National legislation is good for BTC! Do you want to get in the car?

In June, after the American country El Salvador legislated to use BTC as a legal currency, countries and regions around the world have continuously withdrawn from relevant policies that are beneficial to BTC. Then Blue Shell Academy will take you to see what policies are in place?

Let's look at the country first; Wuhan City plans to cultivate more than 100 blockchain companies within three years; guidance document. And so on, the release of documents is too numerous to enumerate.

Looking abroad, Germany’s law allowing institutional funds to hold cryptocurrencies came into effect on August 2. From August 2, 2021, German institutional funds (Spezialfonds) will be able to hold up to 20% of cryptocurrency assets, which may The conditions are being created for wider mainstream acceptance of Bitcoin (BTC) and other crypto assets by pension funds in the country.

According to Bloomberg, the new law changes the rules for fixed investments in German institutional funds, also known as special funds, which are only available to institutional investors such as pension funds and insurance companies. German institutional funds currently manage assets worth around $2.1 trillion, or 1.8 trillion euros.

From niche to mainstream adoption, after more than ten years of development, Bitcoin's market value has surpassed Internet giants such as Facebook. Although it failed to become the "peer-to-peer payment system" envisioned by Satoshi Nakamoto, it has gone further and further on the road of value storage, adding more and more companies' balance sheets, and moving in the direction of "super-sovereign currency" develop.

secondary title

The Bitcoin network is still the most secure blockchain network

The Bitcoin network is the earliest blockchain to appear. Judging from the data on the chain, Bitcoin is still the most secure cryptocurrency with the strongest consensus. According to data from Glassnode, as of July 18, there were approximately 640,000 active Bitcoin addresses, and 9 million addresses held more than 0.01 BTC. Every day, 1.17 million BTC was transferred on the chain, equivalent to approximately 36.9 billion U.S. dollars, equivalent to Bolivia’s There are only 94 countries whose GDP exceeds this value in 2020.

Every new bull market of Bitcoin is accompanied by more users influx. It can also be said that more and more users have caused the price of Bitcoin to rise. This round of bull market is driven by the adoption of large institutions. of. In October 2020, the international payment giant PayPal announced its entry into the cryptocurrency market, allowing users to use PayPal's online wallet to buy, sell and hold Bitcoin and other virtual currencies. Almost at the same time, DBS Bank of Singapore announced the launch of a digital asset trading platform and supported the trading of cryptocurrencies such as BTC. Since then, Tesla, Meitu and other companies have started to buy Bitcoin. Bitcoin is also gradually moving from niche to mainstream adoption.

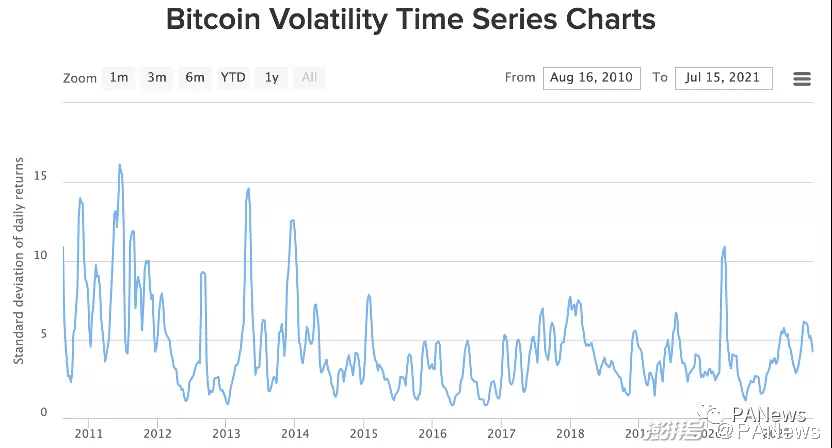

Bitcoin's wild volatility, which many investors struggle with, is becoming less volatile as stronger institutional buyers step in. According to the statistics of BitPremier, from 2010 to the present, the 30-day volatility of Bitcoin has shown an overall downward trend. Even during the 3.12 period last year, the volatility was not as good as that between 2010 and 2014. The reduction in volatility also allows Bitcoin to be allocated by institutions as an alternative asset. Because there is no correlation between Bitcoin and most mainstream assets, holding a portion of Bitcoin can enhance the diversity of an institution's basket of assets.

