The airdrop is carried out in two stages: in the first 18 hours, users who hold at least 251 Alpha points can claim; in the last 6 hours, users who hold at least 226 points can participate on a first-come, first-served basis. Each claim will consume 15 Alpha points, and failure to confirm the claim within the specified time will be deemed as abandonment. Redbrick is a metaverse platform based on user-generated content (UGC), supporting free creation and games, and creating a token economic system that fairly rewards creators.

On June 20, Binance Alpha AVAIL Phase 1 airdrop was available, with a minimum score of 243 points. On June 21, Binance Alpha AVAIL Phase 2 airdrop was available, with users who reach 199 points in Alpha being able to claim 2,667 tokens on a first-come, first-served basis.

On June 20, Binance Alpha announced that users with at least 238 points can participate in the League of Traders (LOT) TGE subscription through the Alpha event page from 16:00 to 18:00 (UTC+ 8) on the same day. Participating in the event will consume 15 points, and users must complete the subscription operation within the specified time.

On June 19, the Matchain (MAT) airdrop event was launched. Eligible users can use Binance Alpha points to claim 16 MAT tokens per person on the Alpha event page. The airdrop is divided into two stages: in the first 18 hours, users with at least 243 points can claim; in the last 6 hours, users with more than 210 points can participate on a first-come, first-served basis until the airdrop pool is full or the event ends. Each claim will consume 15 points and must be confirmed within the specified time, otherwise it will be considered as a waiver.

2. Big events coming up next week

UpTop.meme will announce the specific rules of the Real User Compensation Plan in response to the problem of a large number of users missing out on Pre-TGE allocation opportunities due to abuse by script studios. According to the on-chain analysis conducted by UpTop.meme and Four.Meme engineers, about 58,297 addresses are suspected to be script operations, 41,703 are real users, and more than 600,000 people visited the event page to participate. This compensation plan will issue additional airdrops to wallet addresses authenticated as real users. The relevant details are expected to be officially released in the next few days, which is worth paying attention to.

Binance Alpha will launch the Sahara AI (SAHARA) airdrop event on June 26. Eligible users can use Binance Alpha points to go to the Alpha event page to claim the airdrop rewards after trading is open. The specific claim time and details will be announced on the same day.

Telegrams Web3 trading app Blum will allow users to claim BLUM token airdrops, with the specific time to be announced. Users can currently view achievements and airdrop distribution in the app, and can claim 30% of the tokens during TGE, and the remaining part will be unlocked in equal amounts every day within 180 days. Blum completed a $5 million Pre-Seed and seed round of financing in February this year, led by gumi Cryptos Capital and participated by many well-known institutions. The project development is highly anticipated.

Multi-VM full-chain network Mango Network announced that it will launch the MGO token TGE and open airdrop inquiries. The specific time is to be announced. This airdrop is for testnet participants and active community contributors (including OG roles), with a total allocation of 5% of the total token supply. All airdrop tokens will be unlocked immediately. Mango points holders will also receive airdrop rewards in proportion.

3. Important investment and financing last week

Decentralized data platform PrismaX announced the completion of a $11 million seed round of financing, led by a16z crypto CSX, with participation from Volt Capital, Stanford Blockchain Accelerator, Symbolic Capital and Virtuals Protocol. PrismaX is committed to solving the data scarcity problem of generative models through its unique Proof-of-View mechanism, improving the quality and diversity of multimodal data such as images and videos, promoting the standardization of robot vision data and the development of remote control infrastructure, and accelerating the training and large-scale deployment of physical AI models. (June 17, 2025)

Ethereum re-staking protocol EigenCloud (formerly EigenLayer) announced the completion of a $70 million financing led by a16z. By introducing a re-staking mechanism, EigenCloud allows users to use the staked ETH to provide cryptoeconomic security for other applications, extending blockchain-level trust to Web2 and Web3 scenarios. Its Alpha version was launched in sync with the performance upgrade of EigenDA, achieving a throughput of 50 MB per second on the test network. At the same time, it released a preview version of EigenVerify for adjudicating off-chain system disputes, and is committed to supporting emerging applications such as AI agents and prediction markets. (June 17, 2025)

Ubyx, a stablecoin startup founded by former Citigroup executive Tony McLaughlin, announced the completion of a $10 million seed round of financing, led by Galaxy Ventures, with participation from Founders Fund, Coinbase Ventures, Paxos and VanEck. Ubyx is committed to building a global stablecoin acceptance network similar to Visa and Mastercard, connecting stablecoin issuers, banks and fintech companies to solve interoperability problems in payment scenarios. (June 17, 2025)

Units.Network, a blockchain startup based on the Waves protocol, has raised $10 million in funding led by Nimbus Capital. The funds will be used for infrastructure upgrades and AI product development. Units.Network is a modular blockchain ecosystem that supports users to deploy EVM-compatible sidechains, with L0 scalability, a re-staking consensus mechanism, and a DAO governance model. Its token UNIT 0 is used for transactions, voting, and incentives for ecological projects. (June 19, 2025)

The DePIN project SparkChain AI announced that it has completed a $10.8 million financing led by OakStone Ventures. The funds will be used to expand its decentralized AI computing network. SparkChain AI is an AI-driven DePIN Rollup protocol. Users can participate in network construction by sharing idle bandwidth and computing resources and receive token rewards. The platform focuses on privacy and security, and is committed to building an efficient and decentralized AI infrastructure to support various AI applications. (June 19, 2025)

4. Reference links

1.PrismaX: https://prismax.ai/

2. EigenCloud (formerly EigenLayer): https://www.eigenlayer.xyz/

3. Ubyx: https://www.units.network/

4. Units.Network: https://www.units.network/

5. SparkChain Ai: https://sparkchain.ai/

6. XFX: https://www.xfx.io/

7. BitVault: https://www.bitvault.finance/

8. Nook: https://nookapp.xyz/