Throughout the development of Bitcoin, after encountering numerous crises, Bitcoin has become more and more famous around the world, and the consensus has become stronger and stronger. On August 1, 2017, some miners performed a hard fork at the Bitcoin block height of 478558, and BCH was born. After that, BCH forked out BSV. They all called themselves "real Bitcoin", but they were different from Bitcoin The price ratio keeps going down. In 2014, MtGox, once the largest cryptocurrency exchange in history, closed down due to the theft of $400 million worth of virtual currency. On September 4, 2017, Chinese exchanges began to go overseas due to supervision.

"What doesn't kill you makes you stronger". Various regulations, hacking attacks, etc. did not knock down Bitcoin, but instead made Bitcoin the most secure blockchain network. However, Altcoin (Bitcoin alternative, Bitcoin substitute) is more vulnerable to security problems. For example, the double-spend attack on Bit Gold BTG in 2018 caused the exchange to suffer an economic loss of 110 million yuan. Now the price of BTG is only Less than 10% of the 2017 high.

secondary title

boarding! The value of BTC quality assets should be more applied

As the highest quality encrypted asset, BTC should have been widely used, but the lack of programmability of the Bitcoin network itself, long block generation time, and limited block capacity limit the daily use of BTC. It was once regarded as the lightning of hope. Network and other capacity expansion solutions are also developing slowly. With the prosperity of the Ethereum ecosystem, BTC, as a high-quality asset, has begun to be widely used in DeFi applications on Ethereum. At present, the bitcoin-anchored coins issued on Ethereum have exceeded 1% of the total bitcoin, and this number is still increasing.

secondary title

Benefits to other public chains

Bitcoin's high market value, high liquidity, and low volatility are high-quality assets for any public chain. Therefore, Bitcoin-anchored coins are used as underlying assets and are widely used in lending protocols on Ethereum. For other public chains that lack assets, the introduction of Bitcoin is even more important.

secondary title

Benefits for currency holders

For Bitcoin holders, using Bitcoin on other chains in a cross-chain manner can effectively reduce costs and increase usage scenarios. Using Bitcoin as an anchor currency has many advantages:

The transfer cost is lower. When the network is not congested, the transfer cost in the general Bitcoin network is about $5; while the Gas Price in Ethereum is 10 GWEI, the transfer cost of ERC20 tokens is about $1. The transfer costs on other chains such as Solana, Polygon, and Harmony are basically negligible.

Transaction confirmation is faster. The block generation time of Bitcoin is about ten minutes, and that of Ethereum is about thirteen seconds. The emerging public chain can complete transaction confirmation within a few seconds.

As high-quality assets in mortgage lending, transactions, derivatives, bonds and other agreements, for example, assets such as stablecoins can be lent by mortgaging Bitcoin-anchored coins.

secondary title

Good for the Bitcoin network itself

For the Bitcoin network itself, cross-chain Bitcoin can also increase the consensus of Bitcoin. Cross-chain means that Bitcoin can be accepted by more users on the network, increasing the number of BTC holders. According to the data on the Ethereum blockchain browser, there are currently 33,046 WBTC holding addresses.

It is conducive to consolidating the value storage status of Bitcoin. Native bitcoins are all pledged in the bitcoin network, which will not affect the value storage function of bitcoin, and can obtain income through other networks, and convert the income into more bitcoin assets.

It is beneficial to increase the actual utility of Bitcoin. The block generation speed of Bitcoin is slow, and it is difficult to be applied in the Bitcoin network. It may take 10 minutes for a transaction to be uploaded to the chain, and it takes about 1 hour to wait for 6 blocks to be confirmed. The form of anchor currency is more conducive to the actual use of Bitcoin, and the transaction confirmation speed of blockchains such as Ethereum is faster, and 10 block confirmations can be completed within three minutes.

Will BTC, which has the above five benefits, continue to rise? Welcome to share your views in the message area of Blue Shell College